HVAC systems, designed for indoor & vehicular comfort, allow both desirable indoor air quality & thermal comfort. They are an essential component not only for homes, including single-family residences, apartments, hotels, & senior living facilities but also for medium to large industrial & office establishments such as hospitals. These systems play a major role in keeping safe & healthful indoor conditions by controlling temperature & humidity through the discrete use of outdoor air intake.

Further, the application of HVAC systems stretches a diverse array of settings & building categories, including spaces like shopping centers, industrial complexes, warehouses, & more. These systems play a major role in establishing optimal climate regulation, providing both heating & cooling solutions.

Moreover, they make sure of the critical aspects of air pressure & air quality, making a comfortable & secure environment for building occupants. Integration with Air Conditioning Systems has become especially critical in regions experiencing rising global temperatures.

The HVAC systems market continues to gain momentum with upcoming events and conferences like the 2024 AHR Expo and the Smart HVAC Summit, where industry leaders gather to discuss advancements in energy-efficient technologies, smart systems integration, and sustainable cooling and heating solutions. Recent news highlights an increased adoption of eco-friendly refrigerants and the growing importance of IoT-enabled HVAC systems for residential and commercial spaces.

Surveys reveal that 70% of consumers prioritize energy efficiency in their HVAC purchases, reflecting a shift toward greener choices. Industry pools further underscore significant growth opportunities in emerging markets, driven by urbanization, climate change, and the need for modernized infrastructure. These developments position the HVAC market for robust expansion, innovation, and collaboration.

According to Sensible Digs, HVAC systems significantly impact energy consumption and sustainability. In the U.S., nearly 100 million homes, or over 70% of the 142 million housing units, benefit from air conditioning, contributing to 12% of annual household energy usage. Traditional HVAC systems operate using 3,500 watts on average and run two to three times per hour for 10–15 minutes.

Geothermal HVAC systems offer a sustainable alternative, achieving 400% efficiency. The industry also plays a crucial role in employment, with California leading with over 187,000 workers, followed by New York with approximately 69,400. These trends underline the market's scale and evolving efficiency focus, especially as HVAC solutions increasingly align with

Energy Storage innovations and sustainable infrastructure upgrades.

According to Workyard, the U.S. HVAC systems market sees over $10 billion spent annually on repairs and maintenance, highlighting the sector's critical role in infrastructure. However, the industry faces a pressing shortage of 110,000 technicians, with 25,000 leaving the workforce each year. Geographically, the Midwest (92%) and South (93%) dominate AC adoption, compared to the West’s 73%, with Pacific Coast usage as low as 49%.

Business activity is concentrated in California (12,286 businesses), Florida (9,797), and Texas (9,096), signaling robust demand in warmer regions. Addressing workforce gaps and regional trends will be vital for sustained market growth and efficiency. Additionally, the rise of climate-adaptive infrastructure like

Smart Greenhouse projects is further driving demand for advanced HVAC technologies that can maintain precise temperature and humidity conditions.

Market Dynamic

The rapid growth in industrialization & urbanization across the globe stands out as a major driving factor boosting the market's expansion. The significant growth in the construction of diverse commercial & residential structures on a global scale is creating significant demand for HVAC equipment. These systems serve as major components for space heating & cooling, ventilation control, humidity management, & air purification.

Moreover, within commercial buildings, heating, ventilation, & air-conditioning collectively account for a major share of energy consumption, often exceeding 40%, according to reports by the US Department of Energy. Given this significant energy usage, improvement in HVAC equipment efficiency directly translates into a substantial reduction in overall building operational costs.

However, the high initial cost of HVAC equipment can be a challenge to demand, discouraging customers, especially homeowners & small business owners with restricted budgets, from purchasing or upgrading their systems. Furthermore, the large expense can cause extended periods to recover the investment, which means that even though a new system might save on energy costs over time, it could take years to balance out the initial expenditure.

Research Scope and Analysis

By Type

The dominance of the air conditioning segment within the HVAC systems market is quite evident in 2023, as it secures the largest share of revenue. Moreover, as indicated by data from the International Energy Agency (IEA), air cooling's significant contribution to global electricity consumption, surpassing 10%, proves its significant impact, as this data helps in explaining the extended growth and lead of the air conditioning sector within the broader HVAC equipment market.

Further, the growing adoption of air conditioners, especially in warm regions, has been increased by rising populations & disposable incomes. This trend has further fueled the need for cooling systems like air conditioners (ACs) & unitary ACs.

Furthermore, apart from air conditioning, the heating equipment segment also led in driving the market with incremental growth over time. The long-term projection for this segment shows a growth, driven by the steady shift from conventional fuel-based models to more efficient low-carbon alternatives. Additionally, the expansion of heat pumps powered by solar energy is anticipated to create new opportunities for segment expansion throughout the forecast period.

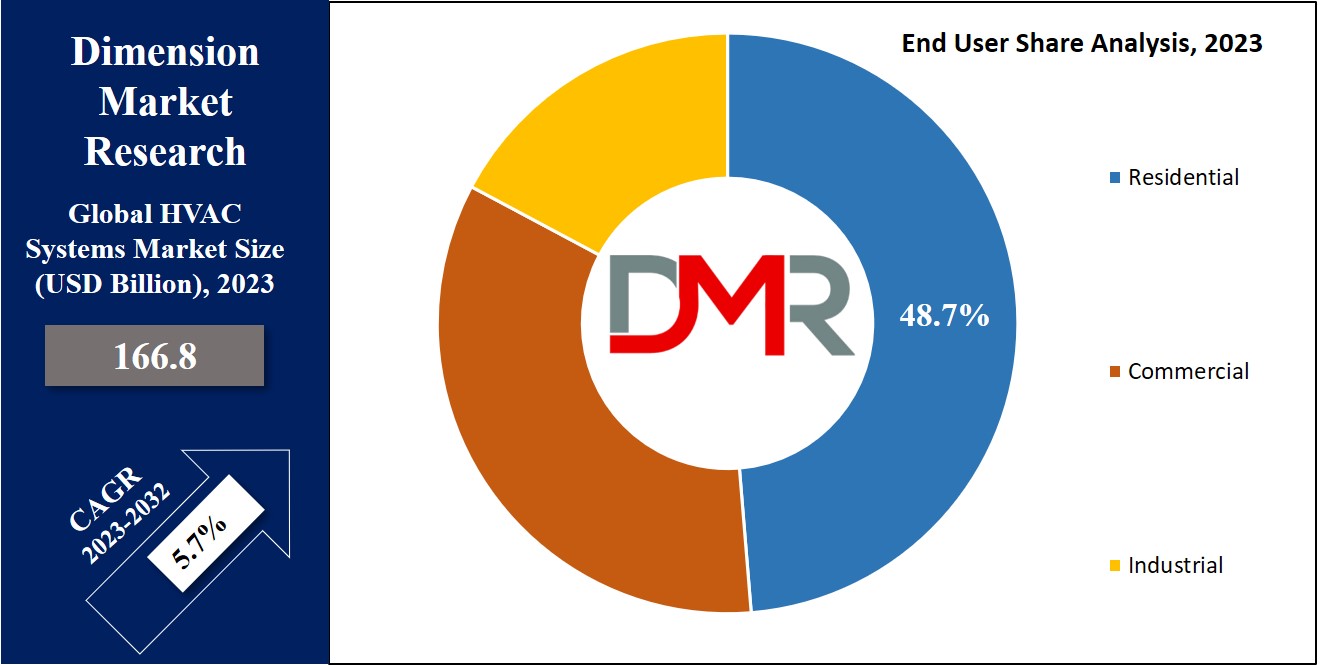

By End User

In 2023, the HVAC systems market is primarily led by the residential segment, constituting the biggest portion of the overall revenue of the global market. The growth in both multi-family residences & individual home ownership is creating the way for significant growth within the residential HVAC sector.

While the need for residential HVAC solutions is projected to notice relatively stable patterns in developed regions, the spotlight induces more on newer markets, particularly in developing economies. This divergence can be said owing to the growth in population base in emerging markets & the advanced state of HVAC markets in developed regions.

Further, significant growth is also evident within the commercial HVAC sector, providing significant opportunities. Major factors like the integration of eco-friendly & intelligent technologies, alongside the adoption of automated systems, are anticipated to have a major role in influencing the growth of the commercial HVAC market in the coming years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global HVAC Systems Market Report is segmented on the basis of the following:

By Type

- Heat Pump

- Air Conditioning Equipment

- Heating Equipment

- De-humidifiers/Humidifiers

By End User

- Residential

- Commercial

- Industrial

Regional Analysis

In 2023, the Asia Pacific region holds a significant market share, contributing about

37.5% of the total revenue in the Global HVAC Systems Market. The region's excellent growth story owes much to increasing urban living, a rise in population, & enhanced consumer spending power. Lately, the commercial sector has also seen growth, opening up exciting possibilities for future regional progress.

Further, regions like North America & Europe also noticed significant growth In the HVAC Systems market and are anticipated to grow more over the forecasted period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Within the global HVAC systems market, vendors are adopting inorganic growth strategies as their go-to approach. To expand their market presence & outdo competitors, companies are looking into strategic partnerships, mergers & acquisitions. The short-term aim for Original Equipment Manufacturers (OEMs) centers on technological development & improved energy efficiency to secure ongoing relevance & profitability.

Alongside expanding their market footprint, market players are putting a strong emphasis on R&D This focuses on introducing technologically advanced & distinctive products, allowing them to have a competitive edge. Moreover, companies are constantly positioning product development with regional regulatory norms, reducing the risk of business upsets due to non-compliance.

For instance, in November 2022, Daikin introduced the Emura indoor climate management system, developed to both purify indoor air & regulate interior temperatures through heating & cooling functionalities. Emura possesses a polished & modest design, catering to a wide range of indoor spaces such as living rooms & offices, with a core focus on delivering efficient & precise temperature control.

Some of the prominent players in the Global HVAC Systems Market are

- LG Electronics

- Johnson Controls

- Emerson Electric

- Samsung

- Daikin Industries

- Mitsubishi Electric

- Bosch

- Zehnder

- Systemair

- Trane

- Other Key Players

Recent Developments

- June 2025: Johnson Controls-Hitachi Air Conditioning unveiled a new portfolio of residential ductless heat pumps using low-GWP refrigerant R-32. The “airHome” mini-splits are designed for cold climates, offering improved reliability, indoor air quality, and simplified maintenance.

- March 2025 (Q1): Trane released updates to its Modular Self-Contained Units, expanding capacity from 20 to 110 tons, introducing low-GWP R-454B refrigerant with leak detection, and standardizing Digital Symbio 500 controls. They also expanded the efficient CoolSense DOAS terminal units and enhanced Tracer system cybersecurity and A2L refrigerant mitigation sequences.

- August 2025: Sentinel Capital Partners agreed to sell NSI Industries’ HVAC division—including the Duro Dyne and Supco brands—to Lennox International for approximately $550 million in cash. The division recorded around $225 million in sales in 2024 and complements Lennox’s existing U.S. and Canadian HVAC offerings.

- May 2025: Samsung Electronics announced its acquisition of Germany’s FlaktGroup for about €1.5 billion ($1.68 billion). The strategic deal strengthens Samsung’s cooling solutions for high-demand data centers, particularly those supporting AI workloads.

- August 2025: Robert Bosch GmbH acquired a majority (74.2%) stake in Johnson Controls-Hitachi Air Conditioning India (JCHAI), marking its largest global acquisition. This enables Bosch to expand significantly in India’s growing air conditioning and climate technology market.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 166.8 Bn |

| Forecast Value (2032) |

USD 275.0 Bn |

| CAGR (2023-2032) |

5.7% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Heat Pump, Air Conditioning Equipment, Heating Equipment, De-humidifiers/Humidifiers), By End User (Residential, Commercial and Industrial) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

LG Electronics, Johnson Controls, Emerson Electric, Samsung, Daikin Industries, Mitsubishi Electric, Bosch, Zehnder, Systemair, Trane, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |