The Industry 5.0 market is set to grow quickly, driven by higher adoption of smart manufacturing technologies. As companies look to combine human expertise with advanced technologies, there is an increase in the demand for systems that can optimize production while maintaining a human-centric approach, which covers a wide range of sectors, like manufacturing, healthcare, logistics, and retail — a clear indicator of the expanding human-centric manufacturing landscape.

Industry 5.0 represents the next evolution in manufacturing, emphasizing creating synergies between humans and advanced technology such as

artificial intelligence (AI) and robotics. Industry 5.0's focus on human-centred approaches aims to foster collaboration between machines and human workers and facilitate greater productivity.

This shift allows for greater individualization, creativity and customization during production processes, creating an environment in which human innovation meets digital precision. Industry 5.0 integrates technologies like the Internet of Things (IoT),

big data and

machine learning with human involvement to foster sustainability, resilience and ethical manufacturing practices for an increasingly smart and responsible industry.

Industry 5.0 is reshaping manufacturing by bringing human creativity together with advanced technologies like AI, IoT, and robotics. Unlike the purely automated focus of Industry 4.0, this new phase is about working alongside machines to enhance productivity, allowing for highly customized, sustainable products that meet today’s consumer expectations.

Driven by the push for more personalized production, especially in fields like healthcare and automotive, Industry 5.0 also emphasizes the value of human skills in a tech-rich environment. This approach enables companies to operate efficiently while reducing waste and focusing on responsible, human-centered innovation that prioritizes ethics and sustainability.

Recent events highlight the growing importance of personalized and sustainable production. Industry 5.0 advocates for the customization of products to meet individual consumer needs, emphasizing eco-friendly manufacturing processes. This trend is gaining traction as companies align with consumer preferences for sustainable, responsible products and aim to reduce environmental impact.

The demand for collaborative robots (cobots) is increasing within the Industry 5.0 framework. Cobots work alongside human workers, enhancing their capabilities and improving productivity without replacing jobs. The focus on safe and efficient collaboration between machines and humans is creating opportunities in sectors like automotive, electronics, and healthcare, where precision and innovation are key — contributing to the growth of the advanced smart factories market.

Opportunities for growth in the Industry 5.0 market are expanding across several sectors. With an increased focus on customization, businesses are exploring new approaches to design and manufacturing. The integration of AI and robotics to boost productivity while ensuring worker safety presents significant growth potential, driving innovation and creating new market segments.

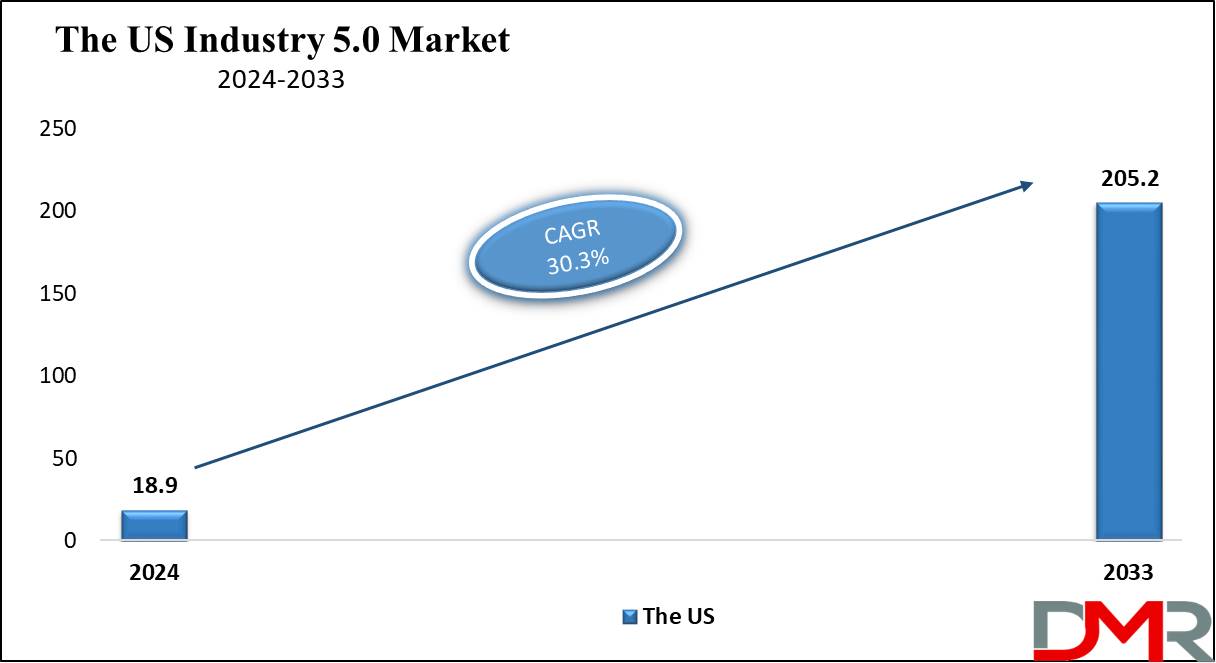

The US Industry 5.0 Market

The

US Industry 5.0 Market is projected to

reach USD 18.9 billion in 2024 at a compound annual

growth rate of 30.3% over its forecast period.

Industry 5.0 in the US has growth opportunities driven by advanced manufacturing, automation, and AI integration. Key sectors like automotive, healthcare, and aerospace benefit from digital twins, cobots, and smart sensors. In addition, the boosts for sustainable energy solutions and personalized products, alongside strong innovation ecosystems, positions the U.S. for significant growth in this market.

Further, the development in automation, AI, and robotics, along with a strong focus on personalized manufacturing and sustainable practices, however, a key challenge is the high cost of implementation and the need for upskilling the workforce to handle complex technologies, which slows broad adoption across industries.

Key Takeaways

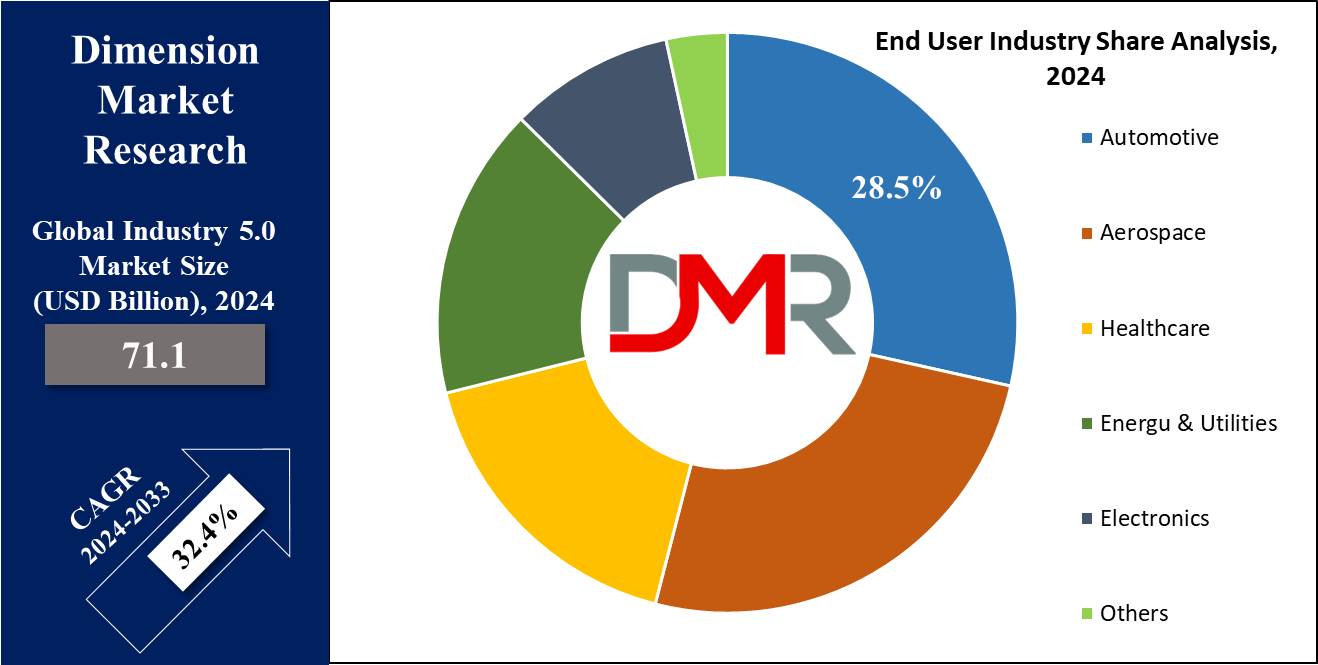

- Market Growth: The Industry 5.0 Market size is expected to grow by 797.9 billion, at a CAGR of 32.4% during the forecasted period of 2025 to 2033.

- By Technology: The Digital Twins segment is expected to be leading the market in 2024

- By End User: The Automotive segment is expected to get the largest revenue share in 2024 in the Industry 5.0 Market.

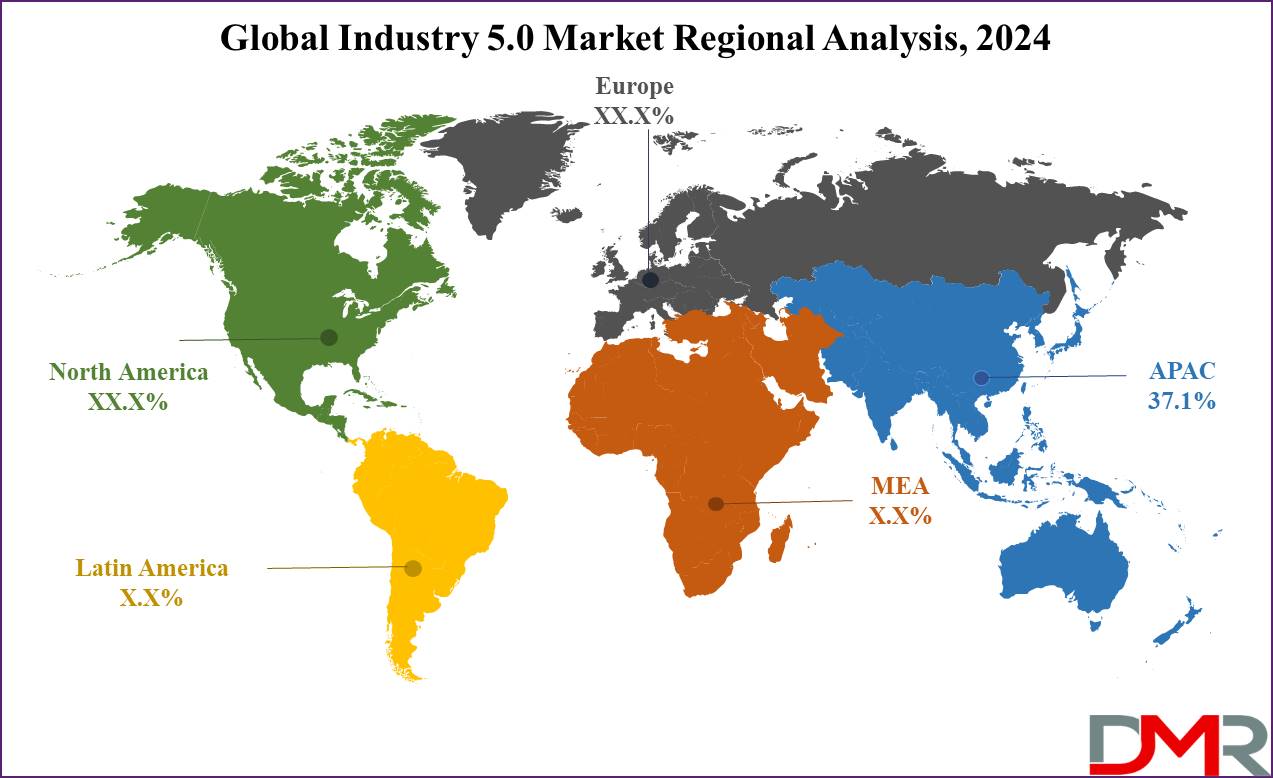

- Regional Insight: Asia Pacific is expected to hold a 37.1% share of revenue in the Global Industry 5.0 Market in 2024.

- Use Cases: Some of the use cases of Industry 5.0 include mass personalization, augmented workforce AI/AR, and more.

Use Cases

- Human-Robot Collaboration (Cobots): Robots work with humans in industries like manufacturing & healthcare, assisting with repetitive tasks. In contrast, humans consider creative or decision-making roles, improving productivity and worker satisfaction.

- Mass Personalization: Using AI and advanced manufacturing techniques (like 3D printing), companies can develop highly personalized products customized to individual preferences at scale, seen in the fashion, automotive, and healthcare industries.

- Sustainability and Circular Economy: Industry 5.0 promotes sustainable practices by integrating technologies to minimize waste, enhance resource efficiency, and encourage recycling, such as smart factories that reduce energy consumption and use eco-friendly materials.

- Augmented Workforce with AI/AR: Augmented Reality (AR) and Artificial Intelligence (AI) tools allow workers to provide real-time information, improving training, troubleshooting, and maintenance processes, commonly applied in sectors like aerospace, construction, and logistics.

Market Dynamic

Driving Factors

Demand for Personalization

The rise in the consumer demand for customized products is driving the growth of Industry 5.0. Companies are adopting advanced technologies like AI,

3D printing, and smart manufacturing to provide customized solutions in sectors like healthcare, automotive, and fashion, fueling market expansion.

Human-Centric Automation

The incorporation of collaborative robots (cobots) and AI-driven systems to help human workers is enhancing productivity and safety, which focuses on enhancing human-machine interaction while maintaining the irreplaceable role of human creativity, is a significant driver for Industry 5.0 growth.

Restraints

High Implementation Costs

The integration of advanced technologies like AI, cobots, and smart manufacturing systems demands significant capital investment. Small and medium-sized enterprises (SMEs) often find it difficult to afford the infrastructure & technology upgrades required for Industry 5.0 adoption.

Skill Gaps and Workforce Readiness

The transition to Industry 5.0 requires a workforce skilled in areas like robotics, AI, and data analysis. A shortage of such skills and the demand for reskilling existing workers act as barriers to large implementation, slowing down adoption rates in various industries.

Opportunities

Sustainable and Green Manufacturing

Industry 5.0 provides opportunities for companies to adopt environmentally friendly practices by integrating sustainable technologies, like energy-efficient systems and circular economy models, which aligns with the increase in the global demand for eco-friendly products and corporate responsibility.

Enhanced Human-Machine Collaboration

With the growth of collaborative robots (cobots) and AI-driven tools, there is an opportunity to develop safer, more efficient, and personalized work environments, which improve productivity while enhancing the quality of jobs, positioning businesses to benefit from a more innovative and adaptable workforce.

Trends

Integration of AI with Human Workers

A major trend is the major focus on integrating AI and machine learning with human skills to develop more flexible, efficient production processes. Cobots are being installed to assist workers and improve decision-making and productivity while maintaining human oversight and creativity.

Focus on Sustainability and Circular Economy

Companies are highly adopting Industry 5.0 to minimize waste and reduce energy consumption. Smart factories are implementing sustainable practices, like the use of renewable energy sources, eco-friendly materials, and closed-loop recycling processes, aligning with global environmental goals.

Research Scope and Analysis

By Technology

In the Industry 5.0 market, as a technology Digital Twin technology is expected to take a leading position by 2024, capturing a majority portion of the market, which creates a real-time digital copy of physical assets, which helps industries enhance operational efficiency and make better decisions.

Digital Twins are mainly useful for predictive maintenance, as they allow businesses to monitor equipment and systems closely, assisting them in identifying issues before they become serious problems. As a result, companies across different industries are highly adopting this technology to improve performance and reduce downtime. Further, Industrial sensors, which gather real-time data and monitor environments, are also gaining a strong foothold, also projected to be holding a significant share of the market share in 2024.

These sensors are critical for enabling smart factories, as they allow production systems to be more adaptive & responsive. In addition, Augmented and Virtual Reality (AR/VR) technologies have secured a considerable market share as well. These immersive tools are transforming the way businesses approach design, employee training, and remote collaboration, making it easy to solve problems and improve productivity. Overall, these technologies are playing an important role in driving Industry 5.0 by creating smarter, more efficient, and connected industrial systems.

By End User Industry

The automotive industry is expected to lead the

Industry 5.0 market in 2024, as rising concerns about climate change and environmental sustainability have driven a switch toward greener transportation options. Manufacturers are highly investing in electric and hybrid vehicles, which have gained assisted from both regulators and eco-conscious consumers. Government incentives, stricter pollution regulations, and higher demand for cleaner alternatives are pushing this trend forward. In addition, the growth of

Mobility as a Service (MaaS) has transformed the way people think about transportation.

Instead of owning a car, consumers now have access to ride-sharing platforms, car subscription services, and on-demand mobility solutions, providing more flexible and affordable options, which is challenging traditional sales models in the auto industry. Further aerospace is experiencing strong growth, due to the use of advanced robotics and digital twin technology, which are improving aircraft design and maintenance.

These technologies make aerospace operations more efficient and precise. Also, healthcare is another major player, using AI and big data to provide personalized patient care, which improves treatment outcomes and efficiency. Moreover, energy utilities with a focus on sustainable energy management. Smart sensors and AI-powered analytics are allowing more efficient energy use and enhancing environmental impact, aligning with global sustainability goals.

The Industry 5.0 Market Report is segmented on the basis of the following

By Technology

- Digital Twin

- Industrial 3D Printing

- AI in Manufacturing

- AR/VR

- Industrial Sensors

- Robots

By End User Industry

- Automotive

- Aerospace

- Healthcare

- Energy & Utilities

- Electronics

- Others

Regional Analysis

The Asia Pacific region is anticipated to become a dominated region in the Industry 5.0 market,

by having 37.1% of the market share by 2024. Businesses in this region are looking on agility, flexibility, and advanced technology to remain competitive globally. As a result, the market is projected to grow significantly, assisted by higher investment in digital infrastructure.

The adoption of next-generation technologies like artificial intelligence (AI), Internet of Things (IoT), and advanced analytics is driving digital transformation in various industries, helping to implement Industry 5.0 principles more effectively. Further, North America is also anticipated to maintain a major presence in the Industry 5.0 market, with steady growth over the coming years. The region’s business-friendly regulations provide opportunities for investment, innovation, and entrepreneurship.

Clear guidelines around industry standards, data privacy, & intellectual property rights give companies a better foundation to grow and innovate. The utilization of new technologies that provide tangible benefits, like cost reductions, better operational efficiency, improved customer experiences, and sustainable practices, is driving the region's expansion in the Industry 5.0 market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the Industry 5.0 market is characterized by a mix of established companies & emerging startups competing to innovate and improve industrial processes. Key players aim to integrate advanced technologies like artificial intelligence, robotics, and the Internet of Things to create smarter manufacturing environments. Collaboration among companies, research institutions, & technology providers is common, fostering innovation and the development of new solutions.

In addition, firms are investing in sustainable practices and eco-friendly technologies to meet the increase in the consumer demand for greener operations. As competition intensifies, companies are also prioritizing customer-centric approaches, offering customized solutions that enhance efficiency and adaptability in various industries.

Some of the prominent players in the Global Industry 5.0 are

- ABB

- Honeywell International Inc

- Siemens

- Rockwell Automation

- KUKA AG

- Bosch Rexroth

- 3D Systems

- Emerson Electric

- Kuka AG

- Nexus Integra

- Other Key Players

Recent Developments

- In June 2024, IIT Delhi's Continuing Education Programme launched an Executive Programme in Healthcare for Industry 5.0, focusing on transforming healthcare education by merging advanced technology with human-centric approaches. Industry 5.0, characterized by the integration of advanced technology and human-centric principles, is set to transform healthcare delivery and patient outcomes.

- In May 2024, the five manufacturing research hubs, led by universities in three of the UK’s four nations, have been assisted by the UK Research and Innovation Engineering and Physical Sciences Research Council (EPSRC) with each hub receiving USD 14.7 million. The hubs have used major co-investment, expertise, and access to facilities to attain faster industrial impact, including partner contributions, cash, and in-kind, the total support committed to the new hubs amounts to more than USD 132 million.

- In April 2024, SenseTime unveiled its latest Large Model, the SenseNova 5.0, at its Tech Day event in Shanghai. With its advanced technology expanding the development of generative AI, SenseTime also introduced the "Cloud-To-Edge" full-stack large model product matrix that is scalable and applicable across many scenarios.

- In November 2023, Rockwell Automation unveiled its investment in Momenta’s Industry 5.0 Fund, a venture capital and value creation fund that helps entrepreneurs focus on resilient, sustainable, and human-centric industrial operations. Switzerland-based Momenta launched the USD 100 million fund in January in cooperation with the EU Commission to help startup companies working to advance the commission’s Industry 5.0 initiative.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 71.1 Bn |

| Forecast Value (2033) |

USD 889.8 Bn |

| CAGR (2024-2033) |

32.4% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 18.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology (Digital Twin, Industrial 3D Printing, AI in Manufacturing, AR/VR, Industrial Sensors, and Robots), By End User Industry (Automotive, Aerospace, Healthcare, Energy & Utilities, Electronics, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

ABB, Honeywell International Inc, Siemens, Rockwell Automation, KUKA AG, Bosch Rexroth, 3D Systems, Emerson Electric, Kuka AG, Nexus Integra, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |