Market Overview

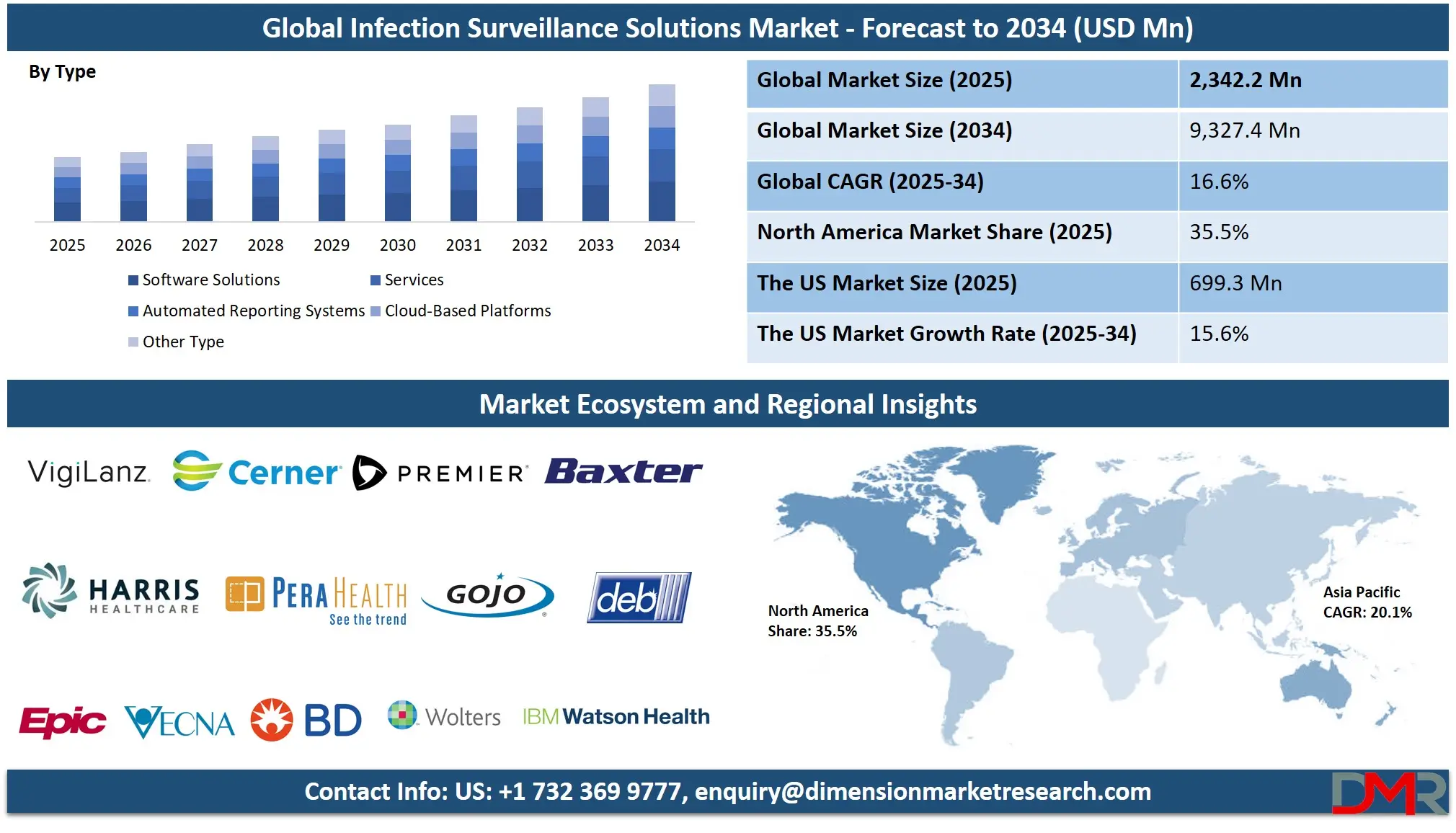

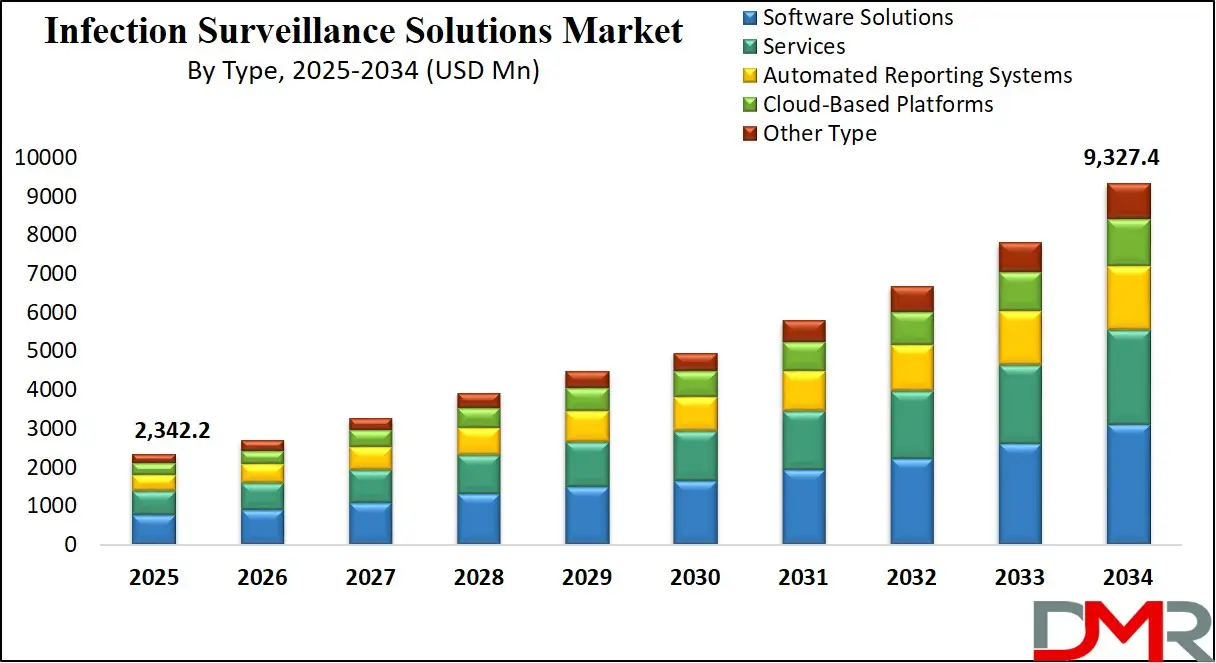

The Global Infection Surveillance Solutions Market is projected to reach USD 2,342.2 million in 2025 and is expected to grow at a CAGR of 16.6% from 2025 to 2034, attaining a value of USD 9,327.4 million by 2034.

This robust growth trajectory is primarily fueled by the escalating global incidence of healthcare-associated infections (HAIs) and the relentless rise of antimicrobial resistance (AMR), which collectively pose a significant threat to patient safety and healthcare economics. Concurrently, a paradigm shift towards value-based care models, which tie reimbursement to patient outcomes and quality metrics, is compelling healthcare providers to invest in advanced digital surveillance tools.

These solutions are critical for moving from a reactive to a proactive infection prevention stance, enabling healthcare facilities to identify outbreaks earlier, intervene more swiftly, and demonstrate compliance with increasingly stringent public health reporting mandates. The integration of sophisticated technologies like artificial intelligence (AI) and cloud computing is transforming infection control from a manually intensive, retrospective process into an automated, real-time, and predictive function that is essential for modern healthcare delivery.

Infection surveillance solutions form the technological backbone of modern infection prevention and control (IPC) programs. They function by automatically and continuously collecting data from a myriad of hospital IT systems, including Electronic Health Records (EHRs), laboratory information systems (LIS), pharmacy databases, and admission-discharge-transfer (ADT) systems.

This data is then synthesized and analyzed using rule-based algorithms and, increasingly, machine learning models to identify patterns indicative of HAIs, such as central line-associated bloodstream infections (CLABSI) or catheter-associated urinary tract infections (CAUTI). The model directly confronts the global challenge of HAIs, which affect millions of patients annually, leading to extended hospital stays, long-term disability, significant financial burdens on healthcare systems, and unfortunately, a substantial number of preventable deaths. By providing actionable insights and automated alerts, these solutions empower IPC teams to implement targeted interventions, ultimately reducing infection rates, mitigating AMR spread, and improving overall patient outcomes.

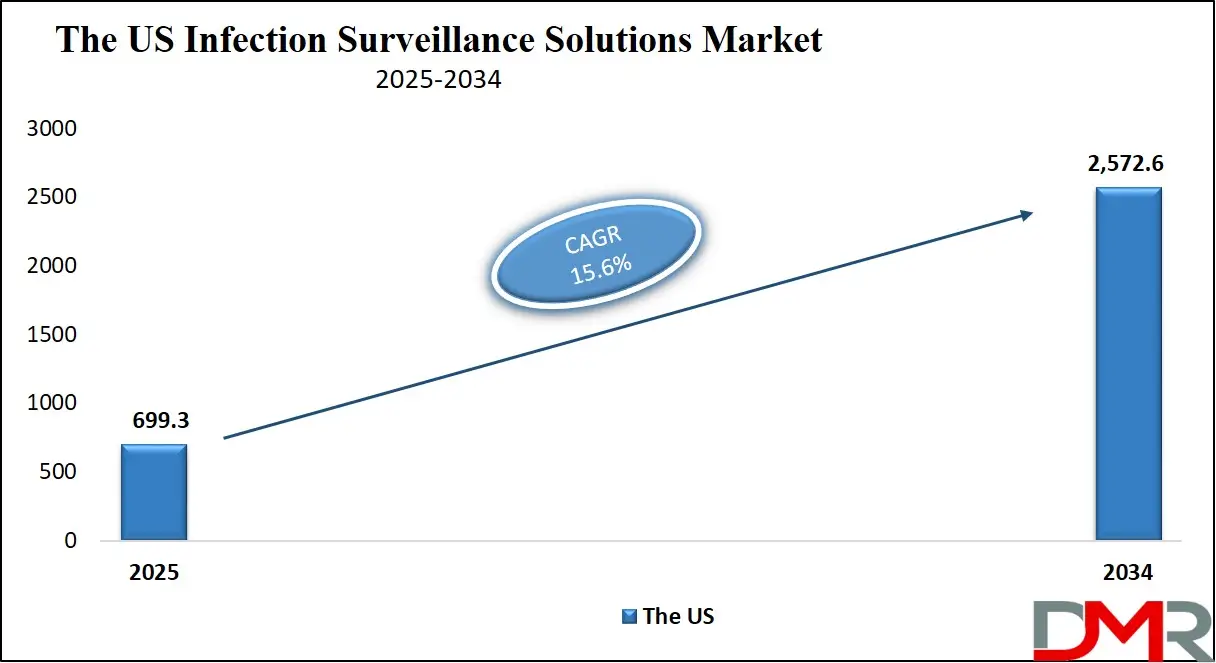

The US Infection Surveillance Solutions Market

The U.S. Infection Surveillance Solutions Market is projected to reach USD 699.3 million in 2025 and grow at a CAGR of 15.6%, reaching USD 2,572.6 million by 2034. The United States stands as the global leader in adoption, a status driven by a perfect storm of factors: a highly advanced healthcare IT ecosystem, an uncompromising regulatory environment, and a payment system that increasingly penalizes poor performance.

With estimates suggesting over 1.7 million HAIs occur in U.S. hospitals each year, the demand for automated, accurate surveillance is immense. The Centers for Disease Control and Prevention (CDC's) National Healthcare Safety Network (NHSN) serves as the nation's central tracking system, and reporting to it is mandatory for hospitals seeking to avoid financial penalties under programs like the Centers for Medicare & Medicaid Services (CMS) Hospital Inpatient Quality Reporting (IQR) Program and the Hospital-Acquired Condition (HAC) Reduction Program.

Major health systems such as HCA Healthcare, Kaiser Permanente, and Mayo Clinic are at the forefront, having integrated sophisticated, AI-driven surveillance platforms that go beyond basic tracking. These systems are capable of predictive analytics for pathogens like MRSA and C. difficile, automated compliance reporting for state mandates, and providing real-time dashboards that give infection preventionists a comprehensive view of their facility's status.

The U.S. reimbursement landscape acts as a powerful accelerant; CMS's value-based purchasing and penalty models create a direct financial incentive for hospitals to invest in technologies that demonstrably reduce HAI rates. This robust market has fostered a competitive vendor ecosystem, with companies like BD, Wolters Kluwer, and IBM Watson Health continuously innovating their cloud-based platforms, enhancing NLP capabilities for mining clinical notes, and developing more sophisticated risk-adjustment models to provide fair and accurate benchmarking.

The Europe Infection Surveillance Solutions Market

The Europe Infection Surveillance Solutions Market is projected to be valued at approximately USD 540 million in 2025 and is projected to reach around USD 2,150 million by 2034, growing at a CAGR of about 16.0% from 2025 to 2034. Europe's market is characterized by its strong, centralized regulatory frameworks and proactive public health initiatives.

The European Centre for Disease Prevention and Control (ECDC) plays a pivotal role, establishing standardized protocols for HAI surveillance and coordinating cross-border efforts to combat AMR. This creates a cohesive environment for solution providers, though it also demands rigorous compliance with data protection laws like the General Data Protection Regulation (GDPR). Countries such as the U.K., Germany, France, and the Scandinavian region have been early adopters, driven by their national health services' focus on quality improvement and cost containment.

The U.K.’s National Health Service (NHS), for instance, has implemented mandatory surveillance for key infections like MRSA and C. difficile, supported by centralized digital platforms that enable real-time data dashboards and performance benchmarking across trusts. Europe’s demographic profile, featuring an aging population and high volumes of complex surgical procedures, inherently increases the risk of HAIs, thereby fueling demand for effective surveillance. Significant funding from European Union initiatives such as EU4Health and Horizon Europe is actively channeled into projects that enhance digital IPC infrastructure, promote interoperability between national health systems, and develop AI tools for predicting and managing health threats, including pandemics and AMR, ensuring Europe remains a highly advanced and integrated market.

The Japan Infection Surveillance Solutions Market

The Japan Infection Surveillance Solutions Market is anticipated to be valued at approximately USD 48 million in 2025 and is expected to attain nearly USD 210 million by 2034, expanding at a CAGR of about 18.2% during the forecast period, representing one of the fastest-growing regional markets.

Japan's growth is fundamentally driven by its super-aging society, where over 30% of the population is aged 65 or older. This demographic is particularly vulnerable to infections and often requires care in both acute hospitals and long-term care facilities, settings that are high-risk for outbreaks. The Ministry of Health, Labour and Welfare (MHLW) has responded by actively promoting digital health strategies that include automated HAI reporting and robust outbreak detection systems.

Japan's unique strength lies in its technological prowess in areas like robotics, IoT, and precision manufacturing. This expertise is being leveraged by domestic technology giants like Hitachi, Fujitsu, and NEC, who are developing innovative "Smart Healthcare" solutions. These integrate IoT-enabled environmental sensors and connected medical devices with centralized cloud surveillance platforms, creating a continuous, data-rich monitoring environment. In urban centers like Tokyo and Osaka, hospitals are deploying AI-driven surveillance in intensive care units, while rural prefectures are utilizing cloud-based systems to connect smaller, isolated hospitals with central public health units and specialist expertise, thereby bridging the healthcare access gap.

Global Infection Surveillance Solutions Market: Key Takeaways

- Strong Global Market Growth Outlook: The market is on a rapid expansion path, expected to grow from USD 2,342.2 million in 2025 to USD 9,327.4 million by 2034. This growth is underpinned by the non-negotiable need to reduce the clinical and financial burden of HAIs and AMR, coupled with the global digital transformation of healthcare infrastructure.

