Market Overview

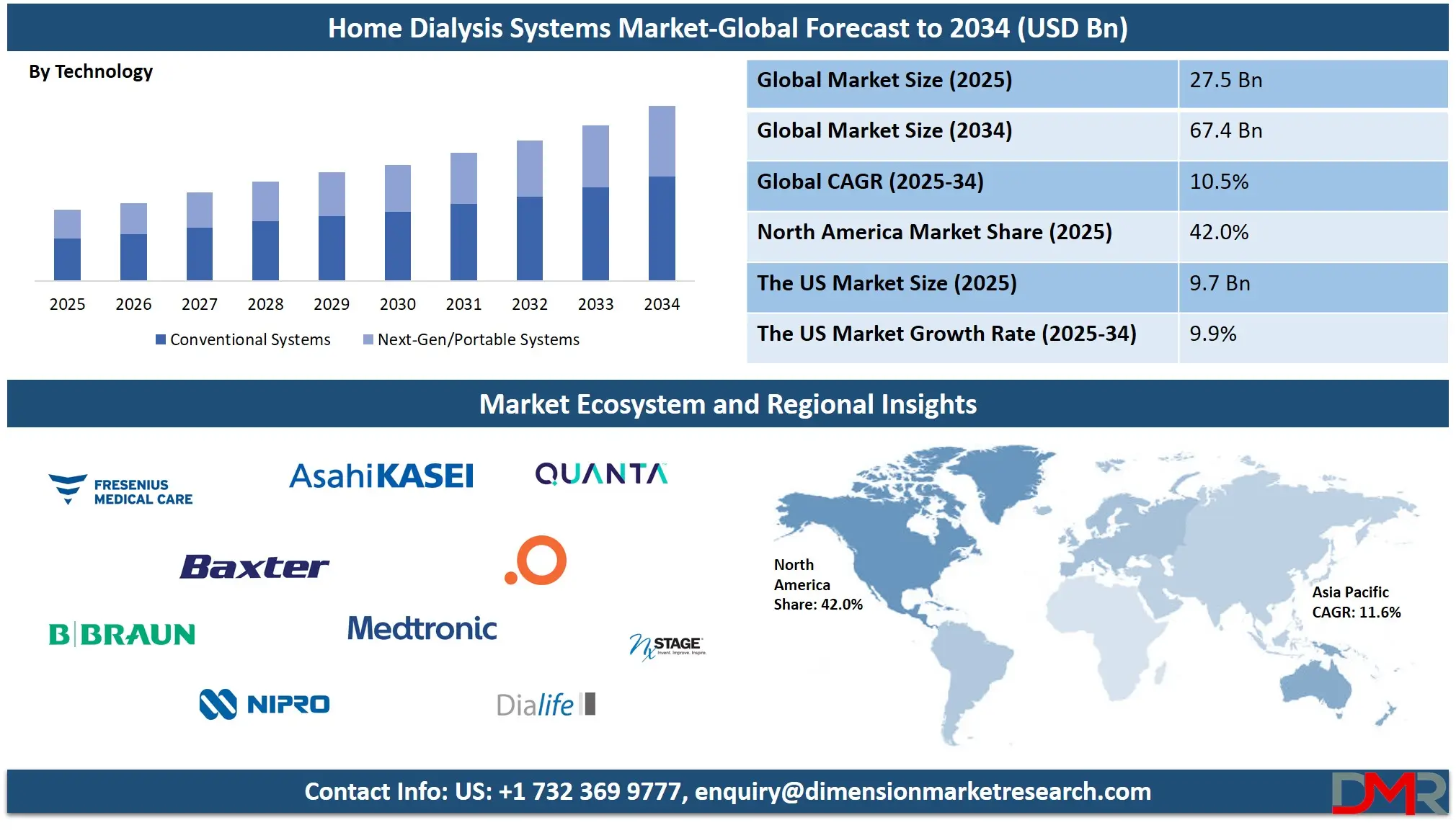

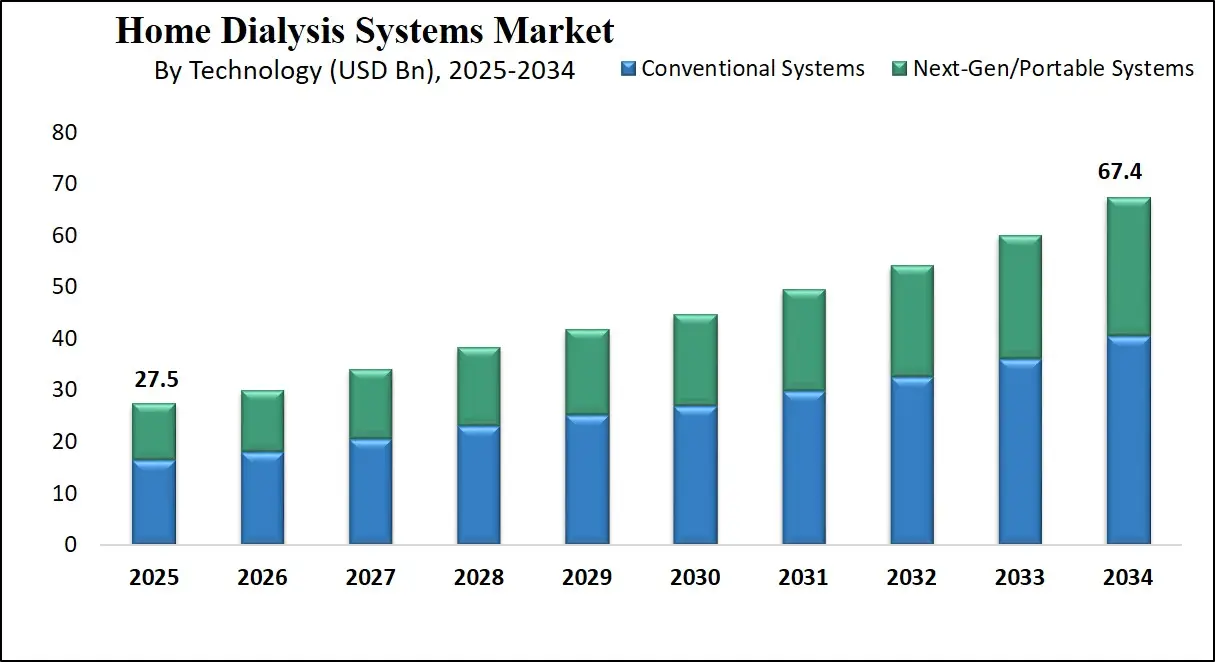

The home dialysis systems market is expected to reach USD 27.5 billion in 2025 and USD 67.4 billion by 2034, growing at a CAGR of 10.5%. Growth is fueled by rising kidney disease cases, demand for home-based care, and advancements in portable dialysis and telehealth solutions.

Home dialysis systems are advanced medical devices that enable individuals with chronic kidney disease to perform dialysis treatment in the comfort of their homes, without needing frequent hospital visits. These systems are designed to replicate the essential functions of the kidneys by removing waste products, excess fluids, and toxins from the bloodstream when the kidneys are no longer able to do so effectively.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

They encompass two main modalities: peritoneal dialysis, which utilizes the lining of the abdomen as a natural filter, and home hemodialysis, which involves an external machine and dialyzer to cleanse the blood. These in-home kidney care solutions are gaining traction due to the rising need for flexible, patient-centric treatment approaches, improved quality of life, and healthcare cost savings, especially among the aging population and those with end-stage renal disease.

Technological advancements, remote monitoring capabilities, and integration with Digital Health platforms are further enhancing the efficacy and convenience of home-based dialysis therapies. The global home dialysis systems market has been witnessing robust growth, primarily driven by growing cases of kidney failure and the global surge in lifestyle-related disorders such as diabetes and hypertension.

As healthcare systems across the globe shift toward value-based care, Home Dialysis has emerged as a cost-effective and clinically beneficial alternative to traditional in-center treatments. Factors such as patient autonomy, reduced dependency on hospital infrastructure, and rising awareness about the benefits of home therapies are encouraging both patients and providers to adopt these solutions. In addition, supportive government policies, reimbursement frameworks, and training programs are further accelerating market penetration, particularly in developed economies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Emerging markets are also presenting new growth avenues for home dialysis systems due to rising healthcare infrastructure investments, improved accessibility, and a growing focus on chronic disease management. The integration of Internet of Things (IoT), compact peritoneal dialysis systems, and AI-driven monitoring platforms is creating new benchmarks in remote patient care. Moreover, leading manufacturers are focusing on user-friendly designs, portable equipment, and Telehealth compatibility to expand their global footprint. The combination of medical technology innovation and shifting patient preferences is positioning the home dialysis systems market as a vital component of the broader renal care ecosystem.

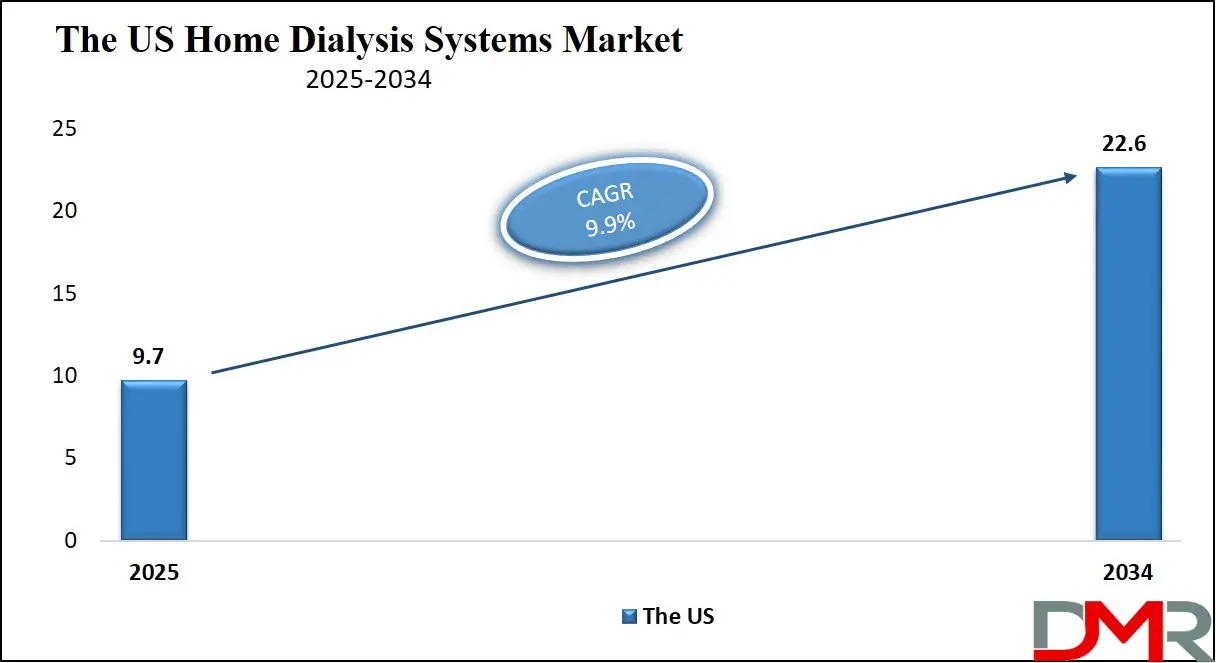

The US Home Dialysis Systems Market

The U.S. Home Dialysis Systems Market size is projected to be valued at USD 9.7 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 22.6 billion in 2034 at a CAGR of 9.9%.

The US home dialysis systems market is witnessing rapid expansion due to the growing burden of chronic kidney disease and the growing shift toward personalized, home-based renal care. With a high prevalence of end-stage renal disease (ESRD) and a large aging population, the demand for accessible and patient-centric dialysis treatment options continues to rise. Home dialysis, encompassing both peritoneal dialysis and home hemodialysis, provides flexibility, reduced travel time, and an improved quality of life, making it a preferred option for many patients.

Supportive Medicare coverage, growing awareness about self-care in nephrology, and government initiatives promoting value-based healthcare delivery are driving adoption across the United States. Additionally, patient training programs and improved home care infrastructure have enhanced the feasibility of in-home kidney therapy solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Technological innovation is playing a key role in reshaping the US home dialysis landscape. The integration of wearable dialysis machines, remote patient monitoring, and smart diagnostic tools is enabling real-time data collection and physician oversight without requiring frequent clinic visits. Major players in the US market are investing in compact dialysis devices, user-friendly home hemodialysis machines, and Digital Health platforms to enhance treatment adherence and safety.

The COVID-19 pandemic further accelerated the shift toward home-based treatments, prompting faster regulatory approvals and greater investment in Telehealth-based nephrology. With continuous advancements in renal replacement therapy, strong reimbursement frameworks, and a growing emphasis on patient empowerment, the US remains one of the most mature and dynamic markets for home dialysis systems globally.

The Europe Home Dialysis Systems Market

Europe is projected to hold a substantial position in the global home dialysis systems market, with an estimated market value of USD 7.7 billion in 2025. This strong foothold is largely attributed to the region’s advanced healthcare infrastructure, growing prevalence of chronic kidney disease, and growing emphasis on patient-centric treatment approaches. Countries such as Germany, France, the United Kingdom, and the Nordic nations are at the forefront of adopting home-based dialysis therapies due to their comprehensive reimbursement frameworks, well-developed support systems, and greater awareness of early renal care management.

The region’s aging population, combined with a rise in lifestyle-related conditions like diabetes and hypertension, is also contributing to the rising demand for long-term dialysis solutions that can be administered outside of traditional hospital settings.

The European home dialysis market is expected to grow at a robust CAGR of 9.8 percent from 2025 to 2034, driven by technological advancements and the growing integration of telehealth into chronic disease management. The adoption of next-generation portable dialysis systems and remote patient monitoring tools is steadily growing, allowing for safer and more effective at-home treatments. Governments and healthcare providers across Europe are also actively promoting decentralized care models, which not only enhance patient convenience but also alleviate pressure on overburdened dialysis centers. Additionally, ongoing investments in healthcare digitization and the inclusion of home dialysis in national health strategies are further accelerating market expansion across the region.

The Japan Home Dialysis Systems Market

Japan’s home dialysis systems market is estimated to reach USD 2.2 billion in 2025. Despite traditionally favoring in-center dialysis, Japan’s high prevalence of end-stage renal disease, integrated with an aging population, is steadily driving interest in home-based treatment options. The country has one of the highest dialysis rates per capita globally, and healthcare providers are recognizing the need to ease the burden on dialysis centers by promoting alternative care models. The rising demand for improved quality of life, combined with advancements in peritoneal dialysis and compact home hemodialysis machines, is gradually shifting patient preferences toward home therapy, particularly in urban and aging communities.

The Japanese market is projected to grow at a CAGR of 8.5 percent from 2025 to 2034, supported by strategic healthcare policy reforms and growing investments in medical technology. Innovations in remote patient monitoring, user-friendly dialysis equipment, and automated systems are making home dialysis more accessible for elderly and mobility-limited patients. Moreover, the government’s focus on reducing healthcare costs through preventive and long-term care strategies is creating favorable conditions for wider adoption of home-based renal care. Although home dialysis adoption in Japan currently lags behind some Western markets, the combination of demographic pressure, technological progress, and policy support positions the country for sustained and meaningful growth in this segment.

Global Home Dialysis Systems Market: Key Takeaways

- Market Value: The global home dialysis systems market size is expected to reach a value of USD 67.4 billion by 2034 from a base value of USD 27.5 billion in 2025 at a CAGR of 10.5%.

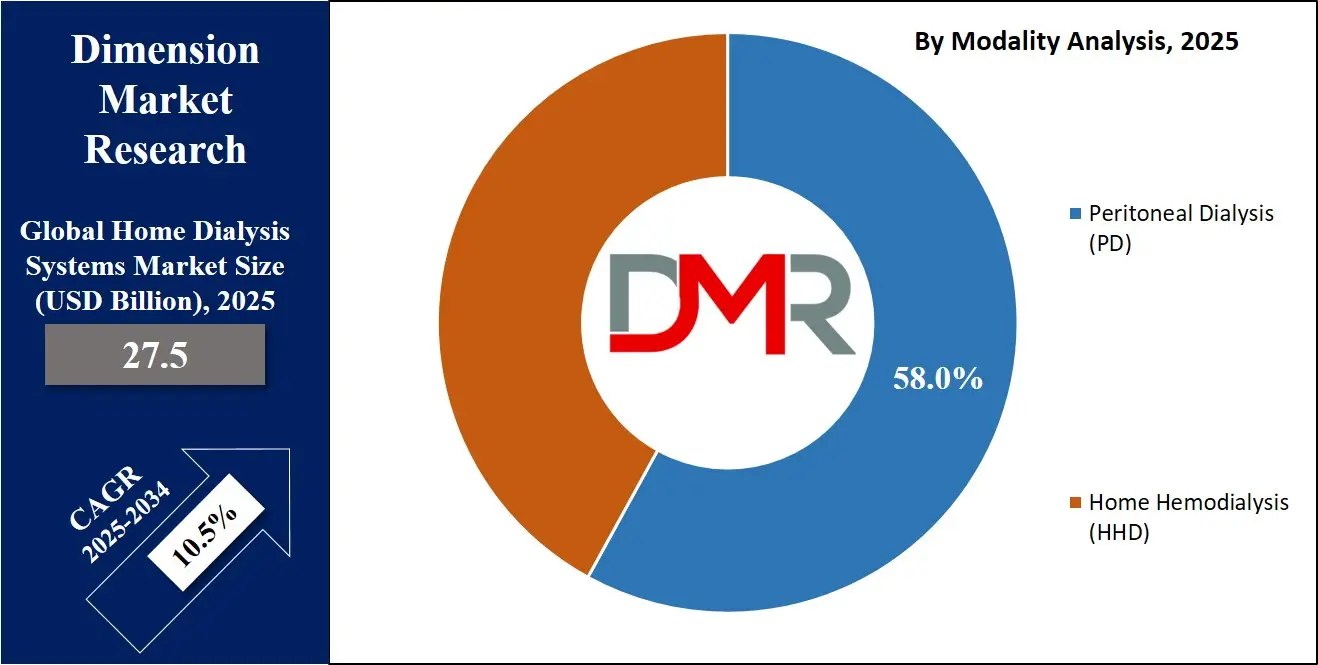

- By Modality Segment Analysis: Peritoneal Dialysis (PD) is anticipated to dominate the modality segment, capturing 58.0% of the total market share in 2025.

- By Component Segment Analysis: Devices are poised to consolidate their dominance in the component segment, capturing 45.0% of the total market share in 2025.

- By Disease Condition Segment Analysis: End-Stage Renal Disease (ESRD) is expected to lead the disease condition segment, capturing 88.0% of the market share by 2025.

- By Age Group Segment Analysis: 45–64 Years group are expected to maintain their dominance in the age group segment, capturing 41.0% of the total market share in 2025.

- By Technology Segment Analysis: Conventional Systems will dominate the technology segment, capturing 60.0% of the market share in 2025.

- By End-User Segment Analysis: Home Care Settings will dominate the end-user segment, capturing 70.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global home dialysis systems market landscape with 42.0% of total global market revenue in 2025.

- Key Players: Some key players in the global home dialysis systems market are Fresenius Medical Care, Baxter International Inc., B. Braun Melsungen AG, Nipro Corporation, Asahi Kasei Medical Co., Ltd., Medtronic plc, Dialife SA, Quanta Dialysis Technologies, Outset Medical, Inc., NxStage Medical, AWAK Technologies, and Others.

Global Home Dialysis Systems Market: Use Cases

- Chronic Kidney Disease Management in Aging Populations: The growing global geriatric population, particularly in developed regions like North America and Western Europe, has led to a surge in chronic kidney disease (CKD) diagnoses. Home dialysis systems provide a vital solution for elderly patients who struggle with mobility or access to in-center treatments. Peritoneal dialysis machines and home hemodialysis units allow patients to manage their therapy independently or with caregiver support, reducing the frequency of hospital visits. These systems are particularly beneficial in managing comorbid conditions, enabling better quality of life through personalized treatment schedules and stable renal function monitoring. Governments and insurers are also supporting this trend with improved reimbursement models, making home-based renal care both accessible and affordable for the elderly.

- Remote Patient Monitoring and Telehealth Integration: The rise of telemedicine and remote patient monitoring has opened new pathways for home dialysis implementation, especially in rural or underserved regions. With wearable dialysis devices and connected monitoring platforms, nephrologists can now track patients’ vital signs, fluid removal rates, and dialysis efficiency in real time. This connectivity ensures timely intervention and reduces complications associated with late detection of treatment-related issues. Patients using home dialysis equipment benefit from real-time feedback and virtual consultations, bridging the gap between home care and clinical supervision. This model of care delivery also reduces the strain on hospital infrastructure and aligns with the growing demand for decentralized healthcare services.

- Post-Hospitalization Renal Support Programs: Home dialysis systems are being utilized in transitional care programs following hospitalization for acute kidney injury (AKI) or other renal complications. Instead of prolonged hospital stays or in-center dialysis sessions, patients can be discharged with portable dialysis systems and trained for short-term or ongoing therapy at home. This approach reduces readmission rates, supports faster recovery, and promotes patient independence. Hospitals partnering with dialysis equipment providers are also implementing patient training and follow-up services to ensure compliance and safety. These post-discharge programs are a critical use case that highlights the flexibility and adaptability of home-based renal care solutions in modern nephrology.

- Emergency and Pandemic-Driven Healthcare Continuity: During health crises like the COVID-19 pandemic, home dialysis systems played a crucial role in ensuring uninterrupted treatment for kidney patients while minimizing exposure to infection. As healthcare systems were overwhelmed, home-based dialysis therapies allowed patients to avoid crowded dialysis centers and maintain continuity of care. Emergency preparedness protocols in many countries now include provisions for home-based treatment to reduce healthcare facility congestion and protect high-risk populations. The availability of compact, automated peritoneal dialysis devices and user-friendly home hemodialysis machines supported this shift, making them an essential component in resilient healthcare strategies for chronic disease management during public health emergencies.

Impact of Artificial Intelligence in the Home Dialysis Market

Artificial Intelligence is revolutionizing the home dialysis systems market by transforming routine renal care into a dynamic, data-driven process. By embedding AI into dialysis machines and remote platforms, providers are delivering more accurate, personalized, and responsive treatment experiences. This shift is enhancing patient safety, reducing clinical dependency, and making at-home dialysis a viable and intelligent alternative to in-center therapies. The result is a smarter, more proactive approach to chronic kidney care.

- Smart Machines, Smarter Decisions

- AI-powered home dialysis systems adapt to each patient’s physiological needs in real time. They automatically regulate fluid extraction, blood flow, and machine calibration, learning and improving with every session.

- Real-Time Monitoring and Alerts

- Built-in AI analytics enable live tracking of treatment performance and patient vitals. If something goes off course, alerts are instantly sent to both patients and healthcare providers, helping prevent complications before they escalate.

- Remote Care and Virtual Oversight

- Artificial Intelligence bridges the gap between home and clinic by enabling nephrologists to remotely monitor treatment sessions. This is particularly useful for patients in underserved or rural areas who may lack immediate access to specialists.

- Predictive Insights and Preventive Action

- AI systems analyze historical data to predict potential issues such as clotting, pressure drops, or hydration imbalances. This proactive intelligence ensures early interventions and optimizes long-term treatment outcomes.

- Automated Logistics and Personalized Support

- Beyond clinical care, AI handles routine logistics such as scheduling, session reminders, and inventory management. Patients receive tailored notifications and insights, empowering them to manage dialysis confidently at home.

Global Home Dialysis Systems Market: Stats & Facts

-

CMS (Centers for Medicare & Medicaid Services)

- In 2025, CMS increased the ESRD Prospective Payment System (PPS) base rate to $273.82 per treatment, projecting a 2.7% rise in total ESRD facility payments.

- The ESRD Treatment Choices (ETC) Model, launched in January 2021, mandates payment incentives to increase use of home dialysis and kidney transplantation across approximately 30% of ESRD facilities in the U.S.

-

National ESRD Networks Census

- As of March 2025, 516,837 U.S. patients were undergoing dialysis treatment.

- At the same time, 316,873 patients were living with functioning kidney transplants.

Global Home Dialysis Systems Market: Market Dynamics

Global Home Dialysis Systems Market: Driving Factors

Increasing Prevalence of Chronic Kidney Disease (CKD) and ESRD

The global rise in chronic kidney disease and end-stage renal disease (ESRD) is a major growth catalyst for home dialysis systems. Sedentary lifestyles, rising incidences of diabetes and hypertension, and an aging population have collectively increased the demand for long-term renal replacement therapies. Home-based dialysis offers flexibility and comfort, which encourages patients to manage treatment without frequent hospital visits. As healthcare shifts towards patient-centric care, home dialysis aligns with the growing emphasis on personalized chronic kidney disease therapy and ongoing disease management.

Technological Advancements in Home Dialysis Equipment

Innovations in compact, user-friendly dialysis machines have significantly improved the feasibility and appeal of at-home renal care. Features like automated peritoneal dialysis, touchscreen interfaces, integrated remote monitoring, and wearable dialysis devices are transforming treatment adherence and safety. These smart dialysis solutions support real-time health tracking and physician engagement, reducing clinical complications and enhancing overall outcomes. As a result, both patients and providers are adopting advanced portable dialysis machines as a standard care option.

Global Home Dialysis Systems Market: Restraints

High Initial Equipment and Setup Costs

Despite long-term cost savings, the upfront investment required for home dialysis equipment, installation, and patient training can be prohibitively expensive for many. Advanced machines, along with consumables like dialysate, tubing, and catheters, can impose a significant financial burden, especially in low- and middle-income economies where insurance coverage for home therapies is limited. This cost barrier remains a key restraint in the wider adoption of home-based renal care.

Limited Patient Eligibility and Training Challenges

Not all patients qualify for home dialysis due to physical, cognitive, or psychological limitations. Proper training, home environment suitability, and caregiver availability are crucial factors for successful treatment. In regions with limited healthcare resources or low digital literacy, training patients and ensuring adherence to complex treatment protocols remain significant challenges. These factors can reduce the effective deployment of home-based dialysis therapy in certain patient populations.

Global Home Dialysis Systems Market: Opportunities

Expanding Access in Emerging Markets

Developing regions such as Asia-Pacific, Latin America, and parts of the Middle East and Africa present untapped potential for the home dialysis systems market. Rising healthcare investments, growing CKD awareness, and improving insurance infrastructure are driving demand in these markets. The introduction of cost-effective, low-maintenance dialysis devices tailored to local needs opens new avenues for manufacturers and service providers to expand their global footprint.

Integration with Digital Health and AI

The convergence of home dialysis systems with digital health tools, including artificial intelligence and predictive analytics, presents a major opportunity. These technologies allow for early detection of complications, personalized dialysis planning, and enhanced patient monitoring. As remote health monitoring becomes integral to chronic disease care, AI-enabled platforms will further streamline treatment workflows and improve the effectiveness of home-based dialysis programs.

Global Home Dialysis Systems Market: Trends

Shift toward Portable and Wearable Dialysis Devices

A growing trend in the market is the development of lightweight, portable, and even wearable dialysis machines. These next-generation systems cater to active patients who prefer mobility and flexibility during treatment. The demand for compact, travel-friendly dialysis solutions is growing, particularly among working-age individuals managing kidney disease while maintaining daily routines.

Rise in Tele-nephrology and Virtual Care Models

With the rise of telehealth, remote nephrology consultations have become a vital component of home dialysis management. Patients and clinicians are adopting virtual platforms for real-time consultations, therapy adjustments, and outcome tracking. This trend supports the decentralization of renal care services, promotes treatment adherence, and reduces the burden on dialysis centers and hospitals.

Global Home Dialysis Systems Market: Research Scope and Analysis

By Modality Analysis

Peritoneal Dialysis (PD) is expected to lead the modality segment of the home dialysis systems market, accounting for approximately 58.0% of the total market share in 2025. This dominance is attributed to several factors, including its relative ease of use, lower infrastructure requirements, and better suitability for at-home administration. PD allows patients to perform dialysis without the need for a complex machine or clinical setting, making it a more convenient and cost-effective option for long-term kidney care. Its flexibility, especially for elderly or mobility-impaired patients, contributes significantly to its widespread adoption. Moreover, automated peritoneal dialysis (APD) systems, which can operate during the night while patients sleep, further enhance treatment compliance and quality of life.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In contrast, Home Hemodialysis (HHD) is gaining traction as an effective alternative for patients who require more intensive blood filtration. While HHD currently holds a smaller market share, it is expected to grow steadily due to advancements in user-friendly hemodialysis machines and growing awareness of its clinical benefits. HHD offers better clearance of toxins, improved blood pressure control, and greater flexibility in dialysis frequency, often leading to better patient outcomes. However, the complexity of setup, need for vascular access, and ongoing training requirements have somewhat limited its penetration compared to PD. Nonetheless, with innovations in compact hemodialysis systems and remote monitoring capabilities, HHD is emerging as a strong complement to peritoneal dialysis in the evolving landscape of home-based renal therapy.

By Component Analysis

Devices are poised to consolidate their dominance in the component segment of the home dialysis systems market, projected to account for approximately 45.0% of the total market share in 2025. This strong position is largely attributed to the central role dialysis machines play in facilitating both peritoneal and hemodialysis treatments at home. Ongoing technological advancements have led to the development of compact, user-friendly, and portable systems, enabling patients to perform dialysis with greater comfort and independence.

Features like touchscreen controls, automated settings, and remote connectivity have enhanced usability, especially for elderly patients or those with limited technical knowledge. As healthcare providers focus more on patient empowerment and at-home treatment models, demand for these sophisticated machines continues to rise, solidifying the dominance of devices within the component landscape.

On the other hand, consumables represent a critical and recurring component of the home dialysis ecosystem. This category includes items such as dialysate fluids, tubing sets, catheters, filters, and disinfectants, all of which are essential for each dialysis session. While they may not carry the upfront cost of machines, consumables contribute significantly to ongoing treatment expenses and play a vital role in maintaining treatment safety and effectiveness.

The consistent and frequent need for these supplies ensures a steady revenue stream for manufacturers, making it a key area of focus for operational expansion. As more patients transition to home-based dialysis, the demand for high-quality, biocompatible, and easy-to-use consumables is expected to grow in parallel with the installed base of dialysis devices.

By Disease Condition Analysis

End-Stage Renal Disease (ESRD) is expected to dominate the disease condition segment of the home dialysis systems market, capturing an estimated 88.0% of the market share by 2025. This significant share is primarily due to the chronic and irreversible nature of ESRD, which necessitates long-term and consistent dialysis treatment for survival. As the global burden of chronic kidney disease continues to rise, driven by factors such as aging populations, diabetes, and hypertension, more patients are progressing to ESRD, growing the demand for reliable and convenient dialysis solutions.

Home dialysis systems offer ESRD patients the flexibility to manage their condition from the comfort of their own homes, reducing the need for frequent hospital visits and allowing for improved quality of life. The consistent, lifelong need for treatment in ESRD patients makes them the primary demographic for at-home dialysis care, supporting the segment’s strong market position.

In comparison, Acute Kidney Injury (AKI) represents a smaller portion of the market but remains an important segment due to its potential severity and growing incidence in hospitalized patients. AKI is typically a sudden and temporary loss of kidney function, often caused by trauma, infections, or certain medications. While dialysis for AKI is usually administered in clinical settings, there is a growing trend toward short-term home-based dialysis for stable patients post-discharge.

This approach helps in early recovery and reduces hospital readmissions. However, because AKI is generally a temporary condition and does not require long-term dialysis in most cases, its contribution to the home dialysis systems market remains limited when compared to the chronic and ongoing treatment requirements of ESRD.

By Age Group Analysis

The 45–64 years age group is projected to maintain its dominance in the age group segment of the home dialysis systems market, capturing around 41.0% of the total market share in 2025. This age bracket represents a high-risk population for chronic kidney disease due to prolonged exposure to contributing factors such as diabetes, hypertension, and sedentary lifestyles. Individuals in this group are often still active in their personal and professional lives, and the flexibility offered by home dialysis systems aligns well with their need to manage treatment without disrupting daily routines.

Moreover, patients in this age range typically possess the cognitive and physical ability to handle the responsibilities of self-administered dialysis, which further supports the growing adoption of home-based renal therapy among this demographic.

The 65+ years age group also holds a significant share in the market and continues to be an important segment due to the rising global geriatric population. Older adults are more prone to developing end-stage renal disease, often due to the cumulative effects of multiple chronic conditions. Home dialysis systems provide a convenient and less physically demanding alternative to frequent in-center visits, which can be particularly challenging for elderly patients with mobility issues.

However, the adoption rate in this age group can be slightly constrained by factors such as the need for caregiver assistance, limited digital literacy, and the presence of additional comorbidities that complicate at-home treatment. Despite these challenges, advances in user-friendly dialysis technology and supportive care models are making it feasible for elderly patients to safely and effectively undergo dialysis at home.

By Technology Analysis

Conventional systems are expected to dominate the technology segment of the home dialysis systems market, accounting for approximately 60.0% of the market share in 2025. These systems have been the backbone of home dialysis for years, offering reliable and proven methods for both peritoneal dialysis and home hemodialysis.

They are typically larger, more robust machines designed for safe and consistent use in home environments. Many healthcare providers and patients continue to rely on conventional systems due to their established track record, ease of access, and support from existing healthcare infrastructure. Additionally, these systems are widely used in training programs and are often covered under existing reimbursement models, which reinforces their widespread adoption and continued dominance.

Next-generation or portable systems, while currently occupying a smaller market share, are emerging as a fast-growing subsegment due to their enhanced convenience, compact design, and advanced digital features. These systems are designed to be lightweight, travel-friendly, and user-intuitive, making them ideal for patients seeking greater flexibility in their treatment routines. Many of these devices are integrated with smart health monitoring tools, enabling real-time data sharing with clinicians and better adherence to treatment plans.

Although the initial cost of these technologies can be higher, the benefits in terms of patient mobility, improved quality of life, and reduced dependency on clinical settings are driving their adoption. As innovation continues and digital health becomes more integral to renal care, next-gen and portable systems are expected to gain significant traction and reshape the future of home dialysis.

By End-User Analysis

Home care settings are projected to dominate the end-user segment of the home dialysis systems market, capturing approximately 70.0% of the total market share in 2025. This dominance is largely driven by the growing preference for patient-centric and flexible treatment options that reduce dependency on hospital-based care. Home dialysis allows patients, especially those with chronic kidney conditions, to manage their therapy on their own schedule in a familiar environment, improving overall treatment adherence and quality of life.

Advances in user-friendly dialysis machines, along with increased awareness and education about self-care, have made it easier for patients and caregivers to administer dialysis safely at home. In addition, healthcare systems and insurers are promoting home-based care models due to their cost-effectiveness and ability to reduce the burden on hospital infrastructure.

Dialysis centers, while holding a smaller portion of the market, continue to play a crucial role in supporting home dialysis adoption. These facilities are often responsible for patient evaluation, training, and periodic monitoring during the transition to home-based therapy.

They also serve as important hubs for managing patients who are not yet ready or eligible for full-time home dialysis. In some cases, dialysis centers provide hybrid models, allowing patients to split treatments between in-center visits and home care. Although not the dominant end-user, dialysis centers remain essential in the ecosystem by ensuring clinical oversight, providing support services, and enhancing the safety and success of home dialysis programs.

The Home Dialysis Systems Market Report is segmented on the basis of the following

By Modality

- Peritoneal Dialysis (PD)

- Home Hemodialysis (HHD)

By Component

- Devices

- Consumables

- Services

By Disease Condition

- End-Stage Disease (ESRD)

- Acute Kidney Injury (AKI)

By Age Group

- 18-44 Years

- 45-64 Years

- 65+ Years

By Technology

- Conventional Systems

- Next-Gen/Portable Systems

By End-User

- Home Care Settings

- Dialysis Centers

Global Home Dialysis Systems Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global home dialysis systems market in 2025, capturing approximately 42.0% of total global market revenue. This regional dominance is driven by a well-established healthcare infrastructure, high prevalence of chronic kidney disease, and widespread adoption of home-based treatment models. The presence of leading market players, favorable reimbursement policies, and strong regulatory support for home dialysis contribute significantly to market growth in the region. Additionally, advancements in telehealth and remote patient monitoring technologies have further strengthened the adoption of home dialysis across the United States and Canada, enabling better disease management and reducing the need for in-center care.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is poised to experience significant growth in the home dialysis systems market over the coming years, driven by a rapidly growing population with chronic kidney disease, rising healthcare expenditure, and growing awareness of home-based renal care. Countries such as China, India, Japan, and Australia are witnessing a surge in demand for flexible dialysis solutions due to expanding urbanization, lifestyle-related health issues, and improvements in medical infrastructure.

Additionally, government support for chronic disease management, the emergence of telehealth platforms, and the introduction of cost-effective, portable dialysis machines are accelerating adoption in both urban and semi-rural areas. This region’s large patient base and shifting healthcare dynamics make it a key growth frontier for the global market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Home Dialysis Systems Market: Competitive Landscape

The global competitive landscape of the home dialysis systems market is characterized by the presence of several established players and a growing number of innovative startups, all striving to expand their market share through product innovation, strategic collaborations, and geographic expansion. Leading companies such as Fresenius Medical Care, Baxter International, and B. Braun Melsungen dominate the market with a broad portfolio of peritoneal and home hemodialysis systems, along with strong distribution networks and after-sales support.

Meanwhile, emerging players like Quanta Dialysis Technologies, Outset Medical, and AWAK Technologies are disrupting the space with compact, portable, and digitally integrated dialysis machines tailored for at-home use. Competition is intensifying as companies invest in remote monitoring capabilities, AI-driven platforms, and patient-friendly designs to meet rising demand for flexible, tech-enabled treatment solutions. This dynamic and innovation-driven environment continues to reshape the global home dialysis landscape, encouraging continual advancements in care delivery and accessibility.

Some of the prominent players in the global home dialysis systems market are

- Fresenius Medical Care

- Baxter International Inc.

- B. Braun Melsungen AG

- Nipro Corporation

- Asahi Kasei Medical Co., Ltd.

- Medtronic plc

- Dialife SA

- Quanta Dialysis Technologies

- Outset Medical, Inc.

- NxStage Medical (acquired by Fresenius)

- AWAK Technologies

- DEKA Research & Development Corp.

- Senzime AB

- EUMEDICA s.a.

- Physidia

- Teleflex Incorporated

- Toray Medical Co., Ltd.

- Diaverum

- Atlantic Biomedical

- Rockwell Medical, Inc.

- Other Key Players

Global Home Dialysis Systems Market: Recent Developments

- June 2025: Fresenius Medical Care received FDA 510(k) clearance for its updated 5008X CAREsystem, enabling broader U.S. commercialization with plans to introduce high-volume hemodiafiltration therapy in clinics by the end of 2025.

- November 2024: Quanta Dialysis Technologies secured FDA clearance for its compact Quanta Dialysis System for home use, offering high dialysate flow and flexibility across multiple treatment modalities.

- June 2025: Fresenius Medical Care completed a strategic merger combining Fresenius Health Partners, InterWell Health, and Cricket Health under the unified InterWell Health brand to strengthen value-based kidney care services in the U.S.

- August 2024: Baxter International announced the divestiture of its Kidney Care segment to Carlyle for approximately USD 3.8 billion, with plans to operate independently under the new name Vantive.

-

Funding Rounds & Investments

- February 2025: OLI Technologies raised USD 700,000 in seed funding to develop affordable, user-friendly home dialysis solutions targeting underserved populations.

- ovember 2024: Quanta Dialysis Technologies closed a USD 60 million Series E funding round led by Novo Holdings to support U.S. market expansion and commercial scaling of its home hemodialysis system.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 27.5 Bn |

| Forecast Value (2034) |

USD 67.4 Bn |

| CAGR (2025–2034) |

10.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 9.7 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Modality (Peritoneal Dialysis and Home Hemodialysis), By Component (Devices, Consumables, and Services), By Disease Condition (End-Stage Renal Disease and Acute Kidney Injury), By Age Group (18–44 Years, 45–64 Years, and 65+ Years), By Technology (Conventional Systems and Next-Gen/Portable Systems), and By End-User (Home Care Settings and Dialysis Centers) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Fresenius Medical Care, Baxter International Inc., B. Braun Melsungen AG, Nipro Corporation, Asahi Kasei Medical Co., Ltd., Medtronic plc, Dialife SA, Quanta Dialysis Technologies, Outset Medical, Inc., NxStage Medical, AWAK Technologies, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global home dialysis systems market?

▾ The global home dialysis systems market size is estimated to have a value of USD 27.5 billion in 2025 and is expected to reach USD 67.4 billion by the end of 2034.

What is the size of the US home dialysis systems market?

▾ The US home dialysis systems market is projected to be valued at USD 9.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 22.6 billion in 2034 at a CAGR of 9.9%.

Which region accounted for the largest global home dialysis systems market?

▾ North America is expected to have the largest market share in the global home dialysis systems market, with a share of about 42.0% in 2025.

Who are the key players in the global home dialysis systems market?

▾ Some of the major key players in the global home dialysis systems market are Fresenius Medical Care, Baxter International Inc., B. Braun Melsungen AG, Nipro Corporation, Asahi Kasei Medical Co., Ltd., Medtronic plc, Dialife SA, Quanta Dialysis Technologies, Outset Medical, Inc., NxStage Medical, AWAK Technologies, and Others.

What is the growth rate of the global home dialysis systems market?

▾ The market is growing at a CAGR of 10.5 percent over the forecasted period.