Market Overview

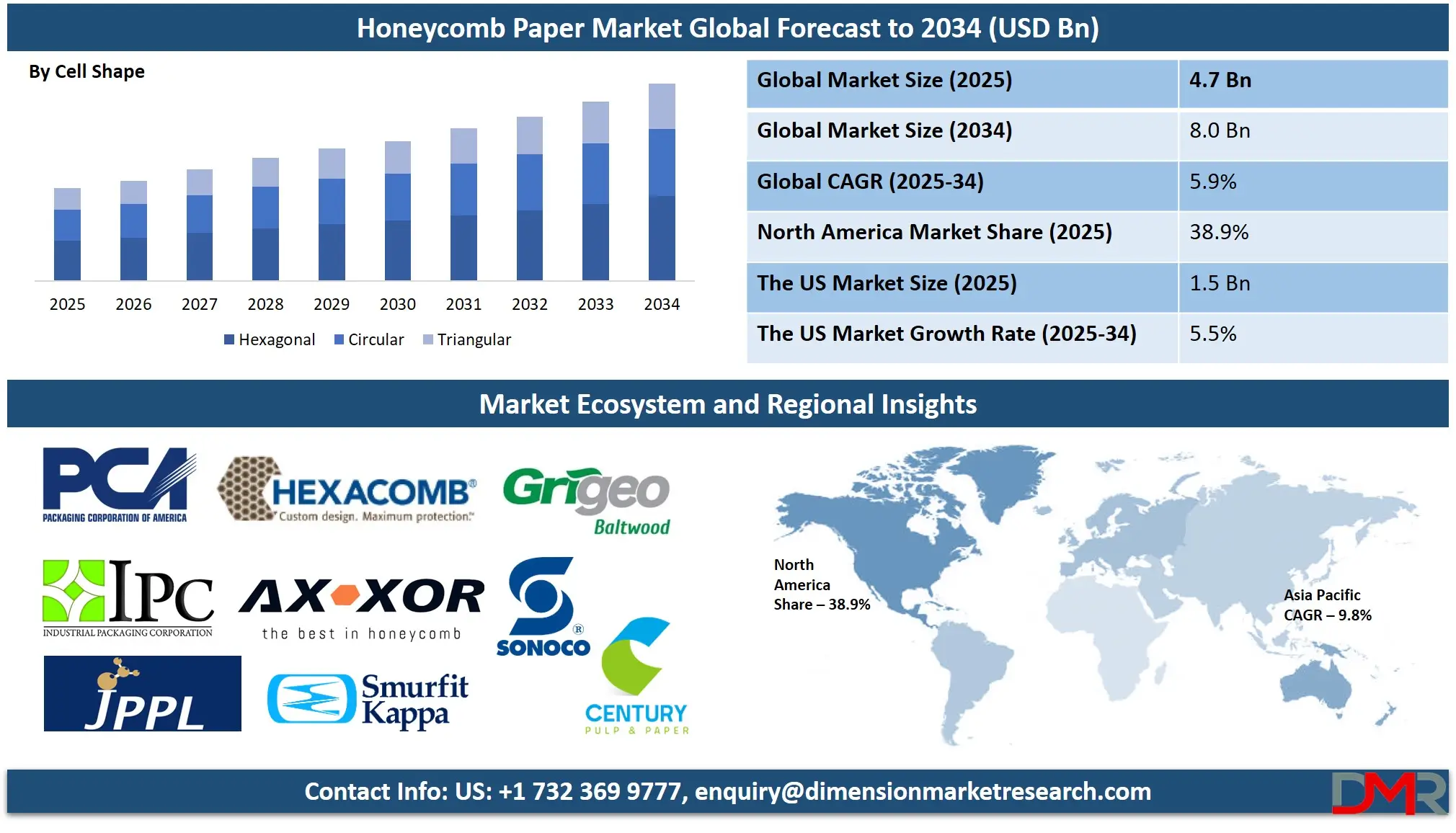

The Global Honeycomb Paper Market is expected to reach

USD 4.7 billion in 2025 which is further expected to grow up to

USD 8.0 billion in 2034 at a

CAGR of 5.9%.

Honeycomb paper's global market is experiencing exponential growth thanks to rising consumer demand for lightweight, sustainable, and eco-friendly packaging products across multiple industry sectors. Due to growing environmental consciousness and decreasing plastic usage limits, businesses are switching over to greener alternatives such as honeycomb paper which offers greater strength, longevity, and recycling value helping drive market expansion further along. Protection packaging used within furniture production or automotive assembly operations also utilizes honeycomb paper which contributes further.

Furthermore, with online shopping increasing, so do demands for cost-effective shock-absorbing packages like honeycomb paper material making this market growth trending forward as more businesses turn green with increasing plastic usage limitations which limits plastic use with honeycomb paper becoming even more popular globally. Businesses are also investing in R&D to advance product performance and meet wider applicability demands.

The market is providing great opportunities, particularly within emerging economies where industrialization and urbanization are increasing the demand for sustainable packaging. Online business through retail and increasing exports are increasing consumption of protection packaging, set to spur demand for honeycomb paper. New manufacturing processes also make affordable manufacturing possible, and reduction of dependence on conventional materials. The aviation industry and logistics industry also explore honeycomb paper alternatives due to its lightweight characteristic, enabling organizations to reduce carriage costs and environmental impacts. Sustainable practice-friendly government policies also make market growth achievable.

Despite the positive outlook, there are limitations on the industry ranging from fluctuating raw material prices to market competition by substitute products like expanded foam and molded pulp. The use of paper-based raw materials exposes producers to disruptions of supplies and fluctuations in costs. The lack of awareness by customers of the advantages of using honeycomb paper also prevents its global use, particularly in developing markets. Producers have to invest in effective marketing campaigns and consumer awareness to ensure better market coverage. The limitations of recycling facilities also exist where good facilities of waste management have to be put in place to ensure maximum sustainability of the material.

The growth trend of the market of honeycomb paper is healthy, backed by continuing innovation and increasing regulation favoring sustainable products. Companies are investing in creating top-performance products of honeycomb paper that have greater load-carrying capacity along with greater water resistance.

The coming of circular economy activities is also driving sustainable use of material, good tidings for industry outlook. Merger deals and strategic alliances of industry players will consolidate markets, increasing manufacturing facilities along with distribution channels. With business houses focusing on sustainable business, honeycomb paper is expected to make itself well-established in diverse industrial use, driving sustained growth.

The US Honeycomb Paper Market

The US Honeycomb Paper Market is anticipated to be valued at USD 1.5 billion in 2025 which is further expected to reach USD 2.5 billion in 2034 at a CAGR of 5.5%

The Honeycomb paper sales in the US have experienced steady expansion over recent years due to growing consumer interest in eco-friendly packaging solutions and lightweight structural materials. E-commerce plays an integral part in this growth trend as companies prioritize eco-friendly and cost-effective packaging to lower logistics expenses and decrease logistics expenses. With stringent environmental regulations encouraging their use, industries such as automotive, construction, and furniture production use honeycomb paper extensively as part of their manufacturing processes - while increased last-mile delivery services and protective packaging requirements fuel market expansion even further.

The US is fortunate in terms of demographics; as consumer preference for sustainable products grows exponentially, buying decisions are increasingly driven by these choices. Advanced manufacturing infrastructure allows for high-quality honeycomb paper production in the US, guaranteeing constant supplies both domestically and for export markets.

Automation and digitalization in packaging industries are increasing efficiency and cost-effectiveness while government initiatives encouraging eco-friendly alternatives and tax breaks for sustainable packaging are driving market expansion. Honeycomb paper's versatility, environmental advantages, and long-term reliability position it as an attractive long-term solution ensuring continued expansion across a variety of applications in the United States.

Key Takeaways

- Global Market Value Insights: The global honeycomb paper market size is estimated to have a value of USD 4.7 billion in 2025 and is expected to reach USD 8.0 billion by the end of 2034.

- The US Market Growth Rate: The US honeycomb paper market is projected to be valued at USD 1.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.5 billion in 2034 at a CAGR of 5.5%.

- Regional Insights: North America is expected to have the largest market share in the global honeycomb paper market with a share of about 38.9% in 2025.

- Key Players Insights: Some of the major key players in the global honeycomb paper market are Packaging Corporation of America, Smurfit Kappa Group, Sonoco Products Company, Signode Industrial Group, Jagannath Polymers Pvt. Ltd, and many others.

- Global Growth Rate Insights: The market is growing at a CAGR of 5.9 percent over the forecasted period.

Use Cases in the Global Honeycomb Paper Market

- Protective Packaging: Honeycomb paper is also mostly utilized to protect sensitive items such as electronics, glass items, and furniture, providing shock protection and minimizing damage in transit.

- Automotive Industry: The product is employed to manufacture lightweight panels, headliners, and crash-impact absorbers on cars, enabling vehicle manufacturers to save on weight without losing structural strength or compromising on fuel efficiency.

- Construction Applications: Honeycomb paper is also used as a basic building material in doors, partitions, and temporary buildings, offering strength, insulation, and cost-effectiveness compared to traditional building products.

- Furniture Manufacturing: It is also utilized to manufacture lightweight but sturdy designs of tables, cabinets, and panels, providing a sustainable alternative to using solid wood and saving on material costs.

Stats & Facts in the Global Honeycomb Paper Market

- Exceptional Strength & Rigidity: Paper honeycomb offers an exceptional strength-to-weight ratio, making it suitable for applications demanding maximum durability and load-bearing capacity. Furthermore, its rigidness-to-weight ratio guarantees great structural integrity as well as predictable crushing strength under compression which makes it suitable for protective packaging or industrial uses.

- Sustainable & Eco-Friendly: Honeycomb paper's eco-friendliness lies in its production from renewable paper materials. By replacing plastics and foams with honeycomb paper packaging materials instead, industries can improve sustainability efforts while staying cost-efficient.

- Versatile Applications: Paper honeycomb has become increasingly versatile over the past years and now finds use across industries like automotive, construction, furniture design, packaging logistics, and interior design. It serves as lightweight yet sturdy core material in applications including acoustic walls and exhibition panels as well as high-end visual design solutions in furniture and interior designs.

- Ultra-Lightweight Design: Paper honeycomb offers exceptional structural integrity while remaining ultralight weight per cubic meter, making it the ideal material for weight-sensitive applications such as transportation, aerospace, and logistics where weight reduction contributes directly to fuel savings and cost reductions. This feature makes paper honeycomb an effective option.

- Customized Product Forms: Paper honeycomb comes in various physical forms that allow for customization: continuous unexpanded core (supplied on pallet loads for large-scale use), slices unexpanded (cut-to-size pieces tailored specifically for applications), and pre-expanded sheets customized specifically to specific dimensions. Each variation offers versatility when it comes to design and manufacturing processes - meeting different industry demands at every point along the supply chain.

Market Dynamic

Driving Factors in the Global Honeycomb Paper Market

Expansion of E-commerce and Logistics Sectors

The surge of e-commerce shopping along with last-mile deliveries has hugely boosted demand for protection packaging products. The lightweight but very strong feature of honeycomb paper makes it ideal to use as a shock absorber of breakable items while shipping without compromising on product safety but adding very little cost to shipping. With e-commerce giants Amazon along retailers emphasizing sustainable packaging, the use of honeycomb paper shock absorbers that can also be recycled is expected to become much larger.

Government Regulations Promoting Eco-friendly Materials

Many countries have implemented stern laws banning single-use plastics, making industries shift to using paper-based packs. Subsidies, mandates, and incentives on sustainable products are driving demand for the honeycomb paper market. The European Union’s Action Plan on Circular Economy along with extended producer responsibility programs of North America and Asia-Pacific is driving wide-ranging adoption. Such supportive regulation makes markets sustainable in the long run by inducing investments in producing honeycomb paper.

Restraints in the Global Honeycomb Paper Market

Fluctuations in Raw Material Prices

The honeycomb paper industry is very much reliant on adhesives and kraft paper, whose costs fluctuate due to variations in pulp costs or disruptions within the supply chain. The cost of raw materials consumed by other industries, geopolitical tensions, and economies also have impacts on the costs of production. The resultant high input costs can make honeycomb paper non-competitively priced relative to alternatives, thereby affecting market size and profitability.

Competition from Alternative Packaging Solutions

While honeycomb paper is gaining traction, there is also sustainable substitute competition such as expanded foam, corrugated board, and molded pulp. All of these substitutes have comparative protection features, though there are areas where there is also lower manufacturing cost. Some of the markets also have fear of using honeycomb paper due to its performance under unfavorable conditions, hence its full acceptance is held up by this challenge. It requires sustained innovation and awareness of the benefits of honeycomb paper to overcome this challenge.

Opportunities in the Global Honeycomb Paper Market

Rising Demand in the Automotive and Aerospace Industries

The automotive industry is also making use of honeycomb paper on a wider scale for lightweight structural applications. The lightweight properties of its use in automotive headliners, door liners, and shock absorbers make vehicle weights lower, enhancing mileage while maintaining emission levels lower. The same is true of aviation where its strength-to-weight ratio is preferable to use on airplane interiors, cargo doors, and protection of sensitive devices. With power-saving measures on top of its agenda along with sustainability, these industries provide a lucrative growth avenue.

Emerging Markets in Asia-Pacific and Latin America

Rapid industrialization and developing economies' urbanization are triggering massive demand for honeycomb paper in the construction, furniture, and logistics sectors. The manufacturing activity is on the upswing in economies of economies like China, India, Brazil, and Mexico, where affordable and sustainable products are sought after. The increasing e-commerce activities within economies also contribute to market growth. The increasing disposable income along with environmental awareness within economies is also expected to give demand for sustainable products a fillip, leading to greater use of honeycomb paper.

Trends in the Global Honeycomb Paper Market

Growing Demand for Sustainable Packaging Solutions

Environmental concerns combined with strict regulation on plastic packaging are driving demand for sustainable alternatives like honeycomb paper. Consumer goods, e-commerce, and logistics are also switching to biodegradable and reusable alternatives to meet sustainability goals. Firms are including honeycomb paper packs to meet environment-friendly customers along with regulation compliance, driving their market share up. The trend is also supported by corporate sustainability initiatives, striving to reduce carbon footprints along with establishing circular economies.

Technological Advancements in Honeycomb Paper Manufacturing

Innovation in manufacturing processes has developed improved properties of honeycomb paper such as greater strength, water resistance, and cost-effectiveness. New automation and digitalization of manufacturing facilities make possible high-quality mass manufacturing along with reduced wastage of material. The application of biodegradable coatings and water-resistant treatments has also expanded honeycomb paper use beyond its classical use of packaging. With investments by companies in R&D, newer product variations that have better performance along with greater customizability are making market entrance, satisfying diverse industrial demands.

Research Scope and Analysis

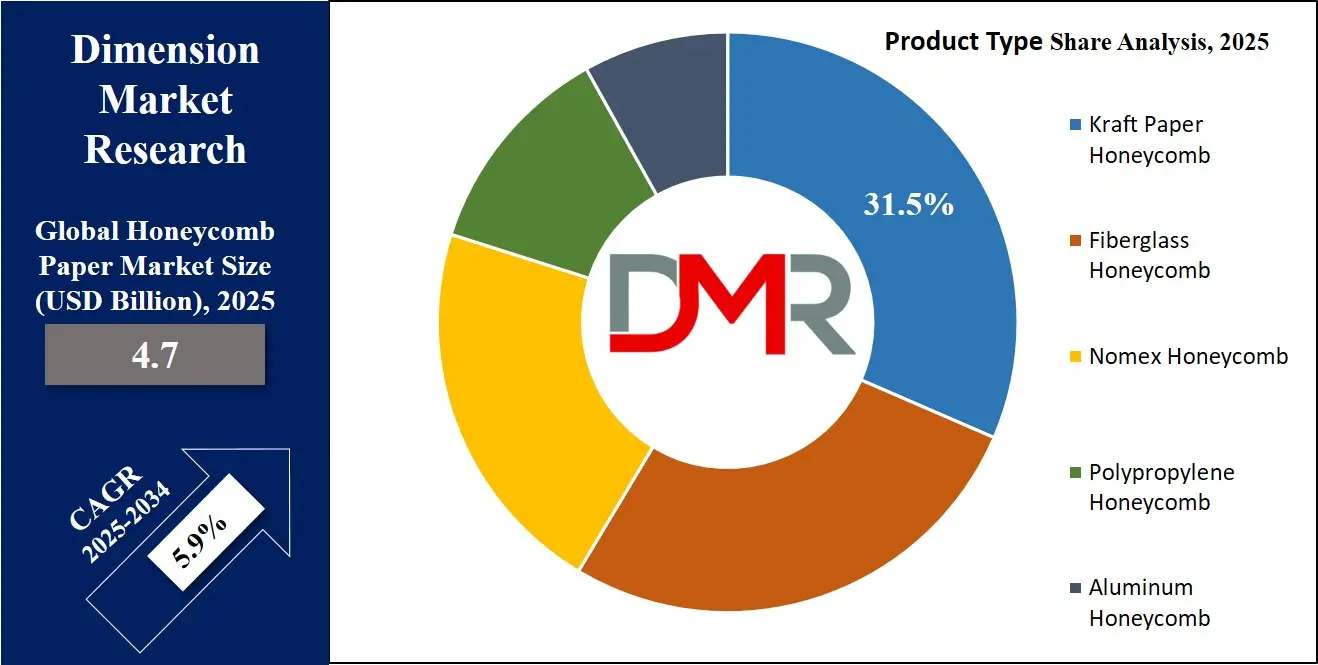

By Product Type

Kraft paper honeycomb is projected to be the market leader in the global market share of honeycomb paper due to its greater strength, cost-saving features, and environmental sustainability. Due to its tremendous tensile strength and hardness, kraft paper is extremely effective in protecting goods that are packaged, hence making it most demanded by packaging, automotive, and building industries. The shock absorbency of kraft paper combined with its characteristic of weight distribution makes it extremely appropriate to use within e-commerce and courier business. The tremendous structural strength of kraft paper honeycomb makes it consistently reliable to use, even under maximum weights, hence making it reliable to use within protection packs.

Another key driver of its success is its sustainability. With increasing global restrictions on plastic packaging, industry players and customers are increasingly focusing on biodegradable and reusable products. The kraft paper is produced using natural wood pulp and is 100% reusable, complementing global sustainability initiatives. The demand by customers for environment-friendly package material is also increasing, strengthening its market share. The kraft paper honeycomb is also lightweight, reducing transit costs and consumption of fuels, making it appealing to cost-saving and carbon footprint reduction-minded industry players.

Its versatility is also the most important key to its universal applicability. It can also be adapted by thickness, density, and coatings to meet specific industrial specifications. From automotive to building, its versatility makes it omnipresent throughout its scope of use. It is continually adapting through manufacturing innovation that improves its water resistance and its loading capacity, making its domination supreme within its market of honeycomb paper products.

By Core

The continuous unexpanded core is expected to be a dominant force in this segment in the market of honeycomb papers due to its strength, stability, and manufacturing cost-effectiveness. Pre-expanded cores are distinct from continuous unexpanded cores, which are sold in compressed form, hence easy to store, ship, and handle before expanding. It is cost-saving on logistics, hence suitable for producers that need effective management of supplies.

One of its most valuable advantages is its greater structural strength. When expanded, it produces a very strong and uniform honeycomb that can withstand weights very evenly. It produces very good load-carrying properties, making it very suitable to use in heavy-duty products of packaging, furniture, and automotive markets. Uniformity of expansion enables good performance within most of its applications without wastage of material, making products very reliable.

Additionally, the unexpanded continuous core is very malleable, making producers able to make sheets of honeycomb paper of varied densities and thicknesses based on use demand. The cost-effectiveness of its use also contributes to its popularity, where producers can adjust material use to make manufacturing affordable without compromising performance. Relative to other designs of cores, continuous unexpanded cores have better scalability and customizing options, making them applicable on a commercial scale. As industries continue to demand lightweight, high-strength materials, the dominance of continuous unexpanded cores in the honeycomb paper market is expected to persist.

By Cell Size

Honeycomb paper of cell size up to 10mm is market-dominating through its improved strength-to-weight ratio, better shock resilience, and broader industrial applicability. The lower cell size ensures that there is tighter cell arrangement along with greater density, providing better-loading properties of the material along with its overall life expectancy. It is therefore well suited to employ where there is greater mechanical performance required, including automotive interiors, furniture panes, and packaging of greater strength.

The increased surface area of finer cells ensures better force of impact and weight distribution, minimizing material deformation under pressure. It is especially useful where maximum shock absorbency is needed within products while in transit. The demand is also driven by e-commerce and logistics where there is a need for extremely lightweight but very resilient material.

Additionally, honeycomb cells of lower cell size have better insulation properties that make them ideal for use in construction, e.g., doors and partition walls. Their lower cell size makes them have greater compression strength, enhancing product reliability and longevity. The versatility of cell sizes of 10mm or lower ensures that they reign supreme in most fields.

Manufacturers prefer this size due to its cost-saving material use and cost-effectiveness. The use of a cell size that is smaller helps save the waste of raw material while providing better levels of performance. With industries continually seeking out lightweight, greener, and stronger material, up to 10mm cell size of honeycomb paper remains a market favorite globally.

By Cell Shape

The hexagonal cell shape is anticipated to dominate the honeycomb paper market due to its superb structural efficiency, where maximum strength is acquired through minimum material use. The hexagonal geometry is adapted from the natural shapes of honeycombs within bee hives, providing the most desirable ratio of strength to weight of all geometric shapes. It is therefore most appropriate form of loading transmission, providing maximum resilience and shock protection in most situations.

One of the most important reasons for its superiority is its ability to provide outstanding compression strength. The cells' symmetrical arrangement makes it possible that there is very little material deformation under loading, making it extremely reliable to employ within protection packaging, automotive body panels, and building products. Hex cells are superior to others such as triangular or square cells, offering better mechanical stability through lower material use, maximizing cost effectiveness on manufacturing.

Additionally, the hexagonal shape contributes to sustainability by allowing producers to employ lower levels of raw material without affecting performance. It is also on par with most industry demand for sustainable alternatives. The form also enables there to be flexibility regarding customizing cell size and cell density to meet specialized applications.

Given its wide range of use in areas ranging from aerospace to furniture to logistics, its hexagonal cell structure remains the industry standard for honeycomb paper. Because of its proven success of providing strength, resilience, and lightweight features, ensures its continued dominance in the market.

By Density

Low-density honeycomb paper is projected to dominate the density segment in this market due to its lightweight feature, cost-saving benefits, and sustainability factors. The most critical benefit of low-density honeycomb structures is that they can reduce overall material use without sacrificing strength levels in most of their use areas. For that reason, it is most attractive to industry players that have cost-saving but strong alternatives to heavier counterparts.

Low-density honeycomb paper is also employed on a big scale in packaging where its lightweight feature is valuable for saving on transit costs. The e-commerce market, in particular, benefits from its protection without adding unnecessary weights on shipments, meaning lower consumption of fuels and lower transit costs, keeping up with an increasing focus on sustainable transit options.

Another key advantage is its versatility of application where lightweight but rigid material is required, e.g., automotive interiors, furniture paneling, and disposable protection devices. Though there is greater loading of high-density honeycomb paper, lower-density products are employed where cost effectiveness along with reduction of material is of greater priority.

Manufacturers favor using low-density honeycomb paper because of its ease of manufacture and customizability. With global regulation of sustainable products on the rise, the use of low-density honeycomb paper continues to expand, paving the way to dominate this market.

By Application

The automotive industry is projected to be one of the largest consumers of honeycomb paper due to its requirement for lightweight but extremely strong products that improve vehicle efficiencies. Honeycomb paper is also employed on a large scale on vehicle interiors, headliners, doors, and crash-impact designs. The lightweight characteristic of honeycomb paper is what helps to reduce vehicle weights overall, improve mileage, and reduce carbon footprints, making it extremely critical to automotive manufacturing today.

With increasing limitations on emission and consumption of fuels, vehicle manufacturers are seeking novel ways of utilizing lightweight but tough materials in vehicle designs. Honeycomb paper fulfills these requirements along with offering cost-effective manufacturing processes. It is also appropriate for crash-resistant designs due to its shock-absorbing feature, making its use in safety devices possible.

The rise in the use of electric vehicles has also seen demand for honeycomb paper increase. The use of lightweight materials by electric vehicle producers is driven by enhancing battery performance and driving range. The sustainability attributes of honeycomb paper along with its recyclability also complement the surging demand for sustainable automotive manufacturing processes. Additionally, its cost-effectiveness compared to conventionally utilized materials such as plastics and metals makes it omnipresent within vehicle segments. With automotive manufacturers increasingly focusing on sustainability and lightweight, honeycomb paper is also among the top material choices within the industry.

The Honeycomb Paper Market Report is segmented on the basis of the following:

By Product Type

- Kraft Paper Honeycomb

- Fiberglass Honeycomb

- Nomex Honeycomb

- Polypropylene Honeycomb

- Aluminum Honeycomb

By Core

- Continuous unexpanded core

- Slices unexpanded

- Pre-expanded sheets

By Cell Size

- Upto 10 mm

- 10 to 30 mm

- Above 30 mm

By Cell Shape

- Hexagonal

- Triangular

- Circular

By Density

By Application

- Automotive

- Building & construction

- Household appliances

- Furniture

- Food & beverages

- Ceramics

- Glass

- Distribution

- Electronics

- Metal Mechanics

- Others

Regional Analysis

The Region with the Highest Market Share

North America is projected to dominate this market as it holds a 38.9% market share of the global honeycomb paper market in 2025. North America is home to the largest market share of global honeycomb paper, backed by well-established automotive, furniture, and e-commerce markets of the region. The environmental protection laws of the region along with greater emphasis on sustainable products have boosted demand for the use of honeycomb paper in packaging and structural use. The region also has advanced manufacturing plants along with sizeable R&D investments, enabling it to make high-quality products of honeycomb paper.

North America will continue to be the leading market for honeycomb paperboard packaging owing to surging demand for lightweight, sustainable, and recyclable products. The necessity of limiting plastic consumption has also driven demand for alternatives that use paper, complementing the market forces. The trend is also backed by industry leaders investing in automated manufacturing technology to enhance productivity and sustainability. With e-commerce markets and transportation markets continuing to grow, demand for protection packaging such as honeycomb paper will continue to remain strong.

The Region with the Highest CAGR

The Asia-Pacific region is also witnessing the demand boosted by skyrocketing industrialization, urbanization, and infrastructural development of prominent economies like China, India, and Indonesia. The economies are leading customers of honeycomb paper in the fields of logistics, e-commerce, and buildings.

The expansion of the e-commerce business, particularly in China and India, has generated tremendous demand for lightweight but resilient package material. Honeycomb Paper’s cost-saving, sustainable, shock-absorbed package product is hence the most sought-after by courier operators and e-retailers.

The move by governments to use environment-friendly products along with increasing regulation on plastics is also making business houses move to recycling-friendly package alternatives. The manufacturing cost advantage of the region along with investments in automation is also making its market size bigger. The region’s low-cost manufacturing advantage and increasing investments in automation are further enhancing its market potential.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape in the Global Honeycomb Paper Market

Honeycomb paper market competition is intense globally, Key players such as Smurfit Kappa Group, Hexcel Corporation, Grigeo AB Packaging Corporation of America, and Dufaylite Developments invest heavily in research and development efforts to bring out advanced honeycomb paper solutions with enhanced strength, moisture resistance, and cost-effectiveness.

Mergers and acquisitions play a critical role in market consolidation. Leading firms are expanding production capacities and geographic reach by acquiring regional players in emerging markets like India, China, and Southeast Asia through mergers or acquisitions. Furthermore, strategic collaborations between raw material suppliers, logistics providers, and e-commerce giants drive industry expansion and contribute to industry development.

Technological developments including automation, AI-powered packaging solutions, and biodegradable coatings are revolutionizing the honeycomb paper industry. Companies are also emphasizing customization and product diversification to address niche applications within automotive, aerospace, and construction applications.

As new players specialize in eco-friendly and high-performance honeycomb products, competition between established players continues to heat up. To remain market leaders, established players are prioritizing sustainable production methods, digital supply chain optimization, and expansion into high-growth regions such as Asia-Pacific and Latin America.

Some of the prominent players in the global Honeycomb Paper Market are:

- Packaging Corporation of America

- Smurfit Kappa Group

- Sonoco Products Company

- Signode Industrial Group

- Jagannath Polymers Pvt. Ltd.

- Industrial Packaging Corporation

- Century Papers Pvt. Ltd.

- Axxor N.V.

- Grigeo AB

- Plascore Incorporated

- Hexacomb Corporation

- Corinth Group

- Other Key Players

Recent Developments in the Global Honeycomb Paper Market

- December 2024: Strategic Alliance: HoneyTech Innovations and SustainPack Global joined forces in a joint R&D initiative to pioneer advanced, eco-centric material formulations for the honeycomb paper industry.

- December 2024: Global Honeycomb Paper Expo, Frankfurt: GlobalHoney Industries led the event, showcasing breakthrough production techniques, sustainable innovations, and future market trends, drawing a record number of international industry experts.

- November 2024: Capital Infusion: EcoPanel Solutions secured a strategic funding round of USD 50M to expand high-capacity production facilities in Europe, targeting increased global market share.

- October 2024: Industry Consolidation: A high-profile merger between GlobalHoney Industries and SustainPack Global resulted in a consolidated entity with enhanced R&D capabilities and an expanded global distribution network, positioning the new organization for robust future growth.

- August 2024: Regional Expansion: GreenCore Packaging attracted significant investor capital aimed at scaling operations across the Asia-Pacific region, emphasizing next-gen process technologies and market diversification.

- September 2024: Co-Development Venture: InnoCell Technologies and AeroHoney Systems formalized a collaborative venture to co-develop aerospace-grade honeycomb panels, leveraging their complementary technical expertise and market networks.

- July 2024: Innovative Expo, Shanghai: EcoPanel Solutions featured live demonstrations and technical workshops, underlining new product lines and cross-continental supply chain synergies within the honeycomb paper segment.

- May 2024: International Symposium, New York: InnoCell Technologies hosted focused sessions on emerging regulatory frameworks and material performance metrics, providing actionable insights for stakeholders across the supply chain.

- April 2024: Strategic Acquisition: AeroHoney Systems completed the acquisition of a regional competitor, significantly bolstering market penetration, broadening product offerings, and streamlining the supply chain to reinforce a competitive edge in key geographies.

- February 2024: Sealed Air Corporation launched QuikWrap Nano, a compact, user-friendly honeycomb paper wrapping solution designed for efficient e-commerce and retail packaging without requiring additional setup or equipment.

- January 2024: Smurfit Kappa promoted its Hexacomb honeycomb solution for sustainable automotive packaging, enhancing its market position and appealing to eco-conscious manufacturers transporting sensitive components.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 4.7 Bn |

| Forecast Value (2033) |

USD 8.0 Bn |

| CAGR (2024-2033) |

5.9% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2024) |

USD 1.5 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Kraft Paper Honeycomb, Fiberglass Honeycomb, Nomex Honeycomb, Polypropylene Honeycomb, Aluminum Honeycomb), By Core (Continuous unexpanded core, Slices unexpanded, Pre-expanded sheets), By Cell Size (Up to 10 mm, 10 to 30 mm, Above 30 mm), By Cell Shape (Hexagonal, Triangular, Circular), By Density (Low, Medium, High), By Application (Automotive, Building & Construction, Household Appliances, Furniture, Food & Beverages, Ceramics, Glass, Distribution, Electronics, Metal Mechanics, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Packaging Corporation of America, Smurfit Kappa Group, Sonoco Products Company, Signode Industrial Group, Jagannath Polymers Pvt. Ltd., Industrial Packaging Corporation, Century Papers Pvt. Ltd., Axxor N.V., Grigeo AB, Plascore Incorporated, Hexacomb Corporation, Corint Group., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |