Market Overview

The Global Hydrogen Peroxide Market size is projected to reach

USD 3,524.6 million in 2025 and grow at a compound annual growth rate of

4.2% from there until 2034 to reach a value of

USD 5,084.9 million.

The global hydrogen peroxide market continues to experience rapid growth through the essential requirements of industries spread across pulp and paper sectors, as well as textiles and healthcare and food processing, and electronics. Industrial users find hydrogen peroxide especially appealing because it breaks down into oxygen and water, producing a sustainable industrial solution. Organizations have switched to the environment-friendly product, hydrogen peroxide, because rising pollution concerns and regulatory requirements related to chlorine-based materials have become stricter. Industries employing pulp and paper production frequently utilize hydrogen peroxide for bleaching purposes, and water treatment operations use it as their primary oxidizing agent.

Market expansion will be supported by current market trends, where electronics fabrication, together with semiconductor manufacturing, continues to drive higher hydrogen peroxide requirements for purity applications. The food and beverage sector's recent developments in packaging sterilization create new possibilities in the market. Multiple obstacles affect the development of this industry despite its growth potential. The chemical's extreme reactivity forces producers to implement stringent storage methods that increase business costs while restricting market expansion because of limited sector adoption. Regional differences in regulatory compliance sometimes create trade barriers that limit cross-border shipment potential.

The long-term projections for the hydrogen peroxide market development remain optimistic because of its underlying potential despite present restrictions. The combination of developing industrial zones alongside rising investments in green chemistry and enhanced wastewater solution understanding will drive market demand further. The hydrogen peroxide market demonstrates potential for sustained and varied growth because emerging applications in advanced manufacturing, together with environmental remediation, will drive its expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Hydrogen Peroxide Market

The US Hydrogen Peroxide Market is projected to reach

USD 889.3 million in 2025 at a compound annual growth rate of

3.9% over its forecast period.

The U.S. hydrogen peroxide market demonstrates strong performance because of its established industrial foundation combined with environmental management practices and technological development priorities. Hydrogen peroxide maintains broad application throughout pulp and paper processing facilities which operate frequently in states that possess extensive forest-based resources. Owing to pollution-related regulations along with consumer demand for green solutions the industry has chosen to shift from chlorine-based bleaching ingredients towards hydrogen peroxide as a bleaching agent.

Major users of water and wastewater treatment belong to facilities throughout the United States, particularly in areas with heavy industrialization and dense population patterns. Water quality goals and odor treatment, alongside pollution oxidation, constitute the primary applications of this compound. The Environmental Protection Agency (EPA) encourages green chemistry approaches, thus fostering increased sales of environmentally friendly oxidants such as hydrogen peroxide.

The medical and pharmaceutical industries maintain continuous demand for sterilization systems that utilize hydrogen peroxide as their base component. Surface disinfection and equipment sanitation within hospitals and clinics depend on hydrogen peroxide, as do pharmaceutical producers who need it for aseptic manufacturing operations. Large healthcare facilities located in cities like New York and California demonstrate higher hydrogen peroxide market volume.

The energy sector depends on hydrogen peroxide for clean fuel technologies and electronic system etching and cleaning operations. Natural regional patterns in the U.S. market demand are influenced by the country's diverse group of people, together with its various geographic areas. Industrial regions across the Midwest and Southeast experience higher hydrogen peroxide application rates than other areas.

The United States pursues sustainability alongside safety and innovation as priorities so the hydrogen peroxide market shows predictable growth with moderate expansion. The emerging sectors of green electronics, hydrogen energy and advanced healthcare sterilization technologies will propel additional market demand perspectives during the following years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Hydrogen Peroxide Market

Europe Hydrogen Peroxide Market size is projected to reach

USD 620.33 million in 2025 at a compound annual growth rate of

3.7% over its forecast period.

Europe's hydrogen peroxide market develops due to the area's strict environmental guidelines combined with its longstanding industrial traditions. The pulp and paper industry utilizes hydrogen peroxide as a bleaching agent to substitute chlorine-based alternatives, which environmental regulations now require removal. Three major paper manufacturing facilities operate throughout Finland, Sweden, and Germany, which sustain continuing demand for these industrial compounds.

Widespread municipal and industrial treatment plant utilzation of hydrogen peroxide emerges from European Union mandates which govern wastewater treatment. It functions as an organic matter degrading agent and odor controller to support the meeting of regional water discharge regulations. These applications demonstrate increasing expansion throughout Central and Eastern European countries that handle infrastructure development projects.

Europe's healthcare, along with pharmaceutical industries, jointly make sizable consumption contributions to hydrogen peroxide usage. The elevated need for non-toxic, efficient disinfectants fuels higher demand in a densely populated healthcare and biotech infrastructure network of hospitals and laboratories across Europe. The cosmetics and personal care industry utilizes hydrogen peroxide for professional teeth whitening services, combined with applications for hair bleaching procedures.

The chemical processing sectors in Western European countries including Germany and France and the Benelux nations operate as central-clustered facilities to produce synthetic and oxidizing compounds utilizing hydrogen peroxide. Europe's dedication to achieving both carbon neutrality and chemical toxicity reduction makes hydrogen peroxide an attractive choice for long-term success.

Europe stays ahead as an innovative leader in hydrogen peroxide market consumption through its robust regulatory system and sustainability-oriented approach and industrial technological integration.

The Japan Hydrogen Peroxide Market

The Japan Hydrogen Peroxide Market size is estimated to reach USD 211.48 million in 2025 and is further anticipated to reach USD 303.61 million by 2034, at a CAGR of 4.1%.

Japan's hydrogen peroxide market demonstrates continuous growth following advances in industrial operations and rising environmental interest, together with systematic technology development. The Japanese technological sector, which forms an essential economic foundation, utilizes high-purity hydrogen peroxide throughout semiconductor manufacturing processes for silicon wafer cleansing and microcircuit etching. The growth of next-generation technology investments throughout the country leads to rising demand for ultra-pure chemicals, especially in hydrogen peroxide.

Hydrogen peroxide serves fundamental purposes in healthcare settings where it performs hospital-grade antiseptic processes and supports wound treatments and machine sterilization. Japan's aging population has grown its healthcare infrastructure, which requires dependable antiseptic solutions. Hygiene-related consumer knowledge continues to expand, which drives household purchases of cleaning and sanitizing products.

Municipal and industrial water facilities use increasing amounts of hydrogen peroxide as an effective solution to pollution management and regulatory compliance. Japan's national initiatives to cut chemical hazards and create sustainable water practices find support through this environmentally safe oxidant technology.

The food and beverage industry depends on hydrogen peroxide solutions to perform product sterilization procedures when packaging dairy products and ready-to-drink beverages. Food safety regulations combined with clean-label packaging requirements enhance this key segment of Japan's market.

Hydrogen peroxide management presents difficulties because its volatile composition necessitates supportive facilities alongside worker training for safely handling and transportation.

The Japanese hydrogen peroxide market will sustain long-term growth thanks to ongoing research and development investment, combined with procedural safety enhancements, along with new applicational areas emerging in response to high-tech standards and ecological industrial requirements.

Global Hydrogen Peroxide Market: Key Takeaways

- Global Market Size Insights: The Global Hydrogen Peroxide Market size is estimated to have a value of USD 3,524.6 million in 2025 and is expected to reach USD 5,084.9 million by the end of 2034.

- The US Market Size Insights: The US Hydrogen Peroxide Market is projected to be valued at USD 889.3 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,259.9 million in 2034 at a CAGR of 3.9%.

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Hydrogen Peroxide Market with a share of about 37.8% in 2025.

- Key Players Insights: Some of the major key players in the Global Hydrogen Peroxide Market are Solvay, Evonik Industries, Arkema, Mitsubishi Gas Chemical Company, Kemira, Akzo Nobel, Nouryon, Taekwang Industrial, Hansol Chemical, OCI Company, Aditya Birla Chemicals, National Peroxide, Gujarat Alkalies and Chemicals, Indian Peroxide, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 4.2 percent over the forecasted period of 2025.

Global Hydrogen Peroxide Market: Use Cases

- Pulp and Paper Industry: The pulp and paper bleaching process extensively relies on hydrogen peroxide as a main agent. Due to its superior environmental compatibility, Hydrogen peroxide has become the preferred bleaching agent when operations pursue sustainability goals. The integration of hydrogen peroxide produces bright paper output at maintained strength levels across all pulping methods.

- Wastewater Treatment: Treatment facilities use hydrogen peroxide within advanced oxidation processes (AOPs) for tackling wastewater from municipal and industrial facilities. Advanced pollutants composed of phenols together with sulfides and organic residues are converted into easier-to-handle substances through this process. The combination of effectiveness combined with environmental friendliness positions hydrogen peroxide as an essential solution for industry players meeting their stringent substance release standards.

- Electronics and Semiconductors: Companies producing electronics employ hydrogen peroxide during the process to clean silicon wafers and etch printed circuit boards. The solution's high reactivity and clean nature enables it to remove sensitive components from organic and inorganic contaminants effectively. Semiconductor manufacturers require increasing amounts of high-purity hydrogen peroxide as their production processes achieve greater precision.

- Healthcare and Hygiene: Medical facilities use hydrogen peroxide as both a disinfectant for sterilization purposes. The compound functions as a tool sanitizer for surgical equipment as well as a surface sanitizing agent and as a vaporized substance for room disinfection. The broad-spectrum microorganism killing capabilities of hydrogen peroxide enable infection control outcomes which improve healthcare safety measures.

- Food and Beverage Processing: People use hydrogen peroxide to sterilize food packaging and equipment which helps prevent food contamination. Aseptic packaging lines use it to create microbial-free conditions which protect products from spoiling while maintaining a residue-free shelf life. The processing of dairy products and juices at regulated low concentrations utilizes this compound.

Global Hydrogen Peroxide Market: Stats & Facts

- U.S. Food and Drug Administration (FDA): In January 2024, the FDA recognized vaporized hydrogen peroxide (VHP) as an established method for sterilizing medical devices, acknowledging its long-standing safety and effectiveness.

- U.S. Environmental Protection Agency (EPA): The EPA promotes the use of hydrogen peroxide in advanced oxidation processes for wastewater treatment, highlighting its role in degrading organic contaminants and reducing environmental impact.

- European Chemicals Agency (ECHA): Hydrogen peroxide is registered under the REACH regulation, ensuring its safe manufacture and use within the European Union.

- National Bureau of Statistics of China: In 2023, China's production of processed paper and cardboard increased by approximately 5.89% to 145.31 million metric tons, indicating robust demand growth in the pulp and paper industry.

- India’s Ministry of Chemicals and Fertilizers: As of fiscal year 2023, India's installed production capacity for hydrogen peroxide was nearly 221.27 thousand metric tons, with actual production reaching approximately 184.4 thousand metric tons.

- U.S. Department of Agriculture (USDA): Hydrogen peroxide is approved for use in organic crop production as a disinfectant and sanitizer, reflecting its acceptance in sustainable agricultural practices.

- Health Canada: Hydrogen peroxide is listed as an active ingredient in various disinfectant products authorized for use against pathogens, including those causing COVID-19.

- European Food Safety Authority (EFSA): Hydrogen peroxide is evaluated and approved for use as a food additive and processing aid within the European Union, ensuring consumer safety.

- U.S. Occupational Safety and Health Administration (OSHA): OSHA sets the permissible exposure limit (PEL) for hydrogen peroxide at 1 part per million (ppm) over an 8-hour work shift, ensuring worker safety in industrial settings.

- World Health Organization (WHO): The WHO includes hydrogen peroxide in its list of essential medicines, recognizing its importance as a disinfectant and antiseptic in healthcare.

- European Commission: The European Commission classifies hydrogen peroxide as a biocide under the Biocidal Products Regulation (BPR), regulating its use in disinfectant products across EU member states.

- U.S. Centers for Disease Control and Prevention (CDC): The CDC acknowledges hydrogen peroxide as an effective disinfectant against a variety of pathogens, including viruses and bacteria, when used appropriately.

- Food Safety and Standards Authority of India (FSSAI): FSSAI permits the use of hydrogen peroxide in food processing under specified conditions, ensuring its safe application in the food industry.

Global Hydrogen Peroxide Market: Market Dynamics

Driving Factors in the Global Hydrogen Peroxide Market

Expansion of Water and Wastewater Treatment Infrastructure

The increasing global demand for clean water is a major driver for hydrogen peroxide. Water and wastewater treatment operations depend heavily on hydrogen peroxide because of its powerful oxidizing capability while featuring environmentally safe breakdown processes. Hydrogen peroxide serves multiple functions in pollution removal and pipeline biological control, as well as organic matter and phenols, and sulfide deleterious substance removal. Public authorities across nations build extensive water processing facilities because they need to respond to expanding metropolitan water consumption requirements within developing nations.

Asian and African countries actively build modern water facilities and update their existing systems because they aim to give their people reliable drinking water access. Advanced oxidation processes (AOPs) incorporate hydrogen peroxide as a critical component because they represent a seek solution for stringent environmental discharge regulations. The ongoing expansion of urban areas, coupled with heightened industrial water use patterns, will dramatically boost the water treatment applications market for hydrogen peroxide.

Increasing Demand from the Healthcare and Hygiene Sectors

The healthcare and hygiene sectors are raising their demand for hydrogen peroxide at an increasing rate. Healthcare facilities depend on hydrogen peroxide because it possesses strong antimicrobial actions. This compound serves hospitals and clinics for conducting wound care procedures, as well as instrument sterilization and facility surface disinfection. Medical environments value hydrogen peroxide because this solution effectively kills everything from bacteria to viruses to fungi, thereby ensuring vital protection during contemporary healthcare emergencies. Hydrogen peroxide vapor (HPV) sterilization systems represent an emerging technology that successfully disinfects overall rooms and delicate equipment through vapor-based operations.

Throughout the COVID-19 pandemic worldwide disinfectant requirements became evident, while heightened hygiene protection practices gained momentum for sustained growth. The product applications of hydrogen peroxide extend to personal care products, which include mouthwash, along with toothpaste and acne treatment formulations. The medical and hygiene industry will continue to increase its dependency on hydrogen peroxide as health expenditure grows alongside the need for safe but efficient sterilants.

Restraints in the Global Hydrogen Peroxide Market

Safety Concerns and Handling Limitations

Industrial benefits of hydrogen peroxide must confront extensive handling limitations along with severe safety hazards. Because of its heightened oxidizing characteristics, hydrogen peroxide acts as an explosive substance that creates dangerous fires when it meets any form of organic substance. Exposure to normal doses of hydrogen peroxide tends to create skin irritation as well as irritation in both the eyes and the respiratory tract.

Organizations require specialized storage methods and operational procedures, together with specific transportation protocols, because of these safety risks, thus leading to higher implementation costs. Safety investments in equipment and training programs, and risk reduction plans are needed by facilities to stop accidents from occurring. Small and medium enterprises show reluctance toward adopting hydrogen peroxide because of limited regional enforcement capabilities, along with inadequate infrastructure.

High-concentration hydrogen peroxide transportation follows strict hazardous material regulations, which restrict global distribution. Security concerns act as major obstacles that create particular problems when companies want to enter new markets that are not completely developed.

Regulatory Variability and Compliance Costs

Global hydrogen peroxide use faces obstacles because of varying regulatory standards between different territories. Low-concentration applications of this compound qualify as non-toxic, but hydrogen peroxide transitions into a hazardous substance when present in higher concentrations. The chemical management rules of REACH in Europe and EPA in the U.S., alongside Asian agencies, create separate requirements related to hydrogen peroxide utilization and disposal protocols and shipment handling.

International companies must handle contradictory international regulations because these guidelines raise their compliance expenses and operational intricacies. The introduction of stricter discharge laws by environmental regulations could result in heightened requirements for biodegradable chemicals, too, thus aggravating industry challenges.

New regulators frequently become mandatory for manufacturers to perform product re-certification as well as new jurisdictional testing. The differences between regional rules create delays that slow product releases while driving up operational expenses, which drive smaller businesses away from innovation efforts. Ongoing compliance challenges arise from these regulatory obstacles obstructions which hold back the market from natural expansion.

Opportunities in the Global Hydrogen Peroxide Market

Development of High-Purity Grades for Advanced Applications

Demand growth for high-purity hydrogen peroxide creates profitable opportunities across industrial settings that depend on strict chemical specifications. Modern industrial processing of semiconductors, pharmaceuticals, alongside food manufacturing requires hydrogen peroxide with highly purified standards. Chip manufacturing depends on semiconductor-grade hydrogen peroxide, which achieves >99.9% purity standards. The high level of purity blocks the formation of tiny flaws, which would destroy high-value components.

The development of domestic semiconductor capabilities, together with cleanroom infrastructure, creates new opportunities for ultra-pure chemical companies. High-purity hydrogen peroxide serves pharmaceutical production needs by safeguarding drugs against microbial contaminants in sterile production areas. Food manufacturers apply this substance to sterilize materials during their aseptic packaging procedures. Chemical producers have a promising business opportunity due to growing industries worldwide, particularly in Asia and the U.S., if they can match production specifications while increasing high-purity component manufacturing scale.

Emerging Applications in Green Energy and Environmental Remediation

Scientists study the growing applications of hydrogen peroxide for its use in innovative energy generation systems, together with environmental cleanup solutions. Research indicates that hydrogen peroxide shows potential as a fuel cell and propulsion system ingredient because it decomposes safely while providing strong oxidation properties.

The substance shows promise for satellite thruster and space application propulsion systems because it represents a safer solution than hydrazine. Through its effective remediation methods, hydrogen peroxide helps to purify ground sources and soil materials but shows particular strength when treating hydrocarbons alongside heavy metals and pesticides. The substance functions as part of in-situ chemical oxidation systems, which destroy contaminants in their natural subsurface environment.

These environmentally driven applications will experience growing adoption because governments and corporations are making net-zero emission goals and decarbonization investments. Hydrogen peroxide will benefit from increasing sustainability interest because its non-traditional applications provide extended growth potential on a worldwide scale.

Trends in the Global Hydrogen Peroxide Market

Adoption of Green and Sustainable Chemicals

Businesses worldwide now adopt green, sustainable chemicals, and hydrogen peroxide stands out as an ideal selection because of its environmental advantages. Hydrogen peroxide decomposes into both oxygen and water during its reaction process, which eliminates dangerous byproducts when compared to chlorine-based oxidants and bleaching agents. Hydrogen peroxide has attracted growing market interest from manufacturers who face dual requirements from regulatory bodies and consumer expectations to lower their environmental impact.

The pulp and paper industry experienced a major shift toward chlorine-free bleaching systems, which depend heavily on hydrogen peroxide. Food sterilization and water treatment processes benefit from hydrogen peroxide because of its non-hazardous decomposition properties, which meet strict safety regulations. Increasing ecological worries about industrial chemicals are compelling companies to replace hazardous agents with hydrogen peroxide in their products. The sustainable nature of hydrogen peroxide combines with growing global acceptance of circular economy and green chemistry principles to make it a crucial component in industrial strategies for the future.

Growing Utilization in Electronics and Semiconductor Manufacturing

The growth of advanced electronics technology has led to increased semiconductor manufacturing utilization of hydrogen peroxide, mainly for wafer cleaning operations and etching applications. The processing of microelectronic circuits requires high-purity hydrogen peroxide to maintain free residues because residue-free cleaning remains an essential condition for manufacturing these circuits. The shrinking size of chipsets, along with their increasing complexity, has raised the importance of ultra-clean processing environments.

Wafers receive widespread treatment with organic matter stripping solutions made of hydrogen peroxide combined with sulfuric acid in piranha mixtures. Asia's fast-growing electronics sector, including South Korea, Taiwan, and Japan, fuels the investments needed to build advanced ultra-pure chemical supply networks. Because 5G and AI, and IoT designs have increased semiconductor development speed, the production requirement for pure manufacturing facilities has resulted in increased hydrogen peroxide demand. Nation-state investments to build domestic semiconductor capabilities will speed up because they aim to decrease dependency, along with establishing technological control.

Global Hydrogen Peroxide Market: Research Scope and Analysis

By Product Function Analysis

The disinfectant function is projected to dominate the global hydrogen peroxide market due to its powerful oxidizing properties, enabling thorough microorganism elimination of bacteria, viruses, fungi, and spores. Hydrogen peroxide serves as both an efficient disinfectant due to its decomposition into water and oxygen byproducts, which remain environmentally benign for applications needing high safety continuity. The use of hydrogen peroxide-based disinfectants has experienced substantial growth during recent years because of rising worldwide concern about hygiene and sanitation and infection prevention needs across healthcare, pharmaceuticals, food processing markets, and residential cleaning applications.

The COVID-19 pandemic quickly intensified the marketplace need for surface disinfectants, hand sanitizers, and air decontamination systems among educational and business facilities, together with households. The hospital industry, together with laboratories, now increasingly uses hydrogen peroxide vapor (HPV) systems to sterilize spaces and equipment. Light disinfectant wipes and spray products, along with antiseptic mouthwashes, use hydrogen peroxide as their primary active ingredient, which expands cleaning applications between household and industrial settings.

Industry applications of hydrogen peroxide in food and beverage manufacturing focus on sterilizing packaging materials, especially when using aseptic packaging methods. Water facilities employ hydrogen peroxide to remove biofilms and kill bacteria without creating harmful DBPs like chlorine-based chemicals. Health safety bodies' support for non-toxic and biodegradable disinfectants through regulatory guidance boosted their extensive market adoption. Expert industry consensus recognizes hydrogen peroxide's disinfectant function as the market leader because of its ability to perform safely at a competitive cost while providing versatile solutions.

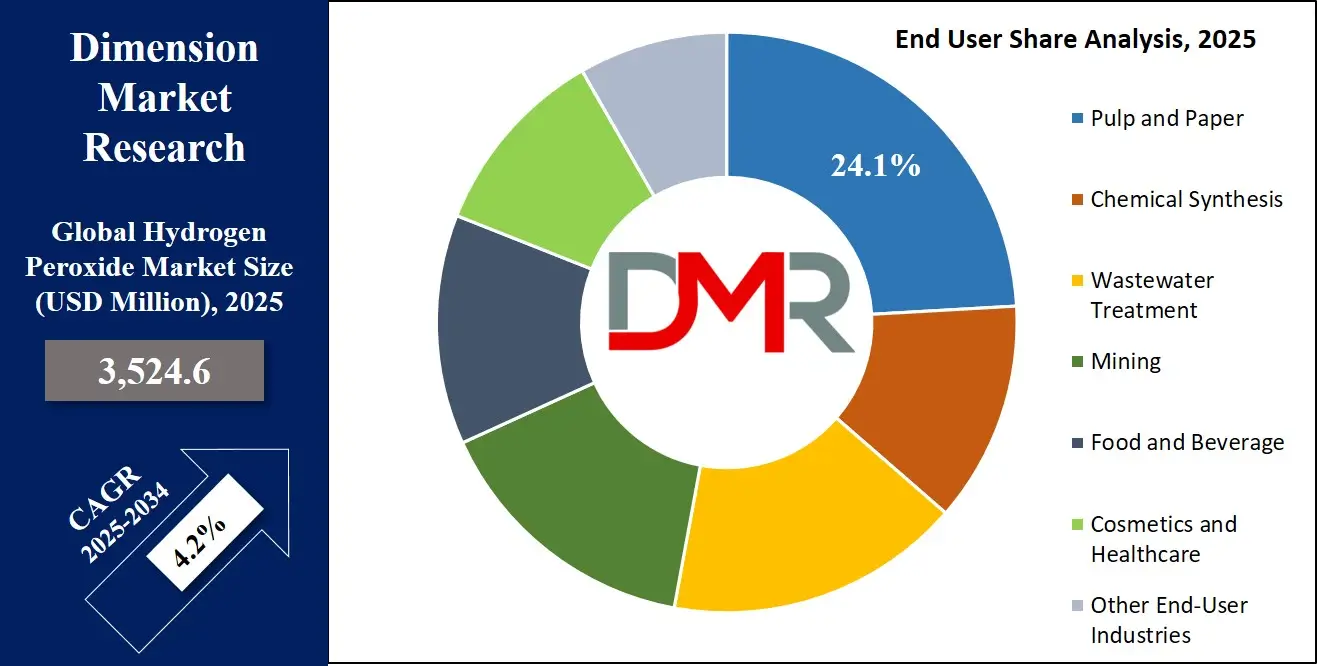

By End-User Industry Analysis

The pulp and paper industry is expected to dominate the end-user segment of hydrogen peroxide in the global market due to its widespread use as a bleaching agent. The pulp and paper industry predominantly chooses hydrogen peroxide because it provides cleaner bleaching than traditional chlorine-based chemicals during the industry's move toward more environmentally friendly solutions. However, the paper industry relies on hydrogen peroxide to develop bright and residue-free paper materials that drive printing media and hygiene business sectors, as well as packaging needs. The selective removal of lignin from pulp by this agent at room temperature protects the pulp's cellulose structure to support high-quality paper production that meets manufacturing needs for both performance and sustainability goals.

The pulp and paper industry's enormous size throughout Asia-Pacific and Europe, and North America creates increased market demand. The pulp manufacturing sector in China and India, along with Indonesia, continues to build its production strength because e-commerce packaging requirements and educational material printing needs, and tissue product demands have increased. Industrial applications of hydrogen peroxide reach beyond pulp bleaching because it helps de-ink recycled paper, leading to circular economy operations and meeting global recycling targets.

Hills respond to environmental requirements for decreased chemical wastewater emissions by selecting hydrogen peroxide as a wastewater treatment solution since it decomposes into water and oxygen, reducing effluent chemical oxygen demand (COD). The product's stability and ease of handling, together with its cost-efficiency, provide an ideal solution for all milling facility scales. The pulp and paper sector will continue to favor hydrogen peroxide as its main agent because sustainable paper demand rises worldwide, along with the adoption of modern, environmentally friendly bleaching methods.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global Hydrogen Peroxide Market Report is segmented on the basis of the following:

By Product Function

- Disinfectant

- Bleaching

- Oxidant

- Other Product Functions

By End-User Industry

- Pulp and Paper

- Chemical Synthesis

- Wastewater Treatment

- Mining

- Food and Beverage

- Cosmetics and Healthcare

- Other End-User Industries

Global Hydrogen Peroxide Market: Regional Analysis

Region with Highest Market Share

Asia Pacific is poised to dominate the global hydrogen peroxide market with 37.8% of market share by the end of 2025. The Asia Pacific region controls the total hydrogen peroxide market because its well-developed industrial base includes extensive pulp and paper production and heavy chemical operations alongside significant textile output.

Industrial fast-growing countries, including China, India, Japan, South Korea, and Indonesia, presently need large quantities of hydrogen peroxide for bleaching and disinfection and chemical synthesis operations. China strengthens the regional market pull for pulp products because it stands as one of the world's largest pulp manufacturers while operating extensive paper and packaging operations. Government backing for industrial growth and low labor costs, together with convenient access to raw materials, make this region commercially successful.

The large population numbers within this region create enhanced demand, which extends to consumer healthcare services and food sterilization requirements, and operational water quality maintenance needs. The combination of developed supply networks with leading players established domestically results in price stability while enabling large-scale manufacturing operations. Asia’s transition to more sustainable chemical regulations creates an opportunity for industries to utilize hydrogen peroxide instead of chlorine-based compounds, which improves the region's market lead.

Region with the Highest CAGR

Asia Pacific leads the hydrogen peroxide market growth expectations because industries accelerate at fast paces while urbanizing and requiring eco-friendly chemical solutions. Three emerging Pacific Asian countries are constructing substantial water treatment facilities and investing heavily in the sectors of textiles, electronics, and healthcare, which represent major fields of application for hydrogen peroxide. Due to escalating environmental worries and demanding federal regulations about wastewater and emissions, multiple industries now choose hydrogen peroxide because it provides a safer and more environmentally beneficial alternative.

Manufacturers of semiconductors in Taiwan, along with those in South Korea, are growing their operations, which creates substantial demand for high-purity hydrogen peroxide. The rising focus on hygiene following COVID-19 has driven exponential increases in pharmaceutical and home care product consumption. The region shows the strongest projected CAGR because it benefits from favorable trade policies and foreign direct investment in production and growing domestic consumption as part of its fast-paced economic development.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Hydrogen Peroxide Market: Competitive Landscape

The global hydrogen peroxide market is moderately consolidated, allowing multinational chemical firms to compete with regional producers through multiple parameters, including pricing and product quality, and purity standards. The major industry players in the hydrogen peroxide market include Solvay, along with Evonik Industries, Arkema, Mitsubishi Gas Chemical Company, and Nouryon, who uphold substantial market dominance because of their expansive production capabilities as well as their advanced technological developments and extensive global supply networks.

Hydrogen peroxide high-purity development receives extensive investment from these companies to serve industries requiring this grade for semiconductor manufacturing and pharmaceutical production segments, where demand continues to grow rapidly. The companies continue to strengthen their Asian Pacific footprint by entering partnerships and building new facilities to tap into increasing regional consumption patterns.

Local companies, together with specialized producers, actively shape market competition because these sectors often operate within areas with strict purity regulations or minimal regulations. The market shows persistent price competition within the bleaching solutions and wastewater treatment sectors because these represent commoditized applications.

Companies must focus on improving their production processes' environmental impact because sustainability, alongside regulatory compliance, stands as a primary selection factor between them and competitors. The combination of vertical business alliances and extended supply agreements with product end-users anchors manufacturers in steady revenue streams. Eco-friendly high-performance chemicals demand will drive an evolving competitive market toward increased innovation and value-added products and regional business growth.

Some of the prominent players in the Global Hydrogen Peroxide Market are:

- Solvay

- Evonik Industries

- Arkema

- Mitsubishi Gas Chemical Company

- Kemira

- Akzo Nobel

- Nouryon

- Taekwang Industrial

- Hansol Chemical

- OCI Company

- Aditya Birla Chemicals

- National Peroxide

- Gujarat Alkalies and Chemicals

- Indian Peroxide

- Kingboard Chemical Holdings

- Guangdong Zhongcheng Chemicals

- Luxi Chemical Group

- Grupa Azoty

- Airedale Chemical

- Merck Group

- Other Key Players

Recent Developments in the Global Hydrogen Peroxide Market

- March 2025: Evonik Industries AG completed the acquisition of Thai Peroxide Co. Ltd., enhancing its production capacity for various peroxide products, including hydrogen peroxide, and strengthening its market presence in the Asia Pacific region.

- February 2025: Solvay announced the expansion of its hydrogen peroxide production capacity at the Shandong Huatai Interox Chemical facility in China, targeting 48 kilotons of photovoltaic-grade hydrogen peroxide annually by 2025.

- January 2025: Solvay and Huatai unveiled plans to expand their hydrogen peroxide production capacity in China, aiming to produce 48 kilotons/year of photovoltaic-grade hydrogen peroxide by 2025.

- December 2024: Evonik Industries AG finalized the acquisition of Thai Peroxide Co. Ltd., a Thai-based manufacturer of peroxide products, expanding its production capacity for hydrogen peroxide and peracetic acid.

- October 2024: Dow and Evonik initiated operations at a new pilot plant for hydrogen peroxide to propylene glycol (HPPG) production, utilizing the HYPROSYN technique for direct synthesis.

- September 2024: Shinsol Advanced Chemicals, a partnership between Solvay and Shinkong Synthetic Fibers Corporation, commenced operations at a new production plant in Tainan, Taiwan, producing electronic-grade hydrogen peroxide with a capacity of 35,000 tons per annum.

- August 2024: DCM Shriram Ltd launched a new hydrogen peroxide plant at its chemical complex in Jhagadia, Gujarat, India, with an annual capacity of 52,500 tonnes.

- June 2024: Nuberg EPC secured a contract to build a 40,000 MTPA hydrogen peroxide plant for PT Sulfindo Adiusaha in Indonesia, addressing the region's growing demand.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3,524.6 Mn |

| Forecast Value (2034) |

USD 5,084.9 Mn |

| CAGR (2025–2034) |

4.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 889.3 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Function (Disinfectant, Bleaching, Oxidant, Other Product Functions, and By End-User Industry (Pulp and Paper, Chemical Synthesis, Wastewater Treatment, Mining, Food and Beverage, Cosmetics and Healthcare, Textiles, Other End-User Industries) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Solvay, Evonik Industries, Arkema, Mitsubishi Gas Chemical Company, Kemira, Akzo Nobel, Nouryon, Taekwang Industrial, Hansol Chemical, OCI Company, Aditya Birla Chemicals, National Peroxide, Gujarat Alkalies and Chemicals, Indian Peroxide, Kingboard Chemical Holdings, Guangdong Zhongcheng Chemicals, Luxi Chemical Group, Grupa Azoty, Airedale Chemical, Merck Group., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Global Hydrogen Peroxide Market?

▾ The Global Hydrogen Peroxide Market size is estimated to have a value of USD 3,524.6 million in 2025 and is expected to reach USD 5,084.9 million by the end of 2034.

What is the size of the US Hydrogen Peroxide Market?

▾ The US Hydrogen Peroxide Market is projected to be valued at USD 889.3 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,259.9 million in 2034 at a CAGR of 3.9%.

Which region accounted for the largest Global Hydrogen Peroxide Market?

▾ Asia Pacific is expected to have the largest market share in the Global Hydrogen Peroxide Market with a share of about 37.8% in 2025.

Who are the key players in the Global Hydrogen Peroxide Market?

▾ Some of the major key players in the Global Hydrogen Peroxide Market are Solvay, Evonik Industries, Arkema, Mitsubishi Gas Chemical Company, Kemira, Akzo Nobel, Nouryon, Taekwang Industrial, Hansol Chemical, OCI Company, Aditya Birla Chemicals, National Peroxide, Gujarat Alkalies and Chemicals, Indian Peroxide, and many others.