Market Overview

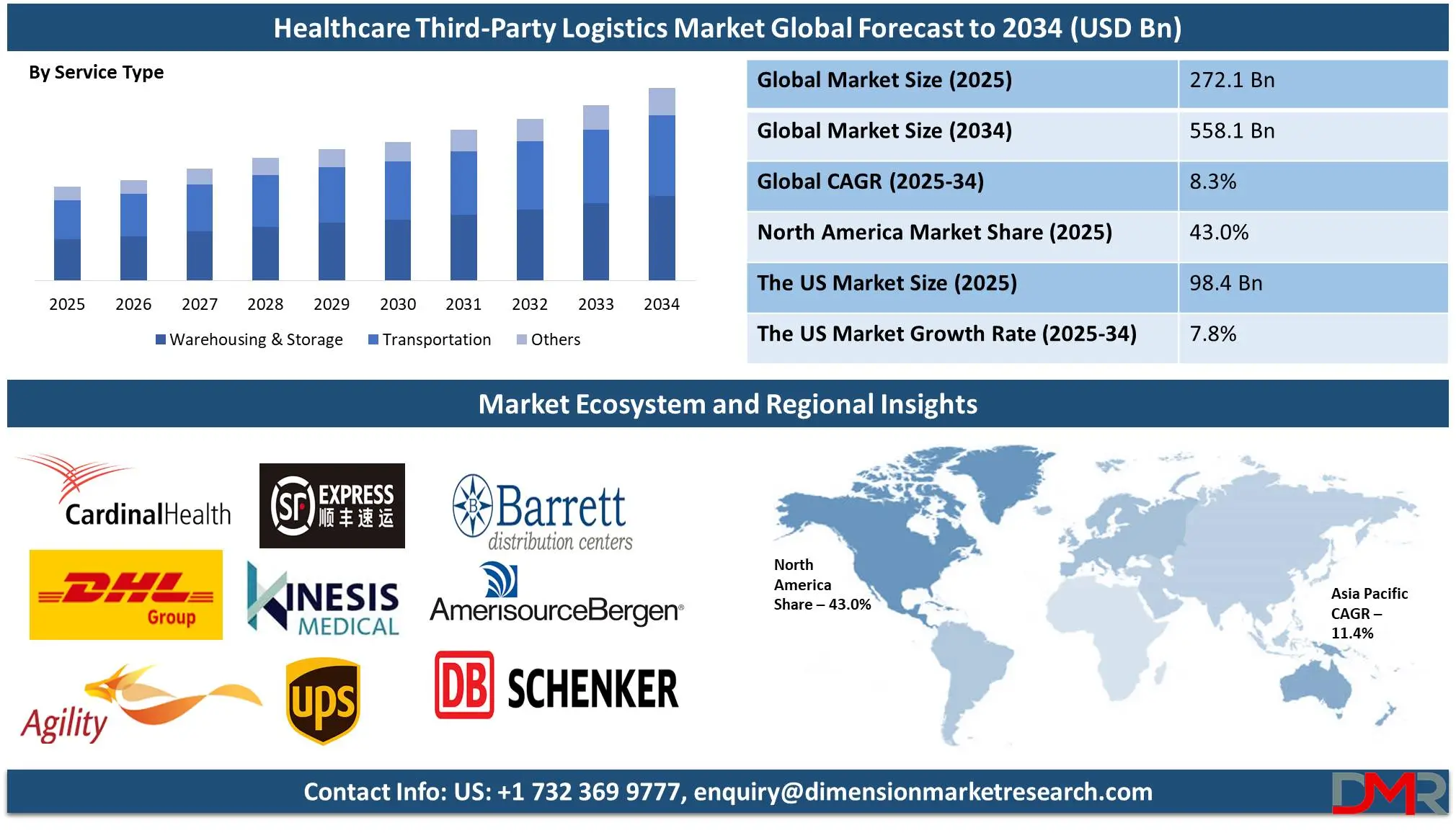

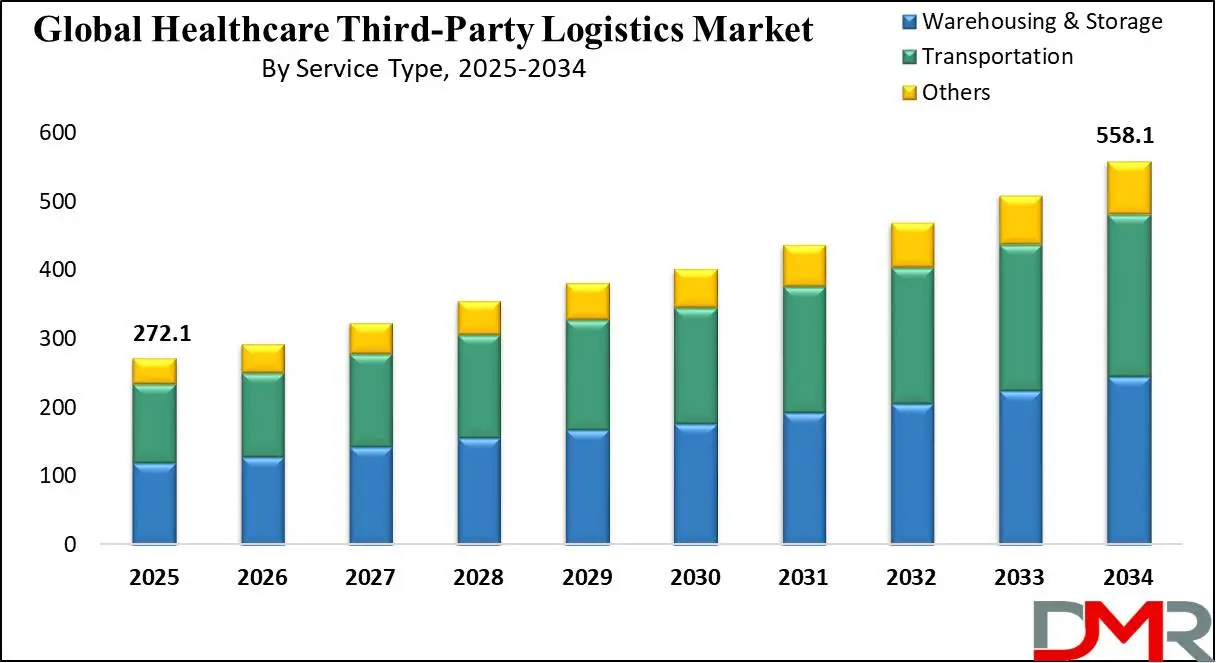

The Global

Healthcare Third-Party Logistics Market size is expected to be valued at

USD 272.1 billion in 2025, and it is further anticipated to reach a market value of

USD 558.1 billion by 2034 at a

CAGR of 8.3%.

The global healthcare third-party logistics (3PL) market plays an essential role in the efficient distribution and supply chain management of healthcare products such as pharmaceuticals, medical devices, biopharmaceuticals, vaccines, and clinical trial materials. Healthcare 3PL providers offer various services like transportation, warehousing, inventory management, packaging, cold chain logistics, and regulatory compliance support to ensure safe timely cost-effective delivery of sensitive medical supplies globally.

The market is experiencing significant growth, driven by the increasing globalization of the pharmaceutical supply chain, the rising demand for temperature-sensitive biologics and vaccines, and the need for advanced logistics solutions to support complex healthcare products. Additionally, the surge in e-commerce for pharmaceutical products, integrated with the growing trend of outsourcing logistics to specialized 3PL providers, is further propelling market expansion.

Key contributors to the growth of the healthcare 3PL market include rapid advancements in biologics, research, and personalized medicine practices, stringent regulatory requirements for product safety, and robust cold chain infrastructure requirements. The global healthcare 3PL market is experiencing robust expansion, driven by several key drivers that are revolutionizing supply chain management in healthcare. These factors not only influence the operational dynamics of the industry but also offer logistics providers an opportunity to innovate and expand their services.

Biologics development is one of the major driving forces behind growth for healthcare 3PL providers. Biologics such as vaccines, monoclonal antibodies, and gene therapies are extremely sensitive to environmental conditions and require rigorous temperature controls, storage facilities with specialized environments, real-time monitoring systems, and inventory controls to protect them. Biologics differ from traditional pharmaceuticals in having shorter shelf lives and requiring careful handling throughout their supply chains.

Regulated requirements for product safety are another major influencer on the growth of the healthcare 3PL market. Healthcare industries adhere to stringent regulations to ensure product efficacy, and quality during storage and transport. Cold chain infrastructure has become even more essential with the increased demand for temperature-sensitive healthcare products such as biologics, vaccines, and some pharmaceuticals. Their distribution requires an uninterrupted cold chain supply to preserve product integrity. As healthcare continues to advance and evolve globally, 3PL providers will increasingly play a vital role in assuring safe, compliant delivery of critical medical products globally.

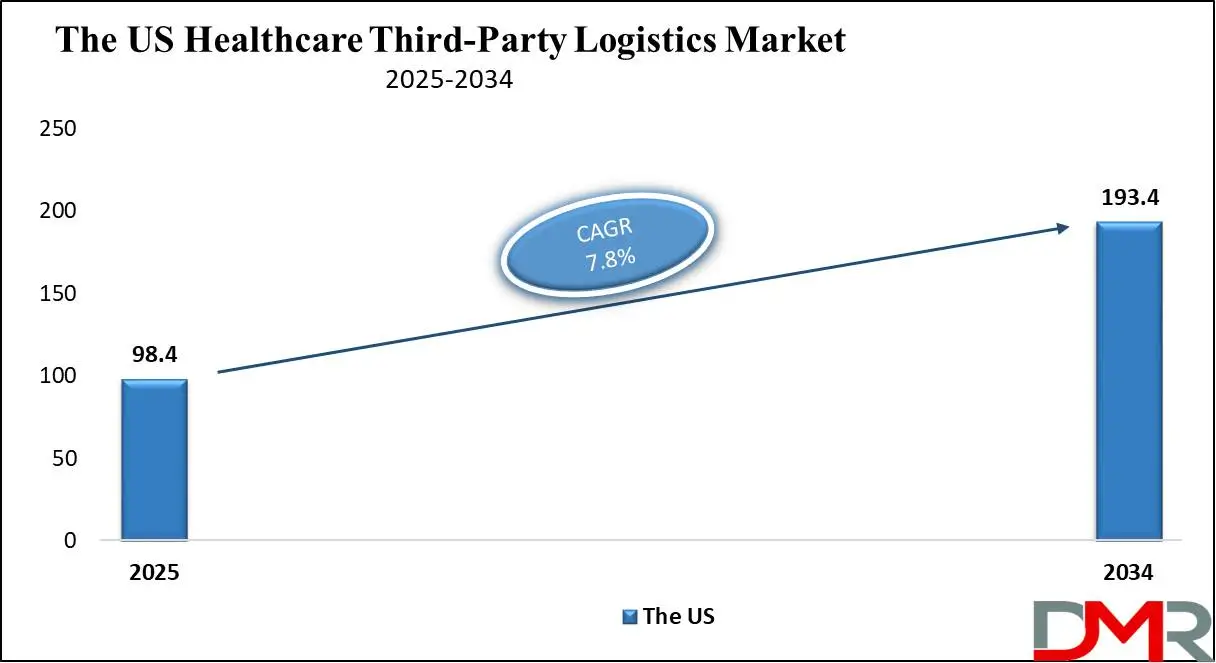

The US Healthcare Third-Party Logistics Market

The US Healthcare Third-Party Logistics Market is projected to be valued at USD 98.4 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 193.4 billion in 2034 at a CAGR of 7.8%.

The US healthcare third-party logistics (3PL) market is an integral component of American healthcare infrastructure, highlighting the efficient distribution of pharmaceuticals, medical devices, biologics, vaccines, and clinical trial materials. It is one of the largest and most advanced healthcare markets globally, which is experiencing remarkable growth driven by technological advancements, regulatory requirements, and an ever more complex pharmaceutical supply chain. Biologics development has been an essential growth driver of the US healthcare 3PL market in recent years.

The US leads biopharmaceutical innovation with a range of gene therapies, monoclonal antibodies, and vaccines on its shelves that require stringent temperature control, handling specialization, and real-time monitoring to maintain efficacy, consequently increasing demand for cold chain logistics providers with expertise managing storage and transportation for temperature sensitive goods like biologics.

Personalized medicine in the US is driving substantial growth in the healthcare 3PL market. Patient-specific therapies, like CAR-T cell therapies and precision oncology treatments, require customized logistics solutions customized specifically for them. U.S. 3PL providers are investing more heavily in infrastructure including secure transportation networks and advanced tracking technologies to support this rapidly developing field of personalized medicine.

US healthcare regulatory requirements are among the strictest around the globe, overseen by agencies like FDA and DEA. Their regulations mandate strict adherence to Good Distribution Practices (GDP) and Good Manufacturing Practices (GMP), especially for controlled substances or high-risk products. Additionally, this regulatory landscape has spurred strong demand for third-party logistics (3PL) providers that specialize in compliance management, supply chain solutions that promote secure supply chains, and quality assurance systems.

Global Healthcare Third-Party Logistics Market: Key Takeaways

- Market Value: The global healthcare third-party logistics market size is expected to reach a value of USD 558.1 billion by 2034 from a base value of USD 272.1 billion in 2025 at a CAGR of 8.3%.

