Market Overview

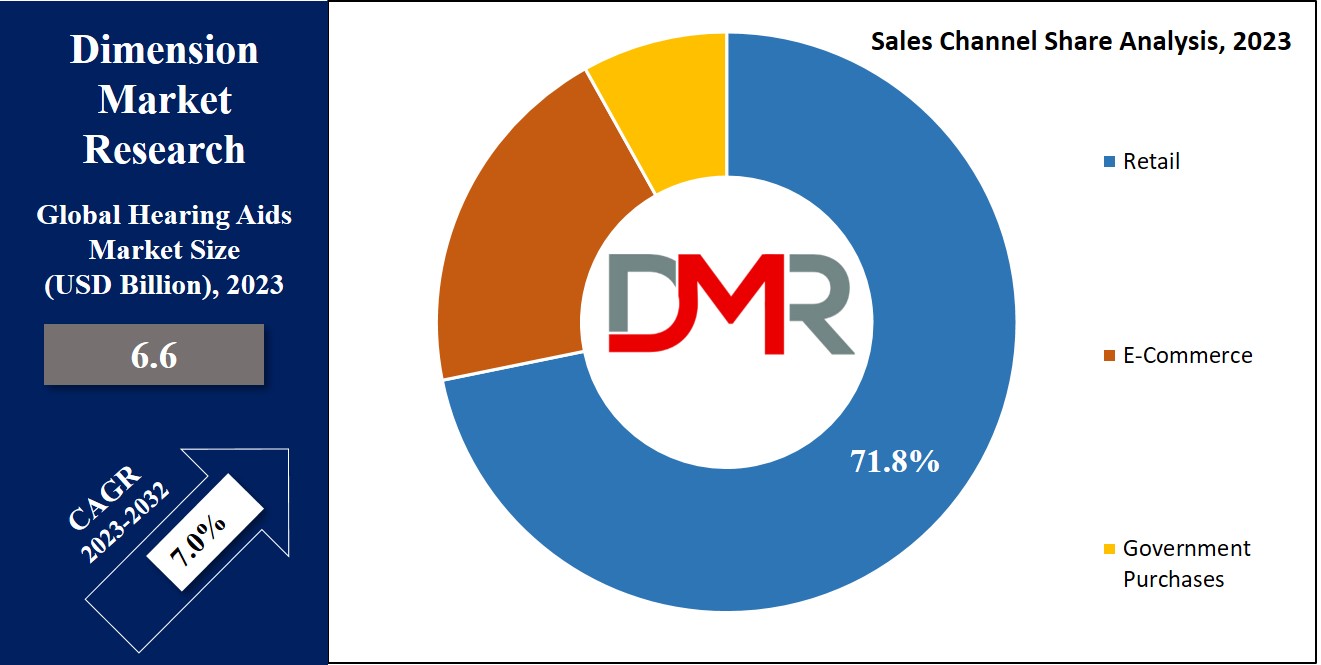

The Global Hearing Aids Market is expected to reach a value of USD 6.6 billion in 2023, and it is further anticipated to reach a market value of USD 12.2 billion by 2032 at a CAGR of 7.0%.

A hearing aid is a medical tool developed to enhance the hearing of individuals with hearing impairments. These devices work by making sounds louder & more accessible to the user. They operate by a simple three-part mechanism, including a microphone to pick up sounds, an amplifier to raise their volume, and a speaker to deliver the amplified sound to the wearer's ear, ultimately improving their ability to hear & understand sounds more clearly.

Key Takeaways

- Market Growth: The global hearing aids market is projected to grow from USD 6.6 billion in 2023 to USD 12.2 billion by 2032, at a 7.0% CAGR, driven by rising hearing loss cases and technological advances.

- Product Leaders: Behind-the-Ear (BTE) hearing aids hold the largest market share due to their adjustability, powerful amplification, and ease of handling, especially for younger users. Canal hearing aids show the fastest growth, favored for their discreetness.

- Digital Dominance: Digital hearing aids dominate the market and are set for rapid growth thanks to customization, noise reduction, and advanced programming, while analog aids remain in limited use for affordability.

- Retail Surge: Retail channels, led by independent stores, generate the most revenue, boosted by the introduction of over-the-counter (OTC) hearing aids and robust e-commerce growth, making devices more accessible and affordable.

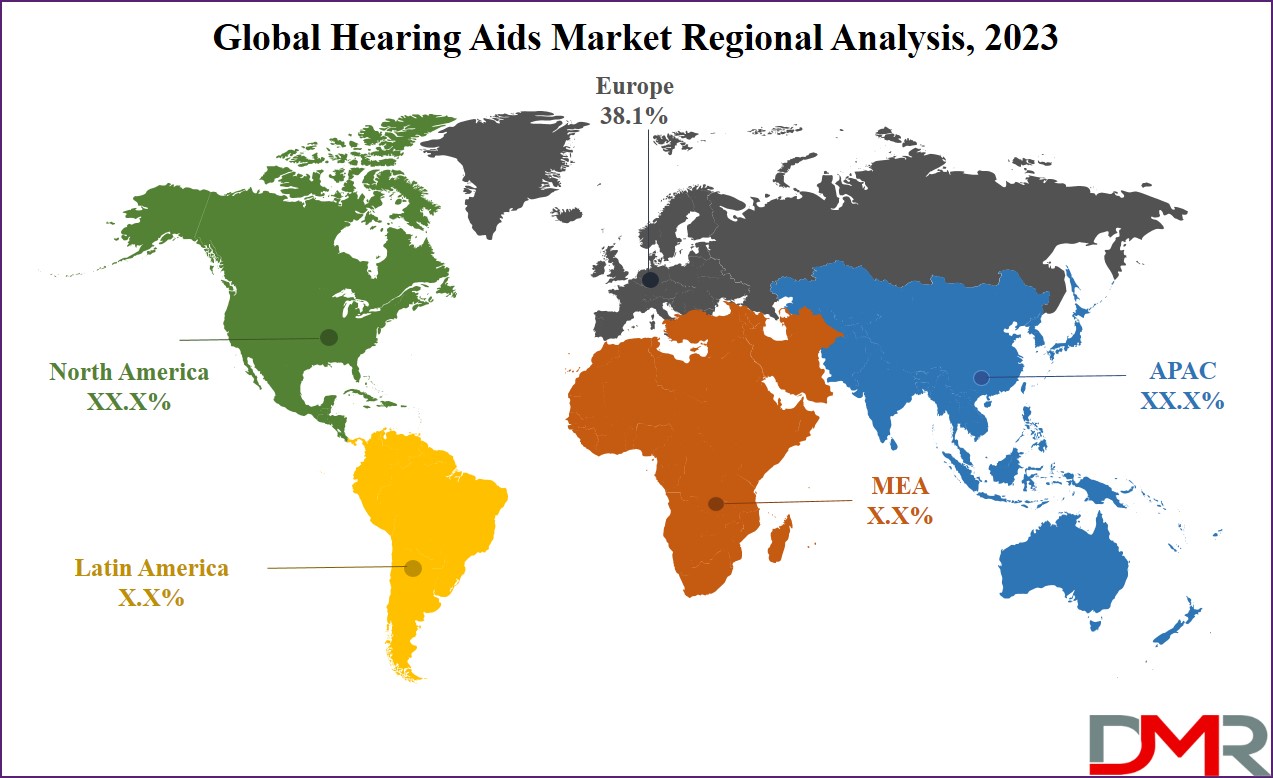

- Regional Highlights: Europe commands the largest market share (38.1% in 2023) due to an aging population and rising hearing loss. North America, especially the US, shows strong growth potential with increasing adoption rates.

- Innovation Focus: Major manufacturers are innovating with advanced, battery-efficient devices and expanding their product portfolios to address evolving consumer needs and extend market reach.

Use Cases

- Clinical Audiology Solutions: Hearing aids are crucial in clinics for personalized treatment of various degrees of hearing loss, improving patients’ quality of life and communication abilities.

- Elderly Care Facilities: Senior living centers use hearing aids to enhance residents’ social engagement, cognitive function, and overall well-being, addressing age-related hearing loss.

- Retail Accessibility Expansion: Over-the-counter and e-commerce hearing aid sales platforms enable broader, more affordable access to hearing technology, reaching underserved populations and new markets.

- Remote Teleaudiology Services: Telehealth-enabled hearing aids support remote fitting, adjustment, and monitoring, improving patient care in rural or mobility-challenged populations.

- Workplace Inclusion Programs: Businesses use advanced hearing aids to create inclusive environments, ensuring employees with hearing impairments can participate fully in meetings and collaborative tasks.

- School Integration Support: Educational institutions adopt discreet hearing solutions to help children with hearing loss integrate into classrooms and social activities without stigma.

Market Dynamic

In industrialized countries, there's a concerning rise in hearing loss cases. As per the World

Health Organization (WHO), by 2050, over 900 million people will struggle with severe hearing impairments, as many factors contribute to this, including vascular problems, chronic inflammation, genetic predisposition, noise exposure, & the natural aging of the ear, mainly affecting older individuals. Fortunately, hearing aid technology has made significant steps in the recent past. These tiny devices now incorporate smart technologies & digital platforms, highly assisting patients in addressing their hearing challenges and enhancing their overall auditory experience.

However, there are challenges to overcome in the hearing aids market, like increasing prices of hearing aid products may restrain the market growth shortly. In addition, the shortage of trained professionals could further challenge the growth of the hearing aids industry.

Research Scope and Analysis

By Product

The global hearing aids market as products are categorized into, behind-the-ear, canal, in-the-ear, and receiver-in-the-ear, where the Behind-The-Ear (BTE) hearing aids segment claims the largest share of revenue in 2023. BTE hearing aids are developed as small curved cases that comfortably fit behind the ear. They can be adjusted by connecting to external sound sources like infrared listening systems & auditory training equipment. Various BTE models are Bluetooth-compatible, enabling enhanced wireless connectivity & driving market demand. These devices provide powerful sound amplification with a bigger battery, and ease of handling & cleaning, making them a favorable choice for younger individuals. Importantly, they don't need frequent replacement as a child grows. Technological advances have led to innovations like the smaller & more comfortable Mini BTE, contributing to the segment's growth.

Further, canal hearing aids are expected to experience the fastest growth in the forecast period. These discreet devices are preferred by young adults due to their easily hidden nature, supporting the reduction of the stigma associated with wearing hearing aids. Technologically advanced canal devices excel at canceling out external noise & reducing tinnitus, factors that will drive their growth in the years to come.

By Technology

In terms of technology, the market has been categorized into digital & analog. In 2023, the digital segment has showcased its dominance in the market, commanding a significant share of the revenue, and it's expected to have rapid growth in the forecast period. This growth in digital device adoption is owing to the rise in preference for these advanced devices over analog ones, driven by ongoing technological developments. Digital hearing aids provide remarkable flexibility in sound programming, customizing the increased sound to address specific patterns of hearing loss, and enhancing their appeal to users.

However, the analog segment is expected to experience moderate market growth. Analog devices work by uniformly amplifying continuous sound waves, including both speech & noise. These hearing aids are highly accessible & remain in demand due to their affordability and a smaller group of resistant users. Although digital devices are overshadowing analog ones with their advanced features, some manufacturers still produce analog hearing aids due to their affordability and the reluctance of a minority of users to transition to digital technology.

By Sales Channel

The retail segment emerges as the dominant revenue generator in 2023, and it is expected to have rapid growth during the forecast period, which is driven by factors like the introduction of over-the-counter (OTC) hearing aids, which play an essential role in boosting retail sales. and can be attributed to various factors, like the growth in retail outlets, the entry of more manufacturing companies into retail sales, & the higher profit margins associated with retailing these devices. When it comes to retail sales, they are further categorized into company-owned & independent retail stores. Among these, independent retail stores lead the market due to their accessibility, profitability, & strong customer interaction, as players in independent retail sales include Walmart, Costco, CVS, and more.

Also, E-commerce sales have emerged as a driving force for the expansion of hearing aid distribution. The internet has become an important tool for information & decision-making when it comes to purchasing hearing aids, mainly for young adults & millennials. These platforms offer screening for hearing loss, comprehensive product information, and facilitate product & price comparisons, aiding consumers in their purchase decisions. E-commerce channels also improve the affordability & accessibility of hearing aids by providing flexible payment plans & removing the markup costs associated with traditional retail & wholesale channels, ensuring affordability for the customers.

The Hearing Aids Market Report is segmented on the basis of the following

By Product

- Behind-the-Ear Hearing Aids

- Canal Hearing Aids

- In-the-Ear Hearing Aids

- Receiver-in-the-Ear Hearing Aids

By Technology

By Sales Channel

- Retail

- E-Commerce

- Government Purchases

Regional Analysis

Europe stands as the leading region in the hearing aids market, securing the highest

market share at 38.1% in 2023, which can be attributed to different factors, including a rise in life expectancy, a growing elderly population, & a growth in the prevalence of hearing impairments among individuals. Further, the segment of elderly patients in the region exhibited the fastest growth during the projection period, highlighting the importance of addressing the hearing needs of the aging population. Adults form a major portion of the overall patient group due to their increase in susceptibility to hearing issues, ensuring a sustained and growing demand for hearing devices in this sector.

Moreover, North America is anticipated for significant development during the forecast period. Within North America, the US is expected to command a major portion of the market, driven by a higher predicted incidence of hearing impairments & a rise in the adoption of hearing aid devices, which reflects the substantial growth potential in the region, showing the rising awareness and use of hearing solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The hearing aids market features a fair degree of fragmentation, with various players operating on both a global and regional scale. Key hearing aid manufacturers are mainly concentrated on two strategic objectives, which are first, consolidating their position in the market, and second, expanding their range of products. Further, these companies are highly emphasizing the development of advanced hearing aid devices equipped with lithium-ion batteries, recognizing the improved advantages they offer, which focus on product innovation & diversification and look into addressing evolving consumer needs, indicating a shift towards more advanced, battery-efficient hearing solutions within the market.

For instance, in March 2022, Sonova acquired the consumer division of Sennheiser Electronic GmbH & Co. KG, which further enhanced the company's product portfolio while also growing its geographical footprint.

Some of the prominent players in the global Hearing Aids Market are:

- Cochlear Ltd

- Eargo Inc

- GN Store Nord A/S

- MED-EL

- Sonova

- Audicus

- MDHearing

- Jabra

- Amplifon

- Demant AS

- Other Key Players

Recent Developments

- In September 2024, Phonak launched the Infinio hearing aid portfolio in the UK, introducing innovative AI-driven and ergonomic designs.

- In August 2024, Sonova introduced Audéo Infinio and Audéo Sphere Infinio platforms under Phonak, enhancing sound clarity using real-time artificial intelligence for improved speech recognition.

- In October 2024, Sonova launched Unitron Ativo hearing devices, adding new Vivante styles, Stride V-M and Stride V-SP, to strengthen its product range.

- In February 2024, Oticon released Oticon Intent with 4D sensor technology, enabling advanced listening support and reduced background noise, representing a major product innovation.

- In March 2024, WS Audiology, collaborating with Sony, launched Rexton Reach, a rechargeable, consumer-friendly hearing aid with self-fitting capabilities for the US market.

- In July 2024, Phonak debuted the Sphere Infinio hearing aid in the US, featuring hands-free connectivity and advanced noise filtering.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 6.6 Bn |

| Forecast Value (2032) |

USD 12.2 Bn |

| CAGR (2023–2032) |

7.0% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Behind-the-Ear Hearing Aids, Canal Hearing Aids, In-the-Ear Hearing Aids, and Receiver-in-the-Ear Hearing Aids), By Technology (Digital and Analog), By Sales Channel (Retail, E-Commerce, and Government Purchases) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Cochlear Ltd, Eargo Inc, GN Store Nord A/S, MED-EL, Sonova, Audicus, MDHearing, Jabra, Amplifon, Demant AS, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Hearing Aids Market is estimated to reach USD 6.6 billion in 2023, which is further expected

to reach USD 12.2 billion by 2032.

Europe dominates the Global Hearing Aids Market with a share of 38.1% in 2023.

Some of the major key players in the Global Hearing Aids Market are Cochlear Ltd, Amplifon, Eargo Inc.,

and many others.

The market is growing at a CAGR of 7.0 percent over the forecasted period.