Market Overview

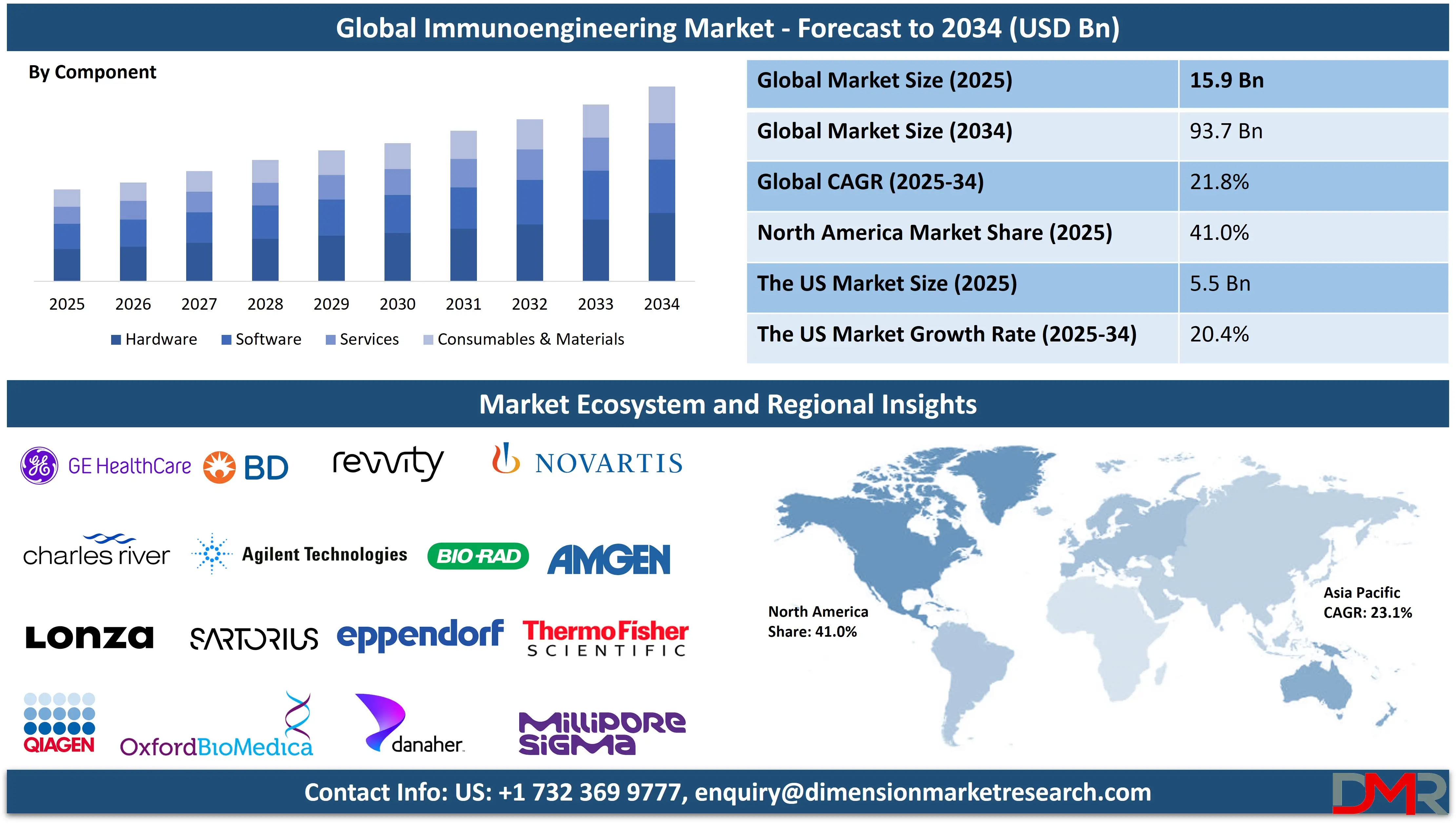

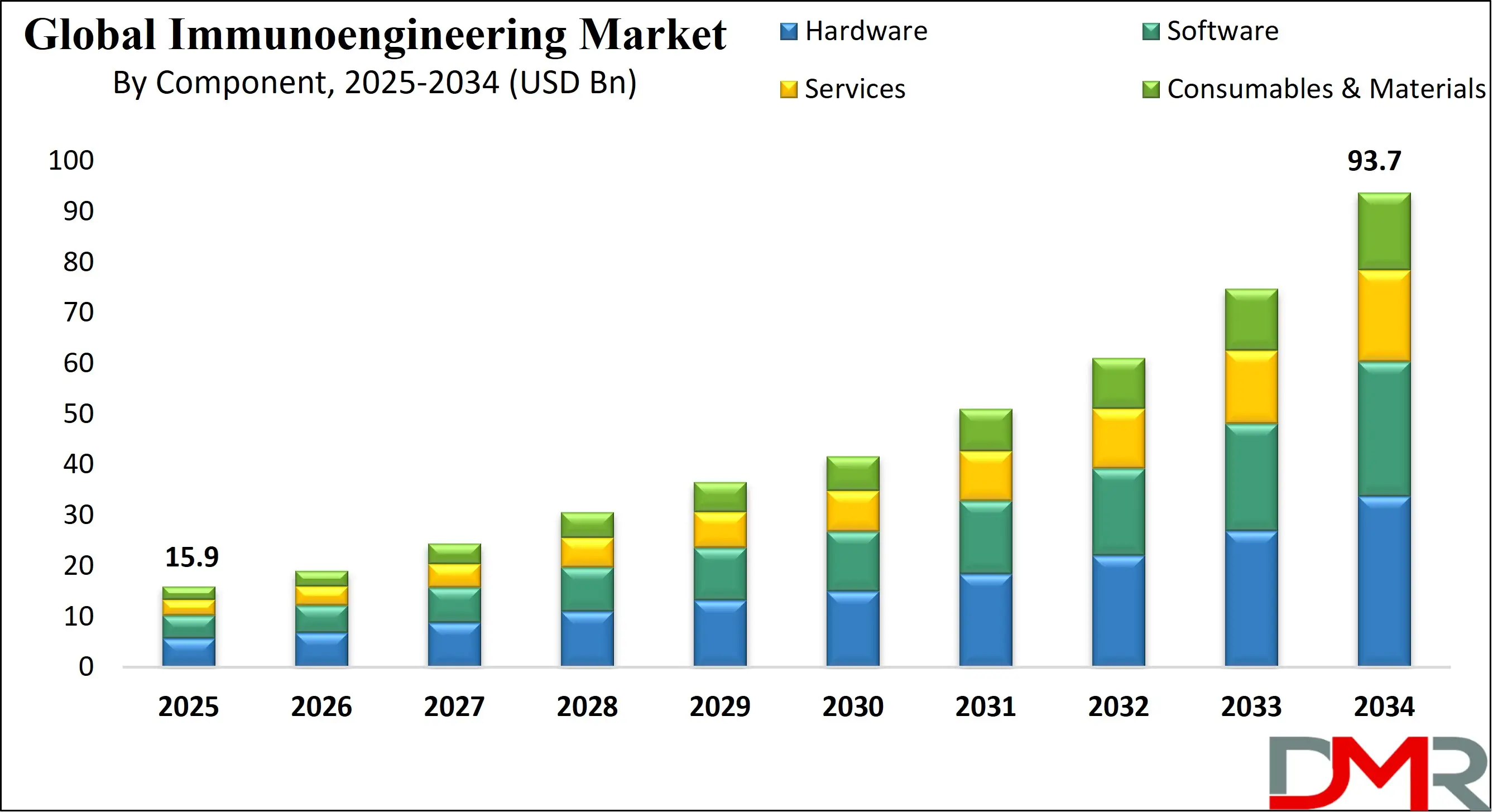

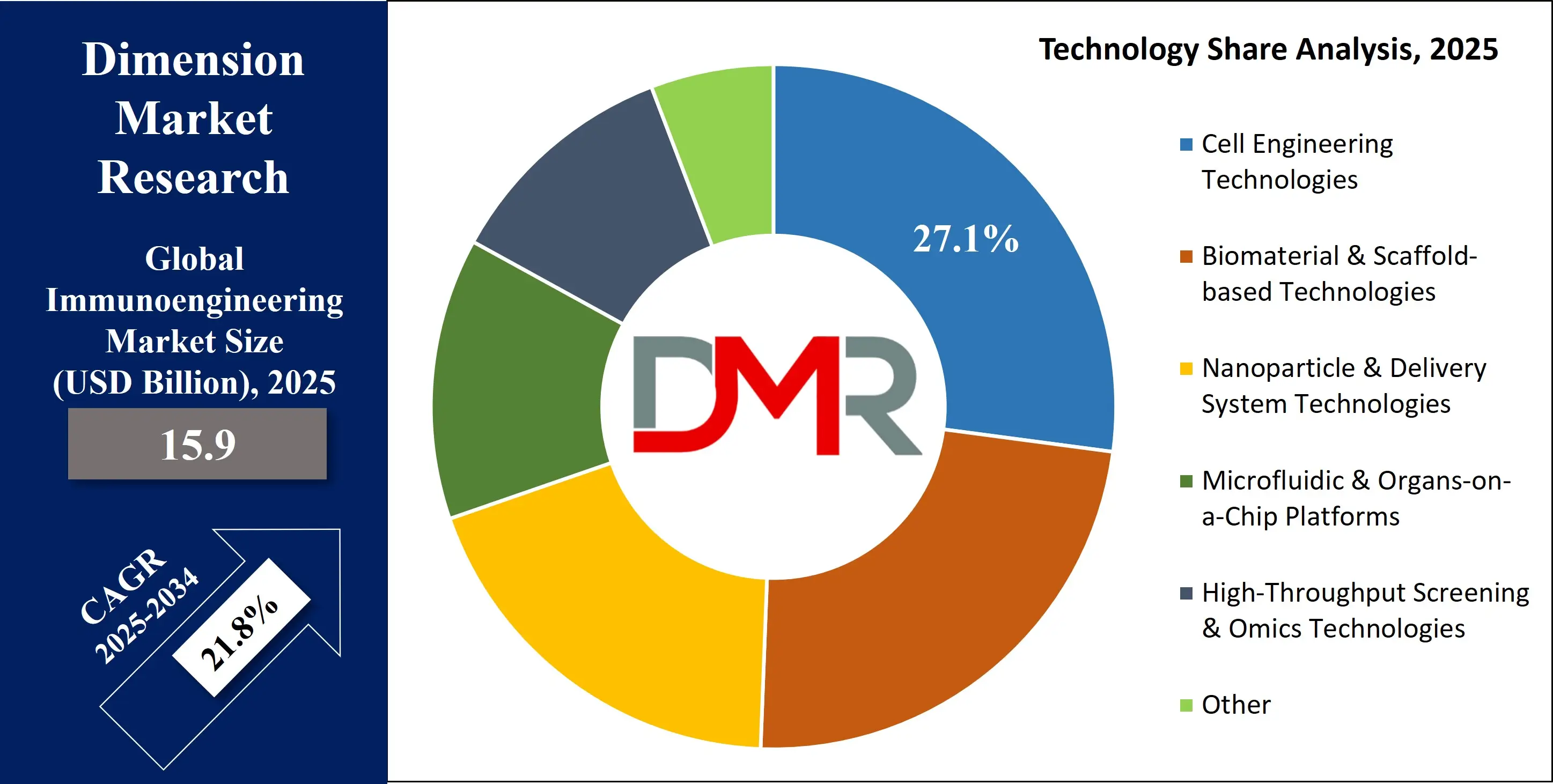

The Global Immunoengineering Market is anticipated to reach USD 15.9 billion in 2025, driven by advancements in immune modulation, cell therapy manufacturing, and targeted drug delivery systems. The market is expected to expand at a robust compound annual growth rate (CAGR) of 21.8% from 2025 to 2034, reaching a projected value of USD 93.7 billion by 2034.

Growth is fueled by the increasing adoption of AI-driven immune profiling and computational modeling, rising demand for personalized cancer immunotherapies, and the integration of biomaterials in immune cell engineering. Additionally, expanding applications in autoimmune disease treatment, vaccine development, and regenerative immunology sectors, coupled with the growing availability of advanced scaffolds, hydrogels, and nano-carriers, are expected to further accelerate market expansion globally.

The global landscape for immunoengineering is experiencing a profound transformation, moving beyond conventional immunology into the core of precision medicine and therapeutic innovation. A significant trend is the shift towards point-of-care cell engineering, where hospitals are establishing in-house facilities to produce patient-specific CAR-T cells and other advanced immunotherapies. This decentralization of manufacturing accelerates treatment timelines and improves therapeutic outcomes by providing tailored, potent immune solutions.

Concurrently, the technology is advancing into synthetic immunology, where research focuses on designing engineered immune cells and tissues, such as lymph nodes and organoids, though this remains largely in the developmental and regulatory phase. The integration of artificial intelligence with immune system modeling is also emerging, optimizing therapeutic designs and automating the cell selection process from patient data.

The market's expansion is fueled by substantial opportunities in personalized medicine, particularly in crafting custom immunotherapies and vaccines that offer unparalleled efficacy and reduced side effects compared to standard solutions. The oncology sector has become a major adopter, leveraging the technology for the precise and rapid production of CAR-T cells and immune checkpoint inhibitors, which has revolutionized cancer treatment workflows.

Furthermore, the ongoing development of novel, biocompatible engineering materials, including advanced hydrogels and functionalized nanoparticles, opens new avenues for creating delivery systems that interact precisely with the immune system. These innovations are poised to address complex clinical challenges in autoimmune disorders and infectious diseases, providing solutions that were previously unimaginable.

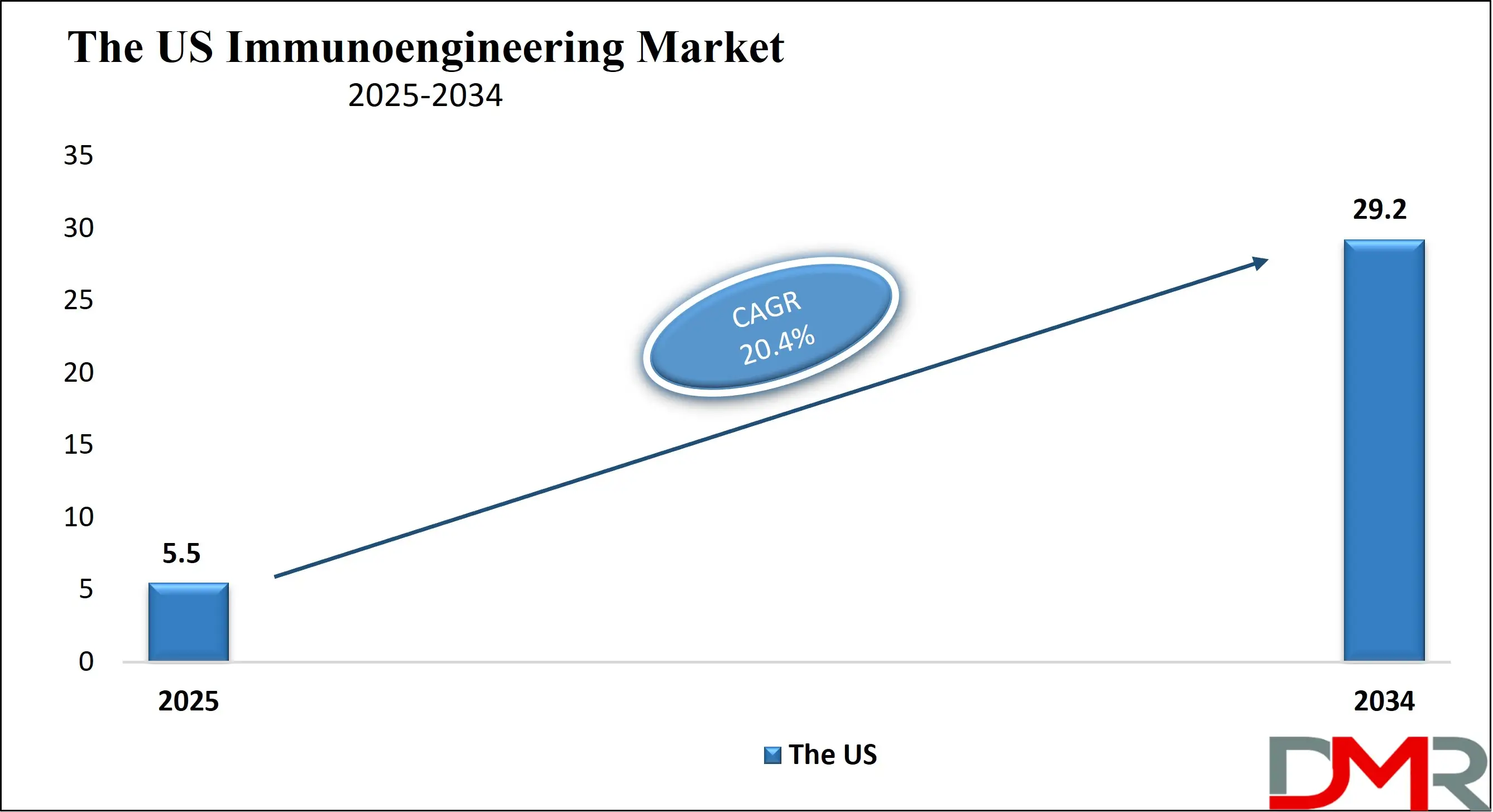

The US Immunoengineering Market

The US Immunoengineering Market is projected to reach USD 5.5 billion in 2025 at a compound annual growth rate of 20.4% over its forecast period.

The United States maintains a leadership position in the immunoengineering landscape, a status fortified by substantial federal investment and a robust regulatory framework. Agencies like the National Institutes of Health (NIH) actively foster innovation through initiatives such as the Cancer Moonshot, which provides resources and funding to accelerate research and clinical translation. The U.S. Food and Drug Administration has pioneered specific regulatory pathways for cell and gene therapies, providing clarity for manufacturers and having already approved over a dozen such therapies in recent years.

This proactive stance from federal bodies creates a stable environment for technological advancement and commercial investment in the sector. The presence of world-leading academic and medical institutions, including the MD Anderson Cancer Center and the Dana-Farber Cancer Institute, further drives clinical adoption through cutting-edge research and the establishment of on-site, point-of-care cell engineering facilities that directly improve patient care.

A significant demographic advantage for the U.S. market is its high incidence of cancer and autoimmune diseases, a trend documented by the Centers for Disease Control and Prevention (CDC). This epidemiological reality predicts a substantial increase in the demand for advanced immunotherapies, which in turn drives the need for personalized medical solutions. The need for patient-specific CAR-T therapies, dendritic cell vaccines, and engineered tissues for immune modulation is rising in direct correlation.

Furthermore, the high healthcare expenditure per capita, as reported by the Centers for Medicare & Medicaid Services (CMS), indicates a system capable of adopting advanced, albeit sometimes costly, technologies. This financial capacity, combined with a growing body of clinical evidence demonstrating the value of immunoengineered solutions in improving survival rates and quality of life, is encouraging more hospitals and biotech firms to integrate this technology into their standard of care, ensuring continued market growth.

The Europe Immunoengineering Market

The Europe Immunoengineering Market is estimated to be valued at USD 2.1 billion in 2025 and is further anticipated to reach USD 10.5 billion by 2034 at a CAGR of 17.8%.

The European immunoengineering ecosystem is characterized by strong collaboration between public research institutions and industry, guided by a comprehensive regulatory framework. The European Medicines Agency (EMA) and the new European Union Advanced Therapy Medicinal Products (ATMP) regulation provide a stringent set of requirements for the certification and clinical use of engineered immune therapies, ensuring high standards of safety and performance across member states.

This is supported by significant funding from Horizon Europe, the EU's key research and innovation program, which has allocated resources to projects focused on immunoengineering, including the development of personalized cancer vaccines and engineered immune tissues. National health services, such as the NHS in the United Kingdom, are exploring the cost-benefit analysis of deploying immunoengineering for specific applications, which is critical for guiding widespread adoption and reimbursement policies.

Europe's demographic and epidemiological structure, as analyzed by Eurostat, presents a clear driver for the immunoengineering sector. The region has a significant burden of cancer and a high prevalence of autoimmune diseases, creating a pressing need for innovative, patient-specific treatments that can improve outcomes. The strong public healthcare systems prevalent across the continent are increasingly focused on value-based care, seeking technologies that can reduce long-term treatment costs and improve therapeutic efficiency.

The presence of a highly skilled biomedical workforce and a dense network of specialized clinical centers facilitates the development and application of complex immunoengineered solutions, from custom CAR-T therapies in Germany to patient-specific immunomodulatory scaffolds in France, positioning Europe as a critical and advanced market for immunoengineering innovation.

The Japan Immunoengineering Market

The Japan Immunoengineering Market is projected to be valued at USD 892 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 4,850 million in 2034 at a CAGR of 19.4%.

Japan's foray into immunoengineering is heavily influenced by its high healthcare standards and significant government investment in regenerative medicine and cell therapy, a strategic priority extensively documented by the Japanese Ministry of Health, Labour and Welfare. This has created an urgent and growing demand for advanced immunotherapies and immune-modulating regenerative products, particularly in oncology and age-related immune decline.

In response, the Japanese government has strategically prioritized immunoengineering and cell therapy through national initiatives, with the Japan Agency for Medical Research and Development (AMED) funding projects that bridge the gap between academic research and clinical application. The Pharmaceuticals and Medical Devices Agency (PMDA), Japan's regulatory body, has been working to establish clear approval pathways for engineered immune therapies, providing a structured, though rigorous, environment for manufacturers to bring new products to market, ensuring they meet the highest safety standards.

The technological advantage for Japan lies in its advanced biotechnology sector and its focus on precision medicine. This drives innovation in creating highly specific, efficient, and safe immune therapies that cater to the specific genetic and physiological profiles of its patient population. The RIKEN Center for Integrative Medical Sciences is actively involved in research on immune cell engineering and biomaterials suitable for these applications.

Furthermore, the high density of advanced medical institutions in urban centers like Tokyo and Osaka serves as an early adopter and testing ground for new immunoengineering applications. This combination of strategic governmental support for technology, a strong regulatory framework, and a culture of innovation positions Japan as a unique and highly advanced market focused on leveraging immunoengineering to address complex medical challenges.

Global Immunoengineering Market: Key Takeaways

- Global Market Size Insights: The Global Immunoengineering Market size is estimated to have a value of USD 15.9 billion in 2025 and is expected to reach USD 93.7 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 21.8 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Immunoengineering Market is projected to be valued at USD 5.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 29.2 billion in 2034 at a CAGR of 20.4%.

- Regional Insights: North America is expected to have the largest market share in the Global Immunoengineering Market with a share of about 41.0% in 2025.

- Key Players: Some of the major key players in the Global Immunoengineering Market are Johnson & Johnson (Janssen), Gilead Sciences (Kite Pharma), Novartis AG, Bristol Myers Squibb, Thermo Fisher Scientific, Danaher Corporation, Lonza Group, Merck KGaA, and many others.

Global Immunoengineering Market: Use Cases

- CAR-T Cell Therapy Production: Clinicians use patient-specific T cells that are genetically engineered to express chimeric antigen receptors (CARs) for targeted cancer treatment, leading to remarkable remission rates in certain blood cancers.

- Cancer Vaccines: Personalized cancer vaccines are developed using engineered antigens or patient-derived immune cells to stimulate a potent and specific anti-tumor immune response.

- Immune-Modulating Scaffolds: Biomaterial scaffolds are engineered to locally deliver immunomodulatory signals, reprogramming the immune microenvironment in autoimmune diseases or to support regenerative processes.

- Autoimmune Disease Treatment: Therapies designed to selectively deplete or regulate specific immune cell populations (e.g., B-cells in lupus) using engineered biologics or cell-based approaches.

- Infectious Disease & Vaccine Development: Engineered nanoparticles and delivery systems are used to enhance the efficacy and speed of vaccine development, as seen in novel mRNA vaccine platforms.

Global Immunoengineering Market: Stats & Facts

National Institutes of Health (NIH)

- NIH lists over 2,500 active grants and clinical trials related to immunoengineering and immunotherapies in its repository.

U.S. Food and Drug Administration (FDA)

- FDA published "Guidance for Industry: Considerations for the Development of Chimeric Antigen Receptor (CAR) T Cell Products" (initial final guidance date: March 2022).

- FDA immunoengineering-related page content was last marked "content current as of September 2023."

- The FDA's Oncology Center of Excellence reported overseeing the review and approval of over 20 cell and gene therapy products for cancer in the past five years.

- FDA reported a 300% increase in Investigational New Drug (IND) applications for engineered immune therapies from 2020 to 2024.

Centers for Disease Control and Prevention (CDC)

- CDC monitors and reports on the growing incidence of autoimmune diseases, now affecting an estimated 5-8% of the US population, driving demand for novel treatments.

Organisation for Economic Co-operation and Development (OECD)

- OECD analysis reported that a 1% increase in R&D expenditure in biotech is associated with a 0.4% increase in the launch of advanced therapy medicinal products (ATMPs).

European Medicines Agency (EMA)

- EMA has approved over 15 Advanced Therapy Medicinal Products (ATMPs), many of which are immunoengineered therapies, under its centralized procedure.

World Health Organization (WHO)

- WHO published "Global Summit on the Future of Advanced Therapies" (publication date 15 January 2024) addressing access, regulation, and equity for cell and gene therapies, including immunoengineering.

International Organization for Standardization (ISO)

- ISO's technical committee for biotechnology (ISO/TC 276) has developed over 25 standards relevant to biotechnology, including several for cell-based therapies.

Global Immunoengineering Market: Market Dynamics

Driving Factors in the Global Immunoengineering Market

Rising Prevalence of Cancer and Autoimmune Diseases

The global increase in cancer incidence and autoimmune disorders is a primary driver for the immunoengineering market. These conditions require highly specific and potent interventions that can modulate the immune system precisely. Immunoengineering technology is uniquely positioned to address these needs through the development of personalized cell therapies, targeted delivery systems, and immune-modulating scaffolds that offer superior efficacy and reduced off-target effects compared to conventional treatments, significantly improving patient outcomes.

Supportive Regulatory Frameworks and Government Funding

The establishment of clearer regulatory pathways by major agencies like the U.S. FDA and the EMA for Advanced Therapy Medicinal Products (ATMPs) has provided the necessary clarity and confidence for manufacturers to invest heavily in the sector. These frameworks validate the safety and efficacy of engineered immune therapies, accelerating their time-to-market. Furthermore, substantial government and institutional funding, such as from the NIH in the U.S. and Horizon Europe in the EU, directly fuels foundational R&D in cell engineering, biomaterials, and clinical applications, catalyzing the transition of immunoengineering from a research field to a mainstream therapeutic tool.

Restraints in the Global Immunoengineering Market

High Cost of Therapy and Manufacturing Complexity

The significant costs associated with developing and manufacturing personalized immunoengineered therapies, such as CAR-T cells, present a major barrier to widespread adoption. The complex, multi-step processes require specialized facilities, stringent quality control, and highly skilled personnel, leading to high prices for end treatments. This financial hurdle can limit patient access and slow market penetration, as healthcare systems and payers must conduct rigorous cost-benefit analyses to justify reimbursement.

Technical and Scientific Challenges

The effective implementation of immunoengineering faces significant scientific hurdles, including controlling immune cell behavior in vivo, managing cytokine release syndromes, and ensuring long-term stability and functionality of engineered therapies. There is a pronounced need for interdisciplinary expertise combining immunology, engineering, and clinical medicine, creating a talent gap. The lack of standardized protocols and scalable manufacturing processes further exacerbates this challenge, hampering the pace of industrial innovation and clinical translation.

Opportunities in the Global Immunoengineering Market

Expansion into Autoimmune and Infectious Diseases

While oncology dominates, there is massive potential in applying immunoengineering to autoimmune diseases and infectious diseases. The technology can be used to develop therapies that selectively suppress aberrant immune responses or enhance immune protection against pathogens. This expansion represents a substantial new addressable market for immunoengineered solutions beyond current applications.

Next-Generation Vaccine Platforms

Immunoengineering offers transformative potential for vaccine development. Technologies like mRNA vaccines, nanoparticle-based antigen delivery, and engineered viral vectors can be optimized for enhanced immunogenicity, stability, and rapid deployment. This capability for rapid, targeted vaccine development could revolutionize pandemic preparedness and routine immunization, opening a major new market segment.

Trends in the Global Immunoengineering Market

Point-of-Care Cell Engineering

A dominant trend is the migration of cell engineering directly into hospital settings, establishing decentralized manufacturing hubs for therapies like CAR-T cells. This shift enables rapid production of patient-specific treatments, reducing lead times and logistical complexities. The benefits include improved patient access, reduced costs, and enhanced therapeutic potency due to shorter vein-to-vein times.

Advanced Biomaterial Development

The industry is witnessing rapid innovation in the development of novel biomaterials tailored for immune system interaction. This includes smart hydrogels for controlled cytokine release, functionalized nanoparticles for targeted antigen delivery, and scaffolds for in situ immune cell programming. These advancements are expanding the application horizon from systemic therapies to localized, controlled immune modulation.

Global Immunoengineering Market: Research Scope and Analysis

By Component Analysis

The Hardware segment, comprising sophisticated equipment such as bioreactors, cell sorters, and genetic engineering instruments, is projected to represent the foundational and currently dominant component in terms of capital investment and market revenue. This dominance is driven by the exceptionally high cost of industrial-grade, GMP-compliant systems required for the precise and scalable production of advanced therapies like CAR-T cells. The initial capital outlay for these systems constitutes a major portion of the market's financial activity, as they are essential for ensuring the viability, sterility, and consistency of engineered immune products.

However, the Consumables & Materials segment is not only the fastest-growing but is also poised to become the most substantial in the long term. It represents a continuous, recurring revenue stream that locks in customers after the initial hardware purchase. This segment includes critical, often single-use, items like cell culture media, cytokines, genetic vectors (viral and non-viral), engineered nanoparticles, and specialty hydrogels. The performance, safety, and ultimate regulatory clearance of any immunoengineered product are intrinsically tied to the quality and specificity of the materials used, making this segment both highly profitable and critically important for technological advancement and clinical adoption. The ongoing need for these specialized inputs ensures sustained growth as the number of clinical therapies and patients increases.

By Technology Analysis

Cell Engineering Technologies (e.g., CRISPR, TALENs, viral vectors) are anticipated to dominate the immunoengineering landscape, being central to revolutionary therapies like CAR-T and TCR therapies. Their dominance stems from their unparalleled ability to precisely modify the genetic code of immune cells, thereby enhancing their therapeutic functions, such as tumor-targeting specificity and persistence in the hostile tumor microenvironment. For therapies that require a controlled local immune environment, Biomaterial & Scaffold-based Technologies are crucial.

These platforms are used to create 3D structures that can present antigens in a specific context or deliver immunomodulatory signals directly to a tissue site, making them invaluable for next-generation vaccines and regenerative immunology applications. Simultaneously, Nanoparticle & Delivery System Technologies are leaders for the targeted delivery of immunomodulatory agents, including siRNA, mRNA, and small molecules. Their dominance is due to their ability to enhance the bioavailability and stability of therapeutic cargo while minimizing systemic toxicity and off-target effects, thereby improving the therapeutic index of a wide range of immuno-modulating drugs.

By Material Type Analysis

Natural Polymers/Biologics (e.g., collagen, alginate, hyaluronic acid, fibrin) are poised to be the most widely used materials by volume and diversity of application. Their dominance is fueled by their inherent biocompatibility, biodegradability, and bioactivity, which mimic the native extracellular matrix. This makes them ideal for applications such as 3D immune cell culture models, drug delivery vehicles, and scaffolds for tissue regeneration where positive interaction with the biological environment is paramount.

In contrast, Synthetic Polymers & Hydrogels (e.g., PEG, PLGA) offer tunable mechanical properties, degradation rates, and chemical functionalities, making them dominant for creating reproducible, scalable, and highly defined immune-modulating platforms for controlled drug release and cell encapsulation. While Engineered Living Materials & Cell-based Constructs currently represent a niche segment in terms of commercial revenue, they are the focal point of the most cutting-edge research. These materials, which consist of or are manufactured by living cells, hold the highest growth potential for creating fully biological, dynamic, and responsive immune therapies that can adapt and integrate with the patient's own physiology.

By Application Analysis

The Oncology application segment is expected to be the undisputed leader in terms of commercial adoption, market revenue, and technological integration. Immunoengineering has fundamentally revolutionized cancer treatment, moving from a niche research area to a core therapeutic modality. This is overwhelmingly demonstrated by the clinical and commercial success of engineered cell therapies, particularly CAR-T cells, for hematological malignancies, and the ongoing development of sophisticated strategies for solid tumors.

The Autoimmune & Inflammatory Diseases segment is a major and critically important application area, driven by the urgent, unmet need for targeted therapies that can modulate specific immune pathways without causing broad, detrimental immunosuppression. This includes the development of engineered biologics to deplete pathogenic B cells, regulatory T cell (Treg) therapies to restore immune tolerance, and tolerogenic vaccines designed to reprogram the immune system's response to self-antigens, offering hope for conditions like rheumatoid arthritis, lupus, and multiple sclerosis.

By End-User Analysis

Pharmaceutical & Biotechnology Companies are projected to be the dominant commercial end-users driving the production side of the market. These established entities leverage immunoengineering across the entire value chain, from early-stage drug discovery and target validation to the large-scale GMP manufacturing of approved cell and gene therapies. Their extensive R&D budgets, manufacturing infrastructure, and global commercial networks position them as the primary engines of market revenue.

Meanwhile, Hospitals & Clinical Research Centers are the fastest-growing and most transformative end-user segment. They are rapidly establishing point-of-care cell processing facilities, often in collaboration with academic partners. This decentralization of manufacturing allows them to administer advanced, often patient-specific, immunotherapies like CAR-T cells directly, reducing vein-to-vein time and logistical complexity. This trend solidifies the hospital's evolving role not just as a consumer of therapeutics, but as an active manufacturer of patient-specific solutions, fundamentally changing care delivery models.

The Global Immunoengineering Market Report is segmented on the basis of the following

By Component

- Hardware

- Bioreactors & Cell Culture Systems

- Genetic Engineering Instruments

- Cell Sorting & Analysis Systems

- Microfluidic & Organ-on-a-Chip Platforms

- Software

- Cell & Immune System Modeling Software

- Clinical Data Management Platforms

- Manufacturing Execution Systems (MES)

- Services

- Contract Research & Development

- Contract Manufacturing Services

- Process Development & Optimization

- Consumables & Materials

- Cell Culture Media & Reagents

- Cytokines & Growth Factors

- Genetic Vectors (Lentiviral, Retroviral, AAV)

- Engineered Nanoparticles

- Hydrogels & Scaffolds

By Technology

- Cell Engineering Technologies

- CRISPR-Cas9 Editing

- TALENs and ZFNs

- Viral Vector Engineering

- CAR-T, CAR-NK, TCR Engineering

- Biomaterial & Scaffold-Based Technologies

- 3D Bioprinting

- Injectable Biomaterials

- Bioactive Scaffold Engineering

- Nanoparticle & Delivery System Technologies

- Nano-Immunomodulators

- Targeted Drug Delivery Nanoparticles

- RNA/DNA Delivery Systems

- Microfluidic & Organ-on-a-Chip Platforms

- Immune Response-On-Chip

- Tumor-Immune Interaction Chips

- Multi-Organ Immune Models

- High-Throughput Screening & Omics Technologies

- Single-cell transcriptomics

- Proteomics & metabolomics platforms

- High-throughput immunoassay systems

- Other Emerging Technologies

By Material Type

- Natural Polymers/Biologics

- Collagen-Based Scaffolds

- Alginate Hydrogels

- Hyaluronic Acid Matrices

- Gelatin-Based Biomaterials

- Synthetic Polymers & Hydrogels

- PEG Hydrogels

- PLGA-based Scaffolds

- PCL & Polyurethane Biomaterials

- Smart/Stimuli-Responsive Polymers

- Ceramics & Inorganic Particles

- Bioactive Ceramics

- Calcium Phosphate Particles

- Silica Nanoparticles

- Metals & Alloys

- Titanium-based Immune-Modulating Implants

- Biodegradable Metal Implants

- Engineered Living Materials

- Engineered Immune Cell Constructs

- Living Scaffolds

- Bacterial & Microbial Immune-Engineering Platforms

By Application

- Oncology

- Immunotherapy Development

- CAR-T/CAR-NK Cell Therapies

- Tumor Microenvironment Engineering

- Autoimmune & Inflammatory Diseases

- Immune Tolerance Therapies

- Cytokine Modulation Therapies

- Infectious Diseases & Vaccine Development

- Viral & Bacterial Vaccine Engineering

- Immune Adjuvant Development

- Transplantation & Regenerative Medicine

- Immune Rejection Modulation

- Tissue-Engineered Grafts

- Allergy & Asthma

- Immune Desensitization Technologies

- Allergen-Specific Immunotherapy

- Other Applications

By End-User

- Pharmaceutical & Biotechnology Companies

- Immunotherapy Developers

- Cell Therapy Companies

- Vaccine Manufacturers

- Hospitals & Clinical Research Centers

- Oncology Centers

- Immunology Specialty Clinics

- Transplantation Centers

- Academic & Research Institutes

- Immunology Labs

- Bioengineering Departments

- CROs & CMOs

- Vector Manufacturing Service Providers

- Clinical Trial Service Providers

- Diagnostic Laboratories

- Immune Biomarker Testing Labs

- Flow Cytometry Labs

Impact of Artificial Intelligence in the Global Immunoengineering Market

- Predictive Immunology & Target Discovery: AI algorithms analyze vast immunological datasets (genomic, proteomic, clinical) to identify novel therapeutic targets, predict patient-specific immune responses, and optimize therapy design.

- Automated Cell Culture & Process Optimization: AI-driven systems monitor and control bioreactor parameters in real-time, optimizing cell growth, differentiation, and transduction efficiency for more consistent and scalable therapy production.

- Clinical Trial Optimization & Patient Stratification: AI analyzes patient data to identify ideal candidates for immunoengineered therapies, predict clinical outcomes, and design more efficient and successful clinical trials.

- Safety & Toxicity Prediction: AI models predict potential adverse immune reactions, such as cytokine release syndrome (CRS) or off-target effects, early in the development process, enhancing therapy safety.

- Accelerated R&D & De Novo Design: AI assists in the de novo design of proteins, antibodies, and genetic circuits for immune cell engineering, drastically reducing development timelines.

Global Immunoengineering Market: Regional Analysis

Region with the Largest Revenue Share

North America, led by the United States, is projected to command the largest share of the global immunoengineering market with 41.0% of market share by the end of 2025, due to a powerful confluence of technological leadership, regulatory clarity, and a favorable biotechnology ecosystem. The region is home to many of the world's leading biopharmaceutical companies and is a hub for cell and gene therapy innovation. This technological edge is complemented by a proactive regulatory framework from the FDA, which has established clear pathways for ATMPs.

Furthermore, the presence of a robust healthcare infrastructure with high per-capita spending enables hospitals and research institutions to invest in cutting-edge technology. High levels of funding from organizations like the NIH fuel foundational research. This synergy creates a virtuous cycle that solidifies North America's dominant market position.

Region with the Highest CAGR

The Asia Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) in the immunoengineering market, fueled by massive healthcare investment, government-led initiatives in biotechnology, and a high burden of diseases amenable to immunotherapy. Countries like China, Japan, and South Korea are making substantial public and private investments in advanced biomanufacturing and cell therapy.

This is coupled with a rapidly expanding healthcare infrastructure and a growing patient pool. The region also has a strong focus on developing cost-effective medical solutions. The growing presence of local biotech firms and CROs is making the technology more accessible. This combination creates an explosive growth environment, positioning the Asia Pacific as the fastest-growing market globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Immunoengineering Market: Competitive Landscape

The competitive landscape of the global immunoengineering market is fragmented and highly dynamic, characterized by a mix of established pharmaceutical giants, specialized biotechnology firms, and a vibrant ecosystem of innovative startups. Dominant players like Johnson & Johnson (Janssen), Novartis AG, and Gilead Sciences (Kite Pharma) leverage their extensive R&D capabilities, manufacturing expertise, and global commercial networks to maintain a stronghold, particularly in cell and gene therapies.

These companies compete not only on technology but also on the strength of their regulatory expertise and clinical development capabilities. A significant trend is the deep foray of traditional pharmaceutical companies aggressively investing in and acquiring biotech firms to build their immunoengineering portfolios. Simultaneously, the market sees intense competition from specialized and regional players, including Lonza Group and Thermo Fisher Scientific in contract development and manufacturing, and startups focusing on disruptive platforms like in vivo cell engineering and AI-driven drug discovery, ensuring continuous innovation and intensifying competition across all segments.

Some of the prominent players in the Global Immunoengineering Market are

- Thermo Fisher Scientific

- BD (Becton, Dickinson and Company)

- Lonza Group

- Merck KGaA (MilliporeSigma)

- Danaher Corporation

- Sartorius AG

- Agilent Technologies

- Bio-Rad Laboratories

- Eppendorf SE

- PerkinElmer (Revvity)

- QIAGEN

- GE HealthCare

- Miltenyi Biotec

- Charles River Laboratories

- Catalent Inc.

- Oxford Biomedica

- Amgen Inc.

- Novartis AG

- GenScript Biotech Corporation

- Precision BioSciences

- Other Key Players

Recent Developments in the Global Immunoengineering Market

- May 2024: The American Society of Gene & Cell Therapy (ASGCT) announces new guidelines for the standardized manufacturing and quality control of engineered immune cell therapies.

- April 2024: Novartis AG and a leading AI drug discovery company announce a strategic collaboration to identify novel targets for next-generation CAR-T therapies.

- March 2024: The FDA announces a new pilot "Platform Technology Designation" program aimed at streamlining the regulatory review process for modular immunoengineering platforms.

- February 2024: Gilead Sciences (Kite Pharma) completes its acquisition of a biotech firm specializing in allogeneic, "off-the-shelf" CAR-NK cell therapies, expanding its immuno-oncology portfolio.

- January 2024: The "Immunoengineering and Biomaterials" conference is held in Boston, USA, featuring keynotes on the use of biomaterials to control immune responses in regenerative medicine.

- November 2023: Thermo Fisher Scientific launches a new suite of GMP-grade cell culture media and reagents specifically optimized for the production of immune cell therapies.

- September 2023: The BIO International Convention features a dedicated track on immunoengineering, highlighting new delivery technologies from several startups.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 15.9 Bn |

| Forecast Value (2034) |

USD 93.7 Bn |

| CAGR (2025–2034) |

21.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 5.5 Bn |

| Forecast Data |

2025 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, Services, Consumables & Materials), By Technology (Cell Engineering Technologies, Biomaterial & Scaffold-based Technologies, Nanoparticle & Delivery System Technologies, Microfluidic & Organs-on-a-Chip Platforms, High-Throughput Screening & Omics Technologies, Other), By Material Type (Natural Polymers/Biologics, Synthetic Polymers & Hydrogels, Ceramics & Inorganic Particles, Metals & Alloys, Engineered Living Materials & Cell-based Constructs), By Application (Oncology, Autoimmune & Inflammatory Diseases, Infectious Diseases & Vaccine Development, Transplantation & Regenerative Medicine, Allergy & Asthma, Other), By End-User (Pharmaceutical & Biotechnology Companies, Hospitals & Clinical Research Centers, Academic & Research Institutes, Contract Research & Manufacturing Organizations (CROs/CMOs), Diagnostic Laboratories) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Thermo Fisher Scientific, BD (Becton, Dickinson and Company), Lonza Group, Merck KGaA (MilliporeSigma), Danaher Corporation, Sartorius AG, Agilent Technologies, Bio-Rad Laboratories, Eppendorf SE, PerkinElmer (Revvity), QIAGEN, GE HealthCare, Miltenyi Biotec, Charles River Laboratories, Catalent Inc., Oxford Biomedica, Amgen Inc., Novartis AG, GenScript Biotech Corporation, Precision BioSciences., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Immunoengineering Market size is estimated to have a value of USD 15.9 billion in 2025 and is expected to reach USD 93.7 billion by the end of 2034.

The market is growing at a CAGR of 21.8 percent over the forecasted period of 2025 to 2034.

The US Immunoengineering Market is projected to be valued at USD 5.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 29.2 billion in 2034 at a CAGR of 20.4%.

North America is expected to have the largest market share in the Global Immunoengineering Market with a share of about 41.0% in 2025.

Some of the major key players in the Global Immunoengineering Market are Johnson & Johnson (Janssen), Gilead Sciences (Kite Pharma), Novartis AG, Bristol Myers Squibb, Thermo Fisher Scientific, Danaher Corporation, Lonza Group, Merck KGaA, and many others.