Market Overview

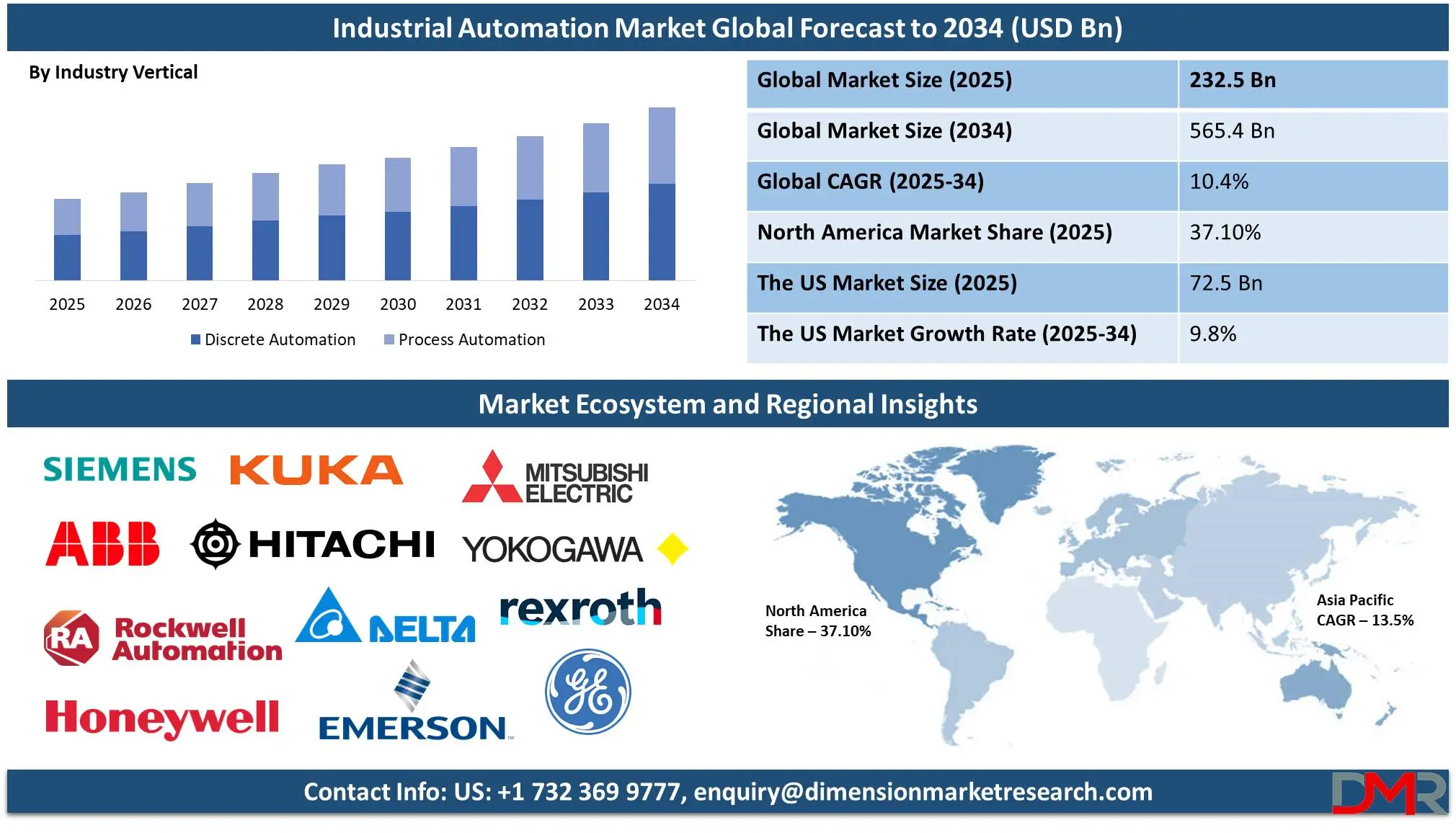

The Global Industrial Automation Market is predicted to be valued at

USD 232.5 billion in 2025 and is expected to grow to

USD 565.4 billion by 2034, registering a compound annual growth rate

(CAGR) of 10.4% from 2025 to 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global Industrial Automation market is experiencing rapid growth with the increasing adoption of Industry 4.0, smart manufacturing solutions, and robots. The market is driven by increasing demand for efficiency, precision, and cost reduction in manufacturing operations. Industry estimates suggest that the market is driven by advancements in AI-based automation, IoT integration, and machine learning. The demand for programmable logic controllers (PLC), distributed control systems (DCS), and human-machine interfaces (HMI) is rising to drive efficient operations in industries such as automotive, electronics, pharmaceuticals, and energy.

The present digital revolution provides immense scope for industrial automation with companies looking to boost efficiency in operations and reduce human intervention. Collaborative robots (cobots), with their adaptability and ability to co-work with human operators, are being accepted more and more in sectors like automotive and electronics. Cloud-based automation platforms are also revolutionizing information handling and workflow streamlining by businesses. Asia-Pacific emerging markets are witnessing a dramatic rise in automation adoption with strong government policies and rising smart factory presence.

High initial investment and integration complexity remain key concerns. Small and medium-sized businesses (SMEs) struggle to transition due to legacy infrastructure and high implementation costs. Security threats also pose risks with interconnected systems being more vulnerable to cyber threats and requiring to be supported with robust security frameworks to counter threats.

The market outlook is very positive with North America, Europe, and Asia-Pacific leading automation adoption. The rise of autonomous manufacturing, artificial intelligence-driven analytics, and real-time monitoring systems will propel industrial automation's future with steady demand in several sectors. The shift to hyper-automation and artificial intelligence-based decision-making will create new opportunities to grow, and automation will become a primary pillar of modern industrial operations.

The US Industrial Automation Market

The US Industrial Automation Market is projected to be valued at USD 72.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 167.8 billion in 2034 at a CAGR of 9.8%.

The US industrial automation industry is among the largest globally because of its technologically advanced manufacturing platform and high adoption of automation through artificial intelligence, robots, and cloud-based industrial software. Major players such as Rockwell Automation, Emerson Electric, and Honeywell have been aggressively investing in smart factory solutions through the Industrial Internet of Things (IIoT), machine learning, and 5G connectivity to boost real-time monitoring and decision-making through data.

Strong demand in industries such as automotive, aerospace, pharmaceuticals, and electronics is fueling automation technology adoption at a rapid rate. The country boasts a skilled workforce and technological capabilities to build a competitive edge in automation with robotics and artificial intelligence. The shortage of labor and aging workforce are also compelling businesses to integrate autonomous systems to maintain efficiency and productivity.

Government policies supporting smart factories, digital transformation, and industrial adoption of artificial intelligence (AI) are also propelling market growth. Incentives at state and federal levels and industrial cloud and cybersecurity solution investment are enabling companies to shift to automated manufacturing facilities. However high initial investment costs, cybersecurity threats, and integration challenges pose barriers to small and medium businesses (SMEs).

Despite such challenges, the U.S. remains at the forefront of industrial automation with continued innovations in AI, robotics, and smart control systems. As it invests more in predictive maintenance, autonomous logistics, and human-machine collaboration, the country is shaping industrial operations of the future with the continued expansion of manufacturing automation, supply chain efficiency, and industrial applications of AI.

Global Industrial Automation Market: Key Takeaways

- The Global Market Size Analysis: The Global Industrial Automation Market size is estimated to have a value of USD 232.5 billion in 2025 and is expected to reach USD 565.4 billion by the end of 2034.

- The US Market Size Analysis: The US Industrial Automation Market is projected to be valued at USD 72.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 167.8 billion in 2034 at a CAGR of 9.8%.

- Regional Analysis: North America is expected to have the largest market share in the Global Industrial Automation Market with a share of about 36.10% in 2025.

- Key Players Insights: Some of the major key players in the Global Industrial Automation Market are Siemens AG, ABB Ltd., Rockwell Automation, Inc., Schneider Electric SE, Honeywell International Inc., Emerson Electric Co., Mitsubishi Electric Corporation, General Electric Company, and many others.

- The Global Market Growth Rate Insights: The market is growing at a CAGR of 10.4.0% over the forecasted period of 2025.

Global Industrial Automation Market: Use Cases

- Smart Manufacturing: Businesses are implementing both SCADA and MES systems to enable real-time monitoring, predictive maintenance, and process optimization. This enhances production efficiency, reduces downtime, and assures quality standards compliance.

- Robotics in Automotive: Automobile manufacturers utilize robot arms and artificial intelligence-powered assembly lines to increase efficiency in production. The quality of output has been improved with automated painting, welding, and material handling while lowering labor costs and human error.

- Energy Management: Industrial automation in power plants and renewable energy facilities is realized through energy optimization with smart control systems. Energy loads are effectively balanced through smart grids and artificial intelligence-driven analytics.

- Pharmaceutical Production: Implementation of automated packaging, inspection, and dosing systems has revolutionized pharmaceutical production. Automation guarantees regulatory compliance while increasing precision and batch consistency.

- Warehouse Automation: Autonomous mobile robots (AMRs) and artificial intelligence-powered sortation systems help logistics companies maximize inventory management. The automated warehouses help to fill orders more quickly and lower operating expenses.

Global Industrial Automation Market: Stats & Facts

- New automation technology provides a golden opportunity to 94.0% of businesses with time-consuming and repetitive workloads to boost efficiency and productivity by a substantial margin, according to a study by Kissflow on business automation.

- Only 55.0% of businesses use generative AI to power automation, showing a significant gap in AI-fueled process optimization that has been cited by CompTIA to reflect untapped business opportunities in pursuit of efficiency in operations.

- A nearly unanimous majority of experts 94.0% would welcome a single platform to streamline workflow automation and do away with inefficiency caused by disparate systems, something Workato discovered that speaks to the power of seamless digital integration.

- Automation and artificial intelligence can add $15.7 trillion to the economy by 2030, highlighting their transformational value as projected by PwC, making automation and artificial intelligence key drivers of productivity and economic growth.

- Automation can save businesses as much as 77.0% of their time, leaving their employees to focus on strategic initiatives, as reported by Gitnux, indicating that businesses can increase efficiency in their workflow and management of resources.

- 50.0% of business executives believe that automation can do 30.0% of their work, making their work more efficient and reducing their effort, according to Kissflow, showing the tremendous impact of automation on workforce management.

- Implementation of hyper-automation and redesign of business processes can reduce operating expenses by up to 30.0%, yielding substantial cost savings, according to Gartner, making automation a cost-effective business solution to sustainability.

- 90.0% of business leaders predict automation will have a significant effect on workforce capacity within three years, as reported by Deloitte, indicating a general anticipation of efficiency improvements through automation.

- 35.0% of small and medium-sized businesses credit automation with increased customer service and support capabilities, as reported in a Zapier survey, indicating automation's effect on responsiveness in operations.

- 46.0% of administrative and 44.0% of legal professionals foresee at least a quarter of their jobs being automated, according to Goldman Sachs, indicating automation's rising presence in professional occupations.

- The highest automated functions across industries are data entry (38.0%), document management (32.0%), lead nurturing (30.0%), and inventory control (27.0%) as reflected in a Zapier report that shows businesses utilizing automation.

- Automated marketers have a 95.0% greater chance of reporting extremely effective strategies compared to their non-automated counterparts, HubSpot says, citing automation as a primary driver of effective marketing.

- 66.0% of executives believe that C-suite executives must oversee ethical AI/ML practices in financial institutions, says the Institute of International Finance, underscoring the importance of AI in governance.

- 88.0% of finance and insurance executives have sped up automation adoption since 2020, based on McKinsey's report that shows rapid technology adoption in financial services.

- 85.0% of companies utilized robotic process automation (RPA) to perform IT functions in 2022, making operations more efficient according to Strategic Market Research, highlighting RPA's increasing popularity.

- By 2025, half of enterprises will use AI and automation orchestration platforms to drive IT operations, as projected by Redwood, showcasing IT’s shift toward automated systems.

- Automation and artificial intelligence can increase telecom labor productivity by up to 40.0%, significantly enhancing efficiency, as FTI Delta's estimation emphasizes AI's role in telecom optimization.

- 67.0% of telecommunication companies that have adopted AI and automation witness revenue growth, with 19.0% reporting over 10.0% increases, as reported by a study by NVIDIA, indicating automation's financial contribution.

- Manufacturing platforms increased automation by threefold and cut non-recurrent engineering costs by 40.0%, as reported by Vention, indicating automation's cost-effectiveness.

- • The number-one investment priority of industrial automation in the coming year among manufacturing companies is generative AI, according to Rockwell Automation, reflecting a turning point in industry trends.

- • Engineers place more importance on quality (96.0%), service/support (93.0%), and speed of delivery (82.0%) over price while selecting automation parts, says a study by Assembly with a focus on product reliability.

- Industrial businesses will spend 25.0% of their capital on automation over the next five years, based on McKinsey's forecast, to finance long-term automation spending.

- 25.0% of companies utilize HR automation, mainly to recruit and hire employees, as noted by Zavvy, indicating HR's technological advancement.

- 70.0% of recruiters think that AI can minimize unconscious bias in hiring choices, according to a Tidio study that attests to the role of AI in unbiased recruitment.

- A medical office realized more than $4,000 in savings each month by streamlining paper-based operations, increasing efficiency, as discovered in a Gravity Flow study that demonstrated automation's cost savings.

- 91.0% of knowledge workers say that automation enhances their work experience by eliminating repetitive tasks, as reported in a Zapier report that supports automation's positive impact at work.

- 50.0% of workers worry that automation will threaten their job security, making job issues a concern, as reported by Authority Hacker, showing workforce concern regarding automation.

- 60.0% of employees respond favorably to workplace automation and see advantages to it, as found through a Harvard Business Review study that indicates workforce acceptance of artificial intelligence.

- 60.0% to 70.0% of today's work can be automated with today's technology to increase efficiency, according to McKinsey's estimation, attesting to the ability of AI to revolutionize workflows.

- 45.0% of total economic value will be fueled by product enhancements through artificial intelligence by 2030, revolutionizing sectors as imagined by PwC, and confirming AI's worldwide economic impact.

Global Industrial Automation Market: Market Dynamic

Driving Factors in the Global Industrial Automation Market

Increasing Demand for Operational Efficiency and Cost ReductionManufacturers globally are prioritizing industrial automation to achieve higher efficiency, precision, and cost savings. Automated production lines minimize human error, boost throughput, and reduce operating expenses by reducing dependency on labor. The demand for real-time monitoring, artificial intelligence-driven analytics, and smart sensors allows industries to detect inefficiencies and predict failures to prevent time-consuming and costly downtime.

The integration of cobots (collaborative robots) in production and assembly lines maximizes productivity while ensuring safety in human-robot interactions. In addition to this, automated material handling solutions like AI-based conveyor systems and automated guided vehicles (AGVs) make supply chains more efficient. Real-time inventory tracking systems are also being implemented by companies to reduce the wastage of stocks and maximize warehouse operations to yield higher cost savings and efficient production operations.

Rapid Industrialization in Emerging Markets

Countries in the Asian-Pacific, Latin America, and countries in the Middle East region are undergoing massive industrialization that is fueling increased investment in automated manufacturing units. The governments of India, China, and Southeast Asia are actively supporting smart manufacturing through subsidies, taxation incentives, and infrastructure development. As labor costs increase and the availability of labor becomes limited, industries in such countries are embracing automation solutions based on artificial intelligence to become competitive.

This rapid growth is driving demand for robotics, SCADA, PLCs, and DCS solutions in the automotive, electronics, and pharmaceutical industries. Apart from this, emerging countries are also driving the adoption of Industry 4.0 technologies like cyber-physical systems (CPS), artificial intelligence-based analytics, and automated robots as they aim to increase their global manufacturing presence. Increased foreign direct investments (FDIs) and collaborations between global automation players and local manufacturers are also driving the rapid industrial automation transformation in such countries.

Restraints in the Global Industrial Automation Market

High Initial Costs and Integration Complexities

While industrial automation has several benefits, high initial investment is a primary deterrent to small and medium enterprises (SMEs). The integration of artificial intelligence-driven robots, IIoT-enabled platforms, and smart manufacturing platforms requires heavy capital expenditure. In addition to this, legacy systems implemented in old manufacturing facilities have no compatibility with new automation technologies and must be upgraded at a high cost.

Most sectors find it difficult to scale automation due to technical limitations, interoperability issues, and a lack of staff to manage complex automation systems. Companies must also spend on training staff to manage AI-driven industrial control systems, automated assembly lines, and IIoT platforms, increasing overall costs. The payback period of automation projects can be long, deterring those with limited financial resources from adopting such technology.

Cybersecurity Risks and Data Privacy Concerns

Since industrial automation relies more on IIoT, cloud computing, and decision-making through artificial intelligence (AI), it is vulnerable to cyberattacks and threats of data breaches. Connected industrial networks, smart factories, and automated production systems can be hacked into and subjected to malware and ransomware attacks. A cyberattack on automation systems can lead to disruption of operations, financial loss, and intellectual property compromise. Robust cybersecurity measures, threat detection capabilities in real-time, and secure data encryption have to be adopted to safeguard industrial automation infrastructure.

The complexity of cyber-physical systems (CPS) also brings with it regulatory compliance and data governance challenges, making automation implementation more difficult. Industries have to deploy complex cybersecurity measures such as AI-based threat detection, blockchain-based security, and multilayer authentication to minimize risks. Adherence to stringent industry regulations such as GDPR, NIST, and IEC 62443 is also proving to be a challenge while deploying large-scale automation in industries.

Opportunities in the Global Industrial Automation Market

Expansion of Robotics and Autonomous Systems

The industrial robot market is likely to grow significantly with demand arising for high-speed precision-based automation in industries such as automotive, food & beverage, and logistics. Improvements in autonomous mobile robots (AMRs), artificial intelligence (AI)-)-powered robotic arms and self-learning automation systems are enabling industries to boost manufacturing adaptability. Edge AI computing is also enabling real-time decision-making by robots with improved response time and optimized production workflows.

The demand for warehouse automation using AI is increasing and presents a lucrative opportunity to industrial automation players. Robotics manufacturers are also developing human-robotic collaboration with robots helping human workers to maximize complicated operations with safety. Improvements in soft robots, AI-powered machine vision, and adaptive control systems in robots are enabling robot automation to reach new domains of application in more flexible and customized manufacturing operations.

Integration of Cloud Computing and Edge AI in Industrial Automation

The convergence of cloud computing, edge AI, and real-time analytics is revolutionizing industrial automation with seamless integration of data between manufacturing facilities. Cloud automation platforms enable companies to analyze big data, optimize supply chains, and enhance cybersecurity measures. Edge AI ensures that automation systems handle information at the point of origin to reduce lag and enhance efficiency.

The increased shift to AI-based digital twins, augmented reality (AR)-driven maintenance, and cloud-based SCADA solutions presents a substantial business opportunity for automation vendors. Companies also leverage AI-based predictive analytics to enhance quality control and identify potential faults beforehand. Apart from this, cloud automation facilitates remote monitoring and control of manufacturing operations to allow companies to manage operations at multiple locations with ease, reducing downtime and enhancing efficiency overall.

Trends in the Global Industrial Automation Market

Expansion of AI-Driven Automation and Hyperautomation

The emergence of hyper-automation and artificial intelligence (AI)-driven automation is transforming industrial operations through enhanced efficiency, reducing downtime, and enabling autonomous decision-making. Hyperautomation integrates AI, machine learning (ML), robotic process automation (RPA), and advanced analytics to create self-optimized manufacturing environments. The move is particularly notable in smart factories, with predictive maintenance through AI and automated quality control eliminating waste and enhancing productivity.

Computer vision, AI-enabled robots, and cognitive automation are being adopted by businesses to make complex industrial operations more streamlined, a shift from traditional automation to self-learning and smart systems. AI-enabled analytics are also making real-time decision-making more efficient, with businesses being able to identify inefficiencies and enhance process optimization. The convergence of autonomous production lines, AI-based scheduling, and robotic process automation (RPA) to conduct administrative work is transforming industrial efficiency.

Rising Adoption of Industrial Internet of Things (IIoT) and Smart Manufacturing

Industrial IoT (IIoT) adoption in manufacturing is powering real-time analytics, predictive maintenance, and production efficiency maximization. IIoT products like networked sensors, smart actuators, and edge platforms enable industrial assets to seamlessly communicate with one another, providing enhanced visibility and control over operations. The trend is compelling businesses to adopt digital twins that allow businesses to create virtual representations of physical assets to simulate, analyze, and optimize performance in real-time.

The demand for networked industrial ecosystems is compelling manufacturers to move to cloud-based automation platforms that provide scalability and adaptability. Furthermore, rising 5G connectivity and edge computing adoption are enhancing IIoT capabilities by enabling ultra-low-latency communication and near-instantaneous processing of information. The convergence of technology is powering mass adoption of automation platforms that incorporate artificial intelligence and can self-optimize production workflows based on real-time demand and production conditions.

Global Industrial Automation Market: Research Scope and Analysis

By Component Analysis

The hardware category is projected to dominate this segment in the industrial automation market because it offers a platform that underpins automated operations in all sectors. Robotics, programmable logic controllers (PLCs), distributed control systems (DCS), sensors, actuators, and industrial PCs make up industrial automation's backbone and mostly rely on hardware. All of these hardware products make up automation's backbone to offer precision, efficiency, and reliability to manufacturing and production plants. Hardware cannot be replaced since it conducts mechanical and electronic functions, unlike software that enhances and optimizes automation. Hardware is thus the key component of industrial automation.

Among the primary drivers of hardware supremacy is the increasing adoption of robots and artificial intelligence (AI)--)-powered machines in industrial settings. Robot arms, automated guided vehicles (AGVs), and autonomous mobile robots (AMRs) have widespread uses in the automotive, electronics, and food & beverage sectors. The demand for collaborative robots (cobots), deployed in combination with human operators to increase efficiency and safety, has also propelled hardware demand. In addition, machine vision systems based on AI and real-time sensors enhance automated quality control, making production more precise and minimizing errors.

Industry 4.0 and smart manufacturing have also boosted demand for state-of-the-art hardware, particularly edge computing hardware and IIoT-enabled sensors. Such hardware components facilitate real-time collection of information, predictive maintenance, and decision-making with artificial intelligence to lead to higher productivity and lower operation downtime. Furthermore, businesses have been investing in high-speed industrial PCs and PLCs to make automation workflows efficient and integrate smart factory environments. The increasing adoption of 5G-enabled automation hardware to offer ultra-low-latency communications in industrial operations is another factor fueling the hardware segment's dominance.

Furthermore, regulatory and safety requirements in industries such as pharmaceuticals, aerospace, and heavy machinery require top-level hardware solutions that offer precision and regulatory compliance. While software plays a key role in automation, it is physical automation infrastructure that performs operations, enabling hardware to dominate industrial automation.

By Industry Vertical Analysis

The discrete automation industry is projected to dominate the industrial automation industry due to its application in industries that require precise, repetitive, and high-speed production operations. Discrete automation finds application primarily in industries such as automotive, electronics, aerospace, and medical equipment, where single pieces and parts must be fitted together with precision. Unlike process automation which is continuous in operations, discrete automation is concerned with assembling, testing, and packaging single units and thus plays a crucial role in mass production and high-precision production.

The dominance of discrete automation can be attributed to its extensive use in the automotive industry with automated assembly lines employing robots, artificial intelligence-powered welding machines, and automated inspection methods enhancing efficiency and quality. The demand for electric vehicles (EVs) and autonomous driving technology has also increased the demand for discrete automation solutions to reduce human intervention and increase production line efficiency. In addition to this, artificial intelligence-based quality control systems and machine vision-based defect detection offer enhanced product reliability at lower waste and rework costs.

Another industry that supports discrete automation's dominance is that of semiconductors and electronics. Smartphone assembly, microchip assembly, and consumer electronics assembly require high-speed robot assembly, automated material handling, and precision testing in real-time. The requirement to miniaturize parts and make high volumes has resulted in discrete automation being essential to preserve precision and consistency in electronics manufacturing. Furthermore, the use of AI-powered robots and digital twins in semiconductor fabs has also increased production efficiency.

Discrete automation is also finding its way into medical device manufacturing with precision and regulatory compliance at the forefront. Computer-controlled assembly lines to assemble surgical instruments, implants, and diagnostic equipment assure consistent quality while meeting stringent safety standards. The need for automated sterilized packaging and artificial intelligence-driven inspection systems has also sealed discrete automation's dominance in healthcare.

In addition, increased labor shortages and production cost hikes in developed countries have resulted in industrial sectors investing in discrete automation solutions. Combining advanced robots, PLCs, and artificial intelligence-based automation systems allows companies to achieve scalability, cost-effectiveness, and improved production speed, making discrete automation the leading industrial automation sector.

The Global Industrial Automation Market Report is segmented on the basis of the following

By Component

- Hardware

- Sensors

- Controllers

- Robotics

- Drives

- Industrial PCs

- Others

- Software

- SCADA (Supervisory Control and Data Acquisition)

- HMI (Human-Machine Interface)

- MES (Manufacturing Execution Systems)

- PLC (Programmable Logic Controller)

- DCS (Distributed Control System)

- Others

- Services

- Consulting Services

- Integration & Deployment Services

- Support & Maintenance Services

By Industry Vertical

- Discrete Automation

- Automotive

- Electronics

- Heavy Manufacturing

- Packaging

- Others

- Process Automation

- Oil & Gas

- Chemicals

- Pulp & Paper

- Mining and Metals

- Healthcare

- Others

Global Industrial Automation Market: Regional Analysis

Region with Highest Market Share in the Industrial Automation Market

North America is projected to be at the forefront of the industrial automation industry as it commands over

37.10% of the market share by the end of 2025, with early adoption of state-of-the-art technologies, high manufacturing capacity, and heavy investment in automation infrastructure. The U.S. dominates with the mass adoption of artificial intelligence-based robots, industrial IoT (IIoT), and cloud-based automation platforms in the automotive, aerospace, and pharmaceutical industries.

The region's dominance is backed by key automation players such as Rockwell Automation, Emerson Electric, and Honeywell International through continuous innovations and technological advancements.

In addition to this, demand for smart factories and hyper-automation is picking up steam in North America with government initiatives such as the Advanced Manufacturing Partnership (AMP) and Industry 4.0 initiatives.

The region's high labor cost and lack of workforce have led industries to embrace robotic process automation (RPA) and autonomous manufacturing solutions to enhance productivity. In addition to this, industrial automation with 5G-enabled technology, edge computing, and artificial intelligence (AI)-driven predictive maintenance is being adopted at a rapid scale to further establish North America's dominance. The high level of priority being accorded to cybersecurity frameworks and compliance standards also enables hassle-free adoption of interconnected automation technology in various industry verticals.

Region with Highest CAGR in the Industrial Automation Market

The Asia Pacific region is anticipated to have the highest industrial automation CAGR driven by rising industrialization, government-backed smart manufacturing initiatives, and investment in automation with artificial intelligence. China, India, Japan, and South Korea are aggressively adopting industrial robots, automation systems with IIoT capabilities, and cloud-based SCADA solutions to boost production efficiency.

The largest production hub of the world, China, is seeing massive investment in automation with robots and artificial intelligence under the drive of the Made in China 2025 program. India's Make in India initiative is fueling industrial automation adoption in auto, electronics, and heavy machines at a fast rate. Southeast Asia nations are also positioning themselves as key players with low-cost automation adoption and increasing demand for smart factories.

The Asia-Pacific region is being driven by a vast pool of cost-effective labor that is shifting to automation, driving demand for collaborative robots (cobots), machine vision with artificial intelligence (AI), and digital twins. Furthermore, increasing semiconductor production and logistics automation are driving the region's high growth rate.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Industrial Automation Market: Competitive Landscape

The industrial automation industry is very competitive with leaders investing in automation with artificial intelligence, IIoT integration, and cloud-based industrial solutions. The leaders such as Siemens AG, ABB Ltd., Schneider Electric, Rockwell Automation, and Mitsubishi Electric dominate the market by continuously innovating and expanding their automation solutions.

Strategic acquisitions, collaborations, and R&D expenditures are some of the primary initiatives of market leaders to establish their presence worldwide. For instance, Siemens is investing aggressively in AI-based industrial automation and digital twin technologies, while ABB is developing its business in robotics to create smart manufacturing capabilities. Schneider Electric and Emerson Electric are focusing on edge computing and cybersecurity solutions to ensure industrial automation security and efficiency.

Additionally, players such as Fanuc and Yaskawa Electric in Japan are driving industrial automation and

automation based on artificial intelligence. Cloud-based automation and industrial ecosystems through

IIoT are led by players such as Honeywell and Rockwell Automation. More adoption of industrial

automation through 5G, machine learning-based predictive maintenance, and quality control through

artificial intelligence is revolutionizing the competitive scenario with new players and start-ups also

making investments in automation technology.

Some of the prominent players in the Global Industrial Automation Market are

- Siemens AG

- ABB Ltd.

- Rockwell Automation, Inc.

- Schneider Electric SE

- Honeywell International Inc.

- Emerson Electric Co.

- Mitsubishi Electric Corporation

- General Electric Company

- Yokogawa Electric Corporation

- Omron Corporation

- FANUC Corporation

- Bosch Rexroth AG

- Hitachi, Ltd.

- Texas Instruments Incorporated

- Beckhoff Automation GmbH & Co. KG

- Delta Electronics, Inc.

- KUKA AG

- Keyence Corporation

- Advantech Co., Ltd.

- Fuji Electric Co., Ltd.

- Other Key Players

Recent Developments in the Global Industrial Automation Market

2025

- March 2025: ABB Ltd. introduced an AI-powered robotic automation system, improving precision manufacturing and enabling autonomous industrial workflows, reducing errors, and optimizing efficiency in high-demand sectors.

- February 2025: Siemens AG partnered with Microsoft to develop cloud-integrated industrial automation, enhancing real-time analytics, predictive maintenance, and AI-driven operational efficiencies across multiple industries.

- January 2025: Fanuc Corporation invested in smart robotic automation, focusing on AI-driven manufacturing, real-time monitoring, and adaptive robotics to optimize industrial processes.

2024

- December 2024: Rockwell Automation hosted Automation Fair 2024, unveiling next-gen industrial IoT solutions, including AI-driven process control and IIoT-powered predictive maintenance technologies.

- November 2024: Emerson Electric acquired a cybersecurity firm to enhance secure automation networks, preventing cyber threats in AI-driven industrial environments.

- October 2024: Mitsubishi Electric launched an edge AI-powered automation platform, improving autonomous production, real-time analytics, and energy-efficient smart factory operations.

- September 2024: Yaskawa Electric invested $200 million in cobots and AI-driven robotics, accelerating smart factory automation and human-machine collaboration.

- August 2024: Schneider Electric introduced an AI-powered autonomous control system, enhancing machine learning-driven industrial automation and efficiency.

- July 2024: Honeywell collaborated with NVIDIA to integrate AI-enhanced digital twins, optimizing industrial simulation and predictive analytics.

2023

- June 2023: Siemens AG showcased 5G-driven industrial automation at the Industrial Automation Conference 2023, focusing on ultra-low latency machine communication.

- May 2023: Rockwell Automation and ABB Ltd. announced a joint venture to develop AI- powered industrial automation models, enabling self-learning manufacturing systems.

- April 2023: Schneider Electric invested $500 million in IIoT-driven smart manufacturing projects, accelerating automation adoption across industries.

- March 2023: Mitsubishi Electric expanded its cloud-based automation portfolio, integrating AI and IoT technologies for industrial efficiency.

- February 2023: Fanuc Corporation launched high-speed robotic arms, enhancing precision manufacturing for automotive and semiconductor production.

- January 2023: Emerson Electric partnered with Intel to advance real-time predictive maintenance, reducing downtime in industrial automation.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 232.5 Bn |

| Forecast Value (2034) |

USD 565.4 Bn |

| CAGR (2025-2034) |

10.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 72.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Hardware, Software, and Services), By Industry Vertical (Discrete Automation, and Process Automation) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Siemens AG, ABB Ltd., Rockwell Automation, Inc., Schneider Electric SE, Honeywell International Inc., Emerson Electric Co., Mitsubishi Electric Corporation, General Electric Company, Yokogawa Electric Corporation, Omron Corporation, FANUC Corporation, Bosch Rexroth AG, Hitachi, Ltd., Texas Instruments Incorporated, Beckhoff Automation GmbH & Co. KG, Delta Electronics, Inc., KUKA AG, Keyence Corporation, Advantech Co., Ltd., Fuji Electric Co., Ltd, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Industrial Automation Market?

▾ The Global Industrial Automation Market size is estimated to have a value of USD 232.5 billion in 2025 and is expected to reach USD 565.4 billion by the end of 2034.

What is the size of the US Industrial Automation Market?

▾ The US Industrial Automation Market is projected to be valued at USD 72.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 167.8 billion in 2034 at a CAGR of 9.8%.

Which region accounted for the largest Global Industrial Automation Market?

▾ North America is expected to have the largest market share in the Global Industrial Automation Market with a share of about 36.10% in 2025.

Who are the key players in the Global Industrial Automation Market?

▾ Some of the major key players in the Global Industrial Automation Market are Siemens AG, ABB Ltd., Rockwell Automation, Inc., Schneider Electric SE, Honeywell International Inc., Emerson Electric Co., Mitsubishi Electric Corporation, General Electric Company, and many others.

What is the growth rate in the Global Industrial Automation Market in 2025?

▾ The market is growing at a CAGR of 10.4.0% over the forecasted period of 2025.