Market Overview

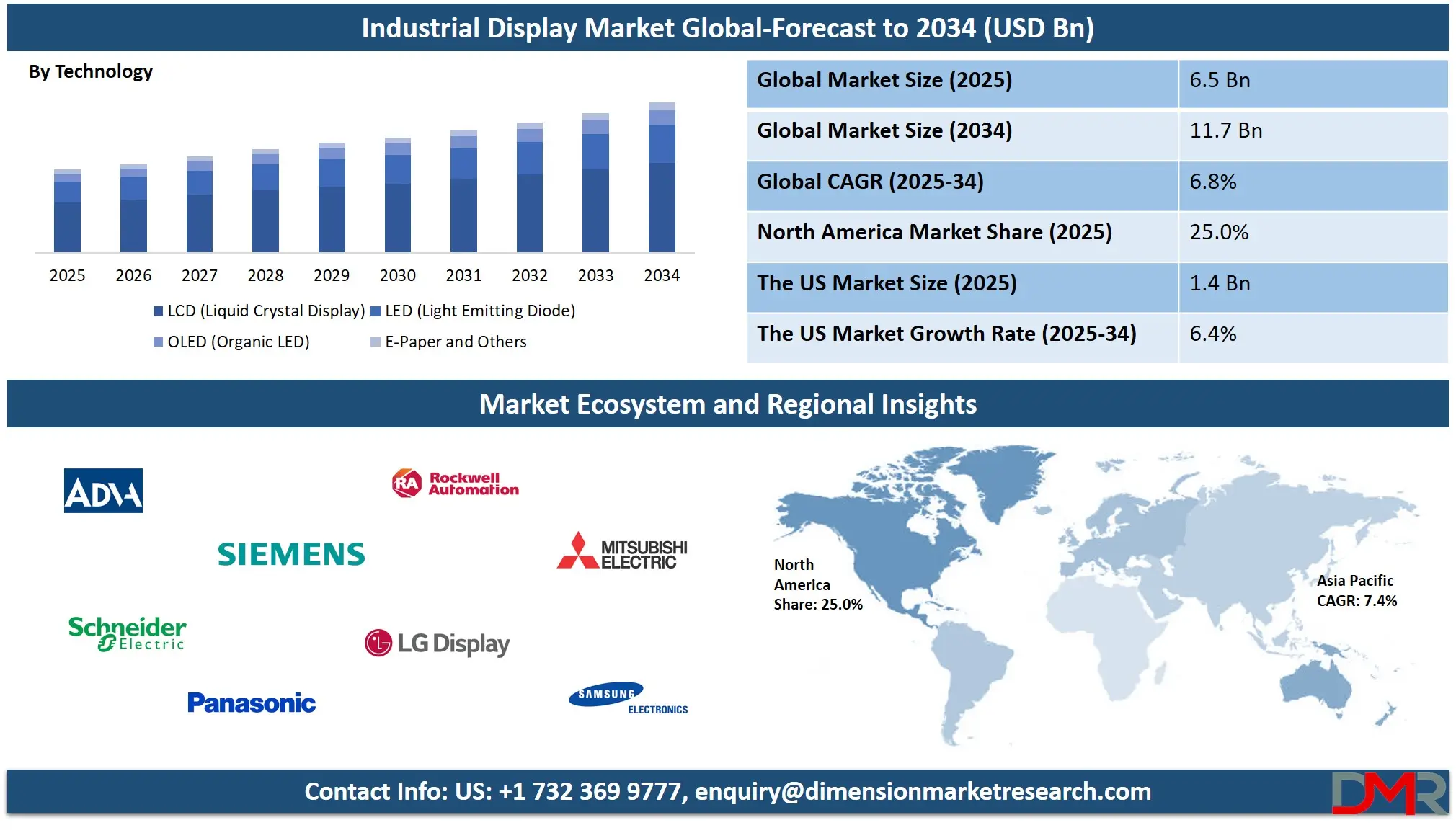

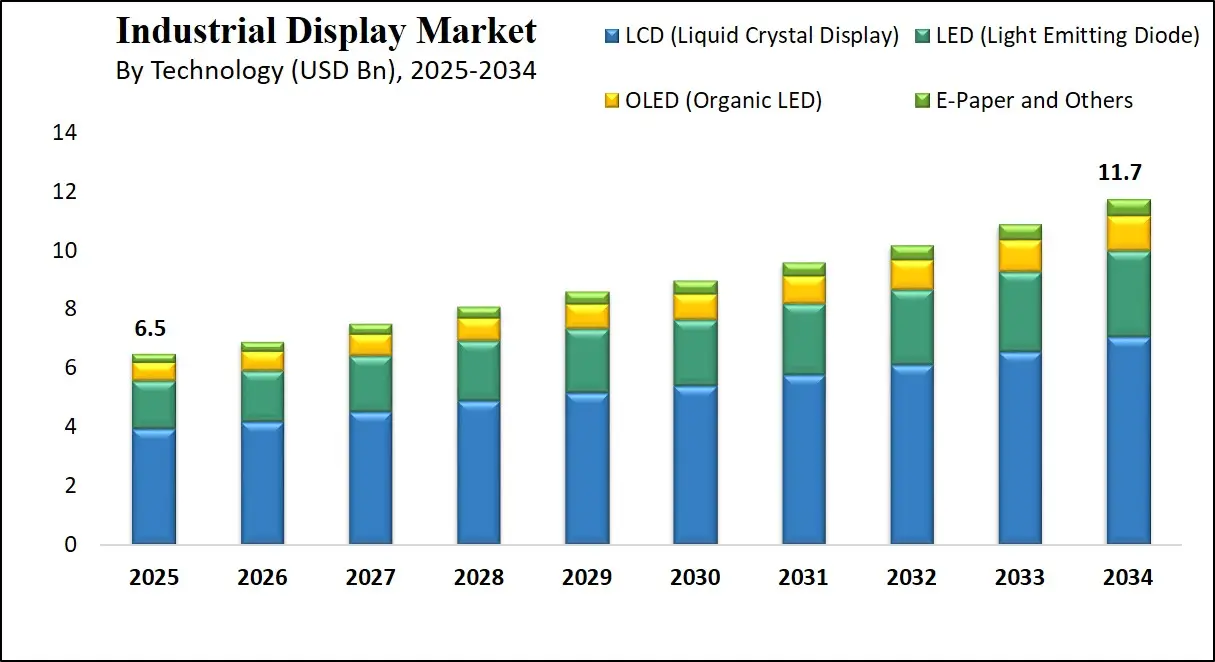

The global industrial display market is projected to grow from USD 6.5 billion in 2025 to USD 11.7 billion by 2034, registering a CAGR of 6.8%. This growth is driven by rising demand for rugged displays, HMI panels, and smart visualization systems across manufacturing, energy, transportation, and automation sectors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

An industrial display refers to a specialized visual interface system designed for use in harsh, demanding, or controlled industrial environments. Unlike consumer-grade screens, these displays are built to withstand extreme temperatures, moisture, dust, vibration, and electromagnetic interference, making them ideal for critical operations in manufacturing plants, oil and gas facilities, transportation systems, and process control applications. These units can take the form of rugged monitors, touch screen panels, open-frame displays, and digital signage solutions that offer high durability and continuous performance. Industrial displays are integrated into control systems and human-machine interfaces, providing operators with real-time process data, system alerts, and analytics visualizations. Features such as sunlight readability, wide viewing angles, long product life cycles, and advanced connectivity support further enhance their application in automation systems, SCADA platforms, and remote monitoring solutions.

The global industrial display market encapsulates the production, distribution, and utilization of robust visual systems engineered for industrial purposes across various sectors, including energy, aerospace, defense, healthcare, automotive, and logistics. As smart factories and industrial automation proliferate, demand for durable and high-resolution display systems that support real-time data monitoring and predictive analytics has increased globally. The market encompasses a broad spectrum of technologies such as LCD, LED, OLED, and TFT panels tailored to meet specific industrial use cases, including machine vision, process tracking, and control panel integration. North America, Asia Pacific, and Europe represent key regional markets driven by the adoption of IIoT devices, increased investments in Industry 4.0 technologies, and growing emphasis on operational efficiency. Rising digital transformation across industries and the integration of advanced features such as capacitive touch, ruggedized enclosures, and edge computing compatibility are further propelling the expansion of industrial-grade display technologies globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

With growing reliance on automation and data-driven decision-making, industrial displays are evolving from static interfaces into intelligent visualization hubs that enhance system interoperability and control accuracy. These displays are now embedded with smart features like multi-touch capability, gesture recognition, real-time diagnostics, and wireless connectivity to support seamless integration with SCADA systems, programmable logic controllers, and industrial PCs. Their ability to deliver high brightness, low latency, and energy-efficient performance even in mission-critical applications makes them indispensable in sectors like marine navigation, mining, and utilities. The growing trend of digital twins, remote operations, and augmented reality overlays in industrial settings is also amplifying the need for advanced display solutions that can visualize complex datasets with clarity and speed.

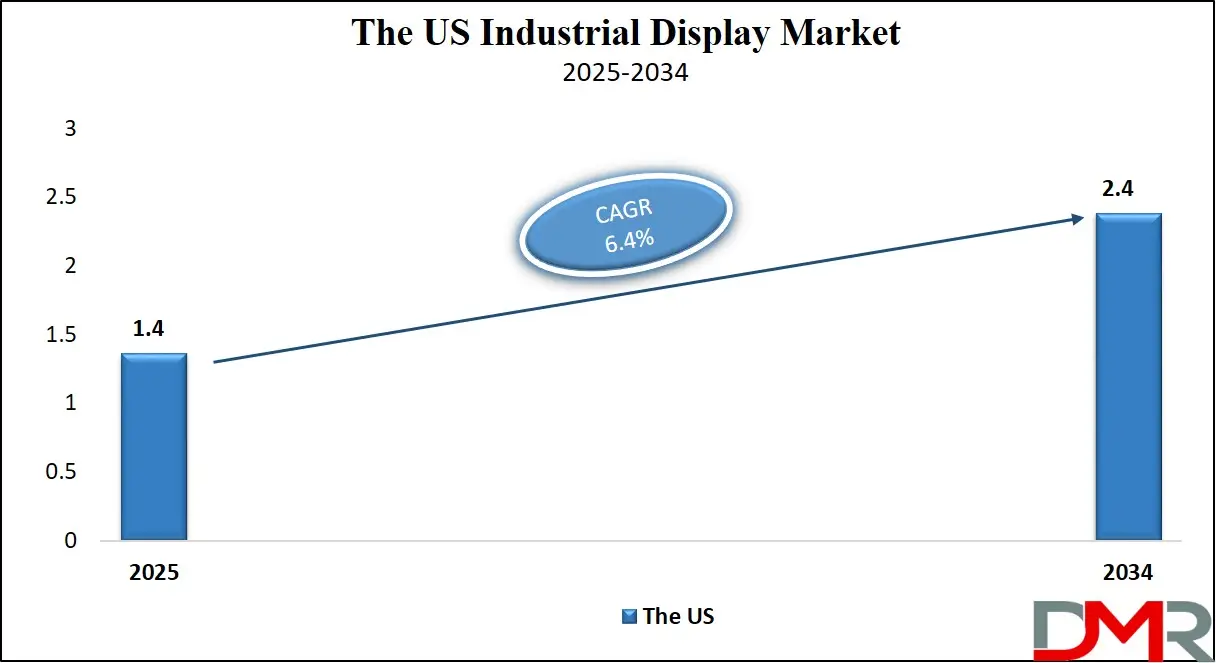

The US Industrial Display Market

The U.S. Industrial Display Market size is projected to be valued at USD 1.4 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.4 billion in 2034 at a CAGR of 6.4%.

The US industrial display market represents a significant share of the global landscape, fueled by the country’s advanced manufacturing base, early adoption of Industry 4.0 technologies, and growing investment in automation and smart infrastructure. Industries such as aerospace, oil and gas, automotive, utilities, and pharmaceuticals are deploying rugged touchscreen panels, sunlight-readable monitors, and high-performance HMI interfaces for real-time monitoring and control. The integration of industrial IoT (IIoT), edge computing, and data visualization tools has created demand for intelligent display systems capable of operating in extreme conditions while offering precision and clarity. These displays are critical in environments where uptime, reliability, and fast decision-making are essential, such as in control rooms, assembly lines, and transportation hubs.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In addition, the US market benefits from the strong presence of key technology providers and systems integrators offering custom-built display solutions tailored for diverse industrial applications. The shift toward energy-efficient LCD and LED displays, along with advancements in capacitive touch technology, has enhanced user interaction and performance in factory automation and remote monitoring setups. Government incentives for smart grid deployment, increased focus on workplace safety through visual alert systems, and expansion of digital signage in logistics and defense sectors are further contributing to market growth. The trend of retrofitting existing industrial systems with modern display units is also on the rise, ensuring compatibility with new communication protocols and control architectures.

The Europe Industrial Display Market

The Europe industrial display market is projected to be valued at approximately USD 1.3 billion in 2025. This strong positioning is driven by the region’s mature industrial ecosystem, high degree of automation, and widespread adoption of advanced manufacturing technologies across sectors such as automotive, aerospace, energy, and food processing. Countries like Germany, France, and Italy are leading the adoption of smart factory initiatives, integrating industrial displays into control panels, HMI terminals, and process visualization systems. European manufacturers place a premium on quality, safety, and compliance, which further drives the demand for durable, high-resolution, and touch-enabled industrial display systems designed to meet rigorous regulatory standards and operate reliably in demanding conditions.

With a forecasted CAGR of 6.1% from 2025 to 2034, the European market is expected to grow steadily, supported by growing investments in Industry 4.0 and digital transformation programs. The shift toward energy-efficient technologies, such as LED and OLED-based displays, and the growing need for remote monitoring in industrial and utility operations are expanding the scope of applications for industrial displays. Additionally, the region's emphasis on sustainability and automation in sectors like renewable energy, pharmaceuticals, and logistics is fostering further demand for intelligent visualization tools. As more European facilities transition to data-driven operations, the role of industrial displays as critical interfaces between operators and machines will continue to rise, reinforcing Europe’s strategic importance in the global industrial display landscape.

The Japan Industrial Display Market

Japan’s industrial display market is estimated to reach a valuation of USD 500 million in 2025. This strong presence stems from Japan’s highly automated manufacturing landscape, which includes globally recognized sectors such as automotive, electronics, and precision engineering. Japanese industries have long emphasized efficiency, quality control, and advanced machine integration, all of which rely heavily on robust display technologies for monitoring, control, and data visualization. Industrial displays are widely used in factory automation systems, robotics, and diagnostic tools, providing high-resolution interfaces that enable operators to manage processes with precision and reliability. The market is further supported by Japan’s domestic display technology innovators, which continue to refine LCD and OLED platforms for industrial use.

With a projected CAGR of 5.6% from 2025 to 2034, the growth of Japan’s industrial display market is expected to remain steady, though somewhat moderate compared to emerging economies. This is largely due to the country’s mature industrial base and slower expansion in greenfield manufacturing facilities. However, ongoing upgrades to aging equipment, increased investment in smart manufacturing infrastructure, and the integration of AI and IoT (Internet of Things) technologies into production systems are creating fresh demand for intelligent, touch-enabled, and ruggedized display units. Additionally, Japan's push for energy-efficient production and the advancement of its semiconductor and electric vehicle industries are expected to sustain the need for high-performance industrial displays in years to come.

Global Industrial Display Market: Key Takeaways

- Market Value: The global industrial display market size is expected to reach a value of USD 11.7 billion by 2034 from a base value of USD 6.5 billion in 2025 at a CAGR of 6.8%.

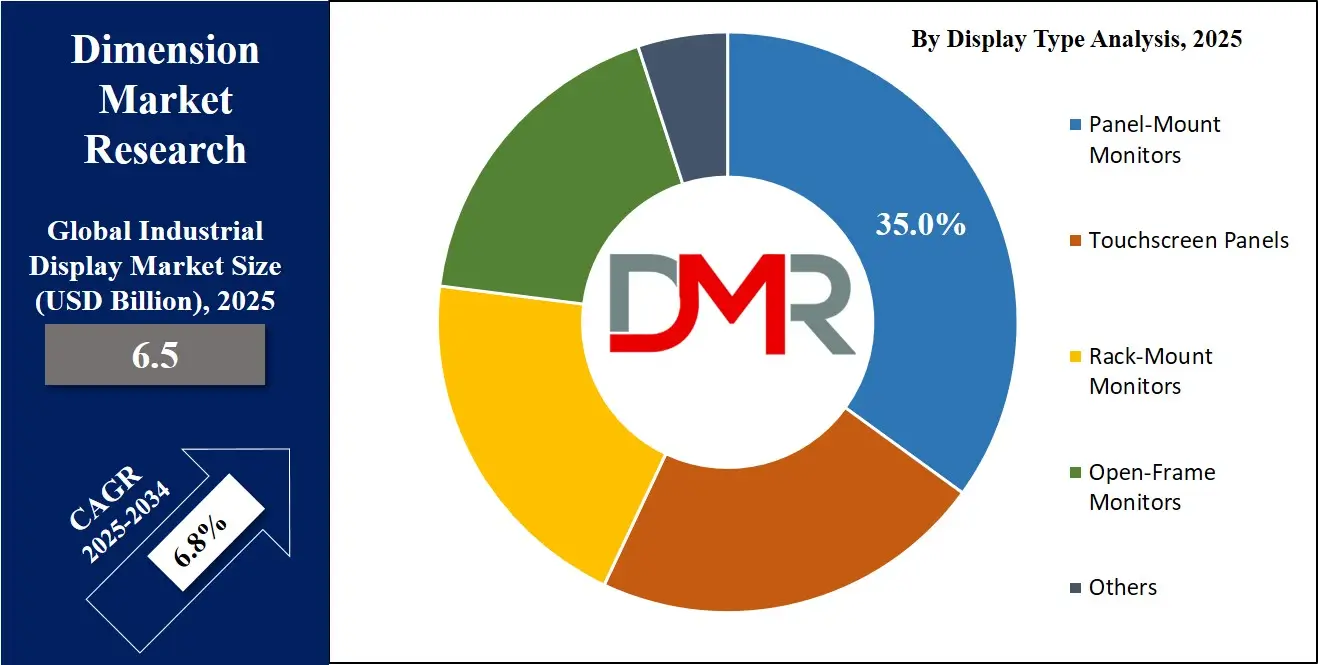

- By Display Type Segment Analysis: Panel-Mount Monitors are anticipated to dominate the display type segment, capturing 35.0% of the total market share in 2025.

- By Panel Size Segment Analysis: 14” – 21” panel size is poised to consolidate its dominance in the panel size, capturing 45.0% of the total market share in 2025.

- By Technology Segment Analysis: LCD (Liquid Crystal Display) technology is expected to maintain its dominance in the technology segment, capturing 60.0% of the total market share in 2025.

- By Application Segment Analysis: The Human-Machine Interface (HMI) applications will dominate the application segment, capturing 40.0% of the market share in 2025.

- By End-User Industry Segment Analysis: Manufacturing industry will lead in the end-user industry segment, capturing 30.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global industrial display market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global industrial display market are Advantech, Siemens, Schneider Electric, Panasonic, Rockwell Automation, LG Display, Samsung, Mitsubishi Electric, BOE Technology, AU Optronics, Winmate, Planar Systems, Eizo, Sparton, Pepperl+Fuchs, GE Automation, and Other Key Players.

Global Industrial Display Market: Use Cases

- Smart Factory Automation and Control Systems: In modern smart factories, industrial displays serve as essential components of human-machine interfaces (HMI), enabling operators to interact with machines, monitor production metrics, and control processes in real-time. These displays are integrated with programmable logic controllers (PLCs) and SCADA systems to provide live data visualization, error diagnostics, and performance analytics. Rugged touchscreen monitors with high resolution and capacitive input are used on factory floors to endure harsh environments, including dust, moisture, and vibrations. By supporting predictive maintenance and real-time feedback loops, industrial displays significantly improve operational efficiency, reduce downtime, and optimize workflow in sectors like automotive, electronics, and food processing.

- Oil & Gas Field Monitoring and Hazardous Zone Applications: In the oil and gas industry, industrial-grade displays are deployed in onshore and offshore locations for process visualization and remote equipment monitoring. These environments often involve explosive atmospheres and extreme temperature variations, requiring intrinsically safe and explosion-proof display solutions. Panel-mounted displays with anti-glare coatings and wide temperature tolerance are used in control rooms, while field operators rely on sunlight-readable monitors with glove-compatible touch interfaces. Real-time display of pressure levels, flow rates, and safety alarms allows for fast decision-making and compliance with health and safety regulations, enhancing asset reliability and risk management across drilling rigs and refineries.

- Transportation System Command and Control Centers: Public transportation systems, including railways, airports, and subways, leverage industrial display systems for centralized traffic control, fleet tracking, and passenger information dissemination. Control centers use large-format industrial monitors and video walls to oversee vehicle movement, signal status, and real-time incident reporting. These displays are integrated with GPS tracking, AI-based traffic analysis, and sensor data to streamline logistics and ensure safety. In terminals, weatherproof industrial signage displays provide arrival and departure schedules, service updates, and emergency alerts. With 24/7 operational durability and anti-reflective coating, these systems deliver continuous performance in both indoor and outdoor transportation environments.

- Healthcare Laboratory and Diagnostic Equipment Interfaces: In healthcare and medical device applications, industrial displays are utilized in diagnostic labs, imaging equipment, and surgical systems to ensure precision and clarity. These interfaces offer high brightness, color accuracy, and antimicrobial coatings to meet stringent hygiene and performance requirements. In laboratories, displays are integrated into automated analyzers and sample tracking systems, allowing technicians to interact with real-time assay results, workflow dashboards, and calibration alerts. Touchscreen HMI panels also support medical imaging systems like ultrasound and MRI machines, enabling detailed visual analysis and fast user input. The demand for high-reliability display solutions in healthcare continues to rise with the expansion of connected health technologies and digital diagnostics.

Impact of Artificial Intelligence on Industrial Display Market

- Smart Predictive Maintenance and Monitoring: AI-enhanced displays are now capable of real-time system diagnostics. By analyzing sensor inputs and performance metrics, AI can predict potential hardware failures such as pixel burnout or interface malfunctions and alert technicians before issues escalate. This proactive monitoring reduces downtime and extends the operational lifespan of industrial display systems.

- Adaptive Display Calibration and Image Optimization: Machine learning algorithms continuously adjust brightness, contrast, and color settings based on environmental factors like ambient light, user interaction, and operating conditions. This ensures optimal readability in various factory or outdoor settings, from bright control rooms to dim inspection bays without manual recalibration, enhancing user comfort and reducing errors.

- Context Aware User Interfaces and Alert Management: AI-driven industrial displays can learn user behavior and prioritize alerts or data streams accordingly. By recognizing patterns such as which metrics operators view most often, these systems can highlight critical information and suppress less relevant notifications. This intelligent prioritization reduces operator fatigue and supports faster decision-making on the factory floor.

- Enhanced Touchscreen Security and Anomaly Detection: Industrial touchscreen systems integrated with AI can monitor touch pattern anomalies such as incorrect gestures, repeated failed inputs, or unauthorized access attempts and trigger security protocols like temporary lockouts or alerts. This adds an intelligent security layer directly at the human–machine interface, safeguarding sensitive industrial processes.

- Data Fusion and Edge Analytics for Operational Insights: Modern industrial displays often feature embedded AI engines capable of aggregating real-time data from multiple sensors, controllers, and machines. By performing edge analytics directly on the display panel, AI can deliver immediate insights such as production bottlenecks or quality deviations without requiring centralized server processing, enabling faster responses and reducing network latency.

Global Industrial Display Market: Stats & Facts

-

India – Ministry of Communication & IT, National Electronics Policy

- India’s electronics systems and design manufacturing (ESDM) sector expanded from USD 45 billion in 2008–09 to a projected USD 400 billion by 2025.

- This includes growth in domestic panel manufacturing capacity and support for industrial display component production through Make in India initiatives.

-

World Bank & UN COMTRADE (via WITS)

- Official trade statistics for industrial displays and components are recorded through HS-code-based data in UN COMTRADE.

- Countries such as China, Germany, Japan, and the U.S. are major exporters and importers of display modules and electronic interfaces used in industrial systems.

Global Industrial Display Market: Market Dynamics

Global Industrial Display Market: Driving Factors

Rising Adoption of Industrial Automation and Smart Manufacturing

The growing deployment of automation technologies across sectors such as automotive, energy, and electronics is significantly driving demand for industrial displays. As factories transition toward smart manufacturing and Industry 4.0 models, the need for real-time data visualization, machine control interfaces, and intuitive dashboards has surged. These displays act as essential nodes within control networks, offering seamless integration with SCADA systems, industrial PCs, and programmable logic controllers. This transformation enhances productivity, reduces manual errors, and improves process transparency, fueling strong market growth.

Growing Need for Rugged and High-Performance Display Solutions

Industries operating in harsh environments such as mining, oil and gas, and transportation require ruggedized display systems that can withstand extreme conditions, including shock, dust, humidity, and fluctuating temperatures. The demand for high-brightness screens, anti-glare coatings, and wide operating temperature ranges is boosting the use of specialized industrial-grade displays. These durable systems are critical for uninterrupted performance in mission-critical applications like pipeline monitoring, heavy equipment operation, and field-based diagnostics.

Global Industrial Display Market: Restraints

High Initial Cost of Deployment and Integration

While industrial displays offer long-term benefits, the high upfront investment required for rugged hardware, custom integration, and industrial-grade certification acts as a barrier, especially for small and mid-sized enterprises. The cost associated with compatibility testing, retrofitting legacy systems, and software-hardware synchronization can delay adoption. For cost-sensitive industries, this becomes a major restraint, limiting market penetration in developing regions.

Limited Interoperability and Upgrade Challenges

Many industrial display systems face limitations when integrating with older legacy equipment or disparate automation protocols. The lack of standardized connectivity and communication interfaces can hinder smooth deployment in complex industrial environments. Additionally, frequent changes in operating systems, industrial software platforms, and user requirements may render some display systems obsolete without adequate upgrade paths, thereby creating technological bottlenecks.

Global Industrial Display Market: Opportunities

Expansion of Edge Computing and IIoT Integration

As industries adopt edge computing for localized data processing, industrial displays are becoming critical visualization points at the edge of industrial networks. The integration of displays with industrial IoT (IIoT) sensors and analytics platforms allows operators to view actionable insights and system performance data in real time. This opens new opportunities for display manufacturers to provide smart interfaces with built-in processing power, network connectivity, and diagnostic capabilities tailored for edge deployments.

Demand Surge in Emerging Economies and Infrastructure Projects

Rapid industrialization in regions such as Asia Pacific, Latin America, and the Middle East is creating a strong demand for industrial display technologies. Infrastructure modernization, increased manufacturing activity, and government-led digital transformation initiatives are expanding the need for advanced HMI displays, control room visualization systems, and intelligent dashboard solutions. These markets present significant growth potential for global players willing to offer scalable, affordable, and rugged solutions.

Global Industrial Display Market: Trends

Integration of AI and Touchless Control in Display Systems

A growing trend in the industrial display landscape is the integration of artificial intelligence and touchless interaction technologies such as gesture control and voice recognition. These innovations improve user ergonomics, reduce the need for physical contact in sterile or hazardous environments, and enable predictive monitoring. AI-driven displays are also enabling real-time fault detection, adaptive screen configurations, and enhanced user analytics for informed decision-making.

Shift Toward Modular and Customizable Display Platforms

Manufacturers are focusing on modular display designs that can be customized for specific use cases and environmental conditions. Whether it’s wall-mounted HMI panels for cleanrooms or ultra-wide screens for mining control centers, the demand for tailored display solutions is rising. Modular architectures allow for flexible upgrades, better maintenance, and reduced downtime, aligning with the evolving requirements of smart factories and adaptive production systems.

Global Industrial Display Market: Research Scope and Analysis

By Display Type Analysis

Panel-mount monitors are expected to lead the display type segment within the industrial display market, capturing approximately 35.0% of the total market share in 2025. These monitors are widely preferred due to their versatile mounting capabilities, ease of installation into machinery and control panels, and durability in demanding environments. Their flat-front design allows seamless integration into enclosures, making them ideal for use in industrial automation, assembly lines, and operator control stations. Their robust construction supports resistance to vibration, dust, and moisture, while offering reliable performance in both indoor and outdoor applications. Industries such as manufacturing, energy, and transportation utilize panel-mount monitors extensively to enable process visualization and machine-level feedback, which helps in real-time monitoring and operational control.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Touchscreen panels also represent a significant and rapidly expanding segment within the industrial display market. These panels provide an interactive human-machine interface that enhances user engagement and efficiency in industrial settings. Touch-enabled displays are being adopted in smart factories, logistics operations, and medical diagnostics, where intuitive control and quick input response are critical. Capacitive and resistive touch technologies are commonly used depending on the application environment, with capacitive screens offering better gesture recognition and resistive screens suited for use with gloves or styluses in rugged conditions. The growth of industrial IoT, along with growing emphasis on process optimization and reduced operator training time, is accelerating the integration of touchscreen panels in diverse industrial sectors.

By Panel Size Analysis

The 14” – 21” panel size category is set to dominate the panel size segment of the industrial display market, accounting for an estimated 45.0% of the total market share in 2025. This size range is considered the industry standard for various industrial applications due to its optimal balance between display area and device compactness. Displays within this range are widely used in control panels, machine interfaces, diagnostic equipment, and manufacturing terminals, where operators require clear visibility without occupying excessive physical space. These panels offer sufficient resolution and screen space to accommodate real-time data visualization, alarms, and process controls. Additionally, the size is versatile enough to be mounted in workstations, embedded into machinery, or used in mobile industrial units, making it highly adaptable across sectors such as automotive, energy, and food processing.

In contrast, panels below 14 inches cater to compact industrial applications where space is limited or portability is crucial. These smaller displays are often used in handheld diagnostic devices, portable testing systems, embedded kiosks, and control units on small-scale machinery. They are particularly suitable for environments where operators need to access information quickly in confined spaces, such as service vehicles, point-of-use monitoring stations, and mobile inspection tools. Although they occupy a smaller share of the market, their utility in niche applications and growing demand for mobile industrial solutions continue to support steady growth within this segment.

By Technology Analysis

LCD technology is projected to retain its stronghold in the technology segment of the industrial display market, commanding around 60.0% of the total market share in 2025. Liquid Crystal Displays have long been favored in industrial applications due to their cost-effectiveness, energy efficiency, and adaptability across a wide range of operating conditions. Their ability to deliver clear image quality, compatibility with touchscreen overlays, and availability in various sizes make them a practical choice for control panels, HMIs, diagnostic equipment, and monitoring systems. LCDs also support high-resolution visuals necessary for displaying detailed operational data, system diagnostics, and process flows, which are critical in sectors like manufacturing, healthcare, and utilities. Their long lifecycle, low heat emission, and relatively low power consumption further contribute to their continued dominance in industrial settings.

LED technology, while representing a smaller share, is steadily gaining traction in the industrial display landscape due to its superior brightness, durability, and performance in outdoor and high-ambient-light environments. Light Emitting Diode displays are particularly suitable for industrial signage, field-based control systems, and environments that demand high visibility and fast refresh rates. These displays offer better contrast, longer operational life, and are being used in rugged applications such as mining, marine navigation, and transportation control centers. While costlier than LCDs, the benefits of LED displays in terms of brightness and energy efficiency make them a compelling choice for mission-critical and high-visibility applications. As the technology continues to advance, LED displays are expected to capture a growing share of industrial use cases.

By Application Analysis

Human-Machine Interface (HMI) applications are set to dominate the application segment of the industrial display market, capturing a projected 40.0% of the total market share in 2025. HMIs serve as the primary communication bridge between operators and industrial systems, enabling real-time control, monitoring, and visualization of complex processes. Industrial displays used in HMI applications are integrated into machines, control panels, and automation systems across sectors like manufacturing, energy, and pharmaceuticals. These displays provide actionable insights by showcasing operational data, system alerts, and performance metrics. Their importance has grown with the expansion of Industry 4.0 and smart manufacturing, where responsive touchscreens, user-friendly interfaces, and compatibility with SCADA systems are essential for efficient plant operations, reduced downtime, and enhanced decision-making.

Interactive display panels also play a growing role in industrial settings, offering more advanced capabilities than traditional static displays. These panels support touch input, gesture control, and multi-user interaction, making them ideal for collaborative environments, training centers, and system dashboards. Used in logistics hubs, utility control rooms, and automotive production floors, interactive displays enhance engagement and usability, allowing operators to interact dynamically with real-time data. Their ability to support complex visual content, such as 3D schematics or multi-layered process maps, makes them valuable in situations where detailed navigation and intuitive control are required. As digital interfaces become more integrated into industrial workflows, the demand for interactive panels continues to rise alongside evolving requirements for visual communication and system accessibility.

By End-User Industry Analysis

The manufacturing industry is anticipated to lead the end-user industry segment in the industrial display market, securing approximately 30.0% of the total market share in 2025. This dominance is driven by the sector's extensive use of automation technologies, real-time monitoring systems, and human-machine interfaces. Industrial displays are critical tools on factory floors, embedded in machinery, quality control stations, and production line terminals to provide live feedback, operational insights, and process visualization. These displays support lean manufacturing, predictive maintenance, and digital twin strategies, helping manufacturers streamline workflows and reduce errors. With growing investments in smart factory initiatives and the adoption of industrial IoT platforms, the role of rugged and high-performance displays in enhancing production efficiency and equipment interaction has become even more vital.

In the energy and power sector, industrial displays are widely utilized for monitoring grid performance, managing power generation systems, and supervising substation operations. These applications require displays capable of handling harsh environmental conditions, high electrical interference, and round-the-clock usage. Touchscreen control panels and remote terminal displays are used in control rooms and field units to visualize power flow, track outages, and perform diagnostics. As the sector moves toward smart grid implementation and renewable energy integration, the demand for reliable, high-visibility displays that can interface with complex energy management systems is rising. The need for real-time situational awareness and system stability makes industrial-grade displays indispensable tools in ensuring operational continuity and safety in power plants and utility infrastructure.

The Industrial Display Market Report is segmented on the basis of the following

By Display Type

- Panel-Mount Monitors

- Touchscreen Panels

- Rack-Mount Monitors

- Open-Frame Monitors

- Other

By Panel Size

- Below 14”

- 14”-21”

- 21”-40”

- Above 40”

By Technology

- LCD

- LED

- OLED

- E-Paper and Others

By Application

- Human-Machine Interface (HMI)

- Interactive Display Panels

- Digital Signage

- Remote Monitoring

- Other

By End-User Industry

- Manufacturing

- Energy & Power

- Oil & Gas

- Transportation & Logistics

- Healthcare

- Retail

- Military & Aerospace

- Others

Global Industrial Display Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to lead the global industrial display market in 2025, accounting for approximately 40.0% of total market revenue. This dominance is driven by rapid industrialization, large-scale manufacturing activity, and the growing adoption of automation technologies across countries like China, Japan, South Korea, and India. The region benefits from a strong presence of display panel manufacturers, expanding smart factory projects, and growing investments in sectors such as electronics, automotive, energy, and logistics. Government initiatives supporting digital transformation and industrial IoT adoption are further fueling the demand for advanced HMI systems, rugged displays, and process control interfaces, positioning Asia Pacific as the most dynamic and high-growth region in the industrial display landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Middle East and Africa region is projected to register the highest CAGR in the global industrial display market during the forecast period. This accelerated growth is attributed to rising investments in industrial infrastructure, energy diversification projects, and smart city initiatives across countries like the UAE, Saudi Arabia, and South Africa. As these nations focus on modernizing their oil and gas operations, expanding utilities, and strengthening manufacturing capabilities, the demand for rugged, high-performance display solutions for control rooms, field monitoring, and industrial automation is rapidly growing. The region’s push toward digital transformation and operational efficiency is creating strong opportunities for advanced industrial display technologies.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Industrial Display Market: Competitive Landscape

The global competitive landscape of the industrial display market is characterized by a mix of established multinational corporations and specialized regional players, all striving to enhance their technological capabilities and global footprint. Key companies such as Advantech, Siemens, Schneider Electric, LG Display, and Rockwell Automation lead the market through a combination of product innovation, strategic partnerships, and vertical-specific solutions. These players focus heavily on integrating advanced features like multi-touch capability, sunlight readability, and edge computing compatibility into their displays to cater to evolving industrial demands. Meanwhile, niche manufacturers such as Winmate, Eizo, and Litemax are gaining traction by offering highly customized, ruggedized display solutions tailored for sectors like defense, maritime, and field-based operations. Continuous R&D investments, expansion into emerging markets, and the development of smart and modular display platforms are key strategies being employed to gain a competitive edge in this fast-evolving landscape.

Some of the prominent players in the global industrial display market are

- Advantech Co., Ltd.

- Siemens AG

- Schneider Electric

- Panasonic Holdings Corporation

- Rockwell Automation, Inc.

- LG Display Co., Ltd.

- Samsung Electronics Co., Ltd.

- Mitsubishi Electric Corporation

- BOE Technology Group Co., Ltd.

- AU Optronics Corp.

- Winmate Inc.

- Planar Systems, Inc.

- Eizo Corporation

- Sparton Corporation

- Pepperl+Fuchs

- GE Automation

- Beijer Electronics Group AB

- Kontron AG

- Litemax Electronics Inc

- Axiomtek Co., Ltd.

- Other Key Players

Global Industrial Display Market: Recent Developments

- June 2025: Planar Systems expanded its industrial display lineup at InfoComm 2025, unveiling several advanced visualization solutions with improved visual performance, easier maintenance, and enhanced flat-panel experience tailored for industrial environments.

- June 2025: Nippon Steel and U.S. Steel finalized a merger agreement under national security review, marking a significant consolidation move that could impact industrial equipment supply chains, including display manufacturers serving heavy industries.

- June 2025: Ellenbarrie Industrial Gases, backed by Mukul Agrawal, set a price band for its INR 852 crore IPO, signaling increased funding activity in the broader industrial sector that may drive demand for rugged visualization technologies.

- May 2025: TE Connectivity agreed to acquire Richards Manufacturing for approximately USD 2.3 billion, strengthening its industrial automation portfolio by integrating rugged display components used in electrical utilities and infrastructure systems.

- March 2025: Colorlight introduced a comprehensive series of LED display systems, featuring ultra‑high-resolution panels, integrated media servers, and advanced calibration tools aimed at industrial signage and control applications.

- January 2025: PocketBook, in collaboration with E Ink and Sharp, launched the InkPoster at CES 2025, a full‑color, ultra‑low‑power e‑paper display designed for digital signage and industrial labeling applications.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 6.5 Bn |

| Forecast Value (2034) |

USD 11.7 Bn |

| CAGR (2025–2034) |

6.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Display Type (Panel-Mount Monitors, Touchscreen Panels, Rack-Mount Monitors, Open-Frame Monitors, Other), By Panel Size (Below 14”, 14”-21”, 21”-40”, Above 40”), By Technology (LCD, LED, OLED, E-Paper and Others), By Application (Human-Machine Interface (HMI), Interactive Display Panels, Digital Signage, Remote Monitoring, Other), and By End-User Industry (Manufacturing, Energy & Power, Oil & Gas, Transportation & Logistics, Healthcare, Retail, Military & Aerospace, Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Advantech, Siemens, Schneider Electric, Panasonic, Rockwell Automation, LG Display, Samsung, Mitsubishi Electric, BOE Technology, AU Optronics, Winmate, Planar Systems, Eizo, Sparton, Pepperl+Fuchs, GE Automation, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global industrial display market?

▾ The global industrial display market size is estimated to have a value of USD 6.5 billion in 2025 and is expected to reach USD 11.7 billion by the end of 2034.

What is the size of the US industrial display market?

▾ The US industrial display market is projected to be valued at USD 1.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.4 billion in 2034 at a CAGR of 6.4%.

Which region accounted for the largest global industrial display market?

▾ Asia Pacific is expected to have the largest market share in the global industrial display market, with a share of about 40.0% in 2025.

Who are the key players in the global industrial display market?

▾ Some of the major key players in the global industrial display market are Advantech, Siemens, Schneider Electric, Panasonic, Rockwell Automation, LG Display, Samsung, Mitsubishi Electric, BOE Technology, AU Optronics, Winmate, Planar Systems, Eizo, Sparton, Pepperl+Fuchs, GE Automation, and Other Key Players.

What is the growth rate of the global industrial display market?

▾ The market is growing at a CAGR of 6.8 percent over the forecasted period.