Market Overview

The

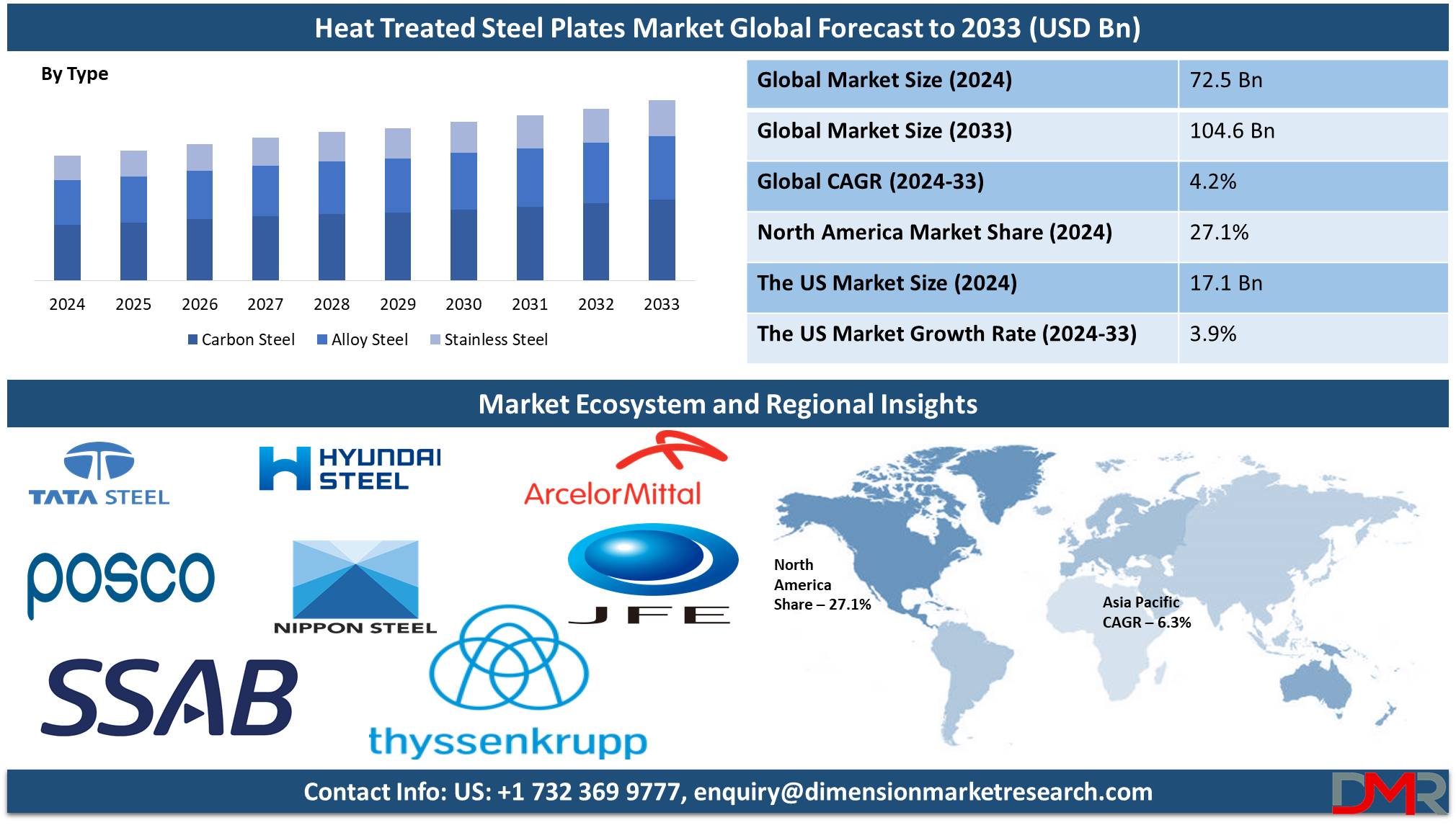

Global Heat Treated Steel Plates Market is projected to reach

USD 72.5 billion in 2024 and grow at a compound annual

growth rate of 4.2% from there until 2033 to reach a

value of USD 104.6 billion.

Heat-treated steel plates are steel plates that go through specific processes, like tempering, normalizing, and quenching to improve their mechanical properties. These treatments are developed to enhance strength, toughness, wear resistance, and ductility, making the material suitable for high-stress applications in many industries. The process of heat treatment alters the microstructure of the steel, optimizing it for use in products that demand durability and long service life under challenging conditions. The versatility of heat-treated steel plates enables them to be used in a variety of sectors, like automotive, construction, energy, and manufacturing.

Moreover, the global demand for heat-treated steel plates has been steadily growing due to the increase in the need for high-performance materials in infrastructure, industrial machinery, and transportation. As urbanization grows in emerging economies and infrastructure development becomes a priority across the world, the requirement for durable, strong materials like heat-treated steel plates is expected to continue rising.

Moreover, industries like construction depend on these plates for key components, like frames, beams, and structural reinforcements, which require materials that can withstand harsh environments, extreme loads, and stress over time. The expanding global population and the push for industrialization are further fueling this demand.

Further, a shift toward advanced heat treatment techniques that allow manufacturers to develop customized steel products with customized properties. For instance, it is possible to produce steel plates with more precise attributes, enhancing their performance in demanding applications. In addition, the trend toward sustainability in the steel industry is pushing manufacturers to explore more energy-efficient and environmentally friendly heat treatment processes. These developments are expected to contribute to the continued growth of the heat-treated steel plate market as industries look for materials that meet both technical & environmental standards.

One of the key insights into the heat-treated steel plate market is the usage of these materials in the energy and power sectors. Heat-treated steel plates are vital in the production of pressure vessels, boilers, and pipelines for energy generation plants. As the world transforms toward cleaner energy sources and investments in energy infrastructure rise, the need for high-strength, heat-resistant materials will continue to expand, which is further supported by rising applications in sectors such as automotive manufacturing, where lightweight but strong materials are essential for vehicle safety and fuel efficiency. With ongoing technological advancements and growing industrial needs, the heat-treated steel plates market is poised for substantial growth.

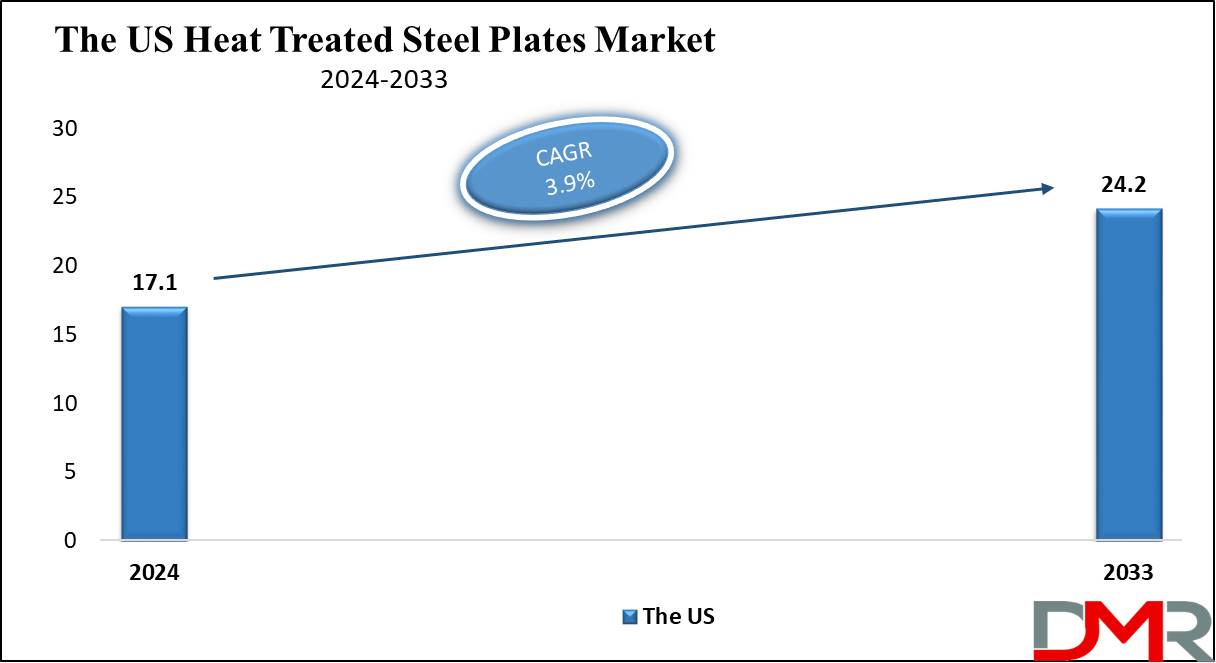

The US Heat Treated Steel Plates Market

The US Heat Treated Steel Plates Market is projected to reach USD 17.1 billion in 2024 at a compound annual growth rate of 3.9% over its forecast period.

The US provides major growth opportunities in the heat-treated steel plates market, driven by growth in construction activity, strong automotive production, and expanding aerospace and defense sectors. Government infrastructure initiatives and higher demand for high-strength, durable materials in industrial machinery further boost the market’s potential. Innovation in manufacturing technologies also supports this growth trajectory.

Further, the market is driven by growing demand from the construction, automotive, and aerospace sectors, supported by government infrastructure initiatives. However, high production costs & environmental regulations provide major restraints, as manufacturers face challenges in balancing efficiency with compliance. These factors collectively shape the market's growth dynamics.

Key Takeaways

- Market Growth: The Heat Treated Steel Plates Market size is expected to grow by 29.4 billion, at a CAGR of 4.2% during the forecasted period of 2025 to 2033.

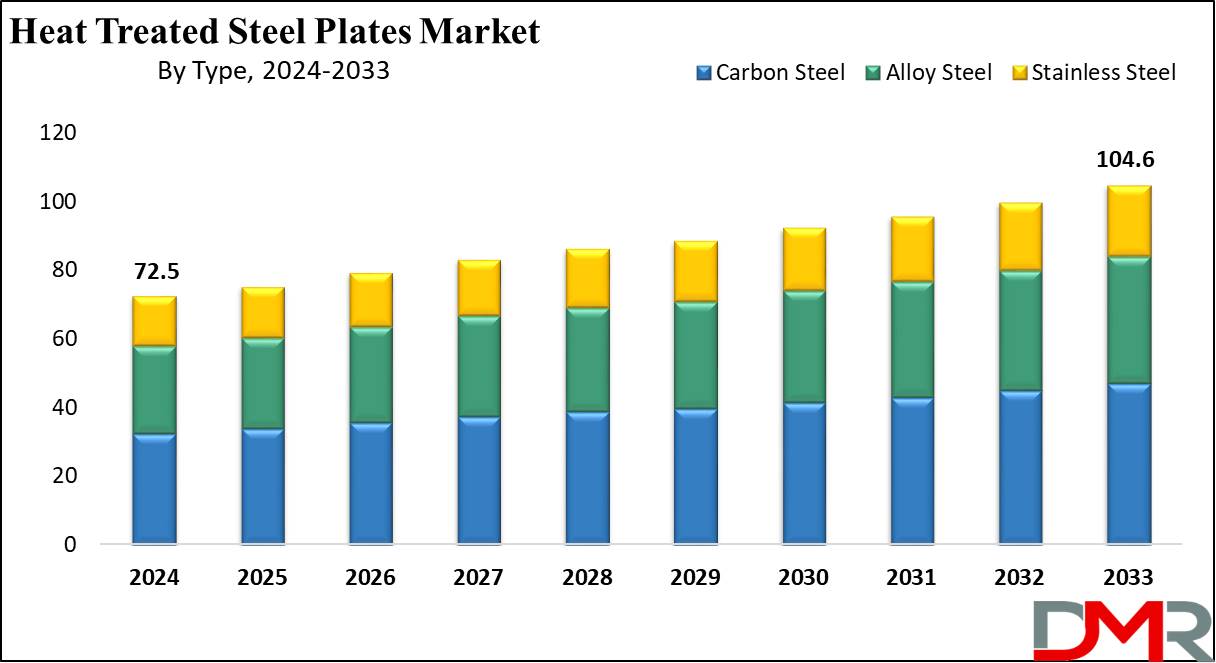

- By Type: The carbon steel segment is anticipated to get the majority share of the Heat Treated Steel Plates Market in 2024.

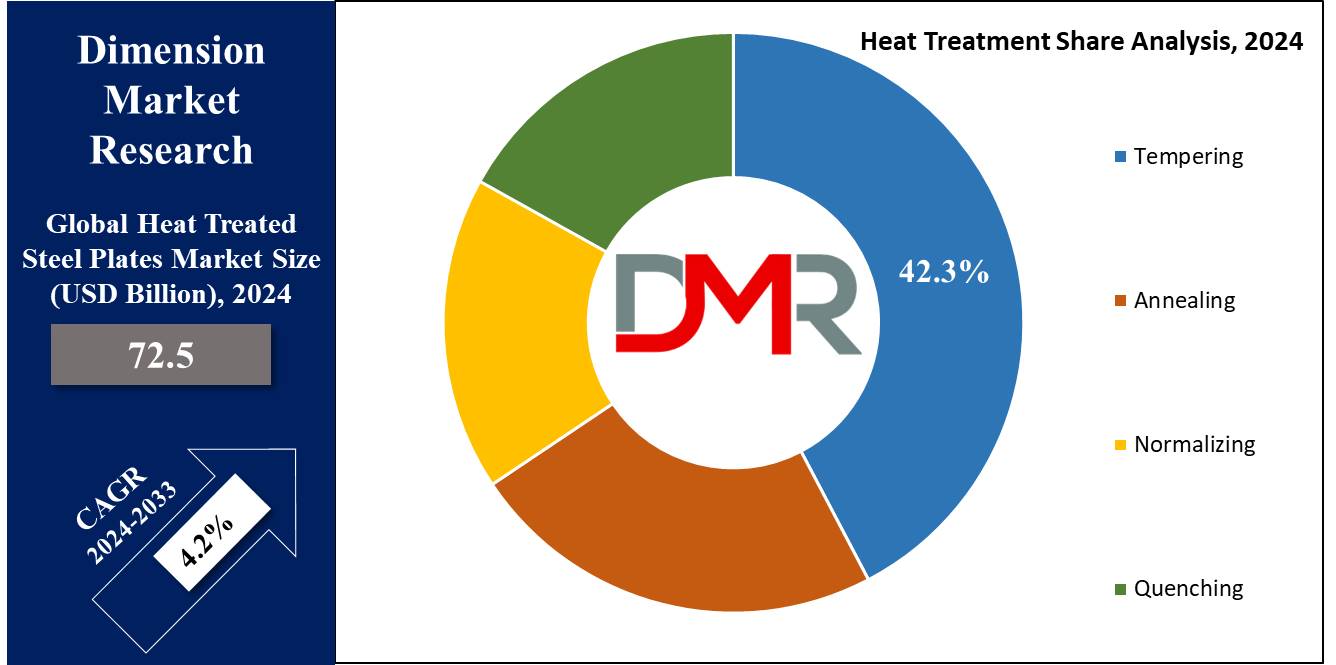

- The tempering segment is expected to be leading the market in 2024

- By Application: The automotive & transportation segment is expected to get the largest revenue share in 2024 in the Heat Treated Steel Plates Market.

- Regional Insight: Asia Pacific is expected to hold a 39.1% share of revenue in the Global Heat Treated Steel Plates Market in 2024.

- Use Cases: Some of the use cases of Smart Parking systems include energy & power, defense & security, and more.

Use Cases

- Construction and Infrastructure: Heat-treated steel plates are utilized in building structures, bridges, and heavy machinery frames due to their improved strength, durability, and resistance to wear and deformation.

- Automotive and Transportation: They manufacture components like chassis, frames, and body panels for trucks, trailers, and railcars, improving load-bearing capacity and impact resistance.

- Energy and Power Plants: Ideal for boilers, pressure vessels, and pipelines, heat-treated plates provide excellent heat resistance and structural integrity under extreme temperatures and pressures.

- Defense and Security: Utilized in armored vehicles, naval ships, and protective barriers, these plates provide high resistance to ballistic impacts and explosions.

Market Dynamic

Driving Factors

Rising Demand from Infrastructure and ConstructionThe global infrastructure boom, like the development of bridges, high-rise buildings, and industrial complexes, drives the need for heat-treated steel plates. Their superior strength and durability make them important for resisting heavy loads and harsh environmental conditions.

Expansion in Automotive and Heavy Machinery Sectors

The growth in the automotive and heavy machinery industries depends on heat-treated steel plates for critical components. Their use improves vehicle safety and performance, while growing industrial automation and mining activities further boost demand for these high-strength materials.

Restraints

High Production and Processing Costs

Heat treatment processes, like quenching and tempering, need significant energy and advanced equipment, leading to high production costs. These expenses can limit adoption, mostly in price-sensitive industries or regions with limited access to affordable manufacturing technologies.

Environmental and Regulatory Challenges

The steel industry is experiencing growth in the pressure to reduce carbon emissions and comply with strict environmental regulations. The energy-intensive nature of heat treatment processes contributes to greenhouse gas emissions, creating challenges for manufacturers in meeting sustainability goals and regulatory standards.

Opportunities

Growth in Renewable Energy Sector

The growth of wind and solar energy projects creates the need for heat-treated steel plates in components like wind turbine towers and solar panel mounting systems. Their high strength & durability make them ideal for harsh environmental conditions and supporting large-scale infrastructure.

Advancements in Heat Treatment Technology

Innovations in heat treatment processes, like induction heating and laser hardening, provide opportunities to minimize production costs and improve material properties, which allows manufacturers to meet diverse industry requirements while improving energy efficiency and reducing environmental impact.

Trends

Growing Demand in Energy and Infrastructure Sectors

The utilization of heat-treated steel plates is expanding in energy and power applications, like boilers and storage tanks in hydropower and nuclear plants. In addition, rapid urbanization and industrialization, mainly in Asia-Pacific, are boosting demand for infrastructure projects and driving market growth.

Adoption of Advanced Manufacturing Techniques

Manufacturers are highly incorporating technologies like automated heat treatment and precision processing to enhance product quality and efficiency, which focuses on meeting the growing demand for customized steel plates in sectors like automotive, aerospace, and industrial machinery.

Research Scope and Analysis

By Type

Carbon steel plays a major role in the growth of the heat-treated steel plates market due to its versatility and affordability. It is highly used in industries like construction, automotive, and machinery for applications demanding high strength and durability. Heat-treated carbon steel plates provide better mechanical properties, like improved toughness and resistance to wear, making them ideal for heavy-duty structural components. As the need for infrastructure and industrial machinery grows, carbon steel’s affordability and performance make it a key driver in the expansion of the heat-treated steel plate market.

Moreover, stainless steel contributes highly to the growth of the heat-treated steel plate market and is set to grow significantly during the forecasted period due to its exceptional corrosion resistance, strength, and durability. It is highly used in industries like energy, chemical processing, and construction, where materials must resist harsh environments. Heat treatment enhances its mechanical properties, making it ideal for pressure vessels, pipelines, and structural components. As industries grow in demand for reliable and long-lasting materials, stainless steel's unique benefits play a major role in driving the market's expansion.

By Heat Treatment

Tempering plays a vital role in the growth of the heat-treated steel plate market by improving the toughness and reducing the brittleness of steel after hardening, which fine-tunes the balance between strength and flexibility, making the steel suitable for demanding applications like construction, automotive, and industrial machinery. By enhancing the material's resistance to cracking and wear, tempered steel plates meet the needs of industries that prioritize safety and durability. As demand for high-performance materials grows, tempering helps drive the expansion of the heat-treated steel plate market.

Moreover, normalizing is essential for the growth of the heat-treated steel plates market because it improves the steel’s uniformity and machinability, as it refines the grain structure, improving mechanical properties like strength and ductility, making the material ideal for applications in construction, automotive, and energy industries. Normalized steel plates provide consistent performance under high-stress conditions, making them suitable for structural components. As industries demand more reliable and versatile materials, the benefits of normalizing support the rising adoption of heat-treated steel plates.

By Application

The automotive and transportation sector is set to be the largest market for heat-treated steel plates in 2024, which is fueled by the growth in the demand for high-strength materials in vehicle production, where safety, durability, and lightweight designs are critical. Heat-treated steel plates are vital in manufacturing key components like chassis, frames, suspension systems, and safety reinforcements.

These plates provide outstanding strength, impact resistance, and fatigue durability, making sure vehicles maintain structural integrity under many conditions. With the global expansion of the automotive industry, the need for these materials is expected to remain strong, reinforcing their dominance in this sector.

Further, the construction sector is anticipated to be the fastest-growing segment for heat-treated steel plates. Infrastructure projects, from commercial buildings to residential housing, depend on materials that can endure heavy loads, extreme weather, and other challenging conditions. Heat-treated steel plates are perfect for structural uses like beams, columns, and foundations, thanks to their superior strength and toughness.

In addition, their resistance to wear, corrosion, and abrasion ensures the long-term reliability of these projects. As urbanization accelerates in growing economies and governments prioritize infrastructure development, the demand for heat-treated steel plates in construction is rapidly increasing, which positions the construction industry as a key driver of market growth.

The Heat Treated Steel Plates Market Report is segmented on the basis of the following

By Type

- Carbon Steel

- Alloy Steel

- Stainless Steel

By Heat Treatment

- Annealing

- Tempering

- Normalizing

- Quenching

By Application

- Construction

- Energy & Power

- Industrial Machinery

- Automotive & Transportation

- Shipbuilding

- Others

Regional Analysis

The Asia-Pacific region is expected to

have 39.1% of the heat-treated steel plates market in 2024, due to higher demand from various industries, as its industrial machinery sector is set to grow significantly, driven by large-scale infrastructure projects in energy, transportation, IT, and water management. Countries like China, India, and Japan are investing heavily in these sectors, creating a strong market for heat-treated steel plates, which provide the strength and durability required for such demanding applications. The region’s fast urbanization and industrial expansion further enhance the demand for these materials.

Further, in North America, the heat-treated steel plate market is also expected for notable growth in the coming years. Key drivers like increased construction activity, stable automotive production, and an increase in the aerospace manufacturing sector. Government investments in aerospace and defense, along with evolving trade policies, are expected to boost demand for these plates, particularly for applications requiring high performance and reliability. The region's focus on innovation and technological developments in manufacturing further supports the market's expansion, making North America a promising area for future growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The heat-treated steel plates market is highly competitive, with a mix of global and regional players competing for market share. Companies aim for product innovation, advanced heat treatment techniques, and sustainable production methods to meet the growing demand across many industries like construction, automotive, and aerospace. Strategic partnerships and capacity expansions are common as manufacturers aim to improve their market presence and cater to evolving customer needs.

Some of the prominent players in the global Heat Treated Steel Plates are

- Tata Steel Ltd

- Hyundai Steel Company

- ArcelorMittal

- Posco

- Nippon Steel Corp

- JFE Holdings

- Thyssenkrupp AG

- SSAB AB

- Unites States Steel Corp

- Sumitomo Metal Industries Ltd.

- Other Key Players

Recent Developments

- In July 2024, SIJ Acroni completed the upgraded annealing and coating line for non-oriented electrical steel with a symbolic handover ceremony. The line is developed to handle all stages of the heat treatment process, making sure the need for electromagnetic and mechanical properties is stipulated by the most stringent standards and, most importantly, meeting the technical specifications of customers in the automotive industry.

- In July 2024, SBS Friction introduced an innovative new backing plate technology for its top-level racing compound, DS Dual Sinter. HeRidium as the new technology is called, is designed to match the extreme racing conditions and need for backing plate stability in World Superbike and mainly in 24 Hours World Endurance Stock class categories.

- In January 2024, Bodycote acquired Lake City HT and announced a GBP 60 million buyback program. Further, the company also announced that it had ended the agreement to acquire Stack Metallurgical Group, based in Albany, Oregon, due to a failure to satisfy all closing conditions of the agreement, which is primarily supplying the orthopedic implant market along with civil aerospace.

- In January 2024, Tata Steel unveiled that it would commence statutory consultation as part of its plan to switch and restructure its UK business, which is intended to reverse more than a decade of losses and transition from the legacy blast furnaces to a more sustainable, green steel business. Further, the transformation would have most of Tata Steel UK’s existing product capability and maintain the country’s self-sufficiency in steelmaking while also reducing Tata Steel UK’s CO2 emissions by 5 million metric tons per year and overall UK country emissions by about 1.5%.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 72.5 Bn |

| Forecast Value (2033) |

USD 104.6 Bn |

| CAGR (2024-2033) |

4.2% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 17.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Carbon Steel, Alloy Steel, and Stainless Steel), By Heat Treatment (Annealing, Tempering, Normalizing, and Quenching), By Application (Construction, Energy & Power, Industrial Machinery, Automotive & Defense Vehicles, Shipbuilding, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Tata Steel Ltd, Hyundai Steel Company, ArcelorMittal, Posco, Nippon Steel Corp, JFR Holdings, Thyssenkrupp AG, SSAB AB, Unites States Steel Corp, Sumitomo Metal Industries Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Heat Treated Steel Plates Market size is expected to reach a value of USD 72.5 billion in 2024 and is expected to reach USD 104.6 billion by the end of 2033.

Asia Pacific is expected to have the largest market share in the Global Heat Treated Steel Plates Market with a share of about 39.1% in 2024.

The Heat Treated Steel Plates Market in the US is expected to reach USD 17.1 billion in 2024.

Some of the major key players in the Global Heat Treated Steel Plates Market are Tata Steel Ltd, Hyundai Steel Company, ArcelorMittal, and others.

The market is growing at a CAGR of 4.2 percent over the forecasted period