Market Overview

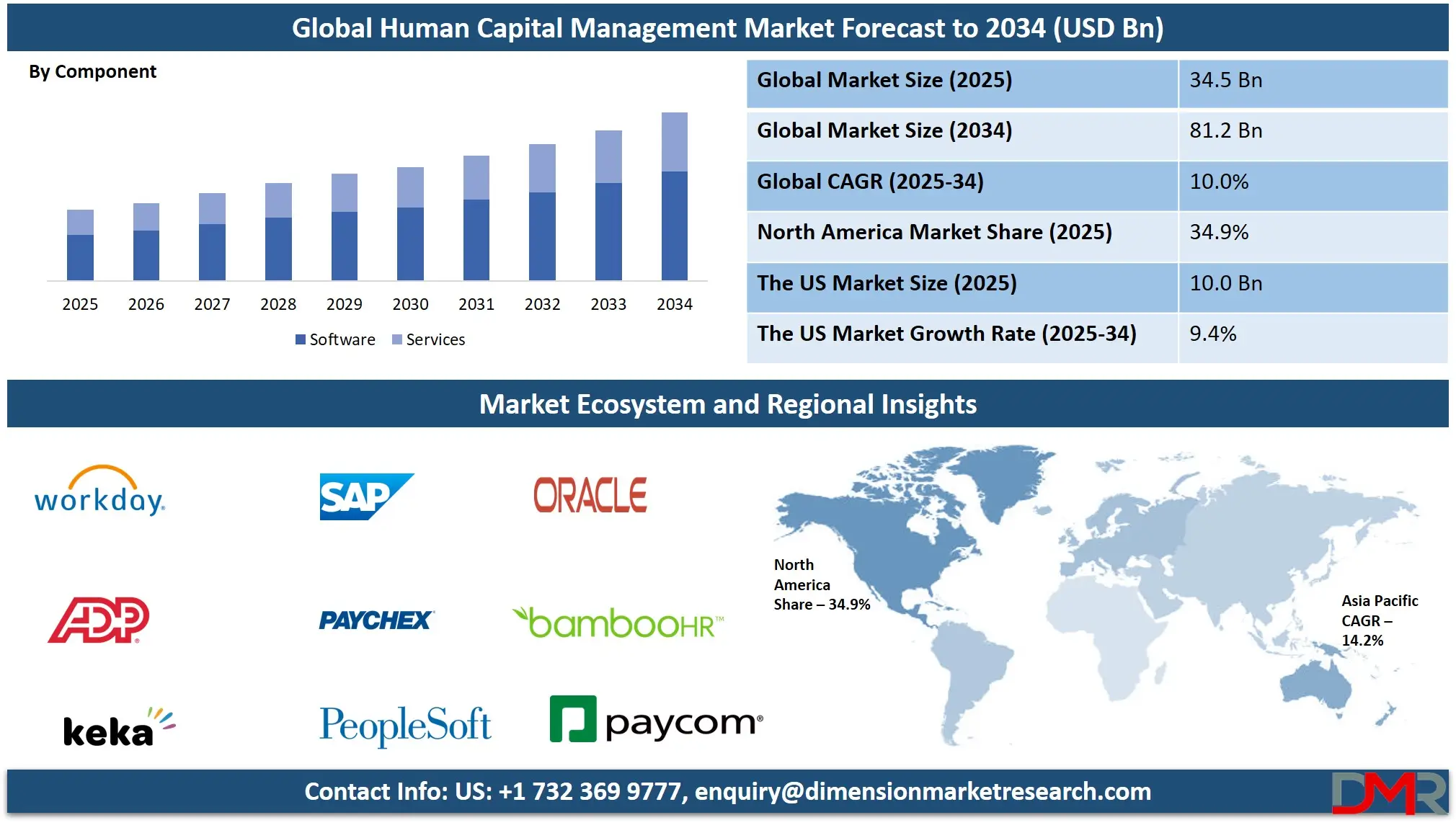

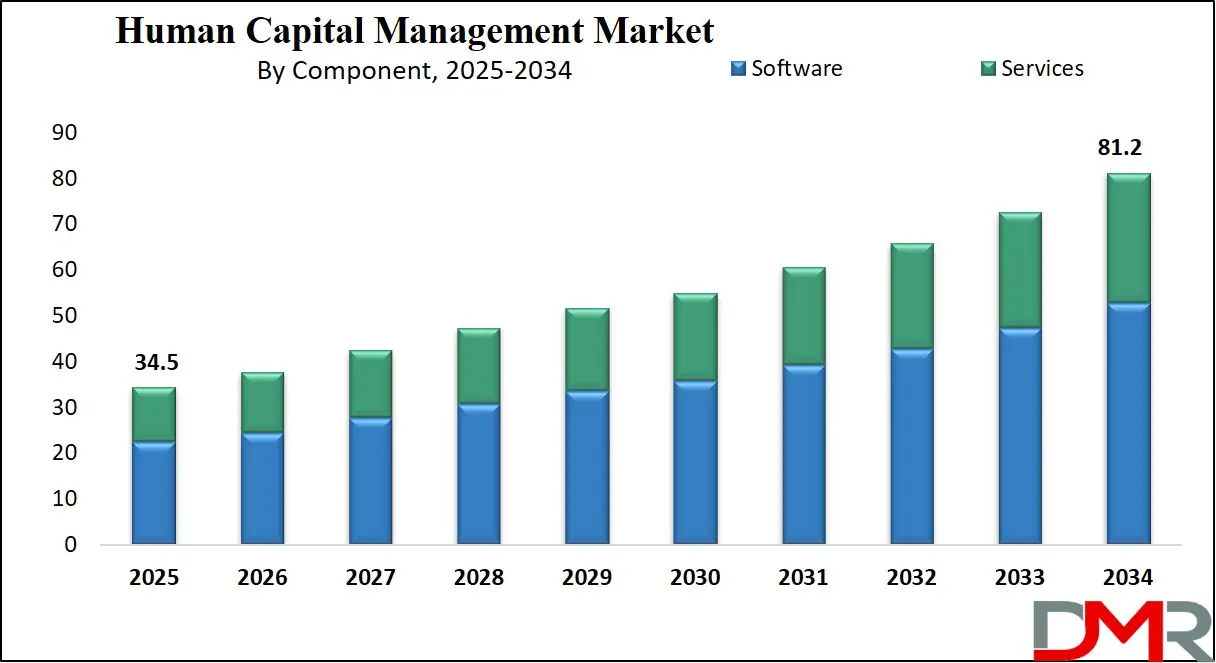

The Global Human Capital Management Market size is projected to reach USD 34.5 billion in 2025 and grow at a compound annual growth rate of 10.0% from there until 2034 to reach a value of USD 81.2 billion.

Human Capital Management (HCM) is a term used to describe the way companies manage their people, also known as human capital. It includes everything from hiring, training, and managing employees to making sure they grow and stay engaged at work. The goal of HCM is to help employees perform well while meeting business goals. It covers areas like payroll, performance management, employee development, benefits administration, and workforce planning. In simple terms, it’s how companies take care of their workers to make sure the business runs smoothly.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Over the past few years, the need for better HCM practices has grown. As workplaces change due to technology, remote work, and shifting employee needs, companies are realizing they must invest more in their people. Employers are looking for ways to make employees happy, productive, and skilled. With greater competition for talent, businesses are focusing more on career development, training, and employee well-being, which has also led to more use of tools that support HCM, including software that can automate many tasks.

There have been several key trends in Human Capital Management. One of the biggest is the use of artificial intelligence and data analytics. Companies now use smart tools to help with hiring, tracking employee performance, and predicting future workforce needs. Another trend is the focus on employee experience making work more flexible, engaging, and personalized. Diversity, equity, and inclusion have also become important, with more HR teams playing a key role in shaping inclusive work environments. Mental health and well-being support have become part of everyday HCM efforts, too.

In recent years, several important events have shaped HCM. The COVID-19 pandemic pushed many businesses to rethink how they manage people, especially with the rise of remote work. Companies had to quickly adjust their HCM strategies to keep operations running and employees safe and engaged. This also led to an increased focus on digital tools and cloud-based HR systems. Another major shift has been the growing voice of employees, especially younger generations, who expect better work-life balance, purpose in their jobs, and opportunities to learn and grow.

Technology has become a key part of modern HCM. Many organizations are now using cloud platforms that bring all HR functions into one system, making it easier to manage employee data and automate tasks. Mobile apps, AI chatbots, and self-service portals have also improved how employees access HR services. These tools help HR teams spend less time on paperwork and more time on people-focused strategies. With more employees working from different locations, having strong digital systems has become essential.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

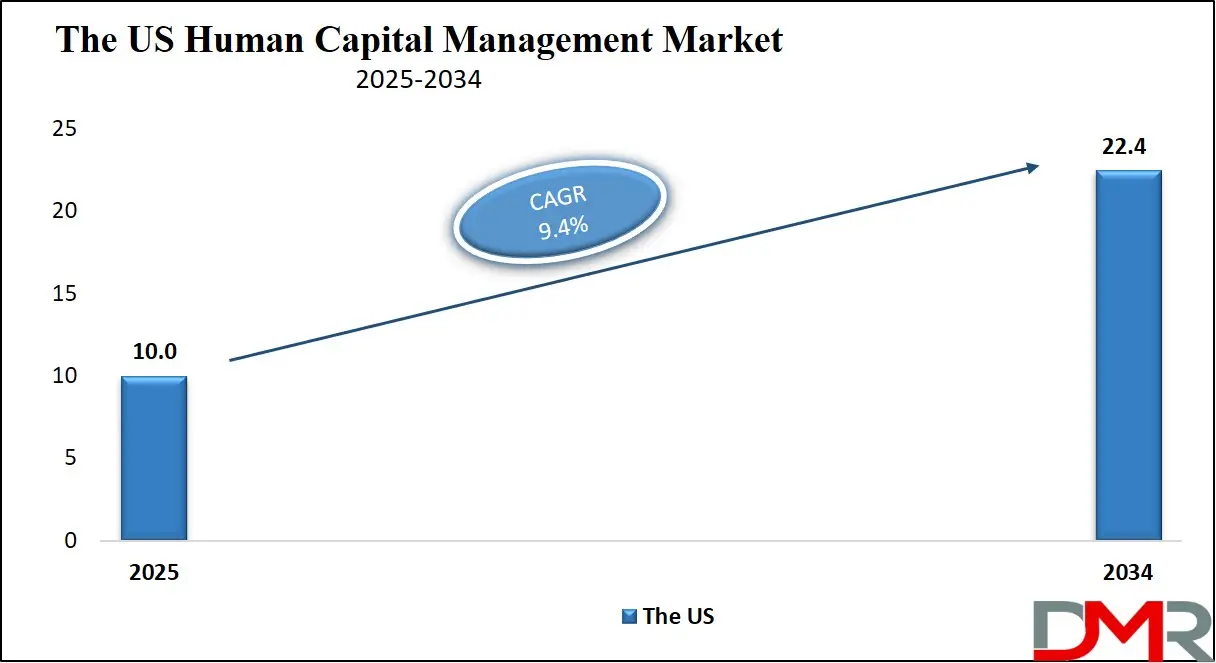

The US Human Capital Management Market

The US Human Capital Management Market size is projected to reach USD 10.0 billion in 2025 at a compound annual growth rate of 9.4% over its forecast period.

The US plays a major role in the Human Capital Management (HCM) market due to its advanced technology adoption and large corporate presence. Many US companies are early adopters of cloud-based and AI-powered HCM solutions, driving innovation in the field. The US market sets trends in employee experience, diversity and inclusion, and workforce analytics that influence global practices.

Additionally, strong regulatory requirements around data privacy and labor laws in the US push providers to develop secure and compliant systems. The demand for flexible work arrangements and continuous learning in US organizations also fuels HCM growth. Overall, the US acts as a major driver and testing ground for new HCM technologies and strategies that shape the global market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Human Capital Management Market

Europe Human Capital Management Market size is projected to reach USD 8.3 billion in 2025 at a compound annual growth rate of 8.7% over its forecast period.

Europe plays an important role in the Human Capital Management (HCM) market by focusing strongly on data privacy, employee rights, and workplace diversity. Strict regulations like GDPR require companies to adopt secure and compliant HCM systems, which encourages innovation in data protection and transparency. European organizations emphasize fair labor practices, inclusion, and employee well-being, influencing the development of tools that support these goals.

The region also shows steady adoption of cloud-based and AI-powered HCM solutions to improve workforce management and productivity. Additionally, Europe’s diverse workforce and multiple languages create a demand for flexible and customizable HCM platforms. Together, these factors make Europe a key market that shapes HCM trends with a strong focus on ethics, compliance, and employee experience.

Japan Human Capital Management Market

Japan Human Capital Management Market size is projected to reach USD 1.4 billion in 2025 at a compound annual growth rate of 13.1% over its forecast period.

Japan plays a unique role in the Human Capital Management (HCM) market, driven by its aging workforce and focus on efficiency. With a shrinking labor pool, Japanese companies prioritize talent retention, reskilling, and workforce planning to maintain productivity. There is growing interest in adopting advanced HCM technologies like AI and automation to support these goals. Japan also emphasizes employee well-being and work-life balance, encouraging companies to implement flexible work policies and health programs.

However, traditional work cultures sometimes slow the rapid adoption of new systems, creating a gradual shift toward digital transformation. Overall, Japan’s focus on overcoming demographic challenges while improving workforce management makes it an important market for tailored HCM solutions that balance innovation with cultural values.

Human Capital Management Market: Key Takeaways

- Market Growth: The Human Capital Management Market size is expected to grow by USD 41.6 billion, at a CAGR of 10.0%, during the forecasted period of 2026 to 2034.

- By Component: TheSoftware segment is anticipated to get the majority share of the Human Capital Management Market in 2025.

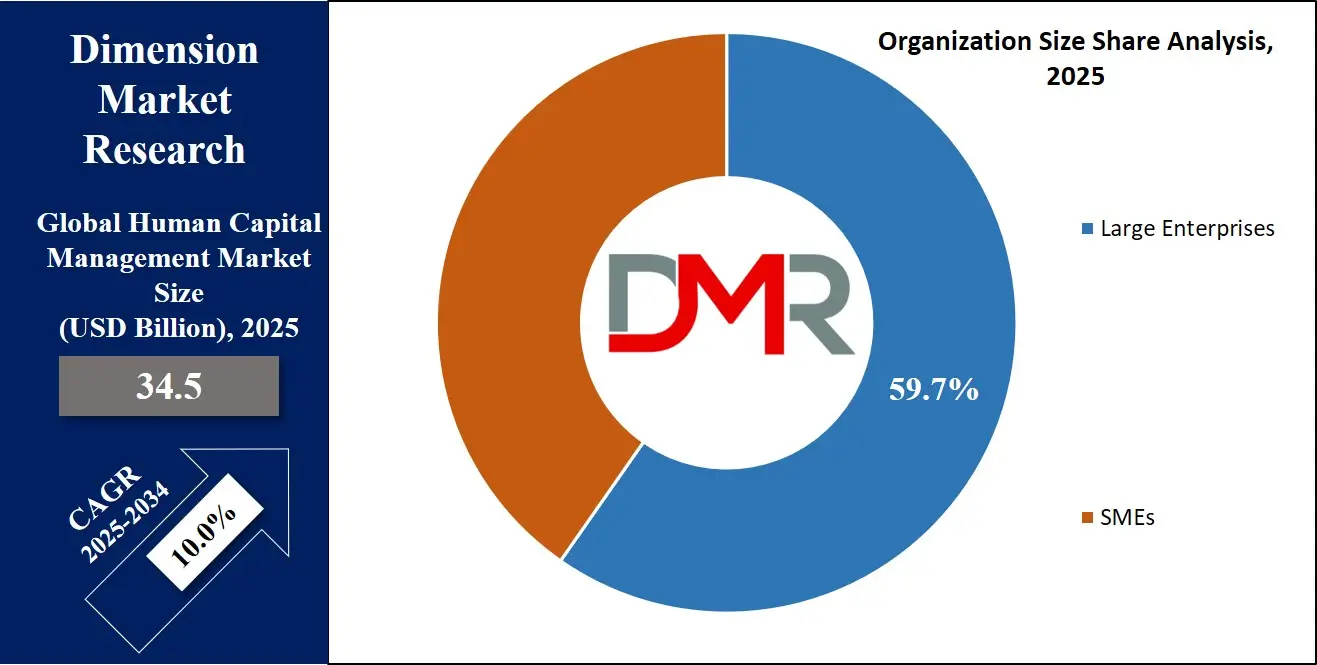

- By Organization Size: The large enterprise segment is expected to get the largest revenue share in 2025 in the Human Capital Management Market.

- Regional Insight: North America is expected to hold a 34.9% share of revenue in the Global Human Capital Management Market in 2025.

- Use Cases: Some of the use cases of Human Capital Management include employee performance management, learning & development tracking, and more.

Human Capital Management Market: Use Cases:

- Recruitment and Hiring Optimization: Human Capital Management systems streamline the entire hiring process from job posting to onboarding. They help track applicants, automate screening, and reduce time-to-hire, which makes it easier to find and hire the right talent efficiently.

- Employee Performance Management: HCM tools allow managers to set goals, track progress, and give feedback regularly, as it helps employees understand expectations and grow in their roles. It also supports fair evaluations and development planning.

- Learning and Development Tracking: Organizations use HCM systems to manage training programs and skill development. Employees can access learning materials, track their progress, and receive certifications. This supports career growth and closes skill gaps.

- Workforce Planning and Analytics: HCM platforms offer insights into workforce data like turnover, productivity, and staffing needs. Leaders can use these insights to plan for future roles and business goals. This helps in making smarter staffing and investment decisions.

Stats & Facts

- According to Pivotal Solution, 50% of HR professionals are already incorporating some form of artificial intelligence into their daily work routines, with AI-based recruiting tools improving speed-to-hire by 10% and overall efficiency by 30%, underscoring a growing reliance on automation to enhance HR operations.

- Based on findings from Pivotal Solution, 82% of HR leaders plan to increase their investment in workplace learning and development, while 59% say reskilling their workforce is critical for future success, reflecting a shift toward continuous employee education to meet evolving organizational needs.

- As reported by Pivotal Solution, companies that implement effective onboarding programs can reduce employee turnover by up to 87%, and those that support remote work see a 25% decline in attrition, illustrating the impact of structured onboarding and workplace flexibility on retention.

- Pivotal Solution notes that organizations with strong learning cultures report 30–50% higher employee engagement rates, and those that prioritize leadership development, currently a top priority for 65% of HR professionals, are better positioned for long-term performance.

- According to Pivotal Solution, employee engagement remains a challenge, with only 32% of U.S. employees reporting active engagement in 2022; however, initiatives such as personalized employee experiences can boost productivity by up to 15%, signaling the importance of tailored HR strategies.

- Pivotal Solution data reveals that 80% of employees feel more loyal to companies that promote diversity and inclusion, while 69% of job seekers consider a company's diversity stance when evaluating job offers, emphasizing the role of inclusive cultures in talent attraction and retention.

- Per Pivotal Solution, advancements in HR software for 2024 are heavily focused on AI integration, and with approximately 70% of HR processes expected to be automated by 2025, companies are poised to achieve significant operational time savings—up to 14 hours per week.

- According to Pivotal Solution, 60% of HR leaders believe their function will take a leading role in talent management and workforce planning, with 82% of organizations already leveraging technology to support these activities, highlighting HR’s strategic evolution.

- Pivotal Solution reports that flexible work arrangements are rated as a top benefit by 67% of employees, while telecommuting has been shown to increase worker productivity by 21%, reinforcing the value of adaptable workplace policies in boosting morale and performance.

- Based on Pivotal Solution insights, the average cost to hire a new employee is $4,129, and the time-to-fill averages 42 days; however, mobile-friendly job applications can increase candidate applications by 11%, and employee referrals enjoy a 45% two-year retention rate.

- According to Pivotal Solution, 46% of companies have streamlined their onboarding processes through new technologies, and 35% now use advanced analytics to monitor employee performance, suggesting a growing focus on data-driven HR management practices.

- Pivotal Solution indicates that while 80% of HR managers believe analytics improve company decision-making, 71% of executives still feel their HR analytics capabilities need improvement, revealing a performance gap that may drive future investments in predictive tools.

Market Dynamic

Driving Factors in the Human Capital Management Market

Increasing Adoption of Cloud-Based Solutions

One major driver for the growth of the Human Capital Management market is the rising adoption of cloud-based HCM solutions. These cloud platforms provide higher flexibility, scalability, and easier access compared to traditional systems. Businesses prefer cloud solutions because they allow employees and HR teams to access data anytime, anywhere, mainly with the rise of remote and hybrid work models.

Cloud-based HCM also reduces the demand for heavy upfront investments in IT infrastructure, making it attractive for companies of all sizes. In addition, cloud platforms often provide automatic updates and enhanced security features, which enhance user experience and data protection, which is pushing more organizations to switch to or upgrade their HCM systems, fueling market expansion.

Focus on Employee Experience and Talent Retention

Another key growth driver is the major focus on improving employee experience and retaining top talent. Organizations understand that engaged and satisfied employees are more productive and less likely to leave. HCM solutions now include features that personalize employee interactions, support career development, and offer wellness programs. With competition for skilled workers intensifying, companies are investing in tools that help them better understand employee needs and provide a positive workplace culture.

These efforts help reduce turnover rates and attract new talent, making employee experience a top priority. As a result, demand for advanced HCM systems that support these goals continues to rise, driving market growth.

Restraints in the Human Capital Management Market

High Implementation Costs and Complexity

One of the main challenges slowing the growth of the Human Capital Management market is the high cost and complexity involved in implementing these systems. For many organizations, especially small and medium-sized businesses, investing in a full-featured HCM platform can require significant financial resources and time.

The process often involves integrating with existing systems, customizing features, and training staff, which can be complicated and disruptive. This complexity can lead to resistance from employees and managers who are accustomed to older ways of working. As a result, some companies delay or avoid adopting new HCM solutions, limiting market expansion.

Data Privacy and Security Concerns

Concerns around data privacy and security also act as restraints on the HCM market. Since HCM systems handle sensitive employee information like personal details, payroll data, and performance records, companies worry about protecting this data from breaches or misuse. Strict regulations around data protection require organizations to ensure compliance, which can add extra costs and complexity.

Fear of cyberattacks or accidental data leaks makes some businesses hesitant to fully adopt cloud-based or digital HCM solutions. These security concerns can slow down adoption and growth in the market.

Opportunities in the Human Capital Management Market

Expansion in Emerging Markets

Emerging markets provide a major opportunity for the Human Capital Management market to grow. Many businesses in developing regions are modernizing their HR practices and seeking efficient ways to manage their workforce as they expand. With increasing internet penetration and digital transformation in these areas, there is a rising demand for affordable and scalable HCM solutions.

Companies entering these markets can customize their offerings to local needs and compliance requirements, opening new revenue streams. Additionally, the growing young workforce in emerging economies creates a strong need for tools that support talent development and engagement, making these regions a fertile ground for HCM growth.

Integration of Artificial Intelligence and Automation

The integration of artificial intelligence (AI) and automation into HCM systems offers another exciting opportunity for the market. AI can improve recruitment by quickly screening candidates, improving employee experience through personalized learning recommendations, and providing predictive analytics for better workforce planning.

Automation reduces manual HR tasks, freeing up time for strategic initiatives. As organizations look for more efficient ways to handle complex HR processes, AI-powered HCM solutions are becoming increasingly valuable. Providers that innovate in this space can gain a competitive edge by offering smarter, faster, and more intuitive tools that meet evolving business needs.

Trends in the Human Capital Management Market

Integration of AI and Human Resources Functions

A major trend in the Human Capital Management (HCM) market is the integration of artificial intelligence (AI) with HR functions. Companies are increasingly adopting AI tools to automate tasks like recruitment, performance evaluations, and employee engagement analysis. For instance, AI can streamline the hiring process by screening resumes and predicting candidate success, thereby minimizing time-to-hire and improving hiring quality.

In addition, AI-driven analytics provide HR departments with insights into employee performance and potential areas for development, allowing more informed decision-making, which not only enhances operational efficiency but also allows HR professionals to focus on strategic initiatives that contribute to organizational growth.

Emphasis on Employee Well-being and Experience

Another notable trend is the major emphasis on employee well-being and experience within HCM strategies. Organizations are recognizing that a positive employee experience leads to higher engagement, productivity, and retention. To foster this, companies are implementing complete well-being programs that include mental health support, flexible work arrangements, and initiatives promoting work-life balance.

Moreover, HCM platforms are evolving to offer personalized experiences, such as tailored learning and development opportunities, and tools that facilitate open communication and feedback. By prioritizing employee well-being, organizations aim to create a supportive work environment that attracts and retains top talent.

Research Scope and Analysis

By Component Analysis

Software will be leading the Human Capital Management market in 2025 with a share of 64.9%, playing a key role in the market’s growth. These software solutions help companies manage employee information, payroll, performance, and training all in one place. With easy-to-use platforms and cloud technology, businesses can quickly adopt these tools and improve how they handle HR tasks.

The rise of mobile-friendly and AI-enabled features also makes HR processes faster and more accurate. Software helps reduce manual work, allowing HR teams to focus on supporting employees and making better decisions. As companies seek better ways to engage and develop their workforce, software continues to be a vital part of HCM growth worldwide.

Further, Services have shown significant growth and is expected to sustain it over the forecast period in the Human Capital Management market. Consulting, implementation, and support services help companies get the most out of their HCM systems by customizing solutions to fit specific needs. These services assist with training HR staff, managing data migration, and maintaining smooth system operation.

Many businesses rely on expert guidance to ensure successful adoption and ongoing improvements. As HCM technology becomes more advanced, the demand for professional services increases, helping organizations use their HR tools more effectively and maximize their investment. This growth in services supports the overall expansion of the HCM market.

By Deployment Mode Analysis

Based on deployment mode, cloud deployment will dominate the Human Capital Management market in 2025 with a share of 68.8%, driving significant growth in the industry. Cloud-based HCM solutions offer easy access from anywhere, allowing employees and HR teams to work remotely and stay connected. These platforms provide scalability, meaning businesses can easily adjust their usage based on their needs.

Cloud systems also reduce the need for costly hardware and IT maintenance, making them affordable for companies of all sizes. With automatic updates and strong security features, cloud deployment helps organizations stay up-to-date and protect sensitive employee data. The flexibility and convenience of cloud solutions make them a popular choice, encouraging more businesses to adopt digital HR tools and boosting the overall growth of the HCM market.

Further, on-premises deployment will experience significant growth over the forecast period within the Human Capital Management market. Many organizations prefer on-premises systems for the control and customization they offer, especially those with strict data privacy and regulatory requirements. On-premises solutions allow companies to manage their infrastructure and tailor software features to fit specific business needs, as it appeal to large enterprises and industries where security is a top priority.

Despite the rise of cloud options, on-premises remains important for companies that want to keep sensitive employee data in-house. The continued investment and enhancements in on-premises HCM systems support steady growth and provide an alternative for businesses looking for direct control over their HR technology.

By Organization Size Analysis

Based on organization size, large enterprises are set to be a prominent segment in the Human Capital Management market in 2025, with a share of 59.7%, playing a major role in its growth. These organizations often have complex HR needs due to their large workforce and multiple locations, which drives the need for comprehensive HCM solutions. Large enterprises invest heavily in advanced software to manage payroll, performance, recruitment, and compliance efficiently.

Their focus on improving employee engagement and streamlining HR processes encourages the adoption of modern technologies like AI and analytics. Additionally, big companies have the resources to implement customized and scalable systems that support global operations. The scale and complexity of large enterprises make them key contributors to the expanding HCM market, pushing innovation and driving market growth worldwide.

The SMEs have shown significant growth over the forecast period in the Human Capital Management market. Smaller businesses are majorly adopting HCM solutions to manage their workforce more effectively as they grow. Cloud-based and affordable platforms make it easier for SMEs to access tools that were once only available to large enterprises.

These companies use HCM systems to simplify hiring, payroll, and employee management without needing large HR teams. As SMEs face talent competition, they focus more on employee development and retention using technology. The rising adoption of flexible and scalable HCM solutions by SMEs supports steady market growth and opens new opportunities for vendors targeting this segment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Industry Vertical Analysis

IT & Telecom is set to dominate the Human Capital Management market in 2025 with a share of 20.7%, mainly driving growth in the sector. This industry relies heavily on skilled talent and rapid innovation, making effective HR management critical. IT & Telecom companies use HCM solutions to handle recruitment, talent retention, and continuous upskilling to keep pace with fast-changing technologies. The need to manage remote and hybrid workforces has also increased demand for flexible and cloud-based HR tools.

Additionally, these companies focus on employee engagement and performance analytics to stay competitive. The fast growth and digital nature of the IT & Telecom sector encourage widespread adoption of advanced HCM systems, boosting overall market expansion.

Further, healthcare has shown significant growth over the forecast period in the Human Capital Management market. The industry experiences unique challenges such as staff shortages, high turnover, and the need for continuous training. HCM solutions help healthcare organizations manage scheduling, credentialing, and compliance more effectively.

With a focus on improving patient care, healthcare providers use these systems to support workforce planning and employee well-being. The rise of telehealth and digital tools also drives demand for modern HR technologies. As healthcare expands and adapts, the adoption of HCM platforms helps streamline operations and retain skilled professionals, contributing to steady market growth.

The Human Capital Management Market Report is segmented on the basis of the following:

By Component

-

Software

- Core HR

- Talent Management

- Workforce Management

- Services

- Managed Services

- Professional Services

- Consulting

- Implementation & Integration

- Support & Maintenance

By Deployment Mode

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- BFSI

- IT & Telecom

- Healthcare

- Retail

- Manufacturing

- Government

- Education

- Hospitality

- Others

Regional Analysis

Leading Region in the Human Capital Management Market

North America is estimated to lead the Human Capital Management market in 2025 with a share of 34.9%, playing a crucial role in the industry’s growth. The region benefits from the presence of many large enterprises and a strong focus on digital transformation, which drives the adoption of advanced HCM solutions. North American companies prioritize improving employee experience, workforce planning, and compliance with strict labor laws, increasing demand for efficient HR technologies.

The rise of remote work and emphasis on diversity and inclusion further fuel the need for flexible and cloud-based HCM systems. Additionally, innovation in AI, analytics, and automation within the region supports smarter HR decision-making. With continuous investments in HR software and services, North America remains a key market influencing global trends and encouraging the development of new tools that enhance workforce management and productivity.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Human Capital Management Market

Asia Pacific is showing significant growth in the Human Capital Management market and is expected to experience rapid growth over the forecast period, driven by rapid digital transformation and expanding businesses in the region. Many companies are adopting cloud-based and mobile-friendly HCM solutions to manage a diverse and growing workforce more efficiently. The region’s rising focus on talent acquisition, employee engagement, and workforce planning increases demand for advanced HR technologies.

Additionally, increasing government support for digital initiatives and improvements in internet infrastructure are helping businesses modernize their HR processes. As organizations in Asia Pacific prioritize employee development and compliance with evolving labor laws, the adoption of innovative HCM platforms continues to rise, making this region a key contributor to global market growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Human Capital Management (HCM) market is growing quickly and becoming more competitive as more organizations focus on improving how they manage people. Many providers are offering various tools, from payroll and time tracking to employee engagement, performance management, and learning systems. The competition is increasing because businesses of all sizes, from small startups to large corporations, are looking for flexible and user-friendly solutions. Companies prefer platforms that are cloud-based, mobile-friendly, and can easily connect with other systems.

As remote and hybrid work continues, demand is rising for tools that support virtual teams and real-time data insights. This competitive space pushes providers to keep innovating, offering better features, and making sure their solutions meet the changing needs of modern workplaces.

Some of the prominent players in the global Human Capital Management are:

- Workday

- ADP

- Paychex

- SAP

- Oracle

- BambooHR

- Paycom

- Namely

- Infor HCM

- PeopleSoft

- Keka HR

- Sage HR

- Breathe HR

- 15Five

- Odoo

- JazzHR

- Papaya Global

- SumHR

- Other Key Players

Recent Developments

-

In May 2025, Darwinbox launched its Model Context Protocol (MCP) Server in Hyderabad, becoming the first major HCM platform to do so., which allows any MCP-compatible AI agent in a customer’s system to securely access Darwinbox, trigger actions, and drive intelligent workflows across enterprise platforms. By offering a unified protocol, MCP eliminates silos between HCM, Finance, CRM, and other systems, simplifying cross-functional processes and enhancing collaboration without complex integrations.

- In August 2024, ANSR acquired hrEntries, a human capital management platform, through an all-stock deal, which strengthens ANSR’s core strategy by expanding its technology offerings and integrating hrEntries into the “GCC SuperApp” platform that includes Talent, Workspace, HR Ops, and Payroll solutions. Co-Founder Vikram Ahuja stated that the acquisition enhances their mission to simplify GCC operations, offering clients greater transparency, flexibility, and control in managing global teams and delivering improved employee experiences.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 34.5 Bn |

| Forecast Value (2034) |

USD 81.2 Bn |

| CAGR (2025–2034) |

10.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 10.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software and Services), By Deployment Mode (On-premise and Cloud-based), By Organization Size (Small & Medium Enterprises (SMEs) and Large Enterprises), By Industry Vertical (BFSI, IT & Telecom, Healthcare, Retail, Manufacturing, Government, Education, Hospitality, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Workday, ADP, Paychex, SAP, Oracle, BambooHR, Paycom, Namely, Infor HCM, PeopleSoft, Keka HR, Sage HR, Breathe HR, 15Five, Odoo, JazzHR, Papaya Global, and SumHR, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Human Capital Management Market?

▾ The Global Human Capital Management Market size is expected to reach a value of USD 34.5 billion in 2025 and is expected to reach USD 81.2 billion by the end of 2034.

Which region accounted for the largest Global Human Capital Management Market?

▾ North America is expected to have the largest market share in the Global Human Capital Management Market, with a share of about 34.9% in 2025.

How big is the Human Capital Management Market in the US?

▾ The Human Capital Management Market in the US is expected to reach USD 10.0 billion in 2025.

Who are the key players in the Global Human Capital Management Market?

▾ Some of the major key players in the Global Human Capital Management Market are Workday, ADP, Paychex, and others

What is the growth rate in the Global Human Capital Management Market?

▾ The market is growing at a CAGR of 10.0 percent over the forecasted period.