Market Overview

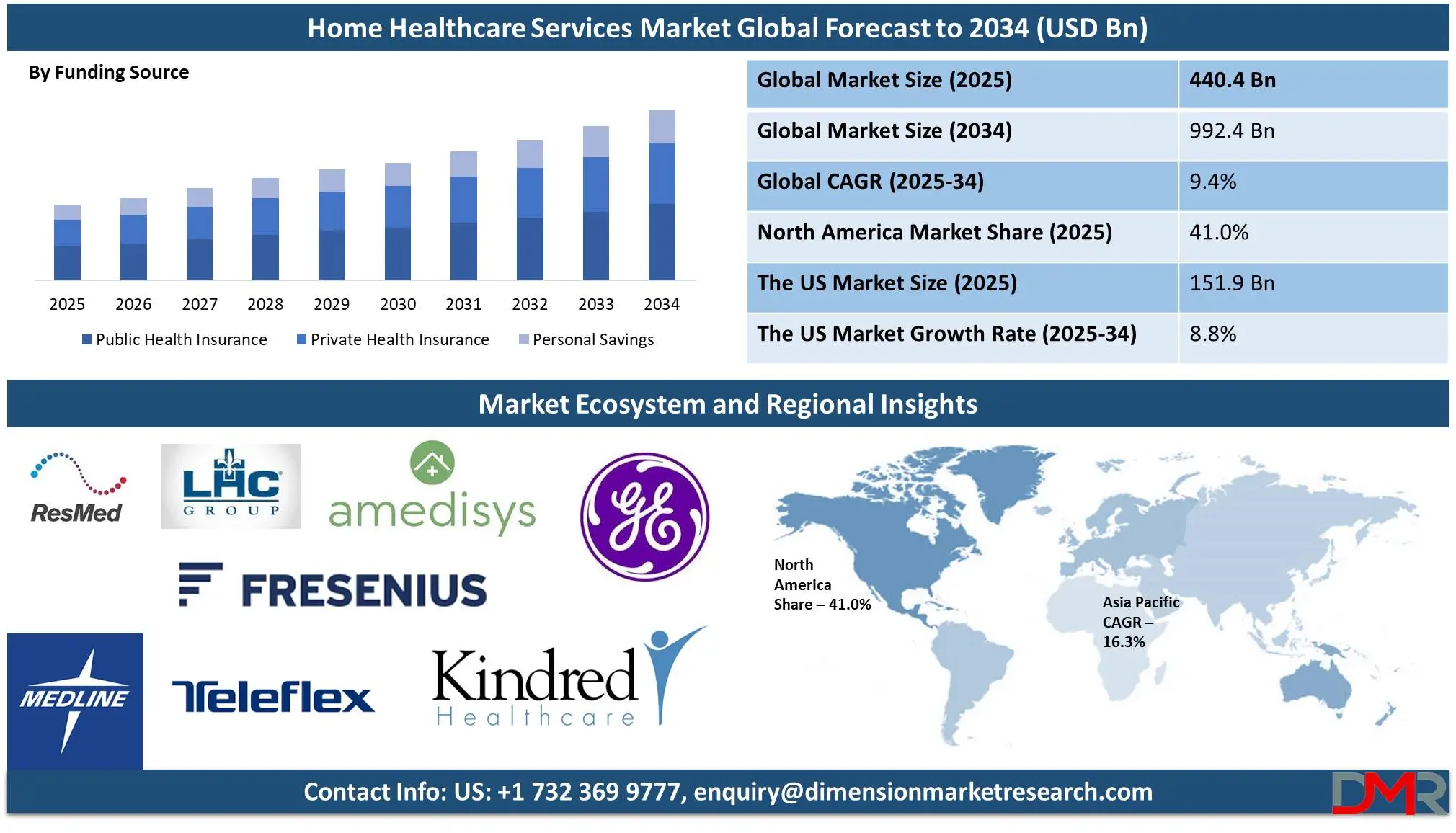

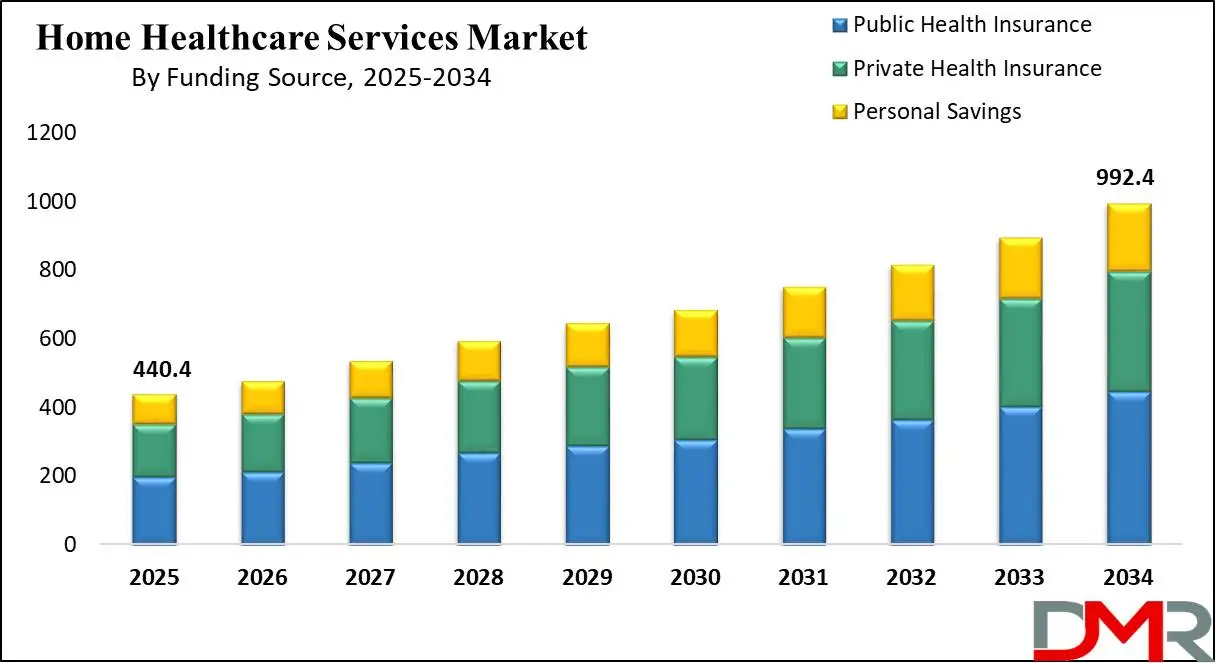

The Global Home Healthcare Services Market is estimated to be USD 440.4 billion in 2025 and is expected to grow to USD 992.4 billion by 2034, registering a CAGR of 9.4% from 2025 to 2034.

Home healthcare services provide medical and non-medical care to individuals in their homes, ensuring comfort and convenience. These services include skilled nursing, physical therapy, personal care, and companionship for elderly, disabled, or chronically ill patients. Home healthcare helps manage diabetes, heart disease, and post-surgical recovery. It reduces hospital visits, lowers medical costs, and improves the quality of life. With an aging population and the rising prevalence of chronic diseases, the demand for home healthcare is increasing. Advanced technologies, such as remote monitoring and telehealth, enhance service delivery, making healthcare more accessible and efficient.

The global home healthcare services market is driven by an aging population, increasing chronic diseases like diabetes and cardiovascular disorders, and the rising preference for in-home care over hospital stays. Cost-effectiveness and technological advancements, such as telehealth, remote monitoring, and AI-driven healthcare solutions, further boost market growth. Additionally, government initiatives supporting home healthcare and the shortage of healthcare professionals in hospitals are key driving factors.

Opportunities in this market include innovations in digital health, increased investments in home-based medical technologies, and expanding insurance coverage for home healthcare services. The growing demand for personalized, patient-centric care and the integration of smart medical devices create significant business potential.

The need for home healthcare services arises from a desire for enhanced comfort, reduced hospital readmissions, and improved patient outcomes. Increasing urbanization and the prevalence of nuclear families also contribute to demand, as more individuals require professional care at home. The demand for home healthcare continues to grow, particularly in developing economies where healthcare infrastructure is evolving. As more people opt for home-based treatment, providers are expanding services to include specialized nursing, rehabilitation, and chronic disease management, shaping the future of the industry.

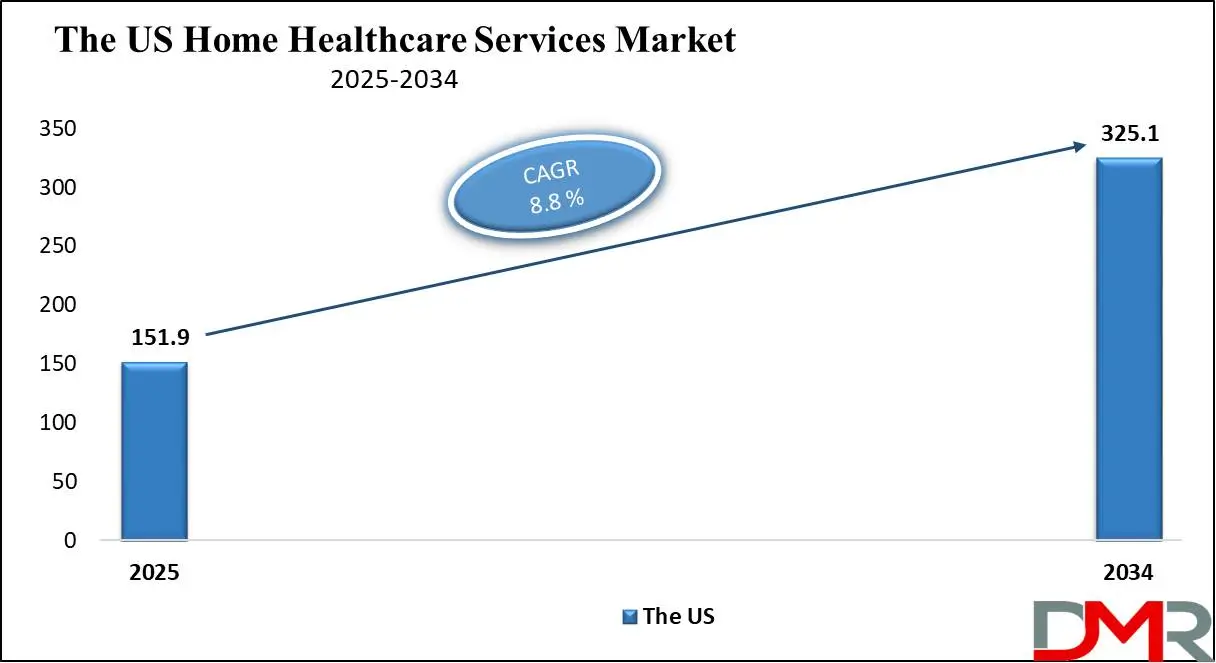

The US Home Healthcare Services Market

The US Home Healthcare Services market is projected to be valued at USD 151.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 325.1 billion in 2034 at a CAGR of 8.8%.

The U.S. home healthcare services market is driven by the aging population, rising chronic diseases, and increasing preference for home-based care over institutional settings. Technological advancements like remote patient monitoring and telehealth enhance service efficiency. Cost-effectiveness compared to hospital care and favorable government policies, including Medicare and Medicaid support, further boost market growth. Additionally, a shortage of healthcare professionals in hospitals and a growing emphasis on personalized care contribute to the increasing demand for home healthcare services.

Key trends in the U.S. home healthcare services market include the integration of AI and IoT for remote monitoring, enhancing patient outcomes, and reducing hospital readmissions. The shift toward value-based care emphasizes efficiency and quality over volume. The growing adoption of telehealth and wearable devices facilitates real-time patient tracking. Additionally, home-based rehabilitation and palliative care services are expanding, catering to the aging population. Mergers and acquisitions among service providers are also reshaping the competitive landscape.

Home Healthcare Services Market: Key Takeaways

- Market Growth: The Global Home Healthcare Services Market is anticipated to expand by USD 514.7 billion, achieving a CAGR of 9.4% from 2025 to 2034.

- Product & Equipment Segment Analysis: The therapeutic equipment segment is expected to dominate the Global Home Healthcare Services Market with a revenue share of 40.2% by the end of 2025.

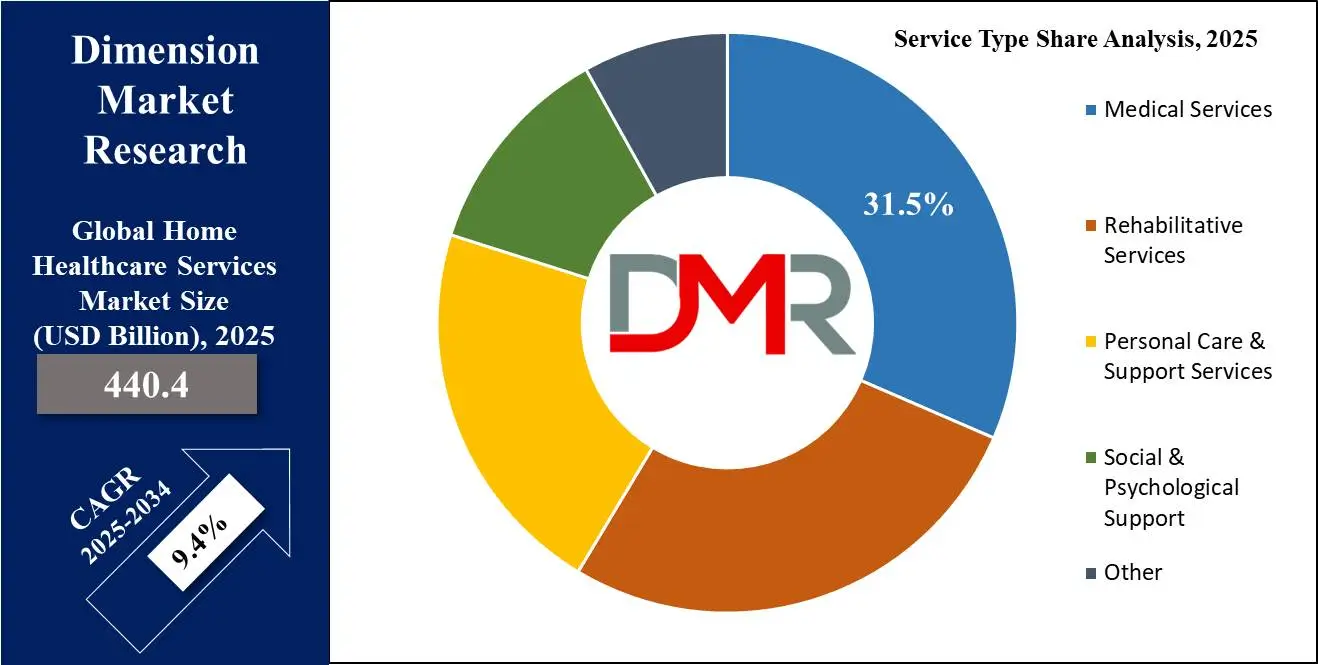

- Service Type Segment Analysis: Medical services are expected to dominate the global home healthcare market with a revenue share of 31.5% in 2025.

- Funding Source Segment Analysis: Public health insurance is expected to dominate the Global Home Healthcare Services Market with a revenue share of 44.9% by the end of 2025.

- Regional Analysis: North America is predicted to lead the global Home Healthcare Services Market with a revenue share of 41.0% in 2025.

- Prominent Players: Some of the major key players in the Global Home Healthcare Services Market are Fresenius SE & Co. KGaA, Amedisys Inc., LHC Group, and many others.

Home Healthcare Services Market: Use Cases

- Post-Surgery Recovery: Patients recovering from surgery often require specialized care, including wound management, medication administration, and physical therapy. Home healthcare services provide professional medical support to ensure a smooth recovery while allowing patients to remain in a comfortable and familiar environment.

- Elderly Care: Many seniors prefer to age at home rather than move to assisted living facilities. Home healthcare services assist with daily activities such as bathing, dressing, meal preparation, and medication management while also providing companionship and monitoring for any health concerns.

- Chronic Disease Management: Individuals suffering from chronic conditions like diabetes, heart disease, or respiratory disorders benefit from home healthcare services. Skilled nurses and therapists help manage symptoms, provide education on disease management, and ensure timely medical interventions to prevent complications.

- Palliative and End-of-Life Care: Patients with terminal illnesses or those in need of palliative care can receive compassionate support at home. Home healthcare providers offer pain management, emotional support, and assistance with daily tasks, helping patients maintain dignity and comfort in their final stages of life.

Home Healthcare Services Market: Stats & Facts

- Growing Senior Population: As reported by the Census Bureau, in 2020, there were approximately 52 million Americans over the age of 65. This number is projected to rise to 73 million by 2030, highlighting the increasing demand for home care services.

- Aging in Place Preference: Research from AARP indicates that nearly 90% of seniors prefer to remain in their own homes rather than transition to assisted living or nursing facilities, emphasizing the need for home care support.

- Seniors Living Alone: Findings from AARP reveal that over 50% of seniors aged 75 and older live alone, which significantly drives the demand for home care services to assist with daily living and combat social isolation.

- Gender Disparity in Home Care Use: Data from the National Center for Health Statistics shows that 65% of home care users are women, while 35% are men. This disparity reflects women's longer life expectancy and a higher likelihood of requiring caregiving assistance.

- Home Care Workforce: Statistics from PHI confirm that approximately 3.5 million individuals are employed as home care workers in the U.S., making this sector a critical pillar of caregiving services.

- Low Wages in Home Care: Research by the Bureau of Labor Statistics states that in 2020, the median hourly wage for home health aides was USD 12.1, contributing to worker shortages and high turnover rates in the industry.

- High Turnover in Home Care Jobs: Reports from Home Care Pulse highlight that home care workers face a 64.3% turnover rate, with an average job tenure of just 1.3 years, creating a significant staffing challenge.

- Demographics of Home Care Workers: Studies from PHI reveal that over 90% of home care workers are women, and approximately 40% are people of color, showcasing the diversity of the caregiving workforce.

- Top States for Home Care Workers: Analysis from PHI indicates that California, New York, and Texas employ the highest number of home care workers, driven by large aging populations and strong demand for in-home services.

- Growth of Telehealth in Home Care: Reports from Home Health Care News demonstrate that the use of telehealth in home care services has surged by 154.0% since 2018, providing remote patient monitoring and virtual consultations.

- Adoption of Telehealth by Agencies: Data from Home Health Care News shows that approximately 60.0% of home care agencies incorporate telehealth technology, enhancing accessibility and convenience for homebound patients.

- Caregiver Matching Improves Satisfaction: Insights from Home Care Pulse reveal that home care agencies implementing a caregiver matching process experience a 9% higher client satisfaction rate than those that do not.

- Job Satisfaction in Home Care: Findings from Home Care Pulse highlight that the top three factors influencing home care worker satisfaction are meaningful client relationships, flexible scheduling, and competitive pay.

- Home Care Workforce Shortage: Studies from PHI predict that by 2040, the number of older adults requiring care will double, whereas the number of available caregivers will increase by only 1%, intensifying workforce challenges.

- Reimbursement for Home Care Services: Research from the Medicare Payment Advisory Commission and CMS states that Medicare reimburses home health services at an average of $150.12 per visit, while Medicaid pays approximately $121 per visit and $20.33 per hour for personal care services.

- Hospice as a Form of Home Care: Findings from the National Hospice and Palliative Care Organization confirm that hospice care, a form of home care for terminally ill patients, serves around 1.5 million Americans annually, with Medicare covering more than 90% of costs.

- Dementia and Home Care: Data from the Alzheimer’s Association suggests that approximately 5.8 million Americans live with Alzheimer’s disease, with 70% of them residing at home, driving demand for specialized dementia care services.

- Mental Health in Home Care: Reports from the National Council on Aging indicate that nearly 20% of adults over 55 suffer from a mental health disorder, with depression being the most prevalent. Agencies offering mental health support have an 8% higher client satisfaction rate.

- Size of the Home Care Industry: Analysis from Gitnux states that the U.S. home care sector consists of around 408,868 providers, ranging from small businesses to large national franchises, catering to diverse client needs.

- Employment in the Home Care Sector: Research from Gitnux highlights that the industry employs over 2 million individuals, making it one of the fastest-growing employment sectors due to rising demand for caregiving services.

Home Healthcare Services Market: Market Dynamics

Driving Factors in the Home Healthcare Services Market

Aging Population and Rising Chronic Diseases

Home healthcare services market growth can be directly attributed to an increasingly older global population. With life expectancies increasing and seniors requiring long-term assistance with daily activities and chronic disease management like diabetes, cardiovascular diseases, and respiratory disorders becoming more prevalent over time; cost-effective yet convenient alternative care settings that ensure elder individuals get appropriate attention in familiar environments have contributed greatly to growing home healthcare solutions market demand. It drives the home healthcare solutions even further forward as solutions of choice for this demographic segment.

Technological Advancements in Home Healthcare

Medical innovations have played a central role in expanding home healthcare service markets. Telehealth platforms, AI-powered diagnostic tools, wearable health monitors, smart medical devices, and mobile health apps enable healthcare professionals to deliver top-quality care outside traditional clinical settings. Wearable health monitors, smart medical devices, and mobile health applications enable real-time tracking of vital signs, medication adherence tracking, and early disease detection to enhance patient outcomes, reduce hospital readmission rates and healthcare costs overall, and expand market reach as technology develops further. Integrating smart healthcare solutions will have significant market growth over time.

Restraints in the Home Healthcare Services Market

High Cost of Home Healthcare Services

Nursing services, medical equipment and advanced home healthcare technologies can all be costly which makes it hard for many patients to afford continuous care. Also, reimbursement policies vary considerably by region limiting access to quality home-based medical services for low and middle-income families alike which restrict widespread adoption. High costs remain one major hindrance that prevents widespread uptake.

Shortage of Skilled Healthcare Professionals

Home healthcare services are declining due to an insufficient workforce availability specifically nurses, caregivers, and therapists. Home-based care requires trained healthcare workers to handle complex medical conditions effectively administer treatments and use advanced medical devices efficiently. Yet many healthcare workers prefer hospital or clinical settings due to better pay, structured work environments, and career progression opportunities. A shortage of trained individuals leads to service delivery gaps as existing caregivers must perform additional duties with additional workload. It is therefore imperative for home healthcare industry growth that this shortage be addressed as quickly as possible to sustainably grow this market segment.

Opportunities in the Home Healthcare Services Market

Expansion of Telehealth and Remote Monitoring

Telehealth and remote patient monitoring present home healthcare service providers with an unprecedented opportunity. Digital health technologies now make possible real-time consultations, virtual check-ups, and continuous health tracking that reduce hospital visits by providing real-time consultations, virtual check-ups and continuous tracking capabilities. Remote monitoring devices, like wearable sensors and AI-powered diagnostic tools, enable healthcare providers to assess patients from a distance and intervene promptly, improving patient convenience while decreasing healthcare costs. As regulations evolve and broadband connectivity improves, digital health solutions should become an integral component of home healthcare delivery and lead to market expansion.

Growing Demand for Personalized and Specialized Care

An increasing desire among home healthcare users for personalized and specialized services provides an enormous growth opportunity in this market. Patients coping with chronic illnesses, post-operative recovery needs, or disabilities typically need tailored healthcare that addresses their particular condition(s). Home healthcare providers provide customized treatment plans, including physical therapy, palliative care, and postoperative support, to promote better patient outcomes. Families increasingly opting for home-based medical services over institutional care due to heightened awareness of patient-centricity. Consumer expectations for high-quality, individual healthcare continue to increase which gives providers who specialize in home care an edge as competition stiffens for such providers.

Trends in the Home Healthcare Services Market

Integration of Artificial Intelligence and Smart Healthcare Technologies

Home healthcare services markets are witnessing an exponential surge in the adoption of AI-powered solutions and smart healthcare technologies, especially diagnostic tools powered by artificial intelligence that enhance diagnostics, predictive analytics, and personalized treatment plans to provide improved patient care at home. AI-enabled chatbots, virtual nursing assistants, and smart medical devices help monitor patients' vital signs, identify early symptoms of illness, and provide real-time health insights in real-time. Wearable devices equipped with IoT allow remote tracking of chronic conditions like diabetes or heart disease which revolutionize home healthcare while simultaneously cutting hospital readmission rates improving efficiency, improving efficiency, and improving outcomes for patient outcomes.

Rising Popularity of Home-Based Rehabilitation Services

As healthcare costs increase and cost-cutting solutions gain importance, home-based rehabilitation services have seen substantial gains. Patients recovering from surgeries, strokes, or injuries prefer home-based physical, occupational, and speech therapy over lengthy hospital stays for recovery purposes. It provides comfort while cutting healthcare expenses. Also, telerehabilitation allows therapists to guide patients remotely thereby increasing accessibility and convenience. This trend in home healthcare has gained steam due to growing post-acute demand and its emphasis on faster healing times and quality-of-life enhancement driving its expansion of home healthcare market.

Home Healthcare Services Market: Research Scope and Analysis

By Product & Equipment Analysis

Therapeutic equipment is likely to lead the Global Home Healthcare Services Market by 2025 with a revenue share estimated to exceed 40% due to rising incidence rates for chronic conditions like diabetes, respiratory illness, and cardiovascular illness. At-home treatments like oxygen therapy, dialysis, and ventilators have experienced exponential growth over the years due to increased demand. Furthermore, portable therapeutic device advancements have rendered home care even more effective and convenient than ever. As hospitals strive to reduce hospital stays and healthcare costs, demand for therapeutic equipment in home settings increases exponentially. Thanks to an aging population and rising interest in in-home care services, this sector should continue its reign of dominance for some time to come.

Monitoring devices are predicted to become the second-largest segment in the Global Home Healthcare Services Market due to the rising adoption of remote patient monitoring and wearable health technologies. Chronic conditions like hypertension, diabetes, and cardiac disorders have driven demand for home continuous tracking at home with innovations like telehealth systems that use AI-powered monitoring solutions as early disease detection techniques while personalized healthcare options remain important. The monitoring devices segment continues to be a key player in the home healthcare market as digital healthcare expands further.

By Service Type Analysis

Medical services are projected to dominate the global home healthcare market with a 31.5% revenue share by 2025 due to chronic illnesses' increasing prevalence, population aging, and demand for cost-cutting alternatives to hospital stays. Telemedicine, remote patient monitoring, and personalized treatment plans have played a large part in driving growth in healthcare services at home. In addition, post-surgery, skilled nursing care, wound treatment, and infusion therapies require professional oversight; thus making home-based services an attractive option.

Home-based treatments are increasingly preferred over institutional care due to increased convenience, lower costs and decreased infection risks are driving market expansion. Government initiatives and reimbursement policies further support medical services' dominance over time. Rehab services are projected to experience the highest CAGR due to rising stroke, orthopedic injury, and neurological disorder incidence rates as well as post-surgery recovery needs. As patients increasingly prefer in-home physical, occupational, and speech therapies due to patient comfort preferences and convenience issues, the demand for home therapy services increases accordingly.

Technological advancements like virtual rehabilitation programs or AI-driven therapy programs enhance service accessibility and efficiency. An increasing global elderly population and efforts to enhance patient mobility and independence contribute to market expansion. Expansion of insurance coverage and favorable healthcare policies further drive rehabilitation services into home healthcare as a growth sector.

By Funding Source Analysis

Public healthcare insurance is projected to hold 44.9% of the revenue share for global home healthcare services by the end of 2025, due in large part to government programs like Medicare and Medicaid in countries like the U.S., Germany, and Canada. These programs provide comprehensive protection to seniors and chronically ill individuals, helping reduce out-of-pocket expenses while increasing access to home healthcare services. An aging population and government efforts to limit hospital admissions driving the rise of this segment. Furthermore, universal healthcare models in many developed nations ensure most expenses for home health services are covered, making public health insurance the key source of funding in this market segment.

Private health insurance represents the second-largest segment in the Global Home Healthcare Services Market. Rising demand for such policies stems from personalized healthcare needs with shorter waiting times and wider coverage options that private plans offer. In countries like the U.S. and Australia, many residents depend on employer-sponsored or individual private insurance plans that offer comprehensive home healthcare benefits. Given the increasing availability of private insurers offering tailored home care packages, this segment has seen consistent expansion over recent years. Higher-income groups and individuals seeking premium care services also contribute significantly to its expansion.

The Global Home Healthcare Services Market Report is segmented based on the following

By Product & Equipment

- Therapeutic Equipment

- Monitoring Devices

- Mobility & Assistive Devices

By Service Type

- Medical Services

- Rehabilitative Services

- Personal Care & Support Services

- Social & Psychological Support

- Other

By Funding Source

- Public Health Insurance

- Private Health Insurance

- Personal Savings

Regional Analysis

Region with the largest Share

North America is expected to dominate the global home healthcare services market with a revenue

share of 41.0% by the end of 2025, due to its advanced healthcare infrastructure, high healthcare expenditure, and increasing elderly population. The rising prevalence of chronic diseases, strong insurance coverage, and favorable government policies further drive market growth.

The presence of key market players and the widespread adoption of telehealth and remote patient monitoring also contribute to the region’s leadership. Additionally, the growing demand for cost-effective and personalized home healthcare solutions, along with technological advancements in medical devices and home-based care services, ensures North America remains at the forefront of this expanding market.

Region with Highest CAGR

Asia-Pacific is expected to experience the highest CAGR in the home healthcare services market due to a rapidly aging population, increasing chronic disease burden, and improving healthcare infrastructure. Rising disposable incomes, growing awareness of home healthcare, and government initiatives supporting elderly care contribute to market expansion. Additionally, the adoption of telemedicine, digital health technologies, and cost-effective service models is accelerating growth. Countries like China, India, and Japan are witnessing high demand for home-based healthcare due to urbanization, changing lifestyles, and a preference for personalized care. The region’s expanding healthcare workforce and investment in homecare solutions further fuel this rapid growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global home healthcare services market is highly competitive, driven by increasing demand for cost-effective and personalized patient care. Key players, including Amedisys, Kindred at Home, LHC Group, and Bayada Home Health Care, compete based on service offerings, geographic presence, and technological advancements. Market growth is fueled by the rising aging population, the prevalence of chronic diseases, and the shift towards in-home care due to cost-efficiency and patient preference. Companies are leveraging telehealth, AI-driven monitoring, and remote patient management to enhance service quality and expand their reach. Mergers and acquisitions are common as firms seek to strengthen market positions and broaden service portfolios.

Regulatory compliance and reimbursement policies significantly influence market dynamics, creating barriers for new entrants while favoring established players with strong healthcare partnerships. The competitive landscape also sees increasing participation from private equity firms investing in home healthcare providers, further intensifying competition. Regional variations exist, with North America and Europe leading due to well-established healthcare infrastructures, while Asia-Pacific presents high-growth opportunities due to increasing healthcare awareness and government support. Overall, innovation, service differentiation, and strategic collaborations will continue shaping the competitive environment of the home healthcare services market.

Some of the prominent players in the Global Home Healthcare Services Market are

- Fresenius SE & Co. KGaA

- Amedisys Inc.

- Bayada Home Health Care

- CareCentrix

- Gentiva Health Services Inc.

- Home Healthcare Solutions Co.

- National HealthCare Corporation

- Omron Healthcare Inc.

- Philips Healthcare

- Roche Holding AG

- Sunrise Medical Inc.

- Abbott Laboratories Inc.

- B. Braun Melsungen AG

- Drive Medical Design & Manufacturing

- Medline Industries Inc.

- Teleflex Inc.

- Welch Allyn Inc.

- ResMed Inc.

- LHC Group

- Kindred Healthcare

- GE HealthCare

- Other Key Players

Recent Developments

- In April 2024, Simple HealthKit introduced at-home diagnostic and follow-up care kits for diabetes (HbA1c), respiratory health, and sexual wellness.

- In October 2023, Daye partnered with Lindus Health to launch a clinical trial for an at-home tampon designed to detect human papillomavirus (HPV) and sexually transmitted infections (STIs).

- In September 2023, 2San and Phoenix Healthcare strengthened their collaboration by releasing self-diagnostic test kits aimed at accelerating diagnoses and empowering consumers to manage their health independently.

- In February 2023, 3M introduced a new medical adhesive designed for various sensors, health monitors, and long-term medical wearables. This initiative enabled the company to broaden its product portfolio and attract a larger customer base.

- In March 2022, Axxess, a leading innovator in home healthcare technology, unveiled a fully independent palliative care software solution. As the latest addition to Axxess’ comprehensive suite of home care solutions, this launch allowed the company to enhance its market offerings and reinforce its competitive position.

Report Details

|

Report Characteristics

|

| Market Size (2025) |

USD 440.4 Bnn |

| Forecast Value (2034) |

USD 992.4 Bn |

| CAGR (2025-2034) |

9.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 151.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product & Equipment (Therapeutic Equipment, Monitoring Devices, and Mobility & Assistive Devices), By Service Type (Medical Services, Rehabilitative Services, Personal Care & Support Services, Social & Psychological Support, and Other), By Funding Source (Public Health Insurance, Private Health Insurance, and Personal Savings) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Fresenius SE & Co. KGaA, Amedisys Inc., Bayada Home Health Care, CareCentrix , Gentiva Health Services Inc., Home Healthcare Solutions Co., National HealthCare Corporation, Omron Healthcare Inc., Philips Healthcare, Roche Holding AG, Sunrise Medical Inc., Abbott Laboratories Inc., B. Braun Melsungen AG, Drive Medical Design & Manufacturing, Medline Industries Inc., Teleflex Inc., Welch Allyn Inc., ResMed Inc., LHC Group, Kindred Healthcare, GE HealthCare, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Home Healthcare Services Market size is estimated to have a value of USD 440.4 billion in 2025 and is expected to reach USD 992.4 billion by the end of 2033.

North America is expected to be the largest market share for the Global Home Healthcare Services Market with a share of about 41.0% in 2025.

Some of the major key players in the Global Home Healthcare Services Market are Fresenius SE & Co. KGaA, Amedisys Inc., LHC Group, and many others.

The market is growing at a CAGR of 9.4 percent over the forecasted period.

The US Home Healthcare Services Market size is estimated to have a value of USD 151.9 billion in 2025 and is expected to reach USD 325.1 billion by the end of 2033.