Market Overview

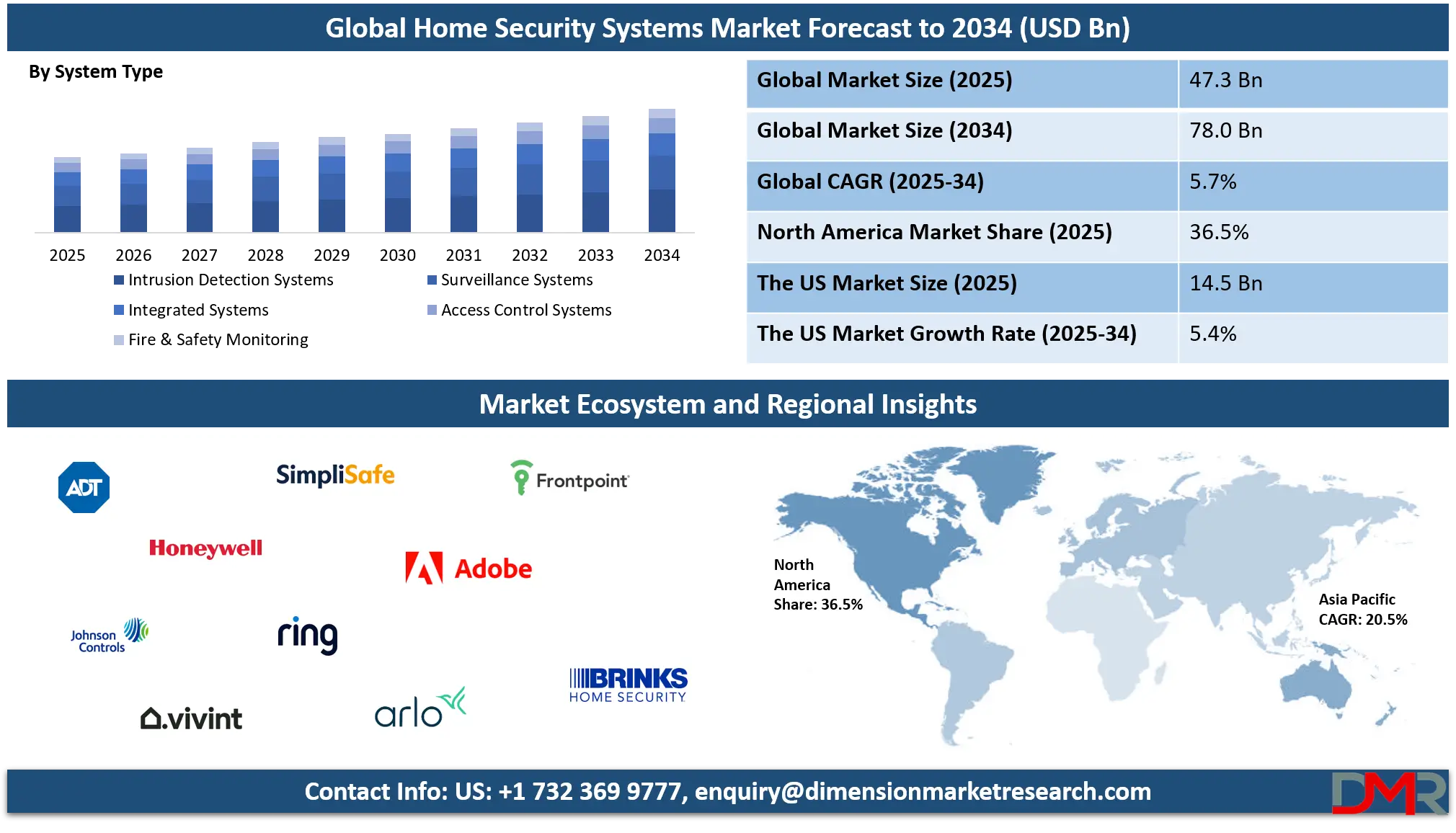

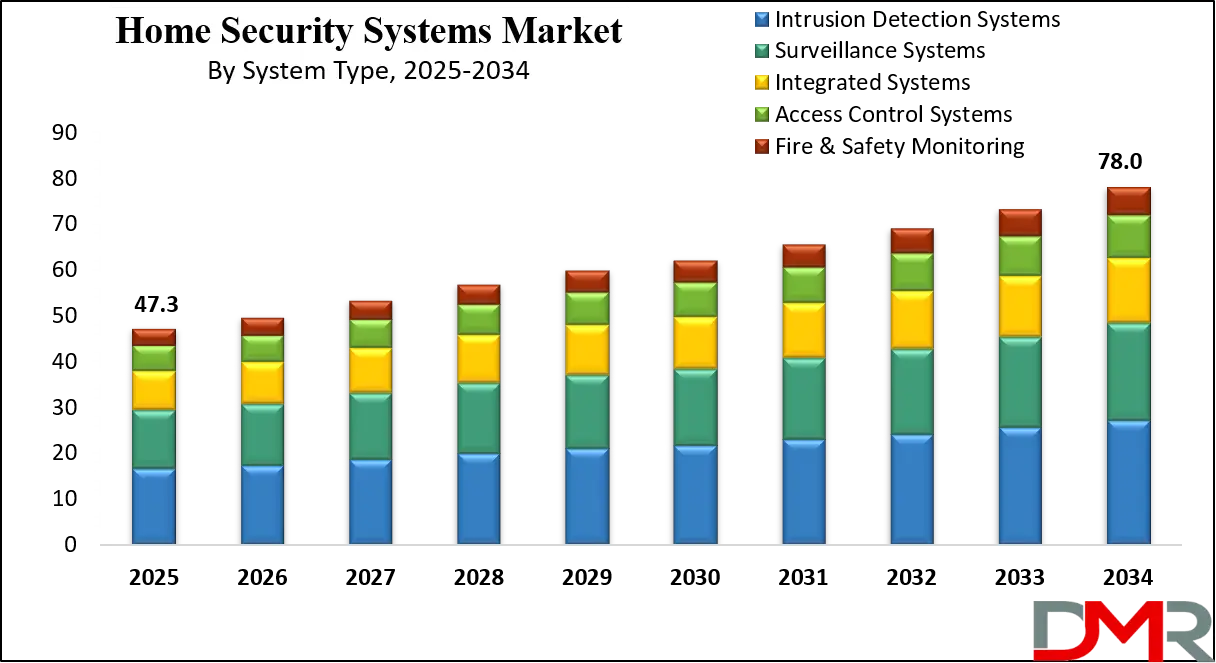

The global Home Security Systems Market size is projected to reach USD 47.3 billion in 2025, driven by increasing consumer demand for advanced security solutions and smart technologies. By 2034, the market is expected to expand to USD 78.0 billion, growing at a robust CAGR of 5.7%. Key drivers include the rising adoption of smart home devices, enhanced security systems, and integration with AI-based surveillance solutions.

Home security systems are integrated solutions designed to protect residential properties from unauthorized access, theft, fire, and other safety threats. These systems typically include a mix of surveillance cameras, motion sensors, door/window sensors, control panels, and smart locks, which work together to create a layered defense mechanism. With advancements in wireless technology, modern home security systems are equipped with remote access capabilities, real-time alerts, and integration with voice assistants, making them both proactive and convenient. They are also scalable, allowing homeowners to add devices or features as needed, offering personalized protection designed for the specific layout and needs of a property.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global home security systems market has evolved into a dynamic ecosystem driven by the convergence of smart home technology and growing safety concerns among consumers. Urbanization and the rise in single-family homes across developed and emerging economies have contributed to the adoption of surveillance and access control systems. With the integration of AI and machine learning, these systems are becoming more predictive, capable of identifying unusual behavior and reducing false alarms. The growing dependence on mobile devices for home monitoring and control has further expanded the usability of these systems, enhancing their relevance in today’s connected lifestyle.

Across different regions, the demand for home automation has fueled investments in home security infrastructure. Developed markets like North America and Europe lead the adoption curve, primarily due to higher disposable incomes, advanced connectivity, and a strong presence of established home security providers. In emerging economies, rising crime rates and increased awareness are prompting middle-income households to invest in basic alarm systems and video surveillance solutions. The availability of affordable DIY security kits has also opened up new opportunities for budget-conscious consumers, particularly renters and first-time users.

Additionally, the emphasis on energy-efficient and smart living environments has encouraged ecosystem players to integrate home security with broader home automation systems. The shift toward subscription-based monitoring services and bundled offerings has created new business models for providers. Cloud-based video storage, real-time mobile alerts, and seamless voice assistant compatibility are now becoming standard, transforming traditional alarm systems into intelligent, user-centric platforms. This evolution not only enhances user experience but also positions home security systems as a critical element of the smart home economy.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Home Security Systems Market

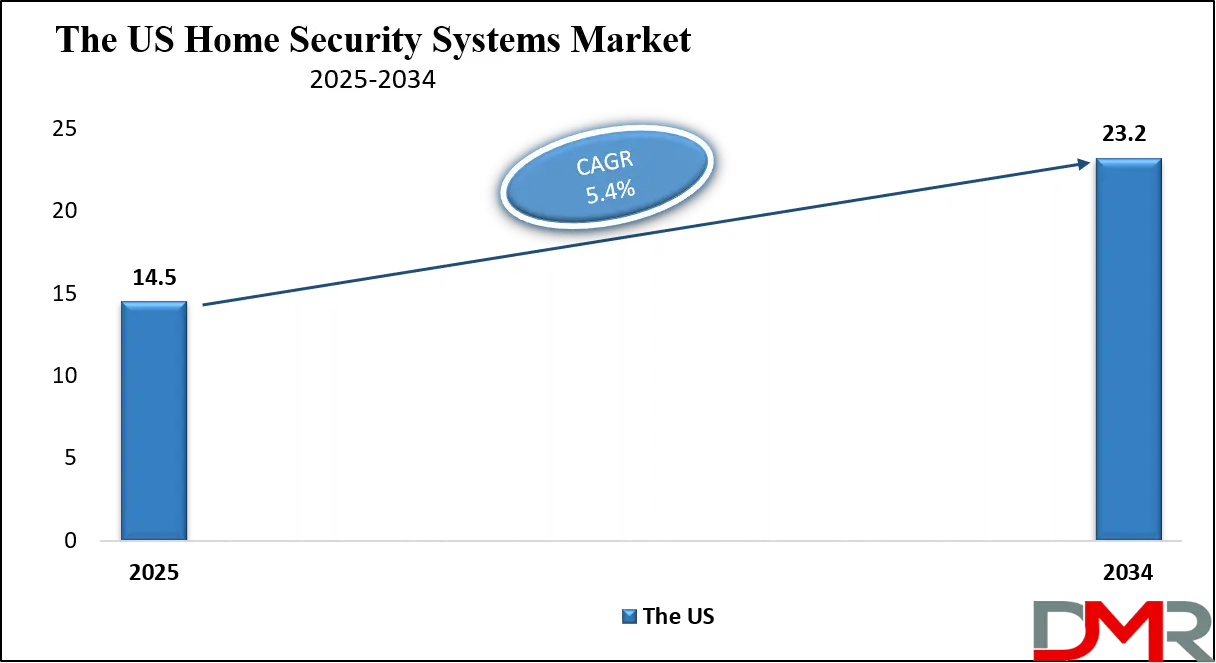

The U.S. home security systems market size is projected to be valued at USD 14.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 23.2 billion in 2034 at a CAGR of 5.4%.

The U.S. home security systems market is one of the most mature and technologically advanced in the world, characterized by a strong consumer demand for smart, integrated, and easy-to-use solutions. A high level of digital penetration, widespread use of smart home devices, and growing security concerns among homeowners have collectively shaped a market that prioritizes both functionality and user experience.

The presence of leading technology companies and established security providers has led to rapid innovation, including AI-powered surveillance, facial recognition, and voice-controlled monitoring. Consumers are seeking systems that not only provide real-time protection but also seamlessly integrate with their existing smart home ecosystems, including lighting, climate control, and virtual assistants.

Consumer expectations in the U.S. are shifting toward customizable solutions, mobile-friendly and offer value-added features beyond traditional alarm services. The rise of DIY home security systems has been especially prominent, driven by tech-savvy users who prefer flexible, contract-free options with remote control capabilities.

Additionally, the increased adoption of cloud-based platforms and subscription-based monitoring services reflects a preference for scalability and convenience. Whether it's single-family homes in the suburbs or apartments in urban centers, the demand for intelligent, connected, and proactive security solutions continues to shape the U.S. market’s trajectory, reinforcing its role as a leader in the global home security landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Home Security Systems Market

Europe home security systems market is projected to reach a value of USD 7.1 billion in 2025, with a robust CAGR of 7.6% over the forecast period. This growth is being driven by a combination of factors, including the rising concerns about home safety, an increasing focus on smart home integration, and the heightened demand for security solutions in both urban and suburban areas. With higher disposable incomes and greater technological adoption, European consumers are increasingly looking for advanced security systems that offer real-time monitoring, video surveillance, and automation.

Countries like the UK, Germany, and France are expected to see the most significant growth, with widespread adoption of IoT-based security products and services. Moreover, Europe is witnessing a shift towards connected, wireless security systems, which integrate seamlessly with other smart home devices, offering enhanced convenience and peace of mind for homeowners.

In addition, Europe’s regulatory environment and urbanization trends are contributing to the market's expansion. As cities across Europe continue to grow, the demand for efficient, scalable security solutions in residential and commercial properties is on the rise. The increasing threat of burglary, vandalism, and other property crimes, alongside the push for digitalization and smart technology, is prompting consumers and businesses alike to invest in sophisticated security systems.

European manufacturers and service providers are also actively innovating, developing AI-powered surveillance solutions and advanced motion detectors to cater to the growing demand for high-quality home security. The presence of leading technology players in Europe, as well as increasing investments in research and development, further solidifies the region's role as a key player in the global home security systems market.

The Japan Home Security Systems Market

Japan’s home security systems market is expected to reach USD 0.9 billion in 2025, with a CAGR of 6.9% during the forecast period. The growth in this market is driven by the increasing demand for smart home solutions, which integrate advanced technologies like AI, IoT, and video surveillance systems to offer real-time security and monitoring. Japan’s aging population is also influencing the market, as elderly residents are increasingly seeking home security solutions that provide both safety and convenience, such as remote monitoring, emergency alerts, and fall detection features. The government’s initiatives to improve safety and security infrastructure, along with a strong focus on digital transformation in the country, are contributing to this surge in demand for innovative security systems.

Furthermore, Japan’s highly urbanized environment, where space is often limited, encourages the adoption of compact, efficient, and scalable security solutions. The demand for wireless security systems and automation is growing as consumers and businesses seek systems that can be easily installed and integrated with other smart devices.

In addition, Japan’s strong technological advancements and a high level of consumer trust in cutting-edge products are boosting the adoption of smart security systems. Companies are also increasingly focusing on enhancing product features, including facial recognition, automated alerts, and advanced video surveillance, to cater to the evolving needs of both residential and commercial customers. The combination of these factors ensures that Japan will continue to be a prominent player in the global home security systems market, with significant growth prospects.

Global Home Security Systems Market: Key Takeaways

- Market Value: The global home security systems market size is expected to reach a value of USD 78.0 billion by 2034 from a base value of USD 47.3 billion in 2025 at a CAGR of 5.7%.

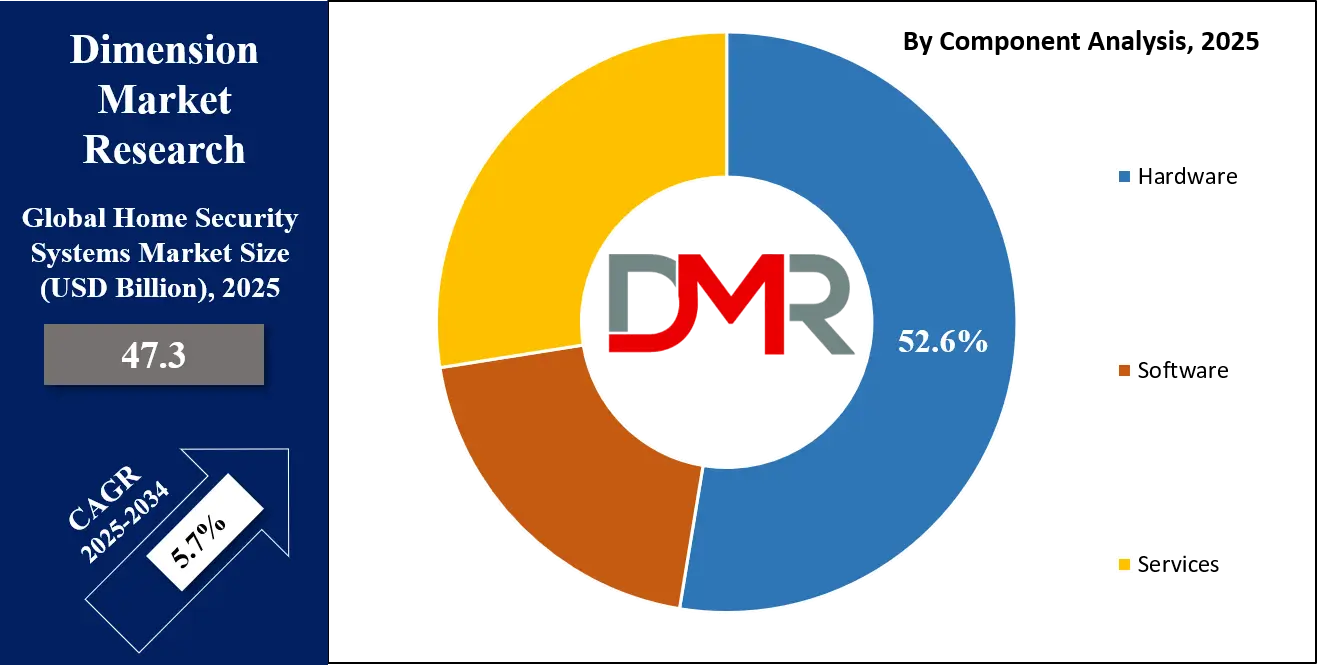

- By Component Segment Analysis: Hardware components are expected to maintain their dominance in the component segment, capturing 52.6% of the total market share in 2025.

- By Installation Type Segment Analysis: DIY (Do-It-Yourself) Systems are poised to consolidate their dominance in the installation type segment, capturing 32.9% of the total market share in 2025.

- By Monitoring Type Segment Analysis: Third-party monitored type is expected to maintain its dominance in the monitoring type segment, capturing 67.8% of the market share in 2025.

- By System Type Segment Analysis: Intrusion Detection Systems are anticipated to dominate the system type segment, capturing 34.7% of the market share in 2025.

- By Technology Segment Analysis: Wireless Systems are expected to maintain their dominance in the technology segment, capturing 54.1% of the market share in 2025.

- By Application Segment Analysis: Residential applications are poised to dominate the application segment, capturing 65.0% of the market share in 2025.

- By End-User Segment Analysis: Homeowners are expected to dominate the end-user type segment, capturing 58.4% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global home security systems market landscape with 36.5% of total global market revenue in 2025.

- Key Players: Some key players in the global home security systems market are ADT Inc., Honeywell International Inc., Johnson Controls, Vivint Smart Home, SimpliSafe, Ring (Amazon), Arlo Technologies, Frontpoint Security, Abode Systems, Brinks Home Security, Bosch Security Systems, Samsung SmartThings, Panasonic, Xiaomi, Hikvision, CP Plus, Axis Communications, Comcast Xfinity Home, Assa Abloy, Alarm.com, and other key players.

Global Home Security Systems Market: Use Cases

- Residential Home Security: In residential homes, security systems are primarily used to protect property and residents from intruders and other emergencies such as fire or carbon monoxide poisoning. Homeowners are integrating smart devices such as surveillance cameras, motion detectors, and smart locks to create a comprehensive security solution. The advent of wireless technology allows homeowners to easily install and control their systems remotely via smartphones or other mobile devices. Additionally, features like smart cameras with facial recognition and video doorbells are gaining popularity for enhancing convenience and safety. As part of home automation, these systems can be integrated with other smart home devices like lighting, heating, and air conditioning, enabling homeowners to manage their entire home environment through a single platform.

- Commercial Property Surveillance: Commercial properties such as offices, retail stores, and warehouses benefit from security systems designed to monitor large areas and ensure the safety of both employees and assets. Surveillance cameras, motion sensors, and access control systems are commonly employed to deter theft, manage facility access, and provide real-time monitoring. Commercial systems often include video analytics that can detect unusual activity and trigger automatic alerts. In addition to physical security, many commercial establishments integrate alarm systems that can alert property managers to any security breaches or environmental hazards. Cloud-based platforms are frequently used in commercial settings to store footage and allow multiple stakeholders to monitor and manage security remotely, enhancing operational efficiency and improving response times in emergencies.

- Smart Security for Apartment Complexes: For apartment complexes and multi-family buildings, integrated security systems offer robust protection against unauthorized access and other risks. These systems typically include intercom systems, smart locks, and video surveillance cameras at entrances, elevators, and parking areas. Residents benefit from keyless entry and mobile app access that allows them to lock/unlock doors and monitor their unit’s security from anywhere. The systems are often integrated with building management software, allowing property managers to control access to common areas and track visitor logs. Additionally, smart sensors can detect irregularities such as gas leaks, smoke, or flooding, alerting both residents and building maintenance teams to take immediate action. This integration of security with overall building management helps increase efficiency and streamline operations for both residents and property managers.

- Healthcare Facility Monitoring: In healthcare environments such as hospitals, clinics, and nursing homes, security systems play a critical role in protecting patients, staff, and sensitive data. Advanced security technologies like biometric access control, video surveillance, and emergency alert systems are integrated into healthcare facilities to prevent unauthorized access to restricted areas and ensure patient safety. These systems are also designed to monitor the premises 24/7, ensuring that any suspicious activity is detected and addressed promptly. In addition to physical security, healthcare institutions are incorporating environmental sensors to monitor conditions like temperature and humidity, which are crucial for maintaining a sterile environment. Real-time alerts and video streaming enable healthcare administrators to respond swiftly to emergencies and maintain a safe and secure environment for all occupants.

Global Home Security Systems Market: Stats & Facts

NSW Bureau of Crime Statistics and Research (Australia)

- Over 20,000 home invasions and break-ins were reported in New South Wales for the year leading up to March 2024.

- More than 8,000 of these incidents occurred in Greater Sydney during the same period.

- Approximately 40% of homes in surveyed streets in Point Piper and Watsons Bay featured surveillance devices.

- In some areas, such as Emu Plains and Penrith, about 40% of homes had security cameras.

- The City of Sydney operates 100 CCTV cameras monitored across the city in a 24-hour operations hub.

National Fire Protection Association (NFPA), United States

- Homes equipped with sprinkler systems have demonstrated a 90% reduction in fire-related deaths.

- These homes also show a 30% reduction in fire-related injuries.

Federal Register, United States

- UL 2610, a standard for commercial premises security alarm units and systems, was issued on January 31, 2023.

- The standard was recognized by the Occupational Safety and Health Administration's (OSHA) Nationally Recognized Testing Laboratory (NRTL) Program.

Department of Homeland Security (DHS), United States

- Police respond to at least 36 million alarm activations each year in the United States.

- The estimated annual cost of these responses is USD 1.8 billion.

- Between 94% and 98% of all alarm calls to law enforcement are false alarms.

- System reliability and user error are the causes of most false alarms.

- False alarms cost local municipalities and their constituents at least USD 1.8 billion annually.

Chicago Police Department, United States

- The city used a USD 5.1 million Homeland Security grant to install an additional 250 surveillance cameras.

- These cameras were connected to a centralized monitoring center, enhancing the city's surveillance capabilities.

New York City Police Department, United States

- Received a USD 350 million grant towards the development of the Domain Awareness System.

- This system includes 18,000 CCTV cameras used for continual surveillance of the city.

Russian Ministry for Digital Development

- As of March 2024, Russia had over 1 million video surveillance cameras.

- Approximately 230,000 of these cameras were in use in Moscow alone.

- One in three of all CCTVs in Russia was connected to a facial recognition system.

Government of India

- India's Smart Cities Mission achieved a 91% project completion rate with a USD 16.97 billion investment across 100 cities as of December 2024.

- This initiative focuses on infrastructure, governance, and sustainable urban development to enhance the standard of urban living.

- The collaboration between manufacturers of security systems, providers of technology, and municipal authorities is expected to fuel market expansion.

- Advanced home security systems are likely to be integrated with smart city frameworks, leading to profitable growth opportunities in the market.

National Council for Home Safety and Security, United States

- Approximately 66% of burglaries are home break-ins.

- The average burglary takes about 90 seconds to 12 minutes.

- An estimated loss of USD 3.9 billion was suffered by victims of burglaries in 2014.

- Police typically only solve 13% of break-in crimes due to a lack of information and witnesses.

- Approximately 95% of break-ins require some type of forceful entry.

Global Home Security Systems Market: Market Dynamics

Global Home Security Systems Market: Driving Factors

Rising Safety Concerns and Crime Rates

The growing concerns over safety and security are one of the main driving factors for the growth of the global home security systems market. With the rise in burglaries, property crimes, and other security threats, homeowners are looking for ways to protect their properties and loved ones. Security systems provide peace of mind and offer real-time surveillance, allowing homeowners to monitor their premises remotely.

As crime rates fluctuate and the general awareness of security risks grows, there is a heightened demand for advanced security solutions like video surveillance, motion detection, and automated alarm systems. This trend is particularly evident in both urban and suburban areas, where residential properties are more susceptible to theft and break-ins.

Technological Advancements and Smart Homes Integration

The integration of home security systems with smart home technologies has revolutionized the market. The rise of smart devices, including voice assistants, smart cameras, and IoT-enabled security solutions, has contributed significantly to the growth of the industry. Consumers are seeking security systems that provide more than just basic monitoring; they want solutions that integrate with their existing smart home setups to control lighting, temperature, and other devices from a single platform.

Cloud-based services and AI-powered analytics, such as facial recognition and automatic incident reporting, have also become essential components in modern security systems. As more homes become connected and the adoption of smart devices increases, the demand for advanced, easy-to-use, and scalable security solutions is expected to continue rising.

Global Home Security Systems Market: Restraints

High Installation and Maintenance Costs

One of the significant restraints in the global home security systems market is the high installation and maintenance costs. While basic DIY security systems are relatively affordable, advanced solutions with professional installation, cloud storage, and 24/7 monitoring services can be costly. This financial burden can deter many homeowners, particularly in emerging economies, from investing in comprehensive security systems.

Moreover, the ongoing costs associated with service subscriptions and regular system maintenance add to the overall expense. This high cost can limit the accessibility of home security solutions for a broader range of consumers, especially renters or those living in low-income areas.

Privacy and Data Security Concerns

With the growing reliance on cloud-based storage and internet-connected devices, privacy and data security concerns have become a significant barrier to the widespread adoption of home security systems. Homeowners are often worried about the safety of the data being collected by surveillance cameras, smart locks, and other monitoring devices. Unauthorized access to sensitive data or breaches in system security could lead to personal privacy violations.

Additionally, there have been instances of cyberattacks targeting security systems, raising fears about the vulnerability of IoT devices and cloud platforms. These concerns can hinder consumer trust and affect purchasing decisions, especially when it comes to systems that collect and store personal information.

Global Home Security Systems Market: Opportunities

Increasing Demand for DIY Security Solutions

The growing popularity of DIY security systems presents a significant opportunity for the home security market. Consumers are becoming more inclined to purchase cost-effective, easy-to-install security systems that can be customized to suit their individual needs. DIY security kits offer flexibility, scalability, and the ability to control security features through mobile apps, making them appealing to tech-savvy consumers and renters.

As the market for DIY products expands, companies have the opportunity to develop and market affordable, user-friendly security solutions that cater to different consumer segments, including first-time buyers and those looking to upgrade their current systems without incurring high installation fees.

Expanding Market for Smart Home Integration

The integration of home security systems with other smart home technologies presents a valuable opportunity for growth in the market. As more consumers embrace smart home devices, there is a significant opportunity for home security companies to collaborate with home automation providers and offer integrated solutions. Security systems that can seamlessly interact with other smart devices, such as thermostats, lighting systems, and voice assistants, are highly attractive to consumers seeking convenience and increased functionality. By offering interconnected security solutions, companies can capitalize on the growing trend of smart homes and expand their customer base.

Global Home Security Systems Market: Trends

Cloud-Based and Subscription-Based Security Services

A notable trend in the home security market is the shift toward cloud-based and subscription-based services. Cloud storage allows users to access their video footage and system logs remotely, eliminating the need for physical storage devices and providing more secure data storage. Subscription services for 24/7 monitoring and remote access to security systems are becoming the standard for many security providers, offering customers peace of mind and enhanced service capabilities. This shift to cloud and subscription models not only allows for more scalable and flexible solutions but also encourages companies to develop ongoing relationships with their customers, ensuring steady revenue streams and increased customer retention.

AI and Machine Learning in Security Systems

Artificial intelligence and machine learning are transforming the home security landscape. AI-powered systems can analyze video feeds, identify unusual behavior, and even differentiate between people, pets, and objects, improving the accuracy of alerts and reducing false alarms. Machine learning algorithms allow security systems to "learn" from past events and adapt to new situations, making them smarter and more responsive over time. Additionally, AI can be used for facial recognition, vehicle recognition, and behavioral analytics, creating more precise security solutions that cater to the growing need for personalized protection. This trend is expected to gain momentum as AI becomes more accessible and integrated into a wide range of consumer products.

Global Home Security Systems Market: Research Scope and Analysis

By Component Analysis

In the global home security systems market, hardware components are expected to maintain a dominant position, capturing 52.6% of the total market share in 2025. The hardware segment includes key elements such as surveillance cameras, motion sensors, door/window sensors, alarm systems, and control panels. These devices form the foundation of home security solutions, providing the necessary physical protection for properties.

As technology advances, there is a growing demand for high-quality, durable, and feature-rich hardware that offers higher resolution cameras, better detection capabilities, and integration with smart home ecosystems. The growth of this segment is being driven by the widespread adoption of connected devices and the growing need for robust security systems that can deter break-ins, monitor property in real-time, and provide emergency alerts to homeowners.

Alongside hardware, services also play a critical role in the home security systems market. These services include professional monitoring, installation, and system maintenance. Subscription-based monitoring services are gaining popularity, offering consumers 24/7 surveillance and real-time alerts in the event of an emergency. Installation services ensure that security systems are set up correctly, which is crucial for optimal performance, especially with complex, integrated systems.

Moreover, regular system maintenance services are essential for ensuring that all components remain in working order, particularly as technological advancements make systems more sophisticated. With the growing demand for integrated and smart security solutions, service providers are focusing on enhancing customer experience through managed services, cloud storage, and remote access, making security more user-friendly and efficient.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Installation Type Analysis

DIY (Do-It-Yourself) home security systems are gaining significant traction in the global market, driven by their convenience, affordability, and the growing preference for consumer empowerment. In 2025, DIY systems are expected to capture 32.9% of the total market share. These systems allow homeowners to install and configure their security solutions independently, without requiring professional help, which makes them ideal for those who prefer a more flexible, cost-effective approach.

DIY systems are particularly appealing to renters and first-time buyers who may not want to invest in expensive installation fees or commit to long-term contracts. With easy-to-follow instructions and plug-and-play devices, DIY security solutions are often compatible with other smart home technologies, enhancing their appeal for tech-savvy users who want to create a personalized security environment. Additionally, the growing availability of wireless and mobile-controlled systems further drives the growth of DIY installations, allowing consumers to set up, monitor, and manage their security from anywhere.

While DIY security systems continue to gain popularity, professional installation remains an important segment within the market. Professional installation services typically appeal to consumers who prefer expert assistance and the assurance that their security systems are set up correctly for optimal performance.

In this segment, experienced technicians install and configure advanced security systems, including surveillance cameras, alarm systems, and motion detectors, ensuring that all components are properly calibrated and integrated. Professional installation is particularly attractive for larger homes or more complex systems that require specialized expertise. These services often come bundled with long-term monitoring packages and maintenance agreements, offering added convenience and peace of mind for homeowners.

Moreover, professional installers can customize the security setup based on the unique layout of the property and address specific concerns, such as blind spots or entry points, ensuring comprehensive protection. As more homeowners seek a high level of expertise and personalized service, the professional installation segment remains a key player in the home security systems market.

By Monitoring Type

Third-party monitored home security systems are projected to maintain a dominant position in the market, capturing 67.8% of the total share in 2025. These systems are favored for their comprehensive, round-the-clock monitoring services, which provide homeowners with a high level of reassurance and security. Third-party monitoring services typically involve a professional security company that monitors the property 24/7 for potential threats such as break-ins, fire, or other emergencies.

When an alarm is triggered, these monitoring centers can alert local authorities or emergency responders instantly, ensuring a rapid response. This level of professional oversight is highly valued by consumers who want the peace of mind that comes with knowing that their property is continuously monitored by experts. Additionally, third-party monitoring systems often come with advanced features such as automated video surveillance, smart notifications, and mobile app integration, which further contribute to their market dominance.

On the other hand, self-monitored security systems are becoming popular as consumers seek greater control and flexibility over their home security setups. Self-monitored systems allow homeowners to manage their security through mobile apps or websites, providing real-time alerts directly to their smartphones or other devices. With no third-party involvement, these systems eliminate the need for monthly subscription fees and offer a more affordable solution for those who want to actively monitor their property.

Self-monitored solutions are particularly appealing to tech-savvy consumers who are comfortable with managing their security and can rely on a range of wireless sensors, cameras, and other connected devices to create a custom security system. While self-monitoring provides significant cost savings and independence, it also requires users to be vigilant and responsive to alerts, as there is no external professional oversight. Despite these challenges, self-monitored systems continue to attract those who value autonomy and simplicity in managing their home security.

By System Type Analysis

Intrusion Detection Systems (IDS) are expected to hold a dominant position in the global home security systems market, capturing 34.7% of the market share in 2025. These systems are integral to modern home security setups, designed to detect unauthorized access or potential threats to a property. IDS typically includes motion sensors, door/window sensors, and smart alarms, all of which are strategically placed around the home to monitor for any suspicious activity.

When an intruder is detected, the system triggers an alarm to alert homeowners, or in some cases, sends notifications to a third-party monitoring service for further action. The rising incidence of burglary and home invasions has significantly fueled the demand for these systems, with consumers looking for effective solutions that offer both deterrence and rapid response capabilities. The growing integration of AI and machine learning into IDS is further enhancing their effectiveness, allowing these systems to differentiate between different types of movements and reducing false alarms.

In addition to intrusion detection, surveillance systems are a critical component of home security solutions. These systems, which include cameras, video doorbells, and other visual monitoring tools, are essential for providing homeowners with live feeds and recorded footage of their property. Surveillance systems are popular due to the added layer of security they provide, enabling real-time monitoring of both the exterior and interior of the home. Advances in high-definition video technology, as well as the integration of cloud storage and mobile app access, have made surveillance systems more accessible and user-friendly.

These systems also play a crucial role in both deterrence and evidence collection, allowing homeowners to document incidents such as break-ins, vandalism, or suspicious activity. With the rise of smart homes, surveillance systems are now being integrated with other security solutions like smart locks and alarms, creating a more comprehensive security infrastructure. This growing trend toward advanced, connected surveillance is expected to continue driving the market, particularly as consumers seek more seamless and integrated security systems for their homes.

By Technology Analysis

Wireless home security systems are projected to dominate the market, capturing 54.1% of the share in 2025. These systems have gained immense popularity due to their flexibility, ease of installation, and scalability. Unlike traditional wired systems, wireless security solutions eliminate the need for extensive wiring, making them ideal for both new constructions and retrofitting older homes. With components like wireless cameras, motion detectors, door/window sensors, and smart locks, these systems can be easily connected and monitored through mobile apps or cloud platforms.

The wireless nature of these systems also allows for greater mobility, enabling homeowners to adjust or expand their security setups as needed. The convenience of wireless security systems, combined with their ability to seamlessly integrate with smart home technologies, positions them as the preferred choice for consumers seeking modern, versatile, and cost-effective security solutions. Furthermore, the growing adoption of IoT devices and the growing availability of reliable internet connections further drive the demand for wireless systems.

In contrast, wired home security systems, although not as widely adopted as their wireless counterparts, continue to have a significant presence in the market, especially in more traditional setups. These systems are typically favored by homeowners who prefer a more stable and reliable connection, as they are less susceptible to signal interference or hacking compared to wireless systems. Wired systems are often chosen for large homes or properties that require a comprehensive, hardwired infrastructure to ensure reliable surveillance and monitoring.

These systems include cameras, motion detectors, and alarm systems that are physically connected via cables to a central control panel or monitoring station. Despite the benefits of stability and security, wired systems are generally more difficult and costly to install, especially in existing homes. However, they remain a popular choice for consumers who prioritize reliability and durability over the convenience offered by wireless solutions. Additionally, wired systems tend to have lower long-term maintenance costs, as they do not rely on batteries or constant wireless connectivity, making them a viable option for specific market segments.

By Application Analysis

Residential applications are expected to dominate the home security systems market, capturing 65.0% of the total market share in 2025. This dominance is largely driven by the growing concerns around burglary, home invasions, and the need for comprehensive personal security solutions. As more consumers prioritize the safety of their homes and families, residential security systems have become a standard feature in modern homes. These systems typically include surveillance cameras, alarm systems, motion detectors, and smart home integration, all designed to provide continuous monitoring and rapid alerts in case of emergencies.

The rise in connected home technologies, such as smart locks, video doorbells, and mobile app-controlled security, further enhances the appeal of residential systems. Additionally, the growing trend of remote monitoring, allowing homeowners to keep an eye on their property via smartphones or other devices, is boosting the adoption of residential security systems. As awareness of home security threats grows, residential consumers continue to invest in advanced solutions to safeguard their homes, driving the expansion of this market segment.

On the other hand, government applications in the home security systems market are growing steadily, driven by the growing need for surveillance and protection in public buildings, government offices, and critical infrastructure. Government entities often require high-level security solutions to ensure the protection of sensitive areas, public safety, and infrastructure against threats such as terrorism, vandalism, or civil unrest. Security systems for government use typically include a combination of advanced surveillance cameras, access control systems, and intrusion detection devices, all of which are often integrated into a central monitoring system for real-time response.

Governments are adopting smart security solutions that provide not only physical protection but also data-driven insights to improve security protocols. With rising concerns about national security and the protection of public assets, the demand for robust government-focused security systems continues to increase. These systems play a critical role in maintaining public order and safety, ensuring that government buildings, public spaces, and critical infrastructure remain secure and well-monitored.

By End-User Analysis

Homeowners are anticipated to dominate the end-user segment of the home security systems market, capturing 58.4% of the market share in 2025. The growing concern over home burglaries, break-ins, and overall personal safety is a primary factor driving this trend. As the cost of advanced security technologies continues to decrease, more homeowners are opting for sophisticated, easy-to-install, and efficient home security systems.

Residential security systems are now incorporating smart home features such as remote access, mobile monitoring, and integration with other IoT devices, making them more attractive to homeowners seeking control and flexibility. The demand for video surveillance, doorbell cameras, motion sensors, and smart locks is growing, especially as consumers prioritize peace of mind and convenience.

Additionally, the rise in smart homes and home automation systems is further boosting the demand for comprehensive, interconnected security solutions. With continuous advancements in technology, homeowners are investing more in upgrading their security systems to protect their properties and loved ones, contributing to the growth of this segment.

In contrast, security service providers also play a significant role in the home security systems market. These providers offer professional monitoring, installation, and maintenance services, catering to both residential and commercial customers. Security service providers often offer end-to-end solutions, including real-time monitoring of alarm systems, video surveillance, and emergency response coordination. Many consumers prefer professional monitoring services as they provide constant surveillance and immediate assistance in case of emergencies.

This service-based approach is especially popular among individuals who want the assurance of expert intervention in case of an alert or break-in, ensuring faster response times from emergency services. Furthermore, these providers are integrating advanced technologies such as artificial intelligence and machine learning into their monitoring systems to enhance the detection of unusual activities and reduce false alarms. The growing trend of subscription-based services, where consumers pay for ongoing monitoring and maintenance, is helping security service providers strengthen their presence in the market. These services are becoming an integral part of the broader home security ecosystem, making security service providers key players in the industry.

The Home Security Systems Market Report is segmented on the basis of the following:

By Component

- Hardware

- Sensors

- Cameras

- Control Panels

- Other Physical Devices

- Software

- Apps

- Cloud Services

- Software Interfaces

- Services

- Installation

- Maintenance

- Monitoring

- Integration Services

By Installation Type

- DIY (Do-It-Yourself) Systems

- Professional Installation

By Monitoring Type

- Self-Monitored

- Third-Party Monitored

By System Type

- Intrusion Detection Systems

- Motion Detectors

- Door/Window Sensors

- Glass Break Detectors

- Surveillance Systems

- CCTV cameras

- Video Doorbells

- IP Cameras

- Access Control Systems

- Smart Locks

- Biometric Systems

- Keyless Entry Systems

- Fire & Safety Monitoring

- Smoke Detectors

- Carbon Monoxide Detectors

- Fire Alarms

- Integrated Systems

By Technology

- Wired Systems

- Wireless Systems

- Hybrid Systems

- IoT-Enabled Systems

By Application

- Residential

- Commercial

- Industrial

- Government

By End-User

- Homeowners

- Renters

- Property Managers

- Security Service Providers

Global Home Security Systems Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global home security systems market, capturing 36.5% of the total market revenue in 2025. The region's dominance is primarily driven by high consumer awareness about home security threats, growing disposable incomes, and the rapid adoption of advanced technologies like smart home integration, IoT devices, and cloud-based monitoring solutions. In the U.S. and Canada, home security systems are viewed as essential investments for protecting homes and families, with many consumers opting for comprehensive solutions that offer real-time alerts, video surveillance, and remote control.

The growth of smart homes, integrated with a high penetration rate of mobile devices and internet access, further fuels the demand for interconnected security systems. Moreover, North America's well-established infrastructure, favorable regulatory environment, and the presence of leading security service providers and technology innovators contribute to the region’s market leadership. As concerns about burglary, vandalism, and home invasions continue to rise, North America remains a key player in shaping the direction of the global home security systems market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific (APAC) region is expected to experience the highest compound annual growth rate (CAGR) in the global home security systems market. The rapid urbanization, growing middle-class population, and growing concerns about safety and security in countries like China, India, Japan, and South Korea are driving the demand for advanced home security solutions.

Moreover, the rising adoption of smart home technologies, integrated with a significant increase in internet penetration and smartphone usage, is fueling the growth of connected and automated security systems in the region. The expansion of infrastructure and growing disposable income among consumers are also contributing factors, making the APAC region a key market for home security system innovations and growth in the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Home Security Systems Market: Competitive Landscape

The global competitive landscape of the home security systems market is highly dynamic, characterized by the presence of numerous established players, as well as emerging companies offering innovative solutions. Major companies such as ADT Inc., Honeywell International, Johnson Controls, and Vivint Smart Home are competing with a wide range of security products, including intrusion detection, surveillance systems, and smart home integrations. The market is also seeing growing competition from tech giants like Amazon with its Ring platform and Google’s Nest products, which integrate smart security features with IoT ecosystems.

Companies are focusing on differentiating themselves through advanced technologies such as AI-powered surveillance, real-time monitoring, and cloud-based platforms, in addition to offering flexible and affordable installation options. Strategic mergers and acquisitions, partnerships, and R&D investments are also prevalent as companies aim to expand their market presence and offer more comprehensive security solutions.

As consumer demand for smarter, more connected security systems grows, companies are prioritizing ease of use, seamless integration with other smart home devices, and scalability of their products. The landscape continues to evolve rapidly as new entrants bring disruptive technologies to the market, and existing players seek to maintain their competitive edge through continuous innovation.

Some of the prominent players in the global home security systems are:

- ADT Inc.

- Honeywell International Inc.

- Johnson Controls

- Vivint Smart Home, Inc.

- SimpliSafe, Inc.

- Ring LLC (an Amazon company)

- Arlo Technologies, Inc.

- Frontpoint Security Solutions, LLC

- Abode Systems, Inc.

- Brinks Home Security

- Bosch Security Systems

- Samsung SmartThings

- Panasonic Corporation

- Xiaomi Corporation

- Hikvision Digital Technology Co., Ltd.

- CP Plus GmbH & Co.

- Axis Communications AB

- Comcast Xfinity Home

- Assa Abloy AB

- Alarm.com Holdings, Inc.

- Other Key Players

Global Home Security Systems Market: Recent Developments

- April 2024: ADT Inc. acquires Red Hawk Fire & Security to expand its portfolio of fire and life safety services.

- March 2024: Johnson Controls completes the acquisition of Qolsys, a smart security technology company, to enhance its smart home security offerings.

- January 2024: Vivint Smart Home merges with Mosaic Acquisition Corp., creating a leading smart home services company.

- October 2023: Ring, an Amazon company, acquires Blink, a home security camera company, to expand its product lineup.

- September 2023: Honeywell International acquires Netatmo, a French smart home security and automation company, to enhance its connected home products.

- July 2023: Comcast’s Xfinity Home secures a partnership with ADT to provide smart security and monitoring services to residential customers.

- May 2023: Arlo Technologies acquires the home security platform, "MyoVision," to strengthen its AI-powered video surveillance offerings.

- March 2023: Assa Abloy acquires the home security startup, "Lynx," to bolster its smart lock product offerings for residential and commercial markets.

- December 2022: Bosch Security Systems acquires a controlling stake in "Cleverciti," a smart surveillance company, to enhance its video surveillance technology.

- October 2022: SimpliSafe acquires Deep Sentinel, a home security startup focused on AI-based surveillance and real-time monitoring.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 47.3 Bn |

| Forecast Value (2034) |

USD 78.0 Bn |

| CAGR (2025–2034) |

5.7% |

| The US Market Size (2025) |

USD 14.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services), By Installation Type (DIY Systems, Professional Installation), By Monitoring Type (Self-Monitored, Third-Party Monitored), By System Type (Intrusion Detection Systems, Surveillance Systems, Access Control Systems, Fire & Safety Monitoring, Integrated Systems), By Technology (Wired Systems, Wireless Systems, Hybrid Systems, IoT-Enabled Systems), By Application (Residential, Commercial, Industrial, Government), By End-User (Homeowners, Renters, Property Managers, Security Service Providers) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

ADT Inc., Honeywell International Inc., Johnson Controls, Vivint Smart Home, SimpliSafe, Ring (Amazon), Arlo Technologies, Frontpoint Security, Abode Systems, Brinks Home Security, Bosch Security Systems, Samsung SmartThings, Panasonic, Xiaomi, Hikvision, CP Plus, Axis Communications, Comcast Xfinity Home, Assa Abloy, Alarm.com, and other key players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global home security systems market?

▾ The global home security systems market size is estimated to have a value of USD 47.3 billion in 2025 and is expected to reach USD 78.0 billion by the end of 2034.

What is the size of the US home security systems market?

▾ The US home security systems market is projected to be valued at USD 14.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 23.2 billion in 2034 at a CAGR of 5.4%.

Which region accounted for the largest global home security systems market?

▾ North America is expected to have the largest market share in the global home security systems market, with a share of about 36.5% in 2025.

Who are the key players in the global home security systems market?

▾ Some of the major key players in the global home security systems market are ADT Inc., Honeywell International Inc., Johnson Controls, Vivint Smart Home, SimpliSafe, Ring (Amazon), Arlo Technologies, Frontpoint Security, Abode Systems, Brinks Home Security, Bosch Security Systems, Samsung SmartThings, Panasonic, Xiaomi, Hikvision, CP Plus, Axis Communications, Comcast Xfinity Home, Assa Abloy, Alarm.com, and other key players.

What is the growth rate of the global home security systems market?

▾ The market is growing at a CAGR of 5.7 percent over the forecasted period