Market Overview

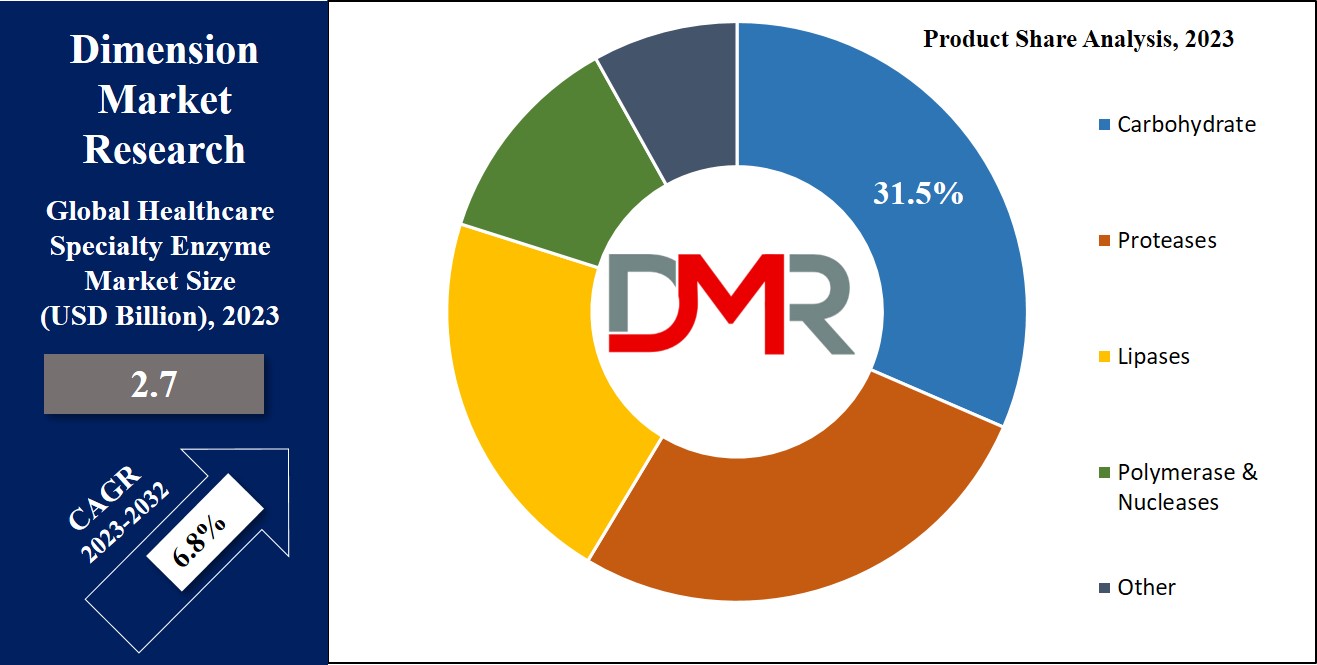

The Global Healthcare Specialty Enzyme Market is expected to reach a value of USD 2.7 billion in 2023, and it is further anticipated to reach a market value of USD 4.8 billion by 2032 at a CAGR of 6.8%.

The global healthcare specialty enzyme marketplace features an extensive variety of specialized enzymes that are essential for diagnostics, therapeutics, and studies inside the healthcare region. These enzymes play a crucial function in diagnostic assays, treatments, drug development, bioprocessing, and biotechnological studies through advancing clinical understanding and programs.

From precision diagnostics utilizing specific enzymes for accurate biomarker detection to rising therapeutic modalities like Cancer Immunotherapy and advanced treatments for

Neurological Disorder Drugs, the market reflects the evolving landscape of healthcare practices. Additionally, factors such as technological improvements, regulatory considerations, global collaborations, and shifts in treatment paradigms contribute to the dynamic nature of this global market.

Public funding and government incentives are pivotal in fostering growth and innovation within the specialty enzymes market by supporting biotechnological research. For instance, the European Union’s Horizon Europe program, with a significant budget of USD 103.6 billion for 2021-2027, emphasizes research and innovation, including advanced biotechnology projects. This initiative promotes the development of cutting-edge biotechnological processes and enzyme-based products.

In the United States, the National Institutes of Health (NIH) allocated over USD 42.0 billion in 2022 for biomedical research, directing a portion towards biotechnology, including the development of novel enzymes for medical and industrial applications.

Similarly, in India, the Biotechnology Industry Research Assistance Council (BIRAC) launched the Biotechnology Ignition Grant (BIG) scheme, allocating Rs. 50 crores (USD 6.7 million) in July 2020 to support around 100 startups and entrepreneurs. This funding is aimed at catalyzing innovation, driving entrepreneurship, and accelerating the development of enzyme-based solutions for biotechnology and pharmaceutical sectors.

Such initiatives foster a thriving ecosystem for research and development, enabling advancements in specialty enzymes and enhancing market competitiveness globally.

Key Takeaways

- Based on product, Carbohydrate-active enzymes dominate this segment as they hold 31.5% of the market share in 2023.

- In terms of source, microorganism dominates this segment with a huge portion in 2023 and is expected to show significant growth in the upcoming period of 2023 to 2032.

- Based on the technique used, clinical chemistry dominates this segment as it holds 33.2% of the market share in 2023.

- In terms of usage, research, and biotechnology dominate this segment as they hold the highest market share in 2023.

- North America dominates this market as it holds 39.3% of the market shares in 2023.

Use Cases

- Precision Diagnostics: Specialty enzymes like polymerases and nucleases are widely used in molecular diagnostics (PCR, NGS) for accurate detection of infectious and genetic diseases, enabling faster and more reliable patient outcomes.

- Drug Development & Biopharmaceuticals: Enzymes act as biocatalysts in therapeutic drug development, improving efficiency and specificity in bioprocessing for oncology, cardiology, and autoimmune disease treatments.

- Gene & Cell Therapy: Advanced enzymes support gene editing (e.g., CRISPR technologies) and cellular therapies, enabling breakthroughs in personalized medicine and regenerative healthcare.

- Point-of-Care & Home Testing: Enzyme-based diagnostic kits enhance rapid testing at home or clinics for conditions like diabetes, infectious diseases, and cardiovascular disorders, improving accessibility to healthcare.

- Biotechnology Research & Innovation: Specialty enzymes play a vital role in genetic engineering, protein modification, and bioprocessing, accelerating innovation in pharmaceutical R&D and sustainable healthcare solutions.

Market Dynamic

The international healthcare specialty enzyme marketplace has experienced dynamic shifts stimulated through numerous key factors as much as the prevailing factor. An outstanding driving force is the escalating demand for diagnostic enzymes, driven by way of the growing occurrence of sicknesses and the search for particular diagnostic tools. Enzymes have emerged as critical in biopharmaceutical production, aligning with the increase of the biopharmaceutical region and its emphasis on innovative cures.

The focus on precision medicine and customized healthcare answers has further propelled the significance of enzymes, particularly in genomics

and molecular diagnostics. Research and development initiatives, strategic collaborations, and improvements in enzyme engineering have fostered innovation in the zone.

The COVID-19 pandemic has significantly impacted the market, intensifying the demand for diagnostic tools and therapeutic solutions related to the virus. Market consolidation, regulatory concerns, and opportunities in emerging markets also play pivotal roles, while shifts in treatment paradigms, such as gene and cell therapies, highlight the evolving landscape of the Healthcare Specialty Enzyme Market.

Driver

The healthcare specialty enzyme market is propelled by rising biopharmaceutical demand for therapeutic and diagnostic applications, particularly through drug development processes that rely on specificity and efficiency of enzymes for drug production. These enzymes play a critical role in drug research processes while offering greater specificity and efficiency during bioprocesses. As chronic diseases such as cancer and diabetes become more commonplace, targeted therapies and specialty enzymes have become ever more essential to care.

Advancements in recombinant DNA technology have also made possible the production of enzymes with enhanced activity and stability, in line with pharmaceutical companies' efforts to increase drug efficacy fuelling market expansion while positioning enzymes as essential biocatalysts.

Additionally, the integration of enzymes with advanced

medical devices,

IOT Microcontroller systems, and next-generation diagnostic platforms expands their application scope, strengthening their role in healthcare innovations.

Trend

A key trend driving the healthcare specialty enzyme market is advancements in enzyme engineering technologies such as protein engineering and directed evolution. These innovations enable the customization of enzyme properties, including stability, activity and substrate specificity to meet particular medical requirements. Integration of artificial intelligence (AI) and computational biology has greatly expedited enzyme discovery and optimization processes.

Enzymes have become a more frequently employed component of molecular diagnostics, particularly next generation sequencing (NGS) and polymerase chain reaction (PCR), to increase precision and reliability. This trend signals a move toward personalized medicine by emphasizing engineered enzymes as integral parts of improving diagnostic and therapeutic outcomes.

Restraints

Although healthcare specialty enzyme markets hold immense potential, their growth remains limited due to high production and purification costs. Enzyme manufacturing requires complex infrastructure and stringent quality control processes, particularly for medical applications, increasing overall production expenses significantly. Furthermore, maintaining enzyme activity during storage and transport poses unique logistical hurdles. Custom enzyme development is prohibitively costly for small and mid sized enterprises, making its accessibility inaccessible for them.

Furthermore, regulatory compliance issues and lengthy approval timelines further hinder market expansion. To meet these challenges, businesses must invest continuously in cost cutting strategies and innovations designed to make specialty enzymes more cost effective and widely accessible in healthcare services.

Opportunity

The expanding role of specialty enzymes in diagnostics offers an exciting window of market growth. Enzymes like polymerases, proteases, and reverse transcriptases play a vital part in both immunoassays and molecular diagnostics assays. As infectious and genetic diseases spread more widely, demand has surged for accurate and rapid diagnostic solutions creating a fertile ground for enzyme based technologies to thrive.

Additionally, point of care (POC) testing and home diagnostic kits has accelerated enzyme adoption for innovative applications. Strategic collaborations between enzyme manufacturers and diagnostic firms may open new market doors while improving early disease detection rates and patient outcomes.

The growing integration of specialty enzymes in areas like Smart Homes Systems for health monitoring, alongside applications in

Cancer Immunotherapy and Neurological Disorder Drugs, highlights the cross-sector potential of this market in shaping the future of healthcare innovation.

Research Scope and Analysis

By Product

Based on product, Carbohydrate-active enzymes dominate this segment as they hold

31.5% of the market share in 2023 and are anticipated to show further growth in the forthcoming period of 2023 to 2032. The dominance of carbohydrates is integral to various industries because of their versatility and catalytic talents.

In the meals and beverage quarter, amylases play a key position in starch hydrolysis for the production of sugars vital in drinks, confectionery, and baked items. Carbohydrase, including cellulases, discover programs in the fabric industry for bio-polishing and enhancing fabric appearance. In brewing and distilling, amylases facilitate the conversion of starches into fermentable sugars vital for alcoholic beverage production.

Carbohydrase enzymes are applied in animal feed to enhance digestibility for farm animals and fowl. In biofuel production, cellulases and hemi cellulases are essential for breaking down lignocellulosic biomass. These enzymes additionally find use inside the detergent industry for starch-based total stain elimination and feature pharmaceutical packages in drug improvement.

By Source

In terms of source, microorganism dominates this segment with a huge portion in 2023. Enzymes derived from microorganisms play a pivotal position in various industries due to their extensive diversity and flexible characteristics. The extensive array of microorganisms, which include bacteria and fungi, allows for the extraction of enzymes with wonderful catalytic activities, making them appropriate for various commercial packages.

Microbial-sourced enzymes benefit from the ease of cultivation and fermentation, making sure price-effective production on a large scale. Genetic manipulation abilities allow the enhancement of specific enzyme residences, contributing to the improvement of tailor-made enzymes with advanced traits. Microorganisms' speedy manufacturing cycles and flexibility in harsh situations cause them to be sustainable for industries with high demand and numerous environmental requirements.

Additionally, the financial feasibility, specialized functionalities, and sustainable manufacturing practices associated with microbial-sourced enzymes cause them to be pivotal contributors to improvements in biotechnology, healthcare, food and beverages, textiles, and biofuels.

By Technique

Based on the technique used, clinical chemistry dominates this segment as it holds 33.2% of the market share in 2023 and is expected to show subsequent growth in the forthcoming years of 2023 to 2032. Specialty enzymes are indispensable in the field of clinical chemistry, where their crucial role is evident in various diagnostic techniques. Enzymes serve as integral components in diagnostic assays, contributing to the accuracy of measurements by acting as labels, reporters, or catalysts.

Immunoassays, a cornerstone of clinical chemistry, benefit from specialty enzymes like alkaline phosphatase and peroxidase, enhancing sensitivity and specificity in detecting hormones, proteins, and infectious agents. Enzymatic reactions using specific substrates are fundamental in tests such as blood glucose assessments.

Clinical enzymology relies on measuring enzyme activities, including ALT, AST, and alkaline phosphatase, to evaluate liver, cardiac, and bone health. Lipid profiling for cardiovascular assessment utilizes enzymatic methods, while coagulation and hemostasis assays assess blood clotting tendencies.

Specialty enzymes also contribute to urinalysis, detecting substances like urea. Technological advancements continually refine clinical chemistry techniques, with specialty enzymes playing a pivotal role in enhancing the precision and efficiency of diagnostic processes.

By Usage

In terms of usage, research, and biotechnology dominate this segment as they hold the highest market share in 2023 and are anticipated to show subsequent growth in the upcoming period as well. Specialty enzymes play a pivotal role in advancing studies and biotechnology because of their versatility and indispensability in several packages. Serving as vital tools in genetic engineering and bioprocessing, enzymes like limit endonucleases and ligases are crucial for manipulating DNA.

Researchers utilize enzymes in protein engineering, enhancing proteins for specific packages and using them in DNA-related methods inclusive of PCR for DNA amplification. The biotechnological enterprise heavily is based on enzymes for bioprocessing, contributing to the production of bio-primarily based products and sustainable technologies.

Enzymes are crucial in drug discovery, allowing the screening of capacity drug applicants and knowledge healing mechanisms. Additionally, enzymes contribute to the standards of inexperienced chemistry through biocatalysis, replacing traditional chemical techniques with environmentally pleasant procedures.

By Application

The dominance of infectious diseases in the healthcare specialty enzyme market in 2023 is attributed to various factors. Enzymes play a crucial role in the accurate and rapid diagnosis of infectious agents through techniques like PCR assays, driving the demand for precise diagnostic tools. Additionally, enzymes are vital in the development of antiviral medications, targeting specific enzymes within pathogens.

The bioprocessing industry, reliant on enzymes, contributes to vaccine production for infectious diseases, reflecting the global emphasis on vaccination. Ongoing research into infectious diseases necessitates enzymes for studying disease mechanisms, drug development, and therapeutic target identification.

The continuous emergence of infectious agents and the potential for pandemics emphasizes the need for advanced diagnostic and therapeutic tools, with specialty enzymes playing a critical role in addressing these challenges. The adoption of enzyme-based technologies further solidifies infectious diseases' dominance in the specialty enzyme market.

The Healthcare Specialty Enzyme Market Report is segmented on the basis of the following

By Product

- Carbohydrate

- Proteases

- Lipases

- Polymerase & Nucleases

- Other

By Source

- Microorganisms

- Plants

- Animals

By Technique

- Clinical Chemistry

- Immunoassays

- Molecular Diagnostics

- Hematology

- Microbiology

By Usage

- Research & Biotechnology

- Diagnosis

By Application

- Infectious Diseases

- Diabetes

- Oncology

- Cardiology

- Nephrology

- Autoimmune Disease

Regional Analysis

North America dominates this market as it holds

39.3% of the market shares in 2023 and is expected to show subsequent growth in the upcoming years of 2023 to 2032. North America's historic dominance within the healthcare specialty enzyme market may be attributed to a mixture of factors.

The place serves as an international hub for biomedical research and improvement, especially within the United States, fostering innovation in enzyme-related technology. Its sturdy healthcare infrastructure, characterized by advanced systems and a high call for unique enzymes, supports the adoption of cutting-edge enzyme-based solutions.

The presence of a significant portion of the global pharmaceutical and biotechnology industries similarly enhances North America's marketplace leadership, with these industries being the main customers of forte enzymes. Regulatory guide and requirements, get right of entry to enough capital, global marketplace leadership of key gamers based inside the area, and a dedication to technological improvements together contribute to North America's stronghold inside the healthcare uniqueness enzyme market.

However, it is crucial to recognize that other regions, such as Europe and Asia, also play vital roles in the market, and evolving global dynamics may influence regional standings in the future.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The healthcare uniqueness enzyme market is characterized by way of a competitive landscape shaped by using key gamers supplying a wide array of enzyme merchandise for diagnostic, therapeutic, and research applications. The competitive panorama, fashioned by way of innovations and pricing techniques, is continuously evolving.

Technological developments, regulatory shifts, and converting patron behaviors contribute to the dynamic nature of markets. Globalization, monetary conditions, and environmental considerations additionally play pivotal roles. These players include Novozymes, which has been identified as having several enzymes in research and investigation, Roche Diagnostics, a leading healthcare provider of enzymes in in vitro diagnostics, and Merck KGAA, which offers more enzymes in particular, and Thermo Fisher Scientific.

Other first-tier sponsors include Biocatalysts Ltd., Amano Enzyme Inc., Codexis, Inc., BASF SE, Dyadic International, Inc., and Advanced Enzyme Technologies Ltd. It is important to know whether there will be a chaotic panorama, with new entries or changes to existing players.

Some of the prominent players in the Global Healthcare Specialty Enzyme Market are

- Advanced Enzymes Technologies Ltd

- Amano Enzymes, Inc.

- Amicogen

- BBI Solutions

- Brain AG

- CPC Biotech

- Creative Enzymes

- EKF Diagnostics

- F. Hoffmann-La Roche Ltd

- Merck KGaA

- Sekisui Chemical Co., Ltd.

- Thermo Fisher Scientific Inc

- Other Key Players

Recent Developments

- In April 2023, Specialty Enzymes & Probiotics launched Pepzyme Pr, a new symbiotic and enzyme product. Pepzyme Pro is designed to address the negative effects of undigested protein on gut and digestive health. The product contains powerful protease enzymes and a symbiotic with 5 probiotic strains and a prebiotic, suitable for vegans and vegetarians. Specialty Enzymes & Probiotics emphasizes its commitment to gut health and offers technical support, positioning itself as a research-driven manufacturer in the field.

- In January 2023, Sun Pharma has acquired three brands – Disperzyme, Disperzyme -CD, and Phlogam – from Aksigen Hospital Care to strengthen its anti-inflammatory drug portfolio. The acquired brands, Disperzyme and Phlogam, are fixed-dose combinations of proteolytic enzymes and bioflavonoids, including Trypsin, Bromelain, and Rutoside. These brands represent the first enzyme-bioflavonoid combination of Trypsin, Bromelain, and Rutoside to complete a clinical study in India and receive DCGI approval.

- In November 2022, Novozymes and Chr. Hansen, a key player in the Danish food ingredient and enzyme sector, reached an agreement to merge. While both companies are involved in enzyme production, Chr. Hansen specializes in enzymes and microbial for the food industry. In contrast, Novozymes operates across diverse business sectors, primarily focusing on enzymes for household products, as well as catering to the food beverage, and biofuels industries.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 2.7 Bn |

| Forecast Value (2032) |

USD 4.8 Bn |

| CAGR (2023-2032) |

6.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Carbohydrate, Proteases, Lipases, Polymerase & Nucleases and Other), By Source (Microorganisms, Plants, and Animals), By Technique (Clinical Chemistry, Immunoassays, Molecular Diagnostics, Hematology and Microbiology), By Usage (Research & Biotechnology and Diagnosis), By Application (Infectious Diseases, Diabetes, Oncology, Cardiology, Nephrology and Autoimmune Disease) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Advanced Enzymes Technologies Ltd, Amano Enzymes Inc., Amicogen, BBI Solutions, Brain AG, CPC Biotech, Creative Enzymes, EKF Diagnostics, F. Hoffmann-La Roche Ltd, Merck KGaA, Sekisui Chemical Co., Ltd., Thermo Fisher Scientific Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

\

Frequently Asked Questions

The Global Healthcare Specialty Enzyme Market size is estimated to have a value of USD 2.7 billion in

2023 and is expected to reach USD 4.8 billion by the end of 2032.

North America has the largest market share for the Global Healthcare Specialty Enzyme Market with a

share of about 39.3% in 2023.

Some of the major key players in the Global Healthcare Specialty Enzyme Market are Advanced Enzymes

Technologies Ltd, Amano Enzymes Inc., Amicogen, and many others.

The Healthcare Specialty Enzyme market is growing at a CAGR of 6.8 % over the forecasted period.