The global industrial bulk packaging market has evolved as one of the most crucial sectors of the industry, as every economic sector depends on transportation and storage facilities for bulk volumes of materials produced by various industries like chemicals, pharmaceuticals, food & beverages, and petrochemicals.

Products such as drums, IBC pails, and sacks offer safety in handling, efficiency in transportation, and durability. While international trade and manufacturing activities are on the rise, thus, the demand for bulk containers is increasing exponentially. Raw materials must be transported in bulk, as does the finished product.

This segment has been driven by improvements in material technologies, the introduction of environmentally friendly packaging solutions, and rising environmental regulations. Packaging made from recycled material decreases waste in raw materials, reduces expenses in transportation, and decreases energy consumption in shipment.

Moreover, with the rise in automation for industrial procedures comes an increased demand for affordable yet energy-saving packaging solutions. However, the dominance of the Asia-Pacific region is contributed by the vast industrial base across countries like China and India, amongst others, housing manufacturing activity in every nook and corner.

Both North America and Europe have also started to see an increase in bulk packaging needs with increasing regulations regarding hazardous material handling, tightened further, and a surge in demand for environment-friendly bulk packaging solutions.

The competition in this market continues to be extreme, with key players adopting innovations, expanding their geographic presence, and making strategic partnerships to deliver the rising global demands for bulk packaging solutions.

Demand for cloud-managed services is growing as organizations face an increase in security concerns and regulatory compliance requirements. Managed services offer reliable solutions that offer proactive monitoring, risk mitigation, and fast response times to support businesses storing sensitive information while striving to maintain business continuity in an ever-evolving digital landscape.

Recent developments indicate that cloud service providers are adopting advanced technologies like artificial intelligence and machine learning to enhance their offerings, such as automation, predictive analytics and real-time decision-making capabilities. Furthermore, more businesses are adopting hybrid/multi cloud approaches in order to avoid vendor lock-in - making managed cloud services all the more essential.

Service providers focusing on customized solutions for specific industries will find ample opportunity in this market, especially those offering tailored solutions tailored specifically to them. IoT, big data analytics and edge computing are creating demand for more robust cloud management tools; as more businesses rely on cloud infrastructure services there exists potential for managed services to help maximize workload optimization while strengthening security measures and fueling innovation across sectors.

Recent surveys indicate that 70% of enterprises have adopted the

Cloud Managed Service Market to increase operational efficiencies and reduce costs, with 58% using hybrid cloud models that combine private and public cloud services. Furthermore, 40% of businesses report saving over 30% by outsourcing IT management costs through specialist providers.

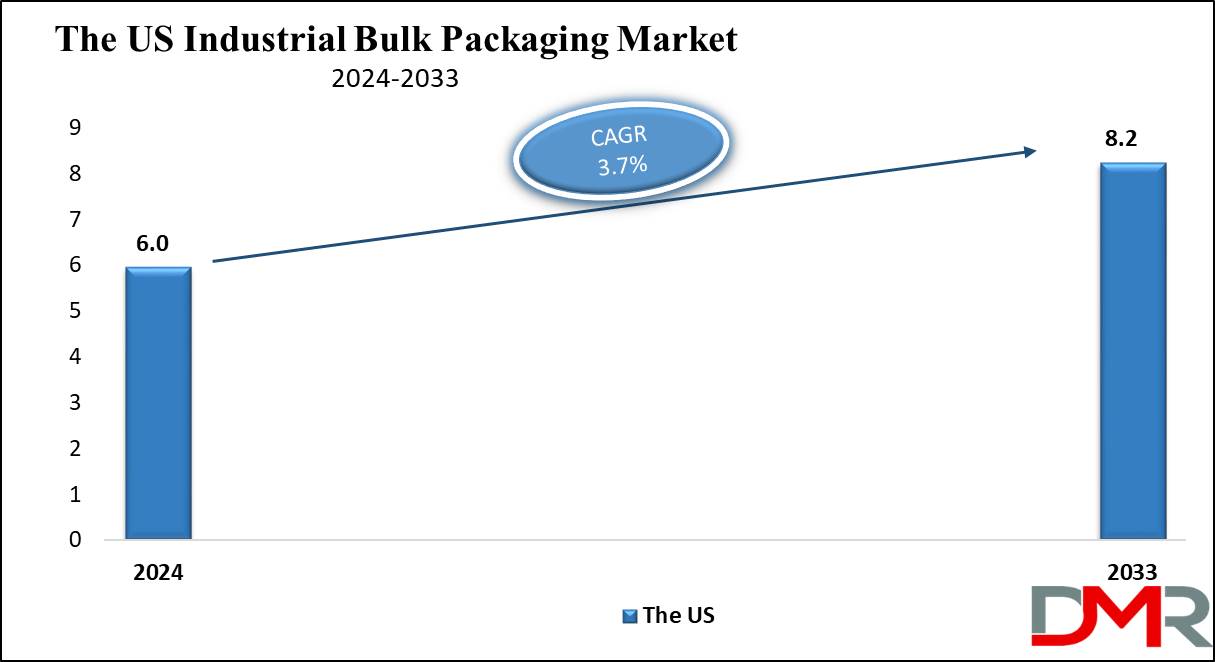

The US Industrial Bulk Packaging Market

The US Industrial Bulk Packaging Market is projected to be

valued at USD 6.0 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds

USD 8.2 billion in 2033 at a

CAGR of 3.7%. U.S. industrial bulk packaging market growth has been dramatic in recent years due to rising demand from pharmaceutical, food & beverages, chemicals, construction, and other sectors of industry.

Sustainability trends can also be observed that the US regulations such as extended producer responsibility laws have encouraged businesses toward non-pollutant recyclable bulk packaging solutions that utilize biodegradable materials while placing greater focus on lightweight IBCs or drums for increased recycling capabilities.

Intelligent packaging has emerged as a crucial innovation, with manufacturing firms increasingly investing in technologies to increase trackability, and monitoring capabilities and automate various processes. By attaching RFID tags or IoT-enabled sensors in bulk packaging materials to access real-time information on product conditions during transit and reduce product loss during supply chains.

Automation in packaging processes has become more prevalent with an effort to cut labor costs and increase operational efficiencies, particularly within the food and chemical industries. One such common bulk packaging system used by these industries includes bulk systems that use large volumes without human intervention is another indicator that U.S. markets have begun moving towards sustainable, smart, and fully automated packaging solutions.

Key Takeaways

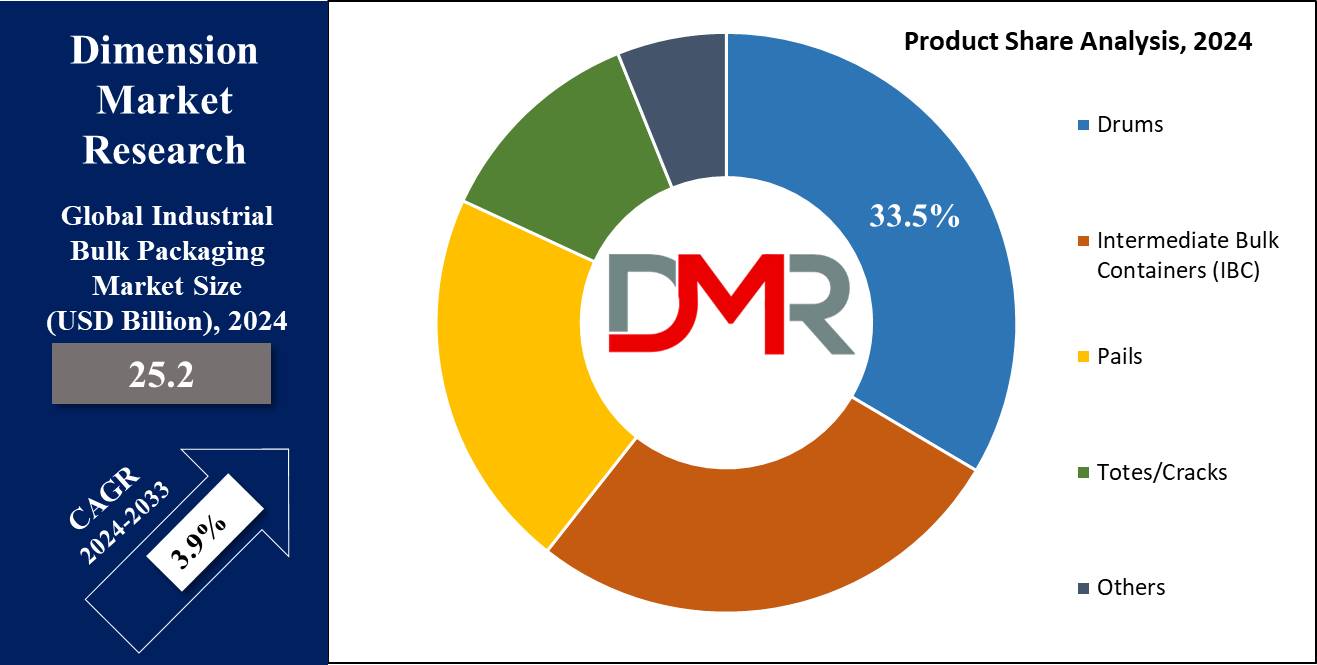

- Global Market Share: The global industrial bulk packaging market size is estimated to have a value of USD 25.2 billion in 2024 and is expected to reach USD 35.7 billion by the end of 2033.

- The US Market Value: The US industrial bulk packaging market is projected to be valued at USD 8.2 billion in 2033 from a base value of USD 6.0 billion in 2024 at a CAGR of 3.7%.

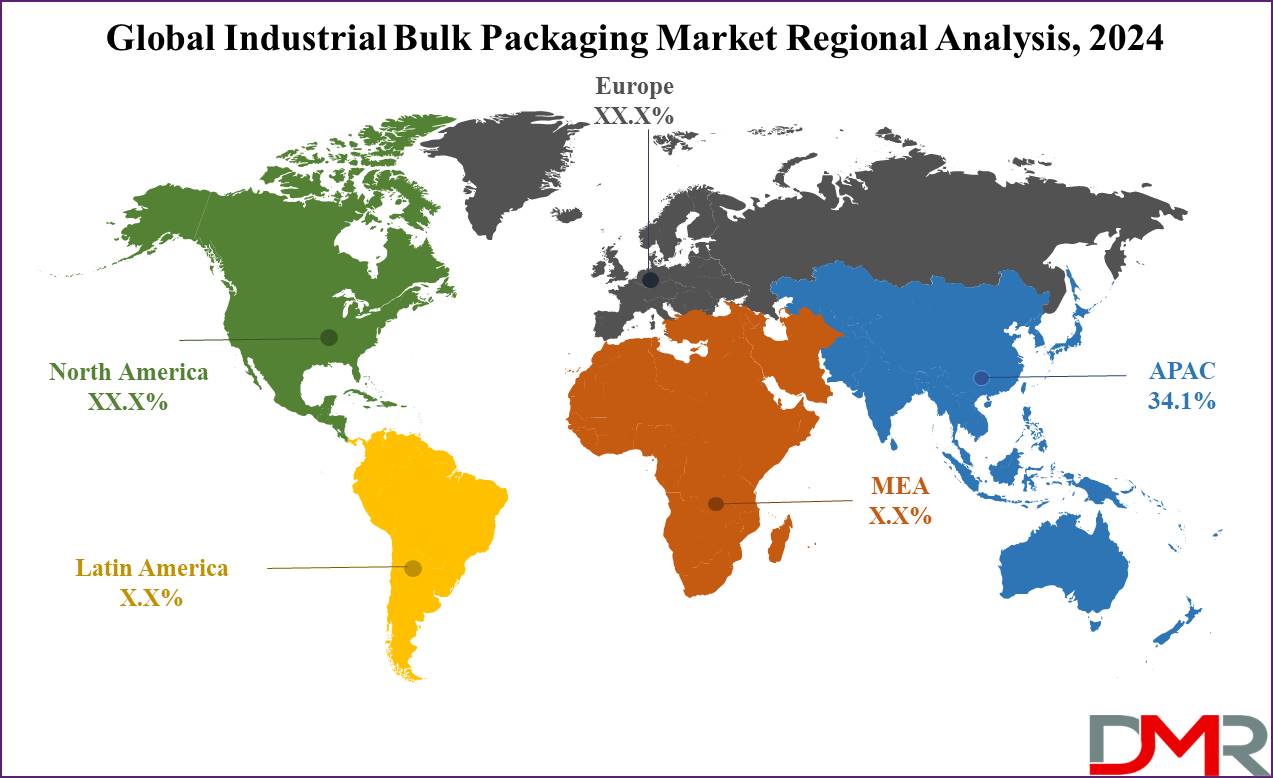

- Regional Analysis: Asia Pacific is expected to have the largest market share in the global industrial bulk packaging market with a share of about 34.1% in 2024.

- By Product Segment Analysis: Drums are projected to dominate this market in the product segment as it will hold 33.5% of the market share in 2024.

- By Technology Segment Analysis: The chemical and petrochemical industry is projected to dominate the application segment in this market as it will hold 36.0% of market share in 2024.

- Key Players: Some of the major key players in the Global Industrial Bulk Packaging Market are Greif Inc., Mauser Packaging Solutions, Berry Global Inc., Schoeller Allibert, and many others.

- Global Growth Rate: The market is growing at a CAGR of 3.9 percent over the forecasted period.

Use Cases

- Chemical Industry: Bulk packaging is a necessity in the chemical industry for hazardous and non-hazardous chemicals. These need to be moved in safe, tough containers such as IBCs, drums, and pails. These solutions are designed to meet strict safety standards that ensure chemicals in large volumes are moved and stored without any incidence.

- Food & Beverage Industry: The pails, drums, and sacks are used to move raw ingredients, oils, and beverages in bulk. Hygienic packaging, prevention of contamination, and freshness rule the roost in this type of Industry to enable the maintenance of quality in perishable food products on account of large periods of transportation.

- Pharmaceuticals: Bulk packaging plays a crucial role in transporting raw materials, active pharmaceutical ingredients (APIs), and other sensitive materials. Pharmaceutical-grade drums and IBCs are designed with compliance based on standards that satisfy hygiene and safety regulations, so pharmaceutical products will not be adulterated.

- Agriculture: There is widespread usage of flexible bulk containers, sacks, and drums in the transportation of agriculture-based products, such as grains, fertilizers, and animal feed. These packages ensure ease in handling and carriage, minimum loss by spillage, and protection to the quality during storage and carriage.

Market Dynamic

Trends

Sustainability PushIn recent times, sustainability as a concept has become a major driver; it's pushing the industrial bulk packaging market to be more in alignment with eco-friendly materials and processes. A significant shift is taking place toward recyclable or reusable packaging as, both the consumers and industries alike, push furiously to lower environmental impact.

The manufacturers are highly engaged with the development of biodegradable plastics, reusable steel drums, and other alternatives that will be environmentally friendly compared to traditional packaging. This trend goes in line with global environmental goals of strict regulations that guarantee a reduction of plastic waste to a minimum, reducing carbon footprints.

Automation Integration

In response to the industrial trend for bulk packaging, automation is envisioned to be the latest development in this market, whereby companies are investing funds in automated packaging systems to enhance their operational efficiency. Automation not only reduces labor costs but proliferates the production process by minimizing errors in packaging and handling.

The automation system makes bulk packaging easier, whereby robotic palletizers, automatic filling systems, and conveyors help accelerate the process. This trend is most evident in food and chemical industries where the volume of bulk products is high and the nature of handling enforces a large degree of efficiency in operations.

Smart Packaging

Increasing innovative technologies of smart packaging have been a game changer concerning the packaging and transportation of goods within an industry. Companies integrate technologies like RFID tags, GPS trackers, and IoT sensors into bulk packaging to enable real-time location and condition tracking.

On the other hand, such innovation for monitoring the temperature, humidity, and safety right from production through the supply chain to the consumer is of particular importance for industries like pharmaceuticals or chemicals. Smart packaging offers enhanced supply chain visibility and reduces the possibility of product loss resulting from spoilage or other forms of mishandling.

Growth Drivers

Rising Industrialization

The rapid industrialization of developing markets is one of the major growth factors in the industrial bulk packaging market. Consequently, this has spurred the emergence of high growth in the chemical, pharmaceutical, and food processing industries in countries like China, India, and Brazil which rely heavily on bulk packaging solutions for the transportation and storage of large volumes of materials. This will lead to a stronger demand for robust, affordable bulk packaging products such as drums, IBCs, and sacks.

Global Trade Expansion

The better demand for Industrial Bulk Packaging Solutions that has been consequent to the expansion in world trade is only a result of increased transportation of raw materials and finished goods across borders. This, in turn, requires robust packaging to ensure safety while handling and efficiency in transportation. This holds particularly true for industries such as petrochemicals, agriculture, and food and beverages where bulk packaging solutions, like FIBCs and pails, are highly crucial in dealing with large volumes of shipment.

Regulatory Compliance

Strict regulations on the transportation and storage of hazardous materials, even more so in the chemical and pharmaceutical industry, demand qualified and certified bulk packaging solutions. UN-certified industrial bulk packaging and other regulatory standards are important to the safe handling and transportation of dangerous goods. These regulations are forcing investment in packaging solutions that are, beyond mere safety requirements, durable and cost-effective.

Growth Opportunities

Emerging Economies

Rapid industrialization in key emerging economies will continue to offer tremendous opportunities for growth in the industrial bulk packaging market, especially in the Asia-Pacific and Latin American regions. For example, India, China, and Brazil are investing in infrastructural development and, at the same time, developing their industries, thus raising demand for bulk packaging. Demand from the chemical, pharmaceutical, and food processing industries in these countries is anticipated to result in higher demand and, consequently, the expansion of the market.

Technological Advancements Improvement in material science and packaging technologies offer great avenues for market participants. The development of new, sustainable materials like

biodegradable plastics and innovative development in the design of packaging that improves durability and efficiency is creating new market segments. Companies that invest in R&D to develop newer intelligent, lighter, and greener bulk packaging solutions would therefore emerge as winners because industries are looking for cost-effective and sustainable alternatives.

Restraints

Environmental ConcernsDespite the industry's effort to achieve sustainability, the environmental impacts of bulk packaging materials, mainly plastics, remain a primary concern. For instance, there are also issues relating to waste management packaging and the lack of recycling facilities in some regions, which negatively affect the adoption of eco-friendly bulk packaging forms. For companies, increased stringency on their environment by governments and regulatory bodies exerts pressure to come up with more sustainable alternatives-a costly and challenging affair for scaling up production.

Stringent Regulations

While in several industries, regulation is already viewed as a growth driver, it also creates problems for companies with complex and primarily expensive requirements that regulators have set for packaging hazardous materials.

In industries such as chemicals and pharmaceuticals, for instance, packaging solutions have to meet strict standards regarding safety and environmental concerns, including UN certification and other global regulations. Compliances, however, might raise the cost of operation and reduce flexibility in adopting innovative packaging technologies, especially for smaller companies that lack the resources to invest in high-cost solutions.

Research Scope and Analysis

By Product

Drums are projected to dominate the global industrial bulk packaging market in the product segment as it will hold 33.5% of the total market share by the end of 2024. Drums dominate the product segment in the industrial bulk packaging market due to their versatility, strength, and wide utilization across diversified industries.

It finds great application in storing and transporting liquids, chemicals, hazardous materials, and foodstuffs that need strong containment solutions. Drums are provided in variants of raw materials such as steel, plastic, and fiber. This gives flexibility to cater to requirements within a particular sector like chemical, pharmaceutical, food & beverage, and petrochemical.

For instance, steel drums boast their strength and resistance to corrosive substances, hence favorable for transporting chemicals and hazardous materials. On the contrary, plastic drums boast their lightweight, corrosion-resistant nature, and affordability, making them suitable for carrying all manner of liquid and semi-solid productions in industries such as agriculture and food processing.

The drums are also UN-certified to carry hazardous goods thus, they are very important to the pharmaceutical and chemical industries. This is especially true in the global acceptance of safekeeping and transportation of hazardous goods.

Reconditioning and reusing the drums, especially the steel and plastic ones, make them even more affordable and thus environmentally friendly.

Reusable drums are increasingly adopted in industries pursuing waste and

carbon footprint reduction as part of sustainable packaging. The different uses that drums can serve, the adherence to regulations, and their durability make them the dominant product in the industrial bulk packaging market, offering the right solution to safely and efficiently transport goods of different natures.

By Application

The chemical and petrochemical industry is anticipated to dominate the application segment in the industrial bulk packaging market as it will

hold 36.0% of the total market share by the end of 2024. The huge scale and complexity of operations in both the chemical and petrochemical industries make it dominate the application segment of industrial bulk packaging.

Products related to chemicals and petrochemicals are mostly moved by bulk transportation and storage facilities, which are both hazardous and non-hazardous in nature, and this makes industrial bulk packaging a very important part of this supply chain. Packaging solutions consisting of drums, IBCs, and FIBCs are some of the popular options for the safe containment of liquids, powders, granules, and pastes within this industry.

This dominance in this sector is possibly due to the need for regulatory compliance. Indeed, all types of chemicals and petrochemicals are subject to strict regulations concerning their transportation globally, especially hazardous ones.

Industrial bulk packaging solutions, in particular UN-certified containers, ensure hazardous materials are transported safely and further help reduce the risk of leakage and spilling that may lead to environmental contamination. These certifications, besides the durability and high reliability of goods like steel drums and plastic IBCs, make bulk packaging the most renowned choice in this vertical.

The chemical and petrochemical industries handle large volumes of raw materials and finished products, therefore they need effective packaging solutions to keep up with high-capacity packaging in perspective with global distribution.

Bulk packaging is a perfect product for such huge amounts of material that are always being processed through these sectors since they come up with cost-effective, flexible packaging options. Moreover, industrial bulk packaging solutions, such as FIBCs or IBCs, are made to be resistant to extreme conditions related to chemicals, temperature, or variations in pressure, thereby further strengthening their lead in the application segment of chemicals and petrochemicals.

The Industrial Bulk Packaging Market Report is segmented on the basis of the following

By Product

- Drums

- Steel Drums

- Plastic Drums

- Fiber Drums

- Intermediate Bulk Containers (IBC)

- Pails

- Totes/ Cracks

- Stackable Totes

- Non-stackable Totes

- Others

By Application

- Chemicals & Petrochemicals

- Industrial Chemicals

- Hazardous Materials

- Oils & Lubricants

- Food & Beverages

- Bulk Liquids

- Grains & Agricultural Products

- Edible Oils

- Pharmaceuticals

- Active Pharmaceutical Ingredients (API)

- Chemicals & Additives

- Sterile Products

- Others

Regional Analysis

Asia-Pacific is projected to dominate the industrial bulk packaging market as it command

about 34.1% of the total market revenue by the end of 2024. This is majorly due to the predictably rapid rise in industrial and manufacturing sectors within the geographical region including countries like China, India, Japan, and South Korea.

These nations have recently established themselves as globally recognized bases for the production of everything from industrial chemicals to food and beverages that need industrial bulk packaging for the transportation and storage of raw materials and finished goods. The sheer scale of these industries within the Asia-Pacific region increases demand for bulk packaging products like drums, IBCs, pails, and sacks.

Another factor contributing to this is the expansion in trade activities. The Asia-Pacific region can be considered one of the leading regions around the globe in terms of trade flow, especially in the exportation of petrochemicals,

agriculture, and industrials. The transportation of such raw materials and their finished products to and throughout international markets requires bulk packaging solutions that ensure safety and efficiency during shipment.

The additional factors contributing to this trend are government policy favorability and investments in infrastructure development of the region, which also accelerated market growth. Most governments in the Asia-Pacific region are promoting industrial growth, while industrial growth coupled with rising urbanization boosts the demand for bulk packaging solutions.

Finally, there is availability of affordable labor and raw materials in the region, which enables the manufacturers to offer competitive prices for the products of industrial bulk packaging. This price advantage, plus growing industrial activities, cements the dominance of Asia-Pacific within this market segment.

The established industries of the United States and Canada within the chemicals, food and beverages, and pharmaceuticals sectors continue to provide the requisite drive for demand in North America.

Therefore, the region's focus on sustainable packaging solutions along with rigorous regulatory requirements for the transportation of hazardous materials encourages the adaption of certified bulk packaging products such as steel drums and UN-certified IBCs. All these factors, added to the growth in e-commerce and the requirement felt for efficient means of packaging, support the extension of the market studied in this region.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the industrial bulk packaging market is characterized by the presence of both global and regional players, each focusing on expanding their product portfolios and geographic presence. Each player is expanding their product portfolio and increasing their geographical presence within the market.

Leading companies like Greif Inc., Mauser Group, and Berry Global Inc. are the forerunners in the market, as they have huge distribution networks and deploy technological innovations to keep pace with the market share.

These players are also investing heavily in sustainable packaging solutions that would meet the increasing demand for eco-friendly products. Strategic M&A is common as firms look to expand their capabilities or enter into new markets.

Indeed, large firms are purchasing much smaller, regionally-focused firms to get closer to the marketplace and also to improve their product range.

Innovation remains a major factor behind the competition between companies which pushes them to invest in research and development to introduce new materials and enhance functionality for their packaging solutions.

In addition to the foregoing, some of the companies are starting to integrate intelligent or smart packaging technologies, inclusively IoT sensors, to be able to offer some value-added services such as real-time tracking and monitoring of packaged goods.

The market is also witnessing increased collaboration among packaging manufacturers and end-users on the development of customized solutions for specific industry demands. This is, in fact, boosting competitiveness in the industrial bulk packaging market.

Some of the prominent players in the Global Industrial Bulk Packaging Market are

- Greif, Inc.

- Mauser Packaging Solutions

- Berry Global, Inc.

- Schoeller Allibert

- Time Technoplast Ltd.

- International Paper

- Schuetz GmbH & Co. KGaA

- Nefab Group

- BWAY Corporation

- Hoover Ferguson Group

- Greystone Logistics

- DS Smith

- Global-Pak, Inc.

- Thielmann – The Container Company

- Other Key Players

Recent Developments

- September 2024: Greif, Inc. launched a new line of reusable eco-friendly drums made from recycled materials. This new product line focuses on reducing the carbon footprint associated with the transportation of chemicals, aligning with the industry's growing demand for sustainable solutions.

- August 2024: Mauser Packaging Solutions expanded its production facility in India, reinforcing its market presence in the Asia-Pacific region. This expansion is aimed at meeting the growing demand for industrial bulk packaging in the region’s fast-growing chemical and pharmaceutical industries.

- July 2024: Berry Global Inc. introduced advanced smart packaging solutions integrated with RFID and IoT technology. The new solutions, which target the food & beverage and pharmaceutical industries, offer real-time tracking of goods in transit.

- June 2024: Schoeller Allibert partnered with a leading agricultural company to develop customized bulk containers for the transport of fertilizers. The partnership leverages Schoeller Allibert's expertise in creating durable, reusable bulk packaging solutions that can withstand the rigors of agricultural transport while ensuring product quality is maintained throughout the supply chain.

- May 2024: Time Technoplast announced the launch of biodegradable bulk containers specifically designed for the pharmaceutical industry. These containers address the increasing regulatory focus on sustainability and the need for environmentally friendly solutions that do not compromise safety and durability.

- April 2024: International Paper completed the acquisition of a regional packaging company in South Korea, further strengthening its presence in the Asia-Pacific market. The acquisition is expected to boost International Paper’s capacity to supply industrial bulk packaging solutions to industries such as chemicals, food & beverage, and electronics.

- March 2024: DS Smith launched an innovative corrugated bulk packaging solution, aimed primarily at the European food industry. This lightweight, recyclable packaging solution is designed to reduce transportation costs and environmental impact while maintaining the durability and strength required for bulk material handling.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 25.2 Bn |

| Forecast Value (2033) |

USD 35.7 Bn |

| CAGR (2024-2033) |

3.9% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 6.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Drums, Intermediate Bulk Containers (IBC), Pails, Totes/ Cracks, and Others), By Application (Chemicals & Petrochemicals, Food & Beverages, Pharmaceuticals, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Mauser Packaging Solutions, Berry Global, Inc., Schoeller Allibert, Time Technoplast Ltd., International Paper, Schuetz GmbH & Co. KGaA, Nefab Group, BWAY Corporation, Hoover Ferguson Group, Greystone Logisticsm, DS Smith, Global-Pak Inc., Thielmann, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |