Market Overview

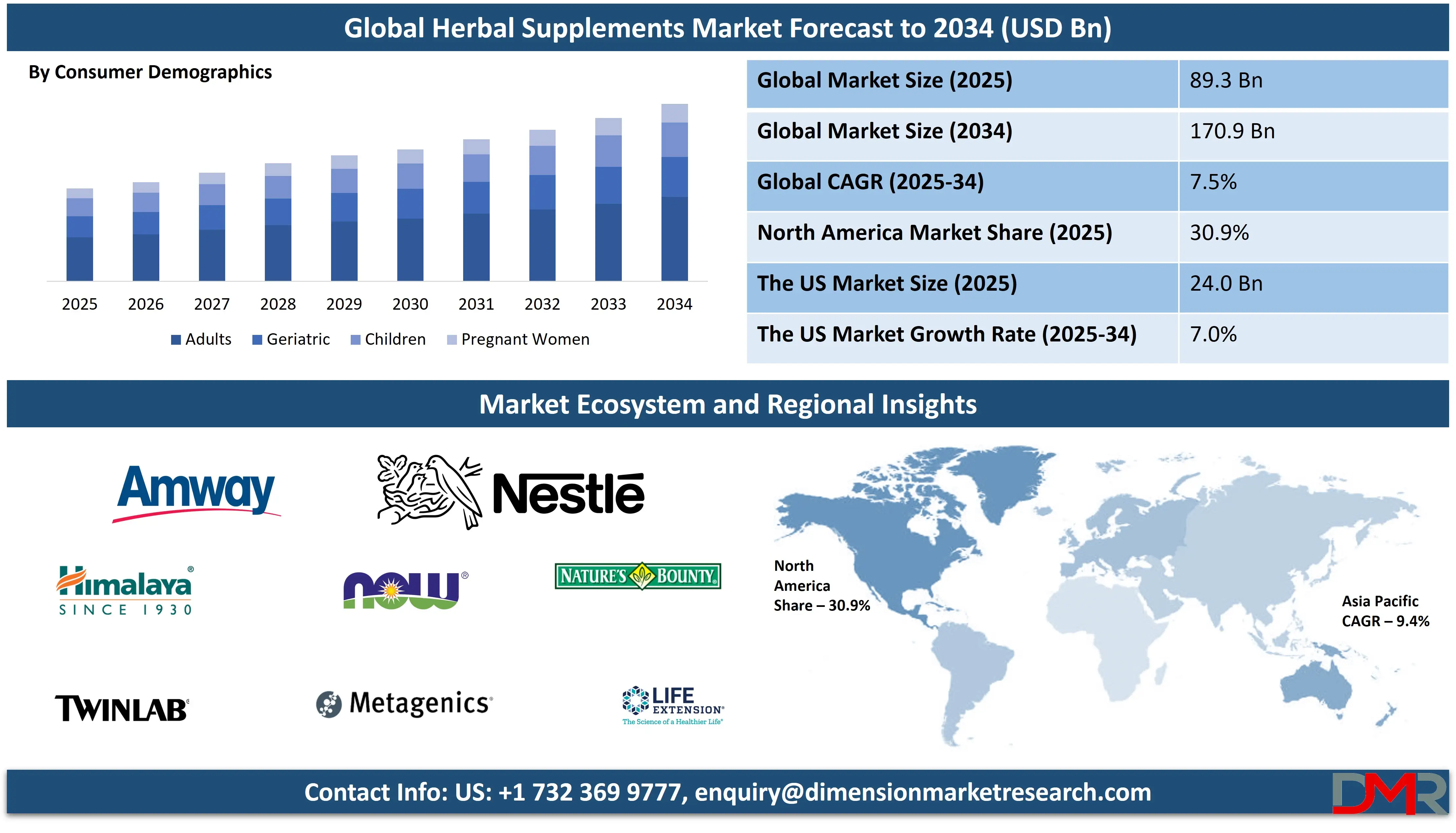

The Global Herbal Supplements Market size is projected to reach

USD 89.3 billion in 2025 and grow at a compound annual

growth rate of 7.5% from there until 2034 to reach a value of

USD 170.9 billion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Herbal supplements are products made from plants and used to support health. These supplements may come from leaves, roots, seeds, flowers, or berries and are often taken to improve overall well-being, boost the immune system, or help with specific conditions like digestion or sleep. People usually take them in the form of capsules, teas, powders, or liquid extracts. Common examples include ginseng, turmeric, echinacea, garlic, and ginger. Herbal supplements are not classified as medicines, so they are often sold over the counter in health stores, supermarkets, and online.

In recent years, the demand for herbal supplements has grown steadily. Many people are turning to natural remedies instead of traditional pharmaceutical products. This shift is partly due to rising interest in natural health, fewer side effects, and a growing belief in the healing power of plants. As more consumers focus on preventive health and personal wellness, herbal supplements have become a regular part of daily routines. They are popular across all age groups, especially among older adults and health-conscious individuals.

Several key trends have helped push the herbal supplement market forward. First, there is more awareness about plant-based diets and natural living. Second, the use of social media and online influencers has helped spread information quickly about herbal benefits. Third, wellness has become a major focus in workplaces and homes. Products with ingredients like ashwagandha, elderberry, and moringa have gained popularity due to claimed immune-boosting and stress-reducing effects. Companies are also combining herbs with vitamins and minerals to make multi-functional health products.

The COVID-19 pandemic had a major impact on the herbal supplements market. During this time, people searched for ways to stay healthy and protect themselves from illness. Many turned to natural products, especially those said to support the immune system. This caused a sharp increase in sales of herbal supplements such as echinacea, elderberry, and turmeric. Companies responded by expanding their product lines, while supply chains adjusted to meet growing demand.

New research and technology have also played a role in shaping this industry. Scientific studies have been exploring how herbal ingredients affect the body, helping to improve product quality and credibility. Better farming methods and quality control processes are making it easier to produce safe and effective supplements. At the same time, regulations in some regions are being updated to ensure product safety and accurate labeling.

The US Herbal Supplements Market

The US Herbal Supplements Market size is projected to reach USD 24.0 billion in 2025 at a compound annual growth rate of 7.0% over its forecast period.

The US plays a major role in the herbal supplements market as one of the largest consumers and innovators in this space. Many consumers in the US prefer natural and plant-based health products, driving strong demand for herbal supplements. The country has a well-developed regulatory system that promotes product safety and quality, which helps build consumer trust. The US market also benefits from extensive research and development efforts, leading to new herbal formulations and innovative delivery methods. Online sales and health stores in the US make these products widely accessible. Additionally, growing health awareness and preventive care trends in the US continue to boost market growth. Overall, the US remains a key player influencing global trends and standards in the herbal supplements industry.

Europe Herbal Supplements Market

Europe Herbal Supplements Market size is projected to reach USD 25.1 billion in 2025 at a compound annual growth rate of 7.1% over its forecast period.

Europe plays a significant role in the herbal supplements market with strong consumer interest in natural and traditional health products. Many European countries have a long history of using herbal remedies, which supports steady demand. The region is known for strict regulations and quality standards, ensuring the safety and effectiveness of herbal supplements. This regulatory environment helps increase consumer confidence.

Europe also focuses on sustainability and organic ingredients, influencing product development and sourcing practices. Growing awareness about preventive health and wellness drives more people to use herbal supplements for immunity, digestion, and stress relief. Additionally, the rise of online retail and specialty health stores in Europe has made these products more accessible, supporting continued market expansion across the region

Japan Herbal Supplements Market

Japan Herbal Supplements Market size is projected to reach USD 4.5 billion in 2025 at a compound annual growth rate of 8.3% over its forecast period.

Japan plays an important role in the herbal supplements market, known for its strong tradition of using natural remedies and herbal medicine. Japanese consumers value high-quality, safe, and effective supplements, leading to strict regulations and thorough quality control in the market. The aging population in Japan creates increased demand for supplements that support healthy aging, immunity, and overall wellness.

Japan also focuses on scientific research to back the benefits of herbal ingredients, helping build trust among consumers. Innovation in product formats, such as easy-to-take capsules and functional drinks, is common. Additionally, the country’s advanced healthcare system encourages preventive health, which further boosts interest in herbal supplements. Overall, Japan combines tradition with technology, making it a key player in the global herbal supplement industry.

Herbal Supplements Market: Key Takeaways

- Market Growth: The Herbal Supplements Market size is expected to grow by USD 75.6 billion, at a CAGR of 7.5%, during the forecasted period of 2026 to 2034.

- By Consumer Demographics: The adult segment is anticipated to get the majority share of the Herbal Supplements Market in 2025.

- By Distribution Channel: The pharmacies/drug stores segment is expected to get the largest revenue share in 2025 in the Herbal Supplements Market.

- Regional Insight: North America is expected to hold a 30.9% share of revenue in the Global Herbal Supplements Market in 2025.

- Use Cases: Some of the use cases of Herbal Supplements include digestive health, immune system support, and more.

Herbal Supplements Market: Use Cases:

- Stress and Anxiety Relief: Herbal supplements like ashwagandha and valerian root are often used to help manage stress and anxiety. These herbs are believed to support the nervous system and promote relaxation. Many people use them as a natural option instead of prescription medications for mild stress-related symptoms.

- Immune System Support: Herbal ingredients such as echinacea, elderberry, and turmeric are popular for boosting immunity. They are commonly taken during cold and flu season or during times of increased illness risk. These supplements are believed to support the body’s natural defense system and help shorten the duration of sickness.

- Digestive Health: Herbs like ginger, peppermint, and fennel are widely used to ease digestive discomfort. These supplements can help with issues such as bloating, gas, and indigestion. Many people take them before or after meals to support healthy digestion naturally.

- Energy and Vitality Boost: Ginseng, maca root, and rhodiola are examples of herbs used to improve energy and reduce fatigue. They are often taken by people with busy lifestyles or those looking to enhance physical and mental performance. These supplements are seen as a natural way to maintain stamina without relying on stimulants.

Stats & Facts

- According to the NIH, more than half of the U.S. population takes a daily multivitamin, showing a strong national trend toward preventive health through supplementation. Among these, vitamin D stands out as the most commonly consumed single supplement, reflecting its wide recognition for supporting bone health, immunity, and overall wellness.

- WHO data highlights that calcium supplements are especially popular among older adults, with 43% of U.S. women over the age of 60 taking them regularly. This trend is driven by concerns over bone density and osteoporosis, especially in post-menopausal women who face higher risks of fractures.

- Based on CDC statistics, approximately 17% of adults in the United States use vitamin E supplements. This usage is often motivated by the antioxidant and skin health benefits of vitamin E, which supports immune function and helps fight oxidative stress.

- WHO reports that iron deficiency continues to affect around 25% of the global population. This widespread health issue is a major factor behind the strong demand for iron supplements, which are essential for preventing anemia and supporting overall energy levels.

- According to the NIH, vitamin C is the second most commonly used vitamin supplement globally, with the market valued at over $1 billion. Its popularity stems from its immune-boosting qualities and role in skin and tissue repair, making it a go-to supplement for many households.

- The NIH states that vitamin B12 deficiency impacts roughly 15% of elderly individuals, which has resulted in increased use of B12 supplements to support nerve function and energy levels. This deficiency is especially common among older adults due to decreased absorption with age.

- From WHO data, magnesium supplements have gained popularity recently, showing a 15% increase in sales. This surge is largely linked to growing consumer interest in natural ways to support sleep quality, muscle recovery, and stress relief.

- The CDC reports that folic acid supplementation among pregnant women in the U.S. has reached about 70%. This high compliance rate is due to its known role in preventing neural tube defects during fetal development, making it a crucial part of prenatal care.

- According to NIH, zinc supplements are often used during cold and flu seasons, with about 12% of the U.S. population turning to them for immune system support. Zinc is known to shorten the duration of common colds and is a staple in many over-the-counter remedies.

- WHO notes that selenium supplements are taken by around 9% of adults in the U.S. These are mainly consumed for their antioxidant properties, which help protect cells from damage and may support thyroid health and immune response.

Market Dynamic

Driving Factors in the Herbal Supplements Market

Rising Health Awareness and Preference for Natural ProductsOne of the main drivers of the herbal supplements market is the growing awareness of personal health and wellness. People are becoming more cautious about what they consume and are showing a strong preference for natural, plant-based solutions over synthetic products. This shift is largely influenced by lifestyle changes, social media, and the widespread sharing of wellness tips online. Consumers now seek out products with fewer chemicals and additives, and herbal supplements fit well into this trend. As more individuals aim to prevent illness rather than treat it, they turn to herbs that support immunity, stress management, digestion, and energy. This ongoing demand for clean, natural, and holistic health products is encouraging more companies to invest in herbal formulas.

Expanding Availability Through Online and Retail Channels

Another strong growth driver is the wider availability of herbal supplements across multiple sales channels. Online platforms, health stores, supermarkets, and pharmacies now regularly stock these products, making them easier to access than ever before. The convenience of e-commerce has especially boosted sales, allowing consumers to explore different brands, read reviews, and receive deliveries at home. Many brands have also improved their packaging and labeling, helping customers understand benefits and dosage better. Subscription services and digital marketing have further supported this growth by keeping users engaged and informed. As a result, even people in remote or smaller towns can now purchase herbal supplements with ease, increasing the overall reach of the market.

Restraints in the Herbal Supplements Market

Lack of Standardization and Quality ControlOne major restraint in the herbal supplements market is the lack of consistent standards and quality control. Unlike pharmaceutical drugs, many herbal products are not strictly regulated in some regions, which can lead to variations in strength, purity, and effectiveness. Some products may contain lower amounts of the active herb than listed, or be mixed with fillers and additives. This inconsistency can reduce consumer trust and affect results, making people hesitant to rely on herbal supplements. Additionally, without clear testing or certification processes, it becomes difficult for users to verify safety. This lack of regulation can limit the growth of the market, especially in areas where consumers demand transparency and high product standards.

Limited Scientific Evidence and Health Claims

Another key challenge for the herbal supplements market is the limited scientific research available to support health claims. While many herbs have been used traditionally for centuries, there is still not enough large-scale clinical evidence to confirm their full effectiveness and safety. As a result, health professionals and cautious consumers may be skeptical about relying on herbal remedies. Restrictions on marketing claims also prevent companies from promoting specific health benefits, making it harder to communicate product value. This creates a gap between consumer interest and scientific backing, which may slow adoption. Until more research is conducted and officially recognized, herbal supplements may face hesitation from a broader medical and consumer audience.

Opportunities in the Herbal Supplements Market

Growing Demand for Preventive Healthcare Solutions

An important opportunity for the herbal supplements market lies in the rising demand for preventive healthcare. People are increasingly looking for ways to stay healthy and avoid illness through daily habits rather than relying solely on medical treatments. Herbal supplements fit well into this lifestyle by offering natural support for immunity, digestion, stress management, and overall wellness. As healthcare costs rise and awareness increases, consumers are more motivated to invest in products that support long-term health. This shift opens the door for more product development focused on daily wellness routines. Brands can capitalize on this by creating easy-to-use, benefit-specific supplements that blend tradition with modern health goals. Preventive health is expected to be a key trend shaping future market growth.

Innovation in Product Formulations and Delivery Methods

Another major opportunity lies in innovation, both in herbal formulations and how supplements are delivered. Instead of traditional pills and powders, consumers are showing interest in gummies, teas, functional drinks, and even herbal-infused snacks. These formats make it easier and more enjoyable to take supplements daily. At the same time, companies are exploring combinations of multiple herbs, vitamins, and minerals to create more effective, all-in-one health solutions. Advances in research and extraction technology are helping improve the absorption and potency of herbal ingredients. This innovation allows brands to stand out in a competitive market and attract younger, more curious consumers looking for convenient and effective wellness products.

Trends in the Herbal Supplements Market

Personalized Nutrition and Functional Blends

A significant trend in the herbal supplements market is the shift towards personalized nutrition. Consumers are increasingly seeking supplements tailored to their individual health needs, driven by advancements in nutrigenomics and microbiome research. This has led to the development of multi-functional blends that combine adaptogens, antioxidants, and immune boosters to support overall wellness. Brands are leveraging digital health tracking and AI-driven formulations to create customized supplement regimens, enhancing consumer engagement and satisfaction. This trend reflects a broader move towards individualized health solutions in the wellness industry.

E-commerce Growth and Digital Marketing

The rise of e-commerce platforms has transformed the distribution of herbal supplements, making them more accessible to a global audience. Online retail channels provide consumers with convenience, variety, and accessibility, driving the sales of herbal supplements. Social media influencers and digital marketing strategies have further amplified product visibility, particularly among younger, health-conscious consumers. Platforms like Xiaohongshu in China have become pivotal in shaping consumer preferences, with user-generated content and targeted marketing driving engagement and sales in the herbal supplements sector.

Research Scope and Analysis

By Product Type Analysis

Tablets as a product type are expected to lead the herbal supplements market in 2025, holding an estimated share of 27.3%. Their popularity comes from ease of use, precise dosage, and convenience for daily consumption. Many consumers prefer tablets because they are portable and have a longer shelf life compared to other forms like powders or liquids. Tablets also allow manufacturers to combine multiple herbal ingredients into one product, offering more comprehensive health benefits such as immunity support, stress relief, and digestion aid. Advances in production technology have improved tablet quality, making them more effective and easier to digest. The growing demand for standardized and reliable herbal supplements is helping tablets remain a top choice in the market.

Oils as a product type are set to experience significant growth in the herbal supplements market over the forecast period. Herbal oils are valued for their natural extraction and quick absorption, making them popular for skin health, pain relief, and overall wellness. The rise of autonomous service robots in manufacturing is helping improve the precision and efficiency of herbal oil production, ensuring consistent quality and purity. This automation supports the increasing demand for high-quality, natural products by reducing contamination and improving packaging. Consumers appreciate oils for their versatility, as they can be used topically or taken orally, driving further market expansion. The growth of herbal oils reflects a wider trend towards natural, easy-to-use wellness solutions.

By Source Analysis

Leaves as a source in the herbal supplements market will play a major role in 2025, with an estimated share of 29.7%. Many popular herbal supplements are made from leaves because they contain high concentrations of active compounds that support health benefits such as boosting immunity, reducing inflammation, and improving digestion. Leaves from plants like green tea, neem, and moringa are widely used due to their natural potency and availability. The preference for leaf-based supplements is also driven by their easy processing into powders, extracts, and capsules. As consumers look for pure and effective natural products, leaf-sourced supplements are gaining more trust. This trend supports steady market growth, making leaves one of the most important raw materials in the herbal supplement industry.

Fruits and vegetables as a source type are expected to show significant growth in the herbal supplements market over the forecast period. These natural sources provide vitamins, antioxidants, and essential nutrients that contribute to overall wellness and disease prevention. Advances in production, including the use of autonomous service robots, are improving the harvesting and processing of fruit and vegetable extracts. This automation enhances efficiency, maintains quality, and reduces contamination risks. Consumers appreciate supplements made from familiar, natural ingredients that support immunity, skin health, and digestion. The convenience and safety offered by fruit and vegetable-based supplements are driving their popularity, making this segment a key area of growth in the herbal supplements market.

By Function Analysis

Immunity enhancement as a function in the herbal supplements market will hold a key position in 2025, with an estimated share of 24.6%. Consumers are increasingly focused on strengthening their immune systems to better fight illnesses and maintain overall health. Herbal supplements containing ingredients like echinacea, elderberry, and turmeric are popular choices for this purpose. The demand for natural immunity boosters has grown due to rising health awareness and the desire to avoid synthetic medicines. This function’s growth is supported by ongoing research that highlights the benefits of herbal compounds in immune support. As more people look for preventive health solutions, immunity enhancement remains a strong driver in the herbal supplements market, encouraging the development of targeted, effective products.

Weight loss as a function is set to see significant growth in the herbal supplements market over the forecast period. Many consumers seek natural and safe options to manage weight, turning to herbal products known to support metabolism, reduce appetite, and improve fat burning. Advances in manufacturing, including the use of autonomous service robots, are improving production efficiency and ensuring consistent quality in weight loss supplements. This automation helps maintain ingredient purity and packaging precision, increasing consumer confidence. The convenience and perceived safety of herbal weight loss supplements attract a growing audience. As health and fitness trends continue to rise, the weight loss segment is expected to be an important factor driving the herbal supplements market forward.

By Consumer Demographics

Adults as a consumer demographic will dominate the herbal supplements market in 2025, with an estimated share of 47.5%. This group includes working professionals and health-conscious individuals who prioritize maintaining their wellness through natural means. Adults often seek supplements that help manage stress, boost energy, support immunity, and improve overall vitality. The convenience of herbal supplements fits well with their busy lifestyles, making tablets, capsules, and ready-to-use products popular choices. Growing awareness about preventive healthcare and a preference for natural remedies over pharmaceuticals contribute to increased demand. As adults continue to focus on long-term health and well-being, their role as the largest consumer segment will strongly influence the development and marketing of herbal supplements.

Geriatrics as a consumer demographic are set to experience significant growth in the herbal supplements market over the forecast period. Older adults often look for natural ways to support joint health, memory, immunity, and overall aging well. Autonomous service robots are playing a role in the manufacturing and packaging of supplements designed for this group, improving precision and ensuring consistent quality. This technology helps produce safer, easy-to-use formulations like soft gels and powders that meet the specific needs of the elderly. The increasing geriatric population’s focus on maintaining independence and quality of life is driving demand for herbal supplements, making this segment important for market expansion.

By Distribution Channel Analysis

Pharmacies and drug stores are expected to lead the herbal supplements market in 2025 with an estimated share of 31.8%. These retail outlets are trusted by consumers for providing genuine and high-quality health products. People often prefer buying herbal supplements from pharmacies because they can also receive guidance from pharmacists, making the experience more reliable and informative. Pharmacies are easily accessible in both urban and rural areas, which helps expand the market reach. The growing demand for immunity boosters, digestion aids, and stress-relief supplements has increased footfall in drug stores. Their established supply chains and consistent availability of trusted brands further support sales growth. As more consumers turn to herbal products for daily wellness, pharmacies and drug stores will remain a key channel in meeting this rising demand.

Online stores as a distribution channel are set to show significant growth in the herbal supplements market over the forecast period. Consumers are drawn to the convenience, variety, and competitive pricing that online platforms offer. With detailed product descriptions, customer reviews, and quick delivery, people find it easier to shop for herbal supplements from the comfort of their homes.

Autonomous service robots are now playing a part in online order fulfillment centers by handling sorting, packaging, and inventory management, helping ensure faster and more accurate deliveries. These advanced systems improve efficiency and customer satisfaction. The rise of mobile shopping apps, digital promotions, and health awareness campaigns are further boosting online sales, making e-commerce a major force in the market’s expansion.

The Herbal Supplements Market Report is segmented on the basis of the following

By Product Type

- Tablets

- Capsules

- Powders

- Soft gels

- Syrups

- Oils

- Others

By Source

- Leaves

- Fruits & Vegetables

- Roots

- Barks

- Flowers

- Others

By Function

- Immunity Enhancement

- Weight Loss

- Digestive Health

- Cognitive Health

- Anti-aging

- Heart Health

- Others

By Consumer Demographics

- Adults

- Geriatric

- Pregnant Women

- Children

By Distribution Channel

- Pharmacies/Drug Stores

- Supermarkets/Hypermarkets

- Online Stores

- Health & Wellness Stores

- Others

Regional Analysis

Leading Region in the Herbal Supplements Market

The North America region is leading the growth of the herbal supplements market in 2025, holding an estimated share of 30.9%. This strong position is driven by increasing consumer interest in natural health products and preventive care. Many people in North America prefer herbal supplements as a safer, plant-based alternative to conventional medicines. The region benefits from well-established regulations that ensure product quality and safety, which helps build trust among users.

Additionally, the rise of online shopping and availability in various retail stores make these supplements easy to access. Growing awareness about wellness and the importance of boosting immunity, managing stress, and improving digestion also contributes to market growth. Innovation in product forms, such as gummies and teas, along with active marketing campaigns, further supports demand. Overall, North America continues to be a key market influencing global herbal supplement trends and expansion.

Fastest Growing Region in the Herbal Supplements Market

The Asia Pacific region is showing significant growth in the herbal supplements market and is expected to persist over the forecast period, driven by increasing consumer awareness of natural health and traditional medicine. Countries in this region have a rich history of using herbal remedies, which boosts demand for these products. The rise of health-conscious consumers seeking immunity boosters, stress relief, and digestive support is also contributing to market expansion.

Additionally, growing urbanization, rising disposable incomes, and improved access to online and retail stores make herbal supplements more available. The region is estimated to play a key role in the global herbal supplements market in 2025, with ongoing innovations and a focus on organic and natural ingredients supporting steady growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The herbal supplements market is highly competitive, with many players offering a wide variety of products to meet growing consumer interest in natural health. Companies compete by focusing on product quality, unique herbal blends, and clean labels with simple, natural ingredients. Some aim at general wellness, while others target specific needs like stress relief, immunity, or digestion. The rise of online shopping has made it easier for both new and established brands to reach customers, increasing competition. Many brands also invest in packaging, marketing, and scientific backing to stand out. As consumer awareness grows, trust, transparency, and innovation are becoming key factors in staying ahead. Overall, the market remains active, with fast changes and new product launches happening often.

Some of the prominent players in the Global Herbal Supplements are

- Nestle

- Amway

- Nature’s Bounty

- Himalaya Wellness

- Now Foods

- Twinlab

- Metagenics

- Life Extension

- Naturelo

- Irwin Naturals

- Botanic Choice

- Life Extension

- Boiron

- Jarrow Formulas

- Nature Made

- MegaFoos

- Gaia Herbs

- Blackmores

- Now Foods

- Other Key Players

Recent Developments

- In March 2025, Novo Nordisk launched NovoCare® Pharmacy, a direct-to-patient service offering all strengths of Wegovy® (semaglutide) injections at a reduced cost of $499 per month for cash-paying patients. This initiative supports uninsured individuals and those with commercial insurance who lack obesity drug coverage. The launch follows the FDA’s announcement that the Wegovy® shortage is resolved, with supply now meeting U.S. demand. NovoCare® Pharmacy expands the company’s approach to helping people with obesity access effective, affordable treatment options.

- In February 2025, SFI Health™ EMEA, part of global natural healthcare leader SFI Health™, is set to launch its Equazen® products in Portugal, expanding its European presence. This follows a February 2024 exclusive license-in agreement with Eqyon Healthcare Solutions, a local distributor with strong expertise in healthcare product sales and marketing. Eqyon will distribute the Equazen® range through pharmacies and parapharmacies. Known for clinically researched products in cognition, microbiome, and well-being, SFI Health™ continues to strengthen its footprint across Europe.

- In February 2025, Lifeasible launched a new sub-brand, Lifeasible Herbal Medicine, to offer targeted solutions for herbal medicine research. Herbal remedies, sourced from plants and natural materials, have been used worldwide for centuries to treat diseases and support overall wellness. Valued for their natural composition and minimal side effects, herbs offer anti-inflammatory, antioxidant, antibacterial, and immune-boosting benefits.

- In August 2024, Eli Lilly announced the availability of Zepbound® (tirzepatide) 2.5 mg and 5 mg single-dose vials for self-pay patients with valid prescriptions. These vials are priced at over 50% less than other GLP-1 obesity medicines, improving access for patients without insurance coverage or savings card eligibility. This move addresses high demand and expands supply. In clinical studies, the 5 mg dose supported an average of 15% weight loss over 72 weeks, offering a valuable option for obesity management.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 89.3 Bn |

| Forecast Value (2034) |

USD 170.9 Bn |

| CAGR (2025–2034) |

7.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 24.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Tablets, Capsules, Powders, Soft gels, Syrups, Oils, and Others), By Source (Leaves, Fruits & Vegetables, Roots, Barks, Flowers, and Others), By Function (Immunity Enhancement, Weight Loss, Digestive Health, Cognitive Health, Anti-aging, Heart Health, and Others), By Consumer Demographics (Adults, Geriatric, Pregnant Women, and Children), By Distribution Channel (Pharmacies/Drug Stores, Supermarkets/Hypermarkets, Online Stores, Health & Wellness Stores, and Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Nestle, Amway, Nature’s Bounty, Himalaya Wellness, Now Foods, Twinlab, Metagenics, Life Extension, Naturelo, Irwin Naturals, Botanic Choice, Life Extension, Boiron, Jarrow Formulas, Nature Made, MegaFoos, Gaia Herbs, Blackmores, Now Foods, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Global Herbal Supplements Market?

▾ The Global Herbal Supplements Market size is expected to reach a value of USD 89.3 billion in 2025 and is expected to reach USD 170.9 billion by the end of 2034.

Which region accounted for the largest Global Herbal Supplements Market?

▾ North America is expected to have the largest market share in the Global Herbal Supplements Market, with a share of about 30.9% in 2025.

How big is the Herbal Supplements Market in the US?

▾ The Herbal Supplements Market in the US is expected to reach USD 24.0 billion in 2025.

Who are the key players in the Global Herbal Supplements Market?

▾ Some of the major key players in the Global Herbal Supplements Market are Nestle, Amway, Nature’s Bounty, and others

What is the growth rate in the Global Herbal Supplements Market?

▾ The market is growing at a CAGR of 7.5 percent over the forecasted period