- High CAGR Driven by Digital Health Adoption: The impressive 16.6% CAGR is a direct result of accelerated telehealth adoption, which has normalized remote data monitoring, alongside the specific integration of AI-powered analytics into core infection control workflows, cloud-based data aggregation, and the relentless increase in chronic conditions that predispose patients to infections.

- Strong Growth Trajectory in the United States: The U.S. market's is projected to growth from USD 699.3 million to USD 2,572.6 million is a testament to its mature yet still evolving ecosystem, where robust reimbursement structures, deep integration of digital health into clinical pathways, and a regulatory environment that mandates performance and transparency create a highly conducive environment for market expansion.

- North America Maintains Regional Dominance: Accounting for approximately 35.5% of the global market share in 2025, North America's leadership is sustained by its advanced healthcare IT infrastructure, high digital literacy among healthcare professionals, early and widespread adoption of AI and cloud technologies, and a well-established culture of data-driven quality improvement.

- Rapid Advancement in Surveillance Technologies: The market is being revolutionized by a wave of innovations. These include AI-based outbreak prediction models that forecast hotspots, real-time antibiograms that dynamically guide antibiotic selection, cloud-integrated EHR platforms that break down data silos, and automated reporting modules that directly submit data to national agencies, collectively enhancing the scalability, accuracy, and cost-effectiveness of infection control.

- Growing Burden of HAIs and AMR Boosts Adoption: The rising global prevalence of multidrug-resistant organisms (MDROs) like MRSA, life-threatening infections such as C. difficile, and common device- and procedure-related infections like CLABSI, CAUTI, and SSI is creating sustained, long-term demand for automated surveillance systems that enable early detection, remote patient monitoring, and data-driven population health management.

Global Infection Surveillance Solutions Market: Use Cases

- Hospital-Acquired Infection (HAI) Monitoring: In this primary use case, hospitals deploy surveillance software to automatically track and alert on specific HAIs. For example, the system can flag a patient with a positive blood culture 48 hours after admission who also had a central line, suggesting a potential CLABSI, thereby triggering an immediate review by the IPC team and allowing for rapid intervention and source control.

- Antimicrobial Stewardship: Surveillance solutions are integrated with pharmacy and microbiology data to monitor antibiotic prescription patterns, duration of therapy, and culture results. This enables stewardship programs to identify inappropriate antibiotic use, provide feedback to prescribers, and monitor compliance with guidelines, directly combating the development and spread of AMR.

- Outbreak Detection and Management: Advanced AI algorithms continuously analyze patient location, movement, and microbiological data to detect unusual clusters of infection in near real-time. For instance, an increase in respiratory syncytial virus (RSV) cases in a pediatric wing can be identified early, allowing the hospital to enact droplet precautions, cohort patients, and restrict visitors to contain the outbreak before it spreads widely.

- Public Health Reporting: Automated surveillance systems streamline the cumbersome process of public health reporting. They can aggregate required data elements and directly submit them to national registries like the NHSN in the U.S. or ECDC in Europe, significantly reducing the administrative burden on hospital staff and improving the timeliness and accuracy of national infection statistics.

- Long-Term Care Facility Surveillance: Cloud-based platforms are particularly valuable in the long-term care setting, where resources are often limited. These systems enable corporate or regional IPC teams to monitor infection rates across multiple facilities from a single dashboard, quickly identifying homes with rising rates of urinary tract infections or influenza-like illness and deploying support and resources where they are most needed.

- The World Health Organization (WHO) highlights that over 1.4 million HAIs occur annually at any given time worldwide, with more than 50% considered preventable. This stark statistic reinforces the critical role of automated surveillance, which, through AI-driven alerts, seamless EHR integration, and intuitive real-time dashboards, has been proven to significantly reduce infection rates and associated mortality.

- The U.S. Centers for Disease Control and Prevention (CDC) reports a sobering reality that one in every 31 hospital patients has at least one HAI on any given day. This high prevalence drives the adoption of surveillance solutions, with studies showing that facilities with mature, automated IPC programs can reduce their HAI rates by up to 35%, translating to thousands of prevented infections and millions of dollars in saved healthcare costs annually.

- The European Antimicrobial Resistance Surveillance Network (EARS-Net) data reveals that AMR is responsible for over 33,000 deaths annually across the European Union. This human toll is accelerating demand for sophisticated surveillance systems that go beyond simple infection tracking to include integrated resistance mapping, enabling public health officials to track the spread of high-priority pathogens like carbapenem-resistant Enterobacteriaceae (CRE).

- The U.S. Department of Health & Human Services estimates that the direct medical costs of HAIs to the U.S. healthcare system range from USD 28 to 45 billion each year. This massive financial burden validates strategic investment in automated surveillance solutions not as an expense, but as a cost-saving measure that also improves patient safety and fulfills regulatory requirements.

- According to Global Health IT Surveys, the adoption of cloud-based infection surveillance platforms is growing at a remarkable rate of over 25% annually in emerging markets. This surge is driven by hospitals in these regions seeking affordable, scalable, and rapidly deployable solutions that do not require extensive on-premise IT infrastructure, thereby leapfrogging older, manual methods.

- The Infectious Diseases Society of America (IDSA) reports that over 60% of U.S. hospitals now utilize some form of electronic surveillance for at least one type of HAI. This figure is expected to climb steadily as regulatory pressures intensify, vendor solutions become more user-friendly, and the evidence base demonstrating their positive return on investment continues to grow.

Global Infection Surveillance Solutions Market: Market Dynamic

Driving Factors in the Global Infection Surveillance Solutions Market

Rising Prevalence of HAIs and AMR

The relentless growth in the burden of healthcare-associated infections and antimicrobial resistance is the single most powerful driver of the market. Global factors such as aging populations with compromised immune systems, increased survival rates from complex medical and surgical interventions, and the overuse and misuse of antibiotics have created a perfect storm. Surveillance solutions are no longer a luxury but a necessity, enabling the early detection of infections, automating the tedious process of data collection for mandatory reporting, and facilitating sophisticated trend analysis that can predict and prevent outbreaks. This capability is crucial for reducing the transmission of multidrug-resistant organisms, supporting antimicrobial stewardship programs, and ultimately alleviating the strain of specialist shortages in epidemiology and infection control, particularly in underserved rural regions.

Regulatory Mandates and Quality Reporting

Stringent and expanding government regulations worldwide are compelling healthcare providers to adopt digital surveillance solutions. In the United States, programs such as the CMS Hospital Inpatient Quality Reporting (IQR) Program and the Hospital-Acquired Condition (HAC) Reduction Program directly tie HAI rates to Medicare reimbursement, creating a powerful financial imperative. Similarly, in Europe, the ECDC surveillance protocols and various national health service mandates require standardized reporting and transparency. These regulations force hospitals to move away from error-prone, manual surveillance methods towards automated, accurate, and auditable digital systems. Compliance is not optional, making investment in these solutions a strategic priority for healthcare administrators seeking to avoid financial penalties and protect their institution's reputation.

Restraints in the Global Infection Surveillance Solutions Market

High Implementation Costs

The significant financial investment required remains a major barrier to adoption, especially for small and mid-sized hospitals, critical access facilities, and those in developing countries. Costs are not limited to initial software licensing fees but also include substantial expenses for system integration with existing EHRs and IT infrastructure, continuous data validation, and comprehensive training for infection preventionists, IT staff, and clinical end-users. Furthermore, ongoing costs for software maintenance, updates, and cloud subscriptions can strain operational budgets, leading to a cautious approach to procurement and slowing down market penetration in cost-sensitive environments.

Data Interoperability and Privacy Concerns

The healthcare IT landscape is often a patchwork of legacy systems and new platforms from different vendors that do not communicate seamlessly with one another. This lack of innate data interoperability can create significant siloes, forcing manual data entry and undermining the automated, real-time promise of surveillance solutions. Even when data can be exchanged, stringent data privacy regulations such as the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. impose complex requirements for data security, storage, and patient consent. Navigating this regulatory maze can slow deployment, increase implementation complexity and cost, and create apprehension among healthcare providers about potential compliance risks.

Opportunities in the Global Infection Surveillance Solutions Market

AI-Integrated National Surveillance Programs

There is a growing trend of governments launching national-level, digital public health surveillance initiatives focused specifically on HAIs and AMR. These programs represent a massive opportunity for solution providers. By integrating AI-based data analysis, these national systems can process surveillance data from hundreds of hospitals in near real-time, identifying regional outbreaks, tracking the spread of resistance patterns, and significantly reducing the data analysis burden on individual facilities. Countries are beginning to deploy these automated models to ensure early diagnosis of public health threats, reduce national AMR rates, and promote uniform access to high-quality infection data for policy-making and resource allocation.

Expansion in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and Africa represent the next major frontier for growth. These regions often suffer from high HAI rates, limited access to trained infection preventionists, and rapidly increasing healthcare digitization. Government-led health missions, such as India's Ayushman Bharat and China's "Internet+ Healthcare" strategy, are creating fertile ground for the adoption of tele-IPC and affordable surveillance solutions. The lower cost of cloud-based models and the availability of simplified, mobile-friendly platforms allow community health workers and nurses to conduct basic surveillance and reporting, creating sustainable and scalable demand as these health systems modernize.

Trends in the Global Infection Surveillance Solutions Market

Cloud-Based Surveillance Platforms

The migration to cloud-based solutions is a dominant and enduring trend. Cloud platforms offer unparalleled advantages, including lower upfront costs (opex vs. capex), effortless scalability to accommodate multiple facilities or health systems, remote access for IPC teams across different locations, and automatic, seamless software updates. They reduce the need for extensive on-premise IT infrastructure and support, making enterprise-grade surveillance capabilities accessible to a broader range of healthcare providers. This model also facilitates the creation of large, anonymized, multi-institutional databases that can be used for advanced benchmarking and research.

AI and Predictive Analytics for Outbreak Prevention

The application of AI is evolving from simple detection to sophisticated prediction. Predictive analytics models use historical and real-time data including patient admissions, procedure schedules, and historical infection patterns to forecast the likelihood of future outbreaks. For example, a model might predict an increased risk of SSIs following a high volume of orthopedic procedures, allowing the IPC team to proactively audit and reinforce sterile techniques and post-operative care protocols. This shift from reactive to proactive intervention represents the future of infection prevention, optimizing resource allocation and preventing infections before they occur.

Global Infection Surveillance Solutions Market: Research Scope and Analysis

By Type Analysis

Software Solutions are projected to dominate the global market and form the core of the digital infection control ecosystem. Their dominance is due to their critical role in automating the entire surveillance workflow: from data aggregation and HAI case identification to analytics, alerting, and compliance reporting. Modern software integrates seamlessly with hospital IT ecosystems, pulling data from EHRs, labs, and pharmacies to provide a centralized dashboard for IPC teams. The segment is further energized by the integration of AI-enhanced modules, which automate the labor-intensive process of validating potential HAIs, prioritizing alerts for the most critical cases, and generating sophisticated reports on infection trends and antimicrobial utilization, thereby driving efficiency and allowing IPC staff to focus on intervention rather than data collection.

Services, while a smaller segment, are crucial for market functionality. They include implementation services, which ensure the software is properly integrated into complex hospital IT environments; training services, which are essential for user adoption and effective utilization of the platform's features; and consulting services, where experts help hospitals optimize their IPC workflows and data analysis strategies. The growing complexity of solutions is ensuring sustained demand for these high-value services.

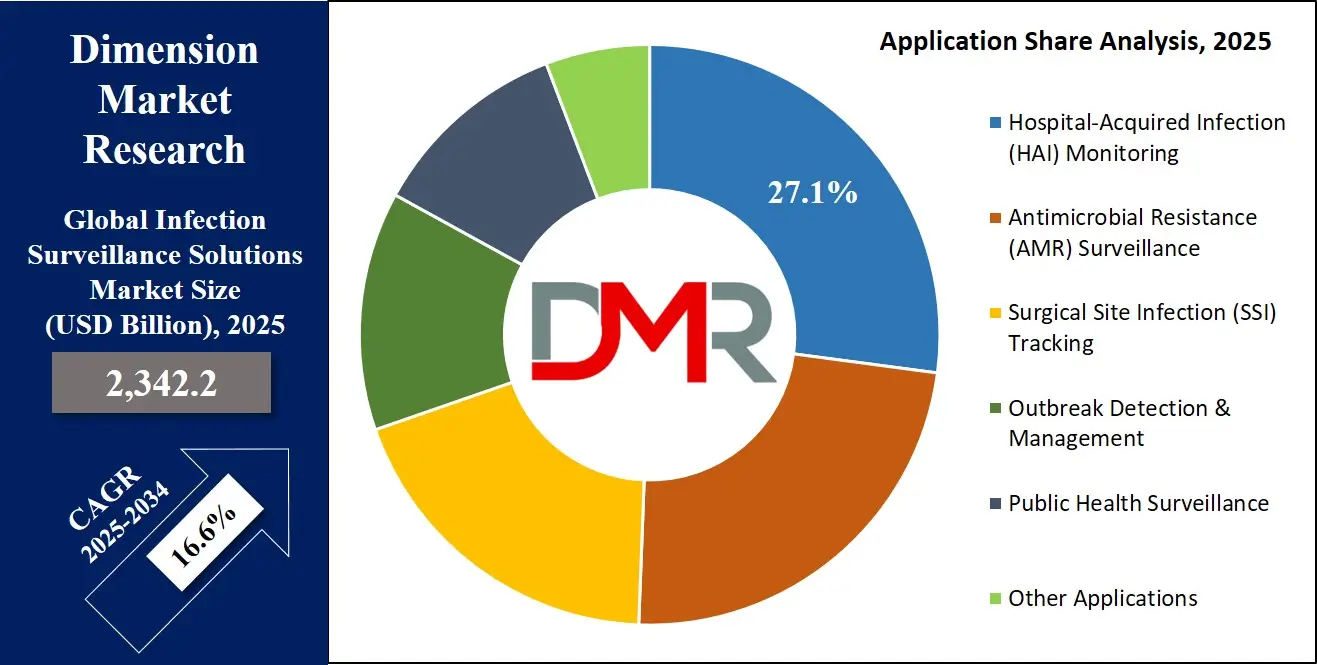

By Application Analysis

Hospital-Acquired Infection (HAI) Monitoring is expected to be the largest and most dominant application segment, and for a compelling reason: HAIs represent a direct, measurable, and costly threat to patient safety that is heavily scrutinized by regulators and payers. Hospitals prioritize automated surveillance for key infections like CLABSI, CAUTI, SSI, and multidrug-resistant organisms (MDROs) because these are often tied to public reporting requirements and financial incentives or penalties. The dominance of this segment is continuously reinforced by value-based purchasing models that demand transparent performance data, making investment in automated HAI monitoring not just a clinical imperative but a financial one.

Antimicrobial Resistance (AMR) Surveillance ranks as the second-largest and fastest-growing application segment. This is directly driven by the global AMR crisis, which the WHO has declared one of the top ten global public health threats. Surveillance solutions are essential for continuous monitoring of local and regional resistance patterns, generating real-time antibiograms that guide empiric therapy, and providing the data backbone for effective antimicrobial stewardship programs. As stewardship becomes a mandatory component of hospital accreditation in many countries, the demand for integrated AMR surveillance tools will only intensify.

By End User Analysis

Hospitals and Acute Care Facilities are anticipated to be the dominant end-user segment throughout the forecast period. These institutions are the epicenters of HAIs, house the most vulnerable patient populations, and are subject to the most stringent reporting mandates. They typically possess the necessary IT infrastructure, dedicated infection preventionists, and financial resources to implement and maintain advanced surveillance systems. Furthermore, hospitals serve as the central hub for interpreting data that may be collected from affiliated clinics or long-term care facilities, and they are the site for subsequent treatment interventions for complex infections, solidifying their central role in the market.

Long-Term Care Facilities represent the second-largest end-user segment and a major growth area. Residents in these facilities are highly vulnerable to outbreaks due to advanced age, comorbidities, and close living quarters. There is increasing regulatory focus on improving infection control in these settings, driven by the devastating impact outbreaks can have. Cloud-based platforms are ideally suited for this segment, as they allow for easy monitoring across multiple facilities by a corporate or regional IPC team, enabling early detection and management of infections like influenza, norovirus, and COVID-19 without requiring on-site IT expertise.

The Global Infection Surveillance Solutions Market Report is segmented on the basis of the following:

By Type

- Software Solutions

- Infection Prevention & Control (IPC) Software

- Real-Time Infection Monitoring Dashboards

- Predictive Analytics & Risk Scoring Software

- Electronic Medical Record (EMR) Integrated Surveillance Modules

- Alert & Notification Management Systems

- Services

- Implementation & Integration Services

- System setup

- Interoperability

- workflow integration

- Training & Education Services

- Clinical training

- platform orientation

- compliance training

- Consulting Services

- Infection control consulting

- workflow optimization

- Maintenance & Support Services

- System upgrades

- Troubleshooting

- remote support

- Automated Reporting Systems

- Automated HAI Reporting Systems

- Automated AMR/Antibiogram Reporting Tools

- Real-Time Outbreak Reporting Systems

- Automated Data Extraction & Validation Tools

- Cloud-Based Platforms

- SaaS-Based Infection Surveillance Platforms

- Hybrid Deployment Platforms

- Cloud Analytics & Reporting Portals

- Other Type

By Application

- Hospital-Acquired Infection (HAI) Monitoring

- CLABSI (Central Line-Associated Bloodstream Infections)

- CAUTI (Catheter-Associated Urinary Tract Infections)

- SSI (Surgical Site Infections)

- VAP (Ventilator-Associated Pneumonia)

- MRSA, C. difficile, and Other Nosocomial Infections

- Antimicrobial Resistance (AMR) Surveillance

- Antibiotic Usage & Stewardship Monitoring

- Resistance Pattern & Trend Analytics

- Multi-Drug Resistant Organism (MDRO) Tracking

- Surgical Site Infection (SSI) Tracking

- Preoperative SSI Risk Assessment

- Postoperative SSI Monitoring

- Cross-Department SSI Analytics

- Outbreak Detection & Management

- Early Warning Detection Algorithms

- Cluster Identification & Root Cause Analysis

- Response Planning & Containment Tracking

- Public Health Surveillance

- Community-Level Infection Reporting

- Epidemiological Trend Monitoring

- Zoonotic & Emerging Infectious Disease Surveillance

- Other Applications

By End User

- Hospitals & Acute Care Facilities

- Long-Term Care Facilities

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Public Health Agencies

- Other End Users

Impact of Artificial Intelligence in the Global Infection Surveillance Solutions Market

- AI for Automated HAI Detection: AI algorithms automate the identification of HAIs by continuously analyzing structured and unstructured data from EHRs, lab results, and clinical notes. This reduces manual chart review by infection preventionists by up to 70%, improves the accuracy and consistency of case finding, minimizes reporting errors, and enables real-time clinical intervention, ultimately leading to better patient outcomes and more reliable public health data.

- Predictive Outbreak Analytics: Machine learning models analyze complex datasets including patient flow, bed occupancy, microbiological results, and even weather data to predict infection clusters and outbreaks before they become clinically apparent. This allows IPC teams to implement preemptive containment measures, such as enhanced cleaning, contact precautions, or staff cohorting, potentially stopping an outbreak from occurring and saving significant costs and resources.

- AMR Pattern Recognition: AI excels at identifying subtle, emerging patterns in large datasets. In AMR surveillance, it can analyze thousands of antibiograms and treatment outcomes to detect nascent resistance trends, predict which antibiotics may become less effective, and provide data-driven support for stewardship decisions, such as refining empirical therapy guidelines or restricting the use of certain antibiotics.

- Natural Language Processing (NLP) for Case Finding: A significant portion of clinical information resides in unstructured physician and nursing notes. NLP technology can scan these notes to identify key phrases and concepts indicative of infection (e.g., "purulent drainage," "fever of unknown origin") that are not captured in structured data fields, thereby significantly enhancing the completeness and accuracy of surveillance.

- Automated Regulatory Reporting: AI can streamline the entire process of regulatory reporting by automatically aggregating the required data elements, mapping them to the specific fields required by agencies like the NHSN, and submitting the reports electronically. This eliminates a massive administrative burden for hospital staff, reduces errors, and ensures timely and compliant reporting.

Global Infection Surveillance Solutions Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the Global Infection Surveillance Solutions Market, holding 35.5% of the market share by the end of 2025. This leadership position is the result of a powerful confluence of factors. The region boasts the world's most advanced healthcare IT infrastructure, with near-universal EHR adoption providing a rich data source for surveillance tools.

Its regulatory environment is among the most stringent, with mandatory reporting to the CDC's NHSN and financial penalties for underperformance creating a non-negotiable demand for accurate, automated solutions. Furthermore, high digital literacy among healthcare professionals, early and widespread adoption of AI and cloud technologies, and a well-established culture of data-driven quality improvement and benchmarking create a highly mature and receptive market. The presence of major global vendors and a robust reimbursement system that acknowledges the value of infection prevention further cement North America's dominant role.

Region with the Highest CAGR

The Asia-Pacific region holds the highest CAGR and is poised for the most dynamic growth, rapidly closing the gap with more established markets. This explosive growth is fueled by a massive population base with a concurrently high and growing burden of HAIs and AMR. The region is home to more than 60% of the world's population, with countries like India and China experiencing rapid increases in diabetes and other chronic conditions that heighten infection risk. Critically, these countries are simultaneously investing heavily in digital health infrastructure through government initiatives like India's National Digital Health Mission (NDHM) and China's "Internet+ Healthcare" strategy. The critical shortage of trained infection preventionists in many APAC countries makes automated, AI-driven surveillance not just an efficiency tool but a fundamental necessity to scale IPC efforts effectively. As cloud-based and mobile-first solutions become more affordable, they are being rapidly adopted to bridge the healthcare quality gap between urban and rural areas, making APAC the epicenter of future market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Infection Surveillance Solutions Market: Competitive Landscape

The Global Infection Surveillance Solutions Market is moderately fragmented, characterized by a dynamic mix of established medical technology giants, specialized software firms, and emerging AI-focused startups. Leading companies like BD, Wolters Kluwer, and Baxter International leverage their deep relationships with healthcare providers and extensive product portfolios to offer integrated solutions. These established players are actively enhancing their offerings through strategic acquisitions, such as Baxter's acquisition of VigiLanz, to add cloud analytics and predictive capabilities. Specialized innovators like RL Solutions and Vecna Technologies compete by offering best-in-breed, user-centric platforms with advanced AI and data visualization tools. The competitive intensity is driving rapid innovation, with a strong focus on cloud-native architectures, advanced AI and machine learning modules for prediction, and achieving seamless interoperability with the broadest possible range of EHR systems. Partnerships between technology firms (e.g., Premier Inc. with Google Cloud) are also becoming common, combining clinical expertise with advanced AI engineering to create next-generation solutions.

Some of the prominent players in the Global Infection Surveillance Solutions Market are:

- BD

- Wolters Kluwer

- IBM Watson Health

- Premier Inc.

- Baxter International

- GOJO Industries

- RL Solutions

- Vecna Technologies

- Deb Group Ltd.

- PeraHealth

- Cerner Corporation

- Epic Systems Corporation

- Harris Healthcare

- VigiLanz Corporation

- Other Key Players

Recent Developments in the Global Infection Surveillance Solutions Market

November 2025: BD launches Clarity ESO

BD introduced Clarity ESO, an enhanced surveillance platform that incorporates AI-driven outbreak prediction algorithms and features fully automated, streamlined reporting directly to the NHSN, significantly reducing the administrative burden on hospital infection prevention teams.

October 2025: Wolters Kluwer showcases POC Advisor™ at IDWeek 2025

At the premier infectious disease event, Wolters Kluwer demonstrated new capabilities in its POC Advisor™ platform, emphasizing its AI-powered, real-time HAI detection from clinical notes and its enhanced decision-support modules for antimicrobial stewardship programs.

September 2025: IBM Watson Health expands partnership with NHS Wales

IBM Watson Health announced a significant expansion of its deployment with NHS Wales, implementing its AI-powered surveillance system across all acute care facilities in Wales for real-time monitoring of HAIs and AMR patterns, creating a unified national data platform.

August 2025: Baxter acquires VigiLanz Corporation

Baxter International completed the strategic acquisition of VigiLanz Corporation, a leader in cloud-based clinical surveillance. This move dramatically enhances Baxter's medication delivery and pharmacy portfolio with advanced predictive analytics for infection prevention and drug safety.

July 2025: Premier Inc. partners with Google Cloud

Premier Inc. entered a strategic collaboration with Google Cloud to integrate Google's advanced AI and machine learning engines into Premier’s proprietary surveillance technology. The goal is to develop next-generation predictive models for infection risk and hospital resource optimization.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2,342.2 Mn |

| Forecast Value (2034) |

USD 9,327.4 Mn |

| CAGR (2025–2034) |

16.6% |

| The US Market Size (2025) |

USD 699.3 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Software Solutions, Services, Automated Reporting Systems, Cloud-Based Platforms, and On-Premise Solutions), By Application (Hospital-Acquired Infection (HAI) Monitoring, Antimicrobial Resistance (AMR) Surveillance, Surgical Site Infection (SSI) Tracking, Outbreak Detection & Management, Public Health Surveillance, Organism-Specific Surveillance, and Environmental & Compliance Monitoring), By End User (Hospitals & Acute Care Facilities, Long-Term Care Facilities, Ambulatory Surgical Centers, Diagnostic Laboratories, Public Health Agencies, Community Clinics, and Academic & Research Institutions) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BD, Wolters Kluwer, IBM Watson Health, Premier Inc., Baxter International, GOJO Industries, RL Solutions, Vecna Technologies, Deb Group Ltd., PeraHealth, Cerner Corporation, Epic Systems Corporation, Harris Healthcare, VigiLanz Corporation., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Infection Surveillance Solutions Market size is estimated to have a value of USD 2,342.2 million in 2025 and is expected to reach USD 9,327.4 million by the end of 2034.

The market is growing at a Compound Annual Growth Rate (CAGR) of 16.6 percent over the forecasted period from 2025 to 2034.

The US Infection Surveillance Solutions Market is projected to be valued at USD 699.3 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,572.6 million in 2034 at a CAGR of 15.6%.

North America is expected to have the largest market share in the Global Infection Surveillance Solutions Market with a share of about 35.5% in 2025.

Some of the major key players in the Global Infection Surveillance Solutions Market are BD, Wolters Kluwer, IBM Watson Health, Premier Inc., Baxter International, and GOJO Industries, among many others.