The Industrial Gas Cylinder Market encompasses high-pressure cylinders' design, production, and distribution for transporting industrial gases such as oxygen, nitrogen, hydrogen, and acetylene. Cylinders play a vital role in manufacturing, healthcare, energy, and aerospace sectors where precise gas delivery is essential for operational efficiency and safety. Advances in materials technology, regulatory standards, and an ever-increasing demand for gas among emerging industries heavily impact market dynamics. Strategic players strive to enhance safety features, expand production capacities, and develop sustainable solutions to meet global industries' ever-evolving needs while supporting high-performance operations.

The Industrial Gas Cylinder Market is projected to experience significant expansion, thanks to technological innovations and changing industry dynamics. Analysts anticipate significant progress for this sector due to its increasing relevance across key industries like manufacturing, healthcare, energy production, aerospace, etc. It's been observed that more efficient, longer-lasting, and eco-friendly cylinder designs and materials have resulted in greater safety and environmental sustainability - providing companies with more opportunities for growth than ever before!

Clean energy's rising popularity and hydrogen's prominence as an essential fuel are redefining market dynamics in the energy sector, driving an explosion in hydrogen cylinder sales driven by their indispensable role in supporting energy storage and sustainable transportation solutions. Meanwhile, healthcare sector expansion has created demand for high-purity medical gas cylinders due to demographic trends and expansion.

Regulatory pressures have an immense effect on market trends, necessitating continuous improvements to cylinder design and manufacturing processes due to stringent safety requirements. Companies are prioritizing compliance and investing in advanced safety features to meet stringent regulatory requirements while improving overall gas handling practices and storage practices. Digital technologies and data analytics are also contributing to inventory optimization and operational efficiencies - further driving market expansion.

Key Takeaways

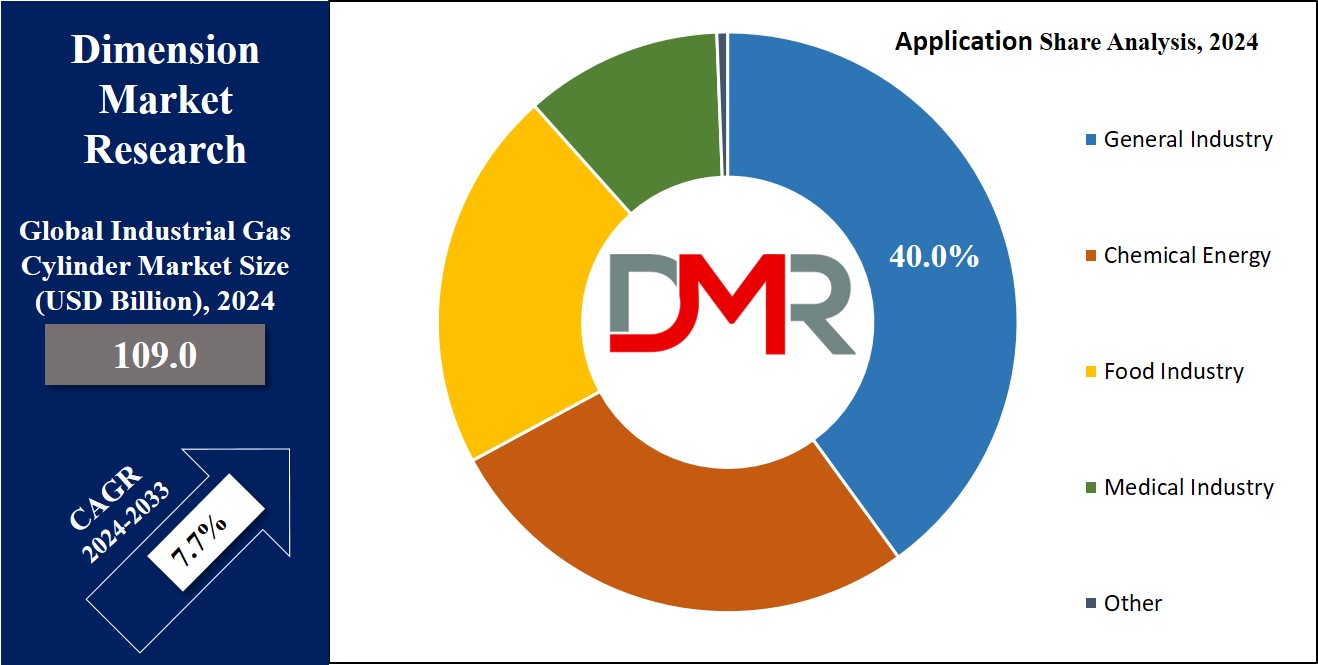

- Market Growth: The Industrial Gas Cylinder Market is projected to grow from USD 109.0 billion in 2024 to USD 213.2 billion by 2033, at a CAGR of 7.7%.

- Dominant Segment: Steel industrial gas cylinders held a significant market share of approximately 45% in 2023, driven by their durability and cost-effectiveness.

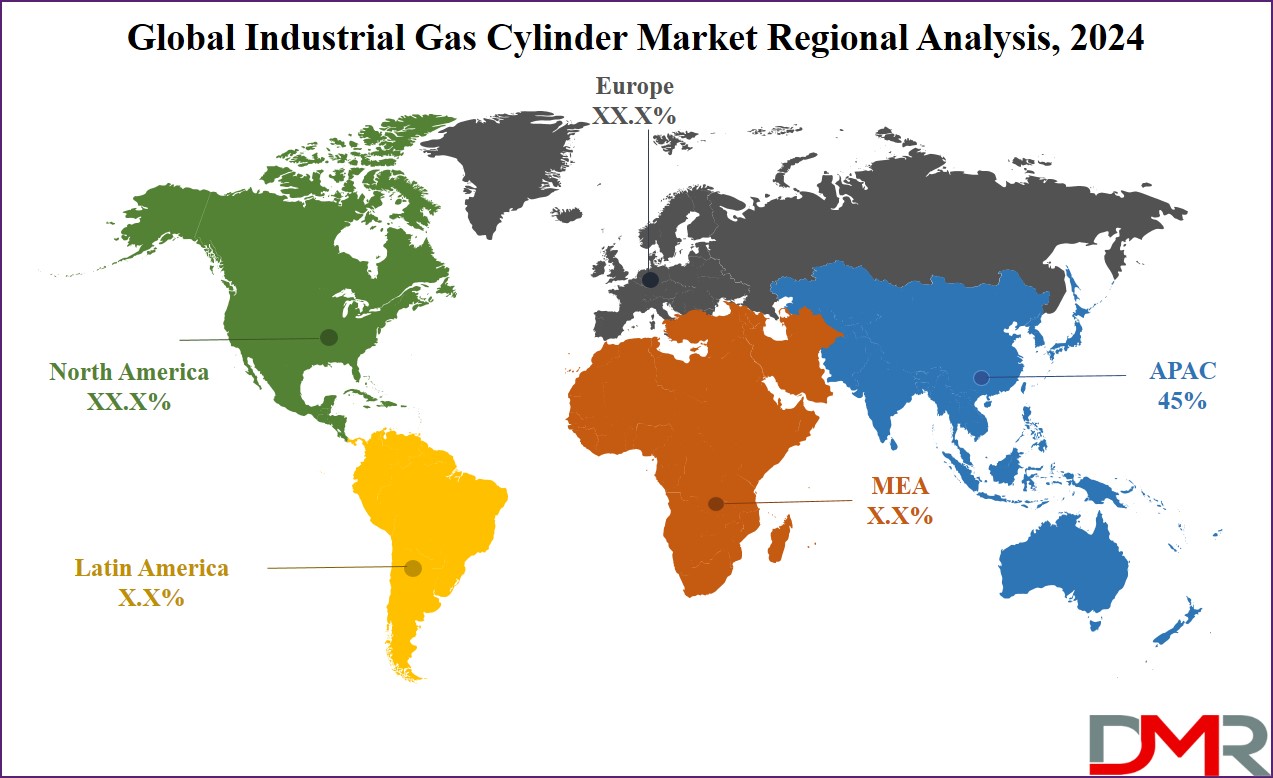

- Leading Region: The Asia Pacific region dominates the market, accounting for around 45% of the global share in 2023, propelled by rapid industrialization and increasing demand for gases.

- Emerging Applications: The automotive sector's shift towards alternative fuel vehicles, especially hydrogen fuel cells, is significantly driving the demand for high-pressure hydrogen cylinders.

- Technological Advancements: The market is seeing a rise in the adoption of smart cylinders with advanced safety features and digital technologies for operational efficiency, aligning with regulatory pressures for enhanced safety.

Use Cases

- Healthcare: High-purity medical gas cylinders are essential for oxygen supply and anesthesia in hospitals, driving demand for safety-compliant designs as healthcare infrastructure expands.

- Manufacturing: A reliable gas supply for welding and cutting is crucial as manufacturing grows. Steel and composite cylinders enhance efficiency and safety, focusing on lightweight and durable innovations.

- Alternative Fuels: The shift to hydrogen fuel cell vehicles is increasing demand for hydrogen cylinders. These are vital for safe storage and transport, supporting the automotive industry's transition to cleaner energy.

- Renewable Energy: Industrial gas cylinders are critical for hydrogen storage in renewable energy projects, enabling safe transport and compliance with environmental standards as the sector grows.

- E-commerce Distribution: The rise of e-commerce is transforming the distribution of gas cylinders, allowing for streamlined operations and improved customer access, enhancing overall market reach and efficiency.

Driving Factors

Manufacturing Activities have witnessed significant expansion

Industrial Gas Cylinder Market growth has been significantly driven by an explosion of manufacturing activities. Industries like automotive, aerospace, and electronics are ramping up production to meet global demand, necessitating efficient and dependable gas cylinders - whether oxygen, nitrogen, or argon for applications such as metal cutting welding and creating an inert atmosphere during production processes.

According to industry reports, the manufacturing sector's post-pandemic recovery and projected growth is projected to create significant demand for industrial gas cylinders. Global manufacturing activity is forecasted to expand at an average compound annual growth rate of 5.4% between 2023-2028; this means increased use of industrial gases which require storage cylinders that ensure safe transportation of these products safely and efficiently. Manufacturing activity not only stimulates this need for storage solutions; it also inspires technological innovations within cylinder technology such as improved materials or designs for enhanced safety and efficiency resulting from manufacturing activities - something this market report predicts will drive significant demand for industrial gas cylinders from 2028 onwards.

Emergence of Alternative Fuel Vehicles

The increase of alternative fuel vehicles such as electric and hydrogen-powered cars is rapidly changing the Industrial Gas Cylinder Market. As more automotive industries transition towards greener technologies, hydrogen fuel cells have emerged as viable replacements to traditional internal combustion engines - hydrogen gas cylinders play a critical role in this transition by providing necessary storage solutions for FCVs (fuel cell vehicles).

The market for hydrogen fuel cells is experiencing rapid expansion, with global vehicle sales projected to hit USD 36.4 billion by 2030 and increasing at a compound annual growth rate of 25.4% from 2023. This surge directly impacts demand for industrial gas cylinders designed for hydrogen storage and transport; further driven by zero-emission vehicles and renewable energy solutions that require clean fuel sources like hydrogen as an alternative fuel source - fueling an even greater need for high-capacity and high-pressure hydrogen cylinders with enhanced technological features like safety features that contribute not only to market expansion but also contributes to technological advances within these cylinder designs and safety features as they advance with alternative fuel sources as the trend takes off at a staggering rate!

Rising Consumer Awareness

Consumer awareness surrounding environmental sustainability and safety is a driving force in the Industrial Gas Cylinder Market. Businesses and individuals increasingly acknowledge their environmental footprint, prompting an increased preference for gas cylinders that offer reduced emissions, enhanced safety features, and overall improved performance - this increased consumer sensitivity influences both demand for and innovation of industrial gas cylinders.

Statistics reveal that global consumers now prioritize sustainability when making purchasing decisions, a shift that has extended to industrial applications where companies are turning toward more eco-friendly gas solutions. With an emphasis on sustainability in mind, many companies have implemented solutions made from recyclable materials with advanced safety technologies to prevent leaks and accidents - leading to further demand for compliant gas cylinders that meet these stringent guidelines enforced by regulatory bodies.

Growth Opportunities

Expanding Renewable Energy Solutions

In 2023, the global Industrial Gas Cylinder Market is projected to experience substantial expansion driven by renewable energy projects. As countries work towards sustainability initiatives and increase investments in wind, solar, and hydrogen sources. Industrial gas cylinders play a pivotal role in these initiatives, particularly in hydrogen storage and distribution for fuel cells and energy storage solutions. Renewable energy sector growth projections call for compound annual growth from 2027-2035, creating an opportunity for market players to innovate and enter new segments of the energy market. With demand expected to surge for high-quality gas cylinders designed to store various industrial gases projected at 8.5% compound annual growth through 2027, high-quality cylinders that can accommodate various forms of industrial gases are sure to see tremendous demand - creating an opportunity for them to capitalize.

Focus on Safety Regulations

2023 offers significant opportunities for expansion within the Industrial Gas Cylinder Market due to strict safety regulations. As industries increasingly prioritize safety and regulatory compliance, demand has surged for gas cylinders that meet current safety standards and technological innovations. New regulations mandate improvements in cylinder design, materials, and handling procedures to mitigate accidents and increase reliability. Companies that can develop and produce cylinders equipped with advanced safety features, like leak detection and pressure control systems, will enjoy an advantage in the market. Focusing on safety not only drives demand but also encourages innovation and raises standards within the industry.

Strategic Collaborations

Strategic Collaborations among gas cylinder manufacturers, energy suppliers, and technology firms present additional growth opportunities. By forging partnerships between businesses of various kinds - gas cylinder manufacturers, energy providers, and technology firms alike - companies can utilize combined expertise to produce cutting-edge solutions while expanding their market presence. Collaborations can also facilitate entry into emerging markets and enhance supply chain efficiency. Joint ventures that develop advanced gas storage solutions or new renewable energy technologies can have a substantial impact on market dynamics; through such alliances, firms share resources, reduce risks, accelerate product development cycles, and strengthen their market positions to drive overall industry expansion.

Key Trends

Global Market Recovery Post-COVID-19

2023 is seeing an encouraging rebound in the Global Industrial Gas Cylinder Market following COVID-19's debilitating effects. The pandemic caused major disruptions to industrial operations and supply chains, temporarily decreasing demand. However, due to an upsurge of industrial activity as a result of renewed investments in infrastructure and manufacturing investments and rising investments into renewable energies and manufacturing, demand is on an upward trend again and allowing market players to capitalize on renewed consumer appetite while adapting supply chains to meet changing market needs.

Focus on Safety Innovations

Safety remains of primary importance in the industrial gas cylinder sector, and 2023 is seeing an increased emphasis on safety innovations. Regulatory bodies are mandating stringent safety standards that push manufacturers towards adopting cutting-edge technologies and features such as smart cylinders with real-time monitoring systems, advanced leak detection, and improved materials; such innovations not only enhance gas cylinder safety but also address industry-specific challenges such as hazardous environments or high-pressure applications - giving companies investing in safety technologies an edge and strengthening their market positions.

Expanding E-commerce Platforms

E-commerce platforms are revolutionizing the Industrial Gas Cylinder Market in 2023. As digital transformation accelerates, more companies are using online platforms to streamline sales and distribution processes, reach more customers more easily, reduce operational costs more efficiently, enhance customer service through digital interfaces more quickly, as well as drive the growth of market growth through increased accessibility and convenience for customers. Companies that successfully incorporate e-commerce strategies into their business models may capitalize on this trend and capture more market shares than their counterparts.

Restraining Factors

Fluctuating Raw Material Prices

The Industrial Gas Cylinder Market has been greatly affected by fluctuations in raw material costs. Steel, aluminum, and various alloys are essential ingredients in the creation of gas cylinders. Prices of these materials can fluctuate due to factors like supply chain disruptions, geopolitical tensions, and changes in global demand; recent spikes in steel prices have increased production costs for gas cylinder manufacturers. These fluctuations directly impact the market by compressing profit margins and possibly raising end-user costs of gas cylinders. Manufacturers face challenges in maintaining price stability, which may deter investment and slow market expansion. Companies must implement strategies to manage cost fluctuations such as diversifying suppliers or investing in alternative materials to minimize their effects on financial performance and market position.

Limited Recycling Options

Industrial gas cylinder recycling options remain one of the key challenges on the market, particularly as long-term usage presents disposal challenges. Recycling infrastructure for these cylinders isn't as advanced or widespread, posing environmental concerns and increasing disposal costs. Absent effective recycling procedures, it becomes impossible to recycle valuable materials effectively and the costs associated with cylinder disposal increase substantially. Environmentalism and economic concerns often result in stricter regulations and increased scrutiny by regulatory bodies, potentially driving up compliance costs for manufacturers. To address this issue, companies must invest in creating more sustainable recycling methods and improving cylinder design to improve recyclability, which will reduce some of the restrictions while supporting more sustained market expansion.

Technological Barriers

Technological barriers are significant impediments to the growth of the Industrial Gas Cylinder Market. Producing advanced gas cylinders with enhanced features, such as smart monitoring systems or improved safety mechanisms, requires significant technological innovations and investments. Manufacturers with limited resources often struggle to stay innovative and remain competitive in an ever-evolving marketplace, hindering their ability to provide innovative products and stay ahead. This may impede their ability to produce cutting-edge items. Technological barriers can impede industry-wide safety standards and best practices implementation, impeding overall market efficiency and growth. To overcome such roadblocks, industry players should collaborate closely on technological projects, invest in research and development activities, and partner with technology providers to advance product offerings while keeping an edge over their competition.

Research Scope Analysis

By Type

Steel Industrial Gas Cylinders were widely preferred due to their durability and ability to withstand high pressures, making them essential in various industrial applications such as manufacturing and gas storage. Their increased usage across different sectors combined with cost-effectiveness over other materials led them to gain approximately 45% market share overall in 2023.

Aluminum Industrial Gas Cylinders held around 30% of the overall market in 2023.

Aluminum cylinders are known for their lightweight and corrosion resistance, making them suitable for applications where portability and reduced weight are key. Their growth was furthered by aerospace and automotive sectors which increasingly adopted aluminum cylinders due to weight reduction being an integral factor. Lighter materials also benefitted from advances in aluminum alloy technologies that improve performance and safety - driving this segment's expansion further still.

Composite Industrial Cylinders account for roughly 25% of market share by 2023 and are steadily gaining ground due to their advanced properties, such as higher strength-to-weight ratios and resistance against extreme temperatures. They're increasingly utilized for applications requiring high-pressure gas storage and transportation where composite materials offer superior performance compared to metal alternatives; their rise can be linked back to growing demands from industries like aviation, military, and medical gas usages for lightweight but strong products.

By Application

In 2023, the General Industry segment held a leading market position within the Product Type segment of the Industrial Gas Cylinder Market with approximately 40% market share. This significant market share highlights the General Industry's strong reliance on industrial gas cylinders for manufacturing, maintenance, construction, and welding activities - further driving demand driven by the global expansion of industrial activities that require efficient gas storage and delivery solutions.

Chemical Energy holds 25% of the overall market, making up one of the strongest segments for demand for industrial gas cylinders. Demand in this segment stems from its need to safely store and transport gases used for chemical processes and energy production, along with an increasing focus on greener energy solutions that require advanced cylinder technologies that can handle various gases used for chemical reactions or energy generation.

Food Industry industrial gas cylinders accounted for an approximate 20% market share in 2023 and were instrumental in processes such as food preservation, carbonation, and packaging. Their growth can be attributed to rising consumer demand for processed and packaged foods that require reliable gas solutions to ensure product quality and safety; innovations in materials and designs that adhere to stringent hygiene and safety standards also helped this segment flourish.

The Medical Industry segment holds an estimated market share of 15% by 2023 and remains critical due to its reliance on high-purity gas cylinders for medical uses such as oxygen supply and anesthesia. Growth is driven by advancements in healthcare infrastructure as well as an emphasis on high-quality medical gas solutions to facilitate patient care and medical procedures.

The Industrial Gas Cylinder Market Report is segmented based on the following:

By Type

- Steel Industrial Gas Cylinder

- Aluminum Industrial Gas Cylinder

- Composite Industrial Cylinder

By Application

- General Industry

- Chemical Energy

- Food Industry

- Medical Industry

- Other

Regional Analysis

Asia Pacific held the dominant position in the global Industrial Gas Cylinder Market in 2023, accounting for around 45% of market share. This dominance can be attributed to rapid industrialization, expanding manufacturing sectors, and rising demand for energy and chemical applications - especially China and India were major drivers behind its rise with their robust infrastructure projects and investments in industrial processes as well as an ever-growing consumer base for medical and industrial gases.

North America stands out as an integral region in the market, accounting for approximately 25% of global sales. Its advanced infrastructure, stringent safety regulations, and rapid adoption rates of innovative gas cylinder technologies continue to drive this growth in North America. Demand in this region is driven by end-user industries like healthcare, food processing, and energy which rely heavily on reliable high-performance cylinders; compliance with environmental regulations as well as technological advances enhance market strength further in this region.

Europe accounts for roughly 20% of the market. Its success can be attributed to stringent safety and environmental regulations as well as technological innovation within gas cylinder manufacturing. Germany, France, and the United Kingdom are key contributors in terms of gas cylinder production; countries like these enjoy significant demand across industries like chemicals, automotive, and aerospace production. Europe also places great emphasis on sustainable energy use to meet its commitments to reducing carbon footprints while simultaneously improving industrial safety.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Sinoma Technology Co and Worthington Industries emerged as key players in the global Industrial Gas Cylinder Market by 2023. Sinoma Technology Co has solidified its position by capitalizing on technological advancements and superior manufacturing capabilities to produce high-quality steel and composite cylinders at scale, while its focus on sustainability and innovation aligns well with market demand for advanced gas storage solutions. Meanwhile, Worthington Industries led with their diverse product portfolio and worldwide distribution network; their focus on customer-centric solutions strengthened their market dominance across various industrial sectors.

Rama Cylinders and Faber Industrie have also contributed significantly to the market's expansion. Rama has expanded its market presence through cost-effective, durable gas cylinders designed for diverse industrial needs with efficient production processes. Faber Industrie excels with lightweight composite cylinders designed to meet rising demand for lightweight storage options with superior strength properties; their focus on innovation and quality assurance demonstrates their dedication to meeting evolving cylinder technologies needs of various industries.

Luxfer Group, Beijing Tianhai Industry Co, and Lianyungang Zhongfu Lianzhong Composite Materials Group Co illustrate the market's diverse competitive environment.

Luxfer Group holds a strong market presence thanks to its comprehensive offering of high-performance cylinders with global reach and remains one of the leading players in their respective markets. Beijing Tianhai Industry Co is known for its high-pressure gas cylinders and technological expertise, particularly within the Asia-Pacific region. Lianyungang Zhongfu Lianzhong Composite Materials Group Co's emphasis on composite cylinder technology underscores the growing demand for lightweight yet durable solutions. They join other key players like Everest Kanto Cylinders and Chart Industries in leading their respective markets forward by driving innovation, quality, and strategic positioning while shaping the industry's future.

Some of the prominent players in the Global Industrial Gas Cylinder Market are:

- Sinoma Technology Co

- Worthington Industries

- Rama Cylinders

- Faber Industrie

- Ningbo Meike Acetylene Bottle Co

- Luxfer Group

- Beijing Tianhai Industry Co

- Hebei Baigong Industrial Co

- Lianyungang Zhongfu Lianzhong Composite Materials Group Co

- Everest KantoCylinders

- Chart Industries

Recent developments

- In 2023, advancements in high-pressure composite cylinders were introduced, enhancing safety and efficiency for hydrogen storage applications with improved strength-to-weight ratios and durability.

- In January 2024, global regulations mandated advanced safety features in gas cylinders, including smart monitoring systems and real-time leak detection, driving manufacturers to invest in cutting-edge technology.

- In June 2023, digital technologies such as AI and IoT were increasingly adopted for inventory and supply chain management, optimizing operations and enhancing efficiency in the gas cylinder sector.

- In September 2022, there was a notable shift towards the development of recyclable gas cylinders and the use of eco-friendly materials, responding to growing environmental and regulatory pressures.

- In December 2023, the market saw significant growth in hydrogen gas cylinder demand, driven by expanding investments in hydrogen infrastructure and fuel cell technology, reflecting a broader trend towards clean energy solutions.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 109.0 Billion |

| Forecast Value (2032) |

USD 213.2 Billion |

| CAGR (2023-2032) |

7.7% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Steel Industrial Gas Cylinder, Aluminum Industrial Gas Cylinder, Composite Industrial Cylinder), By Application (General Industry, Chemical Energy, Food Industry, Medical Industry, Other) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Sinoma Technology Co, Worthington Industries, Rama Cylinders, Faber Industrie, Ningbo Meike Acetylene Bottle Co, Luxfer Group, Beijing Tianhai Industry Co, Hebei Baigong Industrial Co, Lianyungang Zhongfu Lianzhong Composite Materials Group Co, Everest KantoCylinders, Chart Industries |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |