Market Overview

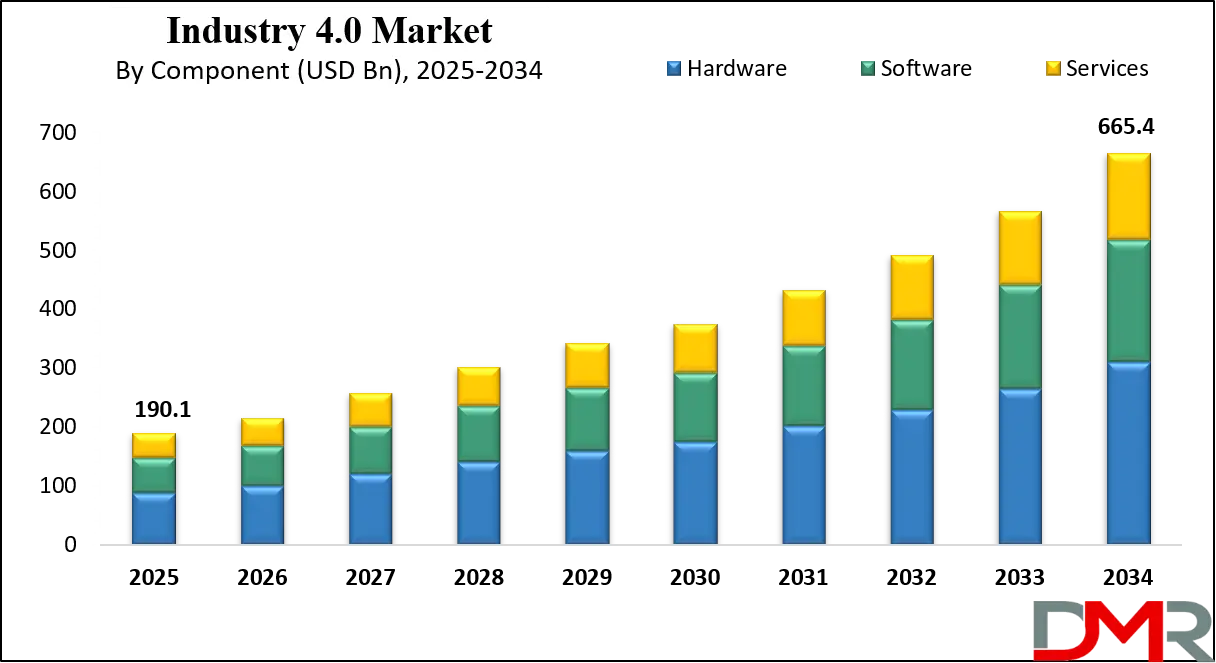

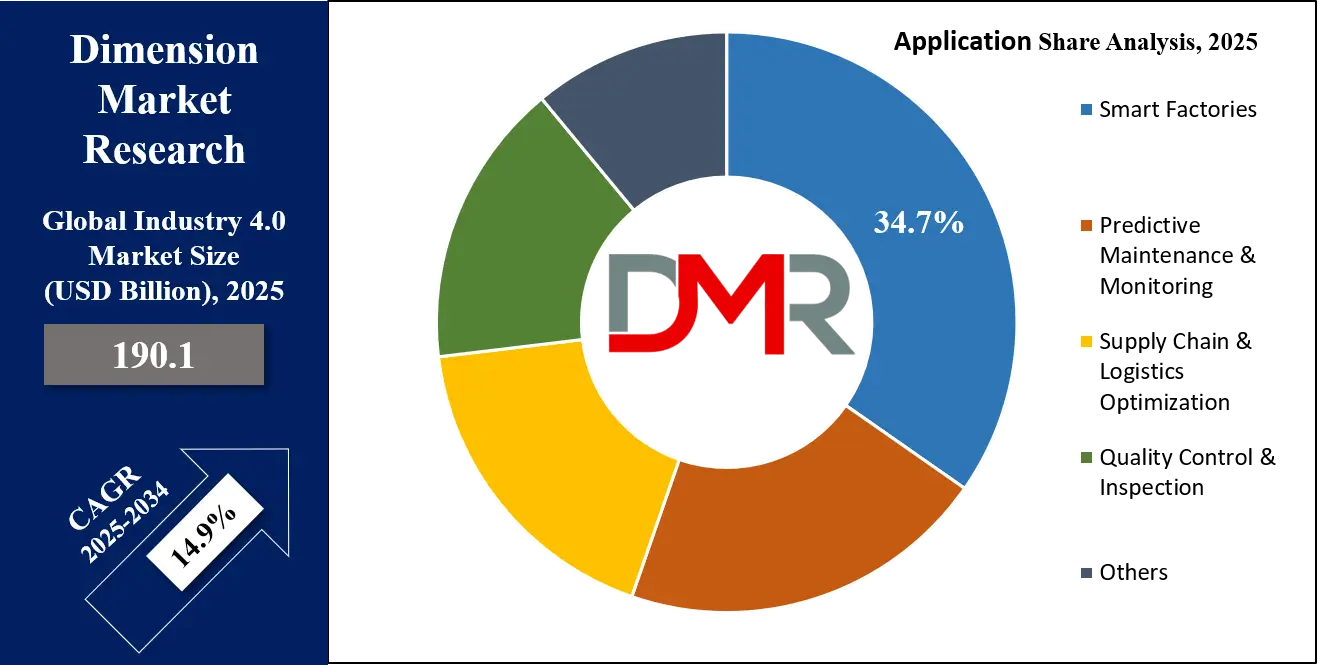

The Global Industry 4.0 Market size is projected to reach USD 190.1 billion in 2025 and grow at compound annual growth rate of 14.9% to reach a value of USD 665.4 billion in 2034.

Industry 4.0 refers to the fourth industrial revolution, where traditional manufacturing and industrial practices are combined with smart technology. It involves the use of automation, the Internet of Things (IoT), artificial intelligence, cloud computing, and big data to create smarter and more efficient production systems. The main idea is to connect machines, systems, and people in a seamless way, allowing businesses to make decisions faster and improve productivity.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The demand for Industry 4.0 is growing because companies want to stay competitive in a fast-changing market. Many industries are adopting smart factories, predictive maintenance, and advanced robotics to reduce downtime and improve product quality. Businesses also see benefits in customization, where production lines can quickly adapt to changing customer needs. This demand is driven by digital transformation and the need for efficiency across supply chains.

Recent years have seen several key trends shaping Industry 4.0. These include the rise of 5G networks, which improve machine-to-machine communication, and the growing importance of cybersecurity to protect connected systems. Another trend is the integration of artificial intelligence and digital twins, where virtual models help predict performance and optimize production. Sustainability has also become a focus, as companies use Industry 4.0 tools to lower energy use and reduce waste.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Events such as the COVID-19 pandemic highlighted the importance of Industry 4.0. Companies that had adopted digital technologies were better able to handle disruptions and continue operations remotely. Governments and businesses worldwide are now investing more in smart technologies, training, and infrastructure to prepare for the future. Overall, Industry 4.0 is transforming industries into smarter, more agile, and more connected ecosystems.

The US Industry 4.0 Market

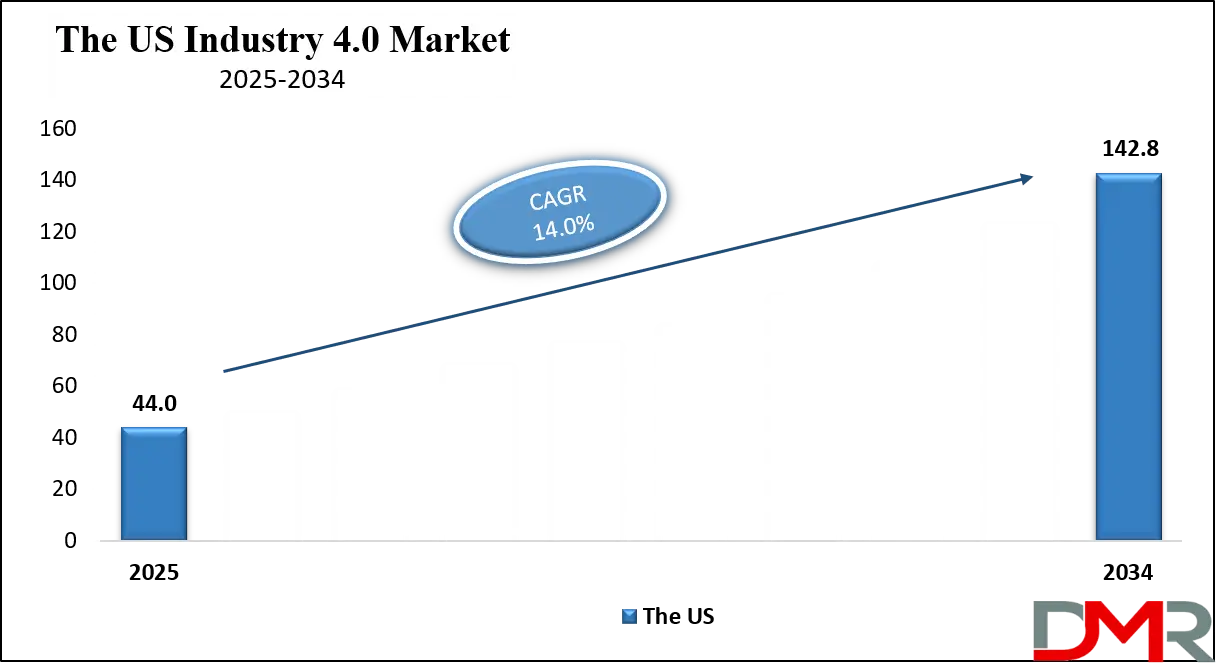

The US Industry 4.0 Market size is projected to reach USD 44.0 billion in 2025 at a compound annual growth rate of 14.0% over its forecast period.

The US plays a leading role in the Global Industry 4.0 market, driving innovation through advanced technology development and adoption. It is home to many research centers and industrial hubs focusing on automation, artificial intelligence, IoT, and smart manufacturing solutions. US companies are investing heavily in digital factories, robotics, and data-driven platforms, setting global standards for efficiency and productivity.

The country also promotes collaboration between industry, academia, and government initiatives, fostering innovation and workforce skill development. Strong infrastructure, access to venture capital, and emphasis on sustainability further enhance the US’s position. Overall, the US continues to influence Industry 4.0 adoption worldwide, shaping trends and technological advancements across multiple sectors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Industry 4.0 Market

Europe Industry 4.0 Market size is projected to reach USD 47.5 billion in 2025 at a compound annual growth rate of 13.8% over its forecast period.

Europe plays a significant role in the Industry 4.0 market by focusing on smart manufacturing, digitalization, and sustainable industrial practices. Several European countries have developed advanced industrial ecosystems that integrate IoT, robotics, artificial intelligence, and cloud-based solutions to improve productivity and efficiency. Europe emphasizes regulatory standards, cybersecurity, and energy-efficient manufacturing, making its Industry 4.0 initiatives more structured and sustainable.

Collaboration between governments, research institutions, and private companies drives innovation, particularly in automotive, aerospace, and electronics sectors. European industries are also investing in workforce upskilling to meet the demands of digital factories. Overall, Europe’s approach balances technological advancement with sustainability and compliance, positioning it as a key contributor to the Global Industry 4.0 landscape.

Japan Industry 4.0 Market

Japan Industry 4.0 Market size is projected to reach USD 13.3 billion in 2025 at a compound annual growth rate of 15.8% over its forecast period.

Japan plays a crucial role in the Industry 4.0 market through its strong focus on advanced robotics, automation, and smart manufacturing technologies. The country is known for integrating precision engineering with digital solutions, including IoT, AI, and data analytics, to enhance productivity and operational efficiency. Japanese industries, particularly in automotive, electronics, and machinery sectors, are adopting intelligent factories and predictive maintenance systems to reduce downtime and improve quality.

Japan also emphasizes innovation through collaboration between government, research institutions, and private enterprises, fostering technological development and workforce training. With a reputation for high-quality manufacturing and technological leadership, Japan continues to influence Global Industry 4.0 trends and set benchmarks for efficient, connected, and automated industrial operations.

Industry 4.0 Market: Key Takeaways

- Market Growth: The Industry 4.0 Market size is expected to grow by USD 439.9 billion, at a CAGR of 14.9%, during the forecasted period of 2026 to 2034.

- By Component: The hardware is anticipated to get the majority share of the Industry 4.0 Market in 2025.

- By Application: The smart factories is expected to get the largest revenue share in 2025 in the Industry 4.0 Market.

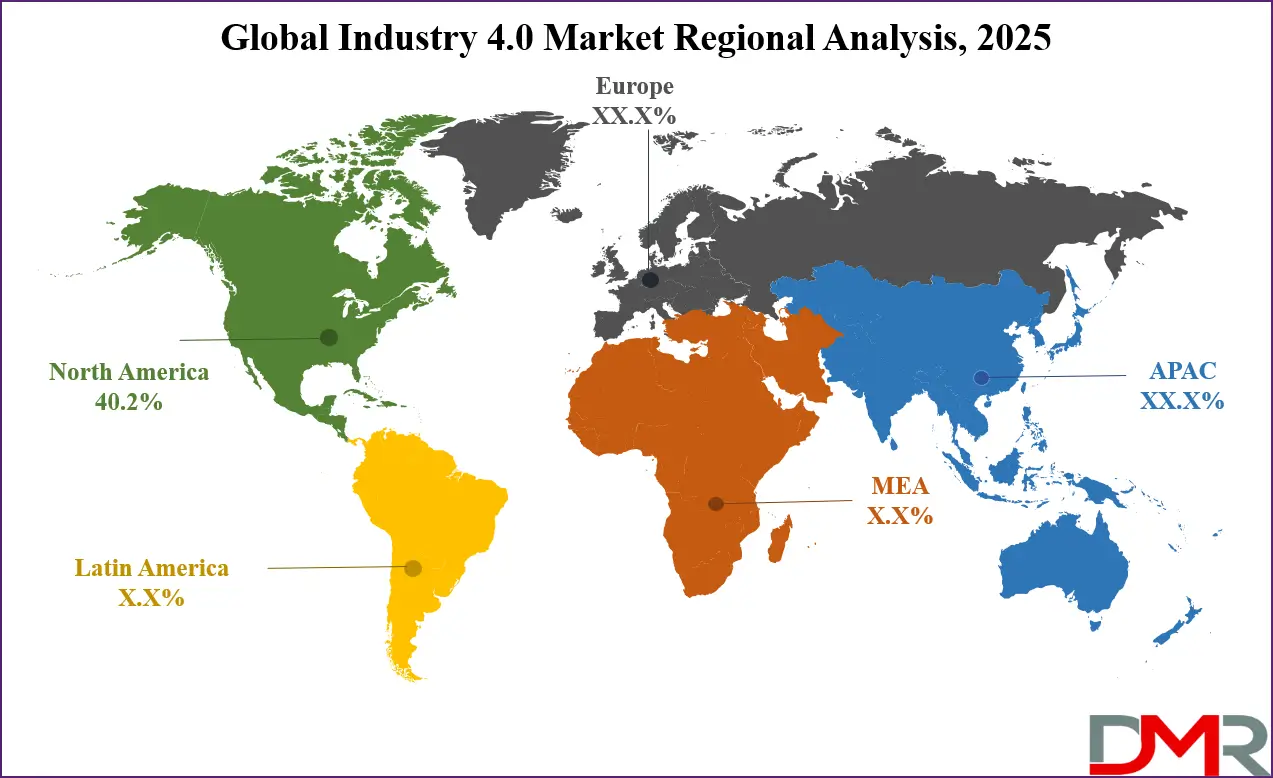

- Regional Insight: North America is expected to hold a 40.2% share of revenue in the Global Industry 4.0 Market in 2025.

- Use Cases: Some of the use cases of Industry 4.0 includes digital twins, supply chain optimization, and more.

Industry 4.0 Market: Use Cases

- Smart Manufacturing: Factories use connected machines, sensors, and automation to monitor production in real time. This helps reduce downtime, improve product quality, and increase overall efficiency by quickly detecting and fixing problems.

- Predictive Maintenance: Using data from IoT sensors and AI, companies can predict when equipment will fail before it happens. This reduces unexpected breakdowns, saves costs on repairs, and ensures smoother operations.

- Supply Chain Optimization: Digital platforms and analytics help track goods, raw materials, and shipments more accurately. Businesses can respond faster to changes in demand, avoid delays, and improve inventory management.

- Digital Twins: Virtual models of machines, factories, or processes are created to test scenarios without risk. This allows businesses to optimize designs, forecast outcomes, and enhance performance in real-world operations.

Market Dynamic

Driving Factors in the Industry 4.0 Market

Growing Need for Smart and Efficient Manufacturing

One of the main drivers of the Industry 4.0 market is the rising demand for smarter and more efficient production systems. Companies are under pressure to reduce costs, improve product quality, and shorten time-to-market in highly competitive industries. By adopting advanced automation, real-time monitoring, and connected devices, businesses can achieve greater flexibility and responsiveness in their operations.

Industry 4.0 enables quick adjustments to production lines, helping companies meet changing customer needs more effectively. It also reduces human error and downtime, ensuring smoother workflows. This push for operational excellence continues to accelerate the adoption of Industry 4.0 worldwide.

Advancements in Emerging Technologies

Another key growth driver is the rapid advancement and integration of technologies such as artificial intelligence, IoT, robotics, cloud computing, and 5G networks. These technologies form the backbone of Industry 4.0 and are becoming more affordable and accessible for companies of different sizes. With AI-driven insights, predictive maintenance, and digital twins, organizations can optimize performance like never before. The availability of 5G further improves connectivity and data exchange between machines, enabling faster and smarter decision-making. As these technologies mature, businesses are more willing to invest in them, fueling the expansion of Industry 4.0 solutions across sectors.

Restraints in the Industry 4.0 Market

High Implementation and Integration Costs

A major restraint for the Industry 4.0 market is the high cost of adopting and integrating advanced technologies. Setting up smart factories requires significant investments in IoT devices, automation systems, cloud infrastructure, and cybersecurity solutions. Small and medium-sized enterprises often struggle with these costs, making it difficult for them to keep pace with larger players.

Additionally, integrating new technologies with older legacy systems can be complex and time-consuming. The need for skilled professionals to manage these solutions adds another layer of expense. These financial and technical barriers slow down the widespread adoption of Industry 4.0.

Cybersecurity and Data Privacy Concerns

Another strong restraint comes from the growing risk of cyberattacks and data breaches in connected industrial environments. Industry 4.0 relies heavily on machine-to-machine communication and cloud-based platforms, which increases the exposure of critical operations to digital threats.

Protecting sensitive production data, intellectual property, and supply chain information requires constant investment in advanced cybersecurity measures. Many organizations hesitate to adopt large-scale digital solutions due to fears of potential disruptions or financial losses from attacks. The lack of standardized global security frameworks also adds uncertainty. These concerns often make businesses cautious, limiting faster adoption of Industry 4.0 technologies.

Opportunities in the Industry 4.0 Market

Rising Adoption of Digital Twins and AI Solutions

A major opportunity in the Industry 4.0 market is the growing use of digital twins and artificial intelligence to optimize operations. Digital twins allow companies to create virtual replicas of machines, production lines, or entire factories, helping them test scenarios and predict outcomes without physical risks.

When combined with AI, these models provide deep insights into performance, efficiency, and future needs. This creates opportunities for industries to reduce costs, enhance productivity, and deliver better products. As more businesses recognize the value of simulation and predictive analytics, demand for these solutions will continue to rise globally.

Focus on Sustainable and Green Manufacturing

The push toward sustainability and reducing environmental impact is opening new opportunities in Industry 4.0. Smart technologies enable manufacturers to track energy use, minimize waste, and improve resource efficiency across operations.

Governments and organizations worldwide are encouraging eco-friendly practices, and Industry 4.0 provides the tools to meet these expectations. By adopting connected sensors, AI-driven energy management, and automated systems, companies can lower their carbon footprint while maintaining profitability. This creates a win-win situation, where businesses achieve regulatory compliance and gain a competitive edge. The shift toward green manufacturing will be a major growth avenue for Industry 4.0 solutions.

Trends in the Industry 4.0 Market

Integration of Generative AI in Industrial Operations

A significant trend in the Industry 4.0 landscape is the integration of generative AI into industrial operations. This technology enables machines to autonomously generate solutions for complex tasks, such as optimizing production schedules, designing components, and predicting maintenance needs. By leveraging vast datasets, generative AI can propose innovative designs and processes that human engineers might not have considered. This advancement not only enhances efficiency but also fosters innovation within manufacturing environments. As industries continue to explore the potential of generative AI, its role in driving automation and creativity is becoming increasingly pivotal.

Advancements in Agentic AI for Autonomous Decision-Making

Another emerging trend is the development of agentic AI systems, which are designed to make autonomous decisions within industrial settings. These systems can analyze real-time data, assess various scenarios, and execute actions without human intervention. While still in the early stages of implementation, agentic AI holds promise for enhancing operational efficiency and responsiveness. Industries are investing in this technology to reduce human error, accelerate decision-making processes, and improve overall system performance. The evolution of agentic AI is expected to play a crucial role in the future of smart manufacturing and industrial automation.

Impact of Artificial Intelligence in Industry 4.0 Market

- Predictive Maintenance: AI analyzes real-time data from machines to predict failures before they happen. This reduces downtime, lowers repair costs, and improves overall production efficiency.

- Process Optimization: AI helps optimize manufacturing processes by identifying inefficiencies and suggesting improvements. This leads to faster production cycles, better quality, and lower operational costs.

- Smart Automation: AI enables machines and robots to perform complex tasks autonomously, reducing human intervention and improving accuracy in repetitive or high-precision operations.

- Supply Chain Efficiency: AI enhances supply chain management by forecasting demand, optimizing inventory, and improving logistics planning. This ensures smoother operations and reduces waste.

- Enhanced Decision-Making: AI provides data-driven insights that help managers make better, faster decisions, from production planning to resource allocation and product development.

Research Scope and Analysis

By Component Analysis

Hardware will dominate the Industry 4.0 market in 2025 with an estimated share of 46.5% is expected to play a crucial role in driving the adoption of smart manufacturing and connected industrial solutions. Hardware components, including sensors, industrial robots, controllers, and IoT devices, form the backbone of digital factories and automated production systems. These devices enable real-time monitoring, data collection, and machine-to-machine communication, which are essential for predictive maintenance, process optimization, and quality control.

Growing investments in industrial automation and smart equipment by manufacturers across automotive, electronics, and heavy industries are boosting hardware demand. With continuous innovation in robotics, embedded systems, and connected machinery, hardware is set to remain a key driver of Industry 4.0 growth, supporting efficient, flexible, and data-driven manufacturing operations globally.

Further, the services segment in the Industry 4.0 market are expected to experience significant growth over the forecast period due to rising demand for integration, consulting, and support solutions. Service offerings, including system integration, software deployment, maintenance, and training, help companies implement Industry 4.0 technologies efficiently. By assisting businesses in setting up smart factories, predictive maintenance systems, and IoT networks, services ensure smooth operations and optimal performance.

Growing awareness of the benefits of digital transformation and the complexity of connected industrial systems is driving the adoption of professional services. Companies increasingly rely on these solutions to reduce downtime, improve productivity, and enhance decision-making. With ongoing industrial modernization and technology adoption, services are set to become a vital component supporting the global growth of the Industry 4.0 market.

By Technology Analysis

IIoT leading the Industry 4.0 market in 2025 with an estimated share of 22.6% will be a major driver in connecting machines, devices, and systems across industrial operations. Industrial Internet of Things (IIoT) devices, including sensors, smart meters, and connected equipment, enable real-time data collection, monitoring, and analysis. This helps manufacturers improve production efficiency, reduce downtime, and optimize resource utilization.

IIoT also supports predictive maintenance, energy management, and supply chain visibility, allowing businesses to respond quickly to operational changes. With increasing adoption of smart factories and digital transformation initiatives across automotive, electronics, and heavy industries, IIoT is expected to play a central role in modernizing industrial processes. The integration of IIoT technologies will continue to strengthen automation, data-driven decision-making, and overall productivity in the Industry 4.0 ecosystem.

AI & Machine Learning in the Industry 4.0 market is expected to see significant growth over the forecast period due to its ability to analyze vast amounts of industrial data for better decision-making. These technologies help optimize production processes, predict equipment failures, and enhance quality control by providing actionable insights. AI and machine learning enable smart automation, allowing machines to learn from data and adapt to changing conditions without constant human intervention.

Industries such as automotive, electronics, and manufacturing increasingly rely on these technologies to improve efficiency, reduce costs, and maintain competitiveness. With ongoing advancements in algorithms, computing power, and data availability, AI and machine learning are set to play a vital role in shaping the future of Industry 4.0, driving smarter, faster, and more connected industrial operations.

By Application Analysis

Smart Factories is set to dominate the Industry 4.0 market in 2025, with an estimated share of 34.7% will play a central role in transforming traditional manufacturing into fully connected, automated, and data-driven operations. Smart factories use IoT devices, robotics, AI, and advanced analytics to monitor and control production processes in real time. This enables manufacturers to optimize efficiency, reduce downtime, and improve product quality while adapting quickly to changing market demands.

The adoption of smart factory solutions allows better resource management, energy efficiency, and predictive insights into operations. With growing industrial automation and digital transformation initiatives across automotive, electronics, and heavy industries, smart factories are set to drive significant growth in the Industry 4.0 market. They provide the foundation for flexible, resilient, and highly efficient production environments globally.

Predictive Maintenance & Monitoring as an application in the Industry 4.0 market is expected to experience significant growth over the forecast period due to its ability to prevent unexpected equipment failures. By using IoT sensors, data analytics, and AI, companies can monitor the condition of machines in real time and predict potential breakdowns. This reduces downtime, lowers maintenance costs, and extends the lifespan of equipment.

Predictive maintenance also improves production efficiency, ensures consistent product quality, and enhances safety within industrial operations. Industries such as automotive, electronics, and manufacturing are increasingly adopting these solutions to maintain smooth operations and optimize resources. With ongoing technological advancements and wider awareness of its benefits, predictive maintenance and monitoring will play a crucial role in supporting Industry 4.0 growth globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User Industry Analysis

Manufacturing, leading the Industry 4.0 market in 2025 with an estimated share of 45.6%, will play a key role in driving the adoption of smart technologies and digital transformation. Manufacturing industries are highly implementing automation, IoT, AI, and robotics to improve production efficiency, reduce operational costs, and maintain high product quality. Connected machines and real-time monitoring systems allow manufacturers to predict maintenance needs, optimize processes, and respond quickly to changes in demand.

The growing focus on flexible and sustainable production is encouraging companies to adopt smart factory solutions and data-driven decision-making. With strong investments in industrial automation and continuous innovation, manufacturing is set to remain the largest end-use sector in the Industry 4.0 market, shaping global trends and accelerating the shift toward highly efficient, resilient, and intelligent production systems.

Pharmaceuticals & Healthcare as an end-use industry in the Industry 4.0 market is expected to experience significant growth over the forecast period due to the rising demand for automation, smart monitoring, and digital solutions. The adoption of connected devices, AI, and IoT in pharmaceutical manufacturing and healthcare operations helps improve production accuracy, quality control, and patient care.

Smart technologies enable real-time tracking of medicines, predictive maintenance of equipment, and better supply chain management. Additionally, Industry 4.0 solutions support faster research and development, personalized treatment, and regulatory compliance. With increasing investments in digital transformation, automation, and data-driven healthcare solutions, the pharmaceutical and healthcare industry is set to play an important role in advancing the Global Industry 4.0 market.

The Industry 4.0 Market Report is segmented on the basis of the following:

By Component

- Hardware

- Sensors

- Controllers

- Industrial Robots

- Networking Equipment

- Software

- Manufacturing Execution Systems (MES)

- Product Lifecycle Management (PLM)

- Industrial Analytics Platforms

- Services

- Consulting & Integration

- Managed Services

- Support & Maintenance

By Technology

- Industrial IoT (IIoT)

- Sensors & Actuators

- Connectivity Solutions

- Edge Devices & Gateways

- Artificial Intelligence (AI) & Machine Learning

- Computer Vision

- Natural Language Processing

- Predictive Analytics

- Big Data & Analytics

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

- Digital Twin

- Product Twin

- Process Twin

- System Twin

- Robotics & Automation

- Industrial Robots

- Collaborative Robots (Cobots)

- Autonomous Mobile Robots (AMRs)

- Others

By Application

- Smart Factories

- Process Automation

- Asset Optimization

- Energy Efficiency

- Predictive Maintenance & Monitoring

- Condition Monitoring

- Failure Prediction

- Supply Chain & Logistics Optimization

- Real-time Tracking & Visibility

- Warehouse Automation

- Quality Control & Inspection

- AI-based Vision Systems

- Automated Testing

- Others

By End-User Industry

- Manufacturing

- Automotive

- Aerospace & Defense

- Electronics & Semiconductors

- Pharmaceuticals & Healthcare

- Others

Regional Analysis

Leading Region in the Industry 4.0 Market

Asia Pacific, leading the Industry 4.0 market in 2025 with an estimated share of 40.2%, is playing a pivotal role in the global growth of smart manufacturing and digital transformation. The region is witnessing rapid adoption of connected devices, automation, robotics, and IoT technologies across manufacturing, automotive, electronics, and heavy industries. Countries like China, India, Japan, and South Korea are investing heavily in advanced industrial infrastructure, workforce training, and digital platforms to enhance productivity and competitiveness.

The growing emphasis on Industry 4.0 solutions is driven by the need for efficient operations, cost reduction, and flexible production capabilities. Asia Pacific’s strong manufacturing base, coupled with supportive government initiatives and rising technology awareness, is encouraging businesses to implement predictive maintenance, smart factories, and data-driven decision-making. As more industries in the region embrace these innovations, Asia Pacific is expected to remain a major hub shaping the future of the Industry 4.0 market globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Industry 4.0 Market

MEA is showing significant growth in the Industry 4.0 market over the forecast period, driven by increasing investments in smart manufacturing, automation, and connected industrial technologies. Countries in the region are adopting IoT, robotics, and data-driven solutions to improve operational efficiency and reduce production costs.

Key sectors, including oil and gas, automotive, and electronics, are implementing predictive maintenance, digital twins, and smart factory solutions to enhance productivity. Government initiatives and industrial modernization programs are supporting the adoption of Industry 4.0 technologies. With rising awareness of digital transformation benefits and infrastructure development, MEA is estimated to become an important contributor to the Global Industry 4.0 market in the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the Industry 4.0 market is shaped by a mix of technology providers, industrial solution developers, and service enablers working together to support digital transformation. Competition is strong as companies aim to offer advanced automation, connected devices, and data-driven solutions that improve efficiency and flexibility in production.

Many players focus on creating platforms that combine cloud, IoT, and artificial intelligence for smarter decision-making. At the same time, partnerships and collaborations are common, as no single provider can meet all needs. The market is dynamic, with innovation and adaptability becoming key factors for success.

Some of the prominent players in the global Industry 4.0 are:

- Intel Corporation

- General Electric (GE)

- IBM Corporation

- Siemens AG

- Cisco Systems Inc.

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Toshiba Corporation

- ABB Ltd.

- Emerson Electric Co.

- Bosch (Robert Bosch GmbH)

- Volkswagen Group

- Toyota Motor Corporation

- Schneider Electric SE

- Rockwell Automation, Inc.

- FANUC Corporation

- DENSO Corporation

- SAP SE

- Stratasys Ltd.

- Swisslog Holding AG

- Other Key Players

Recent Developments

- In May 2025, Kaushalya—The Skill University, in partnership with the Ministry of Heavy Industries, Government of India, inaugurated the iFactory Lab at ITI Kubernagar, Ahmedabad. The facility focuses on training students and industry professionals in Industry 4.0 technologies, including robotics, IoT, data analytics, and cyber-physical systems. Designed to bridge the gap between academics and industry, the lab replicates smart manufacturing environments, offering hands-on modules in automation, intelligent data exchange, and autonomous control for modern industrial processes.

- In February 2025, Moore announced new recipients of the Maryland Manufacturing Industry 4.0 program, which offers grants to small and mid-sized manufacturers for adopting Industry 4.0 technologies. Managed by the Maryland Department of Commerce, the initiative awarded USD 5 million to 43 businesses across 17 jurisdictions, supporting over 2,400 full-time jobs. Emphasizing the importance of adaptation, Moore noted that as technology advances, state programs and the business community must continue evolving to remain competitive.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 190.1 Bn |

| Forecast Value (2034) |

USD 664.4 Bn |

| CAGR (2025–2034) |

14.9% |

| The US Market Size (2025) |

USD 44.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Hardware, Software, and Services), By Technology (Industrial IoT (IIoT), Artificial Intelligence (AI) & Machine Learning, Big Data & Analytics, Digital Twin, Robotics & Automation, and Others), By Application (Smart Factories, Predictive Maintenance & Monitoring, Supply Chain & Logistics Optimization, Quality Control & Inspection, and Others), By End-User Industry (Manufacturing, Automotive, Aerospace & Defense, Electronics & Semiconductors, Pharmaceuticals & Healthcare, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Intel Corporation, General Electric (GE), IBM Corporation, Siemens AG, Cisco Systems Inc., Mitsubishi Electric Corporation, Honeywell International Inc., Toshiba Corporation, ABB Ltd., Emerson Electric Co., Bosch (Robert Bosch GmbH), Volkswagen Group, Toyota Motor Corporation, Schneider Electric SE, Rockwell Automation, Inc., FANUC Corporation, DENSO Corporation, SAP SE, Stratasys Ltd., Swisslog Holding AG, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Industry 4.0 Market?

▾ The Global Industry 4.0 Market size is expected to reach a value of USD 190.1 billion in 2025 and is expected to reach USD 665.4 billion by the end of 2034.

Which region accounted for the largest Global Industry 4.0 Market?

▾ North America is expected to have the largest market share in the Global Industry 4.0 Market, with a share of about 40.2% in 2025.

How big is the Industry 4.0 Market in the US?

▾ The Industry 4.0 Market in the US is expected to reach USD 44.0 billion in 2025.

Who are the key Industry 4.0 Market?

▾ Some of the major key players in the Global Industry 4.0 Market are Intel, IBM, Cisco, and others

What is the growth rate in the Global Industry 4.0 Market?

▾ The market is growing at a CAGR of 14.9 percent over the forecasted period.