Market Overview

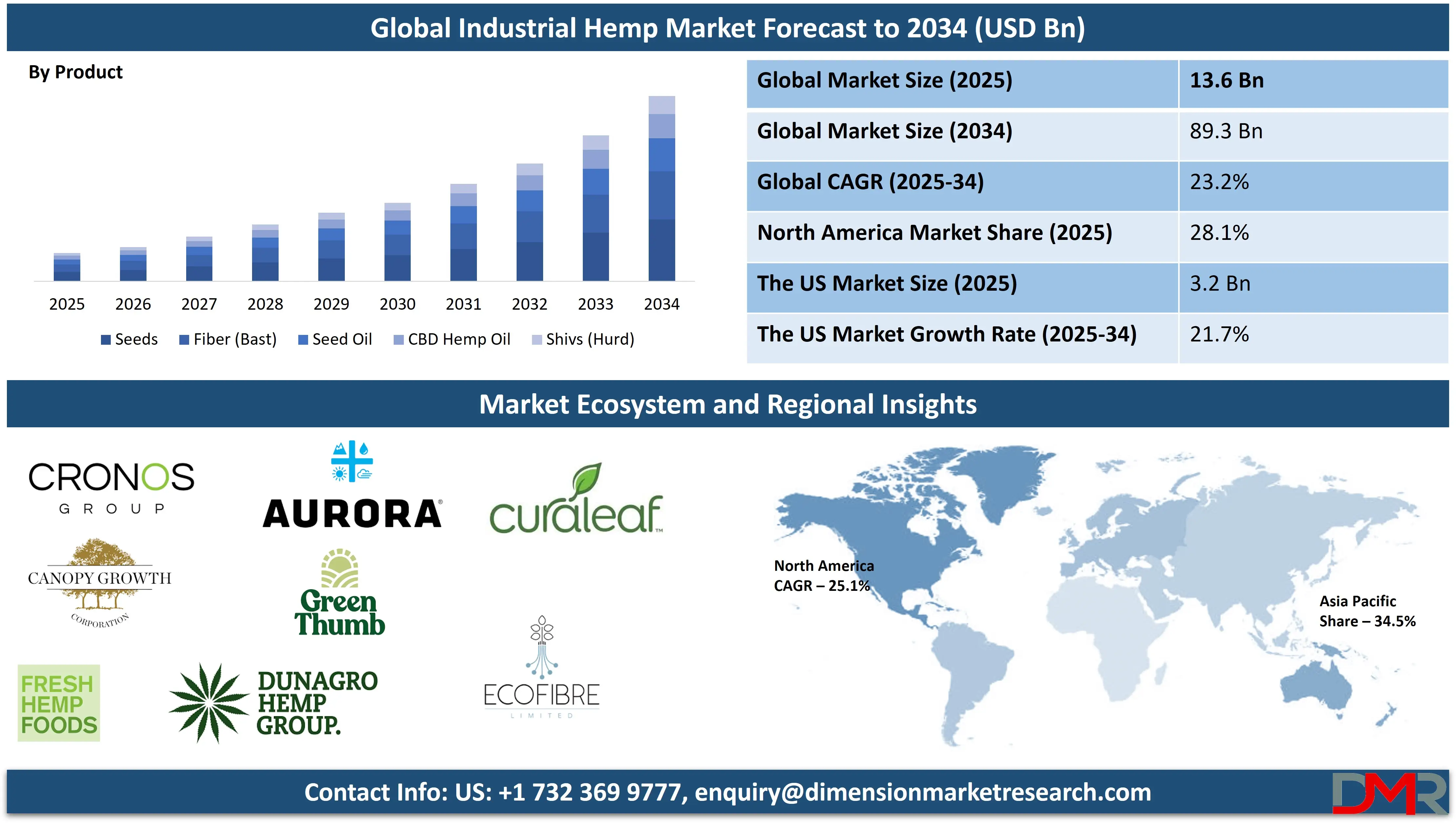

The Global Industrial Hemp Market is predicted to be valued at

USD 13.6 billion in 2025 and is expected to grow to

USD 89.3 billion by 2034, registering a compound annual growth rate

(CAGR) of 23.2% from 2025 to 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Industrial hemp is a versatile variety of the Cannabis sativa plant species grown specifically for industrial and commercial use. Unlike marijuana, it contains very low levels of THC (tetrahydrocannabinol), the psychoactive compound. Hemp is used in the production of textiles, paper,

biodegradable plastics, construction materials, health foods, and biofuels.

Its seeds are rich in protein, fiber, and essential fatty acids, while its stalks provide strong fibers. Hemp grows quickly, requires little pesticide, and improves soil health, making it an environmentally sustainable crop. Its broad utility and eco-friendly characteristics are driving increasing global interest and cultivation in diverse industries.

The industrial hemp market is witnessing substantial growth due to rising demand from various industries. Hemp is a highly versatile crop used in applications such as personal care, textiles, construction materials, automotive components, food and beverages, and paper. Its components, including fiber, seeds, stalks, hurds, and oils, offer multiple functions, making industrial hemp a valuable raw material across both traditional and emerging sectors.

One of the key driving forces behind this growth is the recognition of hemp’s environmental and agricultural benefits. Industrial hemp has a rapid growth cycle, typically between 120 to 150 days, and produces a large biomass yield. This allows for efficient land utilization and supports carbon sequestration. Moreover, hemp contributes to sustainable farming practices by serving as a break crop, which helps improve soil health and reduces the need for chemical fertilizers and pesticides.

There is a growing shift in consumer preferences toward natural and eco-friendly products, which has boosted the demand for hemp-based solutions. In the food and personal care industries, hemp seeds and oils are valued for their nutritional and skincare properties. In the textile industry, hemp fibers are gaining popularity due to their durability and breathability, particularly among environmentally conscious consumers.

Countries such as China, Canada, and France have become major producers and exporters of industrial hemp due to favorable climates and well-developed supply chains. Despite this progress, the industry faces hurdles related to strict government regulations and the misconception linking industrial hemp to psychoactive cannabis varieties. These regulatory challenges continue to limit full-scale adoption in certain regions.

Nevertheless, increasing legislative support and advancements in hemp processing technologies are creating new opportunities. As awareness and acceptance of industrial hemp continue to rise globally, the market is poised for sustained expansion, offering both economic benefits and environmental advantages.

The US Industrial Hemp Market

The US Industrial Hemp Market is projected to be valued at USD 3.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 18.9 billion in 2034 at a CAGR of 21.7%.

The U.S. industrial hemp market has experienced significant growth, driven by several key factors. The 2018 Farm Bill played a pivotal role by legalizing hemp cultivation and removing it from the Controlled Substances Act, thereby facilitating its widespread production and commercialization. This legislative change opened up opportunities for farmers to grow hemp commercially, leading to a rapid expansion of the hemp industry across the country. Additionally, hemp's versatility in applications from textiles and construction materials to food, beverages, and personal care products has spurred demand across various industries.

Several emerging trends are influencing the U.S. industrial hemp market. The demand for hemp-derived products, such as CBD, continues to rise, driven by consumer interest in wellness and natural alternatives. In the beverage sector, for instance, Illinois has witnessed a surge in THC-infused drinks, partly due to tariffs on imported alcoholic beverages, making hemp-derived options more appealing. Moreover, the textile industry is experiencing a shift towards hemp-based fabrics, which are gaining popularity for their durability and eco-friendly properties.

The Europe Industrial Hemp Market

The Europe Industrial Hemp Market is projected to be valued at USD 2.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.5 billion in 2034 at a CAGR of 11.61%.

The European Industrial Hemp Market is experiencing steady growth, driven by increasing demand for sustainable and eco-friendly products. The primary factor fueling this expansion is the growing awareness of environmental issues and the shift towards green solutions. Hemp is gaining popularity in various sectors, including textiles, construction, food, and personal care, due to its versatility, low environmental impact, and potential as a renewable resource.

Government support through favorable policies and regulations is another key factor in driving market growth. Furthermore, hemp's legal status across Europe has contributed to a boost in production and consumption, making it a promising industry for both established companies and startups.

The Japan Industrial Hemp Market

The Japan Industrial Hemp Market is projected to be valued at USD 0.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.6 billion in 2034 at a CAGR of 15.3%.

The Japan Industrial Hemp Market is gradually expanding, driven by shifts in consumer attitudes and increased interest in the potential benefits of hemp products. Japan has historically had stringent regulations surrounding hemp cultivation, but recent relaxation of laws is enabling market growth. The driving factors include the growing awareness of hemp's sustainability and its applications in a variety of industries, including textiles, food, and wellness.

With a strong inclination towards natural, environmentally friendly products, Japan is seeing a rise in demand for hemp-based alternatives in multiple sectors. Furthermore, the growing popularity of CBD products for

health and wellness is boosting the market. As government policies become more supportive, Japan's hemp industry is projected to grow significantly.

Industrial Hemp Market: Key Takeaways

- Market Overview: The global industrial hemp market is forecasted to reach a valuation of USD 13.6 billion by 2025, with expectations to surge to USD 89.3 billion by 2034. This represents a robust compound annual growth rate (CAGR) of 23.2% throughout the forecast period from 2025 to 2034.

- U.S Industrial Hemp Market: In the United States, the industrial hemp market is anticipated to reach USD 3.2 billion in 2025. By 2034, it is projected to grow significantly to USD 18.9 billion, reflecting a CAGR of 21.7%.

- Product Segment Analysis: Hemp seeds are expected to dominate the product segment, holding the largest revenue share of 30.4% by the end of 2025. This is attributed to their increasing demand across rapidly growing sectors such as food, nutraceuticals, personal care, and pharmaceuticals.

- Source Type Analysis: Conventional farming is projected to hold the largest market share, accounting for 54.4% of revenue in 2025. This dominance is driven by its cost-effectiveness, scalability, and well-established agricultural methods.

- Application Segment Analysis: The textile industry is set to lead the application segment with a 24.1% revenue share by 2025. The popularity of hemp in textiles is largely due to its strong and durable fiber characteristics.

- Leading Regional Market: Asia Pacific is expected to command the largest regional share in the industrial hemp market, with a 34.5% share by 2025. This leadership is supported by the region’s favorable growing conditions, extensive cultivation, and well-developed hemp infrastructure.

Industrial Hemp Market: Use Cases

- Textile Industry: Industrial hemp is widely used in the production of sustainable fabrics, offering a more eco-friendly alternative to conventional textiles made from cotton or synthetic materials. Its strong fibers are ideal for making clothing, upholstery, and other fabric-based products.

- Construction Materials: Hemp-based products, such as hempcrete, are used in construction for insulation, walls, and flooring. Hempcrete is particularly valued for its thermal insulation properties, sustainability, and low carbon footprint compared to traditional building materials.

- Biofuel Production: Industrial hemp can be converted into biofuels, such as hemp biodiesel, due to its high oil content in the seeds. This renewable energy source is an alternative to fossil fuels and has the potential to reduce greenhouse gas emissions.

- Health and Wellness Products: Hemp seeds and oil are increasingly used in the health and wellness industry. They are rich in essential fatty acids, proteins, and antioxidants, making them popular ingredients in nutritional supplements, skincare products, and natural remedies.

Industrial Hemp Market: Stats & Facts

- Hemp is defined as Cannabis sativa with ≤0.3% THC in the US; ≤0.2% in Europe, making it non-intoxicating. Hemp is recognized as an efficient carbon sink, with the ability to absorb up to 22 tonnes of CO₂ per hectare, surpassing the carbon uptake of agroforestry.

- Growing two crops per year can offset up to 30 tonnes of CO₂ annually per hectare. Hemp sequesters approximately 45% of the atmospheric carbon it absorbs during photosynthesis, making it one of the fastest CO₂-to-biomass converters known (Source: Provided Statistics).

- Hemp is a high-yield fiber crop. Its bast fibers range from 1.2 to 2.1 meters in length, and the total fiber content from hemp straw can reach 0.2–0.3 tonnes per tonne of straw (Source: Provided Statistics).

- Hemp fibers are eight times stronger and four times more durable than cotton, with tensile strengths between 550–900 MPa compared to cotton’s 287–597 MPa (Source: Provided Statistics).

- Hemp fabric also offers UV protection, blocking up to 99.9% of UVA and UVB rays and earning a UPF rating of 50+ (Source: Provided Statistics).

Industrial Hemp Market: Market Dynamics

Driving Factors in the Industrial Hemp Market

Legalization and Regulatory Support

One of the primary drivers of the industrial hemp market is the increasing legalization and favorable regulatory frameworks across multiple countries. Governments in North America, Europe, and parts of Asia have eased restrictions on hemp cultivation, recognizing its economic and environmental benefits. For example, the 2018 U.S. Farm Bill legalized industrial hemp at the federal level, leading to a surge in cultivation and investment. These legal reforms have also encouraged research and development in hemp-based products, from textiles to bio-composites, creating a conducive environment for market expansion and attracting new players across various verticals.

Rising Demand for Sustainable Products

Sustainability is a growing concern among consumers and industries alike, and industrial hemp fits well within this global push for eco-friendly alternatives. Hemp requires less water, fewer pesticides, and regenerates soil health, making it an environmentally superior crop. Its fibers are biodegradable, durable, and versatile, allowing for use in packaging, construction materials, textiles, and bioplastics. As companies and governments set aggressive carbon neutrality targets, the demand for sustainable raw materials like hemp is expected to climb. This growing environmental consciousness is driving both consumer preferences and industrial usage toward hemp-derived products.

Restraints in the Industrial Hemp Market

Regulatory and Legal Uncertainty

Although there has been significant progress in the legalization of hemp, inconsistent regulations across different countries and even within various regions of the same country remain a major obstacle. Industrial hemp is frequently confused with marijuana due to its association with the cannabis plant. This leads to strict oversight and complex compliance requirements. Variations in THC thresholds, licensing challenges, and unclear laws governing the processing and marketing of hemp-based products further complicate international trade and investment.

These regulatory uncertainties can discourage new businesses from entering the market, limit product innovation, and hinder overall market growth. Without harmonized global regulations, companies face increased operational risks, supply chain inefficiencies, and reduced consumer access to hemp products.

Limited Processing Infrastructure

The lack of adequate processing and manufacturing infrastructure is another major challenge restraining the industrial hemp market. Hemp cultivation is expanding, but there is a bottleneck in facilities equipped to process it into usable forms like fiber, oil, and hurd. This mismatch leads to post-harvest losses, inefficiencies, and increased production costs.

Many regions still lack modern decorticators and other processing technologies, making it difficult to scale operations or maintain consistent product quality. Until investments are made to build out this infrastructure, particularly in developing regions, the growth of downstream applications will remain constrained.

Opportunities in the Industrial Hemp Market

Expansion in the Food and Beverage Sector

Industrial hemp offers significant growth potential in the food and beverage industry due to its nutritional benefits. Hemp seeds are rich in protein, omega-3 and omega-6 fatty acids, and fiber, making them attractive for health-conscious consumers. Hemp-derived ingredients are increasingly being used in plant-based protein powders, milk substitutes, energy bars, and dietary supplements. With the rising popularity of veganism and plant-based diets, the market has ample opportunity to diversify hemp-infused offerings. Additionally, regulatory clarity regarding the use of hemp in consumables could unlock new avenues for product development and market entry in untapped regions.

Innovation in Bioplastics and Construction Materials

The shift toward green alternatives is opening doors for hemp-based innovations in sectors such as construction and packaging. Hemp hurds can be used to make bio-composites and insulation materials, while hemp fibers serve as a strong, lightweight, and biodegradable substitute for conventional plastics. These materials are being adopted in green building practices and sustainable product manufacturing. With governments offering incentives for sustainable infrastructure and reducing plastic use, there's a major opportunity for hemp to penetrate these sectors. Continuous R&D in material science is likely to yield new, commercially viable hemp-based products in the near future.

Trends in the Industrial Hemp Market

Growth of Hemp-Based Textiles in Fashion

As the fashion industry grapples with its environmental footprint, hemp-based textiles are gaining traction as a sustainable alternative to cotton and synthetic fibers. Hemp fabric is not only biodegradable but also stronger and more durable than many conventional materials. Leading apparel brands are incorporating hemp into their collections, marketing it as eco-conscious and ethically produced. Consumer awareness of sustainable fashion is increasing, and demand for natural fibers is on the rise. The hemp textile segment is also benefiting from innovations that improve the softness and versatility of hemp fabrics, making them more appealing for mainstream use.

Increased Investment and Vertical Integration

Another major trend in the industrial hemp market is increased investment and vertical integration. Companies are consolidating their operations from cultivation and processing to distribution, aiming for better control over quality and cost-efficiency. This trend is being driven by venture capital, government grants, and corporate partnerships interested in capitalizing on the hemp boom. Vertical integration allows businesses to streamline supply chains, innovate faster, and meet regulatory standards more effectively. The presence of established players and startups alike is accelerating competition and product diversity, contributing to overall market maturation and stability.

Industrial Hemp Market: Research Scope and Analysis

By Product Analysis

Seeds are projected to lead the industrial hemp market with the highest revenue share of 30.4% by the end of 2025, due to their increasing use across various high-growth industries, including food, nutraceuticals, personal care, and pharmaceuticals. As they offer abundant sources of protein, omega fatty acids, and essential nutrients, which an ideal ingredients in nutritional supplements and functional foods. While hemp seed oil has long been employed in cosmetics to provide skin benefits, its increasing popularity will only further support the expansion of this segment over the coming years.

Hemp fiber is projected to become the second segment in terms of diversity of applications and eco-friendliness, due to its strength, durability, biodegradability, and thermodynamic properties. Used widely across industries like construction, automotive, and textile production due to these qualities. Insulation materials made with hemp fiber offer sustainable alternatives to synthetic counterparts, while the global shift towards eco-friendly building materials and lightweight automotive components further drives their market development. With growing emphasis placed upon sustainability and renewable materials as driving factors of this growth trend, hemp fiber demand should only continue its rise, cementing its position among industrial hemp market leading segments.

By Source Analysis

Conventional farming is likely to dominate the industrial hemp market with the highest revenue share of 54.4% in 2025, due to its cost-efficiency, scalability, and established cultivation practices. Utilizing chemical fertilizers and pesticides results in higher crop yields with enhanced pest resistance, necessary to meet ever-increasing industrial demands. In addition, its lower production costs make conventional methods an appealing option, particularly where organic regulations do not exist or restrictions are imposed. Furthermore, their reliable supply supports various sectors, including textiles, construction, food cosmetics, for maintaining competitive pricing while guaranteeing uninterrupted production processes for manufacturers.

Organic farming is predicted to emerge as the second-dominant segment in the industrial hemp market due to rising consumer preference for sustainable and chemical-free products. By forgoing synthetic pesticides and fertilizers while encouraging environmental friendly practices and improving soil health, this form of farming appeals more directly to health conscious customers than conventional methods more expensive yet less prevalent, organic hemp also finds popularity with premium product markets such as food, wellness and cosmetics - appealing particularly to health conscious shoppers despite limited scale or higher production costs.

By Application Analysis

Textile applications are anticipated to lead the industrial hemp market with a revenue share of 24.1% by the end of 2025, due to its superior qualities of hemp fibers. Hemp fabrics are extremely durable, breathable, and resistant to UV rays, mold, and mildew, making them perfect for textile uses in various settings and hypoallergenic and eco-friendly, which appeals to eco-conscious customers.

Furthermore, hemp blends well with other fibers such as cotton or linen to add texture, stretch, and strength for fashion and industrial textile applications, increasing versatility further. The industrial hemp market is also driving due to growing consumer demand for sustainable and biodegradable clothing, which is gaining traction for hemp textiles.

Food & Beverages is predicted to experience high CAGR due to rising consumer awareness of hemp's nutritional benefits. Hemp seeds and oil contain proteins, essential fatty acids (omega-3 and omega-6), and other vitamins and nutrients, making them attractive options for health-minded shoppers looking for alternative protein sources like hemp.

Increasing demand has also come with plant-based diets becoming more prevalent as well as functional food's inclusion into more food products from snacks to beverages with hemp oil as an ingredient extending market reach further while regulatory support as well as popularity of clean label products all contribute positively towards this sector's robust growth over the coming years.

The Industrial Hemp Market Report is segmented on the basis of the following:

By Product

- Seeds

- Fiber (Bast)

- Seed Oil

- CBD Hemp Oil

- Shivs (Hurd)

By Source

By Application

- Textiles

- Food & Beverages

- Automotive

- Furniture

- Animal Care

- Pharmaceuticals

- Other

Regional Analysis

Region with the largest Share

Asia Pacific is predicted to dominate the industrial hemp market with a revenue share of

34.5% by the end of 2025 due to its strong cultivation base, favorable climate, and established hemp-related infrastructure. Countries like China, India, Japan, and Thailand are major producers and consumers of hemp fiber, seeds, oil, and hurds.

Advancing agricultural technologies and innovation are making harvesting more efficient, boosting production volumes. Additionally, the rising demand for hemp-based food products and supplements, especially in countries with aging populations, is further fueling market expansion. Government support and traditional uses of hemp in textiles and wellness also contribute to the region's market dominance.

Region with Highest CAGR

North America is expected to experience the highest CAGR in the industrial hemp market due to increasing awareness of the plant’s health and environmental benefits. Factors such as high disposable income, a growing elderly population, and rising demand for natural personal care products are driving this growth. In particular, the use of hemp oil in cosmetics, skincare, and

skincare devices is rapidly expanding due to its anti-inflammatory and UV-protective properties.

Furthermore, evolving legal frameworks and investments in hemp farming and processing infrastructure are creating new opportunities, making North America a high-growth region in the global industrial hemp landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the industrial hemp market is characterized by a diverse and evolving set of players who leverage innovation, scale, and geographical advantage to strengthen their market position. Key industry participants focus on cultivating large volumes of high-quality industrial hemp, offering a broad range of variants distinguished by seed size, oil content, and fiber quality. This diversity allows companies to cater to different application segments such as textiles, food, personal care, construction, and bio-composites.

Competition in the industry is largely influenced by factors such as potential crop yields, advanced processing methods, technology adoption, production costs, and profitability. As a result, leading companies are continually investing in research and development (R&D) to enhance crop performance and optimize extraction and processing techniques.

These R&D efforts are aimed at developing strains with higher cannabinoid content, disease resistance, and adaptability to various climatic conditions. Global expansion is another key strategic focus. Players are increasingly establishing cultivation and processing facilities in countries and regions where hemp farming is legally permitted and supported by favorable regulatory frameworks. This geographical diversification not only reduces dependency on a single market but also allows companies to capitalize on emerging opportunities.

Prominent players also differentiate themselves through extensive product portfolios, offering a wide array of hemp-derived products including CBD oil, hemp seeds, protein powders, fibers, and textiles. Their ability to penetrate large markets and cater to various end-use industries further intensifies market competition. Strategic partnerships, mergers and acquisitions, and vertical integration are common approaches adopted by these companies to consolidate their market position and streamline supply chains.

Some of the prominent players in the Global Industrial Hemp Market are:

- Curaleaf Holdings, Inc.

- Green Thumb Industries

- Canopy Growth Corporation

- AURORA CANNABIS INC.

- The Cronos Group

- Ecofibre Ltd

- HempFlax Group B.V.

- Dun Agro Hemp Group

- Fresh Hemp Foods Ltd.

- GenCanna

- Konoplex Group

- Canah International

- MH Medical Hemp GmbH

- Liaoning Qiaopai Biotech Co., Ltd.

- IND HEMP

- South Hemp Tecno

- HemPoland

- Colorado Hemp Works, INC

- Parkland Industrial Hemp Growers Coop Ltd.

- American Hemp LLC

- Hemp Foundation

- Blue Sky Hemp Ventures Ltd.

- Valley Bio Limited

- East Mesa Inc.

- Other Key Players

Recent Developments

- In October 2024, Canopy Growth Corporation acquired Wana, including Wana Wellness, LLC, The CIMA Group, LLC, and Mountain High Products, LLC. As a result, Canopy USA now owns 100% of Wana’s equity interests. This acquisition is expected to strengthen the company’s position in building a prominent, brand-focused cannabis business in the United States.

- In October 2024, Aurora Cannabis Inc. introduced an expanded range of premium medical cannabis oils in Australia through a partnership with MedReleaf Australia. The new products, designed to cater to a variety of patient needs, include Aurora THC 25 (Sativa), Aurora THC 25 (Indica), Aurora 12.5:12.5 oil, Aurora 50:50 oil, and Aurora 10:100 oil, all available in 30 ml bottles for physician prescriptions.

- In June 2024, Curaleaf Holdings, Inc. launched a new series of hemp-derived THC products under its Select and Zero Proof brands. These products, available across 25 states and the District of Columbia, can be accessed through direct-to-consumer delivery and Curaleaf’s nationwide distribution network.

- In May 2024, The Cronos Group partnered with GROW Pharma, a prominent distributor of medicinal cannabis in the UK, to expand its PEACE NATURALS brand into the UK market. This collaboration will enable Cronos to supply premium cannabis products to ensure UK patients have access to the well-known PEACE NATURALS brand.

- In February 2024, RISE Dispensaries, owned by Green Thumb Industries Inc., opened its 15th location in Florida, bringing the total number of stores to 92 nationwide. The new store will offer special promotions and free merchandise to its first customers, expanding access to a variety of products like chocolates, mints, gummies, and tarts from the Incredibles brand.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 13.6 Bn |

| Forecast Value (2034) |

USD 89.3 Bn |

| CAGR (2025–2034) |

23.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Seeds, Fiber (Bast), Seed Oil, CBD Hemp Oil, Shivs (Hurd)), By Source (Conventional, and Organic), By Application (Textiles, Food & Beverages, Automotive, Furniture, Animal Care, Pharmaceuticals, and Other) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Curaleaf Holdings, Inc., Green Thumb Industries, Canopy Growth Corporation, AURORA CANNABIS INC., The Cronos Group, Ecofibre Ltd, HempFlax Group B.V., Dun Agro Hemp Group, Fresh Hemp Foods Ltd., GenCanna, Konoplex Group, Canah International, MH Medical Hemp GmbH, Liaoning Qiaopai Biotech Co., Ltd., IND HEMP, South Hemp Tecno, HemPoland, Colorado Hemp Works INC, Parkland Industrial Hemp Growers Coop Ltd., American Hemp LLC., Hemp Foundation, Blue Sky Hemp Ventures Ltd., Valley Bio Limited, East Mesa Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Global Industrial Hemp Market?

▾ The Global Industrial Hemp Market size is estimated to have a value of USD 13.6 billion in 2025 and is expected to reach USD 89.3 billion by the end of 2034.

Which region accounted for the largest Global Industrial Hemp Market?

▾ Asia Pacific is expected to be the largest market share for the Global Industrial Hemp Market, with a share of about 34.5% in 2025.

Who are the key players in the Global Industrial Hemp Market?

▾ Some of the major key players in the Global Industrial Hemp Market are Ecofibre Ltd., HempFlax Group B.V., GenCanna, and many others

What is the growth rate in the Global Industrial Hemp Market?

▾ The market is growing at a CAGR of 23.2% over the forecasted period.

How big is the US Industrial Hemp Market?

▾ The US Industrial Hemp Market size is estimated to have a value of USD 3.2 billion in 2025 and is expected to reach USD 18.9 billion by the end of 2034.