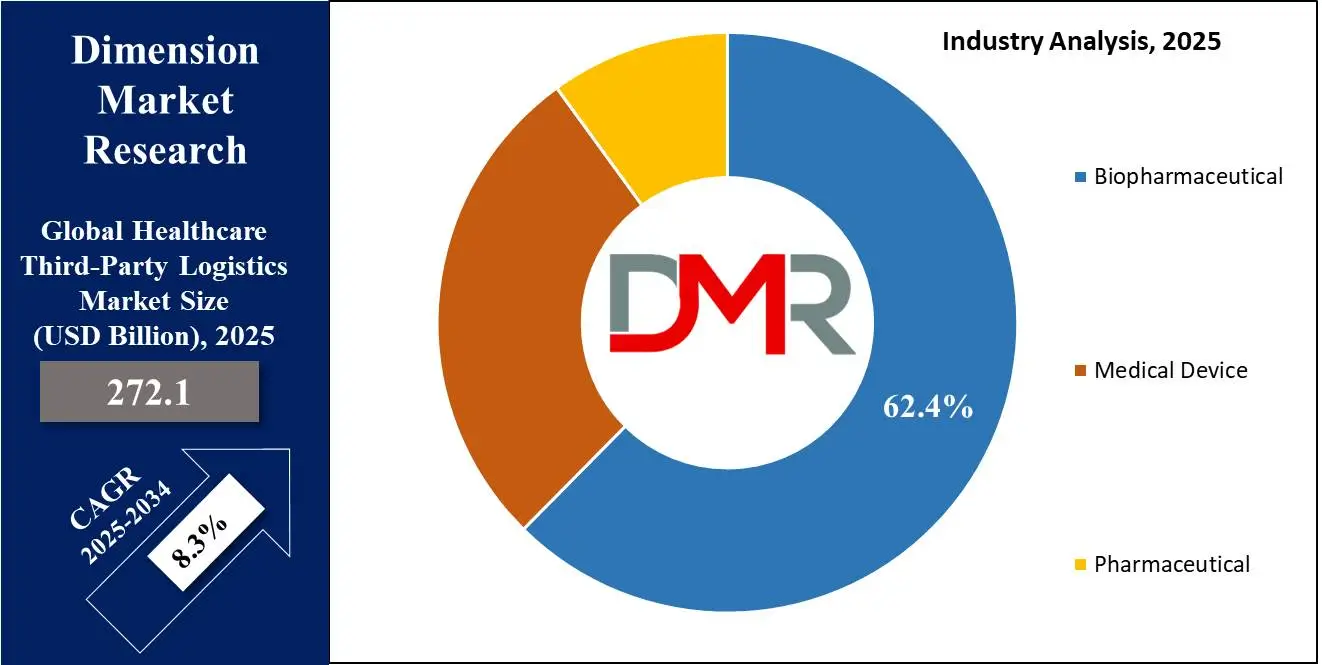

- By Industry Type Segment Analysis: The Biopharmaceutical industry is anticipated to lead in the industry type segment, capturing 62.4% of the market share in 2025.

- By Service Type Segment Analysis: Warehousing & Storage Services is poised to consolidate its market position in the service type segment capturing 44.0% of the total market share in 2025.

- By Supply Chain Type Segment Analysis: The Non-Cold Chain is projected to maintain its dominance in the supply chain type segment capturing 81.2% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global healthcare third-party logistics market landscape with 43.0% of total global market revenue in 2025.

- Key Players: Some major key players in the global healthcare third-party logistics market are Cardinal Health, DHL Group, Agility, SF Express, Kinesis Medical B.V., United Parcel Service of America, Inc., and Other Key Players.

Global Healthcare Third-Party Logistics Market: Use Cases

- Cold Chain Logistics for Temperature-Sensitive Biologics: The transportation and storage of biologics, such as vaccines, insulin, monoclonal antibodies, and gene therapies, require strict temperature control to maintain product efficacy and safety. 3PL providers offer specialized cold chain solutions, including temperature-controlled warehouses, refrigerated transport, and real-time monitoring systems.

- Clinical Trial Logistics and Supply Chain Management: The management of clinical trial materials involves complex logistics, including the distribution of investigational drugs, laboratory samples, and medical equipment to trial sites globally. 3PL providers offer end-to-end solutions such as temperature-controlled shipping, inventory management, regulatory compliance, and reverse logistics for unused products. Their expertise ensures that clinical trial supplies are delivered accurately, on time, and under strict regulatory guidelines, supporting the rapid progression of new drug development.

- Pharmaceutical Distribution and Inventory Management: 3PL providers manage the large-scale distribution of pharmaceutical products from manufacturers to wholesalers, pharmacies, hospitals, and clinics. They offer integrated services, including warehousing, inventory control, order fulfillment, and last-mile delivery. This is particularly critical for high-demand medications and specialty drugs that require precise handling and traceability. By leveraging advanced technologies such as automated warehouse systems and real-time tracking, 3PL companies help optimize the supply chain, reduce costs, and improve delivery efficiency.

- Emergency Medical Supply Chain Support during Crises: In emergencies like natural disasters, pandemics, or humanitarian crises, 3PL providers play a vital role in rapidly mobilizing and distributing critical medical supplies, including PPE, ventilators, medicines, and vaccines. Their global network, expertise in regulatory compliance, and ability to manage complex logistics enable them to respond quickly to urgent healthcare needs.

Global Healthcare Third-Party Logistics Market: Stats & Facts

- The U.S. Food and Drug Administration (FDA) mandates that prescription drug wholesale distributors and third-party logistics providers (3PLs) submit annual reports to ensure compliance with the Drug Supply Chain Security Act (DSCSA). This requirement underscores the critical role of 3PLs in maintaining the integrity of the pharmaceutical supply chain.

- The FDA has proposed national standards for the licensure of wholesale drug distributors and 3PLs. If finalized, this rule would establish a federal licensing system to ensure consistent regulatory oversight across states, highlighting the importance of standardized practices in the healthcare 3PL sector.

Global Healthcare Third-Party Logistics Market: Market Dynamic

Global Healthcare Third-Party Logistics Market: Driving Factors

Rising Demand for Temperature-Sensitive Pharmaceutical Products

The global healthcare third-party logistics (3PL) market is experiencing significant expansion, driven by rising demand for temperature-sensitive pharmaceutical products. This category encompasses biologics, vaccines, specialty drugs, and cell and gene therapies that require temperature-controlled supply chains to preserve efficacy, safety, and quality.

These medications, unlike traditional pharmaceuticals, are extremely sensitive to environmental changes, even minor temperature variations can cause their degradation and become ineffective or harmful. As more pharmaceutical manufacturers turn their focus towards biologics and personalized medicines, the demand for logistics solutions capable of transporting such delicate products has risen.

Biologics have revolutionized the treatment of chronic illnesses like cancer, autoimmune disorders, and rare genetic conditions, but their complex composition makes them highly sensitive to temperature variations. As healthcare regulations become more stringent, the demand for reliable 3PL services increases exponentially.

Authorities like the Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose regulatory guidelines to ensure the safe handling, storage, and distribution of temperature-sensitive drugs. Failure to adhere can have severe repercussions, including product recalls, financial losses, and damage to brand reputation. Pharmaceutical companies are increasingly turning to third-party logistics providers with expertise in cold chain capabilities, regulatory compliance, and risk management.

Increasing Complexity of Global Healthcare Supply Chains

Pharmaceutical and healthcare industries have become more globalized than ever, sourcing raw materials, active pharmaceutical ingredients (APIs), and finished products from multiple countries across continents to source, manufacture, and distribute via 3PL providers who specialize in managing multifaceted processes efficiently. Pharmaceutical companies are under immense pressure to cut costs, improve operational efficiencies, and ensure timely deliveries of critical medical products. However, managing such complex, international supply chains internally is both challenging and resource-intensive.

Coordinating cross-border shipments, handling multiple transportation modes, meeting international regulations, and mitigating risks associated with geopolitical issues, customs clearance delays or supply disruptions require expertise that many pharmaceutical companies lack internally. Personalized medicine, orphan drugs, and clinical trial materials further complicate healthcare supply chains. These products often require special handling techniques as well as faster distribution models that cater to patient requirements. 3PL providers excel in managing such dynamic operations with real-time tracking capabilities, data analytics capabilities, and agile inventory management.

Global Healthcare Third-Party Logistics Market: Restraints

Regulatory Challenges and Compliance Issues

Compliance with Good Distribution Practices (GDP), Good Manufacturing Practices (GMP), and other stringent guidelines require meticulous care at each step in the logistics process, from temperature regulation and packaging security, tracking products in real-time, managing sensitive data securely, adhering to specific documentation and reporting requirements. This places 3PL providers managing temperature-sensitive pharmaceutical products under extreme risk of regulatory penalties, product recalls, and reputational harm. Additionally, regulatory requirements vary significantly across countries and regions, further complicating international logistics.

Navigating cross-border compliance means dealing with various import/export regulations, customs procedures, quality control standards, and supply chain disruptions which can cause delays, and increased operational costs, and supply chain disruptions. Regulatory issues and compliance constraints present a barrier to the growth of the global healthcare 3PL market. Given their complex, variable, and dynamic nature, healthcare regulations present logistics providers with additional risks and costs that hinder expansion efforts or accessing new markets effectively.

High Risk of Product Damage and Security Concerns

The risk of product damage and security concerns during storage and transportation is another major hurdle for the market expansion. Pharmaceutical products like biologics, vaccines, and specialty drugs are highly sensitive to environmental conditions like temperature, humidity, and light exposure, even minor variations from prescribed storage and handling conditions could compromise their safety, efficacy, and quality, leading to financial losses, regulatory penalties and reputational damage for both 3PL providers and pharmaceutical companies. Healthcare supply chains can also be vulnerable to risks related to product theft, counterfeiting, and tampering, particularly when transporting high-value drugs and controlled substances.

Healthcare supply chains can also be vulnerable to risks related to product theft, counterfeiting, and tampering, particularly when transporting high-value drugs and controlled substances. Pharmaceutical cargo has high market value and is easy to resell, as a result, inadequate security measures, lack of real-time tracking systems, and weak points in the supply chain such as transshipment or storage facilities increase security breaches with potential, financial, and health ramifications if stolen products enter into legitimate supply chains.

Global Healthcare Third-Party Logistics Market: Opportunities

Expansion of Emerging Markets

Emerging markets present an invaluable opportunity for the global healthcare third-party logistics (3PL) market, particularly those found in Asia-Pacific, Latin America, the Middle East, and Africa. These regions are experiencing robust economic growth integrated with rising healthcare investments, improving infrastructure, and increased access to advanced medical treatments. Due to an increasing incidence of chronic disease, increasing middle-class populations, and expanding healthcare awareness in emerging economies, pharmaceuticals, vaccines, and medical devices are being consumed at higher rates than ever.

With such an increase in demand, 3PL providers now have an unprecedented opportunity to deliver end-to-end logistics solutions customized to address the unique requirements of these markets. As digital health platforms and e-commerce continue to proliferate in emerging markets, their impact is further altering the healthcare supply chain landscape. The increased adoption of online pharmacies, telemedicine services, and direct-to-patient delivery models requires agile logistics solutions with faster delivery times, real-time tracking capabilities, customized supply chain services, and customizable supply chain services designed specifically for these models.

Adoption of Advanced Technologies in Supply Chain Management

Advanced technologies present a significant growth opportunity for the global healthcare third-party logistics (3PL) market. As healthcare becomes more complex, there is an increasing need for innovative logistics solutions that enhance efficiency, and visibility and ensure compliant transport of pharmaceutical products. Emerging technologies such as the Internet of Things (IoT), artificial intelligence (AI), blockchain, big data analytics, and automation are transforming traditional logistic operations providing 3PL providers with opportunities to provide value-added services to clients.

One of the most beneficial technologies in healthcare logistics is IoT-enabled real-time monitoring systems, which provide continuous tracking of temperature, humidity, location, and other key parameters during transportation and storage of pharmaceutical products that require tight temperature regulation, such as biologics, vaccines, and specialty drugs.

Artificial intelligence and machine learning are driving efficiency in healthcare logistics by offering predictive analytics for demand forecasting, route optimization, and risk management. These technologies can quickly analyze large amounts of data to detect patterns that signal potential supply chain disruptions while offering proactive measures to mitigate them, leading to cost savings, improved delivery timelines, and enhanced decision-making capabilities for both 3PL providers and their healthcare clients.

Global Healthcare Third-Party Logistics Market: Trends

Growing Adoption of Cold Chain Logistics in the Healthcare Industry

One of the major trends impacting global healthcare 3PL markets is the increasing adoption of cold chain logistics. As demand for temperature-sensitive pharmaceutical products like biologics, vaccines, insulin, specialty drugs, and advanced therapies like gene and cell therapies continues to surge, robust cold chain solutions have become ever more essential, this trend is driven by their complexity which necessitates precise temperature controls throughout their supply chains to ensure efficacy, safety, and stability of delivery.

Technology advances are also driving cold chain logistics growth. By using IoT-enabled sensors, GPS tracking, and real-time data analytics to track temperature, humidity, and other key conditions throughout transportation processes, these technologies provide improved supply chain visibility while allowing proactive interventions.

Personalized medicine and biologics with their shorter shelf lives and stringent handling requirements have led to an increased demand for cold chain solutions customized specifically for temperature-sensitive products, including innovative packaging materials, advanced refrigeration systems, and last-mile delivery solutions. Cold chain logistics has emerged as a prominent trend in healthcare 3PL markets globally, as pharmaceutical manufacturers increasingly turn their focus to biologics, personalized therapies, and global distribution networks.

Rising Demand for End-to-End Supply Chain Visibility

Within this highly regulated healthcare industry, where product integrity, safety, and timely delivery of pharmaceuticals are of utmost importance, real-time visibility across every step of supply chains is now an absolute requirement. This can be explained by factors like the globalization of supply chains as well as rising regulatory compliance needs to be integrated with an increase in risk management practices and operational efficiencies that are further driving its development. Pharmaceutical companies face many unique challenges, such as managing temperature-sensitive products, navigating differing regulatory environments, and mitigating risks related to products.

To address these difficulties effectively, healthcare organizations are turning to 3PL providers who offer comprehensive visibility solutions that enable real-time tracking of goods from point of origin to final destination, giving greater control over inventory management, transportation conditions, and storage spaces.

Adopting innovative technologies like the Internet of Things (IoT), radio-frequency identification (RFID), blockchain, and advanced data analytics has proven indispensable for increasing supply chain visibility. IoT devices and RFID tags that collect real-time information such as temperature, humidity, location, and security status help detect issues before they escalate, which further reduces product spoilage risks, minimizes supply chain disruptions, and optimizes overall efficiency.

Global Healthcare Third-Party Logistics Market: Research Scope and Analysis

By Industry Type

The Biopharmaceutical industry is anticipated to lead in the industry type segment, capturing 62.4% of the market share in 2025. This dominance can be attributed to the rapid expansion of the biopharmaceuticals sector, which provides complex products like biologics, monoclonal antibodies, gene therapies, and cell-based treatments. Biopharmaceuticals differ significantly from their pharmaceutical counterparts as they require tight temperature regulation, special handling procedures, and rigorous compliance with regulations across their supply chains. Due to this greater level of complexity, advanced logistics solutions must be deployed effectively.

The medical device segment is poised for significant growth within the global healthcare third-party logistics (3PL) market, driven by rapid technological advancements, increasing healthcare demands, and evolving regulatory landscapes. As the healthcare industry shifts towards more personalized, technology-driven care, the demand for efficient, reliable, and specialized logistics solutions for medical devices is rising steadily, positioning this segment as a key contributor to market expansion.

The surge in demand for advanced medical technologies, particularly in diagnostics, therapeutic devices, and surgical instruments has driven the market expansion. The increasing prevalence of chronic diseases, such as cardiovascular disorders, diabetes, and respiratory conditions, has accelerated the adoption of sophisticated medical devices, including Class II and Class III devices, which require specialized handling, stringent regulatory compliance, and secure transportation.

By Service Type

Warehousing & Storage Services is anticipated to consolidate its market position in the service type segment capturing 44.0% of the total market share in 2025. This growth is being fueled by a growing demand for specialized storage solutions required to store pharmaceuticals, biopharmaceuticals, medical devices, and diagnostic equipment that come from diverse and complex supply chains.

Furthermore, unlike typical consumer goods that only need temperature and humidity regulation, healthcare products require specific environmental controls to preserve safety, efficacy, and quality throughout their shelf lives. One factor contributing to the increasing prominence of warehousing and storage services is a rising need for temperature-controlled and cold-chain storage solutions. Biologics, vaccines, and specialty drugs that are particularly sensitive to temperature variations have necessitated advanced cold storage facilities as a solution.

The transportation segment is emerging as a pivotal growth driver in the global healthcare third-party logistics (3PL) market, fueled by the increasing need for fast, reliable, and secure delivery of pharmaceutical products, medical devices, and biologics across global supply chains. With the healthcare industry becoming more interconnected and patient-centric, the demand for efficient transportation solutions, including air freight, sea freight, and overland transportation, is rising significantly to meet the challenges of time-sensitive and temperature-sensitive product distribution.

One of the primary factors driving the growth of transportation services is the surging demand for specialty pharmaceuticals and biologics, which require expedited delivery under controlled conditions. These high-value products, such as vaccines, gene therapies, and injectable biologics, often have strict temperature requirements and limited shelf lives, making rapid and reliable transportation crucial to maintaining product integrity from manufacturing facilities to end-users.

By Supply Chain Type

The Non-Cold Chain is projected to maintain its dominance in the supply chain type segment capturing 81.2% of the market share in 2025. This dominance can be attributed to the growing demand for non-temperature sensitive healthcare products like generic pharmaceuticals, over-the-counter (OTC) drugs, medical devices, surgical instruments, and diagnostic equipment that don't need temperature-controlled storage conditions, unlike cold chain products which necessitate precise temperature management, making their logistics processes more flexible and cost-effective than their cold counterparts.

One key driver behind the non-cold chain segment's dominance is its high volume of generic drugs and OTC products in the global pharmaceutical market. Generics account for an increasing portion of sales globally due to their affordability, widespread availability, and essential role in treating common health conditions.

The cold chain segment is emerging as a critical growth driver in the global healthcare third-party logistics (3PL) market, with its importance rising rapidly alongside evolving healthcare demands. One of the key factors propelling the growth of the cold chain segment is the rising demand for biologics and biosimilars, which are highly sensitive to temperature variations.

Unlike traditional small-molecule drugs, biologics are complex molecules derived from living organisms, requiring strict temperature conditions, typically between 2°C and 8°C, or even ultra-low temperatures for certain advanced therapies. The surge in biologics for treating chronic diseases such as cancer, autoimmune disorders, and rare genetic conditions has created an urgent need for sophisticated cold-chain logistics solutions to preserve drug efficacy from production to patient delivery.

The Healthcare Third-Party Logistics Market Report is segmented based on the following:

By Industry

- Biopharmaceutical

- Vaccines

- Plasma Derived Products

- Others

- Medical Device

- Class I

- Class II

- Class III

- Pharmaceutical

By Service Type

- Warehousing and Storage

- Transportation

- Air Freight

- Sea Freight

- Overland Transportation

- Others

By Supply Chain

- Non-Cold Chain

- Cold Chain

Global Healthcare Third-Party Logistics Market: Regional Analysis

Leading region with the largest Revenue Share

North America is anticipated to lead the global healthcare third-party logistics market landscape with

43.0% of total global market revenue in 2025. This dominance can be attributed to various key factors, such as its well-developed healthcare infrastructure, high healthcare expenditure, advanced logistics networks, and stringent regulatory environment necessitating specialized logistic services. Furthermore, the presence of major pharmaceutical, biotechnology, and medical device companies reinforces North America's leadership within the global healthcare 3PL landscape.

The region is home to global industry giants who rely heavily on third-party logistics providers to effectively manage their complex supply chains. Companies involved in biopharmaceutical manufacturing produce a variety of products ranging from generic drugs to advanced biologics and personalized therapies that require sophisticated logistics solutions such as temperature-controlled transportation, specialized warehousing facilities, and real-time supply chain monitoring.

Region with the highest CAGR

The Asia-Pacific (APAC) region is projected to experience the highest compound annual growth rate in the global healthcare 3PL market in 2025. This rapid expansion can be attributed to many factors, including the expanding pharmaceutical industry, rising healthcare expenditures, increasing demand for advanced medical products, and improvements in logistics infrastructure. Furthermore, demanding regulatory compliance responsibilities integrated with digital healthcare services has contributed significantly towards this rapid expansion in APAC region healthcare 3PL market growth.

Countries like China, India, Japan, and South Korea are rapidly emerging as centers for pharmaceutical production due to cost advantages, skilled labor availability, and favorable government policies. India is widely recognized as the "pharmacy of the world", due to its massive production of generic medicines. China, on the other hand, has become an active player in both active pharmaceutical ingredients (APIs) and finished drug formulation. As both industries expand rapidly, the demand for logistics services like warehousing, distribution, and cold chain management is rising, necessitating third-party logistics providers as a service solution.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASIAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Healthcare Third-Party Logistics Market: Competitive Landscape

The global healthcare third-party logistics (3PL) market is highly competitive, featuring both established and emerging players who strive to expand their market positions through mergers, acquisitions, partnerships, and technological innovation. This dynamic environment is driven by the increasing complexity of healthcare supply chains' demand for specialized logistics services and compliance with stringent regulatory requirements regarding the transport and storage of sensitive healthcare products.

Leading companies in the healthcare 3PL market are expanding their service portfolios to offer end-to-end logistics solutions, such as transportation, warehousing, cold chain management, inventory control, and distribution.

Major logistics providers are using their extensive global networks, advanced infrastructure, and technological capabilities to offer customized solutions for the unique requirements of pharmaceutical, biopharmaceutical, and medical device manufacturers. These companies are investing heavily in automation technologies, real-time tracking systems, and temperature-controlled logistics to increase supply chain visibility, improve efficiency, and preserve product integrity throughout transportation processes.

Sustainability and green logistics have an increasing effect on competitive strategies as stakeholders demand more eco-friendly practices throughout their supply chains. Companies are taking measures such as adopting eco-friendly packaging materials, optimizing transportation routes to minimize carbon emissions, and investing in energy-efficient warehousing facilities to demonstrate their commitment to global environmental goals while strengthening brand reputation.

Some of the prominent players in the global healthcare third-party logistics are

- Cardinal Health

- DHL Group

- Agility

- SF Express

- Kinesis Medical B.V.

- United Parcel Service of America, Inc.

- Barrett Distribution

- AmerisourceBergen Corporation

- DB Schenker

- FedEx

- KUEHNE + NAGEL

- Kerry Logistics Network Ltd.

- Freight Logistics Solutions

- Other Key Players

Recent Developments

- October 2024: McKesson, Cencora, and Cardinal Health made strategic acquisitions to strengthen their foothold in the oncology sector. These companies have been actively acquiring oncology practices to gain greater control over the distribution of cancer therapies and capitalize on the rising demand for oncology treatments. The integration of cancer-specialist networks into their supply chains allows these wholesalers to streamline logistics for specialty drugs, improve patient access, and enhance profitability within the high-growth cancer care segment.

- September 2024: UPS announced its plans to acquire Frigo-Trans, a Germany-based healthcare logistics firm specializing in temperature-controlled warehousing and freight forwarding across Europe. This strategic acquisition aims to strengthen UPS’s cold-chain logistics capabilities, particularly in the European market. The deal also includes Frigo-Trans' sister company, BPL, with the acquisition expected to be finalized in early 2025. This move reflects UPS’s focus on expanding its presence in the fast-growing pharmaceutical and biologics logistics segment, where temperature-sensitive handling is critical.

- August 2024: C.H. Robinson, a global leader in third-party logistics, announced the expansion of its healthcare logistics division, focusing on pharmaceuticals, medical devices, and biologics. The company introduced new cold chain solutions and enhanced real-time tracking technologies to improve supply chain visibility and ensure the safe transport of temperature-sensitive healthcare products. This expansion is part of C.H. Robinson’s broader strategy to capture a larger share of the growing healthcare 3PL market by offering integrated, technology-driven logistics solutions tailored to the complex needs of healthcare clients.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 272.1 Bn |

| Forecast Value (2034) |

USD 558.1 Bn |

| CAGR (2025-2034) |

8.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 98.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Industry (Biopharmaceutical, Medical Device, and Pharmaceutical), By Service Type (Transportation, Warehousing and Storage, and Others), By Supply Chain (Cold Chain, and Non-Cold Chain) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Cardinal Health, DHL Group, Agility, SF Express, Kinesis Medical B.V., United Parcel Service of America, Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The global healthcare third-party logistics market size is estimated to have a value of USD 272.2 billion in 2025 and is expected to reach USD 558.1 billion by the end of 2034.

The US healthcare third-party logistics market is projected to be valued at USD 98.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 193.4 billion in 2034 at a CAGR of 7.8%.

The market is growing at a CAGR of 8.3 percent over the forecasted period.

Some of the major key players in the global healthcare third-party logistics market are Cardinal Health, DHL Group, Agility, SF Express, Kinesis Medical B.V., United Parcel Service of America, Inc., and many others.