Market Overview

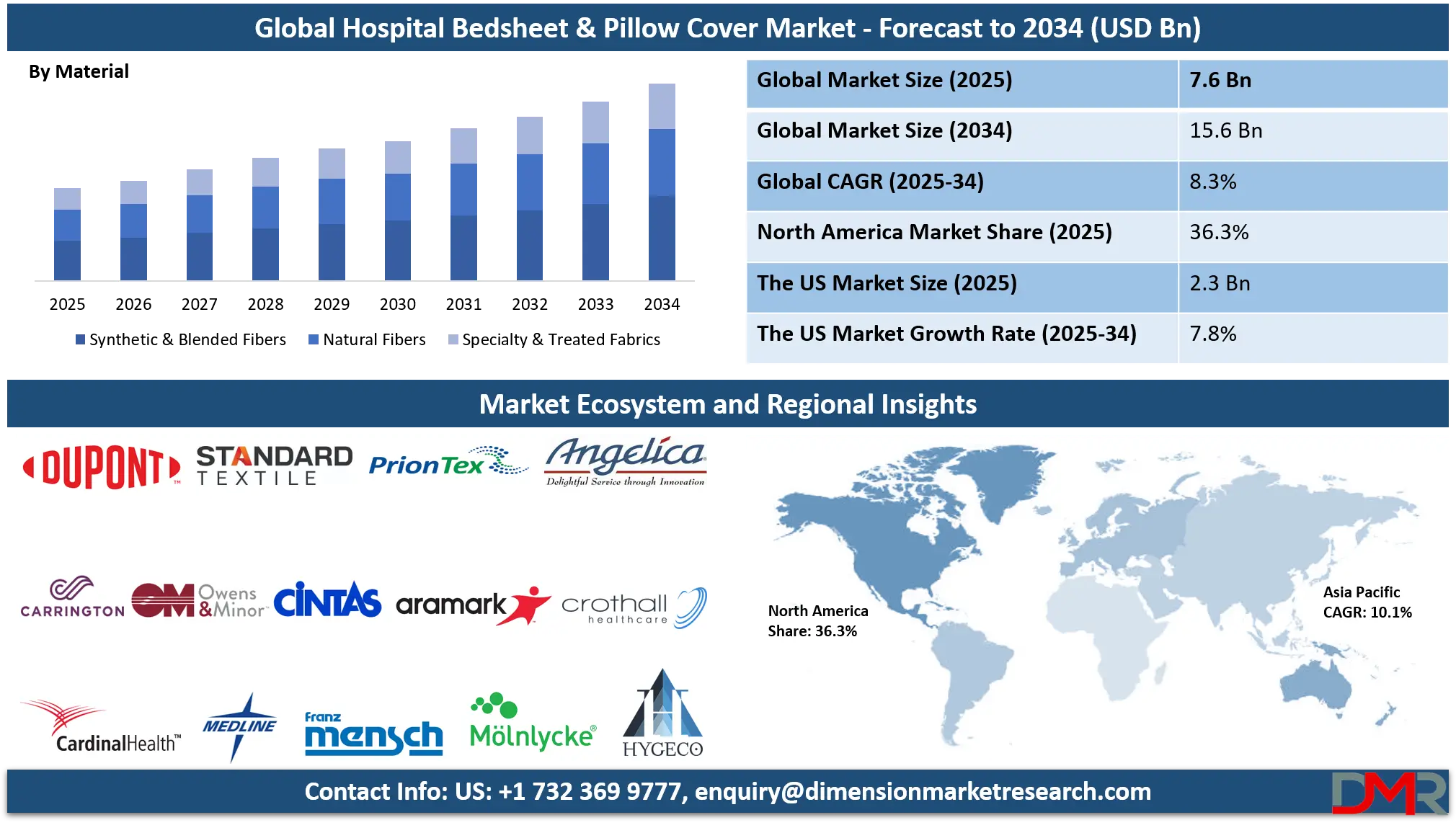

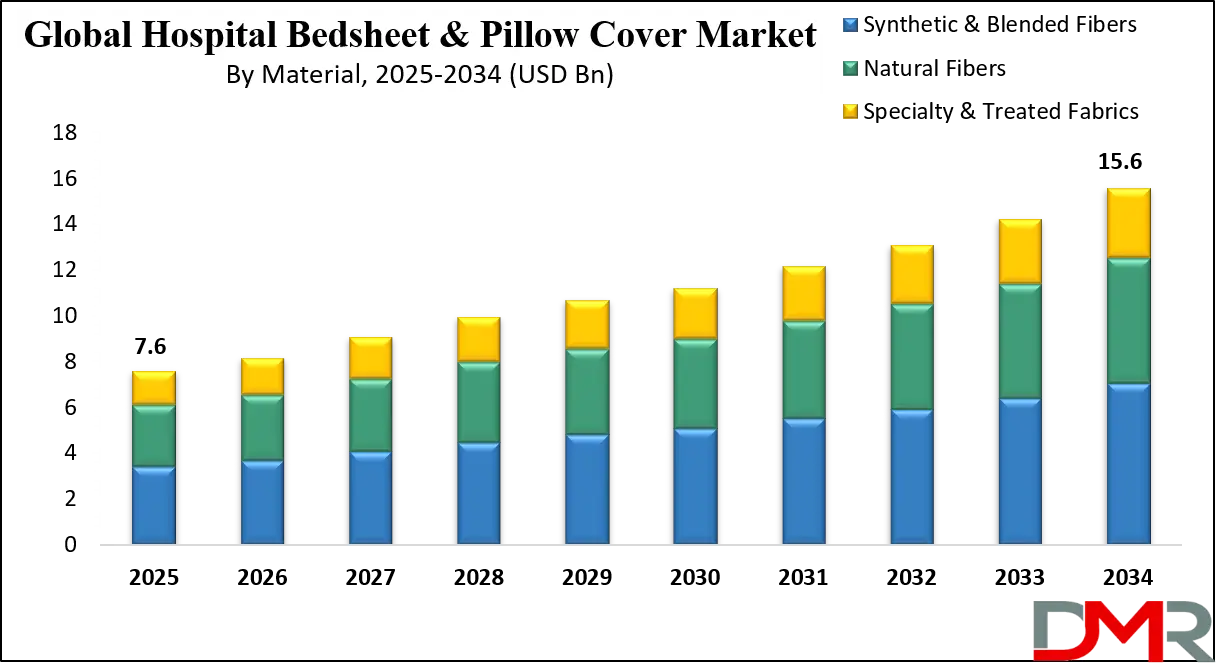

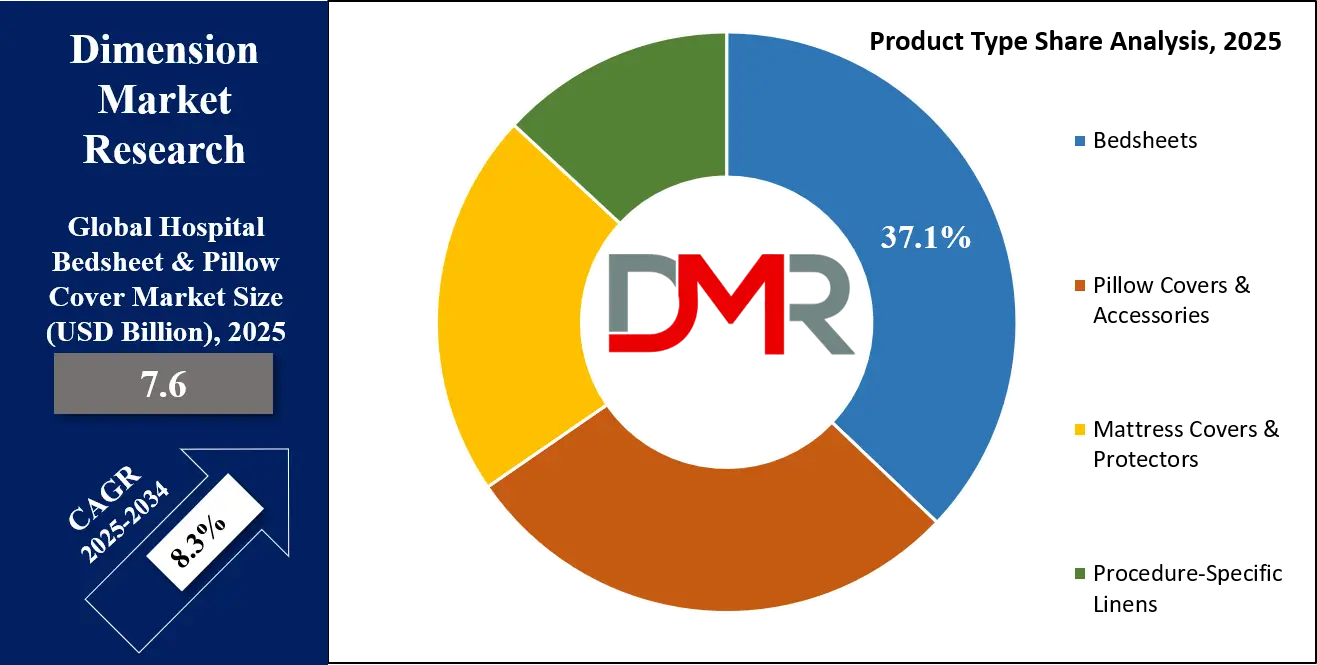

The global Hospital Bedsheet & Pillow Cover market is projected to reach USD 7.6 billion in 2025 and is expected to expand at a compound annual growth rate (CAGR) of 8.3% from 2025 to 2034, reaching an estimated USD 15.6 billion by 2034.

This steady growth trajectory is fueled by the global imperative to enhance healthcare hygiene standards and patient comfort, which are critical factors in patient recovery and infection control. Hospital linens represent a fundamental component of the healthcare environment, directly impacting patient satisfaction, cross-contamination prevention, and operational efficiency.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Unlike standard household linens, hospital-grade bedsheets and pillow covers are specialized textile products engineered for durability, high-frequency laundering, fluid resistance, and antimicrobial properties. This dual function of providing comfort while serving as a protective barrier eliminates the need for additional patient wraps or pads in many cases, reducing material waste and laundry volume. The market's expansion is underpinned by a powerful confluence of drivers: stringent hospital-acquired infection (HAI) control protocols, rising patient expectations for hospitality-like care, technological breakthroughs in smart and antimicrobial textiles, and the global escalation of healthcare facility construction and renovation.

The evolution of hospital linens is characterized by rapid material and functional diversification. Innovations such as copper-infused fabrics with proven antimicrobial efficacy, smart textiles with embedded sensors for monitoring patient vitals or incontinence, and biodegradable bamboo fibers offering superior softness and environmental benefits are unlocking new patient care possibilities.

While the market faces headwinds from the higher initial cost of advanced materials, supply chain complexities for specialized fabrics, and the high operational cost of on-premise laundering, the long-term value proposition is compelling. Total Cost of Ownership (TCO) for premium linens is declining as adoption scales, and its value extends beyond basic functionality to include enhanced patient satisfaction scores (HCAHPS), reduced HAI rates, and regulatory compliance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Supported by robust guidelines from bodies like the Centers for Disease Control and Prevention (CDC) and Joint Commission International (JCI), along with sustainability mandates in public healthcare procurement, advanced hospital linens are transitioning from a standard commodity to a strategic component of modern, patient-centric, and efficient healthcare delivery, positioning itself as a central pillar of the global healthcare infrastructure upgrade through 2034.

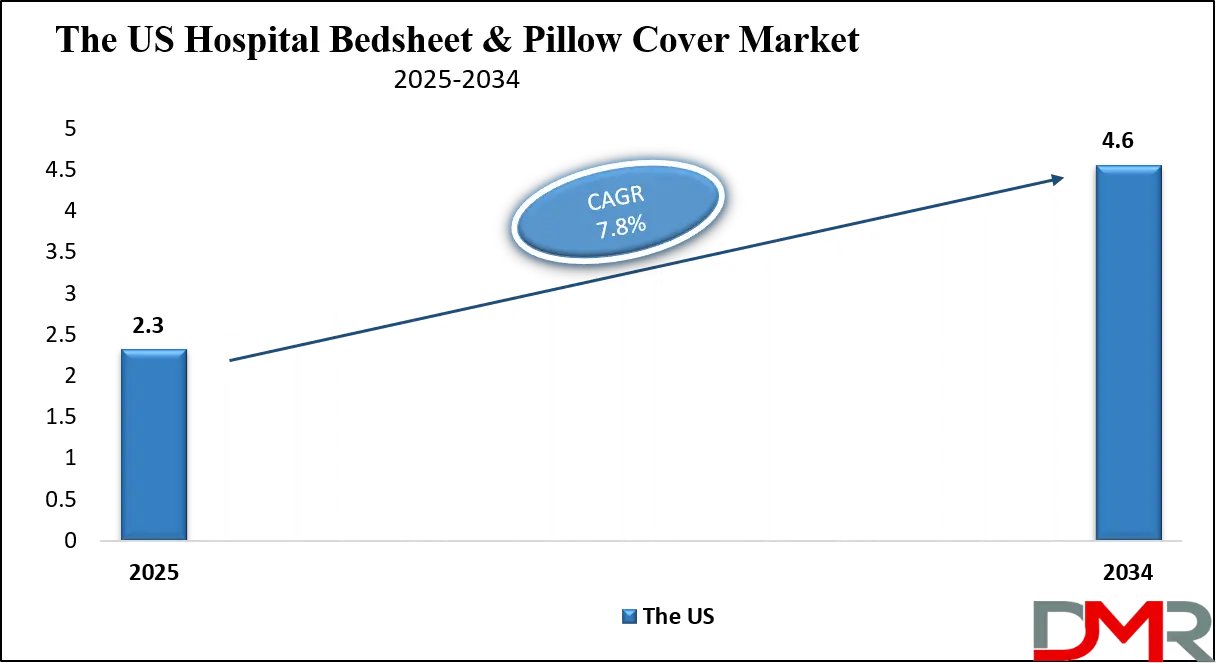

The US Hospital Bedsheet & Pillow Cover Market

The U.S. Hospital Bedsheet & Pillow Cover Market is projected to reach USD 2.3 billion in 2025 and grow at a CAGR of 7.8%, reaching USD 4.6 billion by 2034. The United States market is a dynamic engine of innovation and adoption, driven by a potent mix of regulatory pressure, high patient acuity, and corporate healthcare ambition. The Centers for Medicare & Medicaid Services (CMS) Hospital Value-Based Purchasing Program serves as a foundational catalyst, linking reimbursement rates to patient satisfaction and HAI metrics, making investments in high-comfort, hygienic linens financially critical.

States like California continue to set the pace with its Title 22 regulations governing hospital sanitation, which mandate strict linen handling and quality standards. Beyond regulation, a powerful driver is the private hospital sector's race to meet patient-experience benchmarks to attract patients in a competitive market. Major hospital chains (HCA Healthcare, Ascension, Kaiser Permanente) and specialty surgical centers are increasingly specifying advanced linens for new facilities and renovations, valuing its dual role in improving patient-reported outcomes and serving as a visible marker of care quality.

The innovation landscape is vibrant. Companies like Medline Industries and Cardinal Health are iterating on integrated linen and incontinence management systems, while startups like Xenex Disinfection Services are partnering with textile firms for germicidal linen fabrics. Furthermore, the convergence of linens with Electronic Health Records (EHR) for tracking usage per patient and Internet of Things-based laundry optimization is creating a holistic ecosystem where linen management becomes an interactive node in hospital operational efficiency. This blend of regulation, patient-centric demand, and technological entrepreneurship solidifies the U.S. as a global leader in both hospital linen product innovation and supply chain management.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Hospital Bedsheet & Pillow Cover Market

The Europe Hospital Bedsheet & Pillow Cover Market is projected to be valued at approximately USD 2.2 billion in 2025 and is projected to reach around USD 4.7 billion by 2034, growing at a CAGR of about 8.8% from 2025 to 2034. Europe is the established regulatory and quality leader in healthcare textiles, with a market maturity built on decades of strict EU Medical Device Regulations (MDR) and high environmental standards. The recently emphasized EU Green Public Procurement (GPP) criteria for healthcare is a significant driver, mandating that a significant portion of public sector purchases, including hospital linens, meet stringent environmental and circular economy standards. This creates a non-negotiable demand for durable, recyclable, and low-chemical linens.

National frameworks amplify this effect. Germany's Robert Koch Institute (RKI) guidelines and the UK's NHS National Standards of Healthcare Cleanliness provide detailed protocols for linen management, favoring certified, high-performance materials. Europe's strength lies in its integrated value chain, where longstanding textile manufacturers (Hygeco International, Franz Mensch, Mölnlycke Health Care) collaborate closely with hospital groups and Central Sterile Services Departments (CSSD) to deliver turnkey, compliant linen service solutions.

The region also leads in the renovation and modernization of aging hospital stock, where efficiency and sustainability are paramount. Linen products made from recycled PET or organic cotton with Global Organic Textile Standard (GOTS) certification are critical here. Furthermore, EU-funded research initiatives under Horizon Europe consistently advance next-generation technologies like phase-change material (PCM) infused linens for thermal comfort and non-woven disposable sheets with enhanced biodegradability. This combination of stringent, enforced regulation, deep healthcare textile expertise, and a culture of high-quality sustainable procurement ensures Europe's sustained dominance in market value and product sophistication.

The Japan Hospital Bedsheet & Pillow Cover Market

The Japan Hospital Bedsheet & Pillow Cover Market is anticipated to be valued at approximately USD 983 million in 2025 and is expected to attain nearly USD 2,210 million by 2034, expanding at a CAGR of about 9.3% during the forecast period. Japan's market is uniquely shaped by its rapidly aging population, world-leading hygiene standards (Kirei culture), and advanced robotic automation capabilities. With one of the highest proportions of elderly citizens requiring long-term care, integrating comfort, ease of use for caregivers, and infection prevention in linens is a strategic necessity. The government's Health and Long-Term Care Insurance systems explicitly promote quality care infrastructure, creating a receptive market for advanced patient textile solutions.

Japan's technological prowess is a key differentiator. Companies like Iris Ohyama and Sanyo Chemical Industries have deep expertise in super-absorbent polymers and odor-control technologies integrated into linens, ideal for geriatric care. The concept of reduction of care burden has been a national policy driver, creating demand for linens that are easy to change, reduce skin breakdown, and minimize physical strain on staff. Furthermore, Japan is pioneering "Smart Hospital" integration, where RFID-tagged linens are automatically tracked from warehouse to bed to laundry, optimizing inventory and reducing loss.

Social and demographic trends also fuel growth. An aging population and a declining workforce place a premium on labor-saving, efficient solutions. The cultural emphasis on meticulous cleanliness and patient dignity aligns perfectly with the value proposition of high-quality, fresh, and comfortable linens. Projects range from large-scale "Smart Hospital" developments integrating automated linen handling robots, to subsidized upgrades for long-term care facilities. Japan thus represents a high-growth market where cutting-edge material technology meets acute societal needs, driving rapid and sophisticated adoption.

Global Hospital Bedsheet & Pillow Cover Market: Key Takeaways

- Market Growth from Regulatory & Demographic Insights: The market is set to more than double from USD 7.6 billion in 2025 to USD 15.6 billion by 2034 (CAGR 8.3%), primarily driven by global aging demographics, tightening HAI prevention protocols, and value-based care models that tie reimbursement to patient experience metrics.

- Asia-Pacific as the Volume & Growth Frontier: The APAC region will exhibit the highest CAGR, fueled by massive healthcare infrastructure expansion (especially in China and India), rising medical tourism, and increasing adoption of international accreditation standards (JCI) that mandate high-quality linen services.

- Material Diversification Beyond Cotton: While cotton-polyester blends maintain dominance for their balance of comfort and durability, specialty materials (bamboo for hypoallergenic properties, silk for burn patients, advanced polymers for fluid control) are capturing niche segments, driving premiumization.

- From Commodity to Managed Service Solution: The competitive edge is shifting from selling bulk linens to providing Linen Management as a Service (LMaaS), including RFID tracking, predictive replacement, leased inventory models, and on-site laundry optimization, creating sticky customer relationships.

- The Rise of Sustainability and Circularity: Leading manufacturers are increasingly designing for longer lifecycle, recyclability, and use of eco-friendly materials & dyes, responding to hospital sustainability goals and GPP criteria that assess full lifecycle environmental impact.

Global Hospital Bedsheet & Pillow Cover Market: Use Cases

- HAI Reduction in ICU Settings: Antimicrobial copper-oxide impregnated sheets and pillow covers in Intensive Care Units significantly reduce microbial bioburden on high-touch surfaces, contributing to lower rates of Methicillin-resistant Staphylococcus aureus (MRSA) and Vancomycin-resistant Enterococci (VRE) transmissions.

- Pressure Injury Prevention in Long-Term Care: Advanced microclimate-controlling draw sheets with silicone nubs or alternating pressure points are used for high-risk immobile patients, managing moisture and reducing shear forces to prevent costly and painful pressure ulcers.

- Enhanced Patient Experience in Private Rooms: Hotel-style, high-thread-count cotton or bamboo blend linens in private patient rooms improve patient satisfaction scores, support faster recovery perceptions, and can be offered as a premium service in private healthcare markets.

- Labor Efficiency in High-Turnover Units: Fitted sheets with color-coded corners and easy-grip tags, along with standardized linen packs per bed, reduce changeover time in post-operative and emergency departments, increasing bed availability and staff efficiency.

- Pediatric Patient Comfort and Engagement: Themed, colorful cartoon-character printed pillow covers and sheets are used in pediatric wards to reduce anxiety, create a more welcoming environment, and improve cooperation during treatment.

Global Hospital Bedsheet & Pillow Cover Market: Stats & Facts

World Health Organization (WHO)

- On average, 7% of patients in high-income countries and 15% of patients in low- and middle-income countries acquire at least one healthcare-associated infection during their hospital stay.

- An estimated 1 in 10 affected patients will die from their healthcare-associated infection.

- Improving water, sanitation, and hygiene (WASH) and healthcare waste management in health facilities could reduce the burden of healthcare-associated infections by over 50%.

- Safe healthcare environments, which include clean bedding and textiles, are one of the five core components of the WHO Global Strategy on Infection Prevention and Control.

Centers for Disease Control and Prevention (CDC)

- On any given day, about 1 in 31 hospital patients has at least one healthcare-associated infection.

- Proper handling, transportation, and laundering of contaminated textiles is essential to prevent pathogen transmission in healthcare settings.

- The CDC's "Guidelines for Environmental Infection Control in Health-Care Facilities" dedicate a specific section to the management of healthcare textiles, including bedsheets and pillow covers.

- In the United States, healthcare facilities generate approximately 13.8 kilograms of laundry per patient bed per day, a significant portion of which is linen.

Agency for Healthcare Research and Quality (AHRQ)

- A single surgical site infection (SSI) can add more than $20,000 to the total cost of a hospital stay.

- Healthcare-associated infections represent a significant and costly patient safety issue, contributing to longer hospital stays, long-term disability, and higher mortality.

U.S. Environmental Protection Agency (EPA)

- Textiles are a major component of the municipal solid waste stream, accounting for over 16 million tons in a recent reporting year.

- The EPA promotes the Sustainable Materials Management framework, which encourages the healthcare sector to reduce, reuse, and recycle materials, including linens, to minimize environmental impact.

Joint Commission International (JCI)

- JCI accreditation standards include requirements for healthcare organizations to have written policies and procedures for managing linen and laundry services to prevent cross-infection.

- Facilities are surveyed on their compliance with these standards, which cover the collection, transport, cleaning, storage, and distribution of clean and soiled textiles.

National Institute for Occupational Safety and Health (NIOSH)

- Healthcare laundry workers can be exposed to biological agents, ergonomic hazards, and chemicals; NIOSH provides guidelines for protecting these workers.

- Recommendations include engineering controls, safe work practices, and personal protective equipment for handling contaminated healthcare textiles.

U.S. Department of Health and Human Services (HHS)

- HHS tracks national progress on reducing healthcare-associated infections through its National Healthcare Safety Network.

- The HHS "National Action Plan to Prevent Health Care-Associated Infections" set ambitious national reduction targets, focusing on the multi-faceted approach needed, which includes environmental hygiene.

European Centre for Disease Prevention and Control (ECDC)

- The ECDC estimates that over 4 million patients acquire a healthcare-associated infection in European Union hospitals each year.

- They publish evidence-based guidelines for the prevention of HAIs, which include recommendations on the safe management of healthcare textiles.

Textile Rental Services Association (TRSA)

- Hygienically clean healthcare linens processed by certified laundries must meet specific, quantifiable microbiological standards to be considered safe for patient use.

- TRSA’s Hygienically Clean Healthcare certification requires third-party, outcome-based testing to verify that linens possess a low bioburden.

International Organization for Standardization (ISO)

- ISO standard 9073 specifies test methods for nonwovens, which are increasingly used for disposable patient bedding products.

- ISO 11607 specifies the requirements for materials, preformed sterile barrier systems, and packaging systems for terminally sterilized medical devices, which can be relevant for sterile surgical linen packs.

Global Hospital Bedsheet & Pillow Cover Market: Market Dynamic

Driving Factors in the Global Hospital Bedsheet & Pillow Cover Market

Stringent Infection Prevention Protocols and Value-Based Purchasing

Global and national mandates for HAI reduction, enforced by bodies like CDC, WHO, and JCI, are primary drivers. Value-based care models that link hospital reimbursement to patient outcomes and satisfaction scores create a direct financial incentive to invest in high-comfort, hygienic linens that improve the patient experience and reduce complication rates.

Rising Healthcare Infrastructure Development and Aging Demographics

Massive investments in new hospital construction, especially in emerging economies, and the expansion of long-term care facilities for aging populations globally are creating sustained demand. The growing number of surgical procedures and hospital admissions directly correlates with increased linen consumption and replacement cycles.

Restraints in the Global Hospital Bedsheet & Pillow Cover Market

High Operational Costs and Budget Constraints

Despite the benefits, the total cost of advanced linen systems including procurement, laundering, replacement, and labor remains a significant portion of hospital operational budgets. In cost-sensitive markets and public hospitals with tight funding, this limits adoption of premium solutions in favor of basic, commodity-grade linens.

Complex Supply Chain and Logistical Challenges

The market involves complex logistics from manufacturing to hospital Central Supply, to bedside, to laundry, and back. Inefficiencies in this cycle lead to stockouts, loss, and increased costs. A lack of standardization in bed sizes globally and hospital-specific protocols also complicates inventory management and bulk purchasing.

Opportunities in the Global Hospital Bedsheet & Pillow Cover Market

Adoption of Smart Textiles and RFID Technology

The integration of smart fabrics with patient monitoring capabilities and widespread use of RFID tags for real-time linen tracking presents a major opportunity. This enables just-in-time inventory, reduces loss, provides data on linen lifecycle, and can even monitor patient movement or incontinence, improving care efficiency.

Growth of Outsourced Linen Services and Rental Models

The increasing trend of hospitals outsourcing entire linen management to specialized Textile Rental Services companies represents a significant opportunity. This model converts large capital expenditures into predictable operational expenses, provides guaranteed quality and availability, and transfers compliance burdens, appealing especially to mid-sized and small healthcare facilities.

Trends in the Global Hospital Bedsheet & Pillow Cover Market

Multi-Functional and Patient-Centric Design

The trend is moving beyond basic covering to linens that offer additional functions: pressure-relief properties, temperature regulation, incontinence management with discrete indicators, and therapeutic scents. Aesthetically, the demand is for soothing colors, softer hand-feel fabrics, and printed designs that reduce the institutional feel and promote healing.

Digitalization: RFID Integration and Laundry Management Software

The use of Radio-Frequency Identification (RFID) tags and Laundry Management Information Systems (LMIS) is becoming crucial. This allows for real-time tracking of linen assets from warehouse to patient bed to laundry, enabling accurate inventory control, loss prevention, lifecycle analysis, and automated replenishment, optimizing the entire supply chain.

Global Hospital Bedsheet & Pillow Cover Market: Research Scope and Analysis

By Product Type Analysis

Fitted Sheets are poised to be the largest and most dominant product segment, expected to capture the majority of the market revenue by 2030. The operational logic is compelling: fitted sheets significantly reduce nursing time during bed changes compared to flat sheets, directly impacting labor costs and efficiency on high-turnover units. A well-fitted sheet also minimizes wrinkles and bunching, enhancing patient comfort and reducing the risk of skin irritation and pressure injuries for immobile patients.

This segment is the focus of ergonomic innovation and durability engineering. Driven by the need for staff efficiency and patient safety, hospitals are specifying fitted sheets with features like deep pockets for varied mattress thicknesses, color-coded elastic corners for quick orientation, and reinforced seams. The technical focus is on elastic longevity to survive hundreds of industrial washes without degradation. Consequently, premium fitted sheets command a price premium over flat sheets, justified by their multifunctional returns: labor time savings, improved patient outcomes, and reduced linen waste from improper fitting. This segment sees deep collaboration between textile mills, elastic component suppliers, and hospital ergonomics teams.

Pillow Covers rank as the second-largest product segment, crucial for hygiene and comfort. It encompasses distinct sub-markets. Standard Pillow Cases are high-volume consumables. The key trend here is the shift towards pillow protectors zippered or envelope-style waterproof, yet breathable, covers that go under the standard case. These protect the pillow core from stains and microbial penetration, extending its life and providing an additional infection control barrier, representing a growing value-added segment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Material Analysis

Poly-Cotton Blend Bedsheets & Covers are projected to dominate the global market, holding an highest revenue share through the forecast period. This dominance is anchored in a proven balance of performance and cost. High durability to withstand industrial laundering (often 100+ cycles), comfortable breathability from cotton, and wrinkle-resistance/low shrinkage from polyester deliver optimal functionality. Decades of use provide proven cost-effectiveness and familiarity to procurement and laundry staff. Furthermore, poly-cotton blends benefit from mature, globalized textile supply chains, ensuring competitive pricing and consistent availability.

Their primary application lies in general patient wards and standard hospital rooms where a balance of performance and economy is required. This includes standard flat and fitted sheets, pillowcases, and draw sheets. Continuous advancements such as improved thread counts, puckered seams for strength, and antimicrobial finishes are enhancing their value proposition. While specialty materials excel in niche applications (ICU, Burns, Pediatrics), the poly-cotton blend's combination of proven performance, ease of care, and best-in-class cost efficiency solidifies its position as the workhorse material for the bulk of the hospital linen market.

By End User Analysis

Hospitals (Acute Care) are anticipated to dominate the market, accounting for majoity of total revenue throughout the forecast period. This dominance is structurally inherent. Acute care hospitals, including public, private, and university-affiliated facilities, possess characteristics that drive high-volume, frequent linen usage. They have large, constant patient turnover, requiring daily linen changes per occupied bed. They operate under the most stringent regulatory scrutiny for infection control (CDC, JCI), mandating the use of certified, properly laundered linens. Financially, while budget-conscious, they have the scale to negotiate bulk contracts and increasingly recognize linen quality as integral to core metrics like HAI rates and HCAHPS scores.

The Long-Term Care Facilities (LTCF) & Nursing Homes segment is the second-largest end-user and exhibits a high growth potential (CAGR) driven by demographics. Demand here focuses on durability (linens undergo frequent laundering), incontinence management (high prevalence), and features that reduce caregiver strain (easy-change systems, lift sheets). Products like high-absorbency bed pads and stretch-knit fitted sheets designed for occupied-bed changes are critical in this segment.

The Global Hospital Bedsheet & Pillow Cover Market Report is segmented on the basis of the following:

By Product Type

- Bedsheets

- Fitted Sheets

- Flat Sheets

- Draw Sheets

- Pillow Covers & Accessories

- Pillow Cases

- Pillow Protectors (Waterproof)

- Pillow Inserts

- Mattress Covers & Protectors

- Stretch Knit Mattress Covers

- Zippered Mattress Encasements

- Procedure-Specific Linens

- Surgical Drapes & Sheets

- Underpads/Chux

- Blankets & Thermal Covers

By Material

- Synthetic & Blended Fibers

- Polyester

- Poly-Cotton Blend

- Polyester-Rayon Blend

- Natural Fibers

- Cotton

- Bamboo Fiber

- Silk

- Linen

- Specialty & Treated Fabrics

- Antimicrobial Treated

- Fluid-Resistant/Barrier

- Smart Fabrics (with sensors)

- Fire-Retardant Treated

By End User

- Hospitals

- Long-Term Care Facilities & Nursing Homes

- Clinics & Outpatient Centers

- Ambulatory Surgical Centers (ASCs)

- Home Healthcare Settings

Impact of Artificial Intelligence in the Global Hospital Bedsheet & Pillow Cover Market

- Predictive Inventory and Laundry Optimization: Artificial Intelligence algorithms analyze historical patient admission rates, seasonal trends, and real-time bed occupancy to predict linen demand precisely. This optimizes par levels, automates replenishment orders to the laundry, and minimizes both stockouts and excess inventory holding costs.

- Quality Control via Computer Vision: AI-powered cameras in industrial laundries can automatically inspect washed linens for stains, tears, or wear beyond usable life, sorting them for reprocessing or retirement. This ensures quality consistency and reduces manual inspection labor.

- RFID Data Analytics for Lifecycle Management: AI models analyze data from RFID tags to determine the actual lifecycle of linen items under different use conditions (ward type, wash chemistry). This enables predictive replacement before failure, optimizes procurement schedules, and identifies usage patterns leading to excessive wear.

- Patient Comfort and Safety Monitoring: For smart linens with embedded sensors, AI can analyze data on patient movement, moisture, and temperature to predict and alert staff to potential issues like incontinence episodes, restlessness indicating pain, or early signs of pressure sore development.

- Sustainable Practice Optimization: AI can optimize laundry formulas (water temperature, chemical dosage, cycle length) based on soil level and fabric type detected by sensors, minimizing water/energy use and chemical waste while maximizing linen longevity, supporting hospital sustainability goals.

Global Hospital Bedsheet & Pillow Cover Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate this market as it holds 36.3% of the market share in 2025, because its market fundamentals are primed for advanced adoption today. The region, led by the United States, possesses a critical combination of high healthcare expenditure, stringent and legally enforced infection control standards (CMS conditions of participation), and a highly developed network of group purchasing organizations (GPOs) that drive large-scale, standardized procurement. This creates a consistent, high-value market for advanced and branded linen solutions.

Crucially, this clinical driver is reinforced by a mature outsourcing industry. The widespread adoption of rental linen services from majors like Aramark and Crothall Healthcare creates a stable, recurring revenue stream for suppliers. This environment has nurtured a competitive ecosystem of large medical suppliers (Medline, Cardinal Health) and specialized textile service companies that provide comprehensive solutions. The revenue lead is thus built on a foundation of high-value contracts in the large hospital systems and ASCs, where performance, compliance, and cost predictability are paramount.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia-Pacific achieves the highest CAGR because it represents the planet's most powerful convergence of future demand drivers on an unprecedented scale. The region is home to the world's most rapid healthcare infrastructure build-out, with thousands of new hospital beds being added annually in China, India, and Southeast Asia, creating immense greenfield demand. This is compounded by rising medical tourism in Thailand, Singapore, and Malaysia, which necessitates world-class patient amenities, including high-quality linens. The growth catalyst is the scale of government healthcare investment and the increasing adoption of international accreditation (JCI) by private hospitals, which mandates specific linen handling and quality standards.

While North America's growth is driven by replacement and service models, Asia-Pacific's is volume-led and infrastructure-scale. However, this market is in a development stage. Challenges like price sensitivity, fragmented local suppliers, and varying levels of laundry infrastructure maturity have initially slowed the adoption of premium, integrated solutions, but present a long runway for growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Hospital Bedsheet & Pillow Cover Market: Competitive Landscape

The competitive landscape is dynamic and stratified, characterized by a mix of large diversified med-tech suppliers, specialized textile manufacturers, and regional service providers.

Integrated medical supply giants like Medline Industries, Cardinal Health, and Owens & Minor leverage their vast distribution networks, GPO contracts, and broad hospital supply portfolios. Their strategy is to bundle linens with other consumables, offering convenience and volume pricing, while increasingly adding value through inventory management technology.

Specialist healthcare textile manufacturers like Angelica Corporation, Standard Textile Co., and Mediblue Health Care compete on deep textile expertise, product innovation, and dedicated service. They focus on developing advanced fabrics (antimicrobial, smart), offering customization (hospital logos, specific sizes), and providing direct technical support to hospital laundries.

The competitive ground is shifting from a purely product-price competition to a solutions-and-services competition. Winning requires: a robust product portfolio from basic to high-tech, strong service capabilities (including rental/lease options), technology integration (RFID, LMIS), and sustainability credentials. Mergers and acquisitions, like large distributors acquiring specialty textile firms or rental companies partnering with tech startups, are ongoing as players strive to offer end-to-end solutions.

Some of the prominent players in the Global Hospital Bedsheet & Pillow Cover Market are:

- Medline Industries, Inc.

- Cardinal Health, Inc.

- Owens & Minor, Inc.

- Angelica Corporation

- Standard Textile Co., Inc.

- Mediblue Health Care (Hammock Powered)

- Aramark Uniform Services (Aramark)

- Crothall Healthcare (Compass Group PLC)

- Cintas Corporation

- Franz Mensch GmbH

- Mölnlycke Health Care AB

- 3M Company (Medical Materials Division)

- Hygeco International

- Priontex Ltd.

- Carrington Textiles Ltd.

- Symbiote Inc.

- Lakeland Industries (Healthcare Segment)

- DuPont de Nemours, Inc. (Performance Textiles)

- Kimberly-Clark Professional

- Sierra Pacific Textiles (SPT)

- Other Key Players

Recent Developments in the Global Hospital Bedsheet & Pillow Cover Market

- February 2025: Medline and IBM Announce Partnership for AI-Driven Linen Logistics. The collaboration integrates Medline's LINENTRACK RFID system with IBM's AI analytics to provide predictive inventory and automated restocking for large hospital networks, aiming to reduce linen loss by 25%.

- January 2025: EU Officially Includes Hospital Textiles in Expanded Eco-Design Directive. The new criteria set mandatory thresholds for durability (minimum wash cycles), recyclability, and restricted substances for hospital sheets and pillow covers procured by public health services.

- December 2024: World's First Large-Scale Trial of Self-Disinfecting Nanofiber Linens Completed in Germany. A consortium led by the Robert Koch Institute reported a 99.5% reduction in microbial load on patient bedsheets after 24 hours of use in the trial, demonstrating significant infection control potential.

- November 2024: Cardinal Health Launches "ComfortCare+" Subscription Linen Service. The new service offers hospitals a fixed monthly fee for a complete linen solution, including smart linens with wear sensors, RFID tracking, and guaranteed 4-hour emergency replenishment.

- October 2024: Joint Commission International (JCI) Updates Standards for Linen Management. The 8th edition of JCI standards includes new, specific requirements for validating the efficacy of antimicrobial linens and for tracking linen lifecycle from receipt to retirement.

- September 2024: A Large Private Equity Consortium Acquires Angelica Corporation. The $1.8 billion deal is aimed at consolidating the specialized healthcare linen market and accelerating the rollout of Angelica's sensor-integrated smart linen platform to more hospitals.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.6 Bn |

| Forecast Value (2034) |

USD 15.6 Bn |

| CAGR (2025–2034) |

8.3% |

| The US Market Size (2025) |

USD 2.3 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Bedsheets, Pillow Covers & Accessories, Mattress Covers & Protectors, Procedure-Specific Linens), By Material (Synthetic & Blended Fibers, Natural Fibers, Specialty & Treated Fabrics), By End User (Hospitals, Long-Term Care Facilities & Nursing Homes, Clinics & Outpatient Centers, Ambulatory Surgical Centers (ASCs), Home Healthcare Settings) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Medline Industries, Inc., Cardinal Health, Inc., Owens & Minor, Inc., Angelica Corporation, Standard Textile Co., Inc., Mediblue Health Care (Hammock Powered), Aramark Uniform Services (Aramark), Crothall Healthcare (Compass Group PLC), Cintas Corporation, Franz Mensch GmbH, Mölnlycke Health Care AB, 3M Company (Medical Materials Division), Hygeco International, Priontex Ltd., Carrington Textiles Ltd., Symbiote Inc., Lakeland Industries (Healthcare Segment), DuPont de Nemours, Inc. (Performance Textiles), Kimberly-Clark Professional, Sierra Pacific Textiles (SPT), and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Hospital Bedsheet & Pillow Cover Market?

▾ The Global Hospital Bedsheet & Pillow Cover Market size is estimated to have a value of USD 7.6 billion in 2025 and is expected to reach USD 15.6 billion by the end of 2034.

What is the growth rate in the Global Hospital Bedsheet & Pillow Cover Market?

▾ The market is growing at a CAGR of 8.3 percent over the forecasted period of 2025 to 2034.

What is the size of the US Hospital Bedsheet & Pillow Cover Market?

▾ The US Hospital Bedsheet & Pillow Cover Market is projected to be valued at USD 2.3 billion in 2025. It is expected to reach USD 4.6 billion in 2034, growing at a CAGR of 7.8%.

Which region accounted for the largest Global Hospital Bedsheet & Pillow Cover Market?

▾ North America is expected to have the largest market share in the Global Hospital Bedsheet & Pillow Cover Market, driven by its stringent healthcare regulations, high adoption of outsourced linen services, and advanced procurement systems.

Who are the key players in the Global Hospital Bedsheet & Pillow Cover Market?

▾ Some of the major key players in the Global Hospital Bedsheet & Pillow Cover Market are Medline Industries, Inc., Cardinal Health, Inc., Angelica Corporation, Standard Textile Co., Inc., Aramark, and Mölnlycke Health Care AB, among others.