The Industrial Fans Market refers to a sector focused on the design, production, and distribution of large fans that serve to manage air circulation, ventilation, and cooling in various industrial settings. These fans play an essential part in maintaining optimal operating conditions by improving air quality, temperature regulation, and energy consumption efficiency. Common applications for these fans include manufacturing plants, data centers, and commercial properties. Driven by technological innovations and growing energy-saving requirements, the market for ventilation systems has seen significant change over the past several years - such as smart controls and enhanced materials being introduced into products for mass ventilation applications. Recognizing these trends is integral in strategically deciding large-scale ventilation projects.

The Industrial Fans Market is experiencing significant transformation, driven by rising demands for improved air circulation and climate control in various industrial sectors. According to market researchers, several key trends are shaping this vibrant environment.

Energy efficiency and sustainability have taken center stage as companies shift toward innovation in fan technology. Recent innovations focus on high-performing, energy-efficient models that not only lower operational costs but also support compliance with increasingly stringent environmental regulations. This approach aligns well with corporate sustainability goals while being cost-effective for enterprises alike.

As digital economies continue to flourish, and particularly data center and server farm expansion is rapidly taking place, effective cooling solutions have become even more essential than before. Industrial fans play an essential part in maintaining optimal operating temperatures that ensure reliable IT infrastructure operation; concurrently they also play an essential part in manufacturing and automotive industries where robust ventilation systems ensure worker safety as part of operational efficiencies and worker protection strategies.

Key Takeaways

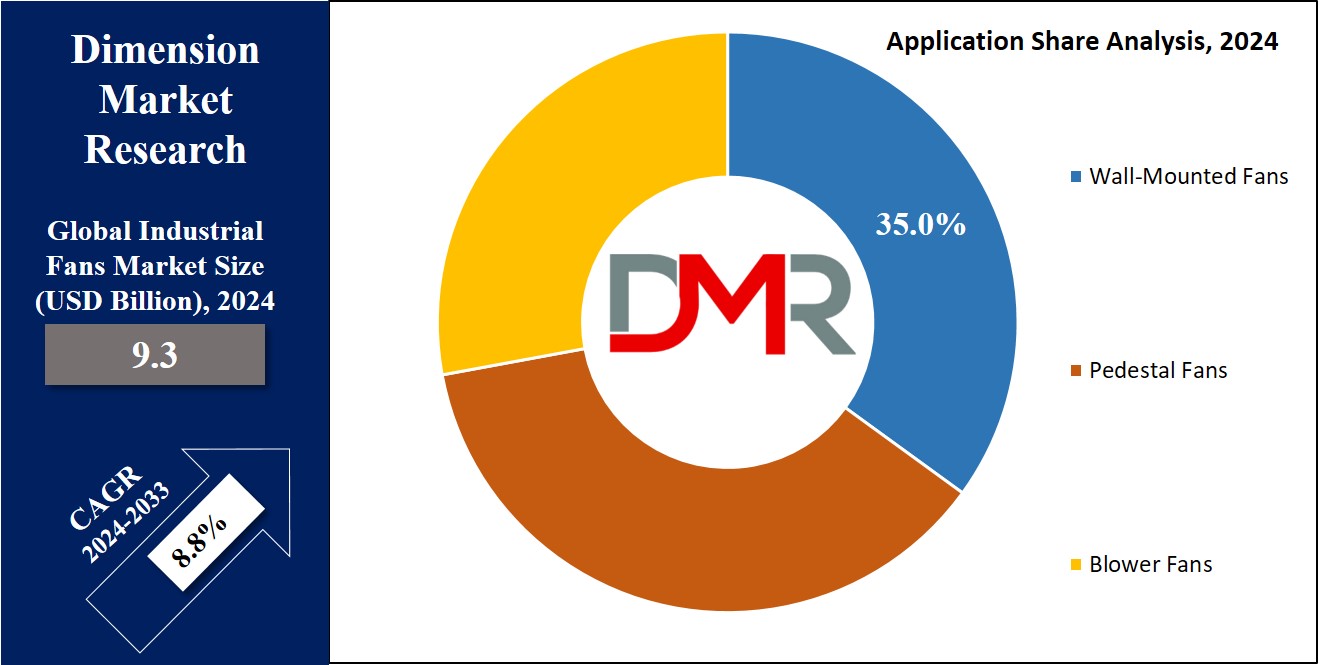

- Market Value and Growth: The market reached USD 9.3 billion in 2024 and is projected to grow to USD 20.0 billion by 2033, reflecting a CAGR of 8.8%.

- Dominating Product Type: Wall-mounted fans held the largest market share in 2023 at approximately 35%, valued for their space efficiency and targeted airflow.

- Leading End-User Sector: The Power Generation sector was the largest end-user, accounting for around 40% of the market share, driven by the need for effective cooling and ventilation.

- Top Regional Market: Asia Pacific led the market in 2023 with a 45% share, fueled by rapid industrialization and high demand from manufacturing and construction sectors.

- Key Growth Drivers: The expansion of the renewable energy sector and increasing demand for energy-efficient and customized solutions are significant growth drivers.

Use Cases

- Power Generation Facilities: Industrial fans are essential for cooling and ventilation in power plants, ensuring equipment stays cool and operational efficiency remains high.

- Data Centers and IT Infrastructure: As data centers grow, industrial fans are crucial for cooling servers and IT equipment, maintaining optimal temperatures for reliable operation and extended equipment lifespan.

- Renewable Energy Infrastructure: In wind and solar projects, industrial fans help manage heat and maintain efficiency, supporting the reliable performance of renewable energy systems in challenging conditions.

- Food and Beverage Production: Industrial fans regulate temperature and humidity in food processing and storage, preventing contamination and ensuring compliance with safety standards.

- Construction Sites: On construction sites, industrial fans improve air circulation and control dust, enhancing worker safety and project efficiency in dynamic environments.

Driving Factors

Issues Regarding Health and Safety Concerns

Health and safety considerations are one of the primary drivers behind Industrial Fans Market growth. An increased focus on maintaining safe working environments drives demand for effective ventilation systems that keep workers healthy. Industrial fans play an essential role in providing adequate air circulation and limiting risks posed by airborne contaminants, excessive heat, and humidity. By improving air quality and cooling, these fans help reduce the incidence of heat stress and respiratory conditions among workers. As health and safety regulations worldwide become more stringent, industrial fans that meet stringent standards are being adopted at an increasing pace - thus driving market demand upwards. Companies prioritizing employee wellbeing as well as regulatory compliance may invest more heavily in high-performance ventilation solutions with safety-oriented features which in turn spur growth within this market segment.

Food and Beverage Industry Growth

The food and beverage industries have had an immense effect on the Industrial Fans Market since their growth has created increasing consumer demands and production scale. Therefore, more effective air circulation becomes essential. Industrial fans play an essential part in maintaining clean environments by controlling temperature and humidity levels - this is essential when handling food for processing or storage, to prevent contamination of products and ensure compliance with health and safety regulations. Food and beverage industries continue their significant expansion, which necessitates using advanced industrial fans for large-scale operations and automated production lines. This increased need for reliable air management solutions contributes directly to market expansion.

Expanding Renewable Energy Sector

Renewable energy expansion is also driving the growth of the Industrial Fans Market. As society shifts toward sustainable sources of power production, cooling solutions for renewable infrastructure (such as wind turbines or solar plants) become even more critical to maintain. Industrial fans play an essential role in maintaining and cooling critical systems that operate under variable and often harsh environmental conditions, like wind turbines. Such installations need robust cooling solutions in place to effectively regulate operational temperatures and ensure efficiency. Renewable energy projects requiring industrial fans require advanced industrial fans that are designed to withstand challenging conditions while offering reliable performance, creating demand from this sector that drives innovation and expands the market for fans, aligning with global sustainability goals while supporting the transition towards cleaner sources of power.

Growth Opportunities

Expanding into Renewable Energy Sector

Renewable energy offers industrial fans an extraordinary growth opportunity. As investments in wind and solar power increase, cooling solutions supporting these technologies become ever more necessary to support operation efficiently and ensure longevity of operation. By catering products specifically to meet the specific requirements of renewable energy infrastructure manufacturers can capture a share of this fast-growing market segment that aligns with global sustainability goals and technological developments.

Custom Designed Solutions for Industry Specific Needs

Customization has become increasingly important as industries seek tailored solutions for unique operational challenges. Industrial fans in industries such as food and beverage, pharmaceuticals, and heavy manufacturing must meet rigorous hygiene, temperature control, and durability standards; developing tailored solutions tailored specifically to these industries' requirements can differentiate manufacturers in an otherwise competitive market and foster client loyalty by emphasizing industry-specific features and regulatory compliance with specialized product offerings that strengthen value proposition and strengthen client relationships while driving market expansion through tailored offerings.

Enhancing aftermarket services

Focusing on comprehensive aftermarket services represents an excellent growth opportunity. As industrial fans become more sophisticated, regular maintenance and support are required for optimal performance and longevity. Enhancing aftermarket services through preventive maintenance, real-time monitoring, and rapid response support services can significantly enhance customer satisfaction and loyalty while simultaneously expanding lifecycle extension through service contracts or upgrades while strengthening market position and creating long-term client relationships.

Key Trends

Focus on Energy Efficiency for maximum savings

Energy efficiency has long been at the core of industrial fan innovation. Driven by rising regulatory requirements and cost-cutting initiatives, there is now more emphasis placed on energy-saving products as industries face increased energy bills and tightened environmental laws worldwide. There has been an emphasis placed on creating efficient fan solutions. Modern industrial fans feature innovative technologies to reduce power consumption while still meeting optimal performance, including variable frequency drives (VFDs) and advanced aerodynamic designs. Adopting energy-efficient fans not only helps businesses meet environmental regulations while cutting operational costs significantly; further cementing market emphasis on sustainability and efficiency.

Emerging Markets Show Significant Signs of Prosperity

Emerging markets are experiencing rapid industrialization and infrastructure development, sparking significant surges in fan demand across Asia-Pacific, Latin America, and parts of Africa. Companies investing heavily in manufacturing, energy production, and construction activities require reliable air management solutions for reliable production processes - an opportunity companies should seize. Tailoring products specifically to fit into emerging market needs such as climate conditions adaptation or compliance with local regulations will be vital in capitalizing on this expansion potential.

Shifting towards Localized Manufacturing

Local manufacturing is revolutionizing the industrial fan industry, driven by shorter supply chains and greater responsiveness to regional demands. Due to global disruptions and rising transportation costs, companies are turning towards local production facilities as an efficient response for increased agility, reduced lead times, customization to specific regional requirements, and strengthened customer relations through enhanced support services - ultimately strengthening market resilience while simultaneously opening opportunities for innovation and market differentiation.

Restraining Factors

Stringent Regulatory Compliance Requirements

Regulative compliance poses a substantial obstacle for the Industrial Fans Market, both operationally and market entry. Industries increasingly must comply with stringent environmental and safety regulations such as emissions standards and energy efficiency mandates that mandate continuous product innovation as well as adherence to complex standards - which increases production costs while lengthening time-to-market. Manufacturers may need to invest in advanced technologies or materials just to meet compliance, placing strain on financial resources, especially for smaller players; additionally, increased prices for end users could eventually stall market adoption and growth.

Competition Is Intense Within This Industry

The Industrial Fans Market is marked by intense competition that restrains profit margins and can thwart innovation. Established and new entrants alike vie for market share; companies must differentiate themselves through pricing strategies, product features, and superior customer service to stay afloat in this environment. Price wars often result in losses for all involved that impact future investments or product developments, leading to lower margins overall as a result of trying to maintain market share while increasing marketing expenditures thereby hindering overall stability and growth potential of their market.

Limited Awareness of Benefits

Lack of awareness among potential customers regarding the advantages of advanced industrial fans hinders market expansion. Despite advances in fan technology that increase energy efficiency and cut operational costs, many industries remain unaware of these advantages; this knowledge gap often results in slower adoption rates or hesitation to invest in more efficient technologies; for instance, some may continue using outdated fans due to a misunderstanding regarding long-term savings and performance enhancement offered by modern solutions; targeted education and marketing efforts are critical in closing this awareness gap and driving market adoption.

Research Scope Analysis

By Product Type

Wall-Mounted Fans held a dominant market position within the Product Type segment of the Industrial Fans Market in 2023, accounting for approximately 35% of the global market share. Their success can be attributed to their space-saving design and ability to provide targeted airflow - two features that make wall-mounted fans ideal for facilities with limited floor space or in industrial environments where ventilation and cooling efficiency is of utmost importance.

Pedestal Fans represent approximately 30% of the market. Thanks to their versatility and mobility, pedestal fans are an increasingly popular choice among consumers and industrial users. Their ability to provide substantial airflow across large surfaces makes pedestal fans ideal for cooling larger areas while improving circulation in environments with fluctuating temperature needs.

Blower Fans were an important segment of the market, making up roughly 25%. Well-known for their high airflow delivery capacity and robust construction, blower fans are an indispensable solution for applications requiring effective ventilation and cooling - such as manufacturing plants or large warehouses where controlling air quality and temperature are crucial elements.

By End-User

Power Generation facilities were an extremely prominent force in the Industrial Fans Market in 2023, accounting for approximately 40% of total market shares. This could be explained by their need for efficient cooling and ventilation to maintain optimal operating conditions and ensure system reliability. Industrial fans played an indispensable role here.

Oil & Gas was close behind, representing around 25% of market share. Industrial fans used in this sector are crucial in maintaining safety and operational efficiency under high temperatures and corrosion, such as cooling and ventilation in refineries and extraction sites. A substantial demand reflects their importance as safety nets to help safeguard operations in these high-stakes environments.

The construction industry held an impressive 15% of the market share. Industrial fans play an essential role on construction sites for controlling dust and improving air circulation - essential elements to worker safety and project efficiency. Their versatility and mobility make them well suited to meet the dynamic conditions found there.

Chemicals made up approximately 10% of market share. Fans are used in this sector to handle hazardous materials safely while also ensuring proper ventilation, which helps create safe working environments by avoiding potential fume build-up.

Iron & Steel and Mining industries each held approximately five percent of the market. Fans were used in both industries to manage high temperatures and ventilation requirements within smelting and processing plants while mining needed fans for providing fresh air into underground operations and controlling dust.

The Industrial Fans Market Report is segmented based on the following:

By Product Type

- Wall-Mounted Fans

- Pedestal Fans

- Blower Fans

By End-User

- Power Generation

- Oil & Gas

- Construction

- Chemicals

- Iron & Steel

- Mining

- Others

Regional Analysis

Asia Pacific emerged as the dominant region in the Global Industrial Fans Market in 2023, accounting for approximately 45% of the total market share. This accomplishment can be attributed to rapid industrialization and rising manufacturing activities within this region, as well as high fan demand driven by construction projects and expanding industrial sectors such as China and India - reinforcing Asia Pacific's significant role within the global market.

North America held a significant market share, which stood at 25%. This strength can be attributed to its advanced infrastructure, high adoption rates of energy-saving technologies, and significant investments into power generation and oil & gas industries; in addition, both countries' emphasis on upgrading industrial facilities while adhering to stringent safety regulations helped drive robust demand for industrial fans.

Europe held approximately 20% market share. Europe's focus on regulatory compliance and environmental sustainability fueled industrial fan installations within industries like chemicals and automotive production, while their commitment to energy efficiency projects and renewable energy initiatives further stimulated demand for advanced ventilation solutions.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

2023 will see the Global Industrial Fans Market being strongly shaped by a diverse set of key players who all bring specific strengths to the industry. Airmaster Fans have excelled at providing energy-efficient solutions that comply with stringent environmental and regulatory standards while EPOCH FANS is known for cutting-edge noise reduction technology that maximizes energy efficiency for commercial as well as industrial applications, making it a top pick among many users.

Berner International and Wujiang Deshengxin Purification Equipment Company Limited have earned notable market shares by specializing in high-quality air curtains and advanced industrial ventilation systems, respectively.

Berner's innovations in air curtain systems provide significant energy savings and climate control; Wujiang Deshengxin strives to meet stringent air quality standards essential to industries like chemicals and manufacturing; while Phoenix Manufacturing and National Fan Company excel at offering cost-effective yet high-performance solutions, expanding their market influence even further.

Triangle Engineering and Hunter Industrial are widely recognized for providing customized fan solutions that enhance operational efficiency across demanding sectors such as power generation and oil & gas. Howden American Fan Company and J&D Manufacturing provide advanced engineering capabilities and reliable fan solutions for critical industrial processes. SPARTAK JSC and Twin City Fan offer extensive product lines tailored specifically to customer requirements, while ANJOS Ventilation Systems make significant strides forward with advanced air handling systems. Ferrari Industrial Fans distinguishes itself in the competitive landscape by providing high-performance, versatile fans designed to suit various industrial applications. Collectively, these players advance the market with innovation, efficiency, and customization aimed at meeting shifting industrial demands as well as technological developments.

Some of the prominent players in the Global Industrial Fans Market are:

- Airmaster Fans

- EPOCH FANS

- Berner International

- WujiangDeshengxin Purification Equipment Company Limited

- Pheonix Manufacturing

- National Fan Company

- Triangle Engineering

- Hunter Industrial

- Howden American Fan Company

- J&D Manufacturing

- SPARTAK JSC

- Twin City Fan

- ANJOS

- Uvents Ventilation Systems

- Ferrari Industrial Fans

Recent developments

- In January 2022, a major UK firm reintroduced a fast product line of industrial fans designed for efficient air transport, expected to boost UK market growth.

- In November 2022, a U.S. company launched CoolMan® Zone Fans to improve worker comfort, cut power costs, and stabilize factory temperatures.

- In September 2023, a key manufacturer introduced IntelliCUBE Axial Fans to enhance its position in the HVAC sector.

- In May 2022, a global leader opened a $30 million production plant in the USA for high-efficiency fans and motors, strengthening its North American presence.

- In June 2022, a company invested $7.5 million in new automation equipment at its Oklahoma facility, increasing production capacity and quality.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 9.3 billion |

| Forecast Value (2032) |

USD 20.0 billion |

| CAGR (2023-2032) |

8.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Wall-Mounted Fans, Pedestal Fans, and Blower Fans), By End-User (Power Generation, Oil & Gas, Construction, Chemicals, Iron & Steel, Mining, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Airmaster Fans, EPOCH FANS, Berner International, WujiangDeshengxin Purification Equipment Company Limited, Pheonix Manufacturing, National Fan Company, Triangle Engineering, Hunter Industrial, Howden American Fan Company, J&D Manufacturing, SPARTAK JSC, Twin City Fan, ANJOS, Uvents Ventilation Systems, Ferrari Industrial Fans, and others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |