Market Overview

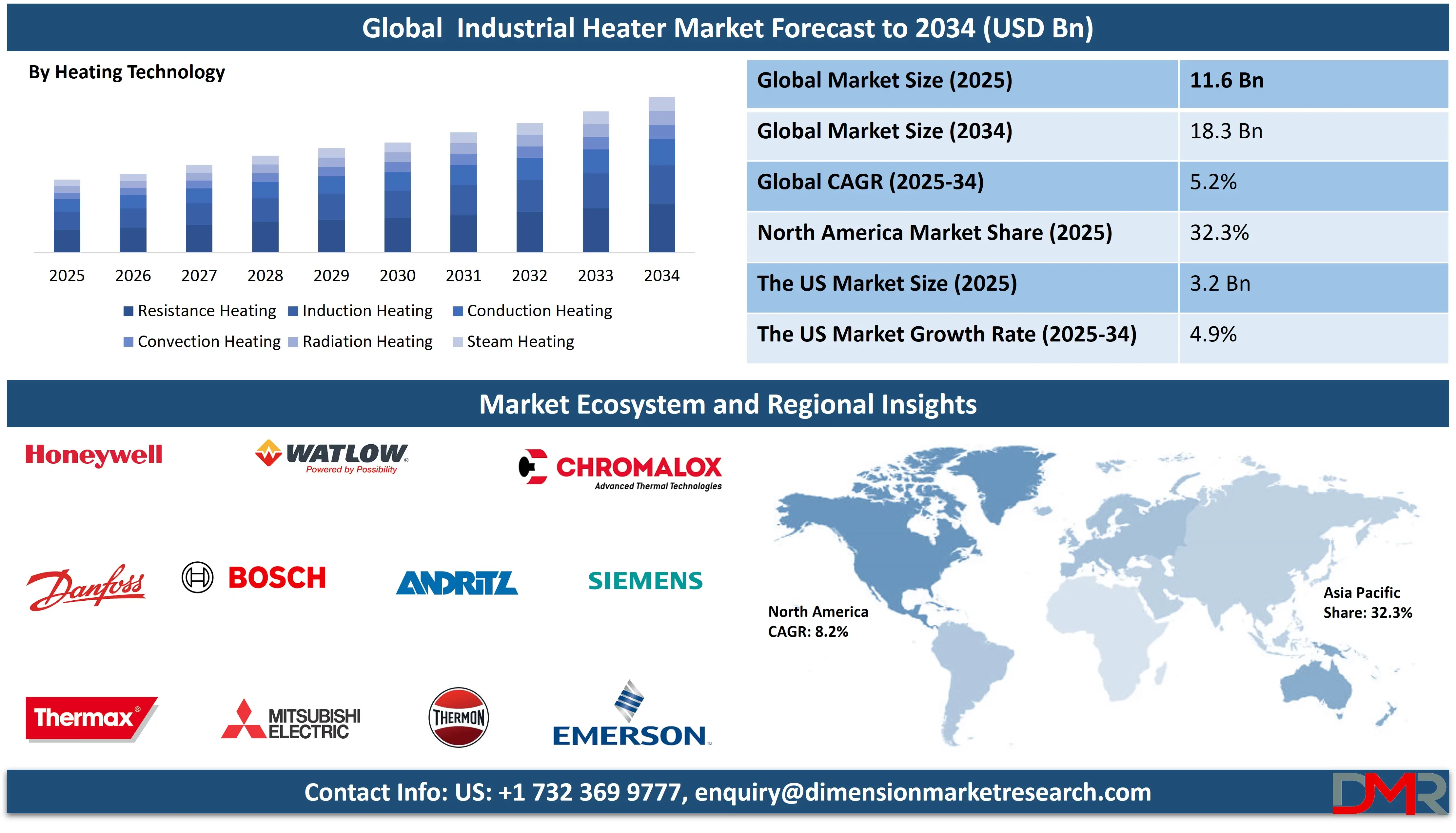

The global industrial heater market is projected to reach USD 11.6 billion in 2025 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2025 to 2034, reaching an estimated USD 18.3 billion by 2034. The market's steady growth is driven by increasing industrialization, expansion of process manufacturing sectors, stringent energy efficiency regulations, and the global shift toward electrification and sustainable heating solutions.

Industrial heaters are critical for precise temperature control, process fluid heating, freeze protection, and space heating across diverse sectors. They enable efficient operations in plants where consistent thermal conditions are essential for quality, safety, and productivity. The market addresses global industrial challenges related to energy consumption, operational downtime, and emission reduction, supporting the transition toward greener manufacturing practices.

Technological advancements, including smart IoT-enabled heaters, advanced ceramic heating elements, high-efficiency induction systems, modular heating solutions, and integrated thermal management platforms, are transforming the market into a more efficient, reliable, and digitally integrated ecosystem. Integration of predictive maintenance algorithms, real-time energy monitoring, and automated temperature control systems is reshaping operational efficiency and lifecycle management.

Growing government initiatives promoting industrial energy efficiency, decarbonization of manufacturing, and smart factory adoption further accelerate global demand. However, barriers such as high initial investment, fluctuating raw material costs, technical complexity in retrofitting, and regional variability in energy infrastructure remain. Despite these limitations, the convergence of digitalization, electrification, and advanced thermal engineering positions industrial heaters as a central component of modern industrial infrastructure through 2034.

The US Industrial Heater Market

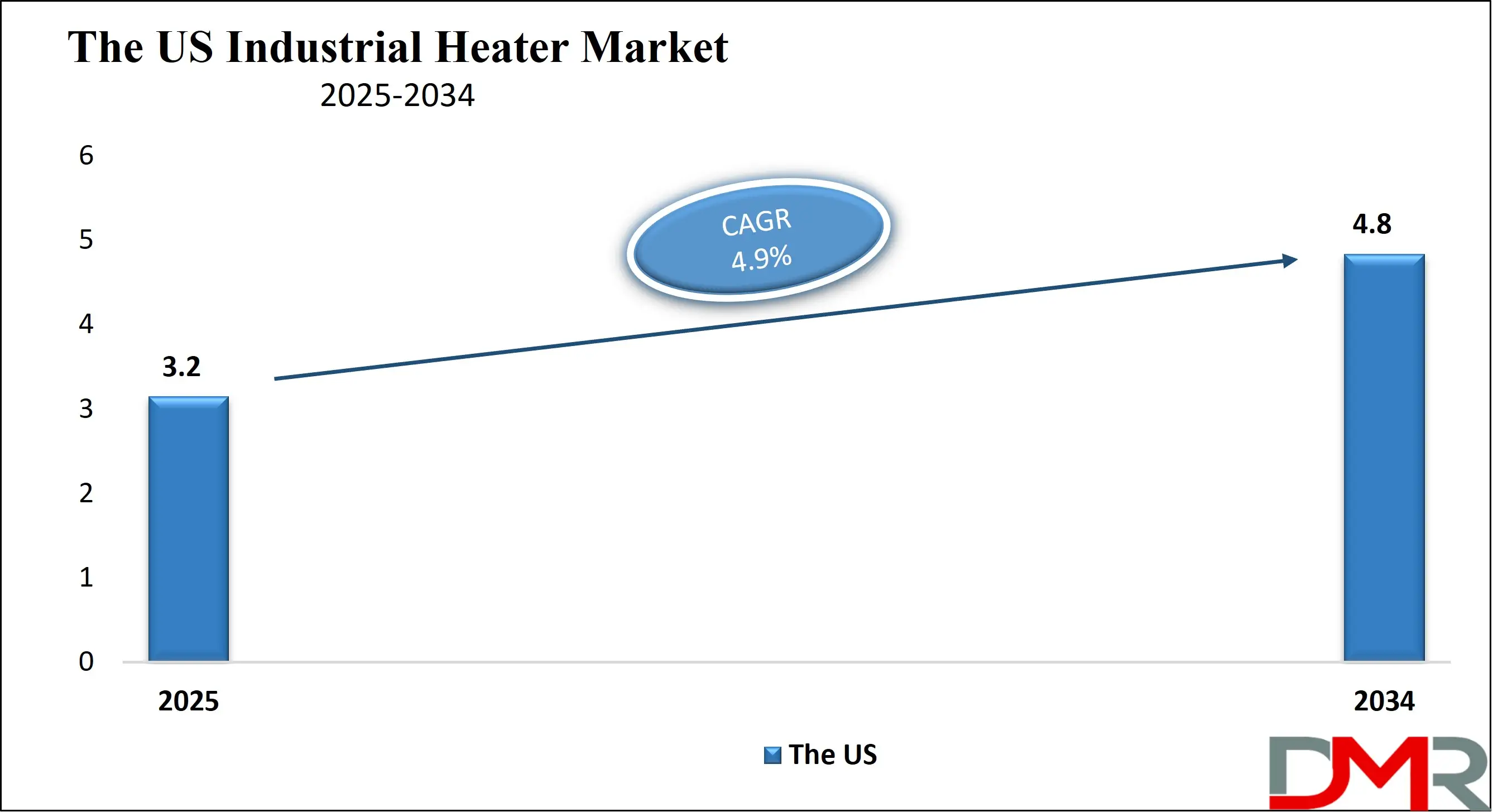

The U.S. Industrial Heater Market is projected to reach USD 3.2 billion in 2025 and grow at a CAGR of 4.9%, reaching USD 4.8 billion by 2034. The U.S. leads global adoption due to its advanced manufacturing base, resurgence in domestic production, strong regulatory focus on energy efficiency, and widespread implementation of smart manufacturing initiatives.

More than 30% of U.S. industrial energy use is attributed to process heating, fueling demand for high-efficiency electric and gas-fired heaters across chemicals, oil & gas, food processing, and pharmaceuticals. Federal agencies such as the Department of Energy (DOE) and initiatives like Manufacturing USA are promoting advanced thermal systems to enhance competitiveness and sustainability. Major industrial players and OEMs are integrating smart heaters with IIoT platforms, predictive thermal analytics, and renewable energy integration.

U.S. regulatory support is expanding, with updated ASME and NEC standards for industrial heating equipment and incentives for electrification in line with carbon reduction goals. National programs and utility rebates further encourage the adoption of high-efficiency heating solutions in medium and heavy industries.

The rapid adoption of modular heating systems, immersion heaters with advanced corrosion-resistant materials, and infrared heating for precision manufacturing continues to redefine the U.S. industrial landscape, positioning the country as a global leader in innovative thermal technology.

The Europe Industrial Heater Market

The Europe Industrial Heater Market is projected to be valued at approximately USD 1.9 billion in 2025 and is projected to reach around USD 3.0 billion by 2034, growing at a CAGR of about 5.0% from 2025 to 2034. Europe's leadership is anchored by stringent EU energy efficiency directives, strong green manufacturing policies, and significant investment in industrial decarbonization.

Countries such as Germany, the U.K., France, Italy, and the Nordic region are widely adopting electric process heaters, heat pump-integrated systems, and high-temperature heat recovery units, driven by compliance with EU Ecodesign regulations and the Fit for 55 package. Europe's push toward circular economy and net-zero industrial zones further drives the replacement of legacy gas and steam systems with electric and hybrid solutions.

Funding from the European Green Deal, Horizon Europe, and national industrial modernization programs is accelerating the adoption of smart heating systems, advanced digital thermal management, and renewable heat integration. Across industrial clusters, IoT-enabled heating networks and cloud-based thermal monitoring platforms are increasingly combined with artificial intelligence–driven optimization, enabling predictive control, adaptive heat distribution, and higher energy efficiency.

With strong engineering capabilities, focus on sustainable manufacturing, and alignment with climate targets, Europe remains one of the most advanced and regulated markets for industrial heating solutions.

The Japan Industrial Heater Market

The Japan Industrial Heater Market is anticipated to be valued at approximately USD 600.4 million in 2025 and is expected to attain nearly USD 1011.2 million by 2034, expanding at a CAGR of about 5.5% during the forecast period. Japan's advanced manufacturing sector, emphasis on precision, energy conservation, and adoption of Society 5.0 initiatives drive demand for efficient, reliable, and smart industrial heating solutions.

The Ministry of Economy, Trade and Industry (METI) actively supports thermal efficiency improvements and electrification through national green growth strategies, enabling adoption of high-efficiency infrared heaters, electric immersion heaters for chemical processes, and integrated heat recovery systems. Japan's leadership in robotics, electronics, and advanced materials accelerates innovation in compact heaters, corrosion-resistant designs, and energy-saving control systems.

Japan's concept of "Smart Factories", driven by companies like Mitsubishi Electric, Omron, and Sakura integrates IoT-enabled heaters with centralized energy management platforms. Manufacturing hubs are deploying predictive maintenance for heating systems, real-time emissivity control in infrared heating, and hybrid heating solutions to optimize energy use. Japan's focus on quality, reliability, and technological innovation positions the country as a high-growth innovator in the industrial heater segment.

Global Industrial Heater Market: Key Takeaways

- Steady Global Market Growth Outlook: The Global Industrial Heater Market is expected to be valued at USD 11.6 billion in 2025 and is projected to reach USD 18.3 billion by 2034, showcasing consistent expansion supported by industrialization, process optimization, and energy transition.

- Moderate CAGR Driven by Industrial Electrification: The market is expected to grow at a CAGR of 5.2% from 2025 to 2034, fueled by electrification of process heat, adoption of IIoT in thermal management, stringent efficiency norms, and expansion of key end-use industries.

- Strong Demand in the United States: The U.S. Industrial Heater Market stands at USD 3.2 billion in 2025 and is projected to reach USD 4.8 billion by 2034, expanding at a CAGR of 4.9% due to reshoring of manufacturing, regulatory support, and integration of smart thermal systems.

- Europe Maintains Focus on Sustainable Heating: Europe is expected to capture a significant share of the global market, supported by strong regulatory frameworks, green manufacturing mandates, and high adoption of electric and hybrid heating technologies.

- Technological Advancement in Heating Solutions: Innovations including IIoT-connected heaters, advanced ceramic and metallic heating elements, modular heater designs, and integrated thermal management software are significantly improving efficiency, controllability, and lifecycle costs.

- Growing Emphasis on Energy Efficiency Boosts Adoption: Rising global focus on reducing industrial carbon footprint, optimizing energy consumption, and complying with international efficiency standards is driving sustained demand for modern, high-performance heating systems.

Global Industrial Heater Market: Use Cases

- Process Fluid Heating in Chemical Plants: Immersion and circulation heaters provide precise temperature control for reactors, storage tanks, and pipelines, ensuring consistent viscosity and reaction rates.

- Freeze Protection in Oil & Gas: Trace heating and band heaters prevent solidification of crude oil, natural gas, and process fluids in pipelines and vessels in cold climates.

- Space Heating in Manufacturing Facilities: Duct heaters and infrared panels maintain ambient temperatures in large assembly halls, warehouses, and paint booths, ensuring worker comfort and product quality.

- Pre-heating in Metal Processing: Induction and radiant heaters preheat metals before forging, casting, or heat treatment, improving material properties and reducing energy waste.

- Sanitary Heating in Food & Beverage: Sanitary circulation and immersion heaters meet hygienic standards for heating water, syrups, and ingredients in food processing lines.

Global Industrial Heater Market: Stats & Facts

International Energy Agency (IEA)

- Industry accounts for about 37% of global final energy consumption.

- Industrial heat demand represents roughly two-thirds of total industrial energy use.

- Heating accounts for nearly 50% of global final energy consumption across all sectors.

- Fossil fuels supply around 75% of global heat demand.

- Electricity accounts for over 20% of industrial final energy use.

- Low-temperature heat (<150°C) represents about 30% of industrial heat demand.

- Medium-temperature heat (150–400°C) accounts for around 25% of industrial heat demand.

- High-temperature heat (>400°C) accounts for over 40% of industrial heat demand.

U.S. Department of Energy (DOE)

- Process heating represents approximately 36% of total energy use in U.S. manufacturing.

- U.S. manufacturing loses over 5 quadrillion BTUs annually as waste heat.

- Improving industrial process heating efficiency could reduce U.S. industrial energy use by 10–15%.

- Electric heating technologies are increasingly viable for low- and medium-temperature industrial processes.

U.S. Energy Information Administration (EIA)

- The industrial sector is the largest energy-consuming sector in the United States.

- Industry accounts for over 40% of U.S. natural gas consumption.

- Chemical manufacturing is the largest industrial energy-consuming subsector in the U.S.

- Industrial electricity consumption in the U.S. has steadily increased over the past decade.

International Renewable Energy Agency (IRENA)

- Heating and cooling together account for around 50% of global final energy demand.

- Renewable energy supplies less than 15% of global heat demand.

- Electrification of industrial heat is essential to meet global decarbonization targets.

- Industrial electrification can significantly reduce direct CO₂ emissions from heat generation.

United Nations Industrial Development Organization (UNIDO)

- Energy-intensive industries account for over 70% of total industrial energy consumption globally.

- Improving industrial energy efficiency can reduce global industrial emissions by up to 25%.

- Thermal processes dominate energy use in chemicals, metals, and food processing industries.

Eurostat (European Union Statistics Office)

- Industry accounts for approximately one-quarter of total energy consumption in the EU.

- Natural gas and electricity together supply over 60% of industrial energy use in Europe.

- Process heat dominates energy consumption in EU chemical and basic metals industries.

Food and Agriculture Organization (FAO – United Nations)

- Thermal processing is a major energy consumer in food and beverage manufacturing.

- Heat-based operations such as drying, pasteurization, and sterilization dominate food processing energy use.

Global Industrial Heater Market: Market Dynamic

Driving Factors in the Global Industrial Heater Market

Industrial Expansion and Modernization

The global expansion of manufacturing, chemical processing, oil & gas, and food & beverage industries is a major driver for industrial heater demand. Aging industrial infrastructure in developed regions and new plant construction in emerging economies significantly increase demand for efficient heating systems. Modernization initiatives focused on energy efficiency, automation, and emission reduction promote the replacement of outdated steam and fossil-fuel systems with electric, hybrid, and smart heater solutions.

Stringent Energy Efficiency and Emission Regulations

Governments worldwide are implementing stricter regulations on industrial energy use and greenhouse gas emissions. Standards such as EPA regulations in the U.S., Ecodesign in the EU, and MEPS in Asia-Pacific compel industries to adopt high-efficiency heaters. Incentives and carbon pricing mechanisms further accelerate the shift toward electric heating, heat recovery, and renewable thermal energy, making regulatory compliance a key market driver.

Restraints in the Global Industrial Heater Market

High Initial Investment and Retrofit Complexity

Advanced high-efficiency and smart heating systems often require significant upfront capital investment. Retrofitting existing industrial plants with modern heaters can be technically complex, involving system redesign, integration with legacy controls, and potential production downtime. This financial and operational barrier can delay adoption, especially among small and medium-sized enterprises (SMEs) and in cost-sensitive regions.

Volatility in Raw Material and Energy Prices

Industrial heaters rely on materials such as steel, copper, nickel alloys, and specialized ceramics. Price fluctuations for these raw materials impact manufacturing costs and final product pricing. Additionally, regional variability in electricity and natural gas prices affects the total cost of ownership and payback period for different heater technologies, creating uncertainty for end-users.

Opportunities in the Global Industrial Heater Market

Growth in Electrification of Process Heat

The global push for industrial decarbonization presents a major opportunity for electric heating technologies, including induction heaters, resistance heaters, and electric boilers. As renewable electricity becomes more affordable and grid carbon intensity decreases, electrification of low and medium-temperature process heat (<400°C) is becoming economically and environmentally attractive. This transition opens vast markets for electric heater manufacturers.

Integration with IIoT and Industry 4.0

The rise of smart factories creates significant opportunities for IIoT-enabled industrial heaters. Integration with plant-wide energy management systems (EMS), predictive maintenance platforms, and digital twins allows for optimized thermal performance, reduced energy waste, and minimized downtime. Heater manufacturers that offer connected, data-rich solutions can capture value in the growing market for intelligent industrial equipment.

Trends in the Global Industrial Heater Market

Adoption of Smart and Connected Heaters

Industrial heaters are increasingly equipped with embedded sensors, connectivity modules, and data analytics capabilities. These smart heaters provide real-time insights into performance, energy consumption, element health, and thermal output. They enable remote monitoring, predictive maintenance alerts, and integration with broader Industrial Internet of Things (IIoT) platforms, trending toward fully automated thermal management.

Modular and Scalable Heating Solutions

There is a growing trend toward modular heater designs that offer flexibility, easier installation, and scalability. Modular systems allow plants to adjust heating capacity based on process needs, simplify maintenance, and reduce spare part inventories. This trend is particularly strong in industries with batch processing, pilot plants, and modular skid-mounted process units.

Global Industrial Heater Market: Research Scope and Analysis

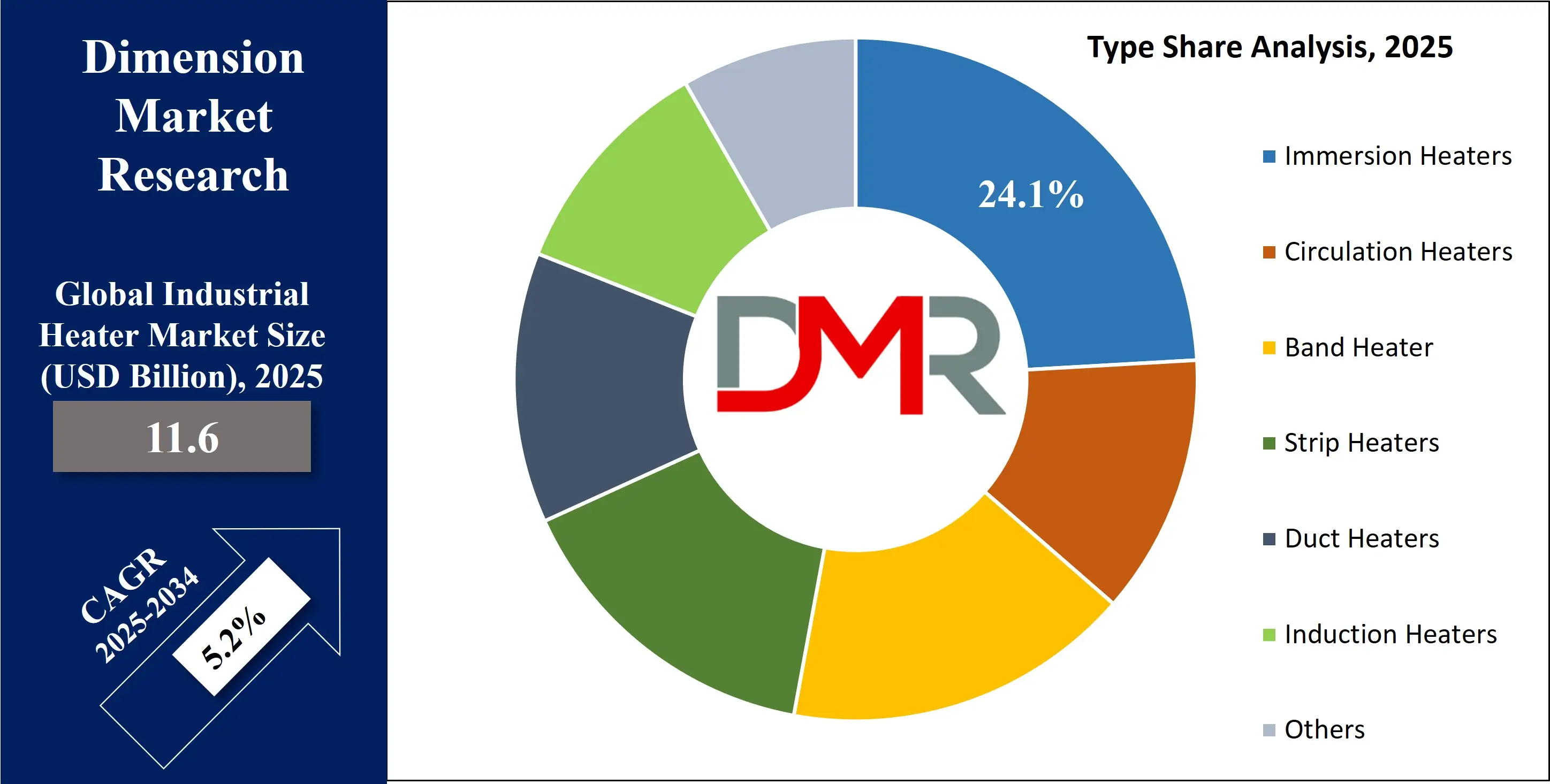

By Type Analysis

Immersion Heaters are projected to dominate the Global Industrial Heater Market by type, holding the largest market share through 2034. This dominance is driven by their fundamental role in direct, efficient, and precise fluid heating across critical process industries, including chemicals, oil & gas, and power generation. Installed directly into tanks, vessels, and pipelines, immersion heaters provide superior heat transfer efficiency and uniform temperature control, which is essential for chemical reactions, product stability, and safety. Their design eliminates the need for complex external heat exchangers, offering a compact and cost-effective solution that simplifies system architecture.

Advancements in materials science have further solidified their position. The development of corrosion-resistant sheath materials (such as Incoloy, titanium, and fluoropolymer coatings), advanced watt density management for precise thermal output, and integrated digital sensors for real-time monitoring have extended their operational life and reliability in harsh environments. The scalability of immersion heaters available in a vast range of sizes, wattages, and voltages makes them universally compatible with existing industrial infrastructures. As global industries intensify their focus on energy efficiency, operational reliability, and process optimization, the immersion heater segment's unmatched versatility and continuous technological evolution ensure its continued market leadership.

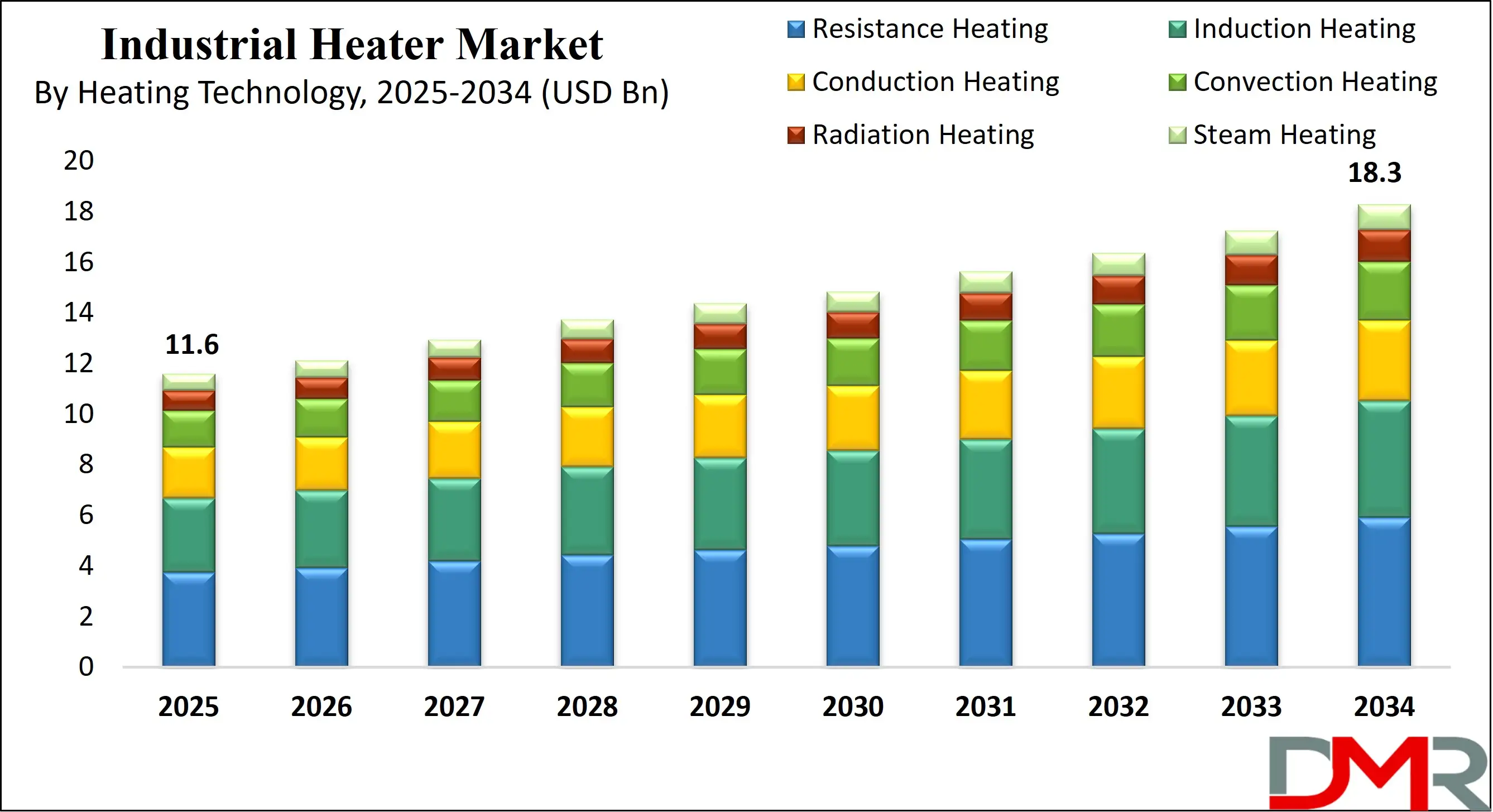

By Heating Technology Analysis

Resistance Heating is anticipated to dominate the Heating Technology segment, accounting for the largest market share throughout the forecast period. This dominance is rooted in its widespread applicability, simplicity, reliability, and high efficiency in converting electrical energy into heat. Resistance heaters, including elements made from nickel-chromium (nichrome) alloys, are the core technology in immersion, circulation, band, and duct heaters, making them ubiquitous across virtually all industrial sectors. Their direct and controllable heat generation allows for precise temperature regulation, which is critical for sensitive processes in chemicals, pharmaceuticals, and food production.

The technology's dominance is reinforced by its compatibility with modern digital controls and Industry 4.0 integration. Advanced resistance heating systems can be seamlessly paired with IoT sensors and programmable logic controllers (PLCs) for exact thermal management, energy optimization, and predictive maintenance. Furthermore, as global industries pivot toward electrification to meet decarbonization goals, electric resistance heating stands as a mature, readily deployable, and increasingly efficient alternative to fossil-fuel-based steam or combustion systems. While induction heating grows rapidly for specific metal processing applications, the foundational role, cost-effectiveness, and ongoing improvements in element efficiency and durability ensure resistance heating remains the leading technology for broad industrial thermal needs.

By Application Analysis

Process Heating is poised to be the largest and most dominant application segment in the industrial heater market. This segment encompasses the core thermal operations required for manufacturing and transforming materials, including heating of fluids, gases, and solids for chemical reactions, distillation, evaporation, and sterilization. It is the fundamental engine of industries such as chemicals & petrochemicals, oil refining, and food & beverage processing, where precise temperature control directly dictates product quality, yield, safety, and reaction rates.

The dominance of process heating is driven by the sheer scale of global industrial output and a dual imperative: modernization and sustainability. As aging infrastructure is upgraded, there is a massive replacement cycle for inefficient, fuel-fired process heaters with high-efficiency electric and hybrid systems. Simultaneously, stringent global regulations on energy consumption and carbon emissions compel industries to invest in advanced, controllable, and efficient thermal solutions. The segment's critical nature ensures continuous capital expenditure, as any failure or inefficiency in process heating leads to significant production and financial losses. The integration of smart, connected heaters into process heating applications for optimized energy use and predictive control further cements its central role and largest market share.

By End User Analysis

The Chemicals & Petrochemicals Industry is projected to dominate the Industrial Heater Market as the leading end-user segment. This sector is the largest and most intensive consumer of industrial heat, requiring reliable, high-temperature, and often corrosive-resistant heating solutions for a vast array of processes including cracking, reforming, distillation, polymerization, and reactor feed pre-heating. The continuous, 24/7 nature of chemical manufacturing demands heaters with exceptional durability, precise control, and failsafe designs, often requiring certifications for hazardous areas.

The segment's dominance is underpinned by sustained global expansion and a powerful drive toward operational excellence and sustainability. New plant construction, particularly in Asia-Pacific and the Middle East, creates substantial demand for new heating installations. Concurrently, existing facilities in Europe and North America are undergoing retrofits to replace legacy systems with energy-efficient, electrified, and digitally integrated heaters to reduce emissions and operating costs. The chemical industry's complex thermal requirements, coupled with its significant capital expenditure budgets and focus on reducing energy intensity (a major cost component), ensure it remains the primary driver of demand and innovation in the industrial heater market.

The Global Industrial Heater Market Report is segmented on the basis of the following

By Type

- Immersion Heaters

- Circulation Heaters

- Band Heater

- Strip Heaters

- Duct Heaters

- Induction Heaters

- Others

By Heating Technology

- Resistance Heating

- Induction Heating

- Conduction Heating

- Convection Heating

- Radiation Heating

- Steam Heating

By Application

- Process Heating

- Space Heating

- Drying and Curing

- Freeze Protection

- Heat Tracing / Pipe Heating

- Temperature Control in Tanks & Vessels

By End User

- Chemicals & Petrochemicals

- Oil & Gas

- Food & Beverage

- Power Generation

- Pharmaceuticals

- Metals & Mining

- Others

Impact of Artificial Intelligence in the Global Industrial Heater Market

- Predictive Maintenance for Heaters: IIoT sensors monitor heater element resistance, sheath temperature, and vibration to predict failures before they occur. This reduces unplanned downtime, extends equipment life, and optimizes maintenance schedules.

- Energy Consumption Analytics: Connected heaters provide granular data on real-time and historical energy use. Analytics platforms identify waste, optimize setpoints, and benchmark performance, supporting energy efficiency initiatives and cost reduction.

- Remote Monitoring & Control: Plant operators can monitor heater status, adjust setpoints, and receive alarms remotely via cloud-based dashboards. This improves operational responsiveness and enables support from OEMs or specialists off-site.

- Integration with Energy Management Systems (EMS): Smart heaters feed data into plant-wide EMS, allowing for coordinated demand-side management, load shedding, and optimization against energy tariffs and renewable energy availability.

- Digital Twins for Thermal Systems: Virtual models of heating systems simulate performance under different conditions, helping design optimal configurations, troubleshoot issues, and plan upgrades without disrupting physical operations.

Global Industrial Heater Market: Regional Analysis

Region with the Largest Revenue Share

Asia-Pacific is projected to dominate the Global Industrial Heater Market as it holds 32.3% of the total market share in 2025, driven by the unparalleled scale and pace of its industrial expansion. The region, led by China, India, and Southeast Asia, is the world's primary manufacturing hub for chemicals, refining, metals, and general manufacturing, creating massive, sustained demand for heating equipment.

This is fueled by large-scale infrastructure projects, strong governmental industrial policies ("Made in China 2025," "Make in India"), and significant foreign direct investment. While energy efficiency is an emerging trend, the core driver remains new capacity addition. The presence of numerous cost-competitive local manufacturers further solidifies APAC's position as the market's volume and revenue leader, a status expected to continue due to its fundamental role in global supply chains.

Region with the Highest CAGR

North America is anticipated to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is propelled not by greenfield expansion, but by a powerful wave of industrial modernization and reshoring. Stringent energy efficiency regulations from the DOE and EPA, coupled with corporate net-zero commitments, are compelling industries to replace aging, inefficient heating systems with advanced electric and smart IIoT-enabled solutions.

The region's mature digital infrastructure and high adoption of Industry 4.0 technologies facilitate the integration of connected heaters with predictive maintenance and energy management platforms. Strategic investments in high-value, onshored sectors like semiconductors, pharmaceuticals, and advanced manufacturing further drive demand for sophisticated, high-performance heating systems, leading to superior growth rates.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Industrial Heater Market: Competitive Landscape

The Global Industrial Heater Market is moderately fragmented, featuring a mix of large multinational electrical equipment conglomerates, specialized industrial heating companies, and regional manufacturers. Leading players Watlow Electric Manufacturing Company, Chromalox (Spirax-Sarco Engineering), Tempco Electric Heater Corporation, and Backer Hotwatt dominate with comprehensive portfolios spanning immersion, circulation, band, and infrared heaters.

Major electrical and process control corporations such as ABB, Siemens, Schneider Electric, and Honeywell influence the market through integrated thermal management solutions, IIoT platforms, and global service networks. These players leverage their broad industrial automation presence to offer heaters as part of larger system packages.

Specialized innovators and material science companies like NIBE Industrier, Friedr. Freek GmbH, and Zoppas Industries focus on high-efficiency elements, advanced alloys, and ceramic heating technologies. Meanwhile, regional players and system integrators strengthen market penetration by offering customized solutions and local service support.

Some of the prominent players in the Global Industrial Heater Market are

- Chromalox

- Watlow

- Thermon

- Emerson Electric

- Siemens

- Honeywell International

- Mitsubishi Electric

- Robert Bosch

- Thermax

- Danfoss

- Atlas Copco

- Johnson Controls

- Carrier

- Babcock & Wilcox

- Fulton

- Miura Boiler

- ANDRITZ

- Lennox International

- Clayton Industries

- IHI Corporation

- Other Key Players

Recent Developments in the Global Industrial Heater Market

- November 2025: Watlow introduced its iQ platform, integrating advanced sensors, edge computing, and cloud connectivity into its heater portfolio. The platform enables predictive maintenance, energy optimization, and seamless integration with plant IIoT systems, targeting high-value process industries.

- October 2025: Chromalox launched a new line of high-voltage electrode steam boilers for industrial process heating. Designed for rapid steam generation and high efficiency, the boiler supports the electrification of steam systems, helping industries reduce fossil fuel dependency.

- September 2025: Siemens and ABB announced an expanded partnership to integrate ABB's high-efficiency heaters with Siemens' MindSphere IoT platform. The collaboration aims to deliver end-to-end digital thermal solutions for smart factories and process plants.

- August 2025: NIBE Industrier acquired a leading European manufacturer of silicone rubber and mica band heaters, strengthening its portfolio for plastics processing and packaging machinery markets.

- July 2025: The U.S. Department of Energy awarded a significant grant to a consortium led by Oak Ridge National Lab and industrial partners to develop ultra-high-efficiency induction heating systems for metal processing, aiming to reduce energy use by 40%.

- May 2025: Tempco introduced a new series of immersion heaters using Grade 7 titanium sheaths for highly corrosive applications in chemical processing and electroplating, addressing a key failure point and extending service life.

- April 2025: Honeywell launched a new module within its Forge platform specifically for monitoring and optimizing industrial heating systems, using AI to balance thermal demand, energy cost, and equipment health.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 11.6 Bn |

| Forecast Value (2034) |

USD 18.3 Bn |

| CAGR (2025–2034) |

5.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.2 Bn |

| Forecast Data |

2025 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Immersion Heaters, Circulation Heaters, Band Heaters, Strip Heaters, Duct Heaters, Induction Heaters, Others), By Heating Technology (Resistance Heating, Induction Heating, Conduction Heating, Convection Heating, Radiation Heating, Steam Heating), By Application (Process Heating, Space Heating, Drying & Curing, Freeze Protection, Heat Tracing/Pipe Heating, Temperature Control in Tanks & Vessels), By End User (Chemicals & Petrochemicals, Oil & Gas, Food & Beverage, Power Generation, Pharmaceuticals, Metals & Mining, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Chromalox, Watlow, Thermon, Emerson Electric, Siemens, Honeywell International, Mitsubishi Electric, Robert Bosch, Thermax, Danfoss, Atlas Copco, Johnson Controls, Carrier, Babcock & Wilcox, Fulton, Miura Boiler, ANDRITZ, Lennox International, Clayton Industries, IHI Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Industrial Heater Market size is estimated to have a value of USD 11.6 billion in 2025 and is expected to reach USD 18.3 billion by the end of 2034.

The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025 to 2034.

The US Industrial Heater Market is projected to be valued at USD 2.1 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.2 million in 2034 at a CAGR of 4.9%.

Asia-Pacific is expected to have the largest market share in the Global Industrial Heater Market, driven by its massive industrial manufacturing base.

Some of the major key players in the Global Industrial Heater Market are Watlow Electric Manufacturing Company, Chromalox, Tempco Electric Heater Corporation, ABB Ltd., Siemens AG, Schneider Electric SE, and Honeywell International Inc., and many others.