Market Overview

Global

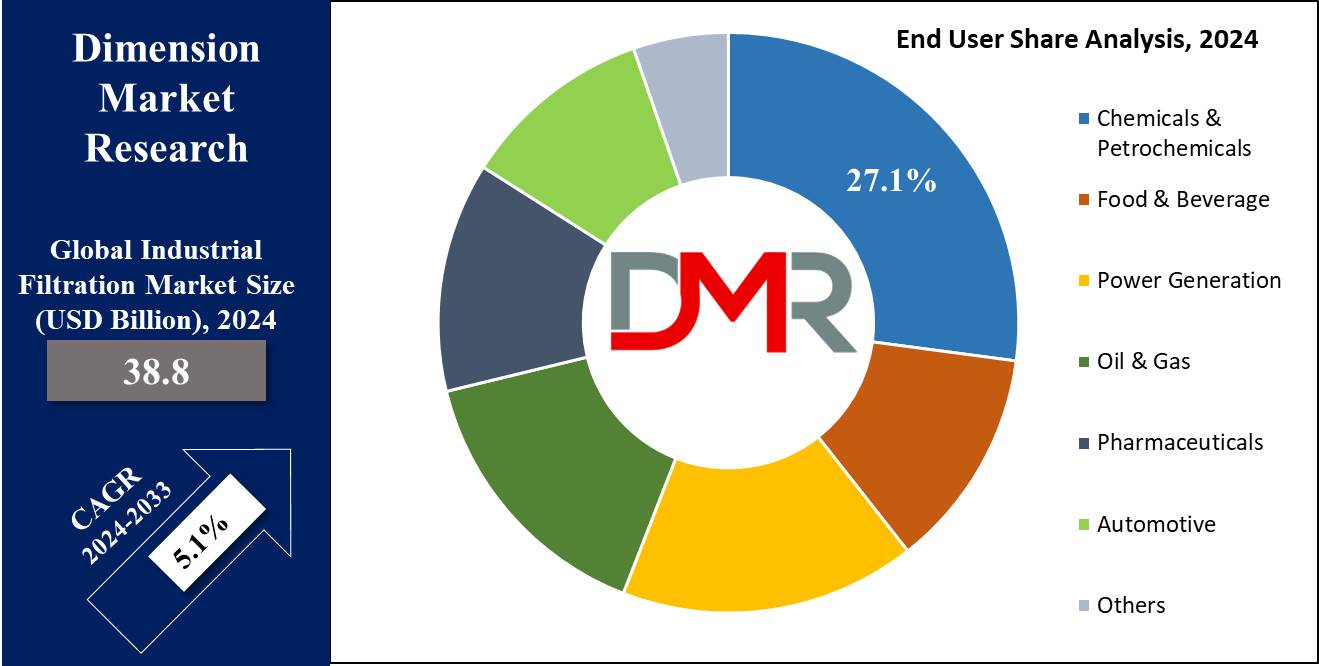

Industrial Filtration Market is forecasted to reach

USD 38.8 billion by the end of 2024 and grow to

USD 60.7 billion in 2033, with a

CAGR of 5.1%.

Industrial filtration is the process of removing unwanted particles, contaminants, or impurities from air, liquids, or gases used in industrial settings. Filtration is a separation method used in industries like chemicals & petrochemicals, metals & mining, and pharmaceuticals, where impurities in air and fluids are removed by placing a barrier between the flow of air or fluids.

There is a growing demand for clean energy, pure water, safe food supplies, and enhanced medical services with the global population expansion and rapid urbanization which is expected to drive market growth.

The US Industrial Filtration Market

The US Industrial Filtration Market is projected to reach USD 12.0 billion by the end of 2024 and grow substantially to an expected USD 18.3 billion market by 2033 at an anticipated CAGR of 4.8%.

The U.S. industrial filtration market is primarily driven by stringent environmental regulations aimed at reducing air and water pollution, such as the Clean Air Act and Clean Water Act. Additionally, advancements in manufacturing technologies, which improve filtration efficiency and reduce energy consumption, are key drivers in the market’s growth.

There is also a growing demand for advanced filtration materials, such as nanofibers and membranes, offering enhanced performance and energy efficiency. Digitalization and the use of IoT-enabled filtration systems for real-time monitoring are gaining momentum, helping industries optimize maintenance schedules.

Key Takeaways

- Market Growth: The global Industrial filtration market is anticipated to expand by USD 20.1 billion, achieving a CAGR of 5.1% from 2025 to 2033.

- Market Definition: Industrial filtration refers to the process of removing impurities and contaminants from fluids or gases in industrial applications.

- Type Analysis: Liquid Filtration is projected to hold the largest revenue share of 69.2% based on products in the market in 2024.

- Filter Media Analysis: Fiberglass is anticipated to lead the market with the largest revenue share of 58.6% based on filter media in the market in 2024.

- Product Analysis: Bag filters are forecasted to lead the global Industrial filtration market in the context of product with a revenue share, in 2024.

- End User Analysis: Chemical & petrochemicals are anticipated to dominate the market with the largest revenue share of 27.1% based on end users in the market in 2024.

- Regional Analysis: North America is projected to dominate the global Industrial filtration market, holding a market share of 35.4% by 2024.

Use Cases

- Water and Wastewater Treatment: Industrial filtration is crucial in water and wastewater treatment plants to remove contaminants such as suspended solids, bacteria, and chemical pollutants.

- Oil and Gas Industry: Filtration systems are essential in the oil and gas sector to separate impurities from crude oil and natural gas. Filtration is applied to remove particulates, water, and other contaminants during production, refining, and transportation processes.

- Pharmaceutical and Biotechnology: Industrial filtration is used to sterilize liquids and gases used in drug production. High-efficiency filters are used to remove bacteria, viruses, and particulate matter from the process fluids, ensuring the production of sterile pharmaceutical products.

- Food and Beverage Industry: Filtration is widely used to ensure the safety and quality of food and beverages. It is employed to remove impurities, such as sediments, bacteria, and unwanted particles, from liquids like juice, beer, and milk.

Market Dynamic

Drivers

Investments in Refinery and Petrochemical InfrastructureThe growing energy demand has led to increased investments in refinery and petrochemical infrastructure. Refineries process crude oil into essential products like gasoline, diesel, jet fuel, and petrochemicals, which are used in various industries, from plastics to pharmaceuticals. This surge in energy needs is driving a rise in demand for refinery and petrochemical filtration systems, which drives the growth of the industrial filtration market.

Employee Health and Safety Considerations

Increasing industrialization and urbanization are some of the major factors driving the industrial filtration market. Rising industrialization operations lead to huge funding for industrial filtration companies which creates new advanced technology solutions for filtration. The health of employees is valuable and that’s why industries are stringent about using industrial filtration on their premises ultimately expanding the growth of the market.

Restraints

High Initial Investment and Operating Costs

Fluctuating prices of raw materials and their unpredictable supply can limit the growth of the industrial filtration market. Industrial filtration systems, particularly advanced ones like membrane filtration and HEPA filters, often require significant capital investment. The installation, maintenance, and energy consumption of these systems can be costly.

Limited lifespan of filter material

Many filtration technologies face limitations in handling diverse industrial applications, such as filtering very fine particles or dealing with high-temperature or chemically aggressive environments. Furthermore, the filters themselves often have limited lifespans and require frequent replacement or cleaning, which can interrupt production processes and add to operational costs.

Opportunities

Potential of Activated Carbon Filters in Water Treatment

Industrial filtration systems are required by the cement, pharmaceutical, paper, and petroleum sectors. It provides a great opportunity for the implementation of activated carbon filters in the water treatment industry to remove chlorine and other effluents. It may lead to an increase in the adoption of these filtration systems in the industries soon, resulting in a faster market growth rate.

Food Safety Concerns and Filtration Solutions

Food & beverage companies are installing filtration systems in their manufacturing facilities to prevent heart disease, obesity, and diabetes. Also, with the growing popularity of organic farming and the widespread application of pesticides and fertilizers, food safety concerns may increase, and demand for filtration systems in the market.

Trends

Impact of Industry 4.0 on Filtration Efficiency

Industrial filtration is being increasingly digitalized as a result of Industry 4.0 adoption, which has aided producers in efficiently tracking operational performance and gathering real-time data. The information gathered in this way aids in monitoring and assessing system performance as well as gathering system overview, forecasting maintenance requirements and downtime, and automating procedures.

Filtration Technologies Extending Human Life Expectancy

Transformative breakthroughs in the pharmaceuticals and life sciences industry have significantly contributed to extending human life expectancy while promoting a healthier, more productive lifestyle. Consequently, sectors like diagnostics and medical research have increasingly turned to filtration technologies, such as microfiltration and ultrafiltration, instead of chemical methods to ensure the safety and purity of products.

Research Scope and Analysis

By Type

Liquid Filtration is expected to dominate the Industrial Filtration Market with a revenue share of 69.2% in 2024, as it involves the removal of suspended solid particles, impurities, and pollutants from a fluid stream. It is performed by passing the liquid (often in the form of slurries and suspensions) through a porous filter medium, which traps and retains the unwanted particles. The filter media pores only allow liquid to pass through while keeping the contaminants on the other side.

Also, Government regulations across the globe are increasingly focused on wastewater treatment and the reduction of industrial emissions. These regulations drive the demand for liquid filtration systems to ensure that industries meet environmental compliance by removing harmful substances from wastewater before its discharge. Liquid filtration serves purposes like purification, clarification, separation, and particle removal across various industries and applications.

Further, there is increasing demand for water conservation and treatment which drives the need for advanced filtration systems. Recent innovations in filtration technology, such as membrane filtration and self-cleaning filters, have enhanced the efficiency and cost-effectiveness of liquid filtration. Meanwhile, the air and gas segment is predicted to have notable growth in the market as sectors such as metals & mining, chemicals, healthcare, and food & beverage are required to filter their air emissions to reduce the release of harmful gases and fumes into the atmosphere.

By Filter Media

Fiberglass filter media is expected to hold 58.6% market revenue share by 2024 due to its lightweight properties and excellent thermal resistance capabilities, enabling it to withstand high-temperature environments without succumbing to dissolution or degradation. These filters are an ideal fit for industries such as power generation, automotive, and chemical processing where hot gases or liquids need filtering out. Their superior strength and durability make them suitable for environments involving high levels of mechanical or chemical stress or exposure.

Fiberglass filters deliver exceptional filtration efficiency when it comes to filtering out fine particles - this makes it the go-to material in air and gas filtration applications. They're cost-effective compared to alternative materials as well, offering both performance and affordability in one solution. Activated Carbon has many unique properties that enable it to be customized into custom filtration systems for various industrial uses, increasing its utility across a wide array of industrial sectors. As such, its market is projected to experience rapid expansion during its projected lifespan due to these unique qualities.

By Product

Bag filters are projected to become the market leader in industrial filtration with the highest revenue share by 2024 due to their widespread applications across different industries. They are used for dust collection and liquid filtration applications in industries like food and beverage production, pharmaceutical manufacturing, chemical processing facilities, cement companies, and more.

Their popularity lies in capturing particulate matter where air quality control and emissions regulation is of critical concern. Bag filters have become an increasingly popular choice due to their modular designs, ease of installation, cost-effectiveness, and large capacity storage capacities - these qualities combined make bag filters highly desirable in industrial processes where downtime cannot be afforded for regular operations.

Cartridge filters are another leading segment in the market and are popularly utilized for fine filtration applications in industries like oil & gas, petrochemicals, and water treatment, which require precise filtration precision. Their effectiveness lies in their removal of smaller contaminants for enhanced purity levels in liquid as well as gas applications.

By End User

Chemical & petrochemicals are likely to lead the industrial filtration market with the highest revenue share of 27.1% in 2024, due to the complex and hazardous nature of the processes involved. Industrial filtration is necessary in this sector to preserve chemical purity, remove impurities from gases and liquids, protect equipment against contamination, and ensure compliance.

Filters are used in an assortment of processes and applications, from refining processes and catalyst recovery to polymer filtration and water treatment, as well as food and beverage segments that follow stringent hygiene regulations. Food & beverage is projected to become one of the leading applications of industrial filtration technology. Filtration plays an essential part in food safety by filtering out contaminants, bacteria, and impurities that might present health concerns.

Filtration technology can be found throughout food manufacturing - water filtration for beverage production, air filtration in food processing environments and liquid filtration for dairy, beverages, oils, and sauce production are just a few applications used across this vast industry. Filtration ensures final food and beverage products comply with required quality standards while food manufacturers can maintain product purity, taste, and shelf life by filtering away particles and contaminants through industrial filtration.

Global Industrial Filtration Market Report is segmented on the basis of the following

By Type

- Air & Gas Filtration

- Liquid Filtration

By Filter Media

- Fiberglass

- Activated Carbon/ Charcoal

- Filter Paper

- Metal

- Nonwoven Fabric

- Others

By Product

- Filter Press

- Bag Filter

- Drum Filter

- Depth Filter

- Electrostatic Precipitator

- Others

By End User

- Chemicals & Petrochemicals

- Food & Beverage

- Power Generation

- Oil & Gas

- Pharmaceuticals

- Automotive

- Others

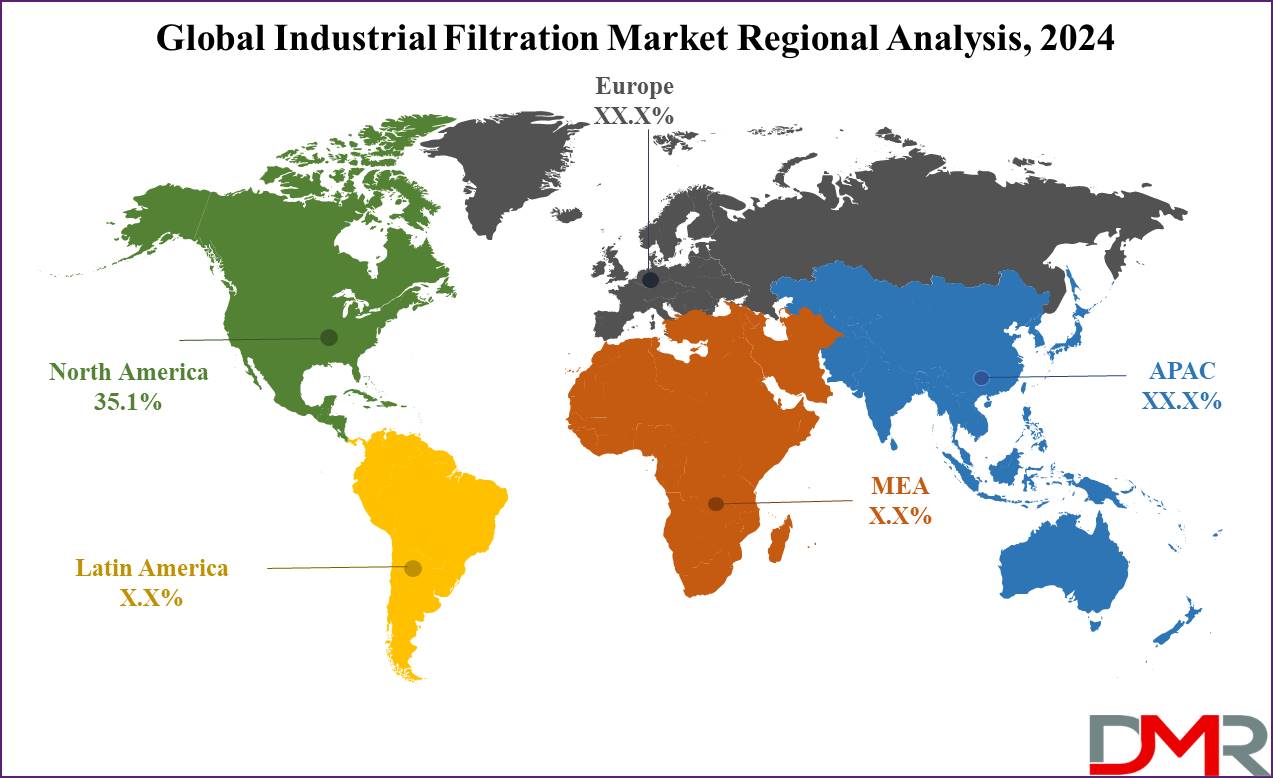

Regional Analysis

North America is projected to lead the industrial filtration market with an anticipated

revenue share of 35.4% by 2024. The industrial filtration market has experienced explosive growth in this region over recent years due to increased investments made in manufacturing to reduce harmful particle emissions and stricter air pollution control regulations. These regions are well known for their high level of government air pollution regulation standards and they host one of the largest power generation pollutants to the market and thereby are credited for market growth.

Many industries are located in these metropolitan regions and these are the Food and beverage; Chemical and Petrochemical; Oil and gas exploration and production; and Automobile industries. All require advanced filtration solutions for operational efficiency, safety, and environmental protection purposes. Regional industries rely heavily on filtration technologies in manufacturing processes. Furthermore, an increase in focus on energy conservation and sustainability among businesses has generated increased interest in more effective filtration systems.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the industrial filtration market is semi-consolidated, with the top 10 companies controlling over 50% of the market share. Leading players have heavily invested in research and development to advance various filtration systems. These market leaders focus on offering a diverse range of filtration media and technologies, along with excellent operational performance and customer service, as key strategies for growth. Additionally, major companies have pursued mergers and acquisitions of smaller firms to expand their product offerings and related services. This trend is expected to influence the global market in the coming years positively.

Some of the prominent players in the global industrial filtration market are

- Pall Corporation

- Mott Corporation

- Aqseptance Group

- Universal Filtration

- Alfa Laval Inc.

- Donaldson Company, Inc.

- Freudenberg Filtration Technologies SE & Co. KG

- Mann + Hummel

- Parker Hannifin Corp.

- Filtration Group

- Markel Corporation

- Lydall, Inc.

- Other Key Players

Recent Development

- In September 2022, ZwitterCo, a startup focused on wastewater reprocessing, revealed it had raised USD 33 million to develop chemically engineered membrane water filtration systems tailored for large farms and industrial clients. The patented filtration technology was developed by researchers at Tufts University.

- In May 2022, EKOTON Industrial Group and ESMIL Process Systems announced a brand merger, with ESMIL Group now operating as the unified name for both companies. The brands were officially merged under a single owner in 2020, and this integration marks the next phase. Leveraging the combined expertise and extensive experience in the water and wastewater sector, the company aims to tackle even the most challenging issues.

- In April 2022, Woosh secured USD 1.3 million in a pre-seed funding round aimed at enhancing indoor air quality and the efficiency of HVAC (heating, ventilation, and air conditioning) systems. The company launched its product on Kickstarter and plans to deliver it to consumers in the fourth quarter of 2022.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 38.8 Bn |

| Forecast Value (2033) |

USD 60.7 Bn |

| CAGR (2024-2033) |

5.1% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 12.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Air & Gas Filtration, Liquid Filtration), By Filter Media (Fiberglass, Activated Carbon/ Charcoal, Filter Paper, Metal, Nonwoven Fabric, and Others), By Product (Filter Press, Bag Filter, Drum Filter, Depth Filter, Electrostatic Precipitator, and Others), By End User (Chemicals & Petrochemicals, Food & Beverage, Power Generation, Oil & Gas, Pharmaceuticals, Automotive, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Pall Corporation, Mott Corporation, Aqseptance Group, Universal Filtration, Alfa Laval Inc., Donaldson Company, Inc., Freudenberg Filtration Technologies SE & Co. KG, Mann + Hummel, Parker Hannifin Corp., Filtration Group, Markel Corporation, Lydall, Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Industrial Filtration Market size is estimated to have a value of USD 38.8 billion in 2024 and is expected to reach USD 60.7 billion by the end of 2033.

North America is expected to be the largest market share for the Global Industrial Filtration Market with a share of about 35.4% in 2024.

Some of the major key players in the Global Industrial Filtration Market are Pall Corporation, Mott Corporation, Donaldson Company, Inc., and many others.

The market is growing at a CAGR of 5.1% percent over the forecasted period.

The US Industrial Filtration Market size is estimated to have a value of USD 12.0 billion in 2024 and is expected to reach USD 18.3 billion by the end of 2033.