Industrial Gas Turbine Market refers to the design, production, and deployment of gas turbines used for power generation, mechanical drives, and various industrial applications. As integral components in energy infrastructure, gas turbines have proven themselves as highly effective units thanks to their efficiency, scalability, and compatibility with renewable power sources. Driven by rising global energy demands and the push toward sustainable solutions, this market is rapidly developing innovative technologies designed to optimize performance while decreasing emissions and optimizing operating costs. Key players increasingly prioritize innovation, operational excellence, and compliance with regulatory standards in an attempt to gain a competitive edge within this complex energy environment. This market provides organizations aiming for strategic differentiation a vital tool in expanding their competitive edge.

Industrial Gas Turbine Market growth is on an impressive upward curve, driven by rising global energy demands and the transition toward sustainable solutions. Industries increasingly prioritize cleaner alternatives like gas turbines due to their superior efficiency and reduced emissions compared to conventional coal or oil-fired power generation systems. Technological advancements relating to combined cycle power plants and turbine design are helping further maximize performance and operational efficiencies for increased performance and operational cost efficiency.

Integration of digital technologies such as IoT and AI is revolutionizing maintenance and operational strategies by providing real-time monitoring, and predictive analytics, minimizing downtime, and optimizing reliability - especially in emerging markets such as Asia-Pacific and Latin America, where rapid industrialization and urbanization drive demand for reliable power solutions.

Gas turbines present significant opportunities in hybrid systems incorporating renewable energy sources, providing greater flexibility and resilience for energy production. However, markets must navigate challenges associated with fluctuating natural gas prices as well as finding skilled labor to operate complex systems.

Key Takeaways

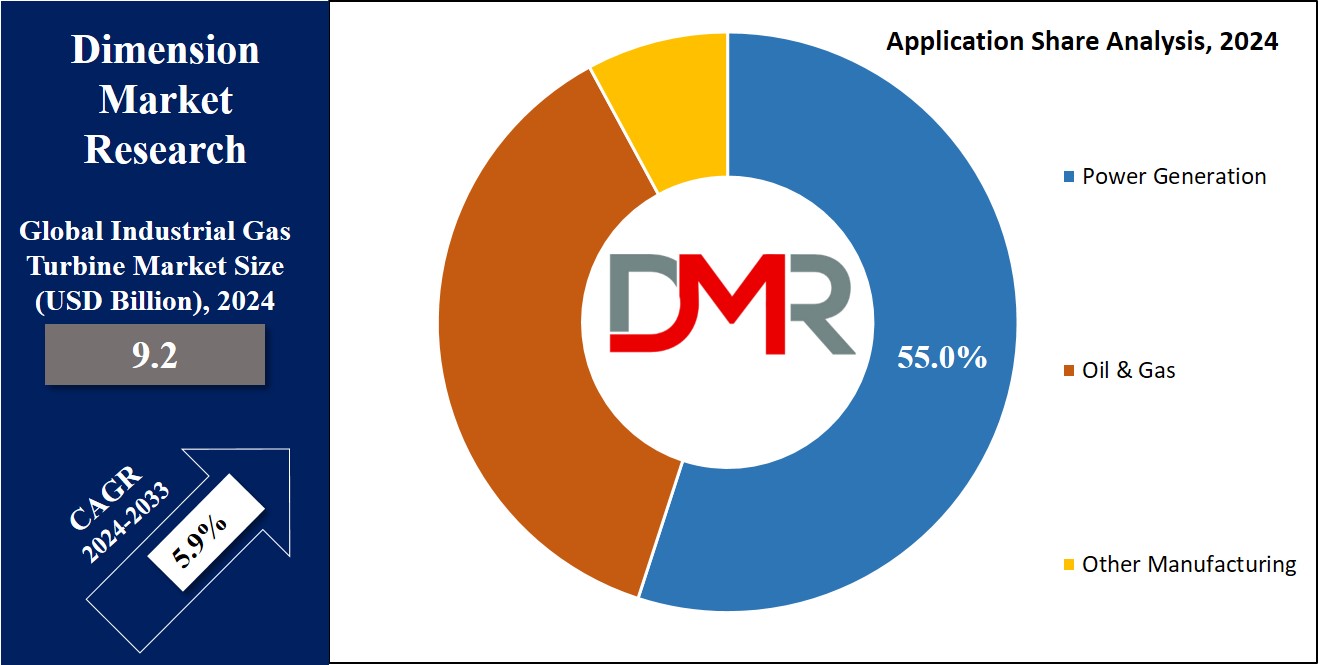

- Market Growth: The global Industrial Gas Turbine Market is projected to grow from USD 9.2 billion in 2024 to USD 15.5 billion by 2033, at a CAGR of 5.9%, driven by rising energy demands and the transition to cleaner technologies.

- Dominating Segment: Power generation accounts for approximately 55% of the market share, fueled by increasing electricity demand, particularly in emerging economies.

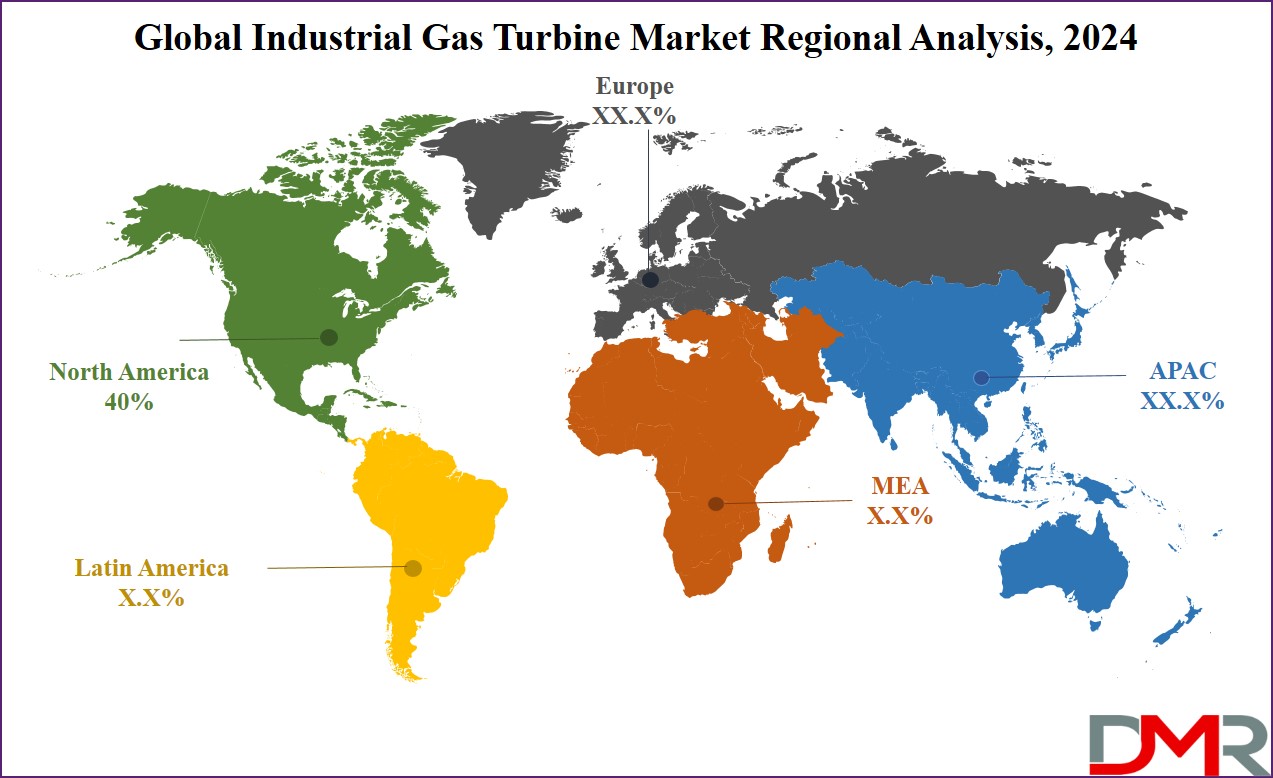

- Regional Leadership: North America holds the largest market share at around 40%, supported by robust energy infrastructure and high natural gas utilization, followed by Europe (30%) and Asia-Pacific (25%).

- Technological Trends: Aero-derivative turbines lead the market with a 55% share due to their efficiency and flexibility, while open-cycle turbines dominate technology segments at 65%.

- Investment Opportunities: Significant investments in natural gas infrastructure and distributed power generation are anticipated to boost market growth, particularly in Asia-Pacific and Latin America.

Use Cases

- Power Generation in Emerging Markets: Deploy gas turbines in emerging economies for reliable, localized electricity, supporting industrialization and urbanization.

- Renewable Energy Integration: Utilize gas turbines alongside wind and solar to provide backup power and enhance grid stability, facilitating a cleaner energy transition.

- Decentralized Industrial Solutions: Implement gas turbines in decentralized energy systems for industries, ensuring quick start-up and resilience against grid failures.

- Offshore Oil and Gas Support: Leverage gas turbines for reliable power in offshore oil and gas operations, maximizing production while minimizing environmental impact.

- Enhanced Maintenance Efficiency: Integrate IoT and AI for predictive maintenance of gas turbines, optimizing performance and reducing operational costs.

Driving Factors

Investment in Natural Gas Infrastructure

Investment in natural gas infrastructure has an enormously positive effect on the Industrial Gas Turbine Market by strengthening the supply and distribution networks necessary for gas-powered generation. Governments and private sectors alike are investing funds in pipelines, processing plants, and storage facilities to assist this transition away from fossil fuels. As a result, natural gas availability has increased allowing its acceptance as an environmentally friendly energy source. This trend can be found throughout North America and Europe, where natural gas serves as a bridge fuel between renewable energies like wind and solar, and traditional sources like coal. According to market reports, investments in natural gas infrastructure are projected to experience compound annual growth at over 7% through 2030 - further expanding the market for gas turbines designed specifically to tap this reliable source of power.

Trends of Distributed Power Generation

Distributed power generation (DPG) is changing the face of energy production and driving forward the Industrial Gas Turbine Market. DPG systems offer localized generation systems that reduce transmission losses while improving energy security. Gas turbines play an essential part in decentralized setups, providing quick start capabilities and operational flexibility. As organizations seek to strengthen energy resilience in the face of natural disasters or grid failures, distributed generation systems using gas turbines become increasingly attractive. The global distributed energy generation market is anticipated to experience compound annual compound annual growth at 8.5% for five years; further increasing demand for efficient yet adaptable gas turbine solutions.

Economic Growth in Emerging Markets

Economic expansion in emerging markets drives the Industrial Gas Turbine Market, with Asia-Pacific and Latin American nations leading the charge. As these nations industrialize and urbanize, their need for reliable power generation systems increases significantly. Forecasts predict that energy consumption in emerging markets is projected to increase by 50% by 2040, spurring an explosion in gas turbine installations and increasing demand. Additionally, these regions prioritize energy diversification to support industrial expansion while simultaneously lowering carbon emissions - making gas turbines a particularly viable choice. Industrial expansion and energy diversification combine to stimulate investment in gas turbines while hastening the adoption of advanced technologies, creating a market that will continue to flourish over the coming years.

Growth Opportunities

Technological Advancements have taken place

Continuous innovations in turbine design, materials, and efficiency are providing substantial opportunities in the Industrial Gas Turbine Market. Innovative turbine technologies like advanced combustion systems and hybrid configurations help operators attain higher efficiencies with reduced emissions while digital technologies like IoT and predictive analytics optimize turbine performance and maintenance schedules further increasing operational efficiencies.

Distributed Power Generation

Distributed power generation (DPG) is revolutionizing global energy landscapes, as industries and municipalities seek greater energy resilience with reduced transmission losses, gas turbines are being adopted more and more for localized generation, supporting both energy independence and sustainability goals, making these devices attractive options for use in microgrid projects or industrial applications.

Offshore Oil & Gas

The offshore oil and gas sector is experiencing a revitalization as companies aim to maximize production while limiting environmental impact. Gas turbines play an essential role in providing power solutions to offshore platforms where reliability is of utmost importance, and are also helping meet regulatory demands for cleaner energy sources - positioning gas turbines as key technologies within this domain.

