Market Overview

The

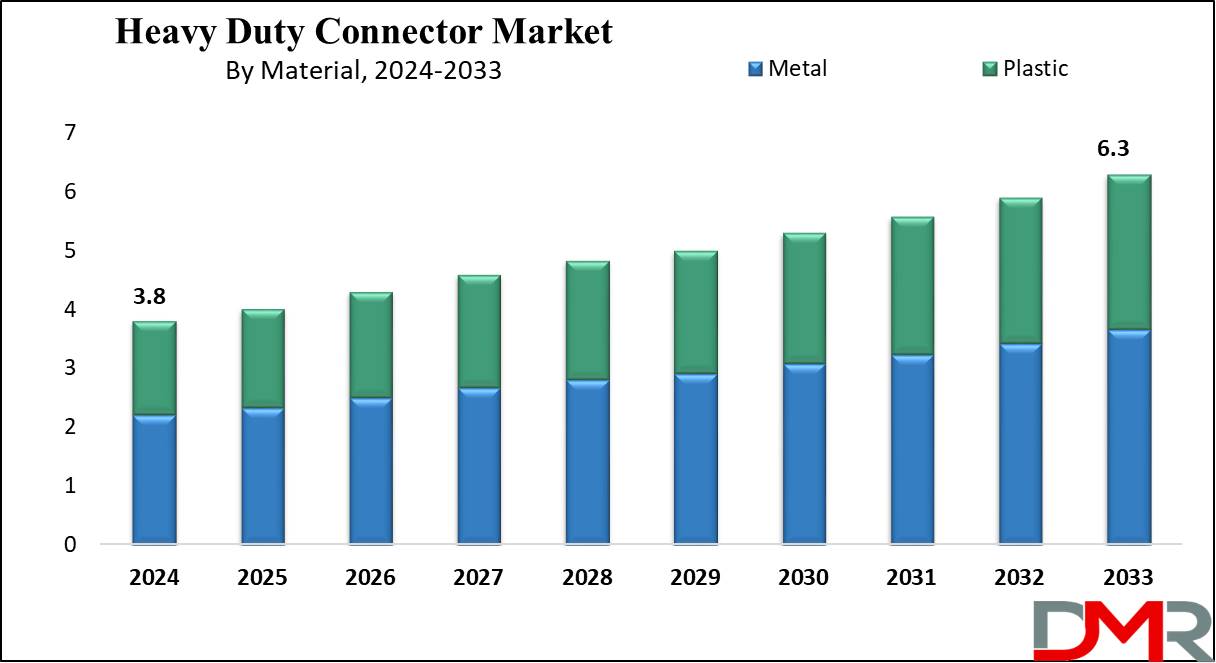

Global Heavy Duty Connector Market is projected to reach

USD 3.8 billion in 2024 and grow at a compound annual

growth rate of 5.7% from there until 2033 to reach a

value of USD 6.3 billion.

Heavy Duty Connectors (HDCs) are advanced, industrial-grade connectors developed to provide secure electrical connections in harsh environments. Made to stay in extreme conditions, HDCs protect against dust, moisture, mechanical impacts, and vibrations, making sure reliable power and data transmission across industrial applications. These connectors are important in sectors like manufacturing, construction, energy, and transportation, where reliable, high-performance connections are important.

Also, their durable design includes components like hoods, housings, inserts, and termination styles that work together to provide stable connections in challenging settings. Further, the demand for HDCs is growing due to expanding industries like automation, renewable energy, and electric vehicles (EVs). In manufacturing, higher automation and smart technology have driven the need for connectors that support specialized control and monitoring systems.

However, the shift toward clean energy has made new applications for HDCs in solar and wind energy infrastructure, where they support efficient power transfer and withstand tough weather conditions. Moreover, the growth of EV infrastructure requires high-quality connectors for charging systems, fueling growth in the HDC market. As industries continue to prioritize reliability and efficiency, the demand for high-performance connectors is projected to increase.

Furthermore, the integration of IoT capabilities and a shift toward compact, modular designs have also been seen a lot in recent times. IoT-enabled connectors provide live diagnostics, allowing for predictive maintenance, which enhances operational efficiency. Modular designs are also becoming popular, as they allow for customizable configurations, demanding the specific needs of various applications and simplifying installation in tight spaces, which reflect a growing emphasis on adaptability and smart connectivity in industrial environments, making HDCs not just robust but also smarter and more flexible. As industries advance technologically, the HDC market is likely to keep evolving to meet the demands of next-generation industrial systems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Heavy Duty Connector Market

The

US Heavy Duty Connector Market is projected to reach

USD 0.9 billion in 2024 at a compound annual

growth rate of 5.4% over its forecast period.

The heavy-duty connector market in the US has growth opportunities driven by growth in investments in automation, electric vehicles (EVs), and renewable energy. As industries look for smart manufacturing technologies, demand for robust, reliable connectors increases. In addition, the growth of EV infrastructure and clean energy projects, like wind and solar, drives the demand for connectors that ensure secure, high-performance connections in challenging environments.

Further, the market is driven by the increasing adoption of industrial automation, EV infrastructure, and renewable energy projects requiring reliable, high-performance connectors. However, high initial costs and complex installation processes act as challenges, deterring smaller businesses and complicating large-scale adoption, mainly in industries with limited budgets or technical resources.

Key Takeaways

- Market Growth: The Heavy Duty Connector Market size is expected to grow by 2.3 billion, at a CAGR of 5.7% during the forecasted period of 2025 to 2033.

- By Material: The Metal segment is anticipated to get the majority share of the Heavy Duty Connector Market in 2024.

- By Termination Style: The Crimp segment is expected to be leading the market in 2024

- By Application: The Manufacturing industry is expected to get the largest revenue share in 2024 in the Heavy Duty Connector Market.

- Regional Insight: Asia Pacific is expected to hold a 33.1% share of revenue in the Global Heavy Duty Connector Market in 2024.

- Use Cases: Some of the use cases of Smart Parking systems include renewable energy, construction machinery, and more.

Use Cases

- Industrial Automation: HDCs are used in manufacturing environments to reliably connect machines, controllers, and sensors, ensuring stable data and power transmission even in rugged conditions.

- Renewable Energy: They connect systems in wind turbines, solar panels, and energy storage solutions, handling high power loads and withstanding harsh weather conditions.

- Railway and Transportation: HDCs are ideal for trains, trams, and buses, providing secure and durable connections for power, signaling, and communication systems amid vibrations and extreme weather.

- Construction Machinery: In heavy machinery like excavators and cranes, HDCs ensure safe and better connections for hydraulic, electric, and control systems, withstanding dust, moisture, and mechanical stress.

Market Dynamic

Driving Factors

Expansion in Industrial Automation and RoboticsThe growth of automation in manufacturing, logistics, and warehousing industries has spiked the need for heavy-duty connectors (HDCs). As more facilities incorporate robotics and automated systems, reliable connectors are vital to support uninterrupted power and data transmission, driving HDC market growth.

Rising Demand for Renewable Energy Solutions

With global transformation toward sustainable energy sources like solar, wind, and hydro, HDCs are highly used in energy storage and grid integration setups. Their ability to handle high power and resist harsh environmental conditions makes them important in renewable energy infrastructure, boosting market demand.

Restraints

High Initial Cost and Maintenance

Due to their advanced design and high-quality materials, heavy-duty connectors are usually more expensive, which can discourage small and mid-sized enterprises from adopting them. In addition, maintaining HDCs in harsh environments can lead to higher costs, limiting their broad adoption.

Complex Installation Process

Installing HDCs in industrial settings requires skilled labor and specialized tools, making the process time-consuming and costly, which can discourage industries from upgrading to HDCs, especially where simpler or preexisting solutions suffice, thus restraining market growth.

Opportunities

Growth in Electric Vehicle (EV) Infrastructure

As the need for EVs rises, so does the demand for high-performance charging infrastructure that can handle high power loads. Heavy duty connectors, with their durability and high current capacity, are well-suited for EV charging stations, providing a growth opportunity in this expanding sector.

Advancements in Smart Grid Technology

The adoption of smart grids and advanced energy systems needs advanced, reliable connectors for data and power transmission. Heavy duty connectors can improve grid resilience and efficiency, making them a valuable component in smart energy projects, which opens up new opportunities in the energy sector.

Trends

Integration of IoT and Smart Connectivity

Recent trends show growth in heavy duty connectors with IoT and smart monitoring capabilities, allowing for real-time diagnostics and predictive maintenance. These “smart” connectors support industries to enhance operational efficiency, making HDCs a part of intelligent industrial ecosystems.

Shift Toward Modular and Compact Designs

Manufacturers are moving towards modular, compact, and user-friendly HDC designs that streamline installation and reduce space requirements, which is driven by the need for connectors that can be customized to specific applications, providing flexibility while maintaining durability and high performance in confined spaces.

Research Scope and Analysis

By Component

In the Heavy-Duty Connector Market, hood and housing components are expected to lead the market in 2024 as the important framework of the connector, providing a durable and secure enclosure that shields electrical connections from harsh industrial conditions. Their dominance in the market is due to this vital role in safeguarding electrical connections against dust, moisture, and mechanical stress, which are common in heavy-duty environments. With the steady growth of industrial automation and machinery usage, the need for dependable hoods and housings is constantly strong, making these components a fundamental part of the market.

Further, inserts & contact have started gaining traction as the fastest-growing segment in the Heavy-Duty Connector Market, due to the growth in demand for more adaptable and versatile connector designs. Inserts provide flexible configurations, allowing for a variety of contact types and additional accessories, which makes them suitable for varied industrial needs. As industries highly look for connectors that provide flexibility and compatibility with different systems, inserts are expanding rapidly to meet these changes in requirements, which makes them an appealing choice for businesses focusing on keeping up with the latest technological demands in industrial connectivity.

By Material

Metal is anticipated to dominate in the heavy-duty connector market in 2024 due to its strength, durability, and excellent conductivity. Metal connectors provide better protection for electrical connections, shielding them from harsh industrial conditions like extreme temperatures, moisture, and mechanical impacts, which makes metal connectors ideal for demanding environments where resilience is essential.

In addition, the metal’s superior conductivity ensures better power and data transmission, reducing energy loss. Metal connectors also provide high resistance to corrosion and wear, which extends their lifespan even in tough applications. As a result, metal remains a preferred choice in industries that need reliable, long-lasting performance from their heavy-duty connectors. Further, Plastic is highly used in the heavy-duty connector market because it provides a lightweight yet durable alternative to metal.

Plastic connectors are resistant to corrosion and can withstand harsh conditions, like moisture and chemicals, making them suitable for many industrial applications. In addition, plastic provides electrical insulation, improving safety in electrical connections. Its lighter weight also smoothly installation and reduces strain on equipment. These benefits make plastic a popular choice for heavy-duty connectors where durability and insulation are key.

By Termination Style

Crimp termination plays a vital role in the heavy-duty connector market and is expected to dominate the market revenue share in 2024 due to its secure and reliable connection. By tightly compressing a contact onto the wire, crimping develops a strong, stable connection that resists vibration, making it ideal for demanding industrial applications, which not only ensures excellent electrical conductivity but also simplifies installation, as it doesn’t need soldering. In addition, crimp connections are easy to inspect and can be applied rapidly, which boosts productivity in large-scale setups. The durability and efficiency of crimping make it a preferred choice for industries needing robust, high-performance connections.

Further, screw termination is a popular choice in the heavy-duty connector market and is anticipated to grow steadily over the forecast period due to its simplicity and secure hold, which includes tightening a screw to fasten the wire in place, and developing a strong and stable connection. It’s easy to install and doesn’t need special tools, making it suitable for various applications. Screw termination is also highly reliable under heavy usage, as it maintains a firm grip on wires, which is important in industrial settings with frequent vibrations.

By Application

Manufacturing is set to be the leading application area for heavy-duty connectors in 2024, highly due to their large utilization in industrial machinery, automation, and control systems., which depends highly on high-quality, reliable connectors to ensure smooth and efficient operations in demanding environments. The constant need for durable connectors in manufacturing processes has kept this sector dominant within the heavy-duty connector market.

Further, the power segment is becoming the fastest-growing application, particularly in solar and wind power. As the world transitions toward sustainable energy, there is a growing demand for connectors that can handle the distinctive requirements of solar panel installations and wind turbines. With a strong focus on clean energy, governments and industries across the world are investing in renewable power, driving rapid growth in this sector. Heavy-duty connectors play a major role in supporting these green energy projects, making them important to the expansion of renewable energy infrastructure.

The Heavy Duty Connector Market Report is segmented on the basis of the following

By Component

- Insert & Contact

- Hoods & Housing

- Accessories

By Material

By Termination Style

By Application

- Power

- Construction

- Railways

- Oil & Gas

- Manufacturing

- Others

Regional Analysis

Asia Pacific plays a major role in the growth of the heavy-duty connector market and is

projected to have 33.1% of revenue share in 2024 due to its rapid industrialization and strong presence in manufacturing, automotive, and renewable energy sectors. Countries like China, India, and Japan are major contributors, with expanding industries that need durable, high-performance connectors for automation, machinery, and energy infrastructure.

The region’s transformation toward renewable energy sources, mainly solar and wind power, is driving demand for heavy-duty connectors in energy projects. In addition, Asia Pacific's growing electric vehicle (EV) market provides new opportunities for connectors in EV charging infrastructure. The integration of industrial growth and technological advancements in this region drives the heavy-duty connector market's expansion.

Further, North America is expected to show steady growth in the heavy-duty connector market, driven by development in industrial automation, renewable energy, and electric vehicle infrastructure. The U.S. and Canada’s looks on smart manufacturing, clean energy solutions, and the expansion of EV charging networks create strong demand for durable, reliable connectors. These sectors require high-performance connectors to support efficient and secure operations, fueling market growth in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The heavy-duty connector market is marked by a varied set of companies providing innovative solutions to meet the increase in demand for reliable, high-performance connectors. Key players look at product development, focusing on durability, versatility, and adaptability to many industrial applications. With industries like manufacturing, energy, and transportation driving demand, companies are competing on factors like customization options, affordable, and technological advancements.

Strategic partnerships, mergers, and acquisitions are also common as businesses aim to expand their market presence and offer more comprehensive solutions to customers.

Some of the prominent players in the global Heavy Duty Connector are

- TE Connectivity

- Molex

- Connector Technology

- JST

- Schneider Electric

- Amphenol Sine

- Walther-Werke

- Lapp Group

- ODU GmbH

- ITT Cannon

- Other Key Players

Recent Developments

- In October 2024, Heilind Electronics unveiled a new global distribution partnership with GCT (Global Connector Technology), a renowned manufacturer of connector and cable assembly solutions, which brings together Heilind's extensive distribution network and industry expertise with GCT's innovative interconnect products, providing customers an even broader range of high-quality connectivity solutions.

- In September 2024, Stäubli launched its latest hands-free Quick-Charging Connector System with industry-leading 7.5 MW charging power to speed up the electrification of mining trucks, which will make heavy-duty electric mining vehicles allow fast, reliable, and safer charging, increasing uptime and productivity.

- In May 2024, ENNOVI launched a new ENNOVI-MB2B multi-row board-to-board (BTB) connector platform for EVs with a snap-in design that enables various connector units to be stacked together without solder, which allows different pin count needs to be accommodated through the same basic interconnect platform without any extra expense or engineering effort, while focusing at electric power steering (EPS) and electronic control units (ECUs) in EVs.

- In March 2024, Standard Motor Products launched Pollak’s new line of Trailer Connectors, Adapters and accessories. The Pollak® line of precision-customized Trailer Connectors, Adapters, extensions and accessories have been particularly designed for towing with light-duty and medium-duty trucks and SUVs.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 3.8 Bn |

| Forecast Value (2033) |

USD 6.3 Bn |

| CAGR (2024-2033) |

5.7% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 0.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Insert & Contact, Hoods & Housing, and Accessories), By Material (Metal and Plastic), By Termination Style (Crimp, Screw, and Others), By Application (Power, Construction, Railways, Oil & Gas, Manufacturing, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

TE Connectivity, Molex, Connector Technology, JST, Schneider Electric, Amphenol Sine, Walther-Werke, Lapp Group, ODU GmbH, ITT Cannon, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Heavy Duty Connector Market?

▾ The Global Heavy Duty Connector Market size is expected to reach a value of USD 3.8 billion in 2024 and is expected to reach USD 6.3 billion by the end of 2033.

Which region accounted for the largest Global Heavy Duty Connector Market?

▾ Asia Pacific is expected to have the largest market share in the Global Heavy Duty Connector Market with a share of about 33.1% in 2024.

How big is the Heavy Duty Connector Market in the US?

▾ The Heavy Duty Connector Market in the US is expected to reach USD 0.9 billion in 2024.

Who are the key players in the Global Heavy Duty Connector Market?

▾ Some of the major key players in the Global Heavy Duty Connector Market are TE Connectivity, Molex, Connector Technology, Inc., and others

What is the growth rate in the Global Heavy Duty Connector Market?

▾ The market is growing at a CAGR of 5.7 percent over the forecasted period.