Market Overview

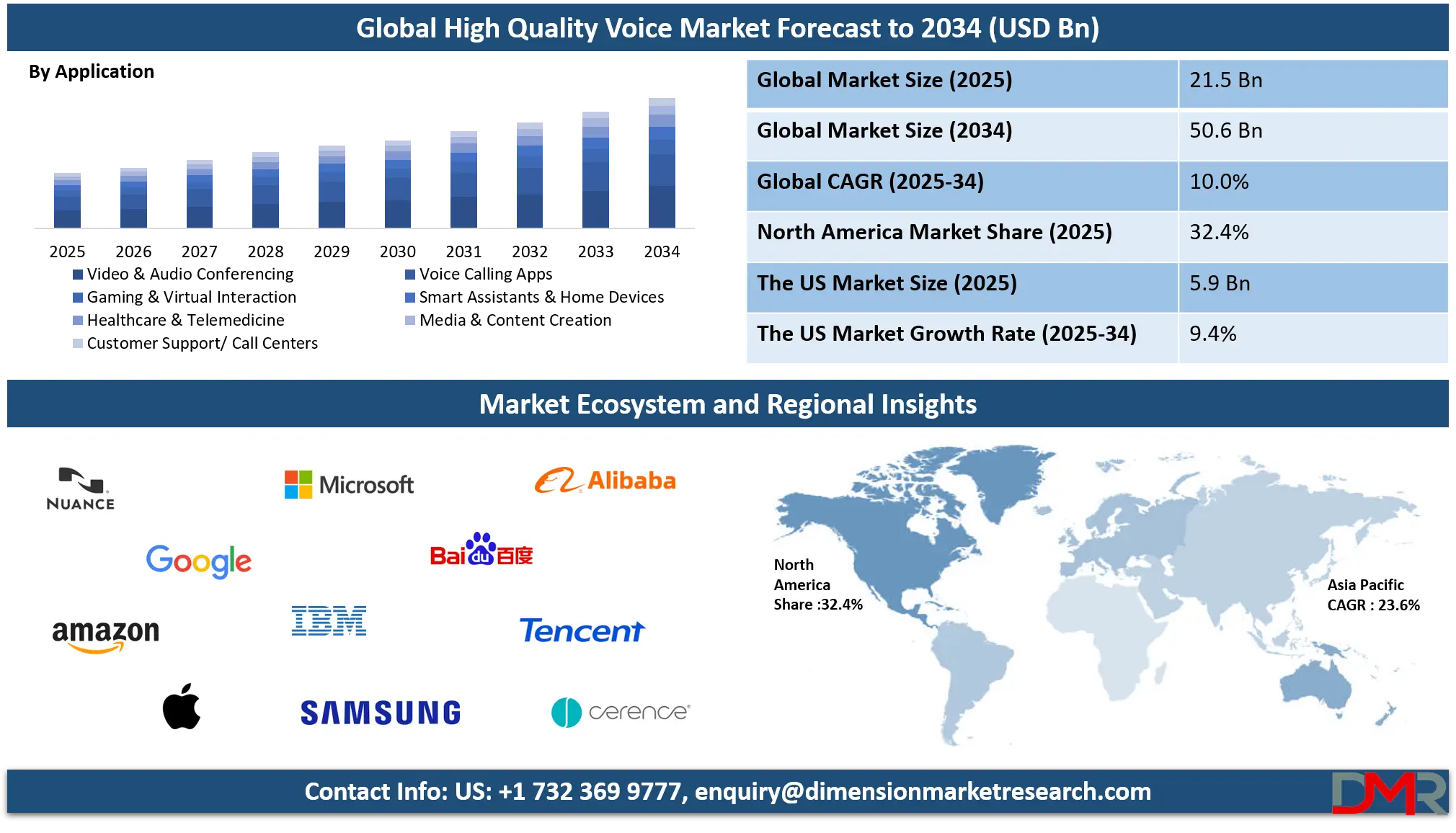

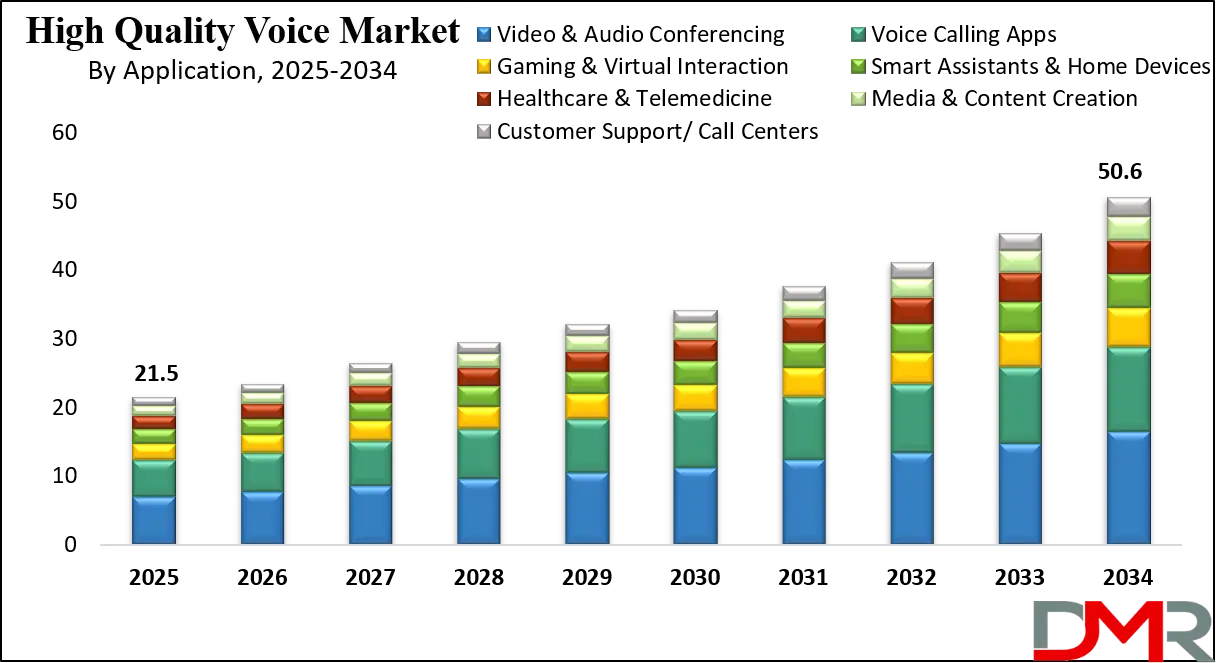

The Global High-Quality Voice Market size is set to reach USD 21.5 billion in 2025, driven by the rise of VoLTE, 5G, and cloud-based communication platforms. By 2034, it is projected to hit USD 50.6 billion, expanding at a CAGR of 10.0%. Key drivers include AI voice assistants, remote work, telehealth, and HD voice solutions.

High-quality voice refers to audio communication technologies that deliver crystal-clear, low-latency, and noise-free sound experiences across various platforms and devices. It goes beyond traditional telephony by leveraging advanced codecs, enhanced network bandwidth, and intelligent audio processing to ensure superior vocal clarity, depth, and consistency. Whether used in mobile networks, VoIP services, enterprise platforms, or smart devices, high-quality voice has become an essential component of modern communication, enabling natural, immersive, and efficient interactions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global high-quality voice market is evolving rapidly with the convergence of telecom infrastructure upgrades, cloud-based communication platforms, and rising consumer expectations for seamless audio performance. Increasing penetration of 5G and fiber-optic broadband is enabling ultra-low latency voice transmission, while telecom providers are aggressively rolling out VoLTE and VoNR services that enhance call clarity across mobile networks. Simultaneously, businesses are shifting to unified communication systems that integrate high-definition audio with video, messaging, and collaboration tools, thereby creating new use cases for high-quality voice in hybrid work environments.

At the consumer level, applications such as mobile calling apps, voice-based gaming, and smart home devices are driving demand for richer and more responsive audio interactions. Voice assistants like Alexa, Google Assistant, and Siri rely on real-time, high-fidelity voice recognition to deliver accurate responses and personalized experiences. In entertainment and media, podcasters and streamers depend on studio-grade audio to engage audiences, while platforms prioritize high-bitrate audio delivery to maintain listener satisfaction. These dynamics underscore the growing relevance of acoustic intelligence, AI-powered noise suppression, and spatial audio in shaping next-generation voice technology.

Beyond personal and enterprise communication, sectors such as healthcare, education, and customer support are adopting high-quality voice to facilitate real-time, secure, and effective engagement. Telehealth platforms rely on clear voice exchanges for virtual diagnostics, therapy, and consultations, while educational institutions leverage high-definition voice in digital classrooms to ensure inclusive learning.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Call centers and virtual agents use AI-enhanced voice systems to streamline customer interaction and sentiment analysis. As voice becomes more integrated with machine learning and natural language processing, its role will only deepen across industries, reinforcing its status as a core pillar of digital communication infrastructure.

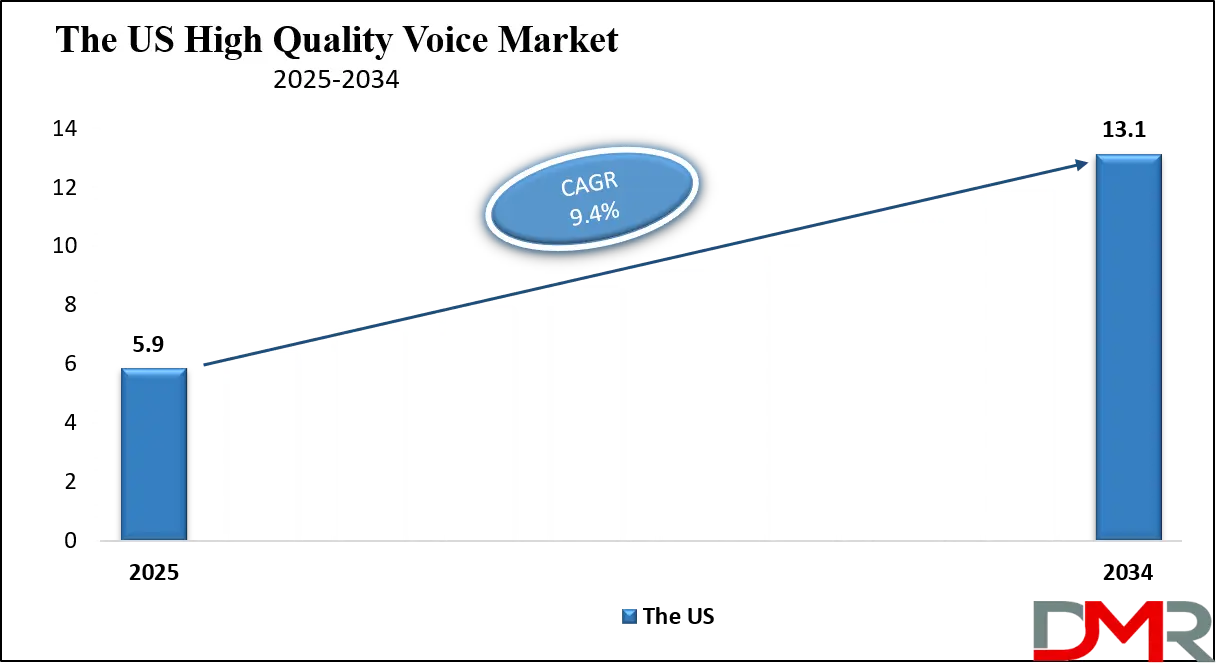

The US High Quality Voice Market

The U.S. high-quality voice market size is projected to be valued at USD 5.9 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 13.1 billion in 2034 at a CAGR of 9.4%.

The U.S. high-quality voice market is one of the most mature and innovation-driven globally, shaped by widespread technological infrastructure, advanced telecom networks, and a strong demand for premium audio communication across sectors. The nationwide adoption of VoLTE (Voice over LTE), Wi-Fi calling, and the growing rollout of 5G have significantly enhanced voice clarity and connectivity, especially for mobile users.

American telecom giants such as Verizon, AT&T, and T-Mobile have been pivotal in enabling HD voice experiences on smartphones, while internet-based services like Zoom, Microsoft Teams, and Google Meet have become essential communication tools across both personal and professional settings. These platforms integrate noise cancellation, echo reduction, and high-bitrate codecs to ensure that users experience natural, uninterrupted conversations.

In parallel, the U.S. enterprise and consumer markets are embracing voice-centric innovations beyond traditional telephony. Cloud-based unified communication platforms are now standard in remote and hybrid work environments, enabling seamless collaboration with crystal-clear audio across geographies. Smart home ecosystems powered by Amazon Alexa, Apple Siri, and Google Assistant have turned voice into a primary interface for information access and device control, reflecting strong consumer trust in voice technologies.

Meanwhile, industries such as healthcare are leveraging high-quality voice for virtual consultations, and content creators are depending on professional-grade audio tools to enhance podcasting and streaming. The U.S. market’s focus on user experience, AI integration, and seamless cross-device functionality continues to position it at the forefront of high-quality voice innovation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe High Quality Voice Market

Europe’s high-quality voice market is projected to reach USD 5.6 billion in 2025, with a CAGR of 8.2% during the forecast period. This growth is being driven by several factors, including the expansion of 5G networks, a growing reliance on cloud-based communication platforms, and heightened demand for seamless, high-definition voice services across both consumer and enterprise sectors.

The European region is undergoing significant digital transformation, with businesses investing heavily in unified communications and high-quality voice solutions for remote work, virtual meetings, and customer engagement. These investments are being bolstered by the region’s advanced telecom infrastructure, which supports the widespread deployment of 5G and fiber-optic broadband, ensuring that consumers and enterprises have access to faster, more reliable voice services. Additionally, European companies are adopting AI-powered voice solutions, such as virtual assistants and automated voice responses, to improve customer service and operational efficiency.

Another key factor contributing to Europe’s market growth is the high level of smartphone penetration and the widespread use of mobile applications that support voice services. Consumers are demanding better voice clarity for everything from personal communication to immersive entertainment experiences, while businesses are focusing on delivering high-quality voice solutions for customer support and virtual team collaboration. As voice becomes an integral part of daily life, the market is poised for continued expansion, with countries like Germany, the UK, and France leading the way in driving demand for advanced voice technologies.

The Japan High Quality Voice Market

Japan's high-quality voice market is expected to reach USD 0.7 billion in 2025, with a CAGR of 7.3% during the forecast period. This growth is fueled by Japan's technological advancements, robust telecom infrastructure, and the growing demand for superior voice communication services across both consumer and enterprise sectors. The country's rapid adoption of 5G technology and continued improvements in broadband networks are key drivers behind the growing market for high-definition voice services.

Japan's businesses are investing in voice-driven solutions, particularly for remote work, virtual meetings, and customer service applications. The country's enterprises are integrating AI-powered voice assistants, advanced call routing systems, and cloud-based communication platforms into their operations to enhance productivity and offer better user experiences. Furthermore, Japan's highly digital-savvy consumer base is pushing for seamless, high-quality voice services, not only for personal communications but also for services like mobile gaming, e-commerce, and video streaming, which require enhanced voice quality.

The strong presence of tech giants in Japan, along with the high penetration of smartphones and other connected devices, is contributing to the growing demand for high-quality voice solutions. The adoption of VoLTE, VoNR, and 5G voice services is expanding rapidly, providing both consumers and businesses with superior voice clarity and low-latency capabilities. As the Japanese market continues to embrace innovative voice technologies, the market is expected to experience steady growth, with a rising emphasis on AI and next-gen voice solutions that further enhance user interaction and communication efficiency.

Global High Quality Voice Market: Key Takeaways

- Market Value: The global high-quality voice market is expected to reach USD 50.6 billion by 2034, up from USD 21.5 billion in 2025, at a CAGR of 10.0%.

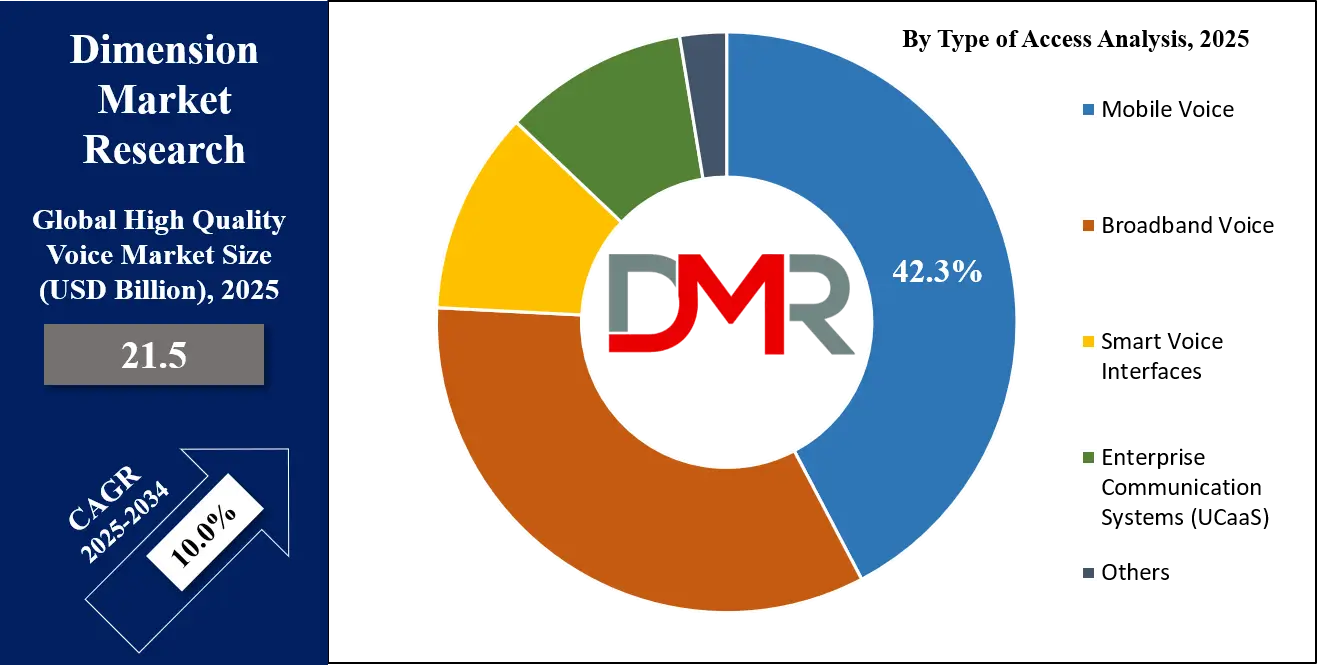

- By Type of Access Segment Analysis: Mobile Voice access is poised to consolidate its dominance in the type of access segment, capturing 42.3% of the total market share in 2025.

- By Application Type Segment Analysis: Video & Audio Conferencing applications are expected to maintain their dominance in the application type segment, capturing 32.5% of the market share in 2025.

- By End-User Segment Analysis: Consumers are expected to dominate the end-user type segment, capturing 53.5% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global high-quality voice market landscape with 32.4% of total global market revenue in 2025.

- Key Players: Some key players in the global high-quality voice market are Nuance Communications, Google, Amazon, Apple, Microsoft, IBM, Samsung, Baidu, Tencent, Alibaba, Cerence, SoundHound, iFlytek, ReadSpeaker, LumenVox, Voiceitt, Acapela Group, VocaliD, Deepgram, Descript, and Other Key Players.

Global High Quality Voice Market: Use Cases

- Enterprise Communication and Unified Collaboration: The growing shift toward hybrid and remote work has accelerated the adoption of high-quality voice solutions in enterprise environments. Platforms like Microsoft Teams, Zoom, and Cisco Webex rely on HD audio, VoIP, and cloud-based telephony to enable real-time, lag-free communication across teams and geographies. Enhanced voice clarity supports better decision-making, lowers miscommunication risks, and drives productivity in fast-paced business operations.

- Telehealth and Virtual Medical Consultations: In modern healthcare, telemedicine platforms demand reliable, crystal-clear voice quality to ensure accurate diagnosis and patient comfort. High-definition audio is essential for seamless doctor-patient interactions, especially when video is limited or unavailable. From remote consultations to mental health therapy sessions, voice-driven communication is becoming a cornerstone of virtual healthcare delivery.

- Smart Devices and Voice Assistants: Smart speakers, virtual assistants, and IoT-enabled devices are transforming everyday life with voice-first interfaces. Devices like Amazon Echo, Google Nest, and Apple HomePod rely on AI-enhanced voice recognition and noise-filtered HD audio for user commands, queries, and content playback. As households adopt voice-activated technology, demand for low-latency, natural-sounding voice processing continues to grow.

- Gaming and Immersive Media Experiences: High-quality voice is becoming a critical component in online gaming, live streaming, and content creation. Platforms like Discord and Twitch prioritize real-time, low-latency audio to enhance player coordination and viewer interaction. Podcasters and streamers also depend on studio-grade voice clarity to engage audiences and deliver professional-level content in competitive digital media markets.

Global High Quality Voice Market: Stats & Facts

- Telecom Regulatory Authority of India (TRAI)

- Mobile Subscribers: India had approximately 1.17 billion mobile subscribers as of March 2024.

- Broadband Subscribers: The country reported over 800 million broadband subscribers by the end of 2023.

- 5G Deployment: India’s 5G services were launched in October 2022, with coverage expanding rapidly across major cities.

- Voice Traffic: Voice traffic accounted for approximately 70% of total telecom traffic in India as of 2023.

- Quality of Service (QoS): TRAI monitors QoS parameters, including call drop rates and call setup success rates, to ensure high-quality voice services.

- Australian Communications and Media Authority (ACMA)

- Mobile Phone Usage: In 2023, 97% of Australians used mobile phones for voice calls.

- Data Consumption: Australians downloaded approximately 12.2 million terabytes of data across retail, wired, and wireless broadband services in the three months to December 2022.

- Fixed-Line Services: About 2 in 10 Australians (18%) used a landline to make voice calls in 2023.

- National Broadband Network (NBN): The NBN carried 83% of the total data downloaded by Australians in the three months to December 2022.

- Voice Services via NBN: Over 6 million voice services were in operation, with the majority serviced using the NBN.

- Infocomm Media Development Authority (IMDA) - Singapore

- Mobile Subscribers: As of April 2023, Singapore had approximately 8.5 million mobile subscriptions.

- Broadband Penetration: The broadband penetration rate in Singapore stood at over 90% as of 2023.

- 5G Adoption: By April 2023, 5G subscriptions made up 15% of total mobile subscribers in Singapore.

- International Call Minutes: Singaporeans made over 1.5 billion minutes of international calls in the first half of 2023.

- Fixed-Line Services: The number of fixed-line subscriptions in Singapore remained stable at around 1.2 million in 2023.

- Ofcom - United Kingdom

- Mobile Subscribers: As of 2023, the UK had approximately 80 million mobile subscriptions.

- Broadband Subscribers: The UK reported over 30 million broadband subscriptions as of 2023.

- 5G Coverage: By the end of 2023, 5G services were available in over 80% of the UK.

- Public Switched Telephone Network (PSTN) Incidents: In 2023, there was a 20% increase in service incidents on the PSTN compared to 2022.

- Service Hours Lost: The number of service hours lost to customers on the PSTN increased by 60% in 2023 compared to 2022.

- Telecom Regulatory Authority of India (TRAI) - Quality of Service

- Call Drop Rate: The average call drop rate across Indian telecom operators was approximately 2% in 2023.

- Call Setup Success Rate: The average call setup success rate was around 98% in India as of 2023.

- Data Speed: The average mobile data speed in India was approximately 20 Mbps in 2023.

- Fixed Broadband Speed: The average fixed broadband speed in India stood at 100 Mbps in 2023.

- Consumer Complaints: The number of consumer complaints related to voice services decreased by 15% in 2023 compared to the previous year.

- Australian Competition and Consumer Commission (ACCC)

- Mobile Sites: As of January 2023, Telstra operated 11,302 mobile sites, the most among Australian providers.

- Mobile Coverage: Telstra's 4G network covered approximately 99% of the Australian population as of 2023.

- Voice Interconnection Services: The ACCC commenced a public inquiry into making access determinations for voice interconnection services in June 2024.

- Consumer Revenue: The five largest telecommunications providers in Australia generated significant consumer and SMB revenue from fixed and wireless services in 2023.

- Service Providers: Smaller retail service providers continue to make inroads in NBN services, with Telstra, TPG Telecom, and Optus holding the largest market shares.

Global High Quality Voice Market: Market Dynamics

Global High Quality Voice Market: Driving Factors

Expansion of 5G Networks and VoLTE Adoption

The widespread rollout of 5G infrastructure and the growing adoption of VoLTE services are significantly enhancing voice clarity, reducing latency, and enabling better call continuity. Telecom operators across regions are upgrading their network capabilities to support HD voice and VoNR (Voice over New Radio), which allows users to experience near-instant voice connection and superior sound quality. This infrastructure upgrade is crucial for supporting high-quality mobile voice traffic, especially in densely populated urban regions and enterprise zones.

Rise in Remote Work and Digital Collaboration

The global shift toward remote and hybrid work environments has increased reliance on real-time audio communication. Enterprises are investing in unified communication systems, cloud-based calling solutions, and virtual meeting tools that rely heavily on high-definition voice quality. This shift has not only increased demand for reliable voice services but also pushed service providers to prioritize improvements in codec performance, background noise reduction, and seamless integration with collaboration software.

Global High Quality Voice Market: Restraints

Limited Infrastructure in Developing Economies

Despite global advancements, many regions, particularly in parts of Africa, South Asia, and Latin America, still face inadequate telecom infrastructure and inconsistent internet connectivity. The lack of reliable broadband access limits the widespread adoption of HD voice services, VoIP platforms, and cloud-based telephony. Additionally, the high cost of deployment and limited investment in fiber and 5G networks create disparities in service quality and accessibility.

Data Privacy and Security Concerns

As high-quality voice technologies leverage cloud computing and AI for call processing, concerns around data privacy, voice interception, and unauthorized recording are rising. Enterprise clients, in particular, are cautious about adopting voice platforms that lack robust end-to-end encryption and secure storage protocols. These concerns may slow adoption rates, especially in regulated industries such as healthcare, finance, and government services.

Global High Quality Voice Market: Opportunities

Integration of AI and Voice Intelligence

Artificial Intelligence is opening new opportunities in the voice tech space by enabling features such as real-time transcription, sentiment analysis, language translation, and conversational analytics. These capabilities add significant value to customer service operations, virtual assistants, and enterprise communication platforms. Companies that integrate AI-powered voice enhancements can offer more intelligent, responsive, and personalized voice experiences to end users.

Growing Demand in Telehealth and EdTech Sectors

High-quality voice communication is becoming a critical tool in sectors like telemedicine and online education. In healthcare, doctors and therapists rely on clear audio for effective remote consultations, especially in low-bandwidth scenarios. Similarly, educators use HD voice tools to deliver engaging virtual learning sessions. As digital healthcare and EdTech continue to expand, so does the demand for voice solutions that offer clarity, reliability, and security.

Global High Quality Voice Market: Trends

Emergence of Voice as a Primary User Interface

The growing popularity of voice-enabled smart devices is reinforcing the trend of using voice as a primary mode of interaction. From smart homes and virtual assistants to voice-activated apps and wearables, the market is seeing an increase in use cases where high-quality voice enhances user experience. This trend is also influencing UX design, speech interface development, and cross-device audio optimization.

Transition to Cloud-Native Communication Platforms

Enterprises and service providers are rapidly shifting from legacy PBX systems to cloud-native communication platforms that offer scalability, flexibility, and advanced audio features. These platforms are designed to deliver consistent HD voice experiences across mobile, desktop, and browser-based environments, supporting remote teams, customer support operations, and global conferencing with minimal infrastructure investment.

Global High Quality Voice Market: Research Scope and Analysis

By Type of Access Analysis

Mobile voice access is expected to maintain a commanding position in the high-quality voice market in 2025, accounting for an estimated 42.3% of the total market share. This dominance is largely driven by the widespread adoption of VoLTE and the accelerating deployment of 5G networks across developed and emerging markets. The mobile voice ecosystem has evolved beyond traditional telephony, offering enhanced voice clarity, reduced latency, and seamless call continuity even in high-traffic environments. With smartphones being the primary communication device for billions of users, telecom operators are prioritizing mobile HD voice services that are embedded directly into native calling functions, removing the need for third-party applications. The integration of advanced audio codecs such as AMR-WB and EVS further boosts mobile voice quality, making it the preferred access type for consumers and enterprises alike.

On the other hand, broadband voice represents a substantial and steadily growing portion of the market, particularly as users rely on internet-based communication platforms. Unlike mobile voice, broadband voice is facilitated through IP-based networks using fixed-line broadband connections. It underpins the functionality of popular VoIP services, including Zoom, Microsoft Teams, Google Meet, and Skype, which are widely used across business, education, and consumer communication settings.

Broadband voice is also crucial for unified communication systems deployed in remote work environments, offering high-definition audio with features like background noise cancellation, echo suppression, and integration with collaboration tools. As fiber-optic broadband penetration deepens and network reliability improves globally, broadband voice will continue to play a pivotal role in delivering consistent, high-quality voice experiences across desktops, laptops, and smart devices.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

Video and audio conferencing applications are projected to remain the leading segment within the application type segment of the high-quality voice market, capturing approximately 32.5% of the total share in 2025. This sustained dominance is fueled by the normalization of remote work, global team collaboration, and the growing frequency of virtual business interactions. Organizations are prioritizing platforms that deliver high-definition audio alongside real-time video to ensure clear, reliable communication across departments and time zones.

These conferencing tools have evolved into integrated collaboration hubs, offering not just voice transmission but also AI-enabled features like live transcription, voice-driven meeting controls, and adaptive audio enhancements that optimize clarity regardless of background noise or bandwidth conditions. As a result, video and audio conferencing applications are becoming essential components of enterprise communication infrastructure and a preferred mode of interaction across industries.

In parallel, voice calling apps continue to expand their influence within the market, especially among consumers and small businesses seeking cost-effective and flexible communication solutions. Unlike traditional telephony, these apps, such as WhatsApp, Telegram, Signal, and Facebook Messenger, utilize internet connectivity to deliver HD voice calls without incurring standard call charges.

Many of these platforms incorporate end-to-end encryption, ensuring secure voice exchanges that appeal to privacy-conscious users. Additionally, modern voice calling apps support features such as adaptive noise reduction, real-time voice compression, and device-agnostic access, making them highly versatile across geographies and demographics. As digital communication preferences shift away from conventional voice channels, these apps are becoming indispensable tools in both personal and professional communication ecosystems.

By End-User Analysis

Consumers are projected to lead the end-user segment in the high-quality voice market in 2025, accounting for approximately 53.5% of the overall market share. This dominance is largely driven by the rapid proliferation of smartphones, the widespread adoption of mobile voice over IP applications, and the integration of HD voice into everyday digital experiences. From casual conversations on messaging apps to immersive audio interactions with smart assistants, consumers are expecting flawless voice quality as a standard feature.

The growing usage of smart speakers, wearable devices, and connected home systems has further entrenched high-quality voice as a core element of the digital lifestyle. Additionally, entertainment platforms such as gaming, streaming, and social media are embedding crystal-clear voice capabilities to enhance user engagement, which further accelerates consumer-led demand in the market.

Enterprises and SMBs, while representing a smaller share, are playing a strategic role in shaping the high-quality voice landscape. Businesses are transitioning from legacy communication systems to cloud-based unified communication platforms that offer reliable, scalable, and secure HD voice solutions. For both large enterprises and smaller firms, clear voice transmission is essential for maintaining professional standards in client interactions, virtual meetings, and customer support operations.

Moreover, the integration of AI-driven voice tools for tasks such as real-time transcription, meeting summarization, and intelligent call routing is turning voice into a productivity asset rather than just a communication tool. As remote and hybrid work models persist, enterprises and SMBs are expected to continue investing in high-fidelity voice solutions that support global collaboration, data compliance, and enhanced digital presence.

The High Quality Voice Market Report is segmented based on the following:

By Type of Access

- Mobile Voice

- Broadband Voice

- Smart Voice Interfaces

- Enterprise Communication Systems (UCaaS)

- Others

By Application

- Video & Audio Conferencing

- Voice Calling Apps

- Gaming & Virtual Interaction

- Smart Assistants & Home Devices

- Healthcare & Telemedicine

- Media & Content Creation

- Customer Support/ Call Centers

By End-User

- Consumers

- Enterprises & SMBs

- Healthcare Providers

- Media & Entertainment Professionals

- Others

Global High Quality Voice Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global high-quality voice market in 2025, accounting for 32.4% of total market revenue, driven by its advanced telecom infrastructure, widespread 5G adoption, and high penetration of smart devices. The region benefits from strong demand across both consumer and enterprise segments, with HD voice becoming integral to business communications, remote work, and digital collaboration.

Major telecom operators and tech companies in the U.S. and Canada are continuously investing in VoLTE, VoNR, and cloud-based voice services, while the proliferation of AI-powered virtual assistants and IoT devices further accelerates voice-enabled user interactions. The region's mature regulatory framework and digital-first consumer behavior continue to foster innovation and early adoption of next-gen voice technologies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

Asia Pacific is projected to witness the highest CAGR in the global high-quality voice market over the forecast period, fueled by rapid digital transformation, expanding 5G infrastructure, and a growing mobile-first population. Countries like China, India, South Korea, and Japan are leading the regional surge, with increased investments in telecom modernization and widespread adoption of VoIP and cloud-based communication platforms.

Rising smartphone penetration, affordable data plans, and the proliferation of remote work and e-learning are further boosting the demand for high-definition voice services. The region’s dynamic tech ecosystem, combined with supportive government initiatives and a large base of digitally engaged users, positions Asia Pacific as the fastest-growing market for high-quality voice solutions globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global High Quality Voice Market: Competitive Landscape

The global competitive landscape of the high-quality voice market is characterized by a mix of established telecom giants, cloud communication providers, VoIP platform developers, and emerging tech innovators, all vying for market share through differentiated service offerings and technological advancements. Major telecom operators such as AT&T, Verizon, China Mobile, and Vodafone are heavily investing in VoLTE and 5G-based voice services to deliver enhanced audio clarity and low-latency performance directly through native mobile networks. These incumbents leverage their extensive infrastructure and customer base to maintain strong regional footholds and drive adoption of next-gen voice technologies.

On the other side, cloud communication providers like Twilio, Zoom, RingCentral, and Microsoft (via Teams) are reshaping the market by offering scalable, software-based voice solutions tailored for enterprises and developers. These platforms integrate high-definition voice with APIs, AI-driven analytics, and unified communication capabilities, allowing businesses to embed voice functionality into apps, workflows, and customer support channels.

In addition, global tech firms like Google, Apple, and Amazon continue to expand their voice ecosystems through smart devices and virtual assistants, placing growing emphasis on natural, real-time, and noise-optimized voice interactions. Startups and regional players are also entering the space with niche innovations such as voice biometrics, multilingual processing, and ultra-low-latency codecs, intensifying competition. Overall, the market is defined by rapid innovation, ecosystem integration, and a strategic shift toward voice as a central component of digital engagement.

Some of the prominent players in the global high-quality voice market are:

- Nuance Communications

- Google

- Amazon

- Apple

- Microsoft

- IBM

- Samsung

- Baidu

- Tencent

- Alibaba

- Cerence

- SoundHound

- iFlytek

- ReadSpeaker

- LumenVox

- Voiceitt

- Acapela Group

- VocaliD

- Deepgram

- Descript

- Other Key Players

Global High Quality Voice Market: Recent Developments

- May 2025: Masimo agreed to sell its consumer audio division, including brands like Bowers & Wilkins and Denon, to Harman International (a Samsung subsidiary) for approximately USD 350 million, refocusing on its core healthcare business.

- March 2025: Alphabet Inc. announced its acquisition of cloud security firm Wiz, Inc. for USD 32 billion, aiming to bolster its cloud infrastructure and security offerings.

- February 2025: xAI, founded by Elon Musk, acquired X Corp. for USD 33 billion, integrating advanced AI capabilities into its platform.

- January 2025: Global Payments acquired Worldpay's remaining 55% stake from GTCR and 45% from FIS for a combined USD 24.25 billion, consolidating its position in the payment processing industry.

- September 2024: Verizon announced its USD 20 billion acquisition of Frontier Communications, expanding its fiber network and broadband services across the U.S.

- September 2024: Salesforce agreed to acquire AI voice agent firm Tenyx, enhancing its AI-driven solutions across various industries.

- June 2024: Exotel launched multilingual autonomous contact centers, following its previous acquisitions of Ameyo and Cogno AI, strengthening its position in cloud-based contact center services.

- May 2024: Zayo Group announced the separation of its European business, creating a standalone entity to focus on fiber network operations across eight countries.

- April 2024: VTech Holdings Limited completed its acquisition of Gigaset Communications, a German manufacturer of DECT telephones, expanding its footprint in the consumer electronics market.

- March 2024: Swisscom agreed to acquire Vodafone Italia for €8 billion, intending to merge it with its Italian subsidiary Fastweb, enhancing its presence in the Italian telecom market.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 21.5 Bn |

| Forecast Value (2034) |

USD 50.6 Bn |

| CAGR (2025–2034) |

10.0% |

| The US Market Size (2025) |

USD 5.9 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type of Access (Mobile Voice, Broadband Voice, Smart Voice Interfaces, Enterprise Communication Systems (UCaaS), Others), By Application (Video & Audio Conferencing, Voice Calling Apps, Gaming & Virtual Interaction, Smart Assistants & Home Devices, Healthcare & Telemedicine, Media & Content Creation, Customer Support/Call Centers), By End-User (Consumers, Enterprises & SMBs, Healthcare Providers, Media & Entertainment Professionals, Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Nuance Communications, Google, Amazon, Apple, Microsoft, IBM, Samsung, Baidu, Tencent, Alibaba, Cerence, SoundHound, iFlytek, ReadSpeaker, LumenVox, Voiceitt, Acapela Group, VocaliD, Deepgram, Descript, Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global high quality voice market?

▾ The global high quality voice market size is estimated to have a value of USD 21.5 billion in 2025 and is expected to reach USD 50.6 billion by the end of 2034

What is the size of the US high quality voice market?

▾ The US high quality voice market is projected to be valued at USD 5.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 13.1 billion in 2034 at a CAGR of 9.4%.

Which region accounted for the largest global high quality voice market?

▾ North America is expected to have the largest market share in the global high quality voice market, with a share of about 32.4% in 2025.

Who are the key players in the global high quality voice market?

▾ Some of the major key players in the global high quality voice market are Nuance Communications, Google, Amazon, Apple, Microsoft, IBM, Samsung, Baidu, Tencent, Alibaba, Cerence, SoundHound, iFlytek, ReadSpeaker, LumenVox, Voiceitt, Acapela Group, VocaliD, Deepgram, Descript, Other Key Players.

What is the growth rate of the global high quality voice market?

▾ The market is growing at a CAGR of 10.0 percent over the forecasted period.