Key Trends

Increase in Demand for Electricity

The Industrial Gas Turbine Market in 2023 will be driven by global electricity demand's continuing surge. As populations expand and economies thrive in emerging markets, reliable and cost-efficient power generation becomes more essential than ever. Gas turbines renowned for their quick start-up capabilities and operational versatility are increasingly adopted to meet this surging need - gas turbines' ability to provide both base-load and peak-load power makes them integral components in developing energy infrastructures.

Distributed Power Generation

Distributed power generation is revolutionizing energy systems globally. Companies and municipalities alike are turning toward decentralized solutions for increased energy security while decreasing dependence on centralized grids. Gas turbines make an excellent fit as they can be installed quickly in smaller-scale local settings while offering essential power with minimal transmission losses - something further reinforced by technological innovations that enable micro grid systems.

Moving Toward Cleaner Energy Solutions

An increasing shift toward cleaner energy sources is also impacting the Industrial Gas Turbine Market. As governments and organizations prioritize carbon reduction and sustainability initiatives, gas turbines have emerged as an attractive option compared to coal and oil-fired power plants, providing lower emissions profiles while being easily integrated with renewable sources such as wind and solar for power production. Their reduced emissions profiles and adaptability for integration with renewable sources - like wind and solar power generation - only add to their appeal in an age of decarbonizing world.

Restraining Factors

Fuel Price Volatility

Fuel price volatility is a significant obstacle in the Industrial Gas Turbine Market, directly impacting operational costs and investment decisions. Natural gas serves as the primary fuel source, so fluctuations can have dramatic ramifications on profitability; sudden increases can reduce profitability considerably; decreasing power production can render power generation less economically feasible, discouraging investments into new facilities or technology upgrades and prompting potential investors to seek alternative sources for power production - ultimately stunting market expansion.

Maintenance and Overhaul Costs

Maintenance costs associated with gas turbines represent another challenge for operators. Although these units may be chosen due to their efficiency and reliability, regular maintenance schedules must still take place to ensure optimal performance. Unfortunately, this can become costly over time for older units that may need upgrades to comply with evolving regulations, accounting for as much as 20% of total operating costs and discouraging expansion efforts thereby restricting market expansion.

Intermittent Renewable Integration Challenges

As renewable sources become an increasing part of our energy landscape, their incorporation presents unique challenges for gas turbine operations. While gas turbines offer flexibility and quick ramp-up capabilities, managing fluctuating renewables may present difficulties when trying to balance operational strategies - and may lead to higher costs and less reliable operations, dissuading utilities from investing in gas turbine technologies in favor of more stable sources such as wind or solar energy.

Research Scope Analysis

By Capacity

In 2023, the 70 MW class held a strong market position within the Industrial Gas Turbine Market, accounting for about 40% of the total market share. Its strength can be attributed to widespread applications in smaller power generation plants, commercial facilities, and industrial applications where lower capacity and flexibility were essential components. Furthermore, their compact designs make = 70 MW turbines suitable for distributed generation systems that address rising localized energy demands.

The > 70 MW to 300 MW segment represented approximately 35% of the market. This range is often preferred for mid-sized power generation facilities that need significant power output without incurring infrastructure costs associated with larger units. Investment in distributed power generation and combined heat and power (CHP) applications has driven investments into this range and further strengthened its market presence.

Finally, the >= 300 MW segment made up approximately 25% of the market in 2016. Though relatively smaller in scale, it remains essential for large-scale power generation applications in utility settings and can often be tied back to government initiatives to expand renewable energy capabilities and ensure grid stability. Though its market share may have decreased from previous years, >= 300 MW turbines continue to play an integral part in providing large-scale yet efficient solutions for energy demands that continue to increase rapidly.

By Product

Aero-derivative turbines were the clear market leaders in 2023's Industrial Gas Turbine Market, commanding approximately 55% market share. Their success can be attributed to their flexibility, quick start-up capability, and high efficiency; ideal characteristics for applications requiring variable power output such as peaking power plants or backup power solutions. Furthermore, Aero-Derivative turbines proved particularly popular among operators living in regions with fluctuating energy demands, providing operators with quick responses for peak loads without negatively affecting operational efficiencies.

Conversely, Heavy Duty turbines accounted for roughly 45% of the market share. Although comparatively smaller in number, heavy-duty turbines play an integral role in power generation applications in industrial settings and utilities, as they offer large-scale continuous power production with reliability as their hallmark trait. Industry initiatives continue to emphasize operational stability and efficiency - driving sustained investment into this segment, especially among oil & gas sectors which value high output and dependability as cornerstones of success.

By Technology

In 2023, open-cycle turbines held a significant market share within the Industrial Gas Turbine Market with approximately 65%. Their dominance can be attributed to their rapid response capabilities and straightforward design - perfect for meeting peak energy demands without incurring significant lead times from operator installations. They were particularly preferred in regions where quick power generation is essential and operators needed efficient management of fluctuations in consumption without lengthy lead times.

At 35% of market share, combined cycle technologies held 35%. Though smaller in market share than their rivals, these technologies are growing in popularity due to their increased efficiency and reduced emissions. Integrating both gas and steam turbines, combined cycle systems maximize energy extraction from fuel for base load power generation in large-scale industrial operations and utility applications - ideal for baseload power production at large-scale operations with increasing environmental regulation demands while still guaranteeing reliable power supplies. Combined Cycle technologies also appeal to operators seeking improved environmental performance while guaranteeing reliable power supplies while improving environmental performance while guaranteeing reliable power supply while improving environmental performance at once.

By Application

Power Generation was the dominant market segment within the Industrial Gas Turbine Market in 2023, accounting for roughly 55% of the total market share. This success can be attributed to rising global electricity demand - particularly within emerging economies where industrialization and urbanization is taking place rapidly - which requires reliable yet cost-efficient sources of power generation energy to meet growing energy needs across various sectors. Power generation applications make use of industrial gas turbines because of their capacity to reliably and efficiently provide power.

Oil & Gas held approximately 30% of the market share, reflecting their significant role in gas turbine usage for upstream and downstream operations. Gas turbines in this sector play an essential role for applications like gas compression and power generation at production facilities. Investment in exploration & production activities coupled with increased emphasis on more efficient technologies is driving their adoption; strengthening their market presence.

Chemical and textile companies comprised about 15% of the total market share for Other Manufacturing. This industry benefits from industrial gas turbines' versatility as they enable diverse manufacturing processes requiring high-temperature / high-pressure steam production. As manufacturers increasingly prioritize operational efficiency and sustainability goals, their demand for gas turbines should increase accordingly.

The Industrial Gas Turbine Market Report is segmented based on the following:

By Capacity

- ≤ 70 MW

- .> 70 MW - 300 MW

- ≥ 300 MW

By Product

- Aero-Derivative

- Heavy Duty

By Technology

- Open Cycle

- Combined Cycle

By Application

- Power Generation

- Oil & Gas

- Other Manufacturing

Regional Analysis

North America held the highest regional share in 2023 of the Global Industrial Gas Turbine Market with approximately 40%, led by robust energy infrastructure, high natural gas utilization rates and modernization and efficiency in power generation. Furthermore, demand for clean energy solutions coupled with stringent environmental regulations further contributed to North America's dominance in this market.

Europe grabbed approximately 30% of the global market. Committed to sustainability and ambitious carbon reduction targets have driven investments in combined cycle gas turbine (CCGT) technology; Germany and UK being leaders in this regard by integrating gas turbines with renewable sources to enhance grid stability while lowering emissions.

Asia Pacific region represented approximately 25% of the market, driven by rapid industrialization and urbanization in countries like China and India. Their rapidly increasing energy demands and investments in infrastructure projects demonstrate their increasing dependence on industrial gas turbines for efficient power generation. Initiatives to increase renewable energy capacity should further contribute to market expansion.

Middle East & Africa accounted for approximately five percent of the market, reflecting increased investments in oil and gas projects within Gulf Cooperation Council countries (GCC). GCC countries have increasingly adopted gas turbines to optimize energy production while meeting rising electricity demands.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Industrial Gas Turbine Market features an intensely competitive landscape dominated by several key players that leverage technological strengths and market expertise to position themselves for success in this space. General Electric (GE) remains at the top of this field thanks to its broad offering of highly efficient combined cycle gas turbines as well as cutting-edge digital solutions that promote operational optimization and predictive maintenance - positioning themselves strategically against increasing demands for reliability and efficiency.

Siemens follows closely, emphasizing sustainability through turbines designed for cleaner energy production, in line with global decarbonization trends and popular with customers seeking eco-friendly solutions. Mitsubishi Hitachi Power Systems plays an instrumental role as well, particularly in Asia where their high-capacity turbine technology meets emerging market energy demands more effectively than others do. Ansaldo Energia completes this landscape by tailoring personalized solutions tailored specifically for oil and gas sectors enhancing competitiveness through flexibility and innovation.

Solar Turbines have distinguished themselves with smaller gas turbine systems designed to support distributed generation and improve energy efficiency for industrial applications. Kawasaki Heavy Industries and Doosan Heavy Industries & Construction are widely known for their engineering capabilities, breaking boundaries of turbine design to meet market requirements for performance and reliability. Companies such as Bharat Heavy Electrical Limited (BHEL), OPRA Turbines, and Rolls-Royce provide more market diversity through local manufacturing solutions and customized solutions that cater specifically to local energy demands and regulatory pressures. Collectively these players drive advancements in efficiency, sustainability, and technology within the industrial gas turbine market that meet evolving energy demands while satisfying regulatory pressures.

Some of the prominent players in the Global Industrial Gas Turbine Market are:

- GE

- Siemens

- Mitsubishi Hitachi Power Systems

- Ansaldo Energia

- Solar Turbines

- Kawasaki Heavy Industries

- Doosan Heavy Industries & Construction

- Bharat Heavy Electrical Limited

- OPRA Turbines

- Rolls-Royce

- Vericor Power Systems LLC

Recent developments

- In October 2023, the HYFLEXPOWER consortium, led by Siemens Energy AG, successfully commissioned a gas turbine operating on 100% renewable hydrogen at Smurfit Kappa's paper mill in Saillat-sur-Vienne, France.

- In September 2023, Kawasaki Heavy Industries, Ltd. announced the launch of its 1.8 MW class gas turbine cogeneration system, GPB17MMX, featuring the world's first burner for 100% hydrogen dry combustion. This innovation represents a significant advancement in clean energy technology, utilizing a proprietary method that combines micro mixture combustion and afterburning.

- In April 2023, GE formed a partnership with UCED Group to supply an LM6000 PC Sprint aeroderivative gas turbine for the UCED Prostějov backup power plant in the Czech Republic. This initiative aims to enhance grid stability while supporting the transition to renewable energy sources, reflecting a broader trend towards reliable backup systems amid increasing energy demands.

- In April 2021, Siemens secured an agreement with EPC Contractor TSK to provide an F-class gas turbine for a new combined cycle power plant in Jacqueville, Côte d'Ivoire, expected to have a capacity of 390 MW.

- In August 2020, General Electric received an order for an 858 MW combined cycle gas turbine (CCGT) power plant for the Zainskaya State District Power Plant. This project emphasizes the growing reliance on gas turbines to enhance efficiency and meet rising energy needs.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 9.2 Billion |

| Forecast Value (2032) |

USD 15.5 Billion |

| CAGR (2023-2032) |

5.9% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Capacity(≤ 70 MW, > 70 MW - 300 MW, ≥ 300 MW), By Product (Aero-Derivative, Heavy Duty), By Technology (Open Cycle, Combined Cycle), By Application (Power Generation, Oil & Gas, Other Manufacturing) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

GE, Siemens, Mitsubishi Hitachi Power Systems, Ansaldo Energia, Solar Turbines, Kawasaki Heavy Industries, Doosan Heavy Industries & Construction, Bharat Heavy Electrical Limited, OPRA Turbines, Rolls-Royce, Vericor Power Systems LLC |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |