Market Overview

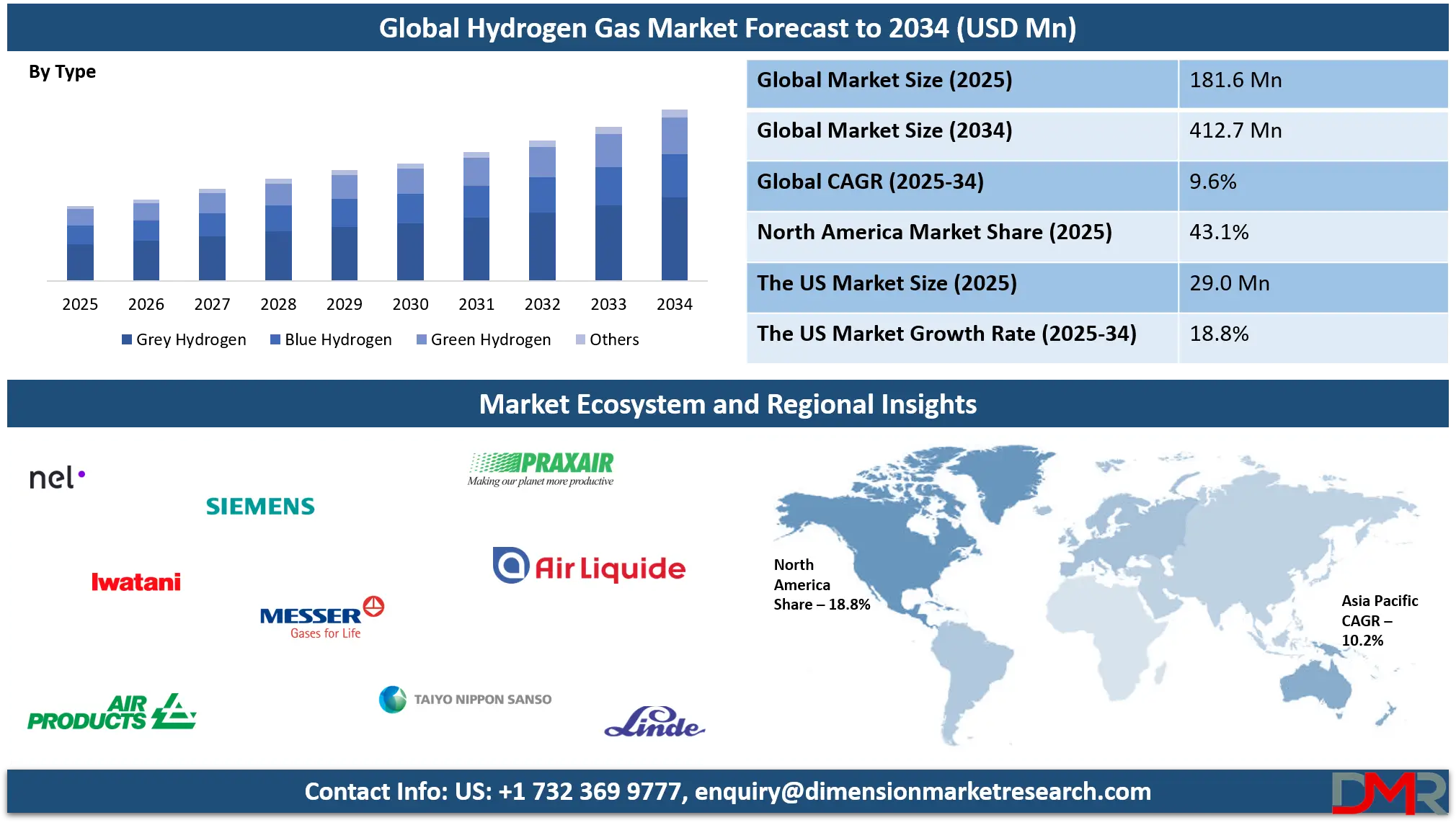

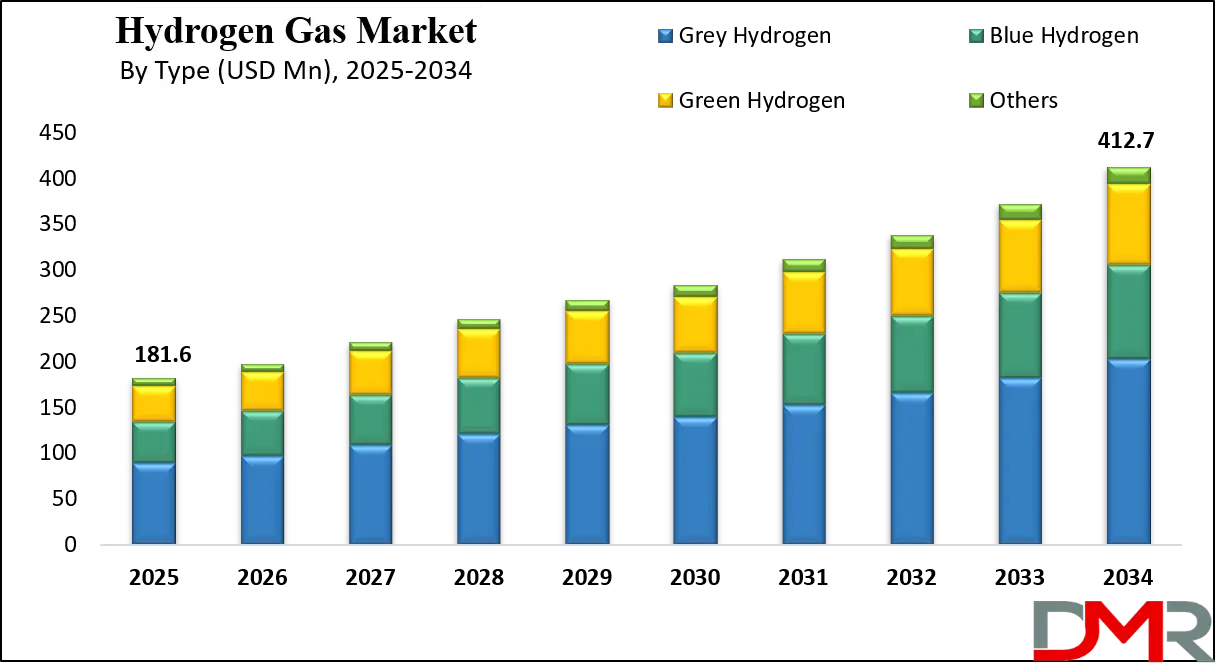

The Global Hydrogen Gas Market size is projected to reach USD 181.6 million in 2025 and grow at a compound annual growth rate of 9.6% from there until 2034 to reach a value of USD 412.7 million

Hydrogen gas is a colorless, odorless, and highly flammable gas that is the lightest and most abundant element in the universe. It is commonly used across various industries such as refining, chemicals, steel manufacturing, and more recently in clean energy applications. Hydrogen can be produced through different methods, including natural gas reforming, coal gasification, and water electrolysis. Based on the production process and energy sources, hydrogen is classified into different types like grey, blue, and green hydrogen.

The demand for hydrogen gas has been growing steadily, especially as industries and governments look for cleaner and more sustainable energy alternatives. This growth is largely driven by the need to reduce emissions from traditional fossil fuels. Hydrogen has shown great potential to support decarbonization in hard-to-abate sectors like heavy industry, aviation, shipping, and long-haul transport. Moreover, hydrogen is being considered as a fuel for electricity generation, particularly when combined with fuel cells, gas turbines, or as a key component in the production of

E-fuels.

In recent years, interest in hydrogen has accelerated as part of global efforts to transition to low-carbon energy systems. Countries are increasingly integrating hydrogen into their national energy strategies, encouraging research and development, infrastructure investments, and public-private collaborations. This momentum has also influenced cross-border hydrogen trade discussions and regional cooperation to create stable supply chains. The versatility of hydrogen in storing and transporting energy further enhances its importance in building resilient and integrated energy networks.

The industrial sector continues to be the largest consumer of hydrogen, especially in ammonia production, oil refining, and methanol manufacturing. However, new demand is rising from mobility, power, and building sectors, where hydrogen is being tested in pilot projects and early-stage applications. Hydrogen-powered buses, trains, and even small aircraft are being explored as future transport solutions. Hydrogen blending with natural gas is another trend emerging in power and heating applications to gradually reduce carbon intensity.

Challenges remain, particularly in terms of production costs, distribution infrastructure, and overall efficiency. Green hydrogen, produced using renewable electricity, holds great promise but is still limited by high costs and availability of clean power. Building a hydrogen economy also involves addressing regulatory barriers, safety standards, and public awareness. Companies and governments are working to align efforts to overcome these obstacles and unlock hydrogen’s full potential.

Overall, hydrogen gas is emerging as a key component in the shift toward cleaner energy systems. Its ability to connect sectors, store energy, and reduce carbon emissions makes it a valuable solution in global decarbonization strategies. While progress is being made, continued innovation, investment, and cooperation are essential for hydrogen to play a lasting role in the future energy mix.

The US Hydrogen Gas Market

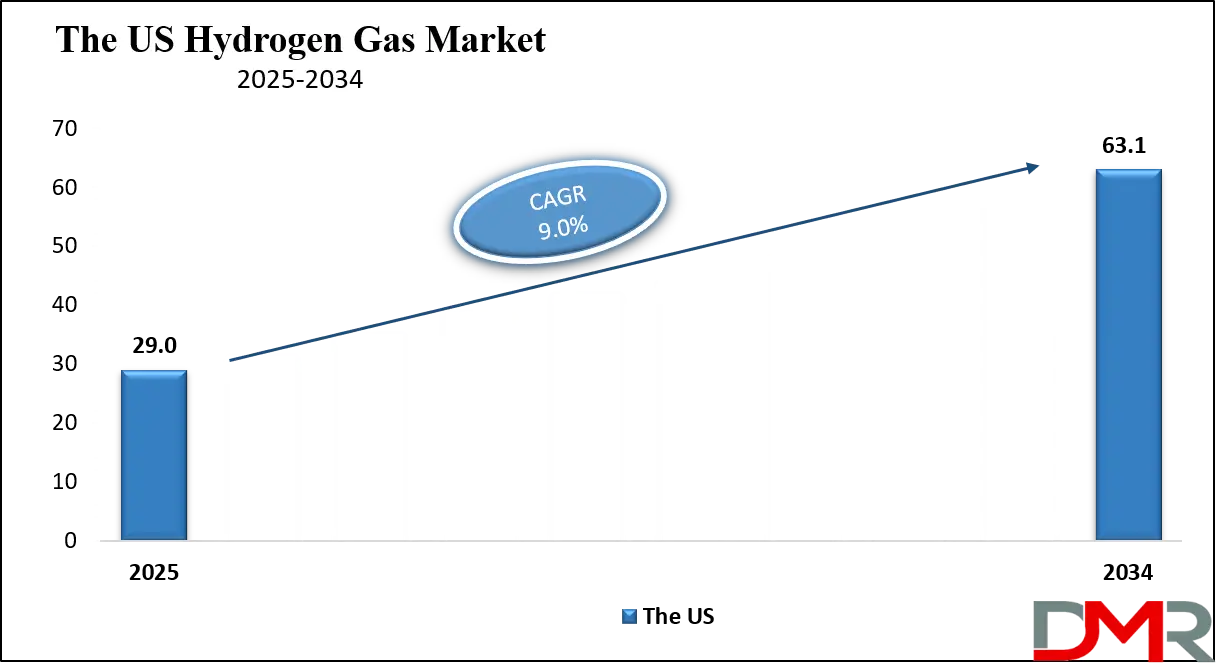

The US Hydrogen Gas Market size is projected to reach USD 29.0 million in 2025 at a compound annual growth rate of 9.0 % over its forecast period.

The US plays a leading role in the global hydrogen gas market through strong policy support, large-scale investments, and innovation in clean energy technologies. The government has introduced national strategies and funding programs to accelerate hydrogen production, particularly green hydrogen made from renewable sources.

The US is focusing on building hydrogen hubs, expanding refueling infrastructure, and supporting research in electrolyzer and fuel cell technology. With its vast renewable energy potential, advanced industrial base, and active private sector, the US is positioned to become a major producer and consumer of hydrogen. It also promotes public-private partnerships and collaborates internationally to set standards and encourage trade. The US aims to make hydrogen a key part of its clean energy transition and climate goals.

Europe Hydrogen Gas Market

Europe Hydrogen Gas Market size is projected to reach USD 45.4 million in 2025 at a compound annual growth rate of 8.8% over its forecast period.

Europe is a key driver in the hydrogen gas market, leading global efforts to develop a clean hydrogen economy. The European Union has launched comprehensive strategies to scale up green hydrogen production and reduce reliance on fossil fuels. Through funding programs, regulations, and international cooperation, Europe supports hydrogen use in industry, transport, and energy storage. Several countries within Europe are investing in cross-border hydrogen pipelines, refueling networks, and large-scale electrolyzer projects.

The region is also fostering innovation by supporting research in hydrogen technologies and promoting public-private partnerships. Europe's strong environmental goals, combined with its technical expertise and coordinated policy efforts, position it as a global leader in shaping hydrogen standards, advancing infrastructure, and accelerating the energy transition.

Japan Hydrogen Gas Market

Japan Hydrogen Gas Market size is projected to reach USD 10.9 million in 2025 at a compound annual growth rate of 9.8% over its forecast period.

Japan plays a pioneering role in the hydrogen gas market, with long-term plans to build a hydrogen-based society. It was one of the first countries to create a national hydrogen strategy, aiming to reduce dependence on fossil fuels and improve energy security. Japan promotes hydrogen use in transportation, particularly through fuel cell vehicles and buses, and supports the development of hydrogen refueling infrastructure across the country.

It also invests in research and international partnerships to import hydrogen from overseas producers. Japan is working to integrate hydrogen into power generation, residential energy systems, and as a complementary fuel for electric vehicle development. With strong government support and industrial collaboration, Japan continues to lead in demonstrating practical applications of hydrogen technology and shaping global standards for its safe and efficient use.

Hydrogen Gas Market: Key Takeaways

- Market Growth: The Hydrogen Gas Market size is expected to grow by USD 215.6 million, at a CAGR of 9.6%, during the forecasted period of 2026 to 2034.

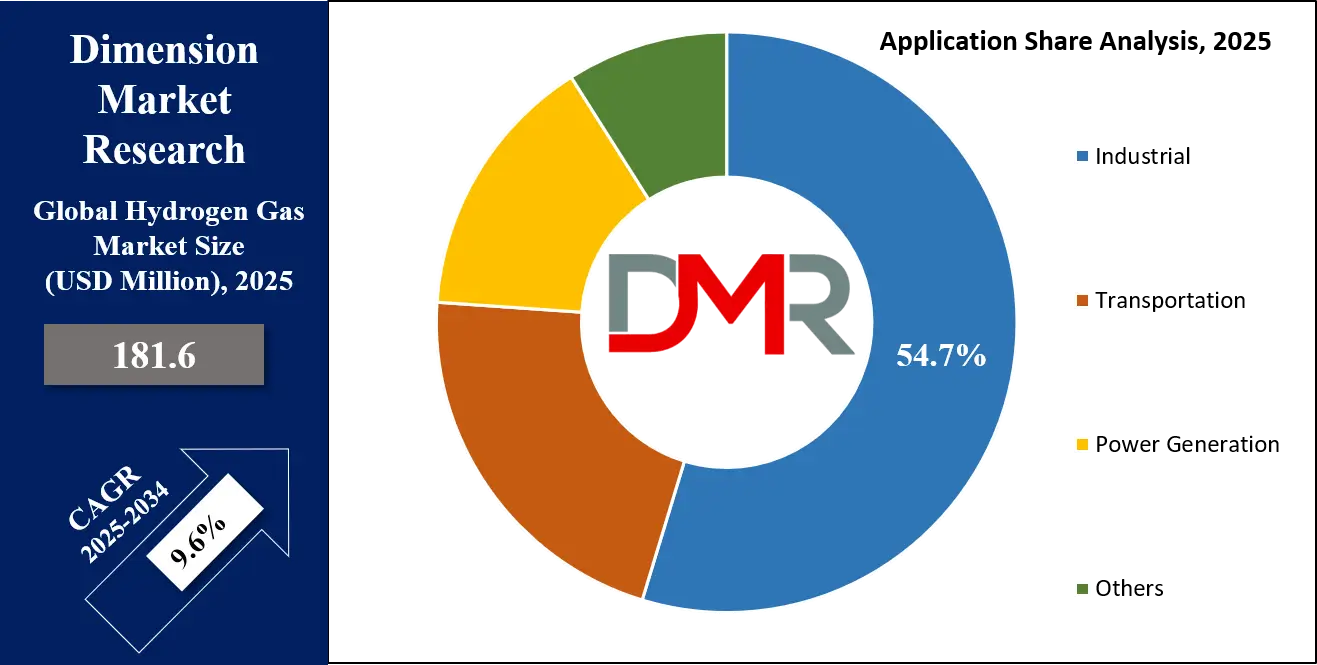

- By Type: The Green Hydrogen segment is anticipated to get the majority share of the Hydrogen Gas Market in 2025.

- By Application: The industrial segment is expected to get the largest revenue share in 2025 in the Hydrogen Gas Market.

- Regional Insight: Asia Pacific is expected to hold a 40.1% share of revenue in the Global Hydrogen Gas Market in 2025.

- Use Cases: Some of the use cases of Hydrogen Gas include transportation fuel, industrial processes, and more.

Hydrogen Gas Market: Use Cases

- Transportation Fuel: Hydrogen gas is used as a clean fuel for vehicles like cars, buses, trucks, and trains powered by fuel cells. It offers fast refueling times and long driving ranges, making it ideal for heavy-duty and long-distance transport. This helps reduce emissions in sectors that are hard to electrify with batteries alone.

- Industrial Processes: Hydrogen plays a key role in industries such as steelmaking, refining, and chemical production. It is used to remove impurities, support chemical reactions, and replace fossil fuels in high-temperature operations. Switching to green hydrogen in these areas can significantly cut carbon emissions.

- Power and Energy Storage: Hydrogen can store excess renewable energy and release it when needed, helping stabilize power grids. It is converted into electricity using fuel cells or turbines, especially during periods of low solar or wind output. This makes hydrogen a useful part of energy backup systems.

- Heating and Residential Use: Hydrogen gas can be blended with natural gas or used alone for residential and commercial heating. It is being tested in heating appliances like boilers and cookers. This application supports the shift away from traditional fossil fuels in buildings and homes.

Market Dynamic

Driving Factors in the Hydrogen Gas Market

Decarbonization Push Across Industries

One of the biggest drivers of the hydrogen gas market is the global movement to reduce carbon emissions across major sectors. Industries such as transportation, heavy manufacturing, and power generation are under increasing pressure to shift away from fossil fuels. Hydrogen, especially green hydrogen produced from renewable energy, offers a clean alternative that can be integrated into existing systems with fewer emissions. Governments and international bodies are setting strict targets for climate neutrality, encouraging industries to adopt hydrogen-based solutions.

Hydrogen is particularly useful in applications that are difficult to electrify, such as aviation, shipping, and high-heat industrial processes. This versatility makes it a favored option in future energy planning. As more industries align with climate goals, the demand for hydrogen is expected to grow steadily.

Government Support and Strategic Investments

Strong support from governments is another major growth factor for the hydrogen gas market. Countries are launching national hydrogen strategies, providing financial aid, tax incentives, and regulatory frameworks to promote hydrogen production and use. Large infrastructure investments are being made to build hydrogen refueling stations, pipelines, and production facilities.

Public-private partnerships are forming to scale up the technology and bring down costs through innovation and mass deployment. These efforts are creating a favorable environment for companies to invest and expand their hydrogen operations.

Additionally, international collaboration is driving research and standardization to make hydrogen more accessible and practical. Such structured support is helping hydrogen gain momentum as a key energy carrier for the future.

Restraints in the Hydrogen Gas Market

High Production and Infrastructure Costs

One of the main restraints in the hydrogen gas market is the high cost of production, especially for green hydrogen made using renewable energy. Electrolysis technology, which splits water into hydrogen and oxygen, is still expensive and energy-intensive. Building the necessary infrastructure, such as pipelines, storage systems, and refueling stations, also requires significant capital investment.

These costs make hydrogen less competitive compared to conventional fuels or even other renewable energy solutions. In many regions, the lack of developed infrastructure slows down adoption. The uncertainty around return on investment further discourages private sector involvement. Until production becomes cheaper and infrastructure more widespread, market growth may face delays.

Storage, Transportation, and Safety Challenges

Hydrogen is a highly flammable and lightweight gas, making its storage and transportation technically complex. It needs to be compressed or liquefied at very low temperatures, which demands specialized equipment and safety systems. These handling requirements increase operational costs and raise concerns about the safety of large-scale hydrogen usage.

Additionally, the lack of a global standard for transportation and storage technologies limits cross-border collaboration and supply chain development. Public perception of hydrogen safety also poses a hurdle, especially in densely populated areas. Without advancements in storage materials and safety protocols, these challenges could limit hydrogen’s wider application across sectors.

Opportunities in the Hydrogen Gas Market

Integration with Renewable Energy Projects

A major opportunity in the hydrogen gas market lies in its integration with solar, wind, and other renewable energy sources. When excess electricity is generated from renewables, it can be used to produce green hydrogen through electrolysis, effectively storing energy that would otherwise be wasted. This hydrogen can later be used for electricity generation, transportation, or industrial processes, making it a flexible energy carrier.

As more renewable projects come online, especially in remote or high-generation areas, hydrogen offers a practical way to balance energy supply and demand. It also helps address the intermittency of renewables by acting as a long-duration storage solution. Governments and companies are recognizing this synergy, leading to new hybrid project designs. This trend creates strong growth prospects for hydrogen in clean energy systems.

Export Potential and Global Trade Development

Another promising opportunity is the potential for hydrogen-rich countries to become major exporters of hydrogen fuel. Countries with abundant renewable energy resources can produce green hydrogen at lower costs and supply it to energy-importing nations with limited resources. This can open new trade routes and create global hydrogen supply chains, similar to current oil and gas trade systems.

Large-scale export terminals, shipping solutions, and international agreements are being explored to make this possible. Such developments could stimulate economic growth in hydrogen-producing regions and increase international cooperation. The global nature of the energy transition supports the idea of hydrogen becoming a key traded commodity. As technologies mature and costs fall, hydrogen exports could significantly boost market expansion and geopolitical energy balance.

Trends in the Hydrogen Gas Market

Shift Toward Green Hydrogen Production:

A key trend in the hydrogen gas market is the strong global shift toward producing hydrogen using renewable energy sources, often referred to as green hydrogen. As environmental concerns rise, industries and governments are moving away from hydrogen made using fossil fuels. Green hydrogen, generated by splitting water with renewable electricity, is becoming more popular due to falling technology costs and supportive energy policies.

This shift is being supported by increasing investments in electrolyzer manufacturing and solar and wind energy infrastructure. While challenges like cost and scale remain, ongoing innovations are making green hydrogen more viable. This trend is also aligned with broader carbon reduction goals. It is expected to play a crucial role in decarbonizing sectors that are hard to electrify, with advanced materials like carbon composites also contributing to efficiency and durability in hydrogen storage and transport solutions.

Expansion of Hydrogen Infrastructure Networks

Another major trend is the rapid development of hydrogen infrastructure, including refueling stations, storage systems, pipelines, and industrial hubs. Countries are rolling out national plans to build networks that can support hydrogen use across multiple sectors. This includes setting up hydrogen corridors for transportation, retrofitting existing pipelines, and creating dedicated zones for hydrogen production and use.

Energy companies and technology providers are collaborating to develop modular and scalable systems that can be deployed quickly. Pilot projects are also exploring blending hydrogen into existing gas grids to reduce reliance on natural gas. As more regions establish infrastructure, hydrogen is becoming more accessible and practical. This trend supports both short-term use cases and long-term adoption goals.

Research Scope and Analysis

By Production Method Analysis

Steam Methane Reforming (SMR), expected to be leading in 2025 with a share of 53.6%, continues to play a major role in the hydrogen gas market due to its established infrastructure and cost-effective production process. SMR uses natural gas to produce hydrogen by separating methane molecules using high-temperature steam. This method is widely used across industries due to its ability to produce hydrogen at scale and meet rising energy demands.

Despite concerns over carbon emissions, it remains dominant because of its availability, maturity, and lower production costs compared to other methods. With ongoing research into carbon capture technologies, SMR is being adapted to become more environmentally friendly, supporting the transition to low-emission hydrogen. Its continued use in oil refining, chemical manufacturing, and industrial fuel applications helps maintain steady market growth. SMR’s reliability and existing presence in global energy systems make it a key contributor to the expansion of the hydrogen economy.

Electrolysis, having significant growth over the forecast period, is gaining strong momentum in the hydrogen gas market as demand for green hydrogen rises. This method produces hydrogen by using electricity from renewable sources to split water into hydrogen and oxygen, making it a cleaner alternative to traditional production methods. Electrolysis supports decarbonization goals and aligns well with energy transition strategies across many regions.

As solar and wind power generation expands, electrolysis becomes more attractive due to its ability to use excess electricity for hydrogen production. Governments and industries are investing in electrolyzer technology to improve efficiency and reduce costs. The method is being promoted for use in sectors like transportation, power storage, and chemical processing. With continued policy support and innovation, electrolysis is expected to play a key role in building a sustainable hydrogen supply chain, helping shift the market toward cleaner fuel sources over time.

By Type Analysis

Grey hydrogen, expected to lead in 2025 with a share of 49.8%, remains a dominant type in the hydrogen gas market due to its long-standing use and lower production costs. Created from natural gas through steam methane reforming without capturing emissions, it is widely used in refining, fertilizer production, and various industrial processes. Its established infrastructure and availability make it a practical choice for industries needing immediate hydrogen supply at scale.

Although it contributes to carbon emissions, grey hydrogen continues to serve as a bridge while cleaner methods develop. Many countries still rely on it because of existing pipelines, production facilities, and steady supply chains. The segment's role is critical in supporting current hydrogen demand as newer technologies such as blue and green hydrogen mature. Until cleaner options become more accessible and affordable, grey hydrogen is likely to maintain a major share in global hydrogen consumption.

Green hydrogen, showing significant growth over the forecast period, is rapidly gaining attention as the cleanest and most sustainable form of hydrogen. Produced using electrolysis powered by renewable energy like wind or solar, it generates no greenhouse gas emissions during the process. This makes it an ideal solution for meeting climate goals and reducing industrial carbon footprints.

Governments and companies across the world are focusing on scaling up green hydrogen projects, building electrolyzer capacity, and creating renewable-powered hydrogen hubs. Its application is growing in areas like fuel cell vehicles, clean power generation, and industrial decarbonization. As policy support increases and renewable energy becomes more widespread, green hydrogen is expected to grow strongly. With the global energy transition underway, this segment is positioned as a long-term solution for clean energy and is attracting major investments for future expansion.

By Application Analysis

Industrial application, expected to lead in 2025 with a share of 54.7%, plays a major role in the growth of the hydrogen gas market due to its essential use in key sectors like oil refining, ammonia production, steel manufacturing, and chemicals. Industries depend on hydrogen as a feedstock and as a cleaner alternative to coal and natural gas in high-temperature processes. With increasing pressure to reduce carbon emissions, many companies are integrating hydrogen into their operations to replace fossil fuels and meet sustainability targets.

Industrial setups already have established systems for handling hydrogen, which makes adoption easier and faster. The demand for clean and reliable energy sources in industrial operations continues to rise, creating more space for hydrogen expansion. This segment not only supports today’s energy needs but also drives innovation in hydrogen-based solutions for tomorrow’s industrial transformation on a global scale.

Transportation application, having significant growth over the forecast period, is emerging as a key area in the hydrogen gas market due to its potential to decarbonize mobility. Hydrogen is being used to power fuel cell electric vehicles, especially in commercial fleets like buses, trucks, and trains where battery alternatives may not be practical. Its fast refueling time and longer driving range make it suitable for long-distance and heavy-duty transport.

Governments are investing in building hydrogen refueling stations and promoting clean vehicle technologies to cut emissions from road transport. This growing network supports the transition to hydrogen-powered mobility in urban and intercity routes. As technology becomes more efficient and infrastructure expands, transportation is expected to play a major role in future hydrogen demand, helping reduce reliance on diesel and gasoline while supporting cleaner air and climate targets.

By End Use Industry Analysis

Chemicals industry, projected to lead in 2025 with a share of 34.8%, plays a crucial part in the growth of the hydrogen gas market due to its consistent and large-scale demand for hydrogen in production processes. Hydrogen is a key raw material in making ammonia for fertilizers, methanol, and other essential chemical products. This sector has long relied on hydrogen, particularly grey hydrogen, for its operations.

However, with rising environmental concerns and global push for cleaner methods, the industry is gradually transitioning to low-carbon hydrogen solutions. Integration of green and blue hydrogen into chemical manufacturing is gaining momentum as companies aim to cut emissions without compromising output. The chemicals sector benefits from well-established systems and infrastructure, which allow smooth adoption of cleaner hydrogen sources. This makes the industry a strong and stable contributor to hydrogen demand, both now and in the long-term shift toward sustainable production.

Automotive industry, experiencing significant growth over the forecast period, is becoming a major force in expanding the hydrogen gas market as it explores clean fuel options beyond conventional engines. Hydrogen is gaining traction for use in fuel cell vehicles, which offer fast refueling and longer ranges compared to battery-electric vehicles. This makes hydrogen ideal for commercial fleets, public transport, and heavy-duty vehicles.

Automakers and governments are working together to promote hydrogen-powered mobility through incentives, pilot projects, and infrastructure development. Hydrogen is also being tested in hybrid systems and advanced automotive designs to improve energy efficiency. With the shift toward zero-emission transportation, the automotive sector is turning to hydrogen to meet future mobility needs, helping reduce the environmental impact of road travel while offering reliable and efficient alternatives to fossil fuels.

The Hydrogen Gas Market Report is segmented on the basis of the following:

By Production Method

- Steam Methane Reforming (SMR)

- Electrolysis

By Type

- Grey Hydrogen

- Blue Hydrogen

- Green Hydrogen

- Others

By Application

- Industrial

- Transportation

- Power Generation

- Others

By End Use Industry

- Chemicals

- Oil & Gas

- Automotive

- Utilities/Power

Regional Analysis

Leading Region in the Hydrogen Gas Market

Asia Pacific, leading in 2025 with a share of 40.1%, plays a central role in the growth of the hydrogen gas market due to strong government support, large-scale industrial demand, and rapid infrastructure development. Countries like Japan, South Korea, China, and Australia are investing heavily in hydrogen projects, focusing on both green hydrogen production and end-use applications such as transportation, power generation, and industrial fuel replacement. This region benefits from a mix of advanced technology, renewable energy capacity, and clear policy direction, which together create a strong foundation for hydrogen market expansion.

Growing concerns over energy security and environmental impact are also pushing industries across Asia Pacific to adopt hydrogen as a cleaner energy option. In particular, China is rapidly expanding its hydrogen refueling network, while Japan and South Korea are promoting fuel cell vehicles. With continued investments, public-private partnerships, and regional cooperation, Asia Pacific is shaping the future of the hydrogen economy and driving global momentum.

Fastest Growing Region in the Hydrogen Gas Market

Middle East and Africa (MEA) region is showing significant growth over the forecast period in the hydrogen gas market, driven by strong interest in energy diversification, decarbonization goals, and the shift toward clean fuel alternatives. Countries in the region are using their abundant solar and wind resources to develop large-scale green hydrogen projects. Governments are partnering with global energy firms to build hydrogen production hubs aimed at domestic use and international export.

Hydrogen gas is gaining attention as a key solution for long-term sustainability and reducing dependence on oil. With rising investments, favorable climate conditions, and clear policy direction, MEA is becoming a vital player in the global hydrogen economy.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The hydrogen gas market is becoming highly competitive as more players enter to take advantage of its clean energy potential. Companies from different industries such as energy, transportation, and manufacturing are investing in hydrogen to meet growing demand for low-emission solutions. The market includes producers, technology developers, equipment suppliers, and infrastructure builders who are all trying to improve efficiency, safety, and cost. Governments are also supporting this growth through policies and funding, making the space even more active.

Innovation is key, with businesses focusing on better production methods, storage solutions, and distribution systems. As the market expands across different regions, competition is increasing not just in technology, but also in gaining access to customers, securing supply chains, and building strategic partnerships.

Some of the prominent players in the global Hydrogen Gas are:

- Air Liquide

- Air Products and Chemicals, Inc.

- Linde plc

- Messer Group

- Nippon Sanso Holdings Corporation

- Praxair Technology, Inc.

- Iwatani Corporation

- Siemens Energy

- Nel ASA

- Plug Power Inc.

- Ballard Power Systems

- Cummins Inc.

- Hydrogenics

- Bloom Energy

- ITM Power

- McPhy Energy

- Hexagon Purus

- H2 Mobility Deutschland

- Toshiba Energy Systems & Solutions Corporation

- Panasonic Corporation

- Other Key Players

Recent Developments

- In November 2024, GE Vernova has announced that its LM6000VELOX gas turbine solution will operate on 100% hydrogen at the Whyalla hydrogen power plant in South Australia. In partnership with ATCO Australia, four units are scheduled for commissioning in early 2026. This will be GE Vernova’s first commercial-scale project using aeroderivative gas turbine technology powered by renewable hydrogen. The Whyalla facility will leverage excess wind and solar energy to produce and store hydrogen, enabling zero CO₂ emissions during turbine operation with 100% renewable hydrogen.

- In October 2024, Adani Total Gas Ltd (ATGL), a joint venture of Adani Group and TotalEnergies, has begun blending green hydrogen with natural gas in parts of Ahmedabad, starting with a 2.2–2.3% mix in Shantigram. This initiative, announced on LinkedIn, supplies over 4,000 domestic and commercial users. Produced via electrolysis using renewable energy, green hydrogen aims to reduce emissions and support net-zero goals. ATGL plans to gradually increase the blend to 5% and eventually 8% as part of its clean energy transition.

- In July 2024, Gold H2, a Houston-based clean hydrogen company, announced its proprietary Black 2 Gold (B2G) biotechnology is now available for pilot demonstrations with select oil and gas operators. This follows a major MOU signed with a leading U.S. oil company, initiating a series of pilots over the next year. The B2G process transforms crude oil into Gold Hydrogen®, aiming to deliver low-cost, clean hydrogen while converting unproductive oil wells into viable hydrogen assets, supporting both industry transformation and the clean energy transition.

- In June 2024, Wärtsilä introduced the world’s first large-scale 100% hydrogen-ready engine power plant. Built on the Wärtsilä 31 engine platform—renowned as the world’s most efficient—it can operate on natural gas and hydrogen blends up to 25% by volume. The engine synchronizes with the grid in just 30 seconds, offering high efficiency, fuel flexibility, and strong load-following capabilities. With over 1 million running hours and 1,000 MW of installed capacity worldwide, it supports reliable and adaptable power generation.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 181.6 Mn |

| Forecast Value (2034) |

USD 412.7 Mn |

| CAGR (2025–2034) |

9.6% |

| The US Market Size (2025) |

USD 29.0 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Production Method (Steam Methane Reforming (SMR), and Electrolysis), By Type (Grey Hydrogen, Blue Hydrogen, Green Hydrogen, and Others), By Application (Industrial, Transportation, Power Generation, and Others), By End Use Industry (Chemicals, Oil & Gas, Automotive, and Utilities/Power) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Air Liquide, Air Products and Chemicals, Inc., Linde plc, Messer Group, Nippon Sanso Holdings Corporation, Praxair Technology, Inc., Iwatani Corporation, Siemens Energy, Nel ASA, Plug Power Inc., Ballard Power Systems, Cummins Inc., Hydrogenics, Bloom Energy, ITM Power, McPhy Energy, Hexagon Purus, H2 Mobility Deutschland, Toshiba Energy Systems & Solutions Corporation, Panasonic Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Hydrogen Gas Market size is expected to reach a value of USD 181.6 million in 2025 and is expected to reach USD 412.7 million by the end of 2034.

Asia Pacific is expected to have the largest market share in the Global Hydrogen Gas Market, with a share of about 40.1% in 2025.

The Hydrogen Gas Market in the US is expected to reach USD 29.0 million in 2025.

Some of the major key players in the Global Hydrogen Gas Market are Air Liquide, Air Products and Chemicals, Inc., Linde plc, and others

The market is growing at a CAGR of 9.6 percent over the forecasted period.