Market Overview

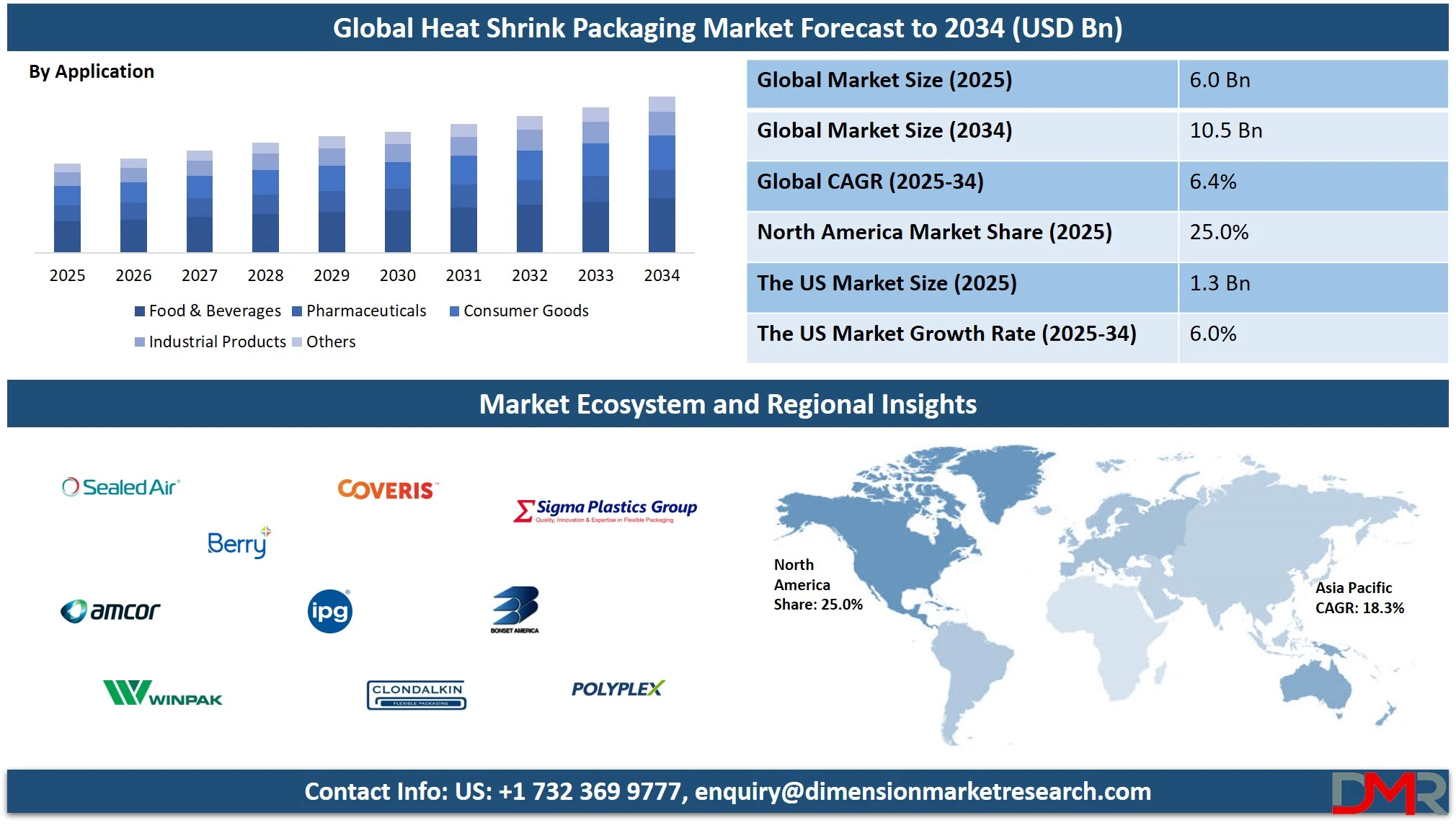

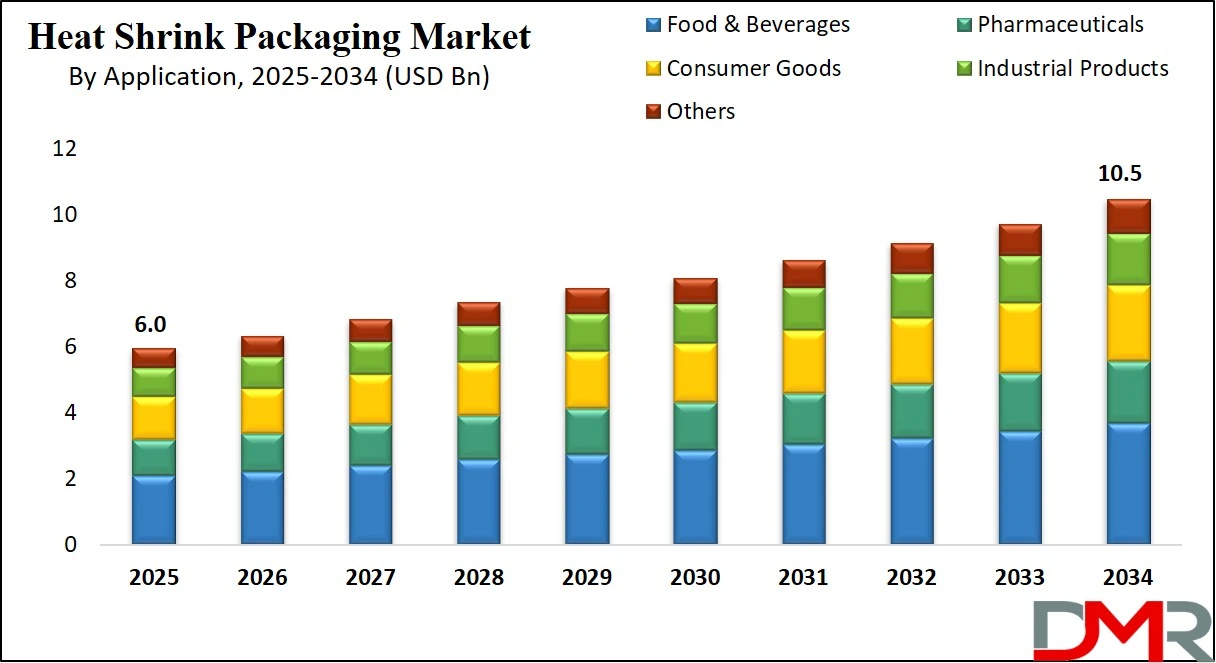

The global heat shrink packaging market is projected to grow from USD 6.0 billion in 2025 to USD 10.5 billion by 2034, registering a CAGR of 6.4%. Growth is driven by increasing demand for tamper-evident packaging, rising adoption in food and beverage, pharmaceuticals, and retail logistics, and a shift toward recyclable and high-clarity shrink films.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Heat shrink packaging is a type of protective packaging method where a thermoplastic film is wrapped around a product and then subjected to heat, causing the film to shrink tightly around the item. This process creates a tamper-evident, durable, and secure seal that conforms to the shape of the product, providing both protection and visual appeal.

The packaging not only helps in safeguarding items from moisture, dust, and contaminants but also aids in stabilizing products during transit or storage. Common materials used in this method include polyolefins, polyethylene, and PVC, which are selected based on the application and required durability. The versatility of heat shrink packaging makes it suitable for a wide range of products, including food items, beverages, pharmaceuticals, electronics, and industrial goods.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global heat shrink packaging market has been witnessing significant growth due to the growing demand for sustainable, secure, and cost-effective packaging solutions across various industries. With the rise in e-commerce, retail shelf optimization, and enhanced product presentation requirements, manufacturers are adopting shrink packaging to improve shelf life and visual impact.

In addition, the food and beverage sector remains a leading application area, where heat shrink packaging is widely used for bundling and wrapping perishable and non-perishable products. This packaging format also aligns with brand identity goals, offering high-clarity films that enable labeling and printability, enhancing marketing efforts.

Growing environmental awareness and technological innovations are shaping the future of the heat shrink packaging market. Introducing biodegradable and recyclable shrink films is driving investments from packaging firms aiming to meet global sustainability targets.

Furthermore, developing economies in the Asia-Pacific and Latin America are becoming vital growth hubs due to expanding manufacturing bases and rising consumer goods consumption. Technological upgrades in shrink machinery and advances in material science are helping businesses improve operational efficiency while reducing waste. These market dynamics underscore the evolving role of heat shrink packaging in the modern supply chain and its adaptability across diverse industries.

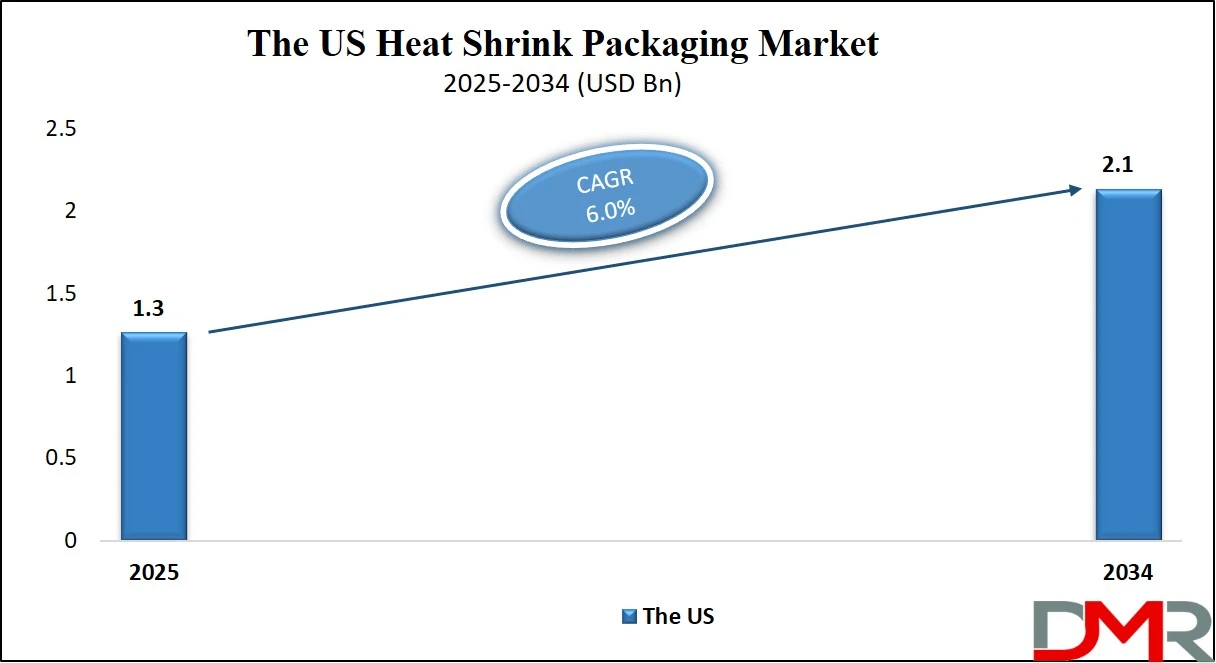

The US Heat Shrink Packaging Market

The U.S. heat-shrink packaging Market size is projected to be valued at USD 1.3 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.1 billion in 2034 at a CAGR of 6.0%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The U.S. heat shrink packaging market is experiencing steady expansion, fueled by the country's mature retail infrastructure, growing e-commerce sector, and demand for secure and visually appealing packaging. Industries such as food and beverages, pharmaceuticals, and personal care are key contributors, as they rely on shrink packaging for its product integrity, shelf impact, and tamper-evidence features.

The adoption of polyolefin and polyethylene shrink films has grown significantly, especially for applications requiring high clarity, flexibility, and puncture resistance. As consumer preferences shift toward convenience and product safety, manufacturers are leveraging shrink packaging to offer unitized multipacks, secure transport wraps, and customized branding.

Environmental concerns and regulatory pressures are also shaping the U.S. market landscape. There is a marked shift toward sustainable packaging materials, with companies investing in recyclable and biodegradable shrink films that align with green packaging standards.

Technological advancements in heat shrink machinery, such as automated shrink tunnels and precision heat control systems, are enhancing packaging speed and efficiency, making it viable for small and large-scale production alike.

The U.S. market is also witnessing increased interest in tamper-proof shrink sleeves for pharmaceuticals and premium packaging solutions in the beverage segment, indicating a broader integration of heat shrink packaging in product innovation and brand differentiation strategies.

The European Heat Shrink Packaging Market

Europe’s heat shrink packaging market is projected to reach a valuation of approximately USD 1.5 billion in 2025, reflecting its substantial presence in the global landscape. The region’s dominance stems from its strong industrial base, strict regulatory frameworks around food safety and packaging sustainability, and a highly developed retail infrastructure.

European countries such as Germany, France, and the UK have consistently led in the adoption of advanced packaging technologies, with shrink sleeves and films widely used across food, beverages, pharmaceuticals, cosmetics, and personal care products.

Additionally, the growing emphasis on reducing packaging waste and transitioning to recyclable and biodegradable materials is encouraging the replacement of traditional plastics with high-performance shrink films that meet environmental compliance standards.

The anticipated CAGR of 5.2% for Europe through the forecast period indicates steady, innovation-driven growth. This momentum is bolstered by consumer preferences for tamper-evident, visually appealing, and lightweight packaging, along with the expansion of private-label brands and e-commerce logistics that require secure secondary packaging.

Furthermore, investments in automation and digital printing technologies are enhancing the efficiency and customization capabilities of shrink packaging lines. As European manufacturers continue to prioritize circular economy principles and carbon footprint reduction, the market is expected to evolve with growing integration of recycled content, mono-material solutions, and smart packaging innovations tailored to both regulatory demands and consumer expectations.

The Japanese Heat Shrink Packaging Market

Japan’s heat shrink packaging market is estimated to reach around USD 0.3 billion in 2025, reflecting its niche yet stable position within the global packaging landscape. The country’s packaging sector is characterized by meticulous quality standards, compact product formats, and a strong emphasis on hygiene and presentation, making shrink packaging a preferred choice across multiple end-use industries.

In Japan, applications such as ready-to-eat foods, beverages, cosmetics, and pharmaceuticals heavily rely on heat shrink films for secure, tamper-evident, and space-efficient packaging. Moreover, the demand for high-precision shrink sleeves, particularly for premium consumer goods and small-format items, supports continued adoption in this mature market.

Despite being a relatively saturated market, Japan is projected to grow at a CAGR of 3.8% through the forecast period, driven by incremental innovation and sustainability goals. With growing environmental consciousness among both regulators and consumers, the shift toward recyclable and thinner shrink films is gaining momentum.

Japanese manufacturers are also integrating automation and smart packaging technologies to improve production efficiency and meet the rising demand for personalization. While overall volume growth may be moderate compared to emerging economies,

Japan’s consistent focus on packaging precision, eco-compliance, and aesthetics ensures it remains a key player in influencing product development trends and high-value segments within the global heat shrink packaging market.

Global Heat Shrink Packaging Market: Key Takeaways

- Market Value: The global heat shrink packaging market size is expected to reach a value of USD 10.5 billion by 2034 from a base value of USD 6.0 billion in 2025 at a CAGR of 6.4%.

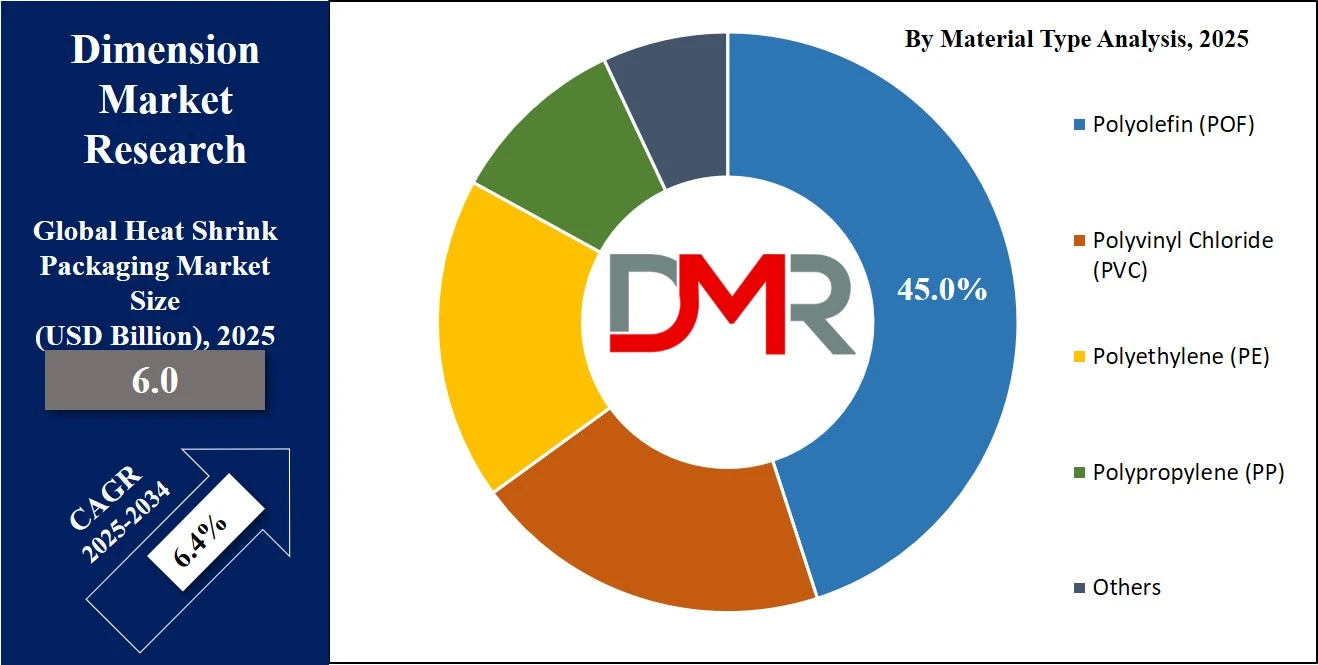

- By Material Type Segment Analysis: Polyolefin (POF) is anticipated to dominate the material type segment, capturing 45.0% of the total market share in 2025.

- By Thickness Segment Analysis: 51–100 Microns thickness materials are poised to consolidate their dominance in the thickness segment, capturing 50.0% of the total market share in 2025.

- By Shrink Method Segment Analysis: Heat Tunnel Shrink method is expected to maintain its dominance in the shrink method segment, capturing 65.0% of the total market share in 2025.

- By Product Type Segment Analysis: Shrink Sleeves will lead in the product type segment, capturing 40.0% of the market share in 2025.

- By Application Segment Analysis: The Food & Beverages applications are anticipated to maintain their dominance in the application segment, capturing 35.0% of the total market share in 2025.

- By End-User Industry Segment Analysis: Retail & Supermarkets will lead the end-user industry segment, capturing 28.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global heat shrink packaging market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global heat shrink packaging market are Sealed Air, Berry Global, Amcor, Winpak, Coveris, Intertape, Clondalkin, Sigma Plastics, Bonset, Polyplex, FLEXOPACK, Kaneka, Buergofol, and Other Key Players.

Global Heat Shrink Packaging Market: Use Cases

- Food and Beverage Multipack Bundling: Heat shrink packaging is extensively used in the food and beverage industry for bundling multiple units of products such as canned drinks, bottled water, dairy products, snacks, and frozen foods. This packaging method ensures the items are held tightly together, reducing the chances of damage during storage and transportation. The high clarity of shrink films like polyolefin allows product visibility, supporting in-store marketing and branding. Moreover, the tamper-evident nature of shrink wrap enhances consumer trust and extends shelf life by protecting against moisture, contaminants, and handling damage. As retailers demand secondary packaging that supports efficient logistics and shelf-ready displays, heat-shrink bundling has become a preferred solution.

- Pharmaceutical Tamper-Evident Sealing: In the pharmaceutical sector, heat shrink packaging plays a critical role in securing products like pill bottles, medical devices, and diagnostic kits. Shrink sleeves and shrink bands are widely used to create tamper-evident seals that assure consumers of product safety and regulatory compliance. With rising concerns over counterfeit drugs and contamination, pharmaceutical companies depend on shrink packaging to provide a visible layer of protection that cannot be removed or replaced without obvious signs of tampering. Additionally, the use of shrink sleeves enables 360-degree labeling, offering ample space for regulatory information, branding, and barcoding, which are vital for patient safety and inventory tracking.

- Electronics and Consumer Goods Protection: Electronics and small appliances require durable and form-fitting packaging to prevent dust, static, and mechanical damage. Heat shrink packaging offers a secure wrap that molds tightly around irregularly shaped items such as headphones, remote controls, chargers, and batteries. Anti-static shrink films are often used for sensitive electronic components to safeguard against electrostatic discharge. Retail electronics also benefit from the visual appeal of high-gloss shrink films that enhance shelf presentation while deterring tampering and theft. In this category, shrink packaging supports both protective and aesthetic needs, making it an integral part of modern electronics packaging strategies.

- Industrial and Logistics Pallet Wrapping: In industrial settings and logistics operations, heat shrink packaging is widely used for pallet stabilization and equipment protection. Large shrink wraps made from heavy-duty polyethylene are applied to palletized goods to prevent shifting and damage during transit. This method is especially useful in sectors like automotive, construction, and machinery where oversized or irregular loads require custom-fit packaging. Heat shrink film provides weather resistance, UV protection, and corrosion prevention, ensuring product integrity even during long-distance shipping or outdoor storage. This application is essential for optimizing warehouse management and reducing cargo damage costs.

Global Heat Shrink Packaging Market: Stats & Facts

European Union — Eurostat & European Commission

Sources: Eurostat, European Commission Waste Statistics

- In 2022, the EU generated 186.5 kg of packaging waste per person, with extremes ranging from 78.8 kg in Bulgaria to 233.8 kg in Ireland.

- Packaging waste composition: 40.8% paper/cardboard, 19.4% plastic, 18.8% glass, 16.0% wood, 4.9% metal, 0.2% others.

- EU packaging waste recycling rate reached 65.4% in 2022, up from 64.0% in 2021.

- Plastic packaging waste recycling rate stood at 38.6%, with higher rates in countries like Lithuania and Czechia.

- Around 41% of EU PE films are used in non-food packaging, including 14% shrink films, according to EU-recognized recycling bodies.

United States — USDA, PHMSA, CalRecycle, NIST

Sources: USDA FSIS, US Dept. of Transportation (PHMSA), California Department of Resources Recycling and Recovery (CalRecycle), National Institute of Standards and Technology (NIST)

- The USDA and FDA mandate that heat-shrink films in food contact packaging must meet food safety and migration test standards.

- According to PHMSA regulations (49 CFR §173.25), shrink-wrapped overpacks must not exceed 20 kg (44 lb) in gross weight.

- CalRecycle identifies bakeries and tortilla manufacturers as high waste generators due to shrink packaging in distribution.

- A study on shrink sleeve bottle packaging in a US facility revealed energy consumption of 34.58 kWh in standard runs and 50.85 kWh in peak process variants.

- NIST notes heat-sensitive plastic deformation in polymer and packaging materials, relevant for heat tunnel calibration.

Japan — Ministry of the Environment & METI

Sources: Ministry of the Environment, Japan, METI Packaging Efficiency Reports

- Japan has maintained a packaging waste recycling rate over 60%, supported by its Container and Packaging Recycling Law.

- METI highlights that over 35% of secondary packaging in the FMCG sector involves heat-sensitive shrink materials.

- Japanese consumer goods firms must follow voluntary guidelines on reducing shrink film gauge and using recyclable mono-materials.

India — CPCB & FSSAI

Sources: Central Pollution Control Board (CPCB), Food Safety and Standards Authority of India (FSSAI)

- India’s EPR 2022 guidelines classify heat shrink films under single-use flexible plastic, now subject to mandatory recycling protocols.

- FSSAI mandates that heat-shrink packaging for food must be free of phthalates and heavy metals, ensuring compliance with BIS and ISO standards.

China — Ministry of Ecology and Environment

Sources: MEE Plastic Pollution Control Action Plan

- Under China’s 2020 plastic reduction roadmap, the use of non-degradable plastic shrink films in food delivery and e-commerce was restricted in tier-1 cities by 2022, with further rollout to other cities by 2025.

- Over 8 million tons of flexible plastic packaging waste are generated annually, of which a significant portion includes shrink packaging.

Global Scientific Research (Gov-funded studies)

Sources: PubMed Central (NIH), FAO-supported studies

- A study on shrink-wrapped cucumbers showed only 0.66% weight loss over storage vs. 11.11% for unpackaged, highlighting the moisture barrier efficiency.

- FAO-backed reports note shrink packaging's role in reducing food loss during cross-border distribution, particularly in fresh produce.

Global Heat Shrink Packaging Market: Market Dynamics

Global Heat Shrink Packaging Market: Driving Factors

Rising Demand for Tamper-Evident and Contamination-Free Packaging

The growing need for product safety across industries such as pharmaceuticals, food & beverages, and personal care is a major driver. Heat-shrink packaging provides a secure, tamper-evident seal that assures consumers of product integrity and hygiene. This is especially critical in pharmaceuticals, where shrink bands and sleeves are used to protect against counterfeit drugs and unauthorized access. The adoption of shrink films that ensure contamination control is becoming standard for high-value and sensitive products.

Growth in Organized Retail and E-Commerce Logistics

As the retail sector modernizes and e-commerce platforms expand, the need for efficient, visually appealing, and damage-resistant packaging has surged. Heat shrink packaging supports fast-moving consumer goods (FMCG) through shelf-ready bundling, multipack promotions, and secure transit packaging. Its compatibility with automated shrink tunnels and ability to reduce packaging volume also make it ideal for high-volume fulfillment centers.

Global Heat Shrink Packaging Market: Restraints

Environmental Concerns over Non-Biodegradable Plastic Films

Despite advances in recyclable materials, a significant portion of shrink packaging still relies on PVC and polyethylene, which are not biodegradable and contribute to landfill waste. Regulatory restrictions and consumer pushback against single-use plastics are challenging manufacturers to transition to more sustainable alternatives. The lack of large-scale adoption of eco-friendly shrink films may slow market growth in sustainability-sensitive regions.

High Initial Investment in Heat Shrink Machinery

For small and medium enterprises (SMEs), the capital cost of advanced heat shrink tunnels, automatic sleeve applicators, and heat guns poses a barrier. Integrating these systems into existing packaging lines requires additional expenditure and training. This financial burden may deter startups or companies in developing regions from adopting shrink technology at scale.

Global Heat Shrink Packaging Market: Opportunities

Shift toward Recyclable and Bio-Based Shrink Films

The growing consumer preference for green packaging is pushing manufacturers to innovate with recyclable polyolefin films, compostable shrink wraps, and bio-based polymers. These materials not only comply with international environmental standards but also open up new market segments in eco-conscious industries. Governments offering incentives for sustainable packaging adoption further fuel this opportunity.

Expansion in Emerging Economies and Industrial Packaging

Rapid industrialization in Asia-Pacific, Africa, and Latin America is creating demand for heat shrink packaging in sectors such as automotive, construction materials, and heavy machinery. These applications require heavy-duty shrink films for pallet wrapping, rust protection, and UV shielding. As manufacturing hubs expand, so does the need for cost-effective and efficient packaging that can protect large and bulky goods.

Global Heat Shrink Packaging Market: Trends

Adoption of Smart and Printed Shrink Sleeves for Branding

Brand owners are using heat shrink sleeves that integrate high-definition graphics, QR codes, and augmented reality (AR) labels to enhance consumer engagement. These printed shrink sleeves not only provide 360-degree branding but also serve as interactive tools for product authentication and marketing. This trend is especially strong in the beverage and cosmetic sectors.

Integration of Automation in Shrink Packaging Lines

To meet the demands of high-speed manufacturing and minimize labor costs, companies are automating shrink packaging with conveyor-fed heat tunnels, robotic sleeve applicators, and programmable sealing systems. This not only improves efficiency but also ensures consistent packaging quality and reduced material waste. Automation is becoming standard in sectors like electronics, pharmaceuticals, and large-scale food production.

Global Heat Shrink Packaging Market: Research Scope and Analysis

By Material Type Analysis

Polyolefin (POF) is expected to lead the material type segment in the global heat shrink packaging market, accounting for approximately 45.0% of the total share in 2025. Its dominance is primarily due to its versatility, high clarity, superior puncture resistance, and ability to shrink uniformly around products of various shapes and sizes.

Polyolefin is widely preferred in industries such as food and beverage, personal care, and retail due to its non-toxic nature and compatibility with direct food contact. Additionally, it performs well at a broad range of temperatures and is compatible with automated packaging machinery, making it a go-to choice for high-speed production environments. The material’s recyclability and lower environmental impact compared to some alternatives also contribute to its growing adoption, particularly as sustainability becomes a focal point in packaging decisions.

Polyvinyl Chloride (PVC), while still used in the heat shrink packaging market, is gradually losing favor due to growing environmental and health concerns. Known for its excellent clarity and shrinkability, PVC was historically a popular choice for tamper-evident bands, shrink sleeves, and packaging for small consumer goods.

However, its composition involves chlorine-based chemicals, which can release toxic substances during production and disposal. Regulatory restrictions and consumer demand for eco-friendly packaging have led to a shift away from PVC in many developed markets.

Despite this, PVC still maintains a niche presence, especially in cost-sensitive applications and regions where alternatives like POF are not as widely available or economically feasible. Its ability to deliver precise shrink results with minimal film memory still makes it a viable option in specific packaging scenarios.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Thickness Analysis

In the global heat shrink packaging market, materials with a thickness range of 51–100 microns are projected to dominate the thickness segment, holding approximately 50.0% of the total market share in 2025. This range strikes an optimal balance between durability, flexibility, and cost-effectiveness, making it suitable for a wide range of packaging applications across industries like food and beverage, pharmaceuticals, personal care, and retail. These films offer superior strength and puncture resistance compared to thinner variants, making them ideal for bundling heavier or irregularly shaped items.

The 51–100 micron range is particularly favored for medium to high-speed shrink wrapping lines, as it provides excellent shrink performance without compromising on transparency or product visibility. Its compatibility with automated machinery and suitability for both primary and secondary packaging further strengthen its position in the market.

On the other hand, shrink films with a thickness of up to 50 microns are typically used for lightweight packaging applications where minimal protection is required. These thinner films are popular for wrapping smaller consumer products, single-unit retail items, or multipacks with low weight. Due to their lower material usage, they are often more cost-effective and are chosen when shelf presentation and cost reduction are priorities over heavy-duty protection.

However, their reduced strength and tear resistance limit their use in transporting or bundling heavier items. While the environmental advantage of using less plastic is a consideration, the need for additional packaging layers or reinforcements in some cases can offset these benefits. As a result, the up to 50 microns category remains a niche segment, serving specific lightweight product packaging needs.

By Shrinkage Method Analysis

The heat tunnel shrink method is expected to remain the most dominant shrink method in the global heat shrink packaging market, accounting for approximately 65.0% of the total market share by 2025. This method is widely adopted across high-volume production environments due to its efficiency, consistency, and ability to handle a wide range of packaging sizes and materials.

Heat tunnels use controlled, uniform heat to ensure precise and even shrinkage of the film around the product, resulting in a clean, professional finish. Industries such as food and beverage, pharmaceuticals, and personal care products prefer heat tunnels for their speed, automation compatibility, and minimal labor requirements. These systems are particularly valuable for businesses aiming to scale their operations while maintaining consistent packaging quality and minimizing film waste.

In contrast, the handheld heat gun method serves more specialized and small-scale packaging applications. Handheld heat guns are typically used in manual or low-volume operations where automation is not feasible due to budget constraints or packaging variety. This method is commonly found in craft packaging, repair packaging, or field-based applications where portability is essential.

While heat guns offer flexibility and are relatively low-cost, they demand skilled operators to ensure proper shrinkage and avoid film burn or uneven application. Their slower processing speed and potential for inconsistent results make them less suitable for high-throughput production lines, but they remain an important option for businesses that require customization or have diverse packaging needs in limited quantities.

By Product Type Analysis

Shrink sleeves are projected to lead the product type segment in the heat shrink packaging market, capturing about 40.0% of the total market share in 2025. Their popularity is driven by the growing demand for 360-degree branding, high-impact graphics, and tamper-evident features in consumer packaging.

Shrink sleeves conform tightly to complex container shapes, making them ideal for bottles, cans, and irregularly shaped products in the beverage, cosmetics, and personal care industries. They allow brands to maximize visual real estate for design, labeling, and regulatory information without requiring adhesive labels.

Additionally, shrink sleeves provide a seamless look, improve product aesthetics, and support anti-counterfeiting measures. Their compatibility with sustainable substrates and ability to be removed easily during recycling are further boosting their adoption in eco-conscious markets.

Shrink wraps, on the other hand, are used predominantly for bundling and protecting multiple units or larger items during storage and transportation. These films offer a tight, secure cover over products or grouped packages, providing dust, moisture, and tamper resistance.

Shrink wraps are commonly seen in food multipacks, electronics, books, and industrial equipment packaging. They are valued for their protective function rather than branding, as they are typically clear or lightly printed.

While they don't offer the same level of visual marketing as shrink sleeves, shrink wraps are a cost-effective solution for unitization and logistical convenience. Their versatility in handling different product sizes and compatibility with various shrink machinery make them an essential component of secondary packaging operations.

By Application Analysis

The food and beverages segment is expected to remain the leading application area in the heat shrink packaging market, accounting for approximately 35.0% of the total market share in 2025. This dominance stems from the widespread use of shrink packaging for bundling, tamper-evidence, and product protection across a wide range of food products, including dairy, beverages, frozen items, and ready-to-eat meals.

Heat shrink films are particularly effective in maintaining freshness, extending shelf life, and providing visibility to consumers, which are crucial factors in the competitive food retail landscape.

The growing popularity of multipack formats and the demand for hygienic and visually appealing packaging in supermarkets and convenience stores are further driving adoption. Additionally, as food producers look for lightweight and cost-efficient packaging solutions that comply with safety and sustainability norms, heat shrink packaging continues to be a preferred choice.

In the consumer goods segment, heat shrink packaging plays a vital role in both protective and promotional packaging. It is used for items such as cosmetics, toiletries, stationery, toys, and homecare products, where shelf appeal, tamper resistance, and compactness are key.

For brands, shrink sleeves and wraps offer a way to differentiate products through customized shapes, clear branding, and decorative graphics, while also ensuring the product remains intact during shipping and handling. In this segment, the flexibility of shrink packaging to accommodate various shapes and sizes without compromising on protection is especially important.

The growth of organized retail and e-commerce platforms has increased the demand for tamper-evident, space-saving, and lightweight packaging in the consumer goods sector, making shrink packaging an essential part of product presentation and logistics.

By End-Use Industry Analysis

Retail and supermarkets are projected to dominate the end-user industry segment of the heat shrink packaging market, capturing around 28.0% of the total share in 2025. This leadership is driven by the critical role shrink packaging plays in enhancing shelf presentation, preventing tampering, and facilitating easy handling of bulk items. Supermarkets often rely on shrink films for bundling multipacks, protecting perishable goods, and maintaining product cleanliness while on display.

Shrink sleeves, in particular, are extensively used to boost branding with full-body graphics and promotional messaging. As modern trade and organized retail expand globally, retailers are demanding packaging that not only secures goods but also attracts consumer attention through clear, aesthetic presentation and compact form factors. The high turnover of goods in these environments also makes durability and tamper-resistance essential, further reinforcing the demand for heat shrink solutions.

Food processing units represent another significant end-user category, where shrink packaging is valued for its hygienic sealing, preservation capabilities, and compatibility with automation. These units process large volumes of packaged food that must be kept fresh, uncontaminated, and ready for distribution to retailers, food service providers, and export markets.

Shrink films are used to protect primary food packaging, bundle items for transport, and provide secure, moisture-resistant covering for frozen and refrigerated goods. Heat shrink packaging also supports compliance with food safety regulations by providing a barrier against dust, bacteria, and physical damage. Additionally, the adaptability of shrink materials to different product shapes and weights allows food processors to streamline packaging workflows and reduce material waste, aligning with both efficiency and sustainability goals.

The Heat Shrink Packaging Market Report is segmented based on the following:

By Material Type

- Polyolefin (POF)

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polypropylene (PP)

- Others

By Thickness

- Up to 50 Microns

- 51-100 Microns

- Above 100 Microns

By Shrink Method

- Heat Tunnel Shrink

- Handheld Heat Gun

- Infrared Shrink

By Product Type

- Shrink Sleeves

- Shrink Wraps

- Shrink Bags

- Others

By Application

- Food & Beverages

- Consumer Goods

- Pharmaceuticals

- Industrial Products

- Others

By End-Use Industry

- Retail & Supermarkets

- Food Processing Units

- Healthcare & Pharma

- Logistics & Warehousing

- Electronics & Appliances

- Others

Global Heat Shrink Packaging Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to dominate the global heat shrink packaging market in 2025, accounting for approximately 38.0% of the total market revenue. This regional leadership is fueled by rapid industrialization, expanding food and beverage sectors, and growing demand for cost-effective, durable packaging solutions across emerging economies such as China, India, and Southeast Asia.

The region’s robust manufacturing base, growing penetration of organized retail, and rising export activities are significantly driving the adoption of shrink packaging in both primary and secondary applications. Additionally, the availability of low-cost raw materials and labor, along with rising consumer awareness of product safety and hygiene, is encouraging local and global players to invest in advanced shrink packaging technologies tailored to high-volume operations in the Asia Pacific.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Middle East and Africa (MEA) region is projected to register the highest CAGR in the global heat shrink packaging market during the forecast period. This accelerated growth is driven by the expanding food processing sector, rising urbanization, and growing demand for secure and efficient packaging across industries such as retail, pharmaceuticals, and consumer goods.

As governments in the region invest in modernizing infrastructure and boosting domestic manufacturing, the need for cost-effective, tamper-evident, and visually appealing packaging is rising steadily. Moreover, the growing influence of organized retail and the influx of international brands are encouraging wider adoption of advanced shrink packaging solutions, making MEA a key emerging market with substantial long-term potential.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Heat Shrink Packaging Market: Competitive Landscape

The global heat shrink packaging market features a moderately fragmented competitive landscape, with key players like Sealed Air Corporation, Berry Global Inc., and Amcor plc leading through strong global networks, advanced technologies, and diversified product offerings. These companies continuously invest in R&D to innovate eco-friendly and high-performance shrink films, catering to the rising demand for sustainable and visually appealing packaging.

At the same time, regional and mid-sized players are carving out niches by focusing on industry-specific applications and expanding into high-growth markets like Asia Pacific and the Middle East. The competition is further intensified by growing consumer preference for tamper-evident, customizable, and cost-efficient packaging, prompting players to adopt automation, digital printing, and localized manufacturing strategies to enhance responsiveness and market share.

Some of the prominent players in the global heat shrink packaging market are:

- Sealed Air Corporation

- Berry Global Inc.

- Amcor plc

- Winpak Ltd

- Coveris Holdings S.A.

- Intertape Polymer Group Inc.

- Clondalkin Group

- Sigma Plastics Group

- Bonset America Corporation

- Polyplex Corporation Ltd.

- FLEXOPACK S.A.

- Kaneka Corporation

- Buergofol GmbH

- Schur Flexibles Group

- Reynolds Group Holdings

- Kureha Corporation

- Uflex Ltd.

- Clysar LLC

- Cosmo Films Ltd.

- Allen Plastic Industries Co., Ltd.

- Other Key Players

Global Heat Shrink Packaging Market: Recent Developments

- May 2025: Klöckner Pentaplast introduced SmartCycle Plus, a heat shrink sleeve film containing 30% post-consumer recycled PET. It offers high clarity, consistent shrink performance, and recyclability within the PET stream, supporting sustainable packaging practices.

- March 2025: Crestview Partners completed the acquisition of Smyth Companies, a provider of labels and custom packaging solutions, to expand its presence in specialty packaging markets, including shrink labeling.

- September 2024: Amcor launched Clear‑Tite 40 shrink bags for fresh and processed meats, achieving high clarity and barrier performance at just 40 microns, reducing film weight by 19% and improving sustainability.

- May 2024: LyondellBasell partnered with Zhengxin Packaging to develop a heat shrink film using up to 60% recycled polyethylene (Circulen Recover PE), aimed at beverage bottles and multipack shrink applications.

- December 2023: Gunze introduced GEOPLAS HCX1, a lightweight shrink sleeve film with 5% chemically recycled content and high shrinkability, ideal for use in automated labeling across beverages, cosmetics, and household products.

- March 2023: Junkosha released a peelable FEP heat shrink tubing for the medical industry, offering easy, damage-free removal with a 1.8:1 shrink ratio, reducing waste and improving catheter manufacturing efficiency.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 6.0 Bn |

| Forecast Value (2034) |

USD 10.5 Bn |

| CAGR (2025–2034) |

6.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Material Type (Polyolefin (POF), Polyvinyl Chloride (PVC), Polyethylene (PE), Polypropylene (PP), and Others), By Thickness (Up to 50 Microns, 51–100 Microns, and Above 100 Microns), By Shrink Method (Heat Tunnel Shrink, Handheld Heat Gun, and Infrared Shrink), By Product Type (Shrink Sleeves, Shrink Wraps, Shrink Bags, and Others), By Application (Food & Beverages, Consumer Goods, Pharmaceuticals, Industrial Products, and Others), and By End-Use Industry (Retail & Supermarkets, Food Processing Units, Healthcare & Pharma, Logistics & Warehousing, Electronics & Appliances, and Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Sealed Air, Berry Global, Amcor, Winpak, Coveris, Intertape, Clondalkin, Sigma Plastics, Bonset, Polyplex, FLEXOPACK, Kaneka, Buergofol, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global heat shrink packaging market?

▾ The global heat shrink packaging market size is estimated to have a value of USD 6.0 billion in 2025 and

is expected to reach USD 10.5 billion by the end of 2034.

What is the size of the US heat shrink packaging market?

▾ The US heat shrink packaging market is projected to be valued at USD 1.3 billion in 2025. It is expected

to witness subsequent growth in the upcoming period as it holds USD 2.1 billion in 2034 at a CAGR of

6.0%.

Which region accounted for the largest global heat shrink packaging market?

▾ Asia Pacific is expected to have the largest market share in the global heat shrink packaging market, with

a share of about 38.0% in 2025.

Who are the key players in the global heat shrink packaging market?

▾ Some of the major key players in the global heat shrink packaging market are Sealed Air, Berry Global,

Amcor, Winpak, Coveris, Intertape, Clondalkin, Sigma Plastics, Bonset, Polyplex, FLEXOPACK, Kaneka,

Buergofol, and Other Key Players.

What is the growth rate of the global heat shrink packaging market?

▾ What is the growth rate of the global heat shrink packaging market?