Market Overview

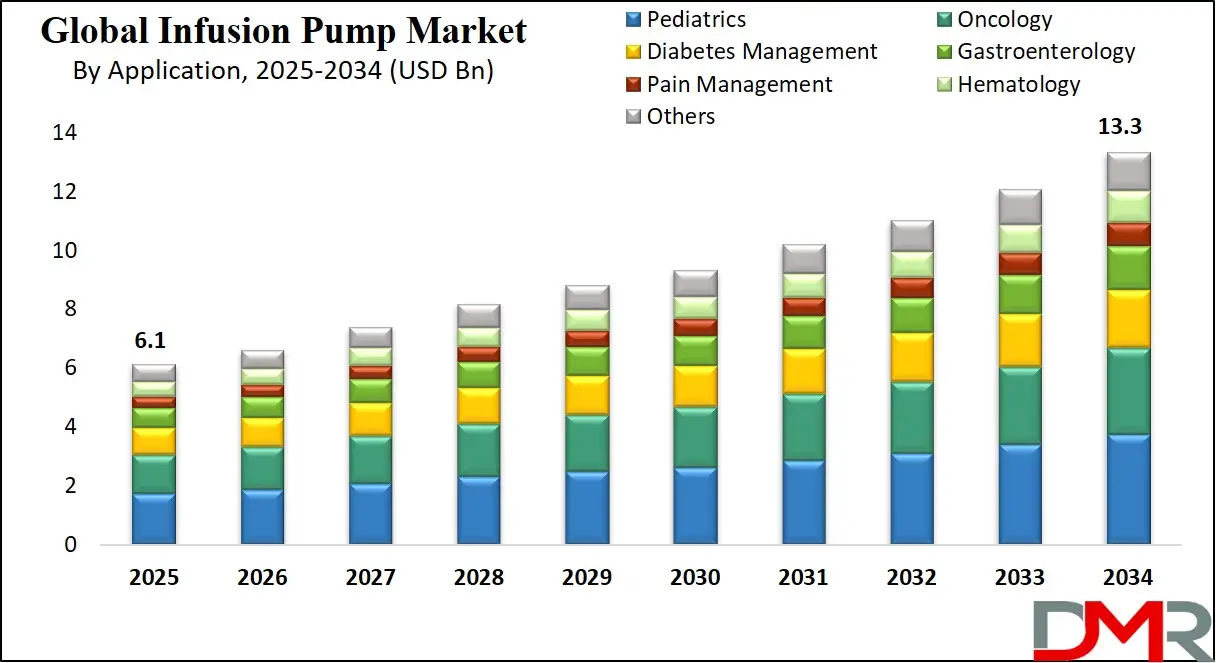

The Global Infusion Pump Market is expected to reach a value of USD 6.1 billion in 2025, and it is further anticipated to reach a market value of USD 13.3 billion by 2034 at a CAGR of 9.0%.

The global infusion pump market encompasses the economic activities associated with the production, distribution, and utilization of infusion pump devices and accessories worldwide. These medical devices, designed for controlled and precise fluid delivery into a patient's body, play a vital role across diverse healthcare settings. The market comprises various types of infusion pumps, including volumetric, insulin, enteral, ambulatory, and implantable pumps, addressing a spectrum of medical conditions.

Factors influencing market dynamics include technological advancements, the prevalence of chronic diseases, a growing emphasis on home care, and regulatory developments. Market participants, including manufacturers, suppliers, and healthcare institutions, contribute to the research, development, production, and distribution of infusion pump technologies. The global infusion pump market is dynamic and responsive to evolving healthcare trends and technological innovations.

The infusion pump industry is shaped by dynamic factors that influence market demand, supply, and overall trends. Ongoing technological advancements, including smart pumps and enhanced connectivity, drive market growth by improving safety and accuracy.

The increasing prevalence of chronic diseases, coupled with a growing aging population, contributes to the demand for infusion pumps, particularly for long-term treatments. The shift towards home healthcare and ambulatory care, accelerated by the COVID-19 pandemic, underscores the development of portable and user-friendly infusion pump solutions.

Stringent regulatory standards, healthcare expenditure levels, market consolidation through mergers, and patient preferences for home-based care also impact market dynamics. Supply chain disruptions, reimbursement policies, and the rising awareness of environmental sustainability further shape the industry landscape.

Successful adaptation to these dynamic factors is essential for businesses in the infusion pump market to navigate challenges, identify opportunities, and remain competitive in the evolving healthcare environment. Continuous monitoring of these market dynamics allows stakeholders to adjust strategies and innovate in response to emerging trends.

The US Infusion Pump Market

The US Infusion Pump Market is projected to reach USD 2.6 billion in 2025 at a compound annual growth rate of 8.5% over its forecast period.

The U.S. infusion pump market is shaped by its robust healthcare infrastructure, rising geriatric population, and high prevalence of chronic diseases. According to the U.S. Census Bureau, the population aged 65 and older is expected to grow significantly, making up over 20% of the total population by 2050. This demographic shift is a key driver for long-term care solutions, where infusion therapy is widely used.

Chronic conditions are a major concern. The Centers for Disease Control and Prevention (CDC) reports that 6 in 10 U.S. adults live with at least one chronic disease, and 4 in 10 have two or more. Diseases like cancer, diabetes, and heart failure frequently require precise drug delivery, which is efficiently managed through infusion pumps. This demand extends from hospitals to home care settings.

Medicare and Medicaid programs under the U.S. Department of Health and Human Services support infusion therapies through various reimbursement models, making them accessible to aging and low-income populations. The Veterans Health Administration also integrates infusion therapy in both inpatient and home-based care models.

With a push for digital health, the Centers for Medicare & Medicaid Services (CMS) has encouraged adoption of smart infusion systems that feature real-time monitoring and alarm capabilities. The U.S. Food and Drug Administration (FDA) also actively monitors and approves infusion technologies to ensure patient safety and innovation. Combined with a mature healthcare delivery system and government support, the infusion pump sector continues to expand in functionality and reach across clinical and non-clinical settings.

The Europe Infusion Pump Market

The Europe Infusion Pump Market is estimated to be valued at USD 915.0 million in 2025 and is further anticipated to reach USD 1,830.0 million by 2034 at a CAGR of 8.0%.

The infusion pump market across Europe is strongly influenced by a rapidly aging population, universal healthcare systems, and increasing chronic disease rates. Eurostat data reveals that over 21% of the EU’s population was aged 65 or older in 2023, with this figure projected to rise sharply in the coming decades. This demographic shift is prompting an expansion in long-term care and hospitalization, where infusion therapies are essential.

The European Centre for Disease Prevention and Control (ECDC) highlights a significant burden of non-communicable diseases, including cardiovascular illnesses, cancers, and diabetes. These conditions often require prolonged or continuous medication via infusion, making such devices indispensable in clinical settings.

Government initiatives like the EU4Health program are aimed at strengthening healthcare system resilience, including medical device access and digital transformation. These initiatives support the procurement and use of advanced drug-delivery devices such as infusion pumps in both public hospitals and community health centers.

The European Medicines Agency (EMA) ensures regulatory compliance for infusion systems across EU member states, fostering trust in their safety and reliability. Reimbursement schemes from public healthcare systems, including Germany’s GKV, France’s CNAM, and the UK’s NHS, help make infusion therapies accessible across socioeconomic groups.

In addition, many countries are promoting out-of-hospital care to reduce strain on inpatient services. This includes funding for home infusion services, enabling the use of portable and smart infusion pumps. Government-backed health modernization, a high share of elderly citizens, and a strong regulatory framework together create fertile ground for the continued adoption of infusion technologies.

The Japan Infusion Pump Market

The Japan Infusion Pump Market is projected to be valued at USD 366.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 708.0 million in 2034 at a CAGR of 7.6%.

Japan’s infusion pump market is largely driven by the country’s unique demographic profile, high standards in healthcare, and strong governmental focus on medical innovation. The Statistics Bureau of Japan states that nearly 29% of the population is aged 65 or older, making Japan the most aged society globally. This fuels demand for chronic disease treatment and post-acute care, both of which often require infusion therapy for medication and nutrition management.

The Ministry of Health, Labour and Welfare (MHLW) plays a central role in shaping the healthcare landscape. Through policy initiatives, funding, and reimbursement systems, the government supports the widespread use of infusion pumps in hospitals, elder care homes, and home-based medical setups.

Infusion therapy is essential for patients undergoing chemotherapy, diabetes treatment, and pain management. These conditions are increasingly prevalent in aging populations, where oral drug administration may not always be feasible. The Pharmaceuticals and Medical Devices Agency (PMDA) ensures that devices entering the market meet stringent safety and efficacy standards, which drives consistent innovation in infusion pump design and function.

Japan’s move toward digitized, community-based healthcare under the “Comprehensive Community Care System” supports remote and home treatment. Infusion pumps, particularly compact, wearable models, are being deployed more frequently for in-home care. Furthermore, the national “Society 5.0” initiative promotes the integration of IoT and robotics into healthcare, opening doors to smart infusion systems with remote monitoring capabilities. These government-led efforts, coupled with Japan’s demographic profile and innovation culture, create strong momentum for infusion pump adoption.

Global Infusion Pump Market: Key Takeaways

- Global Market Size Insights: The Global Infusion Pump Market size is estimated to have a value of USD 6.1 billion in 2025 and is expected to reach USD 13.3 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 9.0 percent over the forecasted period.

- The US Market Size Insights: The US Infusion Pump Market is projected to be valued at USD 2.6 billion in 2025. It is expected to experience subsequent growth in the upcoming period, reaching USD 5.4 billion by 2034 at a CAGR of 8.5%.

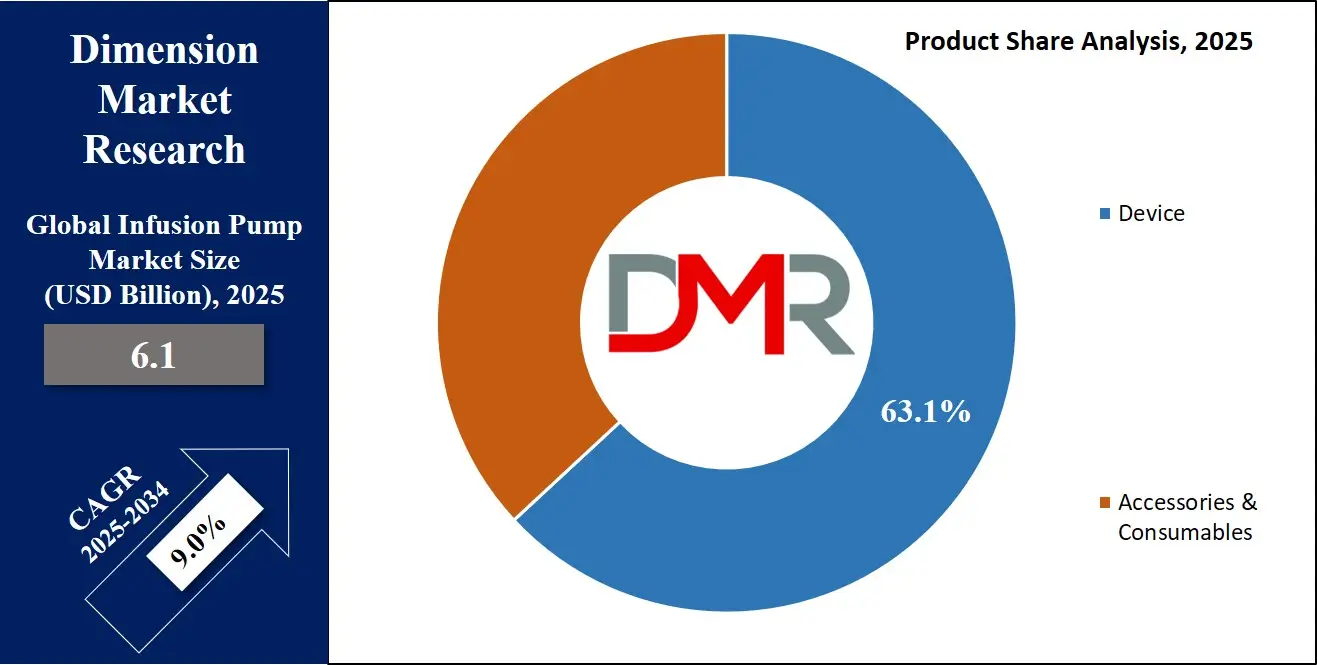

- Product Segment Insights: In the context of the product, devices are poised to dominate this segment as they hold 63.1% of the market share in 2025.

- Application Segment Insights: Based on application, pediatrics is anticipated to dominate this segment as it holds 28.0% of the market share in 2025.

- End User Segment Insights: Hospitals are poised to stand as the predominant end-users in the infusion pump market, driven by their critical patient care infrastructure in 2025.

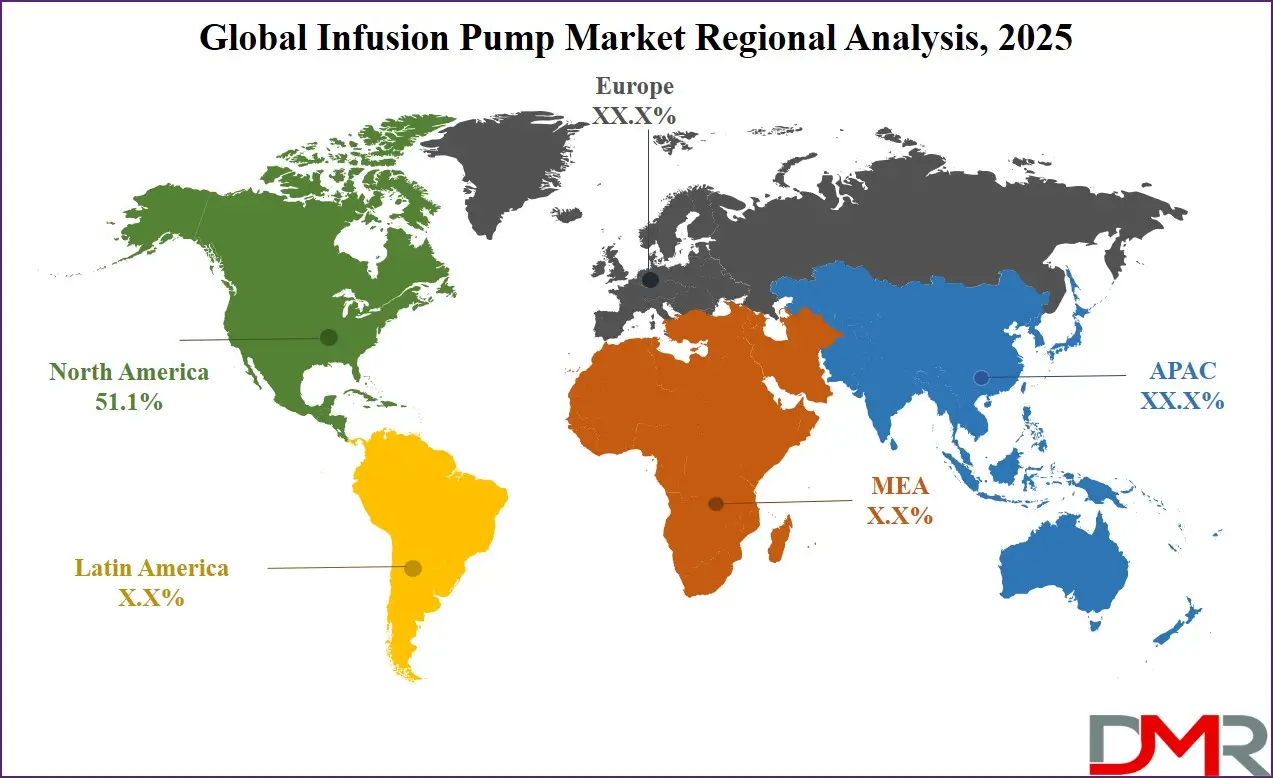

- Regional Insights: North America has the largest market share for the Global Infusion Pump Market, with a share of about 51.1% in 2025.

- Key Players: Some of the major key players in the Global Infusion Pump Market are Abbott, Medtronic, Boston Scientific Corporation, Terumo Corporation, and many others.

Global Infusion Pump Market: Use Cases

- Chemotherapy Drug Delivery: Infusion pumps administer chemotherapy drugs with precision over extended periods, reducing toxicity risks and ensuring steady therapeutic levels. They enable treatment in hospital and ambulatory settings, improving patient comfort and lowering hospital stays.

- Diabetes Insulin Administration: Insulin pumps offer continuous subcutaneous insulin infusion, ideal for Type 1 diabetic patients. These programmable devices improve glycemic control, reduce hypoglycemia incidents, and are increasingly used among pediatric and elderly patients.

- Post-Surgical Pain Management: Patient-Controlled Analgesia (PCA) pumps deliver controlled pain relief after surgery. They allow patients to manage discomfort effectively without overdose risk, contributing to faster recovery and reduced nursing workload.

- Parenteral Nutrition in ICU Settings: Critically ill patients receive total parenteral nutrition (TPN) through infusion pumps. These devices ensure the accurate and safe administration of nutrients, vitamins, and electrolytes in intensive care settings, aiding metabolic balance.

- Antibiotic Delivery in Homecare: Infusion pumps support outpatient antibiotic therapy, allowing patients to receive IV antibiotics at home. This model lowers hospital costs, reduces infection risks, and is ideal for long-term treatments like osteomyelitis or endocarditis.

Global Infusion Pump Market: Stats & Facts

Centers for Disease Control and Prevention (CDC) – USA

- 6 in 10 U.S. adults live with at least one chronic disease.

- 4 in 10 adults in the U.S. have two or more chronic diseases.

