Market Overview

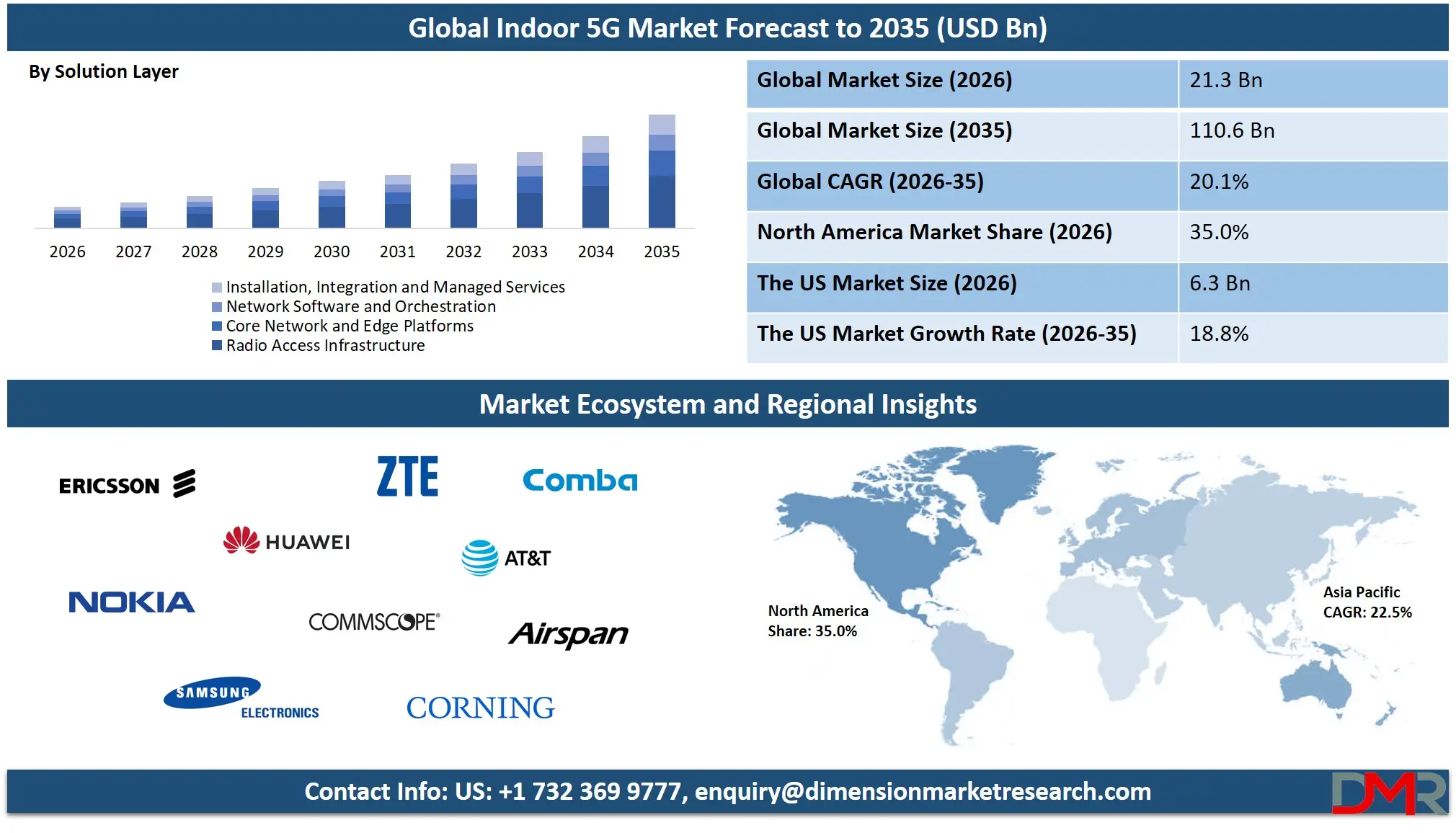

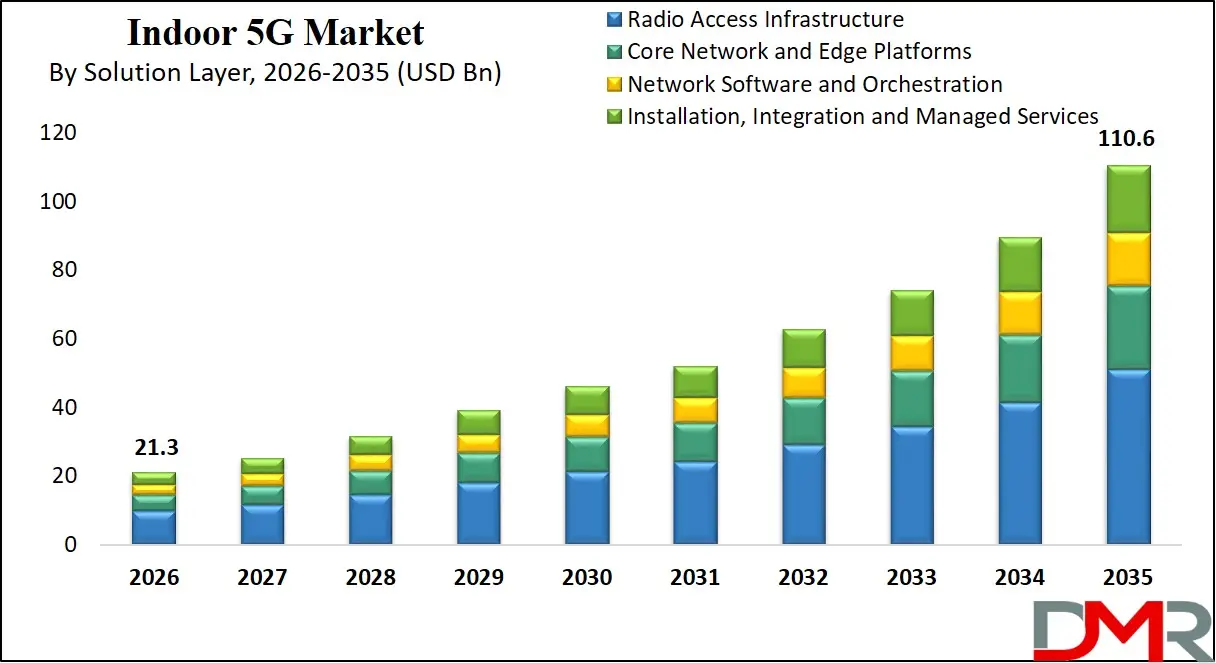

The global Indoor 5G market is expected to reach USD 21.3 billion in 2026 and expand at a CAGR of 20.1% through 2035, reaching USD 110.6 billion, driven by rising enterprise connectivity demand, private 5G networks, smart buildings, indoor wireless broadband, and high capacity in building mobile network infrastructure.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Indoor 5G refers to the deployment of fifth generation mobile network technology inside buildings and enclosed environments to deliver ultra-fast data speeds, low latency, high device density and reliable wireless coverage where outdoor macro networks struggle to penetrate. It uses purpose built indoor radio systems such as small cells and distributed antenna networks combined with local core and edge computing to support demanding digital workloads including real time collaboration, immersive media, automation, connected machines and secure enterprise communications across offices, hospitals, factories, campuses and public venues.

The global Indoor 5G market represents the worldwide ecosystem of technologies, solutions and services that enable high performance wireless connectivity inside commercial, industrial and institutional buildings. It includes radio access infrastructure, spectrum optimized indoor networks, software platforms, edge computing and professional services that together allow enterprises and property owners to deploy private and managed 5G environments. Growth is being driven by the rapid digitization of workplaces, rising demand for smart buildings, increasing use of cloud applications and the need for reliable high capacity wireless networks that support thousands of connected devices simultaneously.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

From a market perspective, global indoor 5G adoption is expanding as enterprises seek greater control over network security, quality of service and data localization while reducing dependence on traditional public cellular coverage. Industries such as manufacturing, healthcare, logistics, retail and education are increasingly investing in indoor wireless broadband to enable automation, real time analytics, connected equipment, digital twins and immersive experiences. As spectrum availability improves and network virtualization advances, the indoor 5G market is evolving into a core layer of modern enterprise infrastructure, supporting next generation digital transformation across regions and verticals.

