Market Overview

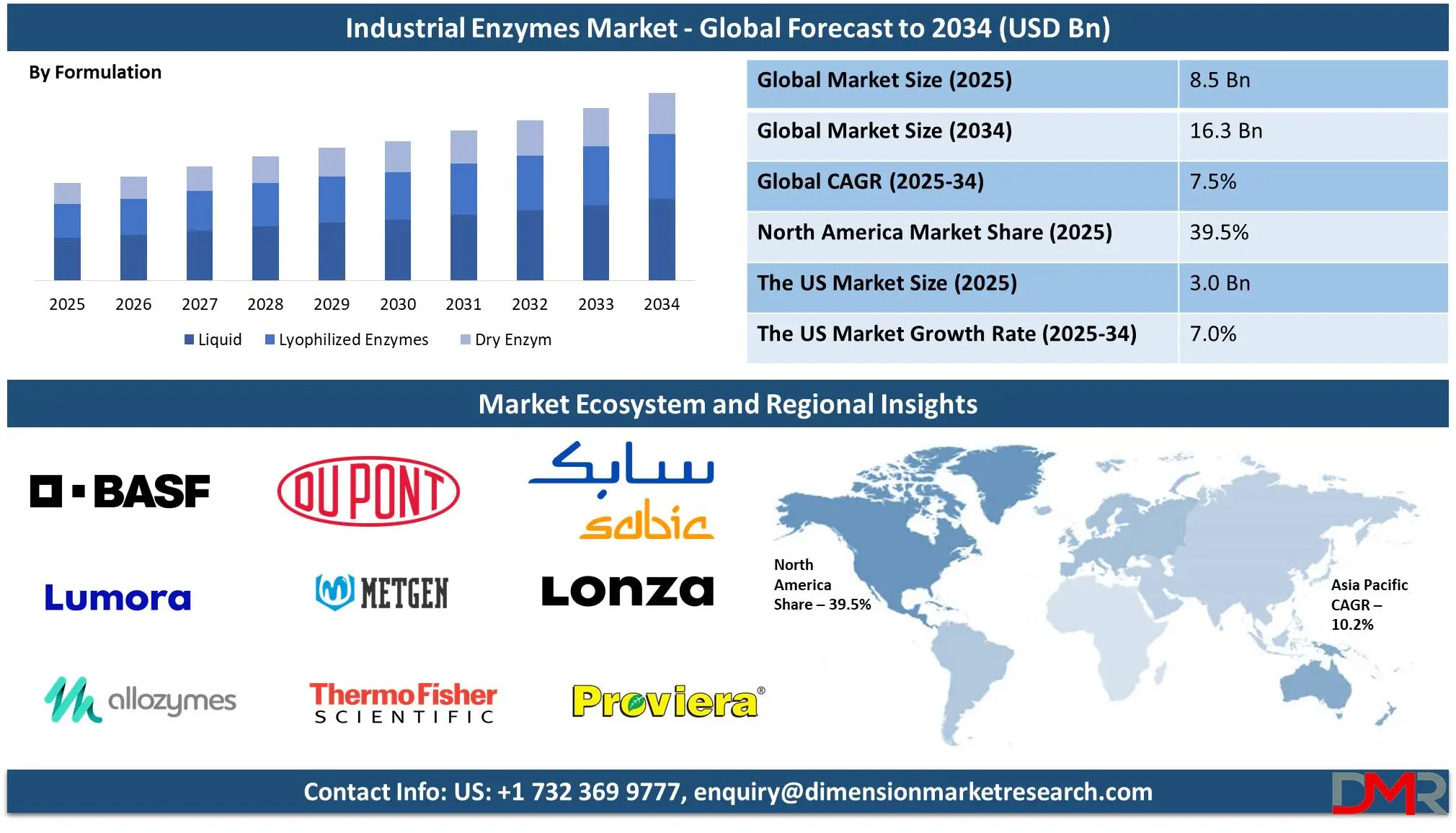

The Global Industrial Enzymes Market is projected to reach USD 8.5 billion in 2025 and grow at a compound annual growth rate of 7.5% from there until 2034 to reach a value of USD 16.3 billion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Industrial enzymes are biological catalysts used to expand chemical reactions across industries. Sourced from microorganisms, plants, and animals for specific tasks like breaking down starch into sugar or improving fabric texture. Common applications for industrial enzymes are food processing, textile manufacturing,

pharmaceutical production, and biofuel production. Being natural and biodegradable, they help in making processes more efficient while decreasing environmental harm.

Industrial enzymes have seen growth in demand due to their eco-friendly nature and ability to improve production efficiency. Food and beverage industries depend on enzymes for baking, brewing, and dairy processing, while textile industries use enzymes to soften fabrics while increasing dyeing quality; biofuel sectors use enzymes as they break down plant material for ethanol production, while companies look for sustainable solutions in many manufacturing processes. Enzymes have become an integral component in modern manufacturing processes!

Further, trends in industrial enzymes focus on major efficiency and sustainability. Biotechnology advances have led to genetically modified enzymes with enhanced performance; detergent manufacturers use enzymes in creating eco-friendly cleaning products without chemical detergents, while pharmaceutical researchers use enzymes as part of drug delivery systems, furthering the trend toward replacing synthetic chemicals with natural enzymes across multiple industries.

There have been many key developments impacting the industrial enzyme market over time. Scientists have discovered new microbes producing enzymes with superior performance; partnerships between biotechnology firms and food manufacturers to create enhanced enzyme solutions, along with their growing use in agriculture to increase soil health and crop yield; governments around the world are supporting enzyme research for green industrial practices.

Though industrial enzymes have seen unprecedented growth, the industry still experiences several challenges. Production can be costly, and some industries hesitate to switch away from traditional chemical methods for the production of enzymes. Stability and performance need improvement across various conditions, as do regulatory hurdles related to genetically modified enzymes; some countries have strict policies against their usage. Tackling these issues effectively is key to expanding industrial enzyme production further.

Industrial enzymes look bright as research tries to increase their efficiency and cost-effectiveness. With growing environmental concerns prompting more industries to adopt enzymes as sustainable initiatives. Genetic engineering and

biotechnology may create innovative enzyme solutions customized specifically for different applications, all while gene editing promises breakthroughs for manufacturing processes. Genes will undoubtedly remain a cornerstone of modern production!

The US Industrial Enzymes Market

The US Industrial Enzymes Market is projected to reach

USD 3.0 billion in 2025 at a compound annual growth

rate of 7.0% over its forecast period.

The U.S. industrial enzymes market provides significant growth potential due to rising demand in the biofuels, food processing,, and pharmaceutical industries. Biotechnology and genetic engineering innovations are creating more efficient and eco-friendly enzymes; eco-friendly solutions in detergents and agriculture also increase demand. Furthermore, R&D investments and industry collaborations help foster expansion.

Further, the market growth is being driven by rising demand in biofuels, food processing, and

healthcare applications as well as advances in biotechnology and genetic engineering that increase the efficiency of enzymes. Unfortunately, market expansion faces difficulties like high production costs and stringent regulatory approval processes that impede innovation and commercialization; yet sustainable practices and eco-friendly solutions continue to create expansion opportunities.

Industrial Enzymes Market: Key Takeaways

- Market Growth: The Industrial Enzymes Market size is expected to grow by 7.2 billion, at a CAGR of 7.5%, during the forecasted period of 2026 to 2034.

- By Formulation: The Liquid segment is anticipated to get the majority share of the Industrial Enzymes Market in 2025.

- By Type: The Carbohydrates segment is expected to get the largest revenue share in 2025 in the Industrial Enzymes Market.

- Regional Insight: North America is expected to hold a 39.5% share of revenue in the Global Industrial Enzymes Market in 2025.

- Use Cases: Some of the use cases of Industrial Enzymes include the textile industry, biofuel production, and more.

Industrial Enzymes Market: Use Cases:

- Food & Beverage Industry: Enzymes like amylases and proteases support baking, brewing, dairy processing, and juice extraction by enhancing texture, flavor, and shelf life.

- Textile Industry: Enzymes like cellulases and pectinases are used for fabric softening, biopolishing, and efficient dyeing, minimizing chemical use & water consumption.

- Biofuel Production: Enzymes like cellulases and hemicellulases break down plant material into bioethanol, making renewable fuel production more efficient & eco-friendlier.

- Detergent Industry: Enzymes like lipases and proteases improve stain removal in laundry and dishwashing detergents, allowing effective cleaning at lower temperatures.

Stats & Facts

- According to GFI (The Good Food Institute) and GFI’s analysis of data from the Net Zero Insights platform, EVERY Co. launched the world’s first precision fermentation liquid egg product in December 2023, supported by patents for recombinant protein purification and precision fermentation-derived recombinant ovomucoid.

- In addition, Melt & Marble secured multiple patents for strain improvements enhancing fatty acid and protein production in fungi, strengthening its proprietary technology in fermentation-derived fats.

- Further, Mycorena AB was granted two patents in Sweden for a dairy replacement and dry food product made from fungal biomass and also developed a patent-pending method for a printable food product using the same biomass.

- Koralo Foods received a patent for an alternative seafood product made through the co-cultivation of fungal mycelium and microalgae, combining seafood-like taste with nutritional benefits from fungal protein and omega-3 fatty acids from microalgae.

- As per GFI, fermentation companies globally raised USD 514.7 million in 2023, reflecting a year-over-year decline in line with broader economic trends, but European fermentation funding grew 22% to a record USD 179.4 million.

- Also, the number of unique investors in fermentation companies grew 22% to 693 by the end of 2023, showing strong ongoing investor interest despite challenging macroeconomic conditions.

- Further, South Africa’s government made what is believed to be the continent’s first public investment in precision fermentation, awarding USD 700,000 million to South African startup De Novo FoodLabs.

- By the end of 2023, there were 158 publicly announced companies focused primarily on fermentation inputs or end products for alternative proteins, reflecting sectoral growth.

- Seven new fermentation facilities opened in 2023, with several more announced or under construction, including Meati Foods’ 100,000-square-foot facility in Thornton, Colorado, and Liberation Labs’ 600,000-liter plant in Richmond, Indiana.

- Large food companies deepened involvement in fermentation technology, with FrieslandCampina and Danone expanding their precision fermentation work and seafood giant Thai Union investing in microalgae-based ingredients.

- Meati Foods’ “Mega Ranch” facility in Thornton, Colorado, launched in January 2023, spans 100,000 square feet and can produce 45 million pounds of product per year, supplying more than 7,000 retailers and restaurants.

- Motif FoodWorks opened its second facility in Northborough, Massachusetts, which serves as a market development and research center and adds fermentation and bioprocessing services to its capabilities.

- Mycorena expanded its Swedish food science development facility, adding increased fermentation equipment and a fully operational production kitchen to accelerate innovation.

- Chunk Foods opened a new facility in Israel capable of producing millions of whole-cut plant-based steaks annually, using fermentation technology to replicate texture and taste.

- Aqua Cultured Foods began construction on a larger manufacturing facility in Chicago, nearly tripling its production space to scale fermentation-enabled alternative seafood production.

- Liberation Labs broke ground on its first commercial-scale precision fermentation plant in Richmond, Indiana, with a 600,000-liter capacity and secured a USD 25 million government-backed loan, indicating strong U.S. federal support for the bioeconomy.

- Liberation Labs’ Indiana facility is expected to begin commercial production by the end of 2024, supplying precision fermentation-derived ingredients to CPG companies and industrial manufacturers.

- Despite global economic headwinds, the fermentation sector demonstrated resilience in 2023 through technological advances, record patent activity, new production facilities, increased investor interest, and growing involvement from both major food companies and public funding sources.

Market Dynamic

Driving Factors in the Industrial Enzymes Market

Rising Demand for Sustainable Solutions

Industries are mainly shifting toward eco-friendly and sustainable processes, driving the need for industrial enzymes. Unlike synthetic chemicals, enzymes are biodegradable and minimize waste, making them ideal for food processing, biofuel production, and detergents. Governments and regulatory bodies are also promoting the usage of green technologies, further boosting enzyme adoption. Consumers prefer natural and chemical-free products, pushing companies to integrate enzymes into their formulations. In addition, industrial processes using enzymes require less energy and water, leading to cost savings and environmental benefits, which focus on sustainability and continue to fuel the expansion of the industrial enzyme market.

Advancements in Biotechnology and Enzyme Engineering

Innovations in biotechnology, like genetic engineering and microbial fermentation, have improved enzyme efficiency and stability. Scientists are developing customized enzymes with enhanced properties, making them more effective in extreme conditions like high temperatures and varying pH levels. These developments have expanded enzyme applications across multiple industries, from pharmaceuticals to textiles. The increase in investment in R&D has led to the discovery of new enzyme-producing microorganisms, further optimizing industrial processes. Enzyme modification technologies also allow cost-effective production, making enzymes more accessible for various industries. As research continues, new and improved enzyme solutions will drive market growth.

Restraints in the Industrial Enzymes Market

High Production Costs and Stability Issues

The production of industrial enzymes includes complex processes like microbial fermentation and purification, leading to high costs. Maintaining enzyme stability under different industrial conditions, including extreme temperatures and pH levels, is another challenge. Some enzymes lose effectiveness when exposed to harsh environments, limiting their usability in certain applications. In addition, the demand for specialized storage & transportation further enhances the costs for manufacturers. These factors make it difficult for small and medium-sized businesses to adopt enzyme-based solutions. Cost-effective production methods and improved enzyme stability are vital to overcome this challenge.

Regulatory Hurdles and Limited Awareness

The utilization of industrial enzymes, mainly those derived from genetically modified organisms (GMOs), is subject to strict regulatory approvals in many countries. Complex approval processes and compliance requirements can delay product launches and increase costs for enzyme manufacturers. In addition, industries unfamiliar with enzyme-based processes may hesitate to replace traditional chemical methods owing to a lack of awareness & expertise. In some cases, consumers also have concerns about the safety and ethical aspects of genetically engineered enzymes.

Opportunities in the Industrial Enzymes Market

Expanding Applications in Emerging Industries

The industrial enzymes market is experiencing new opportunities as emerging industries adopt enzyme-based solutions. Sectors like bioplastics, wastewater treatment, and agriculture are mainly using enzymes for sustainable and efficient processes. In agriculture, enzymes improve soil health and crop growth by improving nutrient absorption. Similarly, the wastewater treatment industry benefits from enzymes that break down pollutants, making water purification more eco-friendly. As industries constantly explore enzyme applications beyond traditional sectors, the demand for innovative enzyme solutions is expected to grow. This expansion into new markets presents a significant opportunity for enzyme manufacturers.

Advancements in Enzyme Engineering and Synthetic Biology

Constant research in enzyme engineering and synthetic biology is unlocking new possibilities for industrial enzymes. Scientists are developing enzymes with enhanced stability, efficiency, and specificity through genetic modifications and protein engineering. These developments allow enzymes to function effectively in extreme conditions, expanding their industrial applications. In addition, synthetic biology allows for affordable enzyme production by designing custom microbes to create targeted enzymes. With the growth in investment in biotechnology and enzyme research, companies have the opportunity to develop innovative solutions for diverse industries. These breakthroughs are expected to drive the future growth of the industrial enzyme market.

Trends in the Industrial Enzymes Market

Growing Adoption of Enzymes in Sustainable Manufacturing

Industries are mainly integrating enzymes into their production processes to replace synthetic chemicals & reduce environmental impact. The transformation toward sustainability has led to the usage of enzymes in biodegradable detergents, eco-friendly textile processing, and biofuel production. Enzymes support lower energy consumption by allowing efficient reactions at mild temperatures and pH levels. In addition, many companies are investing in enzyme-based solutions to meet regulatory and consumer demands for greener products, which is expected to continue as industries emphasize reducing their carbon footprint. The push for sustainable manufacturing is a key driver in the growth of the industrial enzyme market.

Advancements in Genetic Engineering for Enhanced Enzyme Performance

Recent breakthroughs in genetic engineering and protein modification are creating the development of more efficient and stable industrial enzymes. Scientists are developing genetically modified enzymes that work under extreme conditions such as high heat, acidity, or alkaline environments. These advancements have expanded enzyme applications in food processing, pharmaceuticals, and biofuel production. Companies are also using synthetic biology to design custom enzymes for specific industrial needs, enhancing efficiency and reducing costs. The ability to develop highly specialized enzymes is transforming the enzyme market. As research in this field grows, enzyme-based solutions are becoming more precise and cost-effective.

Research Scope and Analysis

By Type

Carbohydrase will likely lead the industrial enzymes market by 2025, accounting for 49.5% of total revenue, which can be attributed to its growing utilization across various industries like animal feed, pharmaceuticals, and food & beverages; breaking down carbohydrates like fructose & glucose into sugar syrups is mainly used across these fields and used for the production of artificial sweeteners and prebiotic products like isomaltose found in wines or juices; this versatile enzyme plays a pivotal role in many manufacturing processes across industries.

Protease enzymes are key in breaking down proteins into amino acids for use in various industries, including animal feed, chemicals, detergents, food, and photography. Common proteases used are aspartate, cysteine, serine, threonine, papain, and glutamic acid metalloprotease. With consumers becoming more health-minded and highlighting higher protein consumption, demand for proteases in food industries should grow; proteases support digestion along with the increased nutrition value, making them useful in various applications, further increasing their use across industries and applications.

Lipases and other enzymes like polymerase and nuclease play an integral part in various industries. Lipases help break down fats and oils and are frequently employed in food processing applications like cheese/yogurt fermentation, baking, detergent manufacturing and even detergent usage. Biodiesel production depends heavily on biodiesel enzymes that break down glycerides and fatty acids into biodiesel-related components such as polymerase for synthesizing nucleic acid polymers while nuclease breaks down bonds between nucleotide subunits. These enzymes play a pivotal role in polymerase chain reaction (PCR) technology, widely used for forensic science, medical research and disease detection - such as HIV and tuberculosis detection. As more cases of infectious diseases emerge each year, demand for PCR technology and its related enzymes will undoubtedly grow substantially over time.

By Source

Microorganisms will dominate the industrial enzymes market in 2025, with an estimated revenue share of 82.1%, owing to low production costs and easy availability. Microbial enzymes include bacteria, fungal, and yeast-based variants; their usage spans detergents, food processing, and medicine applications, along with medicine production processes. Fungal enzymes have become mainly sought-after as key players in soy sauce, beer brewing, bakery goods production, and processing fruits for dairy production, making them integral elements for food production.

Further, animal-derived enzymes come mainly from the pancreas and stomach of cattle and pigs. Unfortunately, their effectiveness in humans is limited as they only work within a specific pH range; when exposed to stomach acid, they quickly lose their potency before they can function effectively. To address this issue, enteric-coated forms have been introduced, which protect these enzymes from stomach acid; their traditional use has since led to a search for alternatives offering greater stability and efficiency, which has opened doors for other sources of enzymes with greater effectiveness.

Plant-derived enzymes are quickly emerging as an attractive solution and are projected to experience rapid expansion over the coming years. Owing to technological development, enzyme production from plants now demands minimal investment costs, making this option highly attractive for manufacturers. Plant-based enzymes are found naturally in many foods, like fruits and vegetables, and can be consumed raw or cooked. Bromelain is one of the most sought-after plant-derived enzymes, known for its anti-inflammatory effects and ability to aid protein digestion and wound healing. Additionally, plant-based diets have become more popular as a means of enhancing digestion and relieving stress on the small intestines, further driving demand for plant-derived enzymes.

By Formulation

Liquid enzymes play a major role in driving market expansion due to their high efficiency, ease of use, and superior solubility in comparison to powdered or solid forms of industrial enzymes and are expected to lead the market in 2025, with a share of 43.9%. Liquid enzymes combine well with different substances, making them perfect for industries such as food & beverages, detergents, textiles, and biofuels. Liquid enzymes help improve product consistency and quality by breaking down complex compounds more effectively in the food industry. Detergents dissolve quickly in water, aiding stain removal and making washing more efficient at lower temperatures. Due to their faster and more uniform processes, detergents have seen an upsurge in popularity, especially within industries requiring rapid enzyme distribution.

Also, the formulations' versatility in industrial settings has contributed greatly to their rapid expansion. Their versatility enables manufacturers to customize them easily to suit specific industry needs, improving production efficiency and reducing waste. For biofuel production, liquid enzymes help break down plant materials into fermentable sugars for increased ethanol yield; textile manufacturers use liquid enzymes in fabric softening and finishing processes, increasing sustainability, while their cost-effectiveness and compatibility with automated systems have persuaded more manufacturers to turn towards liquid enzyme formulations; as more industries focus on improving efficiency and sustainability, liquid enzyme demand will only continue to expand exponentially.

By Application

Food and beverage industries are projected to lead the industrial enzymes market in 2025 with an anticipated revenue share of 25.6%, driven by their higher usage in production processes like cheese production, fruit/vegetable processing, oils/fats refining, and grain processing industries that depends heavily on enzyme solutions like cheese processing, fruit/vegetable processing, oils refining/refining, along with baking/dairy/brewing industries for texture enhancement as well as product quality enhancement using proteases/lipases/carbohydrases which play an important role in improving efficiency/consistency throughout food processing efficiency.

Enzymes have long been used in the detergent industry, mainly proteases, lipases, and amylases. Proteases supports the break down protein-based stains like sweat, grass, eggs and blood to make laundry detergents more efficient; amylases support the removal of starchy food stains like chocolate custard mashed potatoes gravies stains from starchy food items like chocolate custard mashed potatoes gravies as part of safer and eco-friendlier detergent options for laundry and dishwashing detergents; globally, they're becoming popular around the world owing to major awareness around environmental sustainability as well as demand for effective cleaning solutions that enzyme-based detergents offer.

Enzymes have an important place in the animal feed industry. With increasing rates of diseases like Porcine Epidemic Diarrhea (PED) and Bovine Spongiform Encephalopathy (BSE), livestock producers must use high-quality feed for animal health, while global production increases and concerns regarding meat quality have led to an increased demand for enzyme-enhanced feed, which enhances the digestion, nutrient absorption, growth rates, and overall health in animals, thus driving significant increases in enzyme usage among producers over time. As such, use is expected to continue exponentially over time.

The Industrial Enzymes Market Report is segmented on the basis of the following

By Type

- Carbohydrates

- Amylases

- Cellulases

- Others

- Proteases

- Lipases

- Polymerases & Nucleases

- Others

By Source

- Micro-organism

- Plant

- Animal

By Formulation

- Lyophilized Powder

- Liquid

- Dry

By Application

- Food & Beverages

- Baker & Confectionery

- Dairy

- Beverages

- Sugar

- Meat Processing

- Nutraceuticals

- Others

- Detergents

- Laundry

- Automatic Dishwashing

- Others

- Feed

- Ruminant

- Swine

- Poultry

- Aquafeed

- Others

- Bioethanol

- Soil Treatment

- Paper & Pulp

- Textiles & Leather

- Wastewater Treatment

- Oil Treatment

- Others

Regional Analysis

Leading Region in the Industrial Enzymes Market

North America is expected to continue leading the industrial enzymes market in 2025, with a revenue

share of 39.5%, which is driven by the strong presence of key industries, including food & beverages, laundry detergents, pharmaceuticals, and personal care & cosmetics. The region also benefits from extensive R&D activities, leading to advancements in enzyme technology. One notable development is the use of genetically modified microorganism strains to enhance food enzyme production, improving efficiency in food processing. With continuous innovation and widespread industrial applications, North America is expected to maintain its position as the leading market for industrial enzymes in the coming years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Industrial Enzymes Market

Asia Pacific is anticipated to experience the fastest industrial enzymes market during the forecast period due to rising meat consumption, particularly in China, driving demand for high-quality animal feed containing enzymes for improved digestion and nutrient absorption. Furthermore, expanding food processing, textile, and biofuel industries in countries like India and Japan are increasing enzyme consumption rapidly as industrialization and expanding applications expand exponentially over this region of Asia.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The industrial enzymes market is highly competitive, with several global and regional players competing for market share. Companies employ innovative research, strategic partnerships, biotechnology, genetic engineering, and mergers & acquisitions as tools for expanding market presence as demand across various industries grows quickly. Leading firms also invest heavily in biotechnology research for more efficient enzyme solutions, and many also utilize their merger & acquisition capabilities as means of expanding market presence further still. With increasing demands across various industries, companies continue to improve offerings to remain ahead in this rapidly expanding industry.

Some of the prominent players in the Global Industrial Enzymes are

- BASF

- DuPont

- AB Enzymes

- SABIC

- Lumora

- Enzyme Biosystems

- Enzymicals AG

- Biocon

- Lonza Group

- Royal DSM

- Allozymes

- Proviera

- Thermo Fisher Scientific Inc.

- Prozomix Ltd

- MetGen Oy

- Biocatalysts Ltd

- Nagase Viita Co

- Maps Enzymes Ltd

- Sunson Industry Group Co., Ltd

- Advanced Enzyme Technologies

- Other Key Players

Recent Developments

- In November 2024, IFF launched TEXSTAR, an advanced enzymatic texturizing solution that is expected to revolutionize the texture of both dairy and plant-based fresh fermented products, which provides the necessary viscosity in fresh fermented products without the use of added stabilizers. TEXSTAR will allow manufacturers to create products with unique textures that feature familiar, consumer-accepted ingredients

- In August 2024, Twist Bioscience Corporation launched a joint Transaminase Enzyme Screening Kit, which is a curated collection of forty-eight highly diverse transaminase enzymes ready for in-house screening and evaluation.

- In June 2024, Basecamp Research unveiled a partnership with the Ferruz Laboratory at the Institute of Molecular Biology of Barcelona and announced the release of ZymCTRL, a ChatGPT-like tool that generates new sequences from scratch based on a user simply typing in an enzyme identification code, which specifies the desired activity.

- In April 2024, Prozomix introduced a new partnership focused on building the production of next-generation enzyme plates for active pharmaceutical ingredient (API) manufacturing, which focuses on using Ginkgo's Enzyme Services and industry-leading AI/ML models along with Prozomix's existing enzyme libraries and deep experience manufacturing enzyme plates.

Report Details

|

Report Characteristics

|

| Market Size (2025) |

USD 8.5 Bn |

| Forecast Value (2034) |

USD 16.5 Bn |

| CAGR (2025-2034) |

7.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Carbohydrates, Proteases, Lipases, Polymerases & Nucleases, and Others), By Source (Micro-organism, Plant, and Animal), By Formulation (Lyophilized Powder, Liquid, and Dry), By Application (Food & Beverages, Detergents, Feed, Bioethanol, Soil Treatment, Paper & Pulp, Textiles & Leather, Wastewater Treatment, Oil Treatment, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BASF, DuPont, AB Enzymes, SABIC, Lumora, Enzyme Biosystems, Enzymicals AG, Biocon, Lonza Group, Royal DSM, Allozymes, Proviera, Thermo Fisher Scientific Inc., Prozomix Ltd, MetGen Oy, Biocatalysts Ltd, Nagase Viita Co, Maps Enzymes Ltd, Sunson Industry Group Co., Ltd, Advanced Enzyme Technologies, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Industrial Enzymes Market?

▾ The Global Industrial Enzymes Market size is expected to reach a value of USD 8.5 billion in 2025 and is expected to reach USD 16.3 billion by the end of 2034.

Which region accounted for the largest Global Industrial Enzymes Market?

▾ North America is expected to have the largest market share in the Global Industrial Enzymes Market with a share of about 39.5% in 2025.

How big is the Industrial Enzymes Market in the US?

▾ The Industrial Enzymes Market in the US is expected to reach USD 3.0 billion in 2025.

Who are the key players in the Global Industrial Enzymes Market?

▾ Some of the major key players in the Global Industrial Enzymes Market are BASF, DuPont, SABIC, and others

What is the growth rate in the Global Industrial Enzymes Market?

▾ The market is growing at a CAGR of 7.5 percent over the forecasted period.