Market Overview

The Global Hygienic Cladding Market is projected to reach USD 4.0 billion in 2025, and is expected to grow to USD 7.0 billion by 2034, registering a CAGR of 6.2%. This growth is driven by rising demand in healthcare infrastructure, food processing facilities, and cleanroom environments, where antimicrobial wall panels and hygienic surface solutions are critical for compliance and safety.

Hygienic cladding refers to a specialized form of wall and ceiling covering designed to maintain high standards of cleanliness, sanitation, and protection in sensitive environments. Made from materials like PVC, polypropylene, stainless steel, or GRP, these cladding systems are non-porous, easy to clean, and resistant to moisture, impact, and microbial growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Hygienic cladding is primarily used in areas where hygiene compliance is critical, such as hospitals, commercial kitchens, food processing plants, laboratories, and pharmaceutical manufacturing units. Its seamless installation, resistance to chemicals, and compatibility with cleanroom standards make it an ideal choice for maintaining sterile and controlled spaces. Additionally, it helps reduce maintenance costs and improves the longevity of infrastructure by acting as a protective barrier against contamination and physical damage.

The global hygienic cladding market has evolved into a vital segment of the building materials industry, driven by growing awareness about health, safety, and environmental hygiene across various sectors. Demand is steadily rising as industries such as food and beverage, healthcare, biotechnology, and pharmaceuticals invest in facility upgrades to meet stringent regulatory standards.

Modern construction practices emphasize not only durability and cost-effectiveness but also compliance with HACCP and ISO cleanroom requirements, propelling the adoption of antimicrobial and fire-retardant cladding materials. Countries with strong regulatory frameworks, including those in Europe and North America, are leading the charge, while developing regions in Asia and the Middle East are catching up due to urbanization and public health infrastructure development.

In recent years, the market has also been influenced by advancements in cladding technologies, such as the introduction of recyclable and eco-friendly materials, digitally printed finishes, and modular panel systems that reduce installation time. The integration of sustainable building practices and LEED certification goals has further accelerated demand.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Moreover, post-pandemic hygiene consciousness among end-users and industries has elevated hygienic wall and ceiling solutions from niche to essential, particularly in healthcare and high-traffic commercial settings. As global supply chains stabilize and construction activity rebounds, the hygienic cladding market is expected to experience sustained growth, supported by innovation, customization, and rising public-private investments in sanitation-focused infrastructure.

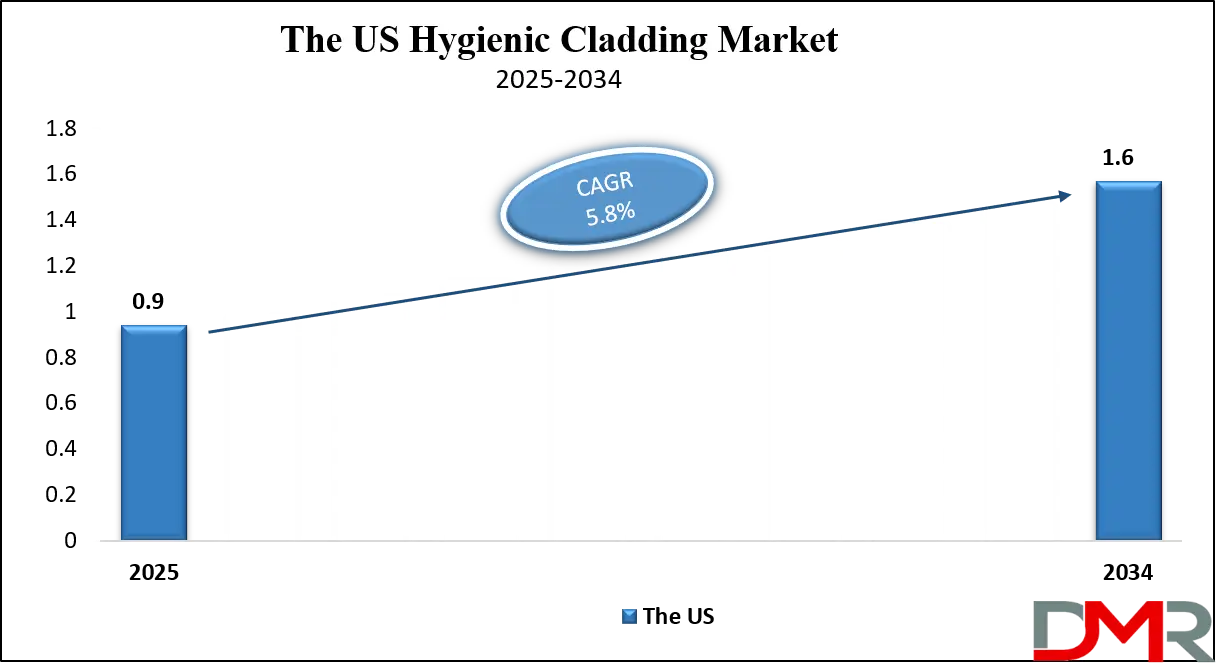

The US Hygienic Cladding Market

The U.S. Hygienic Cladding Market size is projected to be valued at USD 0.9 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.6 billion in 2034 at a CAGR of 5.8%.

The U.S. hygienic cladding market is witnessing significant momentum due to the country's growing focus on infection control, food safety, and regulatory compliance across critical sectors. Hospitals, surgical centers, and diagnostic laboratories are prioritizing the installation of seamless, easy-to-clean wall and ceiling systems to reduce the risk of contamination and support sterile operations.

As healthcare infrastructure continues to expand in both urban and rural areas, demand for antimicrobial cladding materials with properties like chemical resistance and non-porous finishes is rising. Moreover, the renovation of aging facilities and stricter OSHA and FDA standards are further compelling stakeholders to adopt advanced hygienic cladding systems in clinical and pharmaceutical environments.

In parallel, the food and beverage industry in the U.S. is adopting hygienic PVC wall panels, impact-resistant coverings, and mold-inhibiting surface finishes in processing plants, commercial kitchens, and cold storage units. The trend is driven by the need to comply with HACCP guidelines and USDA requirements for hygienic interiors.

Additionally, cleanroom construction in the biotechnology, electronics, and aerospace sectors is contributing to the market, where controlled environments require particulate-free and chemical-tolerant surfaces. The integration of energy-efficient cladding systems and sustainable building materials also aligns with LEED and green building practices, making the U.S. market a key hub for innovation and compliance-led growth in hygienic interior solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Hygienic Cladding Market

In 2025, Europe is expected to command a dominant position in the global hygienic cladding market, accounting for a market value of approximately USD 1.4 billion. This strong regional presence is underpinned by a mature construction ecosystem, advanced healthcare infrastructure, and rigorous hygiene and fire safety regulations set by the European Union.

Countries like Germany, the UK, France, and the Netherlands are at the forefront of this growth, driven by retrofitting initiatives in hospitals, cleanrooms, pharmaceutical plants, and food processing facilities. European consumers and industries also show a strong preference for eco-friendly and low-VOC building materials, which is prompting manufacturers to invest in recyclable and sustainable hygienic cladding products that align with environmental compliance frameworks such as LEED and BREEAM.

Over the forecast period, the European hygienic cladding market is anticipated to grow at a compound annual growth rate (CAGR) of 5.8%. This steady expansion is supported by continuous innovation in material technology, growing public and private investment in infrastructure modernization, and heightened awareness of infection control in the post-pandemic era.

Additionally, regional manufacturers are leveraging advancements in antimicrobial coatings, digital printing on cladding panels, and modular installation systems to appeal to both aesthetics- and performance-driven segments. As demand continues to rise across institutional, industrial, and high-end residential sectors, Europe is likely to remain a critical hub for both consumption and innovation in the hygienic cladding space.

The Japan Hygienic Cladding Market

Japan hygienic cladding market is projected to reach a valuation of USD 0.1 billion in 2025, reflecting its steady role within the global landscape. Despite holding a smaller market share compared to leading regions, Japan exhibits a strong focus on hygiene-centric construction, particularly within its healthcare, food processing, and pharmaceutical sectors. The country’s aging infrastructure, especially hospitals and eldercare facilities, has prompted increased investments in modern, easy-to-clean, and bacteria-resistant surfaces.

Additionally, stringent government regulations related to food safety and cleanliness standards have accelerated the adoption of hygienic cladding solutions in food factories, commercial kitchens, and cold storage units. With Japan’s construction sector emphasizing quality, durability, and long-term value, cladding solutions with low maintenance needs and high performance are becoming essential.

The Japanese market is anticipated to grow at a CAGR of 6.5% over the forecast period, making it one of the fastest-growing markets in the Asia-Pacific region. This growth is largely driven by rising awareness of infection control, growing healthcare renovations, and technological advancements in cladding systems tailored to Japan’s seismic and climatic conditions. Urban redevelopment projects in cities like Tokyo and Osaka are also fostering demand for modern building materials that meet both hygiene and aesthetic requirements.

Moreover, local manufacturers and distributors are expanding product lines to cater to evolving consumer preferences, including antimicrobial PVC panels and lightweight composite claddings. Japan’s focus on high standards of living and cleanliness, combined with supportive policies and innovation, is likely to sustain the upward momentum in its hygienic cladding market.

Global Hygienic Cladding Market: Key Takeaways

- Market Value: The global hygienic cladding market size is expected to reach a value of USD 7.0 billion by 2034 from a base value of USD 4.0 billion in 2025 at a CAGR of 6.2%.

- By Material Type Segment Analysis: PVC (Polyvinyl Chloride) is anticipated to dominate the material type segment, capturing 55.0% of the total market share in 2025.

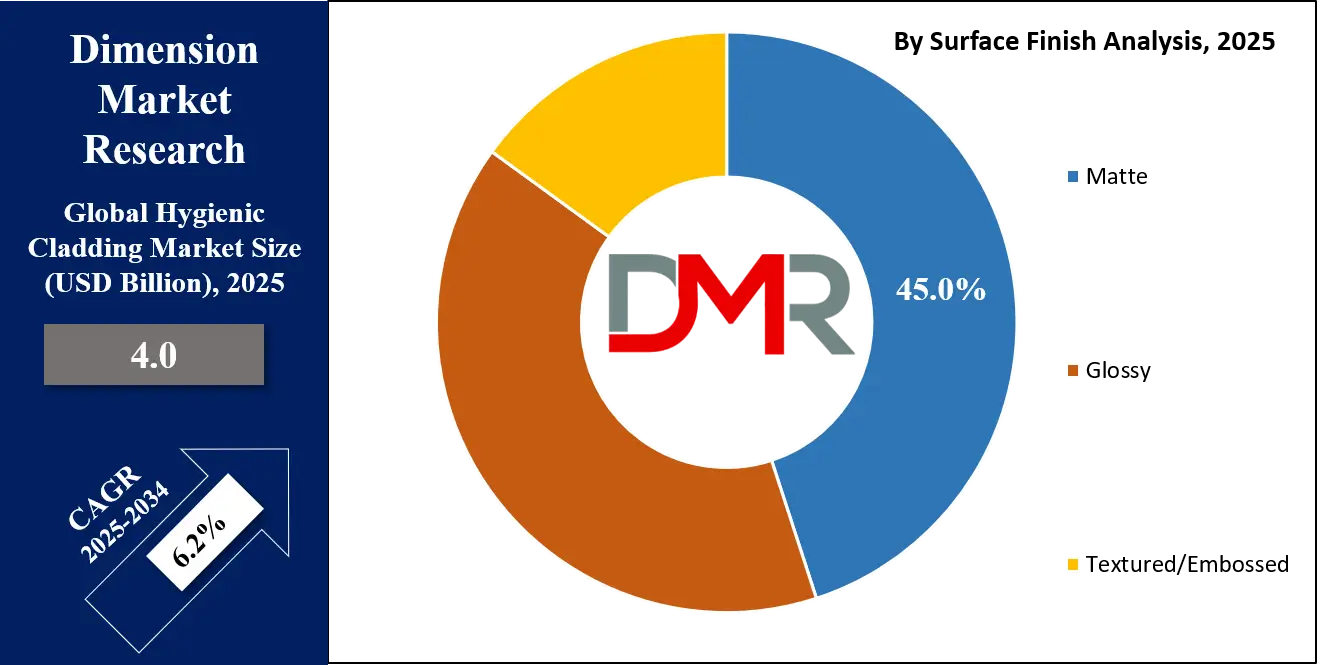

- By Surface Finish Segment Analysis: Matte is poised to consolidate their dominance in the surface finish segment, capturing 45.0% of the total market share in 2025.

- By Installation Type Segment Analysis: Wall Cladding is expected to dominate the installation type segment, capturing 65.0% of the total market share in 2025.

- By Application Segment Analysis: The Healthcare applications are anticipated to maintain their dominance in the application segment, capturing 33.0% of the total market share in 2025.

- By End-User Segment Analysis: B2B will lead the end-user segment, capturing 70.0% of the market share in 2025.

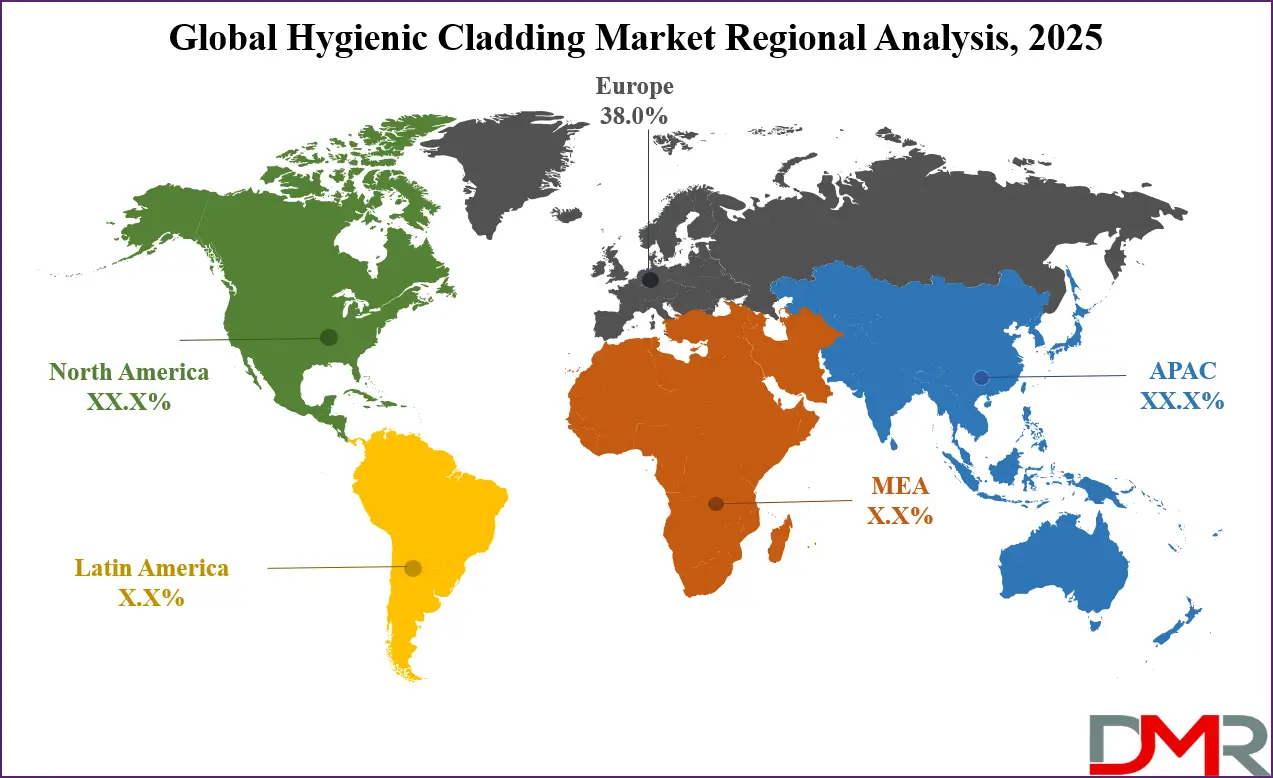

- Regional Analysis: Europe is anticipated to lead the global hygienic cladding market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global hygienic cladding market are Amazon Logistics, FedEx, UPS, DHL, JD Logistics, SF Express, DPDgroup, XPO Logistics, Postmates, DoorDash, Uber Eats, Instacart, Gopuff, Delhivery, Shadowfax, Blue Dart, and Other Key Players.

Global Hygienic Cladding Market: Use Cases

- Infection Control in Healthcare Facilities: In hospitals, clinics, and surgical centers, maintaining sterile conditions is vital to prevent the spread of healthcare-associated infections (HAIs). Hygienic cladding solutions such as PVC wall panels, antimicrobial coatings, and seamless ceiling systems are extensively used in operating rooms, ICUs, patient wards, and laboratories. These cladding materials resist microbial growth, are non-absorbent, and can withstand frequent cleaning with strong disinfectants. Moreover, their ability to create a seamless, joint-free surface ensures there are no cracks or gaps where pathogens can accumulate. Compliance with CDC and WHO hygiene standards, along with ease of maintenance, makes hygienic cladding a critical investment in healthcare infrastructure expansion and refurbishment.

- Food Processing and Commercial Kitchen Hygiene: In food and beverage processing environments, hygienic cladding plays a central role in maintaining a safe and compliant production space. Walls, ceilings, and sometimes even doors are lined with hygienic PVC or GRP panels that are waterproof, chemical-resistant, and easy to sanitize. These surfaces prevent contamination, facilitate rapid cleaning, and comply with FDA, USDA, and HACCP regulations. Hygienic cladding is widely installed in meat processing units, dairy plants, industrial bakeries, and commercial kitchens where temperature variations and food spills are common. Its use minimizes downtime due to cleaning and supports continuous, safe operations.

- Cleanroom Compliance in Pharmaceutical and Biotech Manufacturing: Pharmaceutical and biotech facilities require ultra-clean environments where particle control, chemical resistance, and air-tight surfaces are non-negotiable. Hygienic cladding systems are deployed in cleanrooms, formulation labs, and packaging units to meet ISO classifications and GMP (Good Manufacturing Practices) guidelines. These systems prevent microbial growth, are compatible with HEPA filtration systems, and withstand sterilization procedures such as vaporized hydrogen peroxide (VHP) fumigation. Additionally, the cladding supports electrostatic discharge (ESD) control and chemical resistance, making it suitable for high-tech, contamination-sensitive spaces.

- Hygienic Interiors in Education and Public Buildings: Educational institutions, government buildings, and public restrooms are incorporating hygienic cladding to improve sanitation and extend the life of infrastructure. In schools and universities, hygienic panels are used in cafeterias, science labs, and washrooms to withstand high traffic and frequent cleaning. Public buildings benefit from vandal-resistant, impact-resistant, and graffiti-proof surface finishes that reduce maintenance costs and improve cleanliness. This application is especially relevant in post-pandemic design, where enhanced hygiene has become a priority in community-facing environments.

Global Hygienic Cladding Market: Stats & Facts

European Environment Agency & Eurostat

- An estimated 15.5% of EU‑27 households reported dampness or mould in their dwelling in 2023, up from 12.7% in 2019.

- In the WHO European region, 18% of homes have excessive indoor moisture; within the EU15, 15% are affected, rising to 18% in newer Member States.

- Housing-related environmental hazards, including dampness, are linked to over 100,000 premature deaths annually in the WHO European Region.

World Health Organization (WHO)

- Globally, around 1 in 10 patients acquire a healthcare-associated infection (HAI) during care; in Europe, approximately 9 million HAIs occur yearly, leading to 25 million additional hospital days and costing between EUR 13–24 billion.

- Investments in infection prevention and control (including hygiene surfaces) can reduce HAIs and antimicrobial resistance by 35–70%.

- Globally, 50% of healthcare facilities still lack basic hand hygiene infrastructure at the point of care.

UNICEF / WHO Joint Monitoring Programme for WASH

- Unsafe hand hygiene contributes to approximately 394,000 deaths from diarrhoea and 356,000 deaths from acute respiratory infections annually.

European Environment Agency (Indoor Air Quality)

- European citizens spend around 90% of their time indoors, underscoring the importance of safe building materials and surface hygiene.

- Indoor exposure to dampness, chemicals, and microbes like mould significantly contributes to respiratory illnesses and allergies.

Global Indoor Health Network

- In a survey across 31 European countries, 12.1% of homes had damp, 10.3% had mould, and 10.0% had water damage, with roughly 16.5% of dwellings affected by one or more of these conditions.

Global Hygienic Cladding Market: Market Dynamics

Global Hygienic Cladding Market: Driving Factors

Stringent Regulatory Frameworks in Hygiene-Sensitive Industries

The growing enforcement of global health and safety regulations in sectors like food processing, healthcare, and pharmaceuticals is significantly boosting the adoption of hygienic cladding systems. Regulatory bodies such as the FDA, HACCP, and ISO mandate the use of cleanable, non-porous, and antimicrobial wall and ceiling surfaces to reduce contamination risks. As a result, industries are replacing conventional wall finishes with advanced hygienic surface panels to meet compliance standards and avoid operational penalties.

Expansion of Healthcare Infrastructure Worldwide

Rising investments in healthcare infrastructure, especially in emerging markets, are fueling demand for robust and hygienic interior solutions. With a surge in hospital construction, modular cleanrooms, diagnostic centers, and medical laboratories, the need for easy-to-install, moisture-resistant cladding is at an all-time high. These materials help maintain sterile zones and support infection prevention protocols, making them indispensable in both new builds and refurbishments.

Global Hygienic Cladding Market: Restraints

High Initial Installation Costs

Despite long-term savings and low maintenance, the upfront cost of hygienic cladding can be a deterrent for small and mid-sized facilities. Quality cladding systems, especially those with advanced antimicrobial or fire-retardant properties, come with higher material and installation expenses compared to traditional finishes like tiles or paint. Budget constraints often lead decision-makers to opt for lower-cost alternatives, especially in developing markets.

Lack of Awareness in Emerging Economies

In many developing regions, facility managers and builders remain unaware of the benefits of hygienic wall protection systems. Limited exposure to hygiene-compliant construction standards and the dominance of traditional building materials hinder market penetration. Without a strong regulatory push or targeted awareness campaigns, adoption rates remain relatively low outside major urban centers.

Global Hygienic Cladding Market: Opportunities

Rising Demand for Retrofitting and Renovation Projects

Aging infrastructure in healthcare, food processing, and educational institutions presents a major opportunity for hygienic cladding manufacturers. Facility operators are prioritizing retrofitting with modern, antimicrobial panels to align with post-pandemic hygiene expectations. Retrofit-friendly cladding systems with quick installation and minimal disruption are gaining traction as organizations upgrade without halting operations.

Growth of Sustainable and Eco-Friendly Cladding Solutions

With global emphasis on sustainability, there’s a growing market for hygienic cladding products made from recyclable, low-VOC, and energy-efficient materials. Manufacturers are introducing PVC-free and LEED-compliant solutions that align with green building certifications. This is attracting environmentally conscious buyers in sectors like biotech, healthcare, and government infrastructure.

Global Hygienic Cladding Market: Trends

Integration of Digital Printing and Aesthetic Design

The market is shifting from purely functional to visually appealing, hygienic cladding. Digital printing technologies now allow for custom patterns, branding elements, and textured finishes without compromising hygiene standards. This is especially popular in hospitality, retail, and pediatric healthcare settings where ambiance and aesthetics are important alongside hygiene.

Technological Advancements in Installation and Material Science

Innovations such as interlocking panel systems, antimicrobial nanocoatings, and UV-stabilized surfaces are transforming the hygienic cladding landscape. These technologies enhance durability, reduce installation time, and expand use cases in high-stress environments. Smart material integration, including IoT-enabled surfaces for hygiene monitoring, is also emerging in high-end applications.

Global Hygienic Cladding Market: Research Scope and Analysis

By Material Type Analysis

In the material type segment of the hygienic cladding market, PVC (Polyvinyl Chloride) is expected to maintain a dominant position, accounting for approximately 55.0% of the total market share in 2025. This widespread use is attributed to PVC’s cost-effectiveness, ease of installation, and strong resistance to moisture, chemicals, and microbial growth. Its smooth, non-porous surface allows for easy cleaning, making it ideal for environments that demand high sanitation standards, such as hospitals, food production areas, commercial kitchens, and pharmaceutical facilities.

Moreover, PVC cladding offers flexibility in design, a wide range of colors and finishes, and low long-term maintenance, all of which contribute to its strong market preference. It is also lightweight, reducing structural load, and compatible with various substrates, allowing for quick retrofitting and refurbishment projects.

Glass Reinforced Plastic (GRP), on the other hand, represents a growing but smaller share of the material segment. GRP panels are known for their superior durability, impact resistance, and longevity in harsh environments. They are especially suited for high-traffic or industrial areas where the wall surfaces are subject to heavy wear and chemical exposure.

Unlike PVC, GRP is less flexible and can be more expensive to install, but its robust performance in facilities such as cold storage units, meat processing plants, and pharmaceutical warehouses makes it a preferred choice where heavy-duty applications are necessary. GRP’s resistance to corrosion, thermal variations, and water ingress ensures reliable performance over the long term, making it a strategic material in segments that require extreme hygiene integrated with physical durability.

By Surface Finish Analysis

In the surface finish segment of the hygienic cladding market, matte finishes are expected to lead, capturing around 45.0% of the total market share in 2025. The preference for matte surfaces is largely driven by their non-reflective nature, which reduces glare and provides a more subdued, professional appearance, especially in clinical and sterile environments. Matte cladding is widely favored in hospitals, cleanrooms, laboratories, and pharmaceutical settings where visual comfort, minimal distraction, and reduced light reflection are essential.

Additionally, matte finishes are effective at concealing minor scratches, smudges, and stains, helping to maintain a cleaner look over time with minimal maintenance. Their understated aesthetic also aligns well with modern design preferences in healthcare and institutional buildings.

Glossy finishes, while representing a slightly smaller share of the market, continue to hold relevance in environments where a bright, high-gloss look is desired. Glossy hygienic cladding reflects more light, creating a sense of brightness and openness that can be particularly beneficial in confined spaces or areas lacking natural light. This type of finish is often used in commercial kitchens, high-visibility food preparation areas, and retail settings where visual impact is important.

However, glossy surfaces may require more frequent cleaning as they tend to show fingerprints, dust, and surface marks more readily than matte finishes. Despite this, their sleek appearance and ability to enhance lighting efficiency make glossy cladding a viable option in aesthetic-conscious applications where hygiene and visual appeal go hand in hand.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Installation Type Analysis

In the installation type segment of the hygienic cladding market, wall cladding is projected to dominate, capturing approximately 65.0% of the total market share in 2025. This strong dominance is primarily driven by the extensive use of hygienic wall panels in critical environments such as hospitals, food processing units, commercial kitchens, laboratories, and pharmaceutical facilities. Walls are more exposed to splashes, impacts, and direct contact with equipment and personnel, making them more susceptible to contamination and wear.

Hygienic wall cladding offers a durable, non-porous, and easy-to-clean surface that ensures compliance with sanitation and safety standards. The wide range of available materials, like PVC, GRP, and stainless steel, also allows for customization based on the specific needs of each facility. Quick installation, retrofitting capabilities, and compatibility with existing infrastructure further add to its growing market preference.

Ceiling cladding, although capturing a smaller share of the market, remains a critical component in maintaining a complete hygienic environment. In sectors like healthcare and cleanrooms, where particulate control and cleanliness are vital, hygienic ceiling panels help prevent dust accumulation and microbial growth. These claddings are particularly important in rooms with HVAC systems, as they reduce the risk of airborne contamination and contribute to air quality control.

Ceiling cladding is also valued for its resistance to moisture, mold, and corrosion, especially in environments with high humidity or temperature fluctuations. While ceilings are generally subject to less physical wear than walls, they still require sanitary integrity, especially in regulated industries. The demand for seamless, easy-to-maintain, and light-reflective ceiling solutions is expected to grow steadily, driven by the rising construction of compliant clean environments across the globe.

By Application Analysis

In the application segment of the hygienic cladding market, healthcare is projected to retain the largest share, accounting for 33.0% of the total market in 2025. This dominance stems from the critical need to maintain sterile and contamination-free environments in hospitals, clinics, surgical units, laboratories, and diagnostic centers. Hygienic cladding in healthcare settings is essential for infection prevention, especially in high-risk zones like ICUs, operating rooms, and isolation wards.

Materials such as PVC and antimicrobial-coated panels are preferred for their ability to resist chemical damage from disinfectants, prevent microbial growth, and allow for easy cleaning and maintenance. As healthcare infrastructure expands globally, especially in emerging economies, demand for these advanced interior solutions is expected to rise steadily, supported by stringent hygiene standards and regulatory requirements from health organizations.

Food processing and commercial kitchen applications also represent a significant and growing share of the hygienic cladding market. In this segment, the primary focus is on ensuring surfaces are impervious to moisture, grease, and contaminants to maintain food safety and meet strict sanitation codes. Cladding materials are widely used on walls and ceilings in meat and dairy plants, bakeries, cold storage units, and industrial kitchens to ensure seamless, non-absorbent, and washable surfaces.

These settings often require regular high-pressure cleaning and exposure to temperature extremes, making durability and resistance to chemicals essential. Hygienic cladding supports HACCP compliance and reduces the risk of foodborne illnesses by minimizing bacterial harbor points. With growing awareness of food hygiene and safety regulations, along with rising automation and facility upgrades in the food sector, this application segment continues to offer strong growth potential.

By End-User Analysis

In the end-user segment of the hygienic cladding market, B2B is expected to lead substantially, capturing 70.0% of the total market share in 2025. This dominance is largely driven by large-scale procurement from industries that demand consistent hygiene standards, such as healthcare, pharmaceuticals, food and beverage processing, biotechnology, and manufacturing.

Organizations in these sectors often invest in hygienic cladding systems as part of new facility development, infrastructure modernization, or compliance upgrades. The B2B segment benefits from bulk purchasing, long-term contracts, and project-based installations where product durability, performance certifications, and adherence to industry-specific standards are critical. These buyers typically prioritize functionality, regulatory compliance, and cost-efficiency over aesthetics, making performance-driven cladding solutions more favorable in this segment.

The B2C segment, while comparatively smaller, is gradually gaining momentum as awareness around hygiene and modern interior solutions spreads among residential consumers. Homeowners are turning to hygienic cladding for areas like bathrooms, kitchens, basements, and utility rooms, particularly where moisture resistance, mold prevention, and ease of cleaning are important.

Additionally, B2C demand is rising in upscale housing, assisted living facilities, and high-end apartments that value low-maintenance and hygienic wall surfaces. While this segment is more price-sensitive and design-oriented, it presents a niche opportunity for manufacturers offering customizable, decorative, and easy-to-install cladding products suited for residential environments. As health-conscious home renovations and DIY remodeling projects grow, the B2C share is expected to expand steadily in the coming years.

The Hygienic Cladding Market Report is segmented on the basis of the following:

By Material Type

- PVC (Polyvinyl Chloride)

- GRP (Glass Reinforced Plastic)

- Polypropylene

- Stainless Steel

- Others

By Surface Finish

- Matte

- Glossy

- Textured/Embossed

By Installation Type

- Wall Cladding

- Ceiling Cladding

- Corner and Edge Protection Systems

- Other Fixtures

By Application

- Healthcare

- Food Processing & Kitchens

- Pharmaceuticals & Biotech Facilities

- Retail & Commercial Spaces

- Education & Public Buildings

- Others

By End-User

Global Hygienic Cladding Market: Regional Analysis

Region with the Largest Revenue Share

Europe is projected to lead the global hygienic cladding market in 2025, accounting for 38.0% of the total market revenue, driven by stringent regulatory standards, advanced infrastructure, and strong demand from healthcare, pharmaceutical, and food processing sectors. Countries like Germany, the UK, and France are at the forefront, investing heavily in hygiene-compliant construction and retrofitting projects to meet EU sanitation and safety guidelines.

The region’s mature construction industry, combined with widespread awareness of infection control and cleanroom technologies, supports the adoption of premium cladding materials. Additionally, the push for sustainable and energy-efficient building solutions in Europe further boosts the demand for recyclable and low-VOC hygienic cladding systems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is expected to register the highest CAGR in the global hygienic cladding market, fueled by rapid industrialization, expanding healthcare infrastructure, and rising food safety awareness across emerging economies like China, India, and Southeast Asian nations. As these countries invest in modern hospitals, pharmaceutical facilities, and food processing plants, the demand for cost-effective, durable, and compliant interior wall solutions is surging.

Government initiatives promoting hygiene standards, along with growing foreign direct investments in the medical and manufacturing sectors, are further accelerating adoption. The region’s vast construction pipeline and low market saturation make it a hotspot for future growth and a key focus area for global cladding manufacturers.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Hygienic Cladding Market: Competitive Landscape

The global hygienic cladding market features a competitive landscape led by established multinational players and supported by a growing presence of regional manufacturers focused on innovation, cost-efficiency, and regulatory compliance. Key companies compete by offering a wide range of advanced materials like antimicrobial PVC, GRP, and eco-friendly alternatives, tailored to high-demand sectors such as healthcare, pharmaceuticals, and food processing. With growing emphasis on hygienic standards and sustainability, firms are prioritizing R&D, certifications (like HACCP and ISO), and rapid installation technologies to stay ahead. Market consolidation through partnerships and acquisitions is on the rise, while regional players in Asia and Eastern Europe are gaining ground by offering affordable, localized solutions that cater to developing economies.

Some of the prominent players in the global hygienic cladding market are:

- Altro Ltd

- BioClad Ltd

- Gerflor Group

- Palram Industries Ltd

- Whiterock (part of Altro)

- AM-Clad

- Trovex

- Gradus

- Dumaplast

- Inpro Corporation

- Construction Specialties Inc.

- Isoclad

- Hygienik Systems Ltd

- Polyflor Ltd

- Trimo d.o.o.

- Marvec (Brett Martin)

- Versatile Group

- Protek Systems

- DecraLed

- Stonhard (a division of RPM International)

- Other Key Players

Global Hygienic Cladding Market: Recent Developments

Product Launches

- May 2025: Strong by Form introduced Woodflow‑skin, a timber‑based composite interior cladding line unveiled at Milan Design Week, blending sustainable aesthetics with high-performance composite technology.

- January 2025: Freefoam Building Products launched its new Agate Grey Single Shiplap PVC cladding, offering a modern, muted exterior finish aimed at refurbishment markets.

Mergers & Acquisitions

- November 2024: Dutch cleanroom specialist SRBA Group acquired a 60% stake in Connecticut‑based Corporate Construction Inc., marking a key expansion into the US controlled‑environment market.

- January 2025: Permasteelisa completed the acquisition of US cladding specialist Benson, enhancing operational scale and customer support in the Mid‑Atlantic region.

Funding Events

- May 2025: Indian home‑hygiene brand Cleevo secured USD 1 million in seed funding led by Eternal Capital, with participation from Zeca Capital, iSeed, OTP Ventures, and others to advance its surface cleaning solutions.

- 2024: Clean Conduit (Canada) received government-backed cleantech funding to support SME clean energy and retrofit projects, potentially applicable to sustainable cladding applications.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4.0 Bn |

| Forecast Value (2034) |

USD 7.0 Bn |

| CAGR (2025–2034) |

6.2% |

| The US Market Size (2025) |

USD 0.9 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Material Type (PVC, GRP, Polypropylene, Stainless Steel, Others), By Surface Finish (Matte, Glossy, Textured/Embossed), By Installation Type (Wall Cladding, Ceiling Cladding, Corner and Edge Protection Systems, Other Fixtures), By Application (Healthcare, Food Processing & Kitchens, Pharmaceuticals & Biotech Facilities, Retail & Commercial Spaces, Education & Public Buildings, Others), and By End-User (B2B and B2C). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Amazon Logistics, FedEx, UPS, DHL, JD Logistics, SF Express, DPDgroup, XPO Logistics, Postmates, DoorDash, Uber Eats, Instacart, Gopuff, Delhivery, Shadowfax, Blue Dart, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global hygienic cladding market?

▾ The global hygienic cladding market size is estimated to have a value of USD 4.0 billion in 2025 and is expected to reach USD 7.0 billion by the end of 2034.

What is the size of the US hygienic cladding market?

▾ The US hygienic cladding market is projected to be valued at USD 0.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1.6 billion in 2034 at a CAGR of 5.8%.

Which region accounted for the largest global hygienic cladding market?

▾ Europe is expected to have the largest market share in the global hygienic cladding market, with a share of about 36.0% in 2025.

Who are the key players in the global hygienic cladding market?

▾ Some of the major key players in the global hygienic cladding market are Amazon Logistics, FedEx, UPS, DHL, JD Logistics, SF Express, DPDgroup, XPO Logistics, Postmates, DoorDash, Uber Eats, Instacart, Gopuff, Delhivery, Shadowfax, Blue Dart, and Other Key Players.

What is the growth rate of the global hygienic cladding market?

▾ The market is growing at a CAGR of 6.2 percent over the forecasted period.