Market Overview

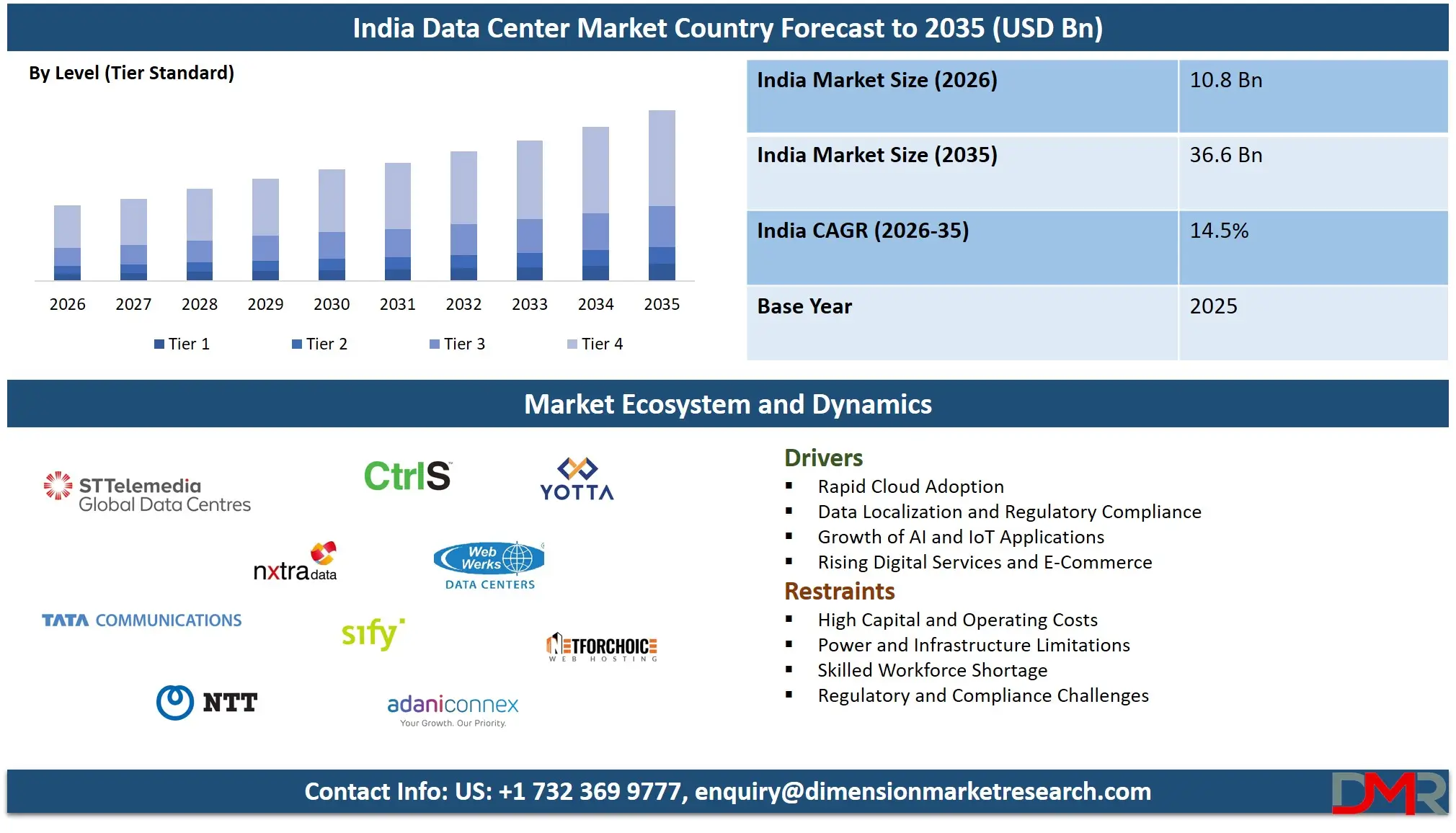

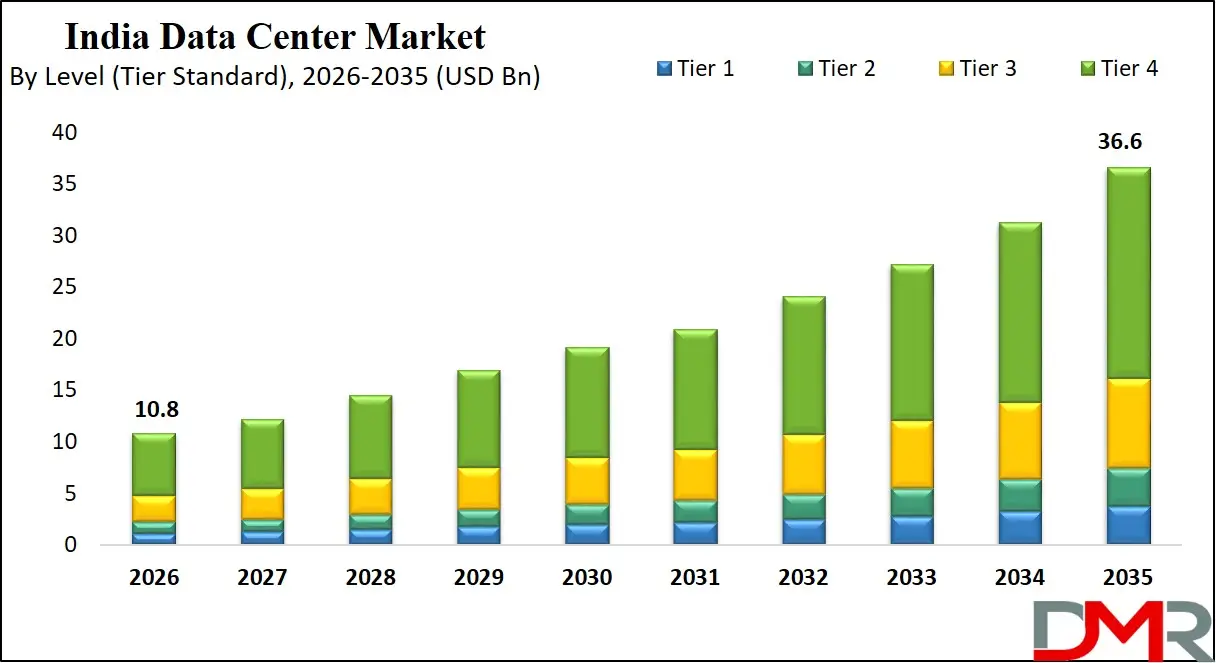

The India Data Center Market is expected to reach USD 10.8 billion in 2026, driven by hyperscale, cloud, and colocation demand, and expand at a CAGR of 14.5% to USD 36.6 billion by 2035, fueled by digital transformation, AI workloads, edge computing, and data localization initiatives.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A data center is a purpose built facility designed to house computing systems and the supporting infrastructure required to process store and transmit digital information at scale. It integrates servers storage arrays networking equipment power distribution and cooling systems within a highly controlled environment to ensure continuous availability data integrity and operational efficiency.

Modern data centers also incorporate virtualization cloud platforms cybersecurity layers and real time monitoring software so organizations can run business applications analytics workloads artificial intelligence models and digital services reliably across connected users and devices.

The India data center market represents the rapidly expanding ecosystem of facilities service providers and technology platforms that support the country’s growing digital economy. Driven by cloud adoption data localization policies ecommerce fintech and video streaming India has emerged as one of the fastest growing hubs for colocation hyperscale and enterprise data centers in Asia. Major metropolitan regions such as Mumbai Chennai Hyderabad and Noida host large campuses that provide high density computing reliable power connectivity and disaster recovery capabilities for domestic enterprises global cloud providers and telecom operators.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In addition to serving traditional enterprise workloads the India data center market is increasingly shaped by emerging technologies such as artificial intelligence internet of things and edge computing which require low latency processing and scalable infrastructure. Investments from hyperscalers cloud service providers and domestic conglomerates are expanding capacity while improving energy efficiency and sustainability through renewable power advanced cooling and modular design. This evolving market plays a critical role in enabling digital transformation across sectors such as banking healthcare retail and government by delivering secure high performance and compliant data hosting environments.

India Data Center Market: Key Takeaways

- Rapid Cloud and Hyperscale Adoption: India’s data center market is being driven by strong demand for cloud computing, hyperscale facilities, and hybrid IT deployments. Enterprises and cloud service providers are increasingly leveraging scalable infrastructure to support AI, big data, and digital services across industries.

- Regulatory and Data Localization Impact: Government policies around data sovereignty, compliance, and digital security are shaping investment decisions. Data localization mandates are encouraging both domestic and global providers to expand local data center capacity, ensuring sensitive information is stored and processed within India.

- Emergence of Edge and Regional Data Centers: The growth of IoT, 5G networks, and latency-sensitive applications is creating opportunities for micro and edge data centers in tier two and three cities. These facilities support real-time processing, smart manufacturing, and regional content delivery.

- Focus on Sustainability and Energy Efficiency: Operators are increasingly adopting renewable power, advanced cooling, and modular designs to improve energy efficiency and reduce carbon footprint. Green data centers are becoming a strategic priority to attract investment, reduce operating costs, and meet global sustainability standards.

- Strategic Role in Digital Transformation: Indian data centers are central to enabling digital transformation across BFSI, healthcare, government, e-commerce, and media sectors. They provide secure, high-performance, and compliant infrastructure, supporting cloud workloads, disaster recovery, and high-availability enterprise applications.

India Data Center Market: Use Cases

- Cloud and SaaS Workload Hosting: Indian data centers are the backbone for cloud computing and software as a service platforms used by startups enterprises and global technology providers. Hyperscale and colocation facilities in cities like Mumbai and Hyderabad host virtual machines databases and application servers that deliver scalable and secure digital services. With growing demand for public cloud private cloud and hybrid cloud models data centers enable high availability business continuity and regulatory compliant data storage for Indian and international customers.

- BFSI and Digital Payments Infrastructure: Banks financial institutions and fintech companies rely heavily on India data centers to run core banking systems payment gateways and fraud detection platforms. These facilities provide low latency connectivity encrypted data storage and disaster recovery to ensure uninterrupted financial transactions and regulatory compliance. With the rise of digital wallets online banking and real time settlement systems data centers support secure data processing and high performance computing for the financial ecosystem.

- E Commerce and Digital Media Platforms: Online retail streaming services and digital content platforms depend on India data centers to manage large volumes of user data and media files. Colocation and cloud data centers provide the scalable storage content delivery and analytics capabilities needed to support high traffic spikes and real time user engagement. This infrastructure helps improve customer experience data driven marketing and reliable streaming across urban and regional markets.

- Government and Smart City Applications: Government agencies and smart city projects use India data centers to host citizen services public records and urban management platforms. These facilities enable secure cloud hosting geographic information systems and internet of things data processing for traffic control utilities and public safety. By supporting digital governance and e administration data centers improve service delivery transparency and operational efficiency across cities and states.

India Data Center Market: Stats & Facts

- Press Information Bureau (Government of India) – Cloud Data Centre Capacity

- Cloud data centre capacity in India has reached approximately 1,280 megawatts, primarily serving banking, power and critical public infrastructure sectors as shared in Parliament.

- The Government informed Parliament that cloud data centre capacity is projected to grow four to five times by 2030 based on current infrastructure trends and digital adoption.

- DD News (Government‑reported Capacity Additions)

- India recorded a sharp rise in data centre capacity additions in 2025, with new supply more than doubling to 387 MW IT, compared to 191 MW in 2024.

- India’s operational data centre capacity reached 1,520 MW IT by end of 2025, with the largest share of operational supply in metropolitan hubs.

- Data centre absorption increased to 427 MW IT in 2025, up from 407 MW IT the previous year.

- Mumbai and Chennai together accounted for nearly 70 percent of total absorption in 2025.

- Union Budget Tax Provisions Announced by Government

- The Government of India proposed a tax holiday for foreign companies using Indian data centres to provide cloud services globally until 2047.

- A safe harbour tax provision of 15 percent on cost was announced for related entities providing data centre services.

- These measures were introduced in the Union Budget 2026‑27 to incentivise long‑term digital infrastructure investment.

- Government in Parliament Statements

- During Parliamentary briefings, it was stated that cloud data centre capacity has expanded significantly and will continue to grow rapidly as part of India’s digitalisation push.

- National data centres under the government’s cloud framework (MeghRaj) provide scalable cloud support to government departments with enhanced data security and compliance frameworks.

- The Government reiterated that data centre growth is linked to strategic national digital transformation priorities.

- Drishti IAS / Government Data (Capacity Projections)

- Government‑linked estimates project India’s data centre capacity to expand from about 1.2 gigawatts in 2025 to nine gigawatts by 2032 to support cloud, artificial intelligence and digital infrastructure needs.

- The projected expansion reflects a substantial planned enhancement of secure, scalable data hosting linked to India’s digital growth objectives.

- Official discussions noted that infrastructure buildout is aimed at reducing dependence on external capacity while enhancing sovereign data capabilities.

- Indian Telecom Regulatory Authority (Government Reference)

- TRAI documentation noted that India’s data centre capacity was forecast to grow from 375 MW in H1 2020 to over 1,000 MW by 2025 under regulatory planning discussions.

- The capacity increase was framed in the context of broader digital infrastructure goals including cloud services, Internet of Things uptake, and internet expansion.

- TRAI highlighted the role of regulatory oversight in ensuring service quality, reliability and data security.

India Data Center Market: Market Dynamic

Driving Factors in the India Data Center Market

Rapid cloud adoption and digitalization

India is witnessing strong growth in cloud computing enterprise software and online services which is directly increasing demand for data center capacity. Businesses across banking retail healthcare and manufacturing are migrating workloads to public cloud and hybrid cloud platforms to improve scalability and reduce infrastructure costs. This digital transformation combined with rising internet users and mobile data consumption is pushing hyperscale and colocation providers to expand their data center footprints across major cities and emerging regional hubs.

Data localization and regulatory compliance

Government regulations related to data sovereignty and data privacy require sensitive information to be stored and processed within India. This has encouraged global cloud service providers fintech companies and multinational enterprises to invest in local data center infrastructure. As a result domestic and international operators are building secure and compliant facilities that support regulatory requirements while offering high availability disaster recovery and reliable data hosting services.

Restraints in the India Data Center Market

High capital and operating costs

Building and running data centers in India requires heavy investment in land power cooling systems and network connectivity. Electricity prices backup power infrastructure and advanced cooling technologies significantly increase operating expenses especially for hyperscale and tier four facilities. These cost pressures can slow down new projects and reduce profitability for smaller colocation and managed service providers.

Power and infrastructure limitations

Although India is expanding its power and fiber network many regions still face challenges related to grid stability and urban congestion. Data centers require uninterrupted power and low latency connectivity but frequent outages or limited transmission capacity can impact operational efficiency. In some cities delays in permits land acquisition and utility connections also create barriers to rapid data center deployment.

Opportunities in the India Data Center Market

Edge computing and regional data centers

The growth of internet of things 5G networks and real time applications is creating demand for edge data centers closer to end users. Regional and micro data centers in tier two and tier three cities can support low latency services such as video streaming online gaming and smart manufacturing. This creates new revenue opportunities for operators looking to serve localized digital ecosystems.

Green and sustainable data center development

India offers strong potential for renewable energy based data centers using solar and wind power. As enterprises and cloud providers prioritize carbon reduction there is rising interest in energy efficient facilities with advanced cooling and power management systems. Green data centers can attract global customers and government incentives while improving long term operating efficiency.

Trends in the India Data Center Market

Rise of hyperscale and wholesale colocation facilities

Large cloud service providers and digital platforms are driving the development of massive hyperscale data centers and wholesale colocation campuses. These facilities offer high density racks modular design and scalable power to support artificial intelligence big data and enterprise cloud workloads. This trend is reshaping the market toward larger and more centralized data center clusters.

Integration of automation and AI driven operations

Modern India data centers are increasingly adopting automation software and artificial intelligence for monitoring cooling and workload optimization. These technologies help improve uptime reduce energy consumption and enhance predictive maintenance. As digital infrastructure becomes more complex smart data center management platforms are becoming a standard feature across hyperscale and enterprise facilities.

India Data Center Market: Research Scope and Analysis

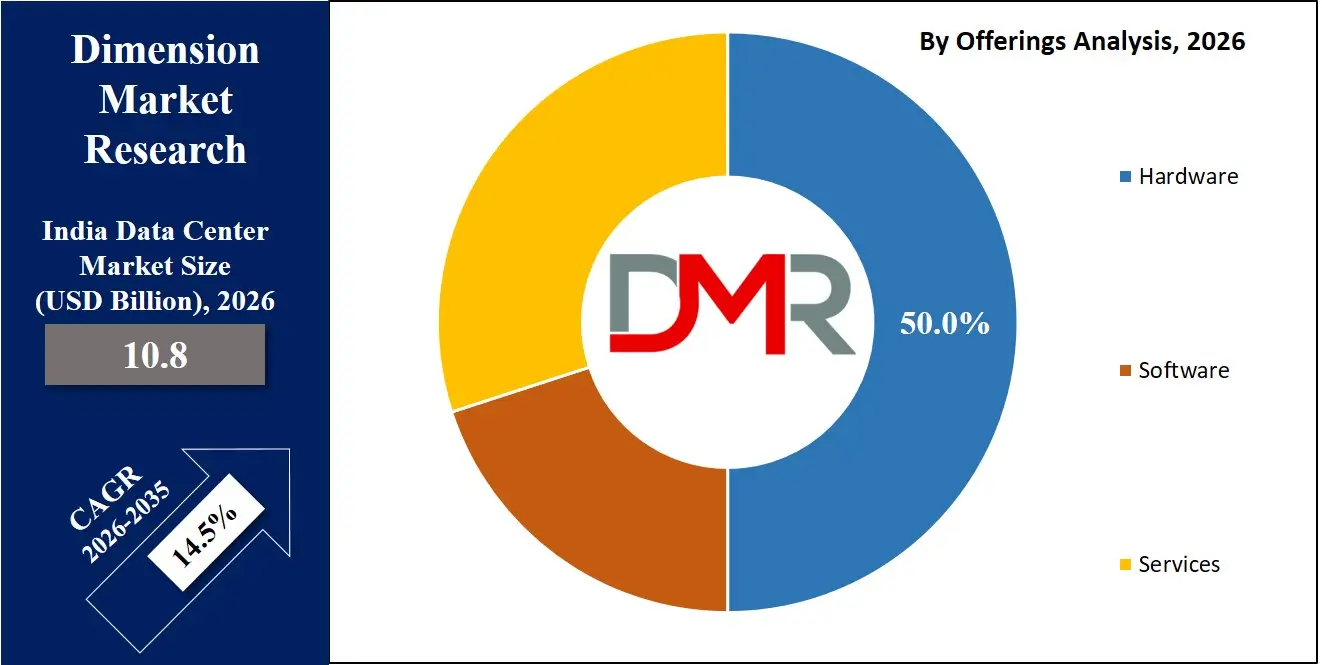

By Offering Analysis

Hardware is anticipated to dominate the offering segment with about 50.0% share in 2026 because India’s data center expansion is being driven by large scale investments in physical infrastructure such as servers storage systems networking equipment power distribution units and advanced cooling technologies. The rapid growth of cloud computing artificial intelligence digital payments and content streaming is pushing operators to deploy high density compute and storage platforms with high availability and energy efficiency. Hyperscale and colocation facilities require continuous upgrades of IT and power equipment which makes hardware the largest revenue contributor in the Indian data center ecosystem.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The services segment is growing strongly as enterprises and cloud providers increasingly depend on external expertise to design build operate and optimize their data center environments. Services such as consulting integration deployment managed hosting and ongoing maintenance help organizations reduce operational complexity while meeting regulatory compliance uptime and cybersecurity requirements. In India the shortage of skilled data center professionals and the rising need for disaster recovery and business continuity solutions are encouraging customers to outsource facility management and infrastructure operations which is driving sustained demand for data center services alongside hardware investments.

By Deployment Model Analysis

Cloud based deployment is anticipated to dominate the deployment model segment with around 50.0% market share in 2026, due to Indian enterprises and global technology firms are rapidly shifting workloads to scalable and flexible cloud environments. The growth of ecommerce digital banking streaming platforms and artificial intelligence applications is creating strong demand for on demand computing power storage and data processing which cloud data centers can deliver more efficiently than traditional setups. Public and hybrid cloud platforms hosted in hyperscale and colocation facilities also support data localization regulatory compliance and faster deployment of digital services which further accelerates their adoption across industries.

On premise deployment continues to remain an important part of the Indian data center market especially for sectors such as banking government defense and large enterprises that handle sensitive or mission critical data. Many organizations prefer to maintain direct control over their IT infrastructure to ensure security customization and compliance with internal governance standards. On premise data centers also support legacy applications and specialized workloads that are not easily migrated to cloud platforms making them a stable and reliable segment even as cloud based models gain a larger share of overall market demand.

By Data Center Type Analysis

Hyperscale data centers are anticipated to dominate the data center type segment with around 45.0% market share in 2026 because they are designed to support massive computing workloads, large scale cloud services, and enterprise applications requiring high performance, scalability, and energy efficiency. These facilities are primarily used by global cloud providers, digital platforms, and large enterprises to host thousands of servers, storage systems, and networking equipment under a single campus with redundant power and cooling systems. The rapid adoption of artificial intelligence, big data analytics, video streaming, and online services in India is driving the expansion of hyperscale data centers to meet the growing demand for reliable, low latency, and high capacity digital infrastructure.

Colocation data centers continue to play an important role in the Indian market by providing flexible and secure infrastructure for small and medium enterprises, regional businesses, and organizations that do not wish to invest heavily in building their own facilities. These centers offer shared space, managed power, cooling, and connectivity services, allowing multiple customers to host servers and networking equipment in a controlled environment. Colocation facilities enable businesses to achieve high availability, disaster recovery, and regulatory compliance while scaling their IT resources efficiently, making them a cost effective and practical solution for growing enterprises and startups expanding their digital operations.

By Level (Tier Standard) Analysis

Tier 3 data centers are anticipated to dominate the level segment with around 56.0% market share in 2026 because they offer a balanced combination of high availability, redundancy, and cost efficiency that meets the requirements of most Indian enterprises, cloud providers, and hyperscale operators. These facilities feature multiple power and cooling distribution paths with concurrent maintainability, ensuring minimal downtime while supporting mission critical workloads such as cloud computing, digital payments, and enterprise applications. The widespread adoption of Tier 3 standards across major cities allows organizations to achieve reliable operations without incurring the significantly higher costs associated with Tier 4 construction and maintenance.

Tier 4 data centers, while smaller in market share, represent the premium segment of the Indian data center market, offering fault tolerant infrastructure with fully redundant systems that can withstand any single failure without affecting operations. These facilities are preferred by organizations handling highly sensitive data, critical government systems, or large scale financial transactions where uninterrupted uptime is essential. Tier 4 centers often incorporate advanced cooling, backup power, and automation technologies to deliver maximum reliability, making them a strategic choice for enterprises and hyperscalers seeking the highest level of operational resilience despite the higher investment and operational costs.

By Enterprise Size Analysis

Large enterprises are anticipated to dominate the enterprise size segment with around 60.0% market share in 2026 because they require extensive data center infrastructure to support complex IT operations, cloud workloads, artificial intelligence applications, and large scale digital platforms. These organizations invest heavily in hyperscale, colocation, and hybrid data center solutions to ensure high availability, security, and regulatory compliance across multiple business units and geographies. The demand from sectors such as banking, telecom, e-commerce, and healthcare drives continuous expansion of data center capacity to handle big data processing, real time analytics, and mission critical enterprise applications.

Small and medium enterprises, while holding a smaller share of the market, represent a growing segment in India as more businesses adopt digital transformation initiatives, cloud computing, and managed IT services. SMEs often prefer retail colocation, hybrid cloud, or outsourced data center services to avoid high capital expenditure and operational complexity. These facilities provide flexible space, scalable compute and storage, and secure connectivity, allowing SMEs to access enterprise grade infrastructure for applications such as online payments, ERP systems, and customer engagement platforms without the need for fully owned on premise data centers.

By End User Analysis

Cloud service providers are anticipated to dominate the end user segment with around 40.0% market share in 2026 because they are driving a majority of data center investments in India to support public cloud, private cloud, and hybrid cloud services for enterprises, startups, and government organizations. These providers operate hyperscale and wholesale colocation facilities that host virtual machines, storage systems, networking infrastructure, and application platforms to deliver scalable, on demand computing and data processing. The rapid growth of digital services, artificial intelligence, big data analytics, and content streaming is fueling demand for secure, high performance, and energy efficient data centers operated by leading cloud companies.

Telecom providers also represent a significant portion of the end user market as they deploy data centers to support mobile networks, 5G infrastructure, enterprise connectivity, and managed services. These facilities handle high volumes of user data, call processing, and real time traffic management while providing low latency connectivity to business and residential customers. Telecom operators often partner with colocation and hyperscale providers or develop captive facilities to enhance network reliability, offer cloud on ramps, and deliver digital services such as video streaming, cloud storage, and edge computing for smart city and IoT applications.

The India Data Center Market Report is segmented on the basis of the following:

By Offering

- Hardware

- IT Modules

- Servers

- Storage Systems

- Networking Equipment

- Power Modules

- UPS Systems

- Power Distribution Units

- Backup Power Systems

- Cooling Modules

- Air-Based Cooling

- Liquid Cooling

- Precision Cooling Systems

- Software

- Monitoring & Management Tools

- Automation & Orchestration Software

- Backup & Disaster Recovery Software

- Security Software

- Virtualization Software

- Analytics & Optimization Software

- Services

- Design & Consulting

- Integration & Deployment

- Support & Maintenance

- Managed Data Center Services

By Deployment Model

- On-Premise

- Hybrid

- Cloud-Based

By Data Center Type

- Enterprise Data Center

- Colocation Data Center

- Retail Colocation

- Wholesale Colocation

- Cloud Data Center

- Hyperscale Data Center

- Edge Data Center

By Level (Tier Standard)

- Tier 1

- Tier 2

- Tier 3

- Tier 4

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End User

- Cloud Service Providers

- Technology Providers

- Telecom

- BFSI

- Healthcare

- Retail & E-commerce

- Entertainment & Media

- Energy & Utilities

Impact of Artificial Intelligence in the India Data Center Market

- Optimized Operations and Resource Management: Artificial intelligence is transforming the India data center market by enabling predictive maintenance, automated monitoring, and intelligent workload management. AI algorithms optimize power consumption, cooling efficiency, and server utilization, reducing operational costs while improving uptime and ensuring scalable, high performance infrastructure for hyperscale and enterprise deployments.

- Enhanced Security and Compliance: AI driven analytics enhance security and data protection in Indian data centers by detecting anomalies, preventing cyber threats, and ensuring compliance with data privacy regulations. Machine learning models continuously monitor network traffic and access patterns, enabling proactive risk mitigation and safeguarding sensitive financial, healthcare, and government data hosted across cloud and on premise facilities.

- Smarter Capacity Planning and Scaling: The adoption of AI facilitates smarter resource allocation and capacity planning for cloud service providers and colocation operators. By analyzing historical demand, workload patterns, and energy usage, AI supports dynamic scaling, efficient rack deployment, and reduced energy wastage, helping India’s data center ecosystem meet growing digital services and high performance computing demands.

India Data Center Market: Competitive Landscape

The India data center market is highly competitive, driven by the rapid expansion of cloud computing, hyperscale facilities, and digital services. Key players focus on increasing capacity, improving energy efficiency, and adopting advanced cooling and automation technologies to differentiate their offerings.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market is shaped by strategic investments in colocation, hybrid cloud, and edge computing infrastructure to meet growing enterprise, government, and telecom demands. Competition is intensified by the need for regulatory compliance, high availability, low latency connectivity, and sustainability initiatives, pushing operators to continuously innovate in design, operational efficiency, and service quality to capture market share.

Some of the prominent players in the India Data Center Market are:

- ST Telemedia Global Data Centres (STT GDC India)

- Nxtra Data (Bharti Airtel)

- Tata Communications

- NTT Global Data Centers India

- CtrlS Datacenters

- Sify Technologies (Sify Infinit Spaces)

- AdaniConneX

- Yotta Data Services

- Web Werks (Iron Mountain India)

- NetForChoice

- Amazon Web Services (AWS India)

- Microsoft Azure India

- Google Cloud India

- Oracle Cloud Infrastructure India

- Alibaba Cloud India

- Larsen & Toubro

- CapitaLand Investment

- Digital Edge (India)

- Everstone Group (Lumina CloudInfra)

- Reliance Jio Data Centers

- Other Key Players

Recent Developments in the India Data Center Market

- Feb 2026: KKR and Singtel consortium agreed to acquire the remaining 82 % stake in ST Telemedia Global Data Centres (STT GDC), valuing the company at approximately USD 13.8 billion. This landmark acquisition underscores strong investor confidence in cloud and AI infrastructure growth across the Asia‑Pacific digital ecosystem, and positions the combined owner as a leading data center operator in the region.

- Jan 2026: UPC Volt, a joint venture between a Netherlands‑based renewable energy group and India‑focused Volt Data Centres, signed a memorandum of understanding with the Government of Telangana to invest around USD 600 million to develop a 100 MW AI‑ready data center campus in the Hyderabad region. The project includes renewable energy commitments to power mission‑critical computing.

- Dec 2025: CapitaLand Investment reported the first close of its India‑focused data center fund with approximately SGD 150 million raised and minority stakes acquired in three Indian data center assets. The fund will support expansion and asset recycling strategies in the country’s digital infrastructure segment as investor appetite grows for reliable capacity.

Report Details

| Report Characteristics |

| Market Size (2026) |

USD 10.8 Bn |

| Forecast Value (2035) |

USD 36.6 Bn |

| CAGR (2026–2035) |

14.5% |

| Historical Data |

2021 – 2025 |

| Forecast Data |

2027 – 2035 |

| Base Year |

2025 |

| Estimate Year |

2026 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Hardware, Software, Services), By Deployment Model (On-Premise, Hybrid, Cloud-Based), By Data Center Type (Enterprise Data Center, Colocation Data Center, Cloud Data Center, Hyperscale Data Center, Edge Data Center), By Level (Tier Standard) (Tier 1, Tier 2, Tier 3, Tier 4), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By End User (Cloud Service Providers, Technology Providers, Telecom, BFSI, Healthcare, Retail & E-commerce, Entertainment & Media, Energy & Utilities) |

| Country Coverage |

India |

| Prominent Players |

ST Telemedia Global Data Centres (STT GDC India), Nxtra Data (Bharti Airtel), Tata Communications, NTT Global Data Centers India, CtrlS Datacenters, Sify Technologies (Sify Infinit Spaces), AdaniConneX, Yotta Data Services, Web Werks (Iron Mountain India), NetForChoice, Amazon Web Services (AWS India), Microsoft Azure India |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the India Data Center Market?

▾ The India Data Center Market size is estimated to have a value of USD 10.8 billion in 2026 and is expected to reach USD 36.6 billion by the end of 2035.

What is the growth rate in the India Data Center Market in 2026?

▾ The market is growing at a CAGR of 14.5% over the forecasted period of 2026.

Who are the key players in the India Data Center Market?

▾ Some of the major key players in the India Data Center Market are ST Telemedia Global Data Centres (STT GDC India), Nxtra Data (Bharti Airtel), Tata Communications, NTT Global Data Centers India, CtrlS Datacenters, Sify Technologies (Sify Infinit Spaces), AdaniConneX, Yotta Data Services, Web Werks (Iron Mountain India), NetForChoice, Amazon Web Services (AWS India), Microsoft Azure India, Google Cloud India, Oracle Cloud Infrastructure India, Alibaba Cloud India, Larsen & Toubro, and many others.