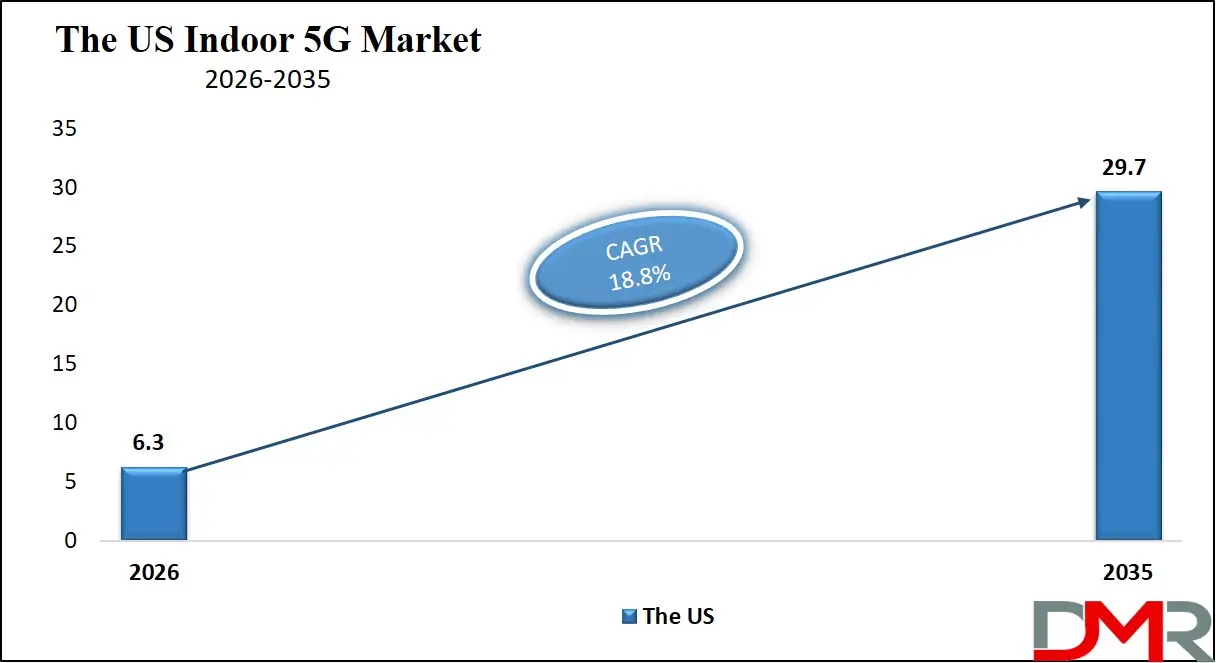

The US Indoor 5G Market

The U.S. Indoor 5G Market size is expected to reach at USD 6.3 billion in 2026. It is further expected to witness subsequent growth in the upcoming period, holding USD 29.7 billion in 2035 at a CAGR of 18.8%.

The US Indoor 5G market is advancing rapidly as enterprises, property owners, and service providers invest in high performance in building wireless connectivity to support digital transformation. Large commercial offices, hospitals, manufacturing plants, logistics hubs, and retail complexes are deploying private and managed indoor 5G networks to ensure reliable coverage, low latency, and high device capacity. The strong presence of hyperscale cloud providers, advanced data centers, and edge computing infrastructure is accelerating adoption, enabling seamless integration of cloud applications, real time analytics, and enterprise mobility across indoor environments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growth in the US Indoor 5G market is also supported by increasing demand for secure enterprise networks, smart building technologies, and connected devices that require consistent high bandwidth. Industrial automation, telemedicine, immersive collaboration tools, and artificial intelligence driven workflows are pushing organizations to move beyond traditional Wi Fi and legacy cellular systems. Regulatory support for shared spectrum, along with rising investments by telecom operators and neutral host providers, is strengthening the indoor 5G ecosystem, positioning the US as a global leader in private wireless and in building 5G deployments.

The Europe Indoor 5G Market

Europe’s Indoor 5G market is expected to reach USD 5.9 billion in 2026, growing at a CAGR of 15.0% as enterprises and property owners continue to invest in high performance in building wireless connectivity. Demand is rising across commercial offices, retail complexes, healthcare facilities, and public venues where reliable mobile broadband and low latency networks are essential for digital operations. The adoption of private 5G networks and managed indoor solutions is helping organizations improve productivity, support cloud applications, and deliver better user experiences in complex indoor environments.

The region’s steady growth is also being driven by increasing investments in industrial automation, smart infrastructure, and secure enterprise communications. Manufacturing plants, logistics hubs, and research campuses across Europe are deploying indoor 5G to connect machines, sensors, and digital systems in real time, enabling data driven decision making and operational efficiency. Supportive spectrum policies, combined with strong emphasis on data protection and network reliability, are further strengthening Europe’s position as a key contributor to the global Indoor 5G market.

The Japan Indoor 5G Market

Japan’s Indoor 5G market is expected to reach USD 2.0 billion in 2026, expanding at a CAGR of 20.0% as the country continues to lead in advanced digital infrastructure and smart technology adoption. Strong demand from manufacturing, electronics, healthcare, and commercial real estate sectors is driving investments in high performance in building wireless networks. Enterprises are increasingly deploying private 5G and managed indoor connectivity to support robotics, cloud applications, and connected devices, reflecting Japan’s focus on productivity, automation, and digital innovation.

The market is further supported by Japan’s emphasis on smart factories, intelligent buildings, and next generation enterprise connectivity. Industrial facilities and logistics centers are using indoor 5G to enable real time monitoring, automated equipment, and data driven operations, while offices, hospitals, and campuses rely on low latency wireless networks for collaboration and critical services. With supportive government policies and a strong ecosystem of technology providers, Japan is positioned as one of the fastest growing indoor 5G markets in the Asia Pacific region.

Global Indoor 5G Market: Key Takeaways

- Indoor 5G is becoming essential enterprise infrastructure: Indoor 5G is now a core platform for cloud access, smart buildings, automation, and real time digital operations, moving beyond basic wireless coverage.

- Private 5G is driving market control and customization: Enterprises prefer private networks to gain better security, data control, and guaranteed performance for mission critical indoor applications.

- Small cells are the backbone of indoor deployments: Small cell networks dominate because they are flexible, scalable, and cost effective for delivering high capacity indoor coverage.

- Industrial and commercial buildings are key demand centers: Factories, offices, and large venues are leading adoption as they require reliable, high density, and low latency wireless connectivity.

- Asia Pacific and North America are shaping global growth: Asia Pacific leads in revenue while North America drives innovation and rapid enterprise adoption of indoor 5G solutions.

Global Indoor 5G Market: Use Cases

- Smart Manufacturing: Indoor 5G supports real time machine communication, robotics, and industrial IoT inside factories. It enables low latency, secure wireless connectivity for automation, predictive maintenance, and digital twins, improving productivity and operational efficiency.

- Smart Buildings: Commercial buildings use indoor 5G for high speed enterprise connectivity, cloud access, and smart building systems. It provides reliable in building wireless coverage for offices, tenants, and connected devices.

- Healthcare Facilities: Hospitals deploy indoor 5G for telemedicine, connected medical devices, and real time patient monitoring. The network ensures low latency and secure data transmission across clinical environments.

- Public Venues: Airports, stadiums, and convention centers use indoor 5G to support high density mobile users, video streaming, and location based services with stable high capacity wireless performance.

Global Indoor 5G Market: Stats & Facts

- International Telecommunication Union (ITU) / UN Sources

- ITU estimated that 5G coverage would reach 51 % of the world’s population in 2024, with 84 % coverage in high-income countries vs 4 % in low-income economies.

- ITU reported that global internet usage reached an estimated 5.4 billion people in 2023, representing 65 % of the world’s population.

- ITU noted that young people aged 15–24 use the internet at 79 %, higher than other age groups.

- ITU data shows gender parity in internet use improved but remains unequal, with 70 % of men and 65 % of women using the internet in 2024.

- ITU reported that global international bandwidth usage more than doubled from 2020 to 2024, reaching 322.8 kbit/s per internet user.

- ITU broadband statistics indicate that fixed broadband costs decreased marginally in 2024, averaging 2.5 % of GNI per capita globally.

- ITU data shows 167 countries had national broadband plans or digital strategies as of 2024.

- ITU connectivity reports highlight that about 2.8 billion people remained offline in 2023, mostly in rural regions.

- ITU notes mobile broadband subscriptions are approaching parity with total cellular subscriptions, reflecting 5G adoption momentum.

- ITU reports that internet access continues to improve affordability, though disparities persist between regions.

- FCC – U.S. Federal Communications Commission (USA)

- FCC data shows total U.S. mobile connections grew from approximately 391 million in December 2023 to about 416 million by June 2024.

- As of June 2024, fixed broadband connections in the U.S. reached roughly 133 million, up 2.3 % from June 2023.

- In June 2024, 82 % of fixed broadband connections in the U.S. provided downstream speeds of at least 100 Mbps.

- FCC reported that only about 6 % of U.S. fixed connections in June 2024 had downstream speeds below 25 Mbps.

- As of June 2024, 94 % of broadband serviceable locations in the U.S. had at least one provider offering speeds of 100 Mbps or higher.

- FCC Form 477 data showed that mobile connections increased by about 2.5 % year-over-year from June 2023 to June 2024.

Global Indoor 5G Market: Market Dynamics

Driving Factors in the Global Indoor 5G Market

Enterprise Digital Transformation and Private Connectivity Demand

Rapid digital transformation initiatives across industries are driving adoption of indoor 5G networks to support high throughput connectivity, secure enterprise communication, and real time data processing. Organizations increasingly favor private 5G solutions over traditional Wi-Fi to enable seamless cloud application access, edge computing integration, and high device density coverage in offices, campuses, and factories.

Growth of Industrial IoT and Automation

The proliferation of industrial IoT devices, robotics, and automated systems in manufacturing and logistics is accelerating demand for reliable in building wireless networks. Indoor 5G’s ultra low latency and robust wireless performance make it ideal for mission critical applications such as predictive maintenance, autonomous guided vehicles, and connected sensors, enhancing operational efficiency and reducing downtime.

Restraints in the Global Indoor 5G Market

High Deployment and Infrastructure Cost

The initial investment required for indoor 5G infrastructure, including small cells, distributed antenna systems, and core network integration, remains a major restraint for many enterprises. The complexity of indoor wireless coverage planning, spectrum licensing fees, and professional services increases total cost of ownership, slowing adoption in cost sensitive segments.

Technical Challenges with Network Integration

Integrating indoor 5G with existing IT networks and legacy systems poses technical challenges related to interoperability, spectrum management, and security. Ensuring seamless handover between outdoor and indoor networks while maintaining quality of service requires advanced network planning and expertise, limiting rapid deployment for some organizations.

Opportunities in the Global Indoor 5G Market

Private 5G as a Service and Managed Connectivity Solutions

Offering private 5G networks through managed services presents a significant market opportunity for service providers and system integrators. Enterprises looking to outsource deployment, maintenance, and optimization can leverage managed indoor 5G solutions to reduce operational burden, accelerate time to value, and scale wireless capacity based on evolving business needs.

Expansion into Emerging Vertical Use Cases

New applications in smart healthcare, AR/VR collaboration, immersive media, and real time analytics open opportunities for indoor 5G adoption beyond traditional commercial and industrial sectors. Hospitals, educational campuses, and smart retail environments are increasingly deploying indoor wireless broadband to support advanced digital services and improve experience for users.

Trends in the Global Indoor 5G Market

Integration with Edge Computing and AI-Driven Networks

Indoor 5G networks are increasingly integrated with multi access edge computing (MEC) and artificial intelligence for real time network optimization, enhanced security, and localized data processing. This trend enhances performance for latency sensitive applications, supports distributed analytics, and enables adaptive resource allocation based on traffic patterns.

Neutral Host and Shared Infrastructure Models

Neutral host models, where multiple operators and enterprises share indoor 5G infrastructure, are gaining traction in high density venues such as airports, stadiums, and convention centers. Shared wireless infrastructure lowers deployment costs, improves spectrum utilization, and ensures consistent high capacity coverage for multiple stakeholders in complex environments.

Global Indoor 5G Market: Research Scope and Analysis

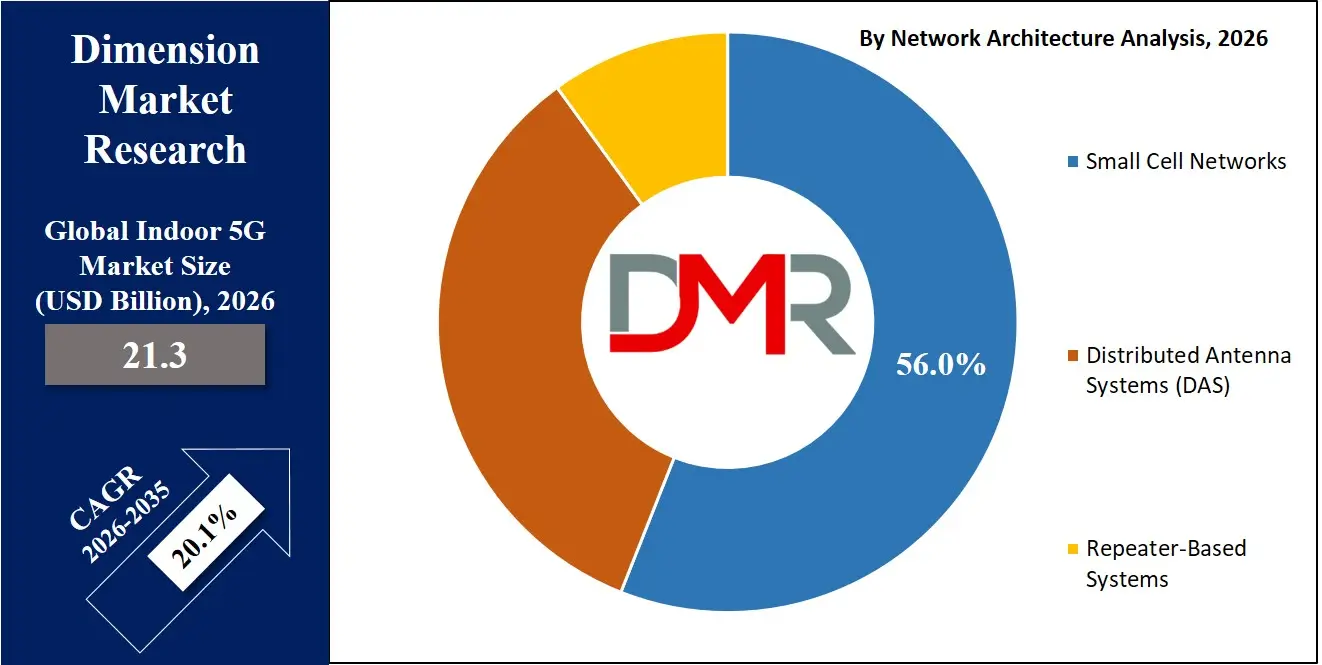

By Network Architecture Analysis

Small cell networks are expected to dominate the network architecture segment with a 56.0% share in 2026 because they offer a highly flexible and cost effective way to deliver high capacity indoor 5G coverage across offices, factories, hospitals, and commercial complexes. These compact radio units can be easily installed throughout a building to provide strong in building signal strength, low latency, and seamless mobility for a large number of connected devices. Their ability to support private 5G networks, enterprise wireless broadband, and high density data traffic makes them ideal for smart buildings, industrial automation, and enterprise digital workplaces, driving widespread adoption globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Distributed Antenna Systems also play a vital role in the indoor 5G network architecture landscape, particularly in large venues and multi-tenant buildings where uniform coverage and multi operator support are required. DAS uses a network of antennas connected to a centralized source to distribute cellular signals evenly throughout a facility, making it well suited for airports, stadiums, shopping malls, and large office towers. While DAS deployments typically involve higher installation costs and more complex infrastructure compared to small cells, they remain essential for delivering consistent indoor mobile connectivity, carrier grade performance, and reliable voice and data services in high traffic environments.

By Spectrum Band Analysis

Sub 6 GHz spectrum is anticipated to dominate the indoor 5G spectrum band segment with a 74.0%share in 2026 because it provides the best balance between coverage, penetration, and capacity for indoor environments. These frequencies travel more effectively through walls, floors, and building materials compared to higher bands, allowing operators and enterprises to deliver consistent in building wireless connectivity across large indoor areas. Sub 6 GHz also supports stable data rates, reliable mobility, and efficient network deployment, making it the preferred choice for enterprise networks, smart buildings, healthcare facilities, and industrial campuses that require dependable indoor broadband.

Millimeter wave spectrum, while holding a smaller share, plays a critical role in delivering extremely high data speeds and ultra-low latency for bandwidth intensive indoor applications. It is especially valuable in dense environments such as convention centers, stadiums, and high tech offices where large volumes of data traffic, video streaming, augmented reality, and cloud computing demand very high capacity. However, millimeter wave signals have limited range and weaker penetration through obstacles, which increases deployment complexity and infrastructure costs, keeping its adoption more focused on targeted high performance indoor zones rather than full building coverage.

By Network Ownership Model Analysis

Private enterprise networks are expected to dominate the network ownership model segment with a 52.0% share in 2026 because organizations increasingly want full control over their indoor 5G environments to meet specific performance, security, and data governance requirements. By owning and managing their own private 5G infrastructure, enterprises can ensure reliable wireless connectivity, predictable network quality, and customized configurations for applications such as industrial automation, real time analytics, smart building systems, and connected devices. This model also supports data localization and cybersecurity compliance, making it highly attractive for manufacturing, healthcare, logistics, and large corporate campuses.

Operator managed indoor networks remain an important part of the market, particularly for enterprises and property owners that prefer to avoid the complexity of building and operating their own 5G infrastructure. In this model, telecom service providers design, deploy, and manage indoor wireless networks while delivering carrier grade performance, spectrum access, and ongoing maintenance. This approach allows businesses to benefit from high quality in building 5G connectivity without heavy capital investment, making it popular in commercial real estate, shopping centers, airports, and multi-tenant buildings where seamless mobile coverage and user experience are priorities.

By Deployment Environment Analysis

Commercial real estate is expected to dominate the deployment environment segment with a 36.0% share in 2026 as offices, business parks, shopping malls, hotels, and mixed use developments increasingly rely on high performance indoor wireless connectivity. Tenants and visitors demand fast and reliable mobile broadband for cloud applications, video collaboration, digital payments, and smart building services, pushing property owners to invest in indoor 5G networks. These environments also benefit from improved tenant experience, higher property value, and better support for connected building systems such as security, energy management, and occupancy monitoring.

Industrial buildings also represent a significant and fast growing deployment environment for indoor 5G as factories, warehouses, and logistics centers adopt advanced digital operations. Manufacturing plants use indoor 5G to connect machines, robots, sensors, and automated vehicles with ultra-low latency and high reliability, enabling real time production control and predictive maintenance. Warehouses and distribution hubs depend on high capacity wireless networks for inventory tracking, asset management, and robotics, making indoor 5G a critical foundation for smart industrial infrastructure.

By Solution Layer Analysis

Radio access infrastructure is expected to dominate the solution layer segment with a 46.0% share in 2026 because it forms the physical foundation of every indoor 5G network. This layer includes small cells, antennas, radio units, and distributed antenna components that directly deliver wireless coverage and capacity inside buildings. As enterprises and property owners expand indoor 5G deployments, significant investment is required in these radio systems to ensure strong signal quality, seamless mobility, and high device density, making this the largest and most capital intensive portion of the indoor 5G value chain.

Core network and edge platforms play a crucial supporting role by enabling intelligent traffic management, security, and real time data processing within indoor 5G environments. These platforms allow enterprises to run applications closer to users and devices, reducing latency and improving performance for use cases such as automation, video analytics, and immersive collaboration. While this layer represents a smaller share compared to radio access, it is becoming increasingly important as organizations adopt private 5G networks, edge computing, and cloud integrated architectures to support advanced digital services.

By Application Type Analysis

High density connectivity is expected to dominate the application type segment with a 29.0% share in 2026 as indoor environments increasingly need to support large numbers of simultaneous users and connected devices. Offices, shopping malls, airports, campuses, and event venues require stable high capacity wireless networks to handle mobile data traffic, video streaming, cloud access, and real time collaboration without congestion. Indoor 5G is well suited for these scenarios due to its ability to deliver consistent performance, low latency, and efficient spectrum utilization in crowded indoor spaces.

Industrial automation and robotics represent a critical application area for indoor 5G, driven by the need for reliable and deterministic wireless communication inside factories and warehouses. These environments depend on ultra-low latency and high reliability to connect robots, autonomous vehicles, sensors, and control systems in real time. Indoor 5G enables precise machine coordination, flexible production layouts, and advanced automation while reducing dependence on wired connections, supporting the transition toward smart factories and digitally connected industrial operations.

The Global Indoor 5G Market Report is segmented on the basis of the following:

By Network Architecture

- Small Cell Networks

- Femtocells

- Picocells

- Microcells

- Distributed Antenna Systems (DAS)

- Repeater-Based Systems

By Spectrum Band

- Sub-6GHz

- Low Band (coverage-focused)

- Mid Band (capacity-coverage balance)

- Millimeter Wave

By Network Ownership Model

- Private Enterprise Networks

- Operator-Managed Indoor Networks

- Neutral-Host Networks

By Deployment Environment

- Commercial Real Estate

- Offices and Corporate Campuses

- Retail and Hospitality

- Industrial Buildings

- Manufacturing Plants

- Warehouses and Logistics Centers

- Healthcare Facilities

- Education Campuses

- Public Infrastructure

- Airports and Metro Stations

- Stadiums and Convention Centers

By Solution Layer

- Radio Access Infrastructure

- Core Network and Edge Platforms

- Network Software and Orchestration

- Installation, Integration, and Managed Services

By Application Type

- High-Density Connectivity

- Industrial Automation and Robotics

- Enterprise IT and Cloud Access

- Video, AR and XR Workloads

- Mission-Critical Communications

Impact of Artificial Intelligence in the Global Indoor 5G Market

Artificial intelligence is playing a transformative role in the global Indoor 5G market by making in building wireless networks more intelligent, efficient, and adaptive to changing usage patterns. AI driven network management platforms analyze real time traffic, user behavior, and radio conditions to automatically optimize spectrum allocation, power levels, and handovers between small cells and antennas. This improves coverage quality, reduces interference, and ensures consistent performance in complex indoor environments such as offices, hospitals, factories, and public venues. AI also enables predictive maintenance of indoor 5G infrastructure by detecting anomalies in radio equipment, edge servers, and network performance before failures occur, minimizing downtime and operational costs.

AI is also enhancing the value of indoor 5G by enabling advanced enterprise and industrial applications that rely on real time data processing at the network edge. In smart factories, AI powered analytics running on edge computing platforms connected to indoor 5G networks support quality inspection, robotics control, and production optimization with ultra-low latency. In commercial buildings and healthcare facilities, artificial intelligence helps manage connected devices, security systems, and video analytics while prioritizing critical traffic across the indoor cellular network. As enterprises increasingly deploy private 5G networks, the integration of AI driven orchestration and automation is becoming essential for scaling operations, improving cybersecurity, and delivering reliable high performance indoor connectivity.

Global Indoor 5G Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to lead the global Indoor 5G market with a 38.0% revenue share in 2026, driven by rapid digitalization, large scale 5G infrastructure investments, and strong demand from manufacturing, smart buildings, and enterprise connectivity across countries such as China, Japan, South Korea, and India.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The region has a high concentration of technology intensive industries, dense urban development, and growing adoption of private 5G networks in factories, logistics centers, and commercial complexes. Government initiatives supporting 5G rollout, smart city programs, and industrial automation are further accelerating indoor 5G deployments, positioning Asia Pacific as the largest and most dynamic regional market globally.

Region with Significant Growth

North America is emerging as a region with significant growth in the global Indoor 5G market, supported by strong enterprise adoption, widespread deployment of private 5G networks, and advanced cloud and edge computing infrastructure. Large investments by telecom operators, neutral host providers, and technology companies are accelerating indoor wireless upgrades across offices, healthcare facilities, industrial plants, and public venues. The rising demand for secure enterprise connectivity, industrial automation, and high capacity in building mobile networks is further driving rapid expansion, making North America one of the fastest growing markets for indoor 5G solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Indoor 5G Market: Competitive Landscape

The competitive landscape of the global Indoor 5G market is characterized by intense innovation, strategic partnerships, and a strong focus on integrated network solutions that combine radio infrastructure, software platforms, and managed services. Market participants compete on the basis of network performance, deployment flexibility, spectrum efficiency, and the ability to support private and hybrid 5G environments for enterprises. The market is also shaped by growing collaboration between telecom operators, cloud service providers, and system integrators to deliver end to end indoor connectivity solutions. As demand rises for smart buildings, industrial automation, and secure enterprise networks, competition is increasingly driven by technological differentiation, scalability, and long term service capabilities.

Some of the prominent players in the Global Indoor 5G Market are:

- Ericsson

- Huawei Technologies

- Nokia

- Samsung Electronics

- ZTE Corporation

- CommScope

- Corning Incorporated

- Comba Telecom

- AT&T

- Airspan Networks

- SOLiD

- Dali Wireless

- Nextivity

- JMA Wireless

- Liteon Technology

- ALCAN

- Extenet Systems

- Mavenir

- Boingo Wireless

- Cisco Systems

- Other Key Players

Recent Developments in the Global Indoor 5G Market

- December 2025: Inseego launched an advanced indoor 5G fixed wireless access router for enterprise and small business environments, designed to deliver secure high speed in building broadband for offices, retail, and distributed workplaces.

- October 2025: Ericsson introduced a new compact indoor 5G radio and baseband solution developed in Canada, aimed at improving indoor coverage and performance in commercial buildings and medium sized enterprise locations.

- April 2025: Airspan Networks completed the acquisition of Corning’s Wireless business, including its distributed antenna system and small cell portfolio, to strengthen its indoor 5G and private network infrastructure capabilities.

- February 2025: Airspan Networks announced an agreement to acquire Corning’s in building wireless business, expanding its footprint in DAS, 5G small cells, and enterprise indoor network solutions.

Report Details

| Report Characteristics |

| Market Size (2026) |

USD 21.3 Bn |

| Forecast Value (2035) |

USD 110.6 Bn |

| CAGR (2026–2035) |

20.1% |

| The US Market Size (2026) |

USD 6.3 Bn |

| Historical Data |

2021 – 2025 |

| Forecast Data |

2027 – 2035 |

| Base Year |

2025 |

| Estimate Year |

2026 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Network Architecture (Small Cell Networks, Distributed Antenna Systems (DAS), Repeater-Based Systems), By Spectrum Band (Sub-6 GHz, Millimeter Wave), By Network Ownership Model (Private Enterprise Networks, Operator-Managed Indoor Networks, Neutral-Host Networks), By Deployment Environment (Commercial Real Estate, Industrial Buildings, Healthcare Facilities, Education Campuses, Public Infrastructure), By Solution Layer (Radio Access Infrastructure, Core Network and Edge Platforms, Network Software and Orchestration, Installation, Integration, and Managed Services), and By Application Type (High-Density Connectivity, Industrial Automation and Robotics, Enterprise IT and Cloud Access, Video, AR and XR Workloads, Mission-Critical Communications) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Ericsson, Huawei Technologies, Nokia, Samsung Electronics, ZTE Corporation, CommScope, Corning Incorporated, Comba Telecom, AT&T, Airspan Networks, SOLiD, Dali Wireless, Nextivity, JMA Wireless, Liteon Technology, ALCAN, Extenet Systems, and many others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Indoor 5G Market?

▾ The Global Indoor 5G Market size is estimated to have a value of USD 21.3 billion in 2026 and is expected to reach USD 110.6 billion by the end of 2035.

What is the growth rate in the Global Indoor 5G Market in 2026?

▾ The market is growing at a CAGR of 20.1% over the forecasted period of 2026.

What is the size of the US Indoor 5G Market?

▾ The US Indoor 5G market is projected to be valued at USD 6.3 billion in 2026. It is expected to witness subsequent growth in the upcoming period as it holds USD 29.7 billion in 2035 at a CAGR of 18.8%.

Which region accounted for the largest Global Indoor 5G Market?

▾ Asia Pacific is expected to have the largest market share in the Global Indoor 5G Market with a share of about 38.0% in 2026.

Who are the key players in the Global Indoor 5G Market?

▾ Some of the major key players in the Global Indoor 5G Market are Ericsson, Huawei Technologies, Nokia, Samsung Electronics, ZTE Corporation, CommScope, Corning Incorporated, Comba Telecom, AT&T, Airspan Networks, SOLiD, Dali Wireless, Nextivity, JMA Wireless, Liteon Technology, ALCAN, Extenet Systems, and many others.