The Industrial Gas Regulator Market refers to devices that regulate gas pressure and flow within industrial applications. These regulators ensure safety, efficiency, and compliance across diverse industries such as manufacturing, healthcare, energy, etc. The market is driven by trends such as automation, increasing safety regulations, and transition to sustainable energy sources among others - with businesses striving for operational excellence at reduced costs whilst remaining cost-effectiveness so understanding this market becomes critical in helping leaders increase productivity, minimize risks, drive innovation in their respective fields.

The Industrial Gas Regulator Market is experiencing significant expansion, thanks to rising demand for safe and cost-effective gas management solutions across various industries. McKinsey analysts point out that industrialization - particularly in emerging economies - is driving this market forward. Furthermore, advanced gas regulators have become essential as organizations focus on increasing operational efficiencies while meeting stringent safety regulations.

As businesses increase their use of alternative energy sources such as hydrogen and biogas, enterprises are investing more heavily in innovative technologies that enable regulators to manage various gas types with differing pressure requirements more effectively. Furthermore, their commitment to environmental sustainability encourages industries to adopt more efficient gas utilization practices.

Market participants are witnessing an increasing shift toward automation, with IoT-enabled regulators offering real-time monitoring and control capabilities. This trend not only enhances safety and operational efficiency but also minimizes downtime; however, fluctuations in raw material costs as well as skilled labor requirements for operating complex systems pose key considerations for stakeholders.

Key Takeaways

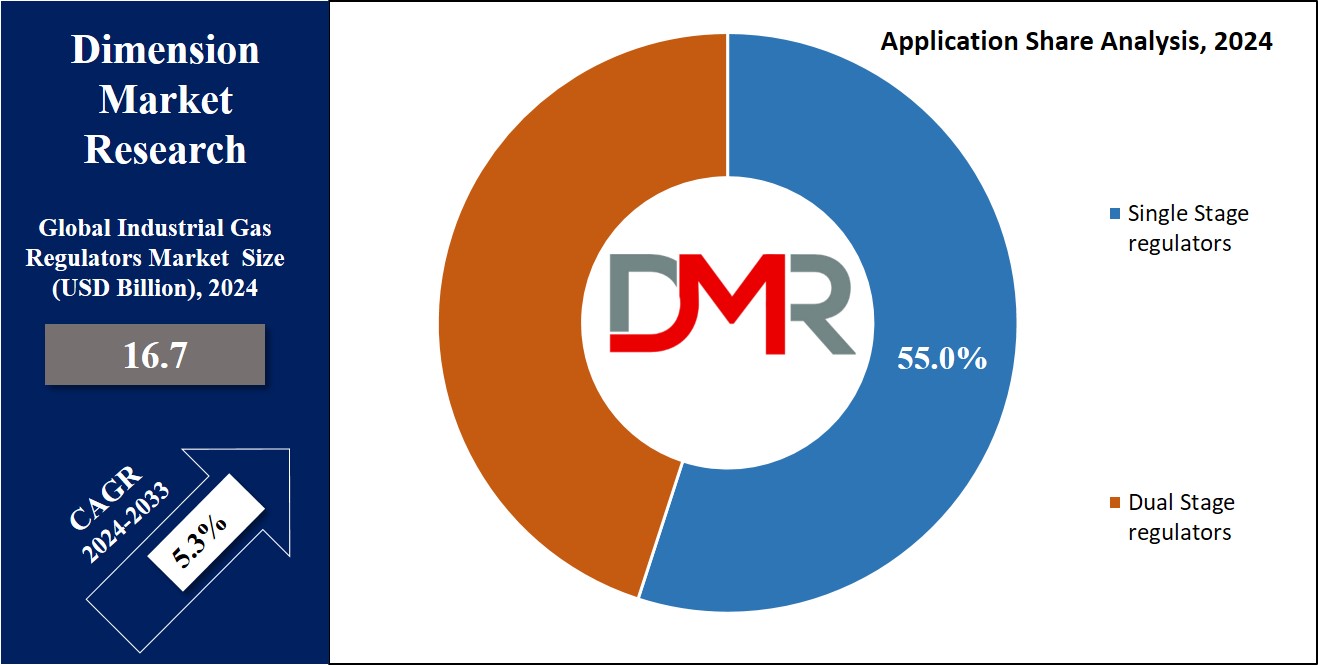

- Market Size and Growth: Valued at USD 16.7 billion in 2024, the market is projected to reach USD 26.5 billion by 2033, growing at a CAGR of 5.3%.

- Dominating Product Segment: Single-stage regulators hold a dominant share of approximately 55% due to their cost-effectiveness and reliability in various industrial applications.

- Regional Leadership: North America leads the market with a 35% share, supported by advanced infrastructure and high natural gas utilization, followed closely by Europe at 30% due to stringent regulations.

- Emerging Markets: The Asia-Pacific region, accounting for about 25% of the market, is experiencing rapid industrialization and investment in infrastructure, driving demand for gas regulation systems.

- Key Drivers: Major growth factors include increased demand in the oil and gas sector, rising healthcare expenditures, and a global economic recovery post-COVID-19.

Use Cases

- Oil and Gas Efficiency: Regulators manage pressure during extraction and refining, enhancing operational efficiency and compliance with safety standards. This drives investments in advanced gas management technologies.

- Healthcare Precision: In healthcare, gas regulators ensure the accurate delivery of medical gases for anesthesia and respiratory therapies, crucial for patient safety amid rising healthcare demands and stringent regulations.

- Manufacturing Optimization: Used in welding and chemical processes, gas regulators support automation and IoT integration, improving safety and efficiency while minimizing downtime and waste.

- Food and Beverage Compliance: Regulators are essential for fermentation and carbonation, meeting increasing safety and quality standards as the industry seeks reliable gas management solutions.

- Sustainable Energy Transition: As industries adopt renewable energy sources, versatile gas regulators are needed to manage varying pressures, supporting environmental goals and compliance with sustainability regulations.

Driving Factors

Rapid Demand Growth in the Oil & Gas Sector

Oil and gas industry companies are one of the key drivers of the Industrial Gas Regulator Market due to their increasing need for effective and safe gas management. As global energy demand continues to surge, predicted to reach 1.8 billion barrels of oil equivalent per day by 2040, the industry is making significant investments in advanced technologies to ensure optimal gas utilization and meet stringent safety regulations. Industrial gas regulators play a critical role in controlling pressure and flow during extraction, refining, and distribution processes to maximize operational efficiency while mitigating risks. Furthermore, increasing eco-conscious practices coupled with unconventional resource exploration necessitate reliable gas management systems and solidify this market's growth.

Healthcare Spending Increases

Healthcare costs, which are projected to reach $10 trillion globally by 2022, have had a considerable effect on the Industrial Gas Regulator Market. Healthcare facilities that expand and upgrade their capabilities face an ever-increasing need for accurate gas delivery systems, particularly for anesthesia and respiratory therapies. Advanced gas regulators are essential in maintaining the safety and efficacy of medical gases such as oxygen and nitrous oxide for medical applications. With increased healthcare demand due to an aging population and chronic disease prevalence driving this market forward, compliance with stringent healthcare regulations provides further opportunities to utilize sophisticated gas management solutions thereby further driving market expansion.

Global Economic Recovery

Following the disruption caused by the COVID-19 pandemic, global economic recovery is encouraging renewed investments across sectors including manufacturing, construction, and energy. As economies strengthen, industrial activities increase, sparking an upsurge in industrial gas consumption and regulator needs. IMF forecasts global economic growth at 6%, leading to increased production capacities and infrastructural developments, as well as prioritizing safety and efficiency, leading to the use of advanced gas regulators. When combined, all these factors create an ideal environment for sustained expansion in the Industrial Gas Regulator Market.

Growth Opportunities

Compliance

The global industrial gas regulator market in 2023 will be heavily influenced by tightening government regulations on gas handling and safety standards, which require industries to comply with stringent government standards regarding handling and safety standards for gas. With these stringent requirements placed upon industries, advanced industrial gas regulators become a necessity in meeting them; companies who can offer compliant yet innovative solutions are well positioned to capture a larger share of this growing industry, thus driving growth and improving competitive advantage.

Investment Opportunities in Infrastructure Projects

Investments in infrastructure development in emerging economies offer industrial gas regulators an outstanding opportunity. When governments and private sectors allocate funds for building or upgrading facilities in sectors like energy, manufacturing and chemicals requiring reliable gas regulation systems - not only does this drive market growth but it opens doors for manufacturers and suppliers to diversify their offerings and increase market opportunities.

Focus on Safety and Efficiency

2023 sees an emphasis on improving operational safety and efficiency across industries. This emphasis has sparked interest in technologically advanced regulators with precise control and monitoring capabilities; specifically IoT-enabled gas regulators which optimize gas usage while reducing waste are particularly popular with companies prioritizing safety measures and environmental sustainability, prompting forward-looking manufacturers to be successful.

Key Trends

Increase in Natural Gas Applications

The global industrial gas regulator market in 2023 will be greatly influenced by natural gas's rapidly increasing applications, both as a cleaner alternative to fossil fuels and as a means of power generation, manufacturing, and transportation. With countries working towards carbon emission reduction initiatives, this trend will only become more prominent creating lucrative opportunities for manufacturers in this market segment.

Environmental Sustainability Initiatives

Environmental sustainability initiatives are changing market dynamics in 2023, prompting industries to adopt cleaner technologies in an attempt to limit greenhouse gas emissions and waste reduction. Gas regulator upgrades may become essential, while companies that develop eco-friendly solutions, particularly those tailored for renewable energy applications, may gain an edge in this evolving environment. This move furthers global sustainability goals.

Increase in Emerging Markets

Emerging markets are experiencing rapid industrialization and urbanization, exponentially increasing their need for industrial gases. Asia-Pacific and Latin America regions in particular are seeing significant investments in infrastructure and energy projects which further elevates this demand for effective gas regulation systems. As these markets mature they present significant growth opportunities for companies willing to meet this growing need safely and efficiently.

Restraining Factors

Gas Processing Costs Continue to Rise

Gas processing costs pose a substantial obstacle to the market expansion of industrial gas regulators. When expenses associated with extracting, refining, and transporting gases increase, companies may pause before investing in advanced regulators due to financial strain caused by such expenses; such costs also lead to higher end-user prices that subsequently decrease demand for industrial products and systems, ultimately slowing adoption rate of innovative gas regulation technologies and ultimately stunting market expansion.

Lack of Trained Personnel

The industrial gas sector faces an acute lack of skilled employees, creating significant challenges to its growth as an emerging gas regulator market. Due to their complexity, modern gas regulation systems require experienced professionals who can install and manage these technologies efficiently. Without sufficient skilled workers, companies may struggle to adopt advanced solutions effectively, leading them to operate less efficiently while being unwilling to invest in new systems. Skill gaps prevent not only innovative technology from being implemented properly but also interfere with safety and compliance measures that limit market expansion. Therefore, an inadequate workforce represents an extremely serious barrier to its potential growth.

Fluctuating Demand Patterns

Fluctuations in demand patterns within the industrial gas sector create uncertainty that hinders market expansion for gas regulators. Seasonal variations and shifting economic conditions can produce unpredictable gas demands that make planning production and inventory levels difficult for manufacturers. Volatility can discourage investment in new technologies and innovations, with companies being wary of committing resources to an uncertain market environment. Furthermore, fluctuating demand can wreak havoc with operational strategies by disrupting resource allocation strategies - ultimately acting as a powerful limiting factor to the overall growth of industrial gas regulator markets.

Research Scope Analysis

By Product Type

Single-stage regulators dominated the product type segment of the industrial gas regulator market in 2023, accounting for roughly 55% of the total market share. Their dominance can be attributed to their simplicity, cost-effectiveness, and suitability for applications where precise pressure control is crucial; single-stage regulators are widely utilized across various applications like welding, cutting, laboratory work, etc. where efficiency and reliability are top priorities.

Dual-stage regulators have seen increasing growth, taking approximately 30% of the market share. Their enhanced pressure stability makes them ideal for applications requiring consistent output pressure regardless of changes to input pressure, such as pharmaceutical and food processing industries where safety and consistency are of the utmost importance.

Both segments exhibit strong growth potential, propelled by increasing industrialization and demand for reliable gas management systems. Technological advancements should enhance the performance and efficiency of both single-stage and dual-stage regulators, further stimulating market expansion. As industries prioritize safety and operational efficiency, their adoption should increase, strengthening their positions within the industrial gas regulator market.

By Material

Brass held an estimated 60% market share among product-type segments of the industrial gas regulator market in 2023. Its dominance can be attributed to its superior corrosion resistance, durability, cost-effectiveness, and cost efficiency - qualities which made it suitable for applications including welding, chemical processing, and HVAC systems. Brass's ability to withstand both pressure fluctuations and temperature variations further enhanced its appeal in environments requiring reliability.

On the other hand, stainless steel regulators are also becoming more prevalent, accounting for around 30% of the market share. Recognized for its strength and resistance to corrosion, stainless steel regulators have become an attractive option among sectors including pharmaceuticals, food processing, and oil and gas due to increased emphasis on hygiene standards in these fields. Furthermore, increased longevity means more demand for stainless steel regulators which offer enhanced performance & longevity compared to their metal counterparts.

Both segments should see continued expansion due to advances in manufacturing technologies and materials, with businesses increasingly prioritizing quality and safety when choosing industrial gas regulators. Brass and stainless steel regulators may further cement their positions within this market segment.

By End Use

In 2023, metallurgy held an almost 40 percent market share for product type industrial gas regulator markets in terms of market segment. This could be explained by their use across many industries such as oil and gas which require robust yet reliable equipment for safe operations - particularly during extreme pressure situations where durable metallurgical regulators prove essential.

Food and beverage sector dominates approximately 25 percent of the market share. Rising safety and quality standards within this industry have increased demand for gas regulators that enable precise control over flow and pressure - essential when performing processes like fermentation or carbonation.

Pharmaceuticals account for roughly 15% of the market share, making industrial gas regulators essential to manufacturing processes using essential gases or in research studies. They must adhere to stringent safety and purity standards and be installed for processes involving critical gases that must remain constant at all times during operations or research studies.

Gas regulators play a vital role in controlling reactions and safely handling volatile substances for use within the chemical industry, while electric power's contribution accounts for around five percent. Gas-powered generation systems use regulators as part of maintaining efficiency.

The Industrial Gas Regulator Market Report is segmented based on the following:

By Product Type

- Single Stage regulators

- Dual Stage regulators

By Material

By End Use

- Metallurgy

- Food & Beverage

- Pharmaceuticals

- Chemical

- Electric power

- Oil & Gas

- Others

Regional Analysis

North America held the greatest market share, accounting for 35% of total industrial gas regulator sales worldwide in 2023. This success can be attributed to advanced industrial infrastructure, substantial investments in manufacturing facilities, and increased use of natural gas across various sectors - along with key players and an effective regulatory framework that supports market development there.

Europe ranks close behind, accounting for about 30% of the market share. Due to stringent environmental and safety regulations as well as a renewable energy source focus, demand has skyrocketed for industrial gas regulators in this region. Germany and the UK are leaders in terms of upgrading gas management systems to keep pace with emerging standards.

Asia Pacific region is experiencing rapid expansion, representing approximately 25% of the global market. This can be attributed to industrialization, urbanization, and rising energy demand; with China and India investing heavily in infrastructure projects leading to demand for reliable gas regulation systems for manufacturing as well as energy industries.

The Middle East and Africa together account for around 7% of the market, where oil and gas sectors continue to develop as countries in this region continue to develop their energy resources and enhance safety measures in gas handling. Latin America accounts for roughly 3%, where growing industrial activities and investments in gas infrastructure are driving demand for industrial gas regulators.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Air Liquide, Air Products and Chemicals, Airgas Inc., and Linde Group dominate the global industrial gas regulator market to an exceptional degree by 2023, as shown by their extensive product offerings, innovative technologies, and focus on safety and efficiency which aligns well with rising regulatory needs and sustainability initiatives. Their strong research and development capacities ensure they continue to introduce advanced gas regulation solutions tailored to customer requirements.

Air Products and Chemicals and Praxair Inc. have taken advantage of strategic partnerships and acquisitions to strengthen their market positions, expanding geographically while diversifying product offerings. Through this strategy they're catering to numerous industries - pharmaceuticals and food processing in particular require sophisticated gas regulators - while Emerson Electric and Colfax Corporation integrate smart technologies such as automation/IoT capabilities that increase operational efficiencies while offering real-time monitoring - appealing particularly to industries focused on optimization/safety.

Emerging players like Cavagna Group and GCE Group have made names for themselves by providing specialty gases used for medical and specialty uses, while established players like Matheson Tri-Gas and Messer Group stand out through customer service excellence and technical support. Overall, industrial gas regulator market growth looks set to accelerate through innovations made possible through strategic initiatives taken by these key players that remain relevant in an ever-evolving environment.

Some of the prominent players in the Global Industrial Gas Regulator Market are:

- Air liquids

- Air products and Chemicals

- Airgas Inc

- Cavanga Group

- Colfax Corporation

- Emerson Electric

- GCE Group

- Iceblick Ltd

- Itron Inc

- Iwatani

- Linde Group

- Matheson Tri-gas

- Messer Group

- Praxair Inc

- Rotarex

Recent developments

- In January 2024, Linde Group and Air Liquide finalized a long-term agreement to supply industrial gases to Samsung Electronics for its new semiconductor fabrication plant in South Korea. This partnership highlights the critical need for high-purity gases in semiconductor manufacturing, reflecting the sector's rapid growth.

- In November 2023, Emerson Electric launched its Fisher EZH and EZHSO regulators, aimed at enhancing safety and reducing emissions in natural gas transmission and distribution systems. This development aligns with the industry's increasing focus on sustainability and regulatory compliance.

- In September 2022, ControlAir introduced the Type 855BP Miniature Back Pressure Regulator, offering a compact and efficient solution for pressure relief. With an adjustable set point, this regulator ensures high performance at a competitive price, addressing user demand for reliability.

- In August 2021, ESAB unveiled its latest gas regulators, the FE300 and ProStage, manufactured at a state-of-the-art facility in the European Union. These products are designed for diverse industrial and commercial applications, underscoring the company's commitment to quality.

- In August 2019, ControlAir launched the Type FA10 Coalescing Filter and the Type FA12 Filter Regulator/Coalescing Filter Combo, further expanding its product line to meet the evolving needs of the gas regulation market.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 16.7 Billion |

| Forecast Value (2032) |

USD 26.5 Billion |

| CAGR (2023-2032) |

5.3% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Single Stage Regulators, Dual Stage Regulators), By Material (Brass, Stainless Steel) By End Use (Metallurgy, Food & Beverage, Pharmaceuticals, Electric Power, Chemical, Oil & Gas) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Air liquids, Air products and Chemicals, Airgas Inc, Cavanga Group, Colfax Corporation, Emerson Electric, GCE Group, Iceblick Ltd, Itron Inc, Iwatani, Linde Group, Matheson Tri-gas, Messer Group, Praxair Inc, Rotarex |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |