Market Overview

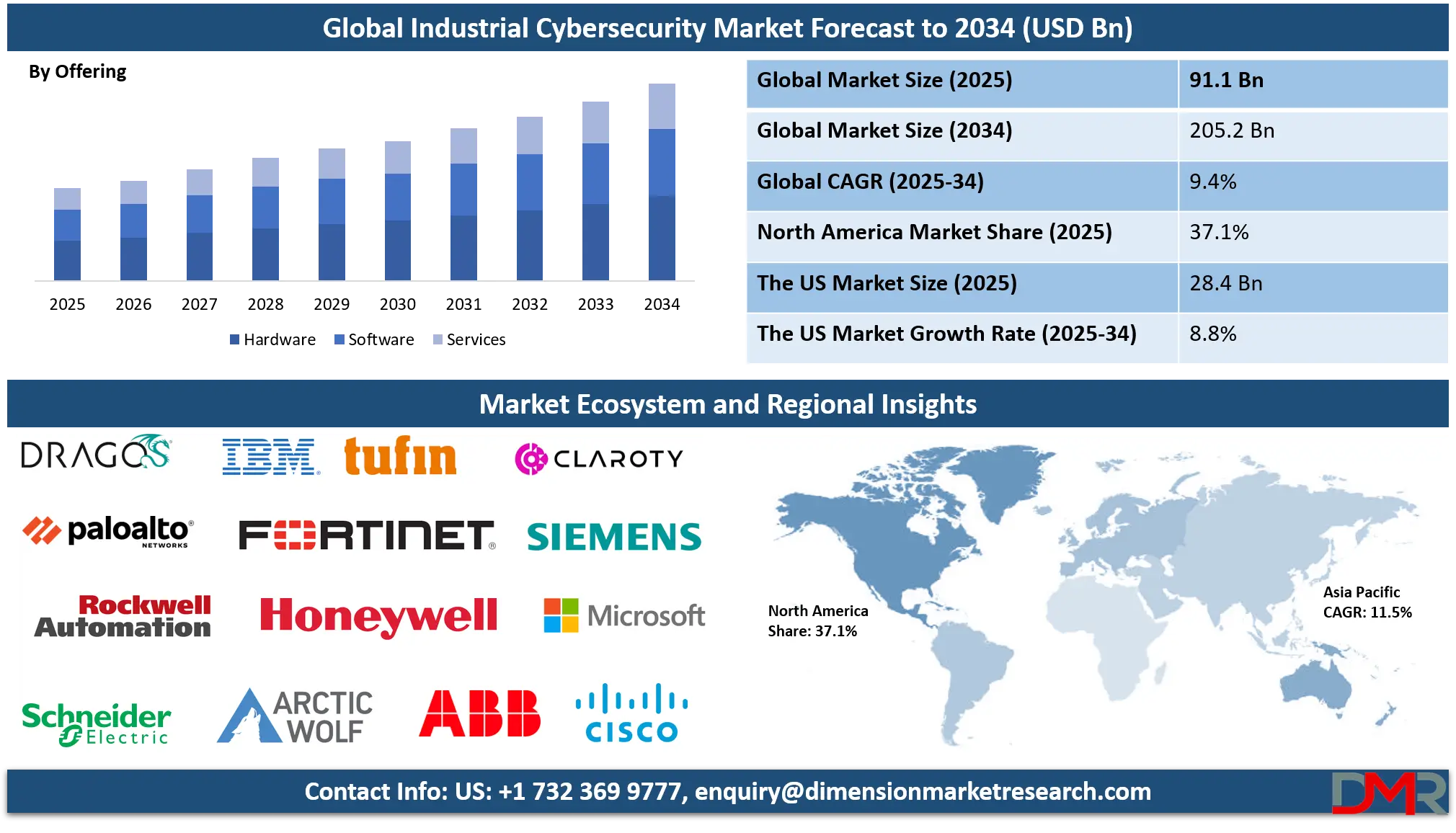

The Global Industrial Cybersecurity Market is projected to reach USD 91.1 billion in 2025 and is expected to grow at a compound annual growth rate (CAGR) of 9.4% from 2025 to 2034, attaining a market value of USD 205.2 billion by 2034. The market’s robust expansion is primarily driven by the rapid digital transformation of industrial sectors, the proliferation of Industrial Internet of Things (IIoT) devices, and the growing complexity of cyber threats targeting operational technology (OT) and critical infrastructure.

As manufacturing, energy, and utilities increasingly integrate connected systems, the demand for network security, endpoint protection, and identity and access management solutions has surged. Additionally, stringent regulatory frameworks such as NIST, ISA/IEC 62443, and GDPR are compelling industries to enhance their cyber resilience. The integration of AI-driven anomaly detection, zero-trust architectures, and advanced threat intelligence solutions is further accelerating market growth.

The global industrial cybersecurity market is experiencing a profound transformation, propelled by the escalating convergence of Information Technology (IT) and Operational Technology (OT). This integration, while driving efficiency, has dramatically expanded the attack surface for critical infrastructure and manufacturing sectors. A dominant trend is the shift from reactive, perimeter-based defenses to proactive, intelligence-driven security postures.

Organizations are increasingly adopting frameworks like Zero Trust, which mandates continuous verification of all devices and users within a network, irrespective of their location. This is complemented by the integration of advanced artificial intelligence and machine learning algorithms for predictive threat analytics and automated incident response, enabling the identification of subtle anomalies that precede major disruptive cyber incidents.

Significant growth opportunities are emerging from the mandatory compliance with stringent government regulations and international standards. The escalating frequency and sophistication of state-sponsored attacks on essential services such as energy grids and water treatment facilities are compelling national governments to enact robust cybersecurity directives. This regulatory push creates a fertile environment for specialized security solutions and professional services. Furthermore, the rapid digitalization of legacy industrial control systems and the widespread deployment of Industrial Internet of Things (IIoT) sensors present a substantial greenfield opportunity for vendors offering solutions that provide seamless security integration without impeding operational performance or physical process safety.

Despite the positive outlook, market expansion faces considerable restraints. A primary challenge is the critical scarcity of a skilled workforce proficient in both cybersecurity principles and operational technology environments. This expertise gap leaves many organizations vulnerable and unable to effectively implement or manage sophisticated defense mechanisms.

Additionally, the inherent resistance to frequent patching in industrial environments due to concerns over operational downtime and system stability creates persistent vulnerabilities. Many legacy assets were designed for longevity and isolation, not for the contemporary connected landscape, making them inherently difficult to secure against modern cyber threats and advanced persistent threats targeting industrial infrastructure.

The US Industrial Cybersecurity Market

The US Industrial Cybersecurity Market is projected to reach USD 28.4 billion in 2025 at a compound annual growth rate of 8.8% over its forecast period.

The United States industrial cybersecurity landscape is heavily shaped by a proactive and directive-led approach from federal agencies, recognizing the nation's critical infrastructure as a prime target for malicious cyber activity. The Cybersecurity and Infrastructure Security Agency (CISA) serves as the central coordinator, continuously issuing alerts, advisories, and guidance on threats to industrial control systems.

A foundational element of the U.S. strategy is the development and enforcement of mandatory cybersecurity performance goals for critical sectors, as outlined in White House directives. This creates a structured, top-down impetus for organizations in the energy, water, and chemical sectors to bolster their cyber defenses, moving beyond voluntary frameworks to concrete requirements. The nation's demographic and economic structure, with its vast and interconnected network of essential services, means a successful cyber-physical attack could have cascading effects on public safety and economic stability, thereby justifying the significant focus and investment.

This focus is further solidified by cross-sector collaborations between government entities and private industry. The Department of Energy (DOE) actively funds research and development into resilient energy delivery systems, emphasizing cybersecurity for the power grid. Simultaneously, the National Institute of Standards and Technology (NIST) provides the foundational framework for improving critical infrastructure cybersecurity, which is widely adopted as a benchmark.

The U.S. government's emphasis on public-private partnerships and information sharing, such as through the Industrial Control Systems Cyber Emergency Response Team (ICS-CERT), provides a distinct advantage. This ecosystem enables a rapid and collective response to emerging threats, leveraging national resources to protect the operational technology that underpins the American economy and way of life, ensuring a unified defense posture.

The Europe Industrial Cybersecurity Market

The Europe Industrial Cybersecurity Market is estimated to be valued at USD 13.6 billion in 2025 and is further anticipated to reach USD 29.6 billion by 2034 at a CAGR of 9.0%.

The European industrial cybersecurity market is characterized by a robust regulatory environment, most notably the Network and Information Security (NIS2) Directive, which significantly broadens the scope and strengthens the security requirements for essential and important entities across member states. This directive compels organizations in sectors like energy, transport, and digital infrastructure to adopt comprehensive risk management measures and report significant incidents, creating a continent-wide baseline for cyber resilience.

The European Union Agency for Cybersecurity (ENISA) plays a pivotal role in supporting this framework by developing certification schemes for critical infrastructure protection and fostering cooperation among national cybersecurity authorities. This harmonized legal approach is crucial for a region with deeply interconnected cross-border infrastructure, where a disruption in one member state can rapidly propagate to others.

Europe's demographic and industrial composition, featuring a high concentration of advanced manufacturing (Industry 4.0) and a commitment to its green transition, shapes its unique cybersecurity needs. The European Commission’s policies explicitly link digital transformation, including the secure deployment of IoT and AI in industrial settings, with strategic autonomy and economic competitiveness.

This dual focus on technological advancement and security is evident in initiatives that fund research into secure and resilient supply chains. The region's strong data protection laws, under the General Data Protection Regulation (GDPR), also indirectly influence industrial cybersecurity by mandating high standards for the protection of personal and operational data processed by industrial systems, ensuring that security protocols align with stringent privacy and data sovereignty requirements.

The Japan Industrial Cybersecurity Market

The Japan Industrial Cybersecurity Market is projected to be valued at USD 5.4 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 11.3 billion in 2034 at a CAGR of 8.6%.

Japan's industrial cybersecurity strategy is intrinsically linked to its national security and economic policy, driven by its status as a global manufacturing leader with a rapidly aging population and a high dependence on stable critical infrastructure. The government's foundational policy is outlined in the Cybersecurity Strategy, which is operationalized by the National Center of Incident Readiness and Strategy for Cybersecurity (NISC). NISC coordinates cross-ministerial efforts to protect vital infrastructure, including power, finance, and transportation, through the Cybersecurity Management Act.

This law mandates that designated critical infrastructure operators take necessary measures to manage cybersecurity risks and report incidents, creating a legally binding imperative for enhanced security posture across essential services. Japan's demographic reality of a shrinking workforce accelerates the adoption of autonomous systems and IoT, making the security of these systems not just an economic issue but a societal imperative.

The Japanese market is further distinguished by its focus on international standardization and public-private collaboration. The government actively promotes the adoption of secure-by-design principles and international standards like IEC 62443 for industrial automation and control systems security. Initiatives led by the Ministry of Economy, Trade and Industry (METI) often involve close-knit partnerships with leading industrial and technology corporations, fostering the development of tailored security guidelines for specific sectors such as manufacturing and energy.

This collaborative model, combined with a high level of public awareness regarding cyber threats, creates a cohesive ecosystem for defending against sophisticated cyber campaigns, particularly those targeting the intellectual property and operational continuity of Japan's world-class industrial base, ensuring the integrity of its advanced technological exports.

Global Industrial Cybersecurity Market: Key Takeaways

- Global Market Size Insights: The Global Industrial Cybersecurity Market size is estimated to have a value of USD 91.1 billion in 2025 and is expected to reach USD 205.2 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 9.4 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Industrial Cybersecurity Market is projected to be valued at USD 28.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 60.9 billion in 2034 at a CAGR of 8.8%.

- Regional Insights: North America is expected to have the largest market share in the Global Industrial Cybersecurity Market with a share of about 37.1% in 2025.

- Key Players: Some of the major key players in the Global Industrial Cybersecurity Market are Siemens, ABB, Cisco Systems, Microsoft, Honeywell, Fortinet, IBM, Schneider Electric, and many others.

Global Industrial Cybersecurity Market: Use Cases

- Energy Grid Protection: A national power grid operator deployed an OT-specific intrusion detection system. The platform identified anomalous communication patterns between an engineering workstation and a turbine control system, indicating a potential compromise. Security teams isolated the asset, preventing a manipulated operational state that could have caused a regional blackout, ensuring the continuous supply of electricity to millions of consumers and businesses.

- Automotive Manufacturing: A robotic welding station in an automotive plant began exhibiting erratic movements, causing production halts. Cybersecurity monitoring tools discovered a malware infection that had spread from the corporate IT network. The incident led to network segmentation, preventing the malware from propagating to other critical assembly lines and safeguarding both production integrity and worker physical safety on the factory floor.

- Water Treatment Facility: A water utility implemented continuous monitoring for its supervisory control and data acquisition (SCADA) system. The system alerted to unauthorized access attempts targeting chemical dosing parameters. The early warning allowed operators to block the attacker and avert a potential public health crisis, ensuring the safety and availability of the municipal water supply for the community it serves.

- Pharmaceutical Production: A pharmaceutical company secured its batch process control systems to protect intellectual property and ensure product quality. By implementing application whitelisting and strict access controls, they prevented unauthorized changes to fermentation temperature and pressure recipes. This maintained drug efficacy, ensured compliance with stringent FDA regulations, and protected a multi-million dollar production batch from sabotage.

- Oil and Gas Pipeline: A pipeline operator used a cyber-physical threat detection solution to monitor its compressor stations. The system correlated network traffic with physical sensor data to identify a stealthy reconnaissance campaign mapping the control network. This pre-emptive discovery enabled a targeted response before any operational disruption or safety-critical shutdown could be initiated by the threat actors.

Global Industrial Cybersecurity Market: Stats & Facts

U.S. Cybersecurity and Infrastructure Security Agency (CISA)

- In FY 2023, CISA's ICS team responded to 174 incidents impacting critical infrastructure, with the Energy sector representing the most frequent target.

- The agency's free vulnerability scanning service assessed over 5,000 organizations, identifying more than 50,000 unique security vulnerabilities.

- CISA's Known Exploited Vulnerabilities (KEV) catalog, a list of flaws with active exploits, has mandated federal agencies to patch hundreds of critical vulnerabilities, many affecting OT systems.

U.S. Industrial Control Systems Cyber Emergency Response Team (ICS-CERT)

- Analysis of reported incidents in a recent year showed that 33% of attacks against critical infrastructure utilized advanced persistent threat (APT) tradecraft.

- Improper input validation and improper restriction of operations within the bounds of a memory buffer were among the most common software weaknesses exploited in control systems.

U.S. Federal Bureau of Investigation (FBI)

- The FBI Internet Crime Complaint Center (IC3) reported that the critical infrastructure sector had the second-highest number of ransomware complaints among all 16 critical infrastructure sectors.

ENISA (European Union Agency for Cybersecurity)

- ENISA's Threat Landscape report identified ransomware as the primary threat to the digital sector, which underpins all critical infrastructure, with 60% of incidents having a financial motivation.

- The report also noted that threat actors are increasingly improving their capabilities to target OT and physical processes.

UK National Cyber Security Centre (NCSC)

- The NCSC reported that it handled a significant number of incidents in the last year, with state-sponsored actors being the most persistent and sophisticated threat to the UK's essential services.

Australian Cyber Security Centre (ACSC)

- The ACSC's Annual Cyber Threat Report revealed that the healthcare and energy sectors were among the top targets for cybercriminals, with a substantial increase in the reporting of cybercrime.

Government of Canada

- The Canadian Centre for Cyber Security (CCCS), in its National Cyber Threat Assessment, stated that critical infrastructure operators in Canada are very likely to face cyber threats from state-sponsored actors, and ransomware is almost certainly the most disruptive threat they face.

Global Industrial Cybersecurity Market: Market Dynamic

Driving Factors in the Global Industrial Cybersecurity Market

Escalating Frequency and Sophistication of State-Sponsored Cyber-Attacks

Critical national infrastructure, including energy grids, water systems, and transportation networks, has become a primary battleground for state-sponsored actors. These adversaries are highly sophisticated, possessing deep knowledge of operational technology and employing tactics designed to cause physical disruption, espionage, or societal harm.

The high-profile nature of attacks on industrial facilities has created a powerful imperative for both public and private investment in advanced cybersecurity defenses. Governments worldwide are not only becoming key clients for security solutions but are also mandating higher security standards through regulations, directly fueling market growth as infrastructure owners are compelled to invest in robust protective measures to ensure national security and public safety.

Stringent Government Regulations and Compliance Mandates

The regulatory landscape for industrial cybersecurity is rapidly evolving from voluntary guidelines to legally binding requirements. Directives like the NIS2 in Europe and sector-specific regulations from bodies like the U.S. Nuclear Regulatory Commission (NRC) and the Transportation Security Administration (TSA) impose strict cybersecurity standards and reporting obligations. Non-compliance results in severe financial penalties and operational restrictions.

This regulatory pressure acts as a powerful catalyst for market expansion, as organizations across essential service sectors must allocate significant budgets to achieve and maintain compliance. This driver effectively transforms cybersecurity from a discretionary IT expense into a non-negotiable cost of operation, creating a sustained and expanding demand for compliant technologies and services.

Restraints in the Global Industrial Cybersecurity Market

Acute Shortage of Skilled OT Cybersecurity Professionals

A fundamental constraint on the market's growth is the severe scarcity of professionals who possess a dual understanding of cybersecurity principles and the operational realities of industrial control systems. These systems prioritize safety and reliability above all else, and securing them requires knowledge of proprietary protocols, legacy equipment, and physical process constraints.

The lack of this specialized expertise means that many organizations are unable to effectively implement, configure, or manage advanced security solutions, leaving them vulnerable. This skills gap also drives up the cost of hiring and retaining qualified personnel, making it a significant barrier to entry, particularly for smaller operators within critical infrastructure sectors, thereby limiting overall market penetration and effectiveness.

Operational and Cultural Resistance to Patching and Updating Systems

Industrial environments are defined by their requirement for continuous uptime and operational safety. Consequently, there is a deeply ingrained cultural and operational resistance to making changes such as applying software patches or updating firmware that could potentially disrupt processes or introduce instability. Many legacy industrial control systems were not designed for the modern threat landscape and cannot be easily patched without extensive testing and planned downtime, which is often scarce.

This creates a persistent window of vulnerability where known exploits can be used against unpatched systems for extended periods. Overcoming this restraint requires not just technological solutions that allow for non-disruptive patching but also a significant shift in operational philosophy to integrate cybersecurity maintenance as a core component of reliability engineering.

Opportunities in the Global Industrial Cybersecurity Market

Expansion of Security Services for Managed Detection and Response (MDR)

The acute global shortage of OT cybersecurity expertise presents a substantial opportunity for specialized service providers. Many industrial organizations lack the in-house skills to manage 24/7 security operations centers (SOCs) tailored for control systems. This gap is driving demand for OT-specific Managed Detection and Response (MDR) services.

These services offer continuous, expert monitoring, threat hunting, and incident response capabilities, providing a cost-effective way for companies to access top-tier security talent and advanced technologies. The service model is particularly attractive for small and medium-sized enterprises within critical infrastructure sectors, allowing them to achieve a high level of cyber resilience without the prohibitive cost of building and maintaining an internal team.

Securing the Proliferation of Industrial IoT (IIoT) and Connected Devices

The massive deployment of IIoT sensors and smart devices across factories, utilities, and supply chains is creating a vast new attack surface. Each connected device represents a potential entry point for attackers if not properly secured. This expansion creates a greenfield opportunity for cybersecurity vendors offering solutions specifically designed for the IIoT ecosystem.

This includes lightweight security agents for resource-constrained devices, secure provisioning and lifecycle management platforms, and network access control (NAC) solutions that can authenticate and segment billions of IIoT endpoints. As industries continue to pursue digital transformation and automation, the need to embed security into these new connected infrastructures from the outset becomes a fundamental and growing market segment.

Trends in the Global Industrial Cybersecurity Market

The Proliferation of Zero Trust Architectures in OT Environments

The traditional "castle-and-moat" security model is becoming obsolete in modern industrial settings where IT and OT networks converge. The Zero Trust principle of "never trust, always verify" is gaining significant traction. This involves implementing micro-segmentation to create secure enclaves around critical control system assets, such as PLCs and RTUs, ensuring that a breach in one segment cannot laterally spread to others.

Furthermore, strict identity and access management (IAM) policies, coupled with continuous monitoring of user and device behavior, are enforced. This trend is driven by the need to contain threats and protect safety-critical processes from sophisticated attackers who may have already bypassed the network perimeter, fundamentally shifting security from a static boundary to a dynamic, identity-centric model.

Integration of AI and Machine Learning for Predictive Threat Intelligence:

Artificial intelligence is revolutionizing industrial cybersecurity by moving beyond signature-based detection to predictive analytics. Machine learning algorithms are trained on vast datasets of network traffic and process behavior from industrial control systems to establish a baseline of "normal" operations. They can then identify subtle, anomalous patterns that may indicate a nascent attack, such as unusual command sequences or minor deviations in sensor readings that would be invisible to human operators.

This capability allows for the early detection of advanced persistent threats (APTs) and insider threats before they can cause operational disruption or physical damage. The automation of incident response, where AI systems can initiate containment protocols, is also emerging, drastically reducing the mean time to respond (MTTR) to cyber incidents in complex industrial environments.

Global Industrial Cybersecurity Market: Research Scope and Analysis

By Offering Analysis

The Services segment is projected to dominate the global industrial cybersecurity market due to the rising complexity of operational technology (OT) environments and the increasing shortage of skilled cybersecurity professionals. Industrial organizations are increasingly outsourcing their cybersecurity functions to managed and professional service providers to gain specialized expertise in threat detection, compliance, and incident response.

Managed security services provide 24/7 monitoring, vulnerability management, and threat intelligence to protect industrial control systems (ICS) and supervisory control and data acquisition (SCADA) networks. Professional services, including consulting, integration, and training, help organizations design robust architectures and meet stringent industry regulations such as NERC-CIP and ISO/IEC 27001.

Furthermore, the growing convergence of IT and OT has heightened demand for expert-led services to identify and mitigate cross-domain threats. As industries adopt IIoT and digital transformation initiatives, cybersecurity services ensure secure device onboarding and data integrity across connected systems. Compared to hardware or software solutions, service-based offerings are more scalable and adaptive, allowing enterprises to respond dynamically to evolving cyber threats. This flexibility and strategic value make the services segment the most dominant and fastest-growing offering category in the industrial cybersecurity market.

By Solution Type Analysis

The Firewall Solutions segment is poised to hold dominance within the global industrial cybersecurity market, serving as the first line of defense for critical operational networks. Industrial networks require continuous communication between IT and OT layers, making them vulnerable to unauthorized access and malware infiltration. Firewalls provide secure segmentation, restricting external access to sensitive industrial assets while maintaining real-time data flow. With the rise of remote monitoring and IoT connectivity, organizations increasingly rely on next-generation firewalls (NGFWs) that offer deep packet inspection, intrusion prevention, and application-layer security.

The expansion of remote work and cloud integration further amplifies the need for advanced firewall protection across industrial control systems. Companies like Cisco, Fortinet, and Palo Alto Networks have launched specialized OT firewalls tailored to SCADA and PLC environments, offering both hardware and virtual options. The ability of firewall solutions to integrate with security information and event management (SIEM) systems enhances their threat visibility and response capabilities.

Moreover, compliance mandates in the energy, manufacturing, and utilities sectors demand firewall deployment as a baseline security measure. The combination of regulatory necessity, versatility, and advanced threat detection positions firewall solutions as the dominant and foundational component within the industrial cybersecurity ecosystem.

By Deployment Mode Analysis

The On-Premises segment is expected to dominate the industrial cybersecurity market owing to the high priority placed on maintaining control over sensitive operational data and infrastructure. Critical industries—such as energy, defense, and manufacturing—prefer on-premises deployment for its ability to offer localized data management, lower latency, and strong compliance adherence.

These systems ensure that industrial control systems (ICS) and operational technology (OT) environments remain isolated from external networks, significantly reducing exposure to cyber intrusions. On-premises cybersecurity deployments are particularly vital for sectors handling classified or regulated information, where data sovereignty and real-time monitoring are essential. Many legacy industrial assets lack cloud compatibility, further driving demand for on-premise protection.

Although cloud-based deployments are gaining traction due to cost efficiency, industries with complex and safety-critical operations still value the reliability and resilience of local solutions. Furthermore, on-premises cybersecurity platforms allow greater customization and integration with proprietary industrial systems. Major vendors such as Honeywell, Siemens, and ABB continue to enhance their on-premise offerings with AI-driven threat analytics, ensuring both compliance and resilience against evolving threats. Hence, the on-premises model remains the dominant choice for organizations prioritizing security control, operational continuity, and data integrity.

By Enterprise Size Analysis

Large Enterprises are anticipated to dominate the global industrial cybersecurity market due to their extensive OT infrastructure, broader attack surfaces, and higher compliance obligations. These organizations operate complex industrial systems—spanning manufacturing plants, energy grids, and transportation networks—that require layered security frameworks and advanced threat monitoring. Large enterprises have the financial capacity to invest in comprehensive cybersecurity architectures, integrating network, endpoint, and cloud protection solutions.

They are also early adopters of technologies such as AI-driven threat detection, zero-trust frameworks, and SIEM integration for real-time analytics. With operations across multiple geographies, these enterprises prioritize cybersecurity to ensure uninterrupted production and regulatory compliance.

Furthermore, the increasing adoption of digital twins and IIoT connectivity has made cybersecurity a board-level priority. Large enterprises also engage managed service providers for round-the-clock monitoring and incident response, further strengthening their defense posture. Regulatory frameworks in industries like energy, defense, and healthcare enforce strict security standards, which large companies can implement more effectively than SMEs. Consequently, the combination of complex operational ecosystems, significant capital investment, and compliance-driven governance makes large enterprises the dominant contributors to the industrial cybersecurity market revenue.

By Security Type Analysis

The Network Security segment is poised to dominate the industrial cybersecurity market as it forms the backbone of protecting interconnected industrial control systems (ICS) and operational technology (OT) environments. Industrial operations rely heavily on real-time communication between distributed assets—ranging from sensors to control servers—making secure network architecture critical. Network security solutions such as intrusion detection systems (IDS), intrusion prevention systems (IPS), and next-generation firewalls (NGFWs) are essential to identify and block unauthorized access or data tampering.

As industrial facilities adopt IIoT and cloud integration, the number of connected endpoints has surged, heightening vulnerability to cyber threats. Network segmentation and anomaly detection technologies are increasingly deployed to isolate malicious traffic and prevent cascading failures in production environments. Moreover, the growing frequency of ransomware and DDoS attacks targeting OT networks has pushed industries to invest heavily in network security frameworks.

Major vendors, including Cisco, Fortinet, and Check Point, provide industrial-grade network defense solutions tailored to critical infrastructure. Additionally, compliance requirements from agencies like NIST and ISA/IEC 62443 further enforce the adoption of robust network security protocols. Therefore, network security remains the largest and most critical segment, underpinning the resilience and reliability of the global industrial cybersecurity landscape.

By Vertical Analysis

The Manufacturing segment is projected to be the dominant vertical in the global industrial cybersecurity market, driven by rapid digitalization and the widespread adoption of the Industrial Internet of Things (IIoT). Modern factories are increasingly automated, integrating connected robots, sensors, and control systems that enhance productivity but also expand cyberattack surfaces. The sector’s reliance on continuous operations and sensitive production data makes it a prime target for ransomware and espionage attacks. Manufacturers are implementing multi-layered cybersecurity strategies that combine network, endpoint, and cloud protection to safeguard intellectual property, production schedules, and safety systems.

Automotive, semiconductor, and electronics manufacturers, in particular, are investing in AI-driven security analytics and threat intelligence platforms to prevent production halts and data theft. Additionally, the emergence of smart factories under Industry 4.0 initiatives necessitates robust OT and IT integration security.

Cyber incidents such as the NotPetya and Colonial Pipeline attacks have reinforced the need for industrial-grade cybersecurity within manufacturing operations. Leading vendors, including Siemens, Rockwell Automation, and Schneider Electric, are developing industry-specific solutions that secure programmable logic controllers (PLCs) and SCADA systems. Consequently, the manufacturing vertical remains the largest and most influential contributor to the global industrial cybersecurity market, ensuring both operational resilience and data integrity.

The Global Industrial Cybersecurity Market Report is segmented on the basis of the following:

By Offering

- Hardware

- Gateways

- Networking Devices

- Hardware Security Modules (HSM)

- Encryption Storage Devices

- Network Encryption Appliances

- Secure USB Drives

- Hardware Tokens

- Network Access Control Devices

- Hardware Firewalls

- Software

- Antivirus and Malware Protection Software

- SCADA Security Software

- SIEM Software

- Encryption Software

- Services

- Managed Services

- Network Monitoring

- Threat Intelligence & Incident Response

- Professional Services

- Consulting

- Integration & Deployment

- Training & Support

By Solution Type

- Antivirus/Malware Solutions

- Firewall Solutions

- Proxy Firewall

- Packet-Filtering Firewall

- Stateful Inspection Firewall

- Next-Generation Firewall (NGFW)

- Data Loss Prevention (DLP)

- Security Information and Event Management (SIEM)

- Intrusion Detection and Prevention Systems (IDS/IPS)

- Identity and Access Management (IAM)

- Other Solution Types

By Deployment Mode

- On-Premises

- Cloud-Based

- Hybrid

By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Security Type

- Network Security

- Intrusion Detection and Prevention Systems (IDS/IPS)

- Firewalls

- Virtual Private Networks (VPN)

- Endpoint Security

- Endpoint Detection and Response (EDR)

- Antivirus and Anti-Malware

- Device Access Control

- Application Security

- Web Application Firewalls (WAF)

- Code Review and Testing Tools

- Secure Software Development

- Cloud Security

- SaaS Security

- Cloud Access Security Brokers (CASB)

- Encryption and Tokenization

- Wireless Security

- Secure Wi-Fi Networks

- Mobile Device Management (MDM)

- Wireless Intrusion Prevention Systems (WIPS)

- Other Security Types

By Vertical

- Healthcare & Life Sciences

- Hospitals

- Medical Device Manufacturers

- Pharmaceutical Companies

- Aerospace & Defense

- Military Systems

- Aviation Manufacturing

- Defense Contractors

- Manufacturing

- Automotive

- Machine Manufacturing

- Semiconductor & Electronics

- Medical Devices

- Other Manufacturing Industries

- Energy & Utilities

- Power Generation Plants

- Nuclear Power Plants

- Thermal & Hydropower Plants

- Renewable Energy Power Plants

- Power Grids

- Oil & Gas Pipelines

- Electric Power Transmission

- Water Treatment and Distribution

- Wastewater Collection and Treatment

- Telecommunications

- Network Operators

- Data Centers

- Internet Service Providers

- Other Verticals

Impact of Artificial Intelligence in the Global Industrial Cybersecurity Market

- Enhanced Threat Detection and Response: AI significantly improves real-time threat detection in industrial environments by analyzing massive volumes of network and operational data. Machine learning (ML) algorithms can identify abnormal behaviors, detect zero-day vulnerabilities, and predict potential cyberattacks before they occur. In operational technology (OT) systems, AI-based monitoring helps prevent disruptions in SCADA and PLC networks by quickly flagging anomalies that human operators might miss.

- Automation of Security Operations: AI automates repetitive cybersecurity tasks such as log analysis, vulnerability scanning, and incident triage. Through Security Orchestration, Automation, and Response (SOAR) platforms, AI-driven tools enable faster investigation and mitigation of threats, reducing human error and operational downtime. This automation allows security teams to focus on strategic risk management in complex industrial ecosystems.

- Predictive Maintenance and Risk Forecasting: AI enhances industrial cybersecurity by linking predictive analytics with asset monitoring. By analyzing historical and real-time equipment data, AI systems can forecast potential security breaches linked to system failures or outdated firmware. Predictive maintenance integrated with cybersecurity ensures system integrity, minimizing the likelihood of cyberattacks exploiting equipment vulnerabilities.

- Adaptive and Self-Learning Defense Systems: AI-powered cybersecurity systems continuously learn from new attack patterns, enabling adaptive defense strategies. These systems evolve in real time to counter advanced persistent threats (APTs) and sophisticated ransomware targeting OT networks. Such adaptive models ensure continuous protection for industrial infrastructures without requiring frequent manual updates.

- Strengthened IT-OT Convergence Security: AI bridges the gap between IT and OT security by providing unified visibility across both domains. It enables secure data exchange between connected industrial systems and enterprise networks while identifying cross-domain vulnerabilities. This integrated protection is vital for Industry 4.0 environments, where IoT, robotics, and automation systems operate in highly interconnected ecosystems.

Global Industrial Cybersecurity Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to lead the industrial cybersecurity market with 37.1% of market share in 2025, because its industrial base, regulatory environment, and cybersecurity maturity combine to create both high demand and rapid adoption of advanced OT/ICS security solutions. The region hosts a dense concentration of large industrial enterprises across energy, manufacturing, utilities, aerospace & defense, and critical infrastructure organizations with complex OT estates, multi-site operations, and stringent uptime requirements that justify significant cybersecurity budgets. U.S. federal and state-level focus on critical-infrastructure protection (CISA advisories, NIST guidance, and industry-specific rules) has raised baseline security expectations and compelled operators to adopt industrial-grade tools, services, and managed programs to remain compliant and resilient.

The prevalence of large system integrators and established vendors (industrial automation and cybersecurity firms headquartered or heavily invested in North America) creates an ecosystem that accelerates solution development, service availability, and vendor-client trust. Another driver is workforce and R&D concentration: universities, cyber-research centers, and a strong professional services market supply specialized OT/ICS talent and consultancy, enabling faster deployment of complex programs.

Finally, frequent, high-profile OT attacks and public disclosure of incidents have translated into board-level prioritization and capital allocation for continuous monitoring (SIEM/EDR for OT), managed detection & response, and integration projects that blur IT/OT boundaries, all of which boost market size in North America relative to other regions.

Region with the Highest CAGR

Asia-Pacific (APAC) exhibits the highest CAGR for industrial cybersecurity because rapid industrialization, aggressive digital transformation (Industry 4.0/IIoT), and massive infrastructure investment are converging with rising cyber threats, creating a fast-growing addressable market.

Governments and large national champions across China, India, Japan, South Korea, and ASEAN are investing heavily in modernization of power grids, manufacturing, transport, and utilities, often deploying connected automation and remote monitoring at scale; these greenfield and brownfield modernization projects create strong demand for both point products and comprehensive managed services. Many APAC operators historically under-invested in OT security and are now accelerating spend to close gaps, adopt vendor-agnostic OT security platforms, and procure professional services, producing higher percentage growth from a lower base.

Another compounding factor is increased local vendor activity and strategic partnerships (regional system integrators with global cybersecurity vendors), which improve distribution and implementation capacity across geographies. Strategic M&A and investments by APAC industrial and automation leaders into OT cybersecurity (including recent high-value deals and partnerships) also signal market maturation and attract further capital.

Finally, the combination of government stimulus for smart infrastructure, expanding cloud adoption for industrial workloads, and the urgent need to secure critical national infrastructure against state-level threats results in faster year-over-year spending growth, hence APAC’s leading CAGR.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Industrial Cybersecurity Market: Competitive Landscape

The competitive landscape in industrial cybersecurity is a mix of large industrial/IT incumbents, specialized OT/ICS vendors, and managed-service providers, creating a layered market where scale, domain expertise, and integration capability matter. Global industrial automation firms (Siemens, ABB, Honeywell, Schneider Electric, Rockwell Automation) leverage deep OT domain knowledge and installed bases to bundle cybersecurity into broader automation and digital twin offers, defending installed assets and offering tailored OT security for SCADA/PLCs.

Pure-play OT cybersecurity vendors (Dragos, Claroty, Nozomi Networks, Industrial Defender) differentiate by deep protocol visibility, threat intelligence for ICS adversaries, and asset-centric detection tailored to industrial environments. Network and IT security leaders (Palo Alto Networks, Fortinet, Cisco, CrowdStrike) bring scalable network protection, NGFW, and endpoint telemetry that increasingly integrate with OT-focused platforms. Managed security and professional services (Arctic Wolf, Fortra, global consultancies) address the talent gap, delivering 24/7 detection, incident response, and OT risk assessments.

Competition is intensified by M&A and strategic investments, incumbents acquire or partner with specialized startups to rapidly add OT capabilities, while startups seek scale and channel reach via strategic funding and alliances. Differentiation factors include protocol-level visibility, low-impact deployment for legacy equipment, threat intelligence specific to industrial adversaries, and the ability to deliver combined IT/OT visibility and response. Vendors who can offer vendor-agnostic visibility, minimally disruptive sensors, and integrated managed detection and response for OT environments capture greater enterprise uptake. Recent consolidation and AI/ML productization are accelerating vendor convergence toward integrated OT-IT security platforms.

Some of the prominent players in the Global Industrial Cybersecurity Market are:

- Siemens

- ABB

- Cisco Systems

- Microsoft

- Honeywell

- Fortinet

- IBM

- Schneider Electric

- Rockwell Automation

- Palo Alto Networks

- Dragos

- Claroty

- Tufin

- Darktrace

- Rapid7

- Industrial Defender

- Arctic Wolf Networks

- CrowdStrike

- Fortra

- Red Canary

- Other Key Players

Recent Developments in the Global Industrial Cybersecurity Market

- October 2025: NTT DATA collaborated with Fortanix to deliver Cryptography-as-a-Service, enhancing industrial data protection across hybrid and AI-driven environments.

- October 2025: Crowe partnered with SecurityScorecard to strengthen third-party cyber risk management solutions, supporting secure industrial and supply chain ecosystems.

- October 2025: ICS Cybersecurity Conference held in Atlanta focused on OT, SCADA, and critical infrastructure protection, attracting major vendors and professionals from the global industrial cybersecurity ecosystem.

- September 2025: Mitsubishi Electric acquired the remaining Nozomi Networks stake, expanding its OT security visibility, network monitoring, and industrial automation cybersecurity capabilities worldwide.

- September 2025: Xona and Radiflow announced a partnership integrating secure remote access with OT risk analytics to support critical infrastructure operators and managed security providers.

- June 2025: Leonardo acquired a European cybersecurity company to expand its industrial and defense cybersecurity offerings, improving protection of aerospace and critical infrastructure assets.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 91.1 Bn |

| Forecast Value (2034) |

USD 205.2 Bn |

| CAGR (2025–2034) |

9.4% |

| The US Market Size (2025) |

USD 28.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Offering (Hardware, Software, Services), By Solution Type (Antivirus/Malware Solutions, Firewall Solutions, Data Loss Prevention (DLP), Security Information and Event Management (SIEM), Intrusion Detection and Prevention Systems (IDS/IPS), Identity and Access Management (IAM), Other Solution Types), By Deployment Mode (On-Premises, Cloud-Based, Hybrid), By Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Security Type (Network Security, Endpoint Security, Application Security, Cloud Security, Wireless Security, Other Security Types), By Vertical (Healthcare & Life Sciences, Aerospace & Defense, Manufacturing, Energy & Utilities, Telecommunications, Other Verticals) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Siemens, ABB, Cisco Systems, Microsoft, Honeywell, Fortinet, IBM, Schneider Electric, Rockwell Automation, Palo Alto Networks, Dragos, Claroty, Tufin, Darktrace, Rapid7, Industrial Defender, Arctic Wolf Networks, CrowdStrike, Fortra, Red Canary, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Industrial Cybersecurity Market size is estimated to have a value of USD 91.1 billion in 2025 and is expected to reach USD 205.2 billion by the end of 2034.

The market is growing at a CAGR of 9.4 percent over the forecasted period of 2025.

The US Industrial Cybersecurity Market is projected to be valued at USD 28.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 60.9 billion in 2034 at a CAGR of 8.8%.

North America is expected to have the largest market share in the Global Industrial Cybersecurity Market with a share of about 37.1% in 2025

Some of the major key players in the Global Industrial Cybersecurity Market are Siemens, ABB, Cisco Systems, Microsoft, Honeywell, Fortinet, IBM, Schneider Electric, and many others.