The Global Industrial Machinery Market encompasses an expansive variety of equipment designed for manufacturing, construction, and industrial processes. This sector encompasses production lines, material handling systems, and assembly machinery used to enhance operational efficiencies and quality outputs. As industries mature their demand for advanced automated solutions grows requiring manufacturers to find unique designs while optimizing performance with smart technologies like IoT or AI to reduce downtime - understanding this market for strategic planning or competitive positioning is imperative to survival and success in business today.

The Industrial Machinery Market has experienced substantial expansion due to the intersection between innovative technologies and evolving industry needs. Analysts note that automation and digital solutions in sectors like manufacturing, construction, and logistics are fundamentally altering operational frameworks; organizations are prioritizing investments in smart machines using IoT/AI/data analytics that facilitate real-time monitoring/predictive maintenance thereby improving both operational efficiency and minimizing downtime while aligning with increased productivity/cost optimization efforts.

Sustainability considerations have become ever more vital as manufacturers face mounting pressure to adopt eco-friendly practices conform to regulatory standards and satisfy customer demands for environmentally responsible production methods. In response, manufacturers have seen advances in energy-saving machines and sustainable production techniques emerge that meet this growing consumer expectation of eco-friendliness. This trend drives innovations like energy-efficient machinery and sustainable production methods that meet this new demand - leading directly to innovations such as Energy Star compliance for machinery as well as sustainable production methods that comply with regulations while meeting expectations from their consumers.

Global supply chain disruptions have forced companies to reassess their production capabilities, prompting companies to seek flexible and adaptable machinery that meets evolving production demands. North America and Asia-Pacific regions are at the forefront of this transformation thanks to strong industrial infrastructures with established manufacturing presences.

Key Takeaways

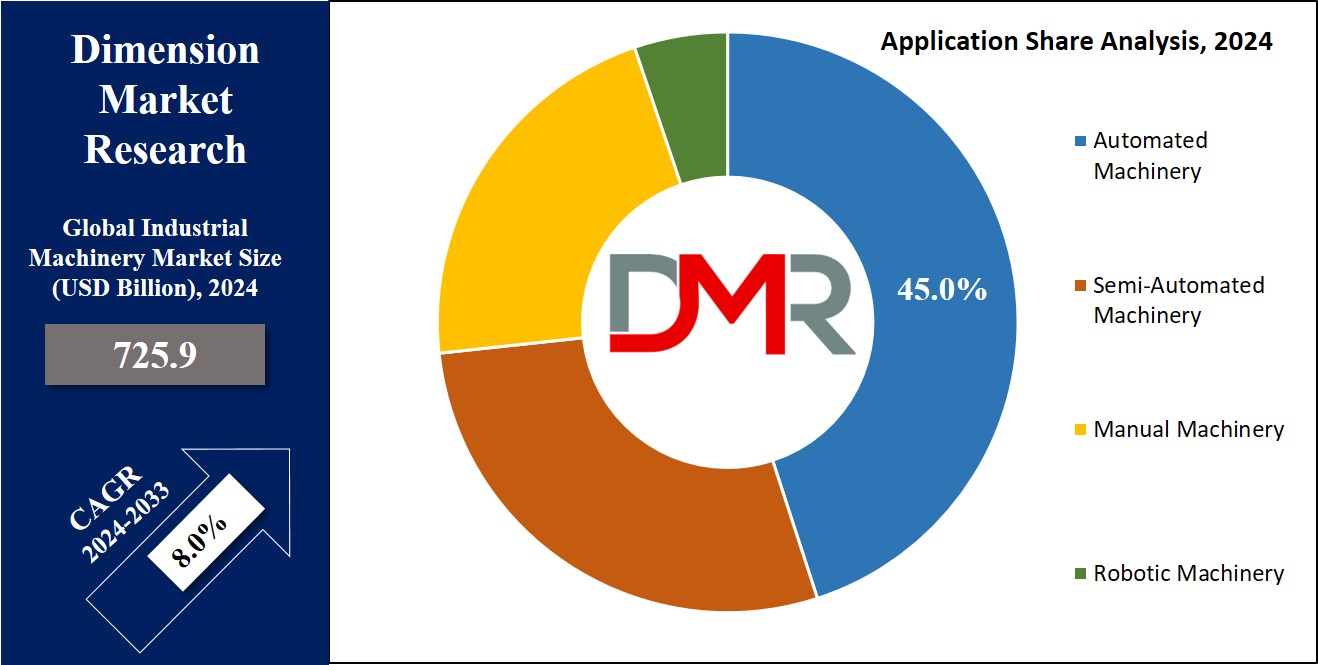

- Market Growth Forecast: The market is projected to reach USD 725.9 billion in 2024, with a CAGR of 8.0%, potentially hitting USD 1,450.7 billion by 2033.

- Dominating Segment: Automated machinery led the market in 2023, accounting for approximately 45% of the total share, driven by demands for efficiency and precision.

- Leading Region: North America dominated the market with about 45% share in 2023, bolstered by advanced manufacturing infrastructure and strong investment in automation.

- Sustainability Trend: Increasing consumer demand for eco-friendly practices is prompting manufacturers to invest in sustainable machinery solutions, with projected growth rates exceeding 6%.

- Key Applications: Agriculture held the largest share at 35%, followed by construction at 25%, reflecting ongoing infrastructure and agricultural demands.

Use Cases

- Automation in Manufacturing: Implementing advanced automated machinery to improve production efficiency and reduce human error. Utilizing IoT and AI technologies enables real-time monitoring and predictive maintenance, minimizing downtime.

- Sustainable Agricultural Equipment: Developing energy-efficient machinery for agriculture to meet eco-friendly standards and boost crop yields through precision technologies, aligning with consumer sustainability demands.

- Smart Construction Machinery: Introducing IoT-enabled machinery for construction projects that offer real-time data analytics, enhance safety, and improve efficiency, supporting urban infrastructure development.

- Custom Food Processing Solutions: Designing specialized food processing equipment that caters to consumer preferences for convenience and quality while ensuring compliance with safety regulations.

- Enhanced Supply Chain Flexibility: Creating adaptable machinery that responds to supply chain disruptions, focusing on local sourcing and diversification to improve operational resilience in changing market conditions.

Driving Factors

Machinery Dependence on the Rise

Rising dependence on machinery across various industries is driving growth in the Industrial Machinery Market. Businesses seek to maximize operational efficiencies, cut labor costs, and maintain competitive advantages through investing in sophisticated machines; demand has skyrocketed as businesses look for ways to enhance operational efficiencies, lower labor costs, and secure competitive advantages through advanced equipment integration in industries like manufacturing, construction, and logistics; reports indicate companies using modern machinery have experienced productivity increases of 20-30% with this move representing not only efficiency needs but also an ongoing shift toward automation and smart technologies - further propelling its market growth!

Global Economic Growth

Global Economic Growth is a key driver for the Industrial Machinery Market, and economic expansion is essential in fuelling its success. When economies expand in emerging markets, infrastructure development increases alongside industrial activities resulting in growth for both sides. As construction, mining, and manufacturing sectors expand their activities rapidly, they must increase demand for machinery across industries like construction. International Monetary Fund (IMF) projects global GDP growth to average around 3% each year over the coming decade, translating directly to increased capital investments in machinery. This trend can be found particularly pronounced in Asia-Pacific and Latin America regions where rapid urbanization and industrialization are creating large infrastructure projects that create demand for heavy equipment.

Market Consolidation and Mergers

Market consolidations and mergers are rapidly altering the Industrial Machinery Market landscape, driving growth through greater efficiency and expanded capabilities. As companies merge or acquire other firms, they often gain access to advanced technologies, broader product portfolios, and larger customer bases. Such consolidation fosters innovation while decreasing operational redundancies allowing firms to provide superior solutions at more reasonable costs. Recent trends indicate an upsurge in mergers within the industrial sector, as companies seek strategic alliances to strengthen their market standing and ensure future success. Recent data demonstrates that nearly 30% of industry players have engaged in mergers or acquisitions within the last few years, signaling an increasingly concentrated marketplace. Consolidation not only enhances competitive dynamics but also accelerates technological advances to fuel further machinery market expansion.

Growth Opportunities

Sustainable Machinery Solutions for all occasions

The Global Industrial Machinery Market is projected to experience substantial expansion by 2023, and sustainable machinery solutions represent one key opportunity. As more industries prioritize eco-friendly practices and manufacturers invest in energy-efficient machines that minimize waste while decreasing environmental impacts - this trend aligns perfectly with regulatory requirements as well as consumer expectations of sustainability. According to recent reports, sustainable machinery solutions should experience compound annual growth rates exceeding 6% over time and show strong consumer interest in green solutions.

Increased Infrastructure Spending

Infrastructure spending presents another lucrative market opportunity. Governments around the globe are increasing investments in infrastructure projects to spur economic development in emerging markets, according to projections by The World Bank, particularly transportation and utility investments. As governments increase investments in this field, demand increases significantly - opening doors for manufacturers who wish to establish themselves and capture more market share by manufacturing heavy machinery or construction equipment products for this growing sector.

Food Processing Demand

Consumer preferences continue to shift toward convenience and quality, driving demand for food processing equipment worldwide. Food companies worldwide are adopting modern machinery to increase production efficiency while protecting food safety - this trend should lead to steady increases in specialized equipment used for processing foods as well as propel growth within the Industrial Machinery Market.

Key Trends

Rise of Smart Packaging

Smart Packaging One of the key trends of 2023 for the global Industrial Machinery Market will be smart packaging solutions. Consumers increasingly value convenience and sustainability; as companies invest in advanced packaging technology that incorporates sensors and IoT capabilities for enhanced traceability and supply chain efficiency - helping meet regulatory standards as well as meet consumer demands efficiently. Smart packaging's growth projection is significant due to real-time data streaming into consumer experiences for improved user satisfaction.

Investment in advanced manufacturing technologies

Investment in advanced manufacturing technologies is another significant trend shaping the market landscape. Companies are adopting automated machinery such as robotics and artificial intelligence to optimize production processes and decrease operational costs - becoming part of Industry 4.0 not only enhances efficiency but allows greater production line flexibility as well. Recent reports estimate productivity gains of 30% or greater through investments in automation/smart technologies for 2023 manufacturers who prioritize them as priority areas of focus.

Demand for Customization

Consumer demand for customized products has revolutionized the industrial machinery landscape. Manufacturers are quickly responding to this booming consumer trend by expanding their capabilities for custom solutions - particularly within sectors like automobile manufacturing, textile production, and consumer products manufacturing where businesses utilize advanced machinery for tailored offerings without compromising efficiency - providing customized offerings not only increases customer satisfaction but also gives businesses an edge in an ever-competing marketplace.ise of Smart Packaging

Smart Packaging One of the key trends of 2023 for the global Industrial Machinery Market will be smart packaging solutions. Consumers increasingly value convenience and sustainability; as companies invest in advanced packaging technology that incorporates sensors and IoT capabilities for enhanced traceability and supply chain efficiency - helping meet regulatory standards as well as meet consumer demands efficiently. Smart packaging's growth projection is significant due to real-time data streaming into consumer experiences for improved user satisfaction.

Investment in advanced manufacturing technologies

Investment in advanced manufacturing technologies is another significant trend shaping the market landscape. Companies are adopting automated machinery such as robotics and artificial intelligence to optimize production processes and decrease operational costs - becoming part of Industry 4.0 not only enhances efficiency but allows greater production line flexibility as well. Recent reports estimate productivity gains of 30% or greater through investments in automation/smart technologies for 2023 manufacturers who prioritize them as priority areas of focus.

Demand for Customization

Consumer demand for customized products has revolutionized the industrial machinery landscape. Manufacturers are quickly responding to this booming consumer trend by expanding their capabilities for custom solutions - particularly within sectors like automobile manufacturing, textile production, and consumer products manufacturing where businesses utilize advanced machinery for tailored offerings without compromising efficiency - providing customized offerings not only increases customer satisfaction but also gives businesses an edge in an ever-competing marketplace.

Restraining Factors

Supply Chain Disruptions

Supply chain disruptions have emerged as a significant impediment to the growth of the Industrial Machinery Market. The COVID-19 pandemic exposed vulnerabilities in global supply chains, leading to delays in raw material availability and increasing costs. Manufacturers that struggled to meet production schedules experienced significant operational setbacks that limited growth opportunities. A recent survey indicated that nearly 60% of manufacturers reported disruptions affecting their ability to meet demand; as a result, companies have adjusted their supply chain strategies in response by prioritizing local sourcing and diversification; yet these adjustments can take time and investment, further hindering overall market expansion.

Skilled Labor Shortages

One of the primary challenges in the industrial sector is finding enough skilled labor. As technology evolves, demand for employees who know how to operate and maintain complex machinery increases exponentially; estimates from industry sources estimate that nearly 2 million manufacturing jobs may remain unfilled due to this skills gap; this shortage not only restricts innovation but also restricts operational efficiency by forcing companies to scale back production or invest heavily in training programs to stay afloat; inability to secure skilled labor can significantly limit expansion within the Industrial Machinery Market

Under-Cost Manufacturers as Competition

Emerging economies' low-cost manufacturers represent a serious threat to established players in the Industrial Machinery Market. Cost-cutting manufacturers provide machinery at lower costs, which attract cost-conscious customers and cut into the profit margins of more established firms. Market analysts reported that nearly 40% of companies identified low-cost manufacturers as being their primary concern. These pressures force many businesses to either reduce prices, which reduces profitability or invest in differentiating their products through innovation and superior quality; both strategies require significant resources that may divert focus from other areas of growth.

Research Scope Analysis

By Operation

Automated Machinery was the leading product type segment in the Industrial Machinery Market in 2023, accounting for roughly 45% of the market share. This can be attributed to increased demands for efficiency and precision during manufacturing processes; automated machinery can speed production rates while simultaneously minimizing human error - an essential feature across a variety of industries such as automotive to electronics production lines. Furthermore, automation reflects Industry 4.0 as smart technologies are integrated into production systems to optimize workflows and streamline processes.

Semi-Automated Machinery was another popular market segment, accounting for roughly 30%. This segment appeals to manufacturers seeking a balance between automation and manual oversight, offering greater productivity while still permitting human oversight; making them particularly suitable in settings where flexibility and adaptability are crucial. As businesses transition toward greater automation, semi-automated solutions should experience sustained growth due to adaptable solutions required in today's rapidly shifting markets.

Manual Machinery comprised approximately 15% of the market share in 2023, although its demand has decreased overall due to automation's rise. Manual machinery remains useful in specific industries where manual operation is preferential - such as crafts, small-scale production, and certain maintenance tasks that rely on it mainly due to its cost-effectiveness and simplicity.

Robotic Machinery accounts for 10% of the market share and is seeing increased adoption thanks to technological innovations that enhance capabilities. Due to advances in artificial intelligence and machine learning, robotic solutions are becoming more versatile and efficient at performing various tasks such as assembly, welding, and packaging - this sector should continue its steady rise as businesses utilize robotics for increased productivity in an ever-evolving marketplace.

By Application

Agriculture held the dominant market position within the Product Type segment of the Industrial Machinery Market in 2023, accounting for 35% of the overall market share. Agriculture's dominance can be explained by increasing demands for efficient farming practices as well as advancements like precision agriculture equipment and automated planting systems that increase productivity to increase output while remaining environmentally sustainable. Agricultural machinery therefore plays an integral part in meeting global food demands while protecting ecosystems and supporting sustainability efforts.

Construction machinery also saw strong market shares at around 25% of total industry turnover in 2016. Construction machinery sales saw considerable gains due to ongoing infrastructure development and urbanization initiatives worldwide, leading to demand for heavy equipment such as excavators, bulldozers, and cranes from both governments and private investors in building projects - driving this sector forward with a growing focus on smart city initiatives as well as needing durable yet efficient construction solutions.

Packaging held approximately 15% market share in 2023. As online and retail sales surge, so has demand for advanced packaging equipment that ensures product safety while increasing shelf appeal - this segment's innovations in automated systems provide solutions tailored specifically towards consumers' preferences and regulatory standards.

Food processing machinery represented roughly 10% of the market share, driven by rising consumer demand for processed and packaged food products. As consumer lifestyles shift towards convenience, food processing machinery plays an essential role in maintaining high standards for production while automating cutting, packaging, and preservation technologies become ever more prevalent.

Mining machinery represented approximately 8% of the market share, reflecting ongoing demands for resource extraction and management. Its growth can largely be attributed to advancements in automation and safety technologies that enhance operational efficiencies while mitigating risks in hazardous environments.

Semiconductor manufacturing machinery represented approximately five percent of the market share. As demand for electronic devices increases rapidly, advanced semiconductor manufacturing equipment becomes more essential. Innovations within this sector aimed at meeting technological advancement quickly remain essential to remain competitive in this competitive landscape.

By Distribution channel

Direct Sales were the dominant market segment within Industrial Machinery Market Product Type Segments in 2023, representing approximately 65% of the total market share. This success can be attributed to manufacturers' close relationships with their clients and ability to provide customized service and tailored solutions through direct sales strategies. Companies using direct sales can better understand customer needs, provide immediate support, facilitate product feedback directly, and build long-term customer loyalty; as companies focus on long-term relationships and comprehensive solutions, direct sales strategies have become essential drivers of revenue and market expansion.

Indirect Sales made up around 35% of market share in 2023. This segment gained momentum as manufacturers’ leveraged distributors and resellers to extend their reach into new markets and penetrate new ones. Indirect sales channels offer significant advantages over direct ones, including wider geographical coverage and access to an array of customers; manufacturers could also take advantage of local partners who understand regional market dynamics as well as customer preferences. Despite direct sales' rise, indirect sales still serve an integral function, particularly for smaller businesses and niche markets that may need tailored offerings and services.

The Industrial Machinery Market Report is segmented based on the following:

By Operation

- Automated Machinery

- Semi-Automated Machinery

- Manual Machinery

- Robotic Machinery

By Application

- Agriculture

- Construction

- Packaging

- Food processing

- Mining

- Semiconductor Manufacturing

- Others

By Distribution channel

- Direct sales

- Indirect sales

Regional Analysis

North America emerged as a dominant region in the Global Industrial Machinery Market in 2023, holding approximately 45% of the total market share. This significant position can be attributed to advanced manufacturing infrastructure, robust investment in automation systems, and technological innovation initiatives in this region. Furthermore, increased government spending on infrastructure projects drives demand for industrial machinery across various sectors such as construction and agriculture.

Europe held around 30% of the market share.

Europe is distinguished by its focus on sustainability and regulatory compliance, leading to significant investments in eco-friendly machinery solutions such as Germany and the UK's digitalization/automation initiatives to boost productivity - with Industry 4.0 initiatives helping advance smart machinery adoption for even further advancement in Europe as a market competitor.

Asia Pacific held approximately 20% of the market share in 2023, driven by rapid industrialization and urbanization across countries like China and India. Infrastructure development projects helped drive demand for industrial machinery within this region; along with companies adopting advanced technologies and manufacturing sectors growing quickly over time. Asia Pacific stands to experience great expansion over the coming years.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

2023 will see the global industrial machinery market increasingly driven by key players who are innovating to meet changing customer demands. A.O. Smith Corp continues to lead in water heating and treatment solutions with their focus on sustainability for energy-efficient products; Lincoln Electric Holdings has made significant strides in welding and cutting technology through automation and robotics for improved productivity on industrial floors - both companies reflecting a broader trend toward eco-conscious yet technologically advanced solutions within this sector.

Manitowoc Company has made waves in the crane and lifting equipment market with their use of telematics and safety features that are essential to modern construction projects. Illinois Tool Works utilizes smart manufacturing practices across industries in its portfolio. Terex Corp and Astec Industries are taking strides toward sustainability with sustainable equipment designed to comply with stringent environmental regulations; such developments demonstrate their efforts at making industrial operations more eco-friendly.

On the technology front, Toyota and Samsung Electronics are expanding their reach into industrial automation by offering cutting-edge smart manufacturing capabilities across traditional sectors. AGCO Corporation is at the forefront of agricultural machinery innovation, investing in precision farming technologies to meet global food supply challenges. Major companies such as Ford, Hewlett-Packard, Hitachi, and IBM are using IoT and AI in their manufacturing processes to increase efficiency and productivity. Meanwhile, Siemens and General Electric continue to lead the digital transformation of the industry by offering solutions that emphasize operational excellence and sustainability - shaping the future of the industrial machinery market.

Some of the prominent players in the Global Industrial Machinery Market are:

- AO Smith Corp

- Lincoln Electric Holdings

- Manitowoc Company

- Illinois Tool Works

- Terex Corp

- Astec Industries

- Toyota

- Samsung Electronics

- AGCO Corporation

- Alamo Group

- Ford

- Hewlett-Packard

- Hitachi

- IBM

- Lindsay Corporation

- Siemens

- General Electric

Recent Developments

- In April 2023, Bosch BASF Smart Farming and AGCO Corporation announced their partnership to integrate Smart Spraying technology on Fendt Rogator sprayers.

- In November 2022, Ingersoll Rand launched the 135MAX heavy-duty air hammer for auto shops. This ergonomic tool features a feather-touch trigger for precise control, making it suitable for light tasks and demanding applications, thus catering to a wide range of automotive repair needs.

- In June 2023, a major construction equipment manufacturer introduced a new line of electric excavators to reduce carbon emissions. This initiative aligns with the industry's shift towards eco-friendly machinery as companies strive to meet stricter regulations and enhance sustainability.

- In January 2023, a leading robotics company unveiled a collaborative robot for small and medium-sized enterprises. Equipped with advanced machine learning, this user-friendly robot adapts to various tasks, making automation more accessible to businesses previously hesitant to adopt such technologies.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 725.9 billion |

| Forecast Value (2032) |

USD 1,450.7 billion |

| CAGR (2023-2032) |

8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Operation (Automated Machinery, Semi-Automated Machinery, Manual Machinery, Robotic Machinery), By Application (Agriculture, Construction, Packaging, Food processing, Mining), By Distribution Channel |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

AO Smith Corp, Lincoln Electric Holdings, Manitowoc Company, Illinois Tool Works, Terex Corp, Astec Industries, Toyota, Samsung Electronics, AGCO Corporation, Alamo Group, Ford, Hewlett-Packard, Hitachi, IBM, Lindsay Corporation, Siemens, General Electric |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |