Market Overview

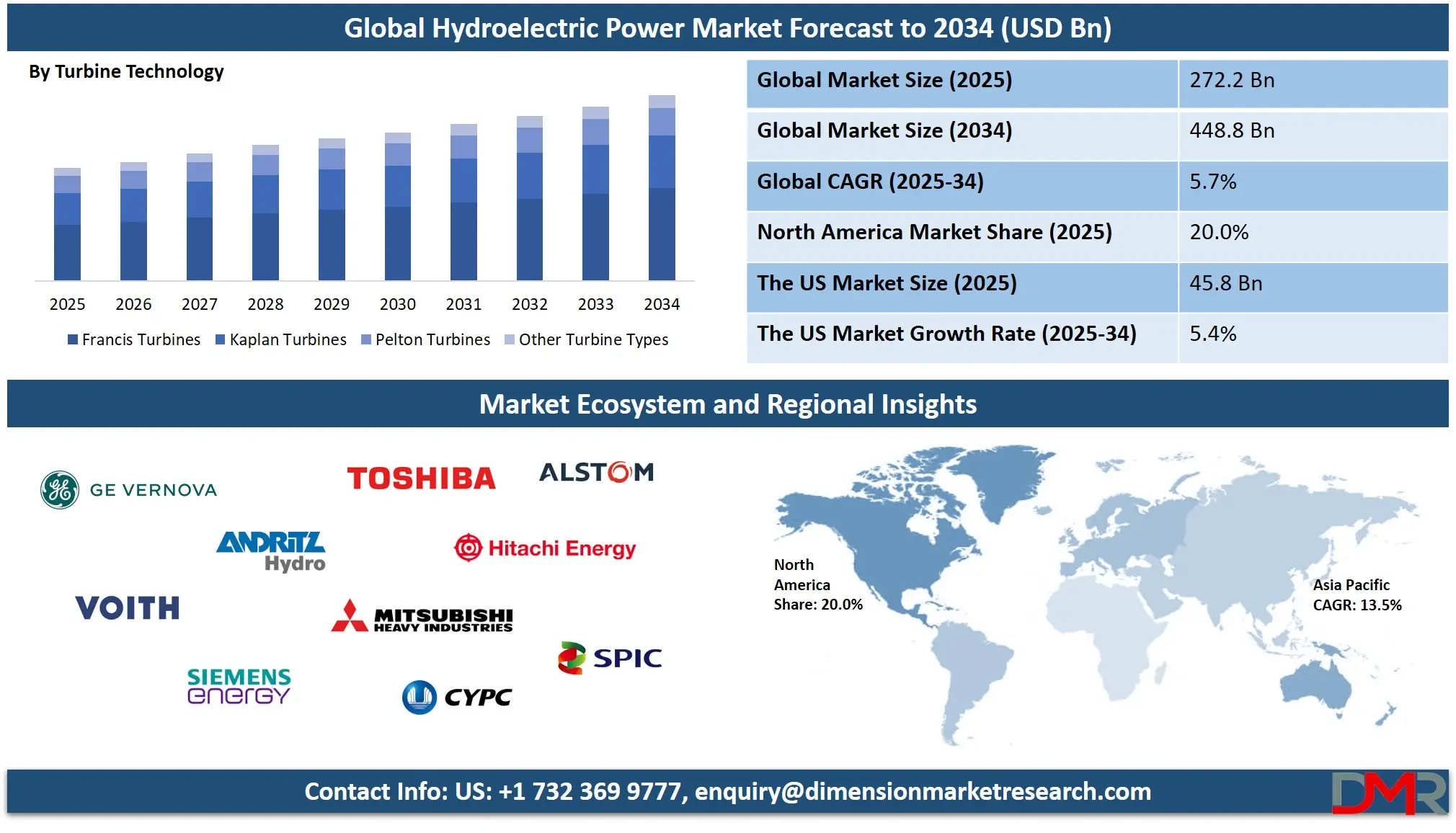

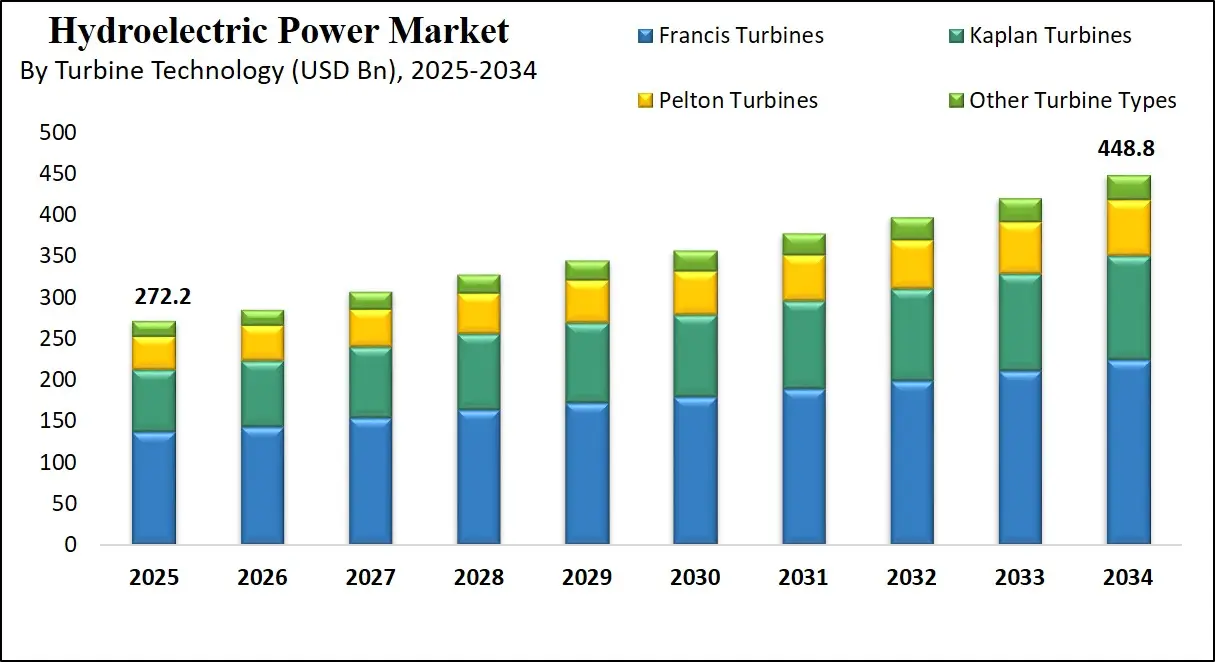

The Global Hydroelectric Power Market is projected to reach USD 272.2 billion in 2025 and is expected to grow to USD 448.8 billion by 2034, reflecting a robust CAGR of 5.7% driven by rising renewable energy deployment, increasing grid stability requirements, modernization of aging hydropower infrastructure and growing investments in sustainable electricity generation.

Hydroelectric power refers to the generation of electricity using the natural movement of water through dams, reservoirs or flowing rivers where the potential and kinetic energy of water is converted into mechanical energy by turbines and then transformed into electrical energy through generators. This form of renewable energy relies on gravity driven water flow and consistent hydrological cycles which makes it one of the most stable and mature clean energy technologies.

It supports long term energy security, helps manage seasonal water resources and offers flexible power dispatch capabilities that complement other renewable sources like wind and solar.

The global hydroelectric power market represents the complete ecosystem of technologies, infrastructure, services and operational models involved in the development, modernization and management of hydro stations across regions. It includes storage based hydropower, run of river systems and pumped storage facilities which play a central role in grid stability, peak load balancing and renewable integration. The market is shaped by growing electricity demand, climate resilience planning, rising investments in sustainable energy and increasing refurbishment of aging plants as nations transition toward low emission power systems.

This market also reflects extensive participation from equipment manufacturers, engineering firms, utility companies and independent producers that work together on construction, turbine installation, digital monitoring and long duration energy storage solutions. Urbanization, water management demands, carbon neutrality targets and the expansion of smart grids further drive global hydropower deployment, creating opportunities for efficiency upgrades, digital automation, advanced turbines, spillway improvements and optimized energy storage operations across both developed and emerging economies.

The US Hydroelectric Power Market

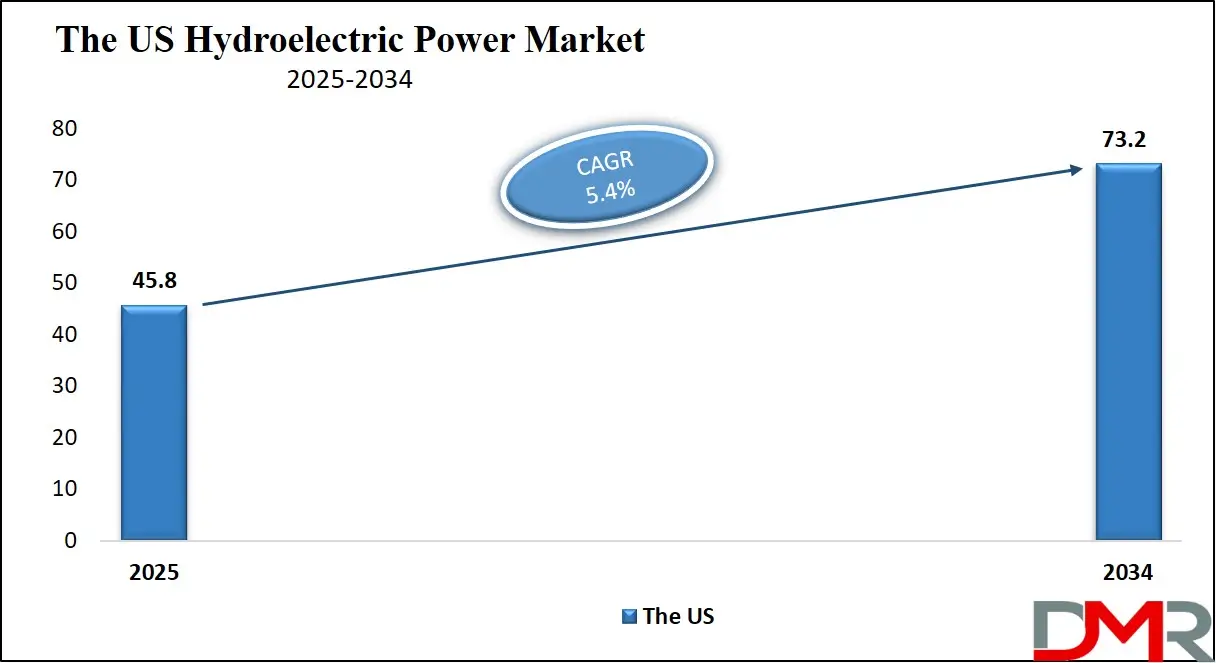

The U.S. Hydroelectric Power market size is projected to be valued at USD 45.8 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 73.2 billion in 2034 at a CAGR of 5.4%.

The United States hydroelectric power market plays a crucial role in the nation’s clean energy portfolio, contributing reliable baseload electricity through a combination of large dams, run of river facilities and pumped storage systems. The market is shaped by extensive federal and state level initiatives that focus on renewable energy expansion, grid modernization and climate resilience. With many hydropower assets operating for several decades, a major share of current activity centers on plant refurbishment, digitalization, turbine upgrades and improved water flow management.

These enhancements help increase generation efficiency, extend operational life and strengthen grid reliability, especially as the nation integrates higher volumes of wind and solar energy. Growing emphasis on long duration energy storage and disaster readiness also supports pumped storage hydropower development in regions with increasing power imbalances and extreme weather conditions.

The US hydroelectric market is further influenced by strong participation from federal agencies such as the US Bureau of Reclamation and the US Army Corps of Engineers, along with regional utilities and private developers. Expansion opportunities arise from upgrading non powered dams, improving fish passage systems, enhancing environmental sustainability and deploying advanced control systems for flexible power dispatch.

Strategic investments in low impact hydropower technologies, rural electrification, water resource optimization, and carbon free electricity targets reinforce long term market stability. Combined with rising demand for clean baseload generation, grid flexibility, drought resilient power solutions and eco friendly infrastructure, the US hydropower sector continues to evolve into a modernized and highly efficient segment of the broader renewable energy landscape.

Europe Hydroelectric Power Market

The European hydroelectric power market is projected to reach USD 50.0 billion in 2025, reflecting the region’s strong focus on renewable energy adoption, grid modernization, and decarbonization initiatives. Countries such as Norway, France, Germany, and Italy have historically relied on hydropower for a significant portion of their electricity generation, and ongoing investments in turbine upgrades, digital control systems, and small to medium scale hydropower plants are further supporting market growth.

The presence of well-established regulatory frameworks and incentives for clean energy deployment also strengthens Europe’s position as a mature and stable hydropower market within the global landscape.

The market in Europe is expected to grow at a CAGR of approximately 4.5%, driven by modernization of aging infrastructure, integration of advanced monitoring and predictive maintenance technologies, and the expansion of pumped storage facilities to enhance grid flexibility. Focus on low impact and environmentally friendly hydropower projects, along with government-backed sustainability targets, is encouraging investment in smaller-scale run of river plants and non-powered dam conversions.

Additionally, increasing demand for reliable renewable baseload generation to complement intermittent sources such as wind and solar is supporting steady growth in the European hydroelectric power market.

Japan Hydroelectric Power Market

The Japanese hydroelectric power market is projected to reach USD 14.0 billion in 2025, supported by the country’s emphasis on renewable energy integration, energy security, and climate change mitigation. Japan has a long history of hydropower utilization, with a mix of large-scale dams and smaller run of river projects contributing to regional electricity supply.

The market benefits from government policies promoting clean energy, grid modernization programs, and incentives for refurbishing aging hydropower infrastructure. Investments in advanced turbine technologies, digital control systems, and environmental compliance measures further strengthen the market’s foundation and support sustainable growth.

The market in Japan is expected to grow at a CAGR of approximately 3.8%, driven by modernization efforts, efficiency improvements, and the expansion of small and medium hydropower plants to meet localized energy needs. Focus on pumped storage hydropower to stabilize grids with increasing shares of solar and wind energy is a key growth factor. Additionally, environmental sustainability initiatives, reduced carbon emission targets, and technological upgrades in monitoring and predictive maintenance are contributing to steady market expansion. These trends position Japan’s hydroelectric power sector as a reliable and increasingly modernized component of the nation’s renewable energy strategy.

Global Hydroelectric Power Market: Key Takeaways

- Market Value: The global Hydroelectric Power market size is expected to reach a value of USD 448.8 billion by 2034 from a base value of USD 272.2 billion in 2025 at a CAGR of 5.7%.

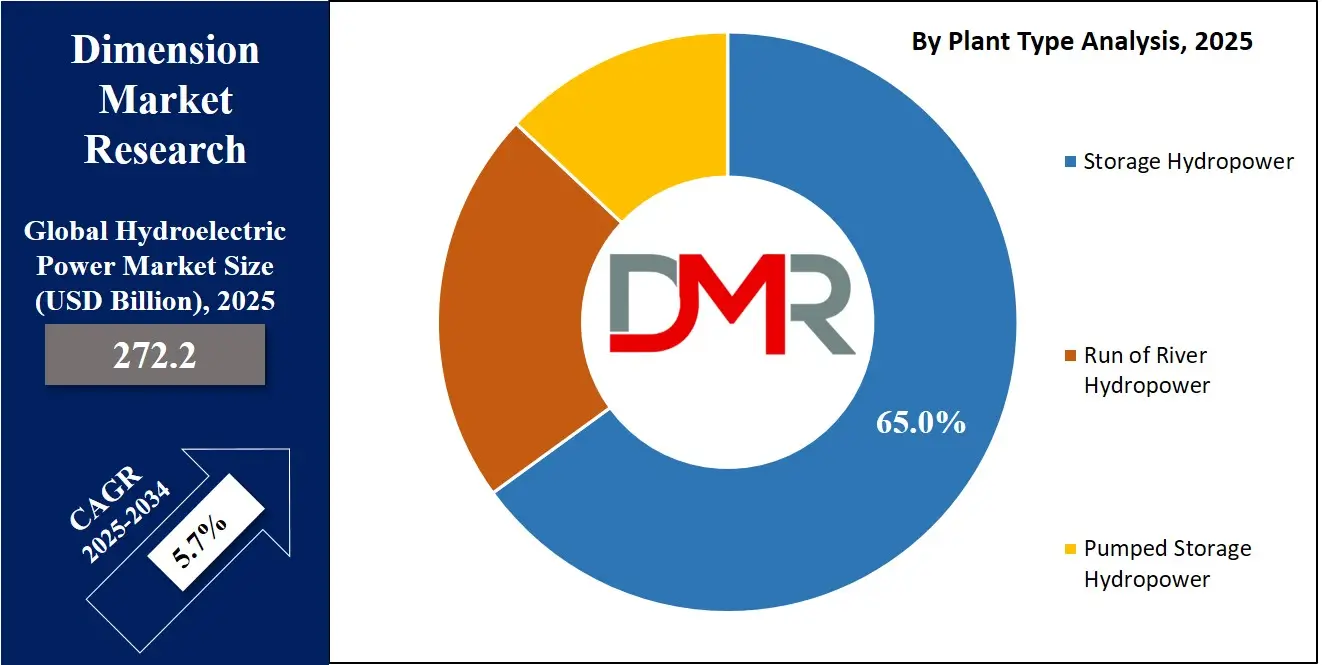

- By Plant Type Segment Analysis: Storage Hydropowers are expected to maintain their dominance in the plant type segment, capturing 65.0% of the total market share in 2025.

- By Plant Capacity Segment Analysis: Large Hydropower Plants (Above 100 Megawatts) are anticipated to dominate the plant capacity segment, capturing 78.0% of the total market share in 2025.

- By Turbine Technology Segment Analysis: Francis Turbines will dominate the turbine technology segment, capturing 50.0% of the market share in 2025.

- By Ownership Segment Analysis: Government and National Utility Ownership will account for the maximum share in the ownership segment, capturing 60.0% of the total market value.

- By Application Segment Analysis: Utility Scale Power Generation will dominate the application segment, capturing 82.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global Hydroelectric Power market landscape with 49.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Hydroelectric Power market are GE Vernova, Andritz Hydro, Voith Hydro, Siemens Energy, Toshiba Energy Systems, Mitsubishi Heavy Industries, Alstom Hydro, Hitachi Energy, China Yangtze Power Company, State Power Investment Corporation, Electricité de France, RusHydro, Statkraft, and Others.

Global Hydroelectric Power Market: Use Cases

- Utility Scale Renewable Power Generation: Hydroelectric power is widely used for large scale renewable electricity generation, supplying consistent baseload energy to national grids. Its ability to run continuously with high efficiency makes it a dependable backbone for clean energy portfolios and supports long term energy security. Utility operators leverage hydropower plants to reduce dependence on fossil fuels, stabilize voltage and frequency and ensure uninterrupted power delivery during high demand periods.

- Grid Flexibility and Peak Load Management: Hydropower facilities, especially pumped storage stations, provide fast response capabilities that help balance variable renewable sources such as wind and solar. Their rapid start up times and flexible generation make them essential for peak load management, frequency regulation and emergency power restoration. This capability strengthens grid reliability, enhances renewable energy integration and supports stable power system operations.

- Water Resource and Environmental Management: Modern hydropower projects play an important role in managing water resources by supporting flood control, irrigation scheduling and reservoir optimization. Integrated hydropower systems enable better watershed planning, aquatic ecosystem protection and sustainable water allocation for agriculture and urban use. These functions make hydropower a multipurpose asset for climate resilience and environmental stewardship.

- Industrial and Regional Electrification: Hydroelectric power supports electrification across industrial clusters, mining regions and remote communities by providing cost effective and low emission energy. Its long operational life and predictable output make it suitable for powering manufacturing facilities, data centers and essential infrastructure in developing and developed markets. This use case promotes economic development, energy affordability and reduced carbon footprints across regions.

Impact of Artificial Intelligence on the global Hydroelectric Power market

Artificial intelligence is transforming the global hydroelectric power market by enhancing operational efficiency, predictive maintenance and real time decision making across both large and small hydropower plants. AI powered analytics process continuous data from turbines, generators, sensors, water inflow patterns and weather systems to optimize power generation with higher accuracy than traditional control systems.

This leads to improved turbine performance, reduced downtime, smarter water flow management and increased overall plant efficiency. Machine learning models also help forecast seasonal hydrology, reservoir behavior and energy demand, allowing operators to plan generation strategies and maximize output during peak pricing periods.

AI is also influencing asset management through advanced predictive maintenance solutions that identify equipment failures before they occur, reducing repair costs and extending the life of aging hydropower infrastructure. Intelligent automation supports remote monitoring of dams, spillways and environmental systems, improving safety and compliance with ecological requirements.

In pumped storage hydropower, AI models simulate millions of grid scenarios to dispatch storage resources more effectively and support renewable integration. These capabilities position artificial intelligence as a key driver of modernization, digital resilience, cost optimization and smart grid integration within the global hydroelectric power industry.

Global Hydroelectric Power Market: Stats & Facts

- International Hydropower Association (IHA)

- In 2024, global hydropower generation rose by 10%, reaching 4,578 TWh.

- Global hydropower capacity grew by 24.6 GW in 2024.

- Of the 24.6 GW added in 2024, 16.2 GW was conventional hydropower and 8.4 GW was pumped storage.

- Total global pumped-storage hydropower (PSH) capacity reached 189 GW by end-2024, a 5% increase.

- The global hydropower development pipeline exceeds 1,075 GW, with ~600 GW of pumped storage and ~475 GW of conventional projects.

- In 2024, China added 14.4 GW of new hydropower capacity.

- Of China’s 14.4 GW added in 2024, 7.75 GW was pumped storage hydropower.

- Africa commissioned 4.5 GW of new hydropower capacity in 2024, more than double its average in the prior three years.

- Global hydropower employed 2.3 million people in 2024.

- In 2024, hydropower avoided approximately 2.2 billion tonnes of CO₂ compared to equivalent gas combined-cycle generation.

- Hydropower operates in more than 150 countries, contributing to system flexibility and clean energy supply.

- In 2023, new hydropower capacity was 13.5 GW, bringing global capacity to 1,412 GW.

- In 2023, pumped-storage capacity grew by 6.5 GW, bringing PSH capacity to 182 GW.

- From 2023 to 2024, IHA reports ~8% increase in the development pipeline.

- The five-year average for annual PSH additions is now ~6 GW/year, up from ~2–4 GW in previous decades.

- International Energy Agency (IEA)

- In 2023, global hydropower generation decreased by over 100 TWh (more than 2%) compared to 2022.

- In 2023, capacity additions reached 13 GW.

- Hydropower’s global share in power generation was 47% of all renewable generation in 2023.

- To align with the Net-Zero Emission pathway, over 40 GW/year of new hydropower capacity must be connected annually through 2030, roughly double the recent average.

- Hydropower became the second-largest renewable electricity technology by capacity in 2023, overtaken by solar PV.

- REN21 (Renewables Global Status Report)

- In 2023, more than 50% of installed hydropower capacity was located in Asia.

- 7.2 GW of conventional hydropower was added globally in 2023.

- By end-2023, global conventional hydropower capacity reached 1,237 GW.

- The top four countries (China, Brazil, Canada, USA) held more than 50% of the global hydropower capacity in 2023.

- The top ten countries accounted for 69% of global hydropower capacity in 2023.

- In 2023, hydropower generation globally fell by 5% (−223 TWh), largely due to droughts.

- The global capacity factor for hydropower in 2023 was 39%, down by 2% from 2022.

- Hydropower made up 47% of all renewable power generation in 2023.

- Over 41% of the 2023 hydropower additions came from five countries (Nigeria, Colombia, Lao PDR, China, Nepal).

- More than half of the newly added capacity in 2023 was in Asia.

Global Hydroelectric Power Market: Market Dynamics

Global Hydroelectric Power Market: Driving Factors

Growing demand for renewable and low carbon electricity

The global shift toward sustainable energy is significantly boosting hydropower development as nations pursue carbon neutrality, grid decarbonization and long term clean energy security. Hydroelectric power offers reliable baseload generation, strong grid stability support and high conversion efficiency, making it an essential component of national renewable energy strategies. Increasing electrification, rising power consumption and stronger climate commitments continue to accelerate investment in new hydropower capacity and modernization of existing plants.

Modernization of aging hydropower infrastructure

A large portion of global hydropower assets is more than three decades old, creating strong demand for refurbishment programs focused on advanced turbines, digital monitoring systems and structural upgrades. Utilities and energy developers increasingly rely on AI based predictive maintenance, automated control systems and upgraded generator technologies to improve energy output and extend project lifecycles. These modernization efforts drive continuous capital inflow into the hydropower sector and support long term operational resilience.

Global Hydroelectric Power Market: Restraints

High upfront capital investment and long project timelines

Large hydropower projects require substantial funding, extensive civil construction and complex environmental permitting, often resulting in long development cycles. These capital intensive requirements can deter private developers and slow deployment in emerging markets. Cost uncertainties, land acquisition challenges and lengthy regulatory reviews further limit the pace of new hydropower installations despite strong demand for renewable energy.

Environmental and ecological concerns

Hydropower development can impact ecosystem balance, river biodiversity and water flow patterns, prompting stricter environmental regulations and community resistance in many regions. Requirements for fish passage systems, sediment management, habitat restoration and continuous ecological monitoring add complexity to project planning. These challenges can delay project approvals and increase operational costs, restraining large scale expansion.

Global Hydroelectric Power Market: Opportunities

Expansion of pumped storage hydropower to support renewable integration

As solar and wind penetration increases globally, grid operators require long duration storage solutions to manage intermittency and enhance energy flexibility. Pumped storage hydropower offers one of the most efficient and mature storage technologies, enabling renewable smoothing, peak shifting and frequency regulation. Rising demand for energy storage, combined with government incentives and smart grid development, creates strong opportunities for new PSH projects and hybrid renewable storage systems.

Development of low impact and small scale hydropower

Advances in modular turbines, run of river systems and fish friendly technologies are opening opportunities for low impact hydropower installations. Non powered dam conversions, micro hydro plants and community based clean energy systems are gaining traction in rural and remote regions. These projects provide cost effective electrification, lower environmental impact and faster installation timelines, creating expanding avenues for developers and technology providers.

Global Hydroelectric Power Market: Trends

Digitalization and AI driven hydropower operations

The adoption of artificial intelligence, digital twins, IoT sensors and advanced automation is transforming hydropower asset management. Real time data analytics enhances turbine optimization, structural health monitoring, hydrology forecasting and dynamic water flow control. Digitalization enables safer, more efficient and predictive operations, reducing downtime and extending asset life while supporting smart grid integration and energy market flexibility.

Growing focus on climate resilience and water resource optimization

Hydropower operators are increasingly adapting plants to withstand climate related risks such as variable rainfall, river flow fluctuations and extreme weather events. Investments in climate resilient infrastructure, adaptive reservoir management and advanced hydrological modeling are becoming essential trends. Improved water resource planning supports flood control, drought mitigation and efficient multipurpose reservoir management, strengthening hydropower’s strategic role in sustainable energy and environmental stewardship.

Global Hydroelectric Power Market: Research Scope and Analysis

By Plant Type Analysis

Storage hydropowers are expected to maintain their leading position in the plant type segment, capturing 65% of the global market in 2025 because they offer reliable baseload generation and strong operational flexibility. These plants rely on large reservoirs that store water and allow operators to regulate flow throughout the year, making them highly effective in managing seasonal variability, balancing electricity demand and ensuring grid stability.

Their long life span, high efficiency, and ability to support multiple functions such as irrigation, flood control and long duration energy storage make them the preferred choice for many national energy programs. Continuous investment in modernization, turbine upgrades and digital control systems further strengthens the dominance of storage based hydropower globally.

Run of river hydropower contributes an important share of the segment as it provides renewable electricity with minimal environmental footprint and lower construction requirements compared to large reservoir systems. These plants generate power by utilizing natural river flow without significant water storage, making them suitable for regions with strict ecological regulations or limited land availability.

Although they do not offer the same level of energy storage or flow control as reservoir based projects, run of river plants are valued for their shorter development timelines, reduced infrastructure costs and suitability for distributed clean energy generation. Their role continues to expand in markets prioritizing sustainable hydropower development with reduced ecological impact.

By Plant Capacity Analysis

Large hydropower plants above 100 megawatts are projected to dominate the plant capacity segment with a 78% market share in 2025 because they generate substantial amounts of baseload electricity and support national level power demand. These large scale facilities are critical components of energy security strategies in countries with growing industrial loads, urban expansion and long term renewable energy goals.

Their ability to integrate advanced turbines, digital control systems and efficient reservoir management allows them to deliver high output with strong reliability. Large hydropower projects also play a central role in grid balancing, long duration energy storage and peak load management, which further reinforces their dominance. Governments and utilities continue prioritizing these plants due to their long operational life, low operating costs and multipurpose benefits including flood control, agriculture support and regional water management.

Medium hydropower plants between 10 and 100 megawatts form an important supporting segment as they offer flexible generation capacity suitable for regional grids, industrial clusters and semi urban demand centers. These plants require lower capital investment compared to large hydropower projects, making them attractive for emerging economies and regions with limited financing capacity. Medium scale facilities also have shorter construction timelines, easier regulatory approvals and smaller environmental footprints, which enable quicker renewable energy deployment. They provide reliable clean power for localized demand, help stabilize distribution grids and are increasingly being modernized with efficient turbines and automated control systems to enhance their output and operational performance.

By Turbine Technology Analysis

Government and national utility ownership will account for 60% of the total market value because hydropower projects typically involve large scale infrastructure, long development cycles and substantial capital requirements that are best managed by public institutions. These entities play a central role in financing, regulating and operating hydropower assets due to their responsibility for national energy security, water resource management and long term infrastructure planning.

Public ownership also ensures stable electricity pricing, strategic reservoir management and alignment with national renewable energy targets. Many countries continue to prioritize government led hydropower development because it supports public welfare objectives such as irrigation, flood control, rural electrification and climate resilience, making state controlled utilities the dominant force in the global hydropower landscape.

Kaplan turbines hold a significant position in the turbine technology segment as they are widely used in low head and medium flow hydropower projects, making them suitable for diverse river conditions across multiple regions. Their adjustable blade design allows operators to maintain high efficiency even when water flow varies throughout the year, which is particularly valuable for run of river plants and river based hydropower systems.

Kaplan turbines are favored for their operational flexibility, ability to handle fluctuating hydrological conditions and compatibility with modern automated control systems. These characteristics make them essential in upgrading aging hydropower facilities, improving plant performance and supporting sustainable generation in areas where environmental constraints limit the use of high head turbines.

By Ownership Analysis

Government and national utility ownership will capture 60% of the total market value because large hydropower projects require extensive capital investment, long construction timelines and complex regulatory approvals that are more efficiently managed by public sector institutions. These entities oversee national water resources, energy security planning and multipurpose reservoir operations, making them best positioned to develop and operate large scale hydro assets.

Public ownership also enables long term infrastructure financing, ensures stable electricity tariffs and supports socioeconomic objectives such as rural electrification, flood management and irrigation. Many countries continue prioritizing government led hydropower expansion as it aligns with national sustainability goals, climate commitments and long term power system reliability.

Independent power producers and private developers form a growing segment of the hydropower market as they contribute to project diversification, regional energy supply and renewable generation capacity in areas with liberalized electricity markets. These private entities are increasingly participating in small and medium scale hydropower projects due to shorter development cycles, lower capital requirements and supportive renewable energy policies.

They bring technological innovation, operational efficiency and competitive financing models that help accelerate hydropower deployment in emerging markets. While they do not match the scale of public sector investments, private developers play an important role in expanding distributed clean energy generation, modernizing aging facilities and introducing flexible business models such as power purchase agreements that support long term project viability.

By Application Analysis

Utility-scale power generation is expected to dominate this segment with an 82.0% share in 2025, largely because large hydropower facilities are designed to supply consistent, baseload electricity to national grids. Their ability to operate continuously with high efficiency, low operating costs, and long asset lifespans makes them ideal for meeting large-scale energy demands. Additionally, many countries prioritize utility-scale hydropower projects as part of their national energy strategies due to their reliability, low-carbon output, and ability to support long-term grid planning.

Energy storage and grid stability applications also play a growing role in this market, driven by the need to balance fluctuating renewable energy sources such as solar and wind. Hydropower plants—especially those with pumped-storage capabilities—enable rapid load adjustments, frequency regulation, and peak shaving, helping to stabilize the grid during demand spikes or renewable generation shortfalls. While their overall market share remains smaller than utility-scale power generation, these functions are becoming increasingly important as grids integrate more variable renewable energy resources.

The Hydroelectric Power Market Report is segmented on the basis of the following:

By Plant Type

- Storage Hydropower

- Run of River Hydropower

- Pumped Storage Hydropower

By Plant Capacity

- Large Hydropower Plants (Above 100 Megawatts)

- Medium Hydropower Plants (Between 10 and 100 Megawatts)

- Small Hydropower Plants (Up to 10 Megawatts)

By Turbine Technology

- Francis Turbines

- Kaplan Turbines

- Pelton Turbines

- Other Turbine Types

By Ownership

- Government and National Utility Ownership

- Independent Power Producers and Private Developers

- Public and Private Partnership Projects

- Community Based and Cooperative Ownership

By Application

- Utility Scale Power Generation

- Energy Storage and Grid Stability

- Multipurpose Projects

- Off Grid and Remote Community Electrification

Global Hydroelectric Power Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is anticipated to lead the global hydroelectric power market with a 49.0% share of total revenue in 2025, driven by rapid industrialization, expanding electricity demand, and strong government commitments to renewable energy development across major countries such as China, India, and Southeast Asian nations.

The region benefits from abundant water resources, large-scale river systems, and favorable topography that support both new hydropower installations and the expansion of existing facilities. Significant investments in grid modernization, rural electrification programs, and long-term clean energy targets are further accelerating hydropower deployment. Additionally, ongoing infrastructure upgrades, cross-border energy cooperation, and the development of pumped-storage projects strengthen Asia Pacific’s position as the global hub for hydroelectric power growth.

Region with significant growth

Latin America is expected to witness significant growth in the hydroelectric power market, supported by abundant natural water resources, rising investments in renewable energy infrastructure, and increasing regional collaboration for sustainable power generation. Countries such as Brazil, Colombia, and Chile are accelerating hydropower expansion through modernization of aging plants, development of small and medium hydropower projects, and integration of flexible pumped-storage systems to stabilize grids with growing renewable penetration.

Supportive regulatory frameworks, public-private partnerships, and government incentives for clean energy development are further boosting market growth. Additionally, the region’s focus on reducing dependence on fossil fuels and enhancing energy security positions Latin America as one of the most dynamic and rapidly emerging hydroelectric power markets globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Hydroelectric Power Market: Competitive Landscape

The global hydroelectric power market features a highly competitive landscape characterized by a mix of large multinational technology providers, regional engineering firms, and state-backed utilities driving extensive project development and modernization initiatives. Competition centers on advanced turbine technologies, digital automation solutions, grid integration capabilities, and long-term operational efficiency.

Companies are increasingly investing in R&D to enhance turbine performance, reduce environmental impact, and improve power generation reliability through AI-driven monitoring and predictive maintenance. Strategic partnerships, EPC contracts, and cross-border collaborations are common as stakeholders work to secure major dam construction, refurbishment projects, and pumped-storage developments. The market also sees growing competition in sustainability-focused innovations, including fish-friendly turbines and low-impact run-of-river systems, reflecting the industry's shift toward environmentally responsible hydropower expansion.

Some of the prominent players in the global Hydroelectric Power market are

- GE Vernova

- Andritz Hydro

- Voith Hydro

- Siemens Energy

- Toshiba Energy Systems

- Mitsubishi Heavy Industries

- Alstom Hydro

- Hitachi Energy

- China Yangtze Power Company

- State Power Investment Corporation

- Electricité de France

- RusHydro

- Statkraft

- BC Hydro

- Hydro Québec

- Duke Energy

- Pacific Gas and Electric Company

- Voith Group

- Iberdrola

- Engie

- Other Key Players

Global Hydroelectric Power Market: Recent Developments

- July 2025: GE Vernova commissions a 250 MW variable-speed pumped storage unit at India’s Tehri hydropower complex as part of a 1 GW system expansion.

- June 2025: Agilitas Energy acquires two hydropower development projects totaling 44 MW across West Virginia and Maryland from Advanced Hydro Solutions.

- March 2025: Gaia Turbine SA raises €1.15 million to advance its high-efficiency micro-hydroelectric turbine designed for decentralized renewable energy generation.

- September 2024: SeaPattern raises €5 million in private financing to scale its plug-and-play micro and mini hydroelectric technology for small-scale hydro projects.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 272.2 Bn |

| Forecast Value (2034) |

USD 448.8 Bn |

| CAGR (2025–2034) |

5.7% |

| The US Market Size (2025) |

USD 45.8 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Plant Type (Storage Hydropower, Run of River Hydropower, Pumped Storage Hydropower), By Plant Capacity (Large Hydropower Plants Above 100 Megawatts, Medium Hydropower Plants Between 10 and 100 Megawatts, Small Hydropower Plants Up to 10 Megawatts), By Turbine Technology (Francis Turbines, Kaplan Turbines, Pelton Turbines, Other Turbine Types), By Ownership (Government and National Utility Ownership, Independent Power Producers and Private Developers, Public and Private Partnership Projects, Community Based and Cooperative Ownership), and By Application (Utility Scale Power Generation, Energy Storage and Grid Stability, Multipurpose Projects, Off Grid and Remote Community Electrification). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

GE Vernova, Andritz Hydro, Voith Hydro, Siemens Energy, Toshiba Energy Systems, Mitsubishi Heavy Industries, Alstom Hydro, Hitachi Energy, China Yangtze Power Company, State Power Investment Corporation, Electricité de France, RusHydro, Statkraft, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The global Hydroelectric Power market size is estimated to have a value of USD 272.2 billion in 2025 and is expected to reach USD 448.8 billion by the end of 2034.

The US Hydroelectric Power market is projected to be valued at USD 45.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 73.2 billion in 2034 at a CAGR of 5.4%.

Asia Pacific is expected to have the largest market share in the global Hydroelectric Power market, with a share of about 49.0% in 2025.

Some of the major key players in the global Hydroelectric Power market are GE Vernova, Andritz Hydro, Voith Hydro, Siemens Energy, Toshiba Energy Systems, Mitsubishi Heavy Industries, Alstom Hydro, Hitachi Energy, China Yangtze Power Company, State Power Investment Corporation, Electricité de France, RusHydro, Statkraft, and Others.

The market is growing at a CAGR of 5.7 percent over the forecasted period.