Market Overview

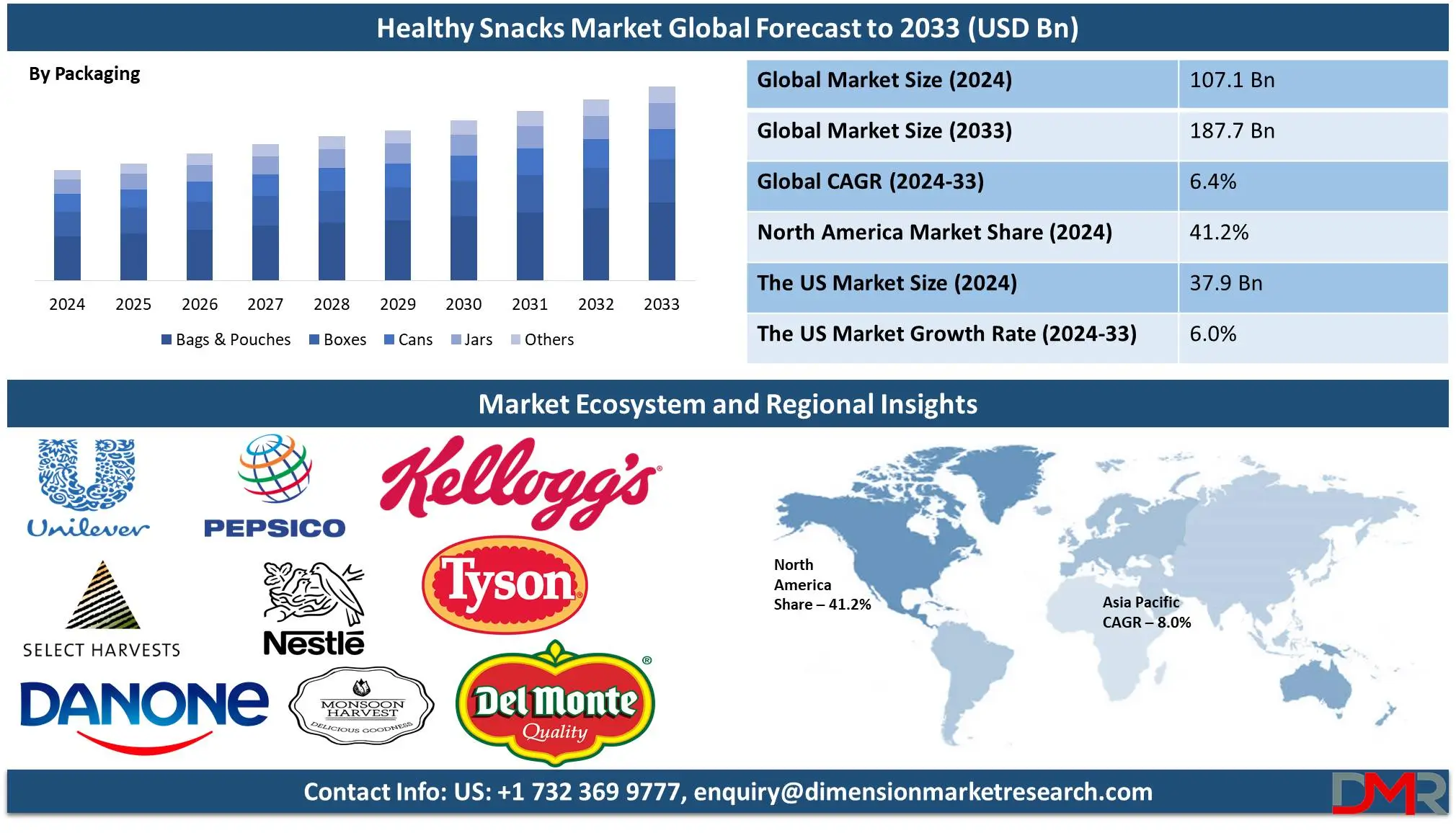

The Global Healthy Snacks Market is projected to reach USD 107.1 billion in 2024 and grow at a compound annual growth rate of 6.4% from there until 2033 to reach a value of USD 187.7 billion.

Rising health awareness, urban lifestyles, and demand for convenient yet nutritious food options are driving this growth across regions. North America currently leads with close to 41.2% share, while Asia-Pacific, led by countries such as China and India, is emerging as the fastest-growing region, with growth rates above 7% annually.

Consumer behavior continues to reshape the industry. Social conversations about healthy snacks have increased by

14.3% year-over-year, highlighting growing public interest. In the U.S.,

0.58% (21,781) of restaurants now feature healthy snack dishes on their menus. A remarkable

93% of consumers have expressed a desire to transition toward healthier options. In India, a survey of over

6,000 people revealed evolving snacking patterns, with

39% of snacking occasions driven by pleasure, followed by

36% for energy management and

25% for goal support. Additionally, innovations such as

Probiotics Packaging are emerging to align with consumer demand for healthier and functional snack options.

Key trends defining the market include the rise of plant-based, clean-label, and functional snacks featuring ingredients such as probiotics, adaptogens, and protein-rich blends. There is also a strong focus on gut health, high fiber, and low sugar formulations, as consumer searches for “high protein” snacks grew by 39%, while “high fiber” options spiked by 159% in the past year. Additionally, sustainability and eco-friendly packaging are becoming important purchase drivers, with younger consumers showing heightened preference for environmentally responsible brands.

At recent global food and nutrition conferences, emphasis was placed on functional snacking, reduced-sugar alternatives, and globally inspired flavors. These innovations are shaping the next wave of healthy snacking, ensuring that the category continues to expand rapidly while aligning with consumers’ evolving health and lifestyle goals.

Healthy snacks are food products that are said to be less harmful to human health in comparison to conventional snacking items, which are consumed in small or limited proportions in between regular meals and are known as snacks. They are available in various forms, like packaging items. However, they can also be made at home utilizing regular food ingredients, as in most cases sweets, sandwiches, nuts, and fruits are considered snacks. Some of them are healthier in comparison to other options, mainly processed or ultra-processed products.

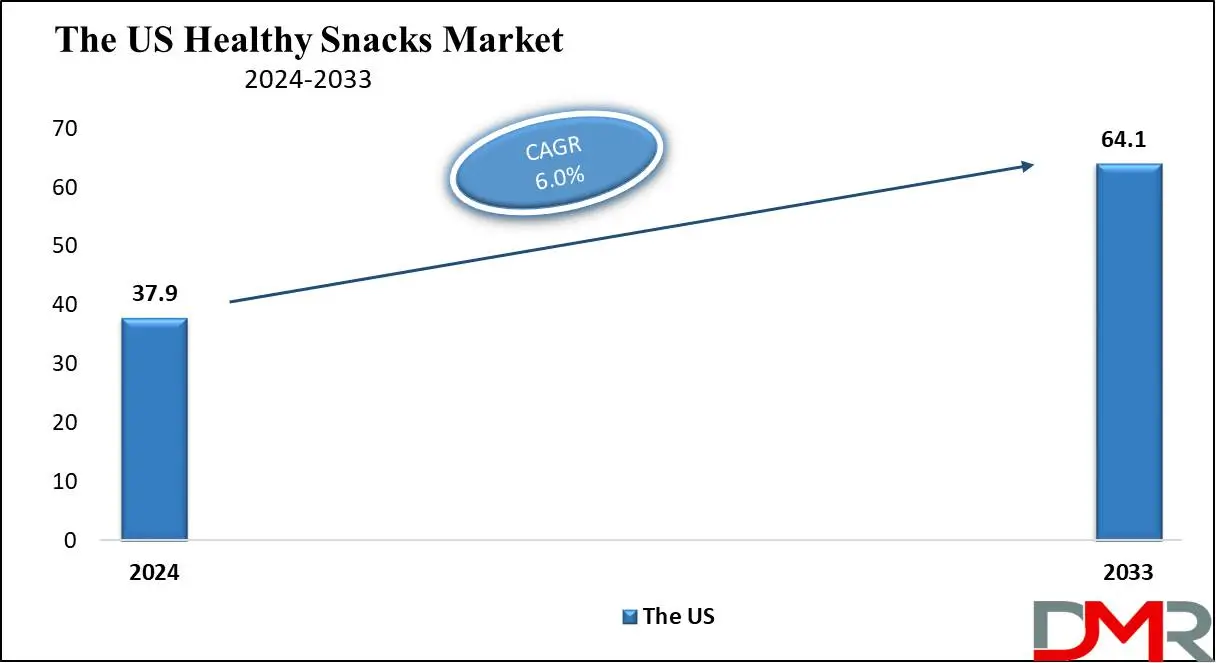

The US Healthy Snacks Market

The US Healthy Snacks Market is projected to reach USD 37.9 billion in 2024 at a compound annual growth rate of 6.0% over its forecast period.

In the US opportunities in the healthy snack market are driven by higher consumer demand for convenient, nutritious options, mainly plant-based and protein-rich snacks. The growing focus on health, driven by awareness of chronic diseases, supports innovation in low-sugar, functional foods. In addition, e-commerce expansion and sustainable packaging trends further boost opportunities in this sector.

Further, the higher consumer preference for nutritious, low-sugar, and plant-based snacks, is driven by growth in health awareness and lifestyle diseases like obesity. However, a major restraint is the higher cost of healthy snacks in comparison to conventional alternatives, which can limit accessibility and discourage price-sensitive consumers.

Key Takeaways

- Market Growth: The Healthy Snacks Market size is expected to grow by 74.5 billion, at a CAGR of 6.4% during the forecasted period of 2025 to 2033.

- By Product: The fruit, nuts, & seeds segment is anticipated to get the majority share of the Healthy Snacks Market in 2024.

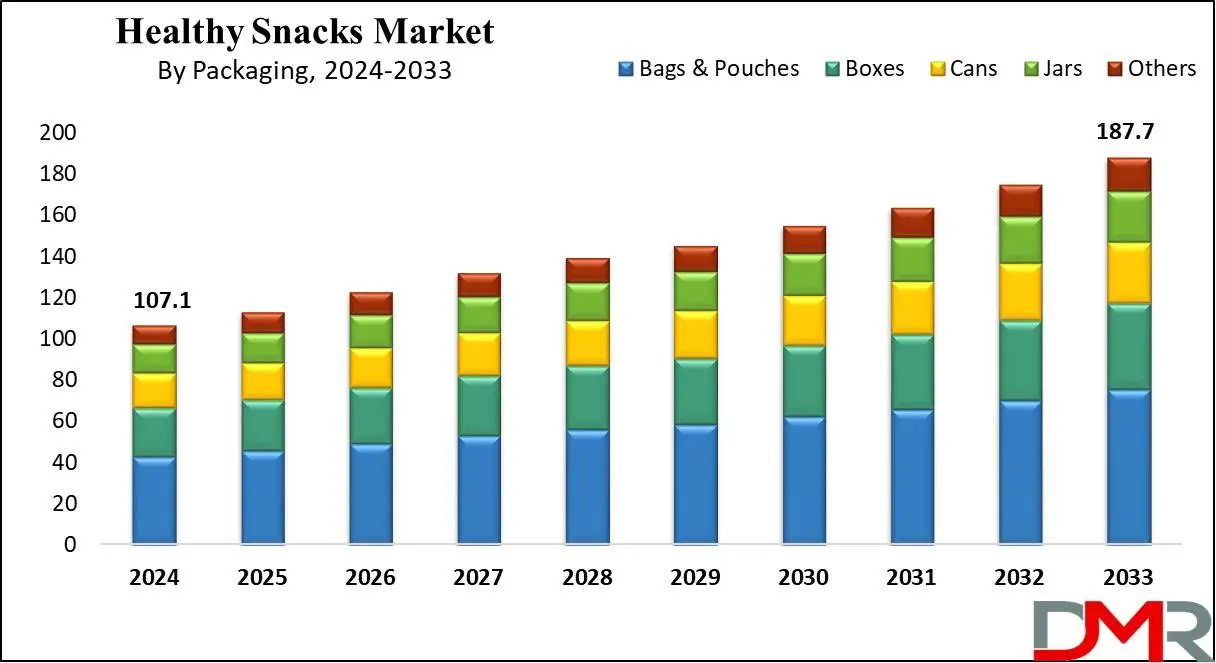

- By Packaging: The Bags & Pouches segment is expected to be leading the market in 2024

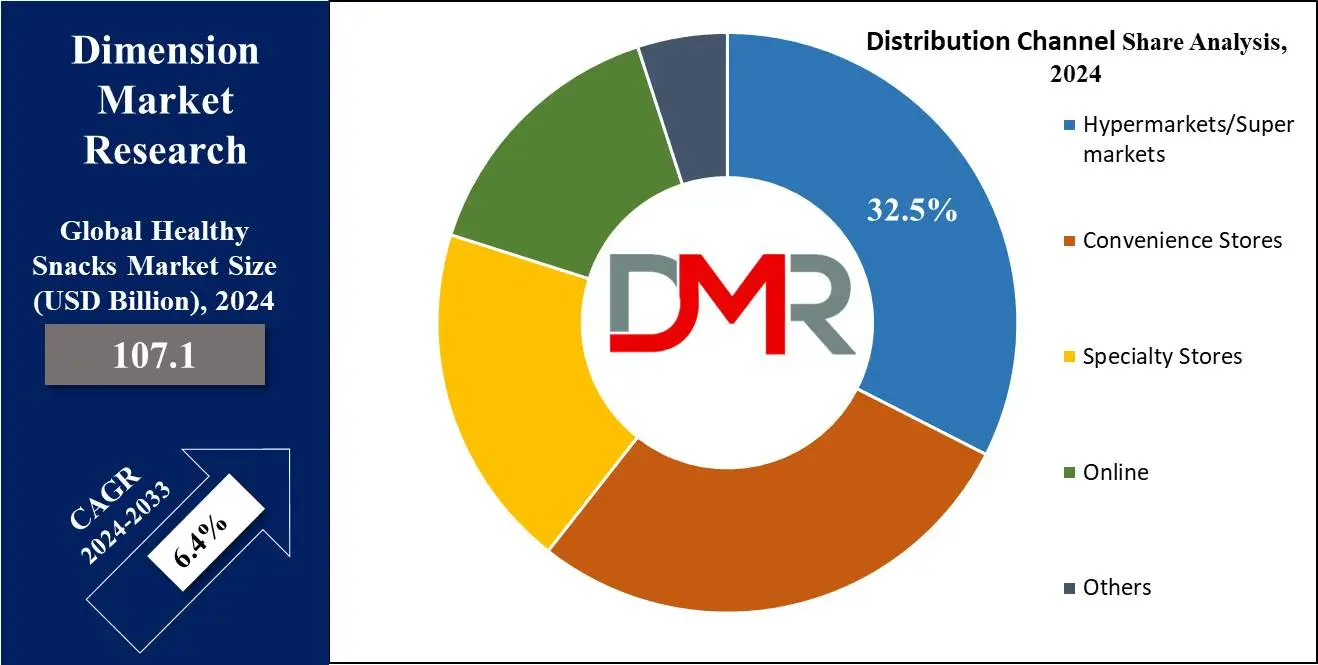

- By Distribution Channel: The hypermarket/supermarkets segment is expected to get the largest revenue share in 2024 in the Healthy Snacks Market.

- Regional Insight: North America is expected to hold a 41.2% share of revenue in the Global Healthy Snacks Market in 2024.

- Use Cases: Some of the use cases of Smart Parking systems include office/study productivity, weight management, and more.

Use Cases

- On-the-Go Nutrition: This is ideal for busy individuals who need quick, portable nourishment to sustain energy throughout the day.

- Post-Workout Recovery: It helps replenish glycogen, promote muscle repair, and maintain hydration with snacks rich in proteins and healthy carbs.

- Office/Study Productivity: Healthy snacks like nuts, fruits, or yogurt curb hunger without causing sugar crashes, keeping look and productivity high.

- Weight Management: Low-calorie, fiber-rich snacks like vegetables, seeds, or whole grains help control portions and prevent overeating during meals.

Market Dynamic

Driving Factors

Rising Health Consciousness

The growing awareness about lifestyle diseases like obesity and diabetes drives consumers to select nutritious snacks, driving the demand for low-calorie, organic, and functional foods.

Convenience and Innovation

The increase in the demand for convenient, on-the-go options has led to product innovations like plant-based snacks, protein bars, and superfood blends, attracting health-focused consumers.

Restraints

High Costs

Premium ingredients (like organic, non-GMO, or gluten-free) and sustainable packaging drive up production costs, making healthy snacks more costly and limiting their accessibility to price-sensitive consumers.

Shorter Shelf Life

The lack of artificial preservatives in many healthy snacks results in reduced shelf life, posing challenges in storage, distribution, and inventory management for retailers.

Opportunities

Expansion into Emerging Markets

The rise of urbanization and the growth in disposable incomes in developing regions provide significant potential for healthy snack brands to tap into new consumer segments.

Customization and Personalization

Providing customized snack options (such as keto-friendly, allergen-free, or high-protein) via digital platforms can attract niche health-conscious consumers and enhance brand loyalty.

Trends

Natural and Clean ingredients

Consumers are looking at snacks with natural ingredients, avoiding artificial additives and preservatives. Clean-label products focusing on low or no added sugar, salt, or fat are becoming highly popular, aligning with the desire for health-conscious eating habits.

Protein-Packed Snacks

High-protein products like bars, shakes, and cereals are gaining popularity across the world. These snacks look into multiple needs ranging from satiety and muscle recovery to meal substitutes mainly among active individuals. Offering indulgent flavors alongside health benefits is also key to their success in the market.

Research Scope and Analysis

By Product

In 2024, the fruit, nuts, and seeds segment is expected to capture a significant share of the healthy snack market, which is due to higher consumer demand for convenient, nutritious, and delicious snack options. As many people become aware of the importance of maintaining a healthy lifestyle, they are looking for snacks that provide real nutritional benefits.

In addition, dietary trends like plant-based diets, veganism, and paleo eating are gaining traction, and fruits, nuts, and seeds fit perfectly within these preferences. Their reputation as wholesome, natural, and sustainable snacks also appeals to environmentally conscious consumers, further driving market demand.

In addition, the healthy bakery snacks segment is also expected to experience steady growth, owing to the change in consumer preferences, with a growing interest in lifestyle diets that favor gluten- and grain-free alternatives along with plant-based foods. The popularity of artisanal and specialty bakery items and the demand for snacks made from natural and organic ingredients are significantly contributing to the growth of this market.

By Packaging

In 2024, bags and pouches are expected to dominate the healthy snacks packaging market, capturing a significant share due to their convenience and lightweight design. These packaging types are popular for their ability to keep snacks fresh and their portability, making them perfect for consumers who are always on the move. The ease of use further enhances their appeal for on-the-go snacking.

Further Boxes are another important packaging option, mostly for items like cereals, bars, and baked goods. They provide sturdy protection and are easy to stack for storage. In addition, it provides excellent branding opportunities, allowing companies to explicitly provide attractive designs and nutritional information that attract health-conscious buyers. While cans are less common, they are still relevant for packaging products like nuts and seeds, valued for their higher shelf life and ability to keep snacks protected from air and light.

Moreover, jars made from glass or high-quality plastic are used for premium snacks, like gourmet spreads and organic items. Their reusable and recyclable nature appeals to environmentally conscious consumers, aligning with the growing trend towards sustainable packaging in the healthy snacks market

By Claim

The low/no-sugar snack segment is set to capture a significant market share in 2024, due to the growing concerns over obesity and heart-related health issues. As consumers become more aware of the risks linked with excessive sugar and fat consumption, they are paying closer attention to product labels.

Snacks with less fat are seen as healthier choices, mainly for managing weight and promoting cardiovascular health. In response, manufacturers are reformulating products to maintain great taste while lowering sugar and fat content, meeting the increase in the demand for nutritious, guilt-free snacking options.

Further, the gluten-free snack segment is also anticipated to expand rapidly in the coming years, which is owing to an increased awareness of gluten sensitivity and the need for dietary alternatives. Gluten, a protein found in wheat, rye, and barley, can cause serious reactions in individuals with celiac disease or non-celiac gluten sensitivity.

As knowledge of these conditions spreads, more consumers are actively looking for gluten-free products, even beyond those with medical conditions, to align with personal health goals, which allows food companies to develop more gluten-free snacks, catering to both dietary needs and evolving consumer preferences.

By Distribution Channel

Supermarkets & hypermarkets are projected to lead the healthy snacks market in 2024, which is largely driven by convenient locations and the immediate availability of products, making it easy for consumers to buy snacks on the go. Numerous supermarket chains are well-known across the world for their variety of products, contributing to market growth. In addition, investments in infrastructure enhancement are further supporting the expansion of this segment, allowing retailers to attract more customers and drive sales of healthy snacks.

Further, the online segment is forecasted to grow the fastest in the market. E-commerce platforms expand from partnerships and collaborations that expand product accessibility and boost demand. Online stores provide convenience by delivering products directly to consumers' homes and providing access to numerous items, overcoming geographical limitations. As online grocery shopping gains popularity, mainly in countries like the US, more consumers are turning to websites and apps for their food needs, which is expected to spread across other regions, further driving the growth of online healthy snack sales.

The Healthy Snacks Market Report is segmented on the basis of the following

By Product

- Fruits, Nuts & Seeds

- Bars & Confectionery

- Savory

- Frozen & Refrigerated

- Bakery

- Dairy

- Others

By Packaging

- Bags & Pouches

- Boxes

- Cans

- Jars

- Others

By Claim

- Low/No Sugar

- Gluten Free

- Low/No Fat

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

Regional Analysis

North America is set to lead the healthy snacks market, holding a

significant 41.2% share in 2024, as a transformation towards healthier eating habits among the North American population is high owing to growing concerns over chronic diseases and obesity. The demanding work culture in the US and Canada encourages individuals to adopt healthier lifestyles, contributing to an increase in the demand for nutritious snack options.

Growth in health awareness, assisted by various health campaigns, is driving people to maintain balanced diets. Moreover, advancements in infrastructure and technology have enabled the production of snacks that are low in sugar and high in protein. Further, the Asia Pacific region is expected to experience the fastest growth in the healthy snack market.

Countries like China, India, and Japan are looking to expand health awareness, leading to a higher demand for nutritious options as lifestyles become busier, which is prompting more manufacturers to enter these markets, thereby improving overall market growth. In addition, social media is playing a major role in informing consumers about global food trends, further boosting the demand for healthy snacks in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The healthy snacks market is highly competitive, driven by transforming consumer preferences for nutritious, convenient, and indulgent products. Companies look into product innovation, providing options like plant-based, protein-rich, and functional snacks to meet distinctive dietary needs. Startups & traditional food brands compete by improving flavors, using clean labels, and incorporating sustainability in packaging.

Market players are also utilizing digital platforms and direct-to-consumer strategies to reach health-conscious consumers. However, challenges like pricing pressures and shorter shelf life make companies balance between premium quality and affordability.

Some of the prominent players in the global Healthy Snacks are

- Unilever

- Nestle

- PepsiCo

- Select Harvest

- Kellogg Company

- Tyson Foods

- Monsoon Harvest

- Danone

- Del Monte Foods

- Hormel Foods Corp

- Other Key Players

Recent Developments

- In October 2024, KIND Snacks announced a series of industry-leading sustainable sourcing milestones by releasing its most ambitious sustainability commitment yet—to source 100% of its almonds from farms using regenerative agriculture practices on a mass-balance basis by 2030. As a brand that buys millions of pounds of almonds each year, KIND believes it has a responsibility to help the industry in moving towards more sustainable practices.

- In September 2024, Family Tree Farms created the Jack & Sun brand under its parent company, PayBack Provisions Inc, along with industry veterans Matt Fuller, Willem Meyer, and Amanda Goers by collaborating on creating healthy and delicious snacks from the fruit grown by Family Tree Farms and other world-class farmers. In addition, the launch of Jack & Sun marks the first line of healthy snacks under the brand, which reflects Family Tree Farms’ ongoing commitment to delivering high-quality produce while embracing innovative snack options that cater to modern families’ needs.

- In March 2024, Saffola Oats unveiled a new campaign for its flavored Oats range, where there are four innovative ad films staging a different scenario of snacking urges amongst a different consumer segment. The campaign attempts to highlight how Saffola Masala Oats provide a healthier and tasty go-to snack with a variety of delicious flavors for their anytime-of-the-day snacking moments.

- In February 2024, RIND Snacks acquired Small Batch Organics, which shows a major milestone in RIND's evolution from a leading dried fruit brand into a vertically incorporating healthy snack platform. At a time when many consumer packaged brands have scaled back in reaction to transforming market dynamics, RIND is making bold moves to proactively strengthen its business by taking ownership of manufacturing and fulfillment while largely expanding its product range and R&D capabilities to ensure long-term success.

- In November 2023, Myna Snacks launched its first product, the Midnight Mini Cookie, with more snack options to follow. Incubated by Connect Ventures, the investment partnership formed by leading entertainment & sports agency Creative Artists Agency (CAA) and global venture capital firm New Enterprise Associates (NEA), Myna brings together leaders in digital lifestyle, CPG, and growth-focused startups to usher in a new era of snacking.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 107.1 Bn |

| Forecast Value (2033) |

USD 187.7 Bn |

| CAGR (2024-2033) |

6.4% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 37.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Fruits, Nuts & Seeds, Bars & Confectionery, Savory, Frozen & Refrigerated, Bakery, Dairy, and Others), By Packaging (Bags & Pouches, Boxes, Cans, Jars, and Others), By Claim (Low/No Sugar, Gluten Free, Low/No Fat, and Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Online, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Unilever, Nestle, PepsiCo, Select Harvest, Kellogg Company, Tyson Foods, Monsoon Harvest, Danone, Del Monte Foods, Hormel Foods Corp, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Healthy Snacks Market size is expected to reach a value of USD 107.1 billion in 2024 and is expected to reach USD 187.7 billion by the end of 2033.

North America is expected to have the largest market share in the Global Healthy Snacks Market with a share of about 41.2% in 2024.

The Healthy Snacks Market in the US is expected to reach USD 37.9 billion in 2024.

Some of the major key players in the Global Healthy Snacks Market are Unilever, Nestle, PepsiCo, and others.

The market is growing at a CAGR of 6.4 percent over the forecasted period.