Market Overview

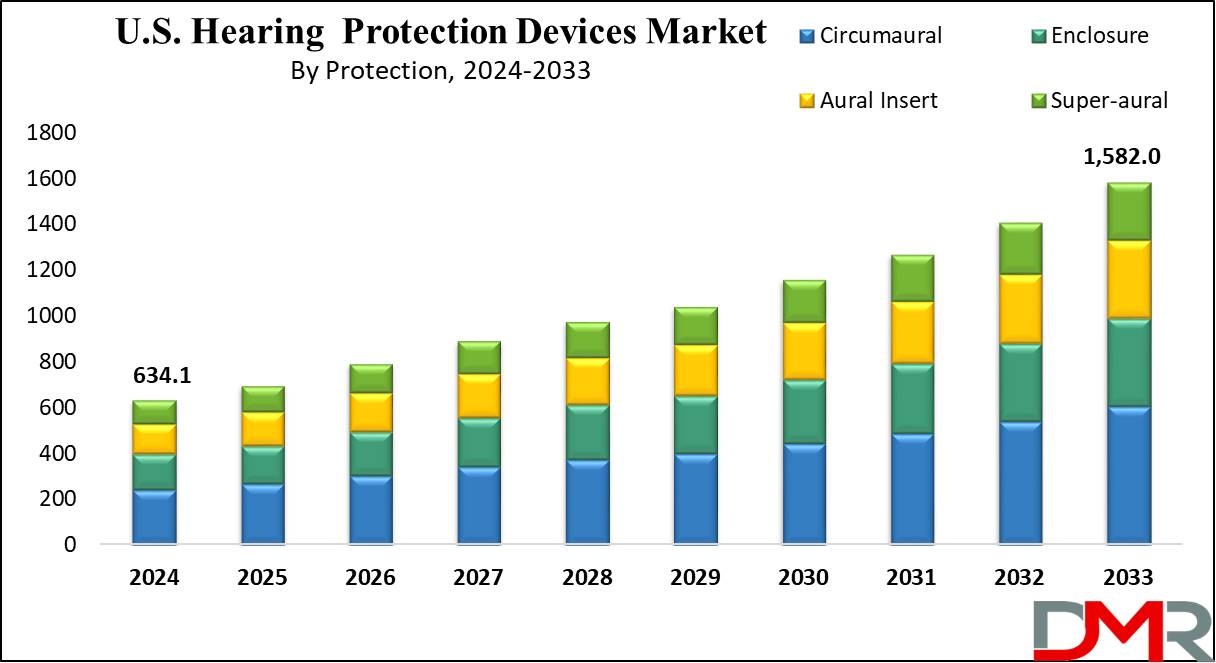

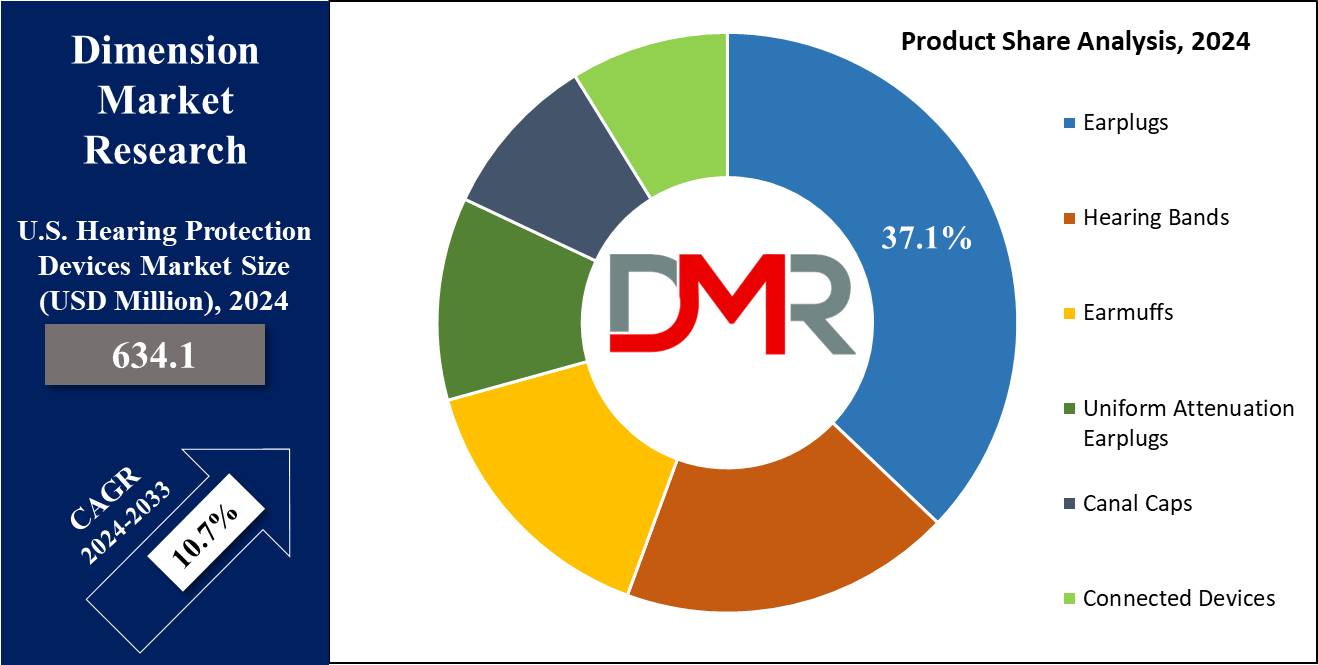

The U.S. Hearing Protection Devices Market is expected to reach a value of USD 634.1 million by the end of 2024, and it is further anticipated to reach a market value of USD 1,582.0 million by 2033 at a CAGR of 10.7%.

As per the CDC, hearing loss affects workers across all U.S. industries, with approximately 12% experiencing hearing difficulty and 8% reporting tinnitus. Alarmingly, 53% of noise-exposed workers do not wear hearing protection, despite 25% having been exposed to hazardous noise, with 14% (22 million) exposed in the past year.

Furthermore, 13% of those tested for noise exposure show hearing impairment in both ears. This significant prevalence of hearing-related issues underscores the critical need for effective hearing protection devices in the U.S. market, driving demand for innovative solutions to safeguard workers' auditory health.

HPD or a hearing protection device is an ear protection device that is placed in or over the ears while exposed to hazardous noise and provides hearing protection to prevent noise-induced hearing loss. HPDs minimize the level of noise entering the ear. HPDs can also protect against other effects of noise exposure like tinnitus & hyperacusis.

As per the Hearing Health Foundation, 30 million U.S. workers are exposed to hazardous noise levels on the job, contributing to a growing demand for hearing protection devices. Alarmingly, nearly 1 in 5 American teenagers are expected to experience hearing loss due to excessive exposure to loud sounds. This trend not only impacts the U.S. Hearing Protection Devices Market but also influences adjacent sectors such as the

Hearing Aids and

Telehealth solutions, where early adoption of auditory care solutions may reduce future demand for rehabilitative devices.

Among older adults, 25% of those aged 65-74 and nearly 50% of individuals 75 and older face disabling hearing loss. Musicians are particularly at risk, being 57% more likely to experience tinnitus. With the prevalence of high-decibel noise in everyday life, effective hearing protection is essential for safeguarding auditory health across all demographics.

Hearing protection devices (HPDs) are essential tools designed to safeguard against harmful noise exposure, particularly in industries such as construction, manufacturing, and aviation. The U.S. hearing protection devices market is experiencing significant growth, driven by increasing awareness of noise-induced hearing loss and stringent regulatory measures.

Innovations in materials and technology, including electronic earplugs and earmuffs, are enhancing user comfort and effectiveness. Recent news highlights a surge in demand for customizable and smart HPDs, creating opportunities for manufacturers to expand their product offerings. Additionally, integration with

Digital Health monitoring systems and IoT-enabled safety platforms is enhancing real-time auditory protection and compliance tracking.

Key Takeaways

- The U.S. Hearing Protection Devices Market is expected to grow by 947.9 million, at a CAGR of 10.7% during the forecasted period.

- By Product, earplugs are expected to lead in 2024 & are anticipated to dominate throughout the forecasted period.

- By Protection, circumaural is anticipated to drive the growth of the U.S. Hearing Protection market.

- By End User, the military sector is expected to have a lead throughout the forecasted period.

- Some of the use cases of hearing protection devices include supply chain visibility, inventory management in retail, and more.

Use Cases:

- Industrial Settings: In manufacturing, construction, & heavy industries, workers are mostly exposed to high levels of noise from machinery, equipment, & processes. HPDs like earmuffs or earplugs are important to protect workers' hearing health. Employers are mandated by the Occupational Safety & Health Administration (OSHA) to provide suitable hearing protection to employees exposed to noise levels exceeding certain thresholds.

- Military and Defense: Military personnel are largely exposed to loud noises from firearms, explosives, aircraft, and other sources. HPDs created for military use provide both hearing protection & communication capabilities, making soldiers hear important commands & sounds while still reducing harmful noise levels. These devices are important for preserving soldiers' hearing during training exercises and combat situations.

- Recreational Activities: Individuals participating in recreational activities like shooting sports, motorcycling, or attending concerts and festivals are at risk of noise-induced hearing damage. Custom-fit earplugs or noise-canceling headphones developed for recreational use provide effective hearing protection while allowing users to enjoy their activities without compromising sound quality or communication. These solutions are also increasingly seen as complementary products in the broader Medical Devices.

- Healthcare and Medical Settings: Healthcare professionals working in environments with high levels of ambient noise, like hospitals, clinics, and emergency rooms, can benefit from HPDs to protect their hearing & maintain focus during patient care. In addition, patients undergoing diagnostic procedures like MRI scans may be provided with ear protection to reduce discomfort from the loud scanner noises.

Market Dynamic

Increasing awareness about hearing loss is important in addressing its rising threat. Hearing loss can lead to isolation, isolating individuals from social interactions and activities. Awareness initiatives help in maintaining caution about hearing health & recognizing early signs of hearing loss. Early detection in children is mainly beneficial, creating timely intervention through hearing rehabilitation programs that support language & social development.

However, factors like limited awareness about hearing protection devices & improper maintenance can restrict market growth. Issues like discomfort, itching, or even pain associated with prolonged use of electronic hearing protection devices further restrain market growth. To drive behavior change, stakeholders like parents, civil society organizations, teachers, parents, & healthcare professionals can educate young people on practicing safe listening habits. Creating awareness about hearing protection is essential for reducing the risks associated with hearing loss

Research Scope and Analysis

By Product

In the U.S. hearing protection devices market, products are segmented into various types like earmuffs, earplugs, hearing bands, canal caps, uniform attenuation earplugs, and connected devices that meet different needs. Among these, the earplugs segment is expected to lead the market throughout the forecasted period, which comes from the growing number of hearing impairments linked to aging & exposure to loud environments.

Earplugs provide a convenient & effective solution to reduce the risk of hearing loss, appealing to a variety of users across industries & recreational activities. As awareness about hearing protection continues to grow, along with regulatory demand in workplaces, the need for earplugs is expected to grow. Further, manufacturers are likely to aim for innovation & customization within the earplug segment to address varied customer preferences & ensure optimal hearing safety in various settings.

By Protection

In terms of protection, the U.S. market for hearing protection devices is segmented into enclosure, super-aural, aural insert, and circumaural designs. Among these, the circumaural segment is anticipated to take the forefront in 2024, due to the increasing number of hearing impairments caused by noise exposure, making individuals look for effective solutions. Further, these devices stand out due to their larger number of uses and broader frequency range, rendering them mainly suitable for studio applications where better sound quality is the main.

With the increase in focus on protecting hearing health across many industries & recreational settings, circumaural devices are expected to witness higher demand. Manufacturers may focus on improving features & comfort levels within this segment to meet changing customer needs and ensure broader adoption among professionals and enthusiasts alike.

By End User

Within the U.S. hearing protection devices market, end-users include various sectors like mining, military, healthcare, construction, manufacturing, and others. Among these, the military segment is projected to lead the market throughout the forecasted period, which is driven by the broad use of earplugs for noise protection among soldiers, granting them a major advantage in combat zones. The military depends largely on hearing protection devices to safeguard soldiers' hearing in the middle of loud environments & explosive situations.

As defense priorities continue to focus on soldier safety & operational effectiveness, the need for hearing protection solutions within the military sector is expected to remain strong. Also, manufacturers may focus on innovating earplug designs & technologies to meet the unique needs of military personnel, ensuring optimal performance & comfort in challenging operational settings.

The U.S. Hearing Protection Devices Market Report is segmented on the basis of the following:

By Product

- Earplugs

- Hearing Bands

- Earmuffs

- Uniform Attenuation Earplugs

- Canal Caps

- Connected Devices

By Protection

- Enclosure

- Aural Insert

- Super-aural

- Circumaural

By End User

- Healthcare

- Mining

- Manufacturing

- Construction

- Others

Competitive Landscape

In the U.S. hearing protection devices market, competition is quite high among manufacturers focusing on differentiating through product innovation, pricing strategies, and distribution networks. R&D efforts drive the introduction of advanced features like better noise attenuation and comfort. Further, partnerships with industry stakeholders improve market penetration, while diverse pricing strategies meet various consumer segments. Also, effective marketing & after-sales support is pivotal in maintaining brand reputation and enhancing customer loyalty.

Some of the prominent players in the U.S. Hearing Protection Devices Market are

- 3M

- ProtectEar USA

- McKeon Products

- DEWALT

- Moldex-Metric

- MSA

- David Clark Company

- Altus Brands

- Honeywell

- SoundGear

- Other Key Players

Recent Developments

- In February 2024, Widex launched the Widex SmartRIC, featuring an innovative L-shaped design that improves microphone angles for better hearing across many environments. Placing the device higher on the ear aligns directional microphones with the wearer's focus, improving the signal-to-noise ratio, which supports engagement in social situations, prioritizing natural sound while selectively applying directionality & noise reduction as needed.

- In November 2023, DKSH’s Business Unit Healthcare launched Ear Pro by Audisol, which is a preventive ear care solution developed to help avoid issues related to water being trapped in the ear canal, Ear Pro by Audisol, focuses on eradicating the swimmer’s ear, which becomes a less pervasive issue due to company's commitment to promoting ear health.

- In October 2023, Savox Communications, launched Noise-Com (NC) 500 series the Savox NC- 520XP hearing protection headsets, developed to meet the needs of professionals working in the most demanding environments, which sets new industry standards by combining safety, innovation, and reliability.

- In August 2023, 3M announced that the company will pay USD 6.01 billion to settle lawsuits by U.S. military veterans &service members who suffered hearing loss from using the company's earplugs The deal comes after a failed attempt by 3M to move the lawsuits, which had grown into the largest mass tort litigation in U.S. history, into bankruptcy court in the hope of limiting its liability.

- In October 2022, Sony Electronics announced the availability of its first over-the-counter (OTC) hearing aids for the U.S. market, with an aim for innovation, accessibility, and personalization. The unique products, developed in partnership with WS Audiology, Sony will improve the lives of consumers by combining its unique premium technology, ultimate ease of use, and uncompromised comfort & wearability, to deliver an exceptional hearing experience that easily connects the gap between the wearer & their environment.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 634.1 Mn |

| Forecast Value (2033) |

USD 1.582.0 Mn |

| CAGR (2023-2032) |

10.7% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Earplugs, Hearing Bands, Earmuffs, Uniform Attenuation Earplugs, Canal Caps, and Connected Devices), By Protection (Enclosure, Aural Insert, Super-aural, and Circumaural), By End User (Healthcare, Mining, Manufacturing, Construction, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

3M, ProtectEar USA, McKeon Products, DEWALT, Moldex-Metric, MSA, David Clark Company, Altus Brands, Honeywell, SoundGear, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The U.S. Hearing Protection Devices Market size is estimated to have a value of USD 634.1 million in

2024 and is expected to reach USD 1,582.0 million by the end of 2033.

Some of the major key players in the U.S. Hearing Protection Devices Market are 3M, ProtectEar USA,

McKeon Products, and many others.

The market is growing at a CAGR of 10.7 percent over the forecasted period.