- Over 37 million Americans have diabetes, a key condition requiring insulin infusion.

- Hospital-acquired infections occur in 1 in 31 hospital patients daily; infusion equipment safety plays a role in prevention.

U.S. Census Bureau

- By 2030, all baby boomers will be age 65 or older in the U.S.

- The 65+ population will exceed 82 million by 2050.

- Adults over 65 will comprise more than 20% of the U.S. population by 2040.

Centers for Medicare & Medicaid Services (CMS)

- Medicare covers home infusion therapy services under the Medicare Part B benefit.

- Reimbursement is available for professional services, including pump set-up and monitoring.

- CMS supports telehealth integration in infusion therapy for home-based patients.

U.S. Food and Drug Administration (FDA)

- The FDA has issued over 90 recalls related to infusion pumps since 2015 due to performance and safety issues.

- Infusion pumps are considered Class II or Class III medical devices depending on risk.

- The FDA launched a Total Product Life Cycle (TPLC) program to monitor infusion pump performance over time.

Eurostat (European Union)

- In 2023, 21.3% of the EU population was aged 65 or older.

- Italy and Germany had the highest proportions of elderly citizens in the EU.

- The EU population aged 80+ is projected to double between 2020 and 2050.

European Centre for Disease Prevention and Control (ECDC)

- Chronic diseases account for over 85% of all deaths in the EU.

- Diabetes, cardiovascular disease, and cancer are the top causes of long-term hospitalization.

- Multidrug-resistant infections are increasing, requiring long-term IV antibiotic use supported by infusion pumps.

European Medicines Agency (EMA)

- EMA regulates infusion pumps as medical devices under the EU Medical Device Regulation (MDR) 2017/745.

- Devices used in infusion therapy must meet essential performance and clinical safety criteria before CE marking.

Statistics Bureau of Japan

- As of 2024, 29% of Japan’s population is aged 65 and over.

- The number of people aged 75+ exceeds 19 million.

- Japan’s aging rate is the highest in the world and continues to increase.

Ministry of Health, Labour and Welfare (Japan)

- Over 70% of hospital beds in Japan are used for patients aged 65+.

- The government promotes home medical care, increasing infusion pump use outside hospitals.

- Chronic diseases like diabetes and cancer account for the majority of hospital admissions.

Pharmaceuticals and Medical Devices Agency (PMDA, Japan)

- All infusion pumps must undergo Good Manufacturing Practice (GMP) evaluation prior to market entry.

- Japan has introduced safety checklists for infusion systems to reduce adverse drug events.

World Health Organization (WHO)

- Non-communicable diseases (NCDs) account for 74% of global deaths each year.

- 422 million people worldwide have diabetes, a leading condition requiring infusion-based insulin delivery.

- Cancer caused nearly 10 million deaths globally in 2020, many of which required infusion-based chemotherapy.

NHS Digital (United Kingdom)

- The UK’s NHS performs over 1.5 million infusion procedures annually across hospitals.

- The NHS supports community-based infusion therapy, especially for oncology and palliative care.

Australian Institute of Health and Welfare (AIHW)

- Around 47% of Australians have one or more chronic conditions.

- Diabetes affects 1 in 20 Australians, with many requiring insulin pumps.

- The country has seen an increase in home-based infusion therapy services, particularly for cancer and infections.

World Bank

- Global life expectancy has risen to over 73 years, increasing demand for age-related medical care.

- Global healthcare expenditure accounts for over 9.8% of world GDP, including drug delivery technologies like infusion pumps.

Global Infusion Pump Market: Market Dynamics

Driving Factors in the Global Infusion Pump Market

Rising Global Burden of Chronic Diseases

The escalating global burden of chronic diseases is a primary driver for the growth of the infusion pump market. Conditions such as diabetes, cancer, cardiovascular disorders, and autoimmune diseases require long-term and often continuous medication regimens frequently administered via infusion devices.

According to the World Health Organization (WHO), non-communicable diseases account for approximately 74% of all global deaths, highlighting the urgent need for sustained therapy and precise drug administration. For instance, Type 1 diabetes patients rely on insulin pumps for glucose control, while cancer patients benefit from programmable infusion systems for chemotherapy delivery.

Infusion therapy is also a preferred route for patients who cannot take medications orally due to gastrointestinal complications or unconsciousness. The aging global population exacerbates this demand, as elderly individuals are more likely to suffer from multiple chronic conditions that necessitate long-term infusion care.

Expansion of Home Healthcare Infrastructure

The rapid expansion of home healthcare infrastructure is significantly boosting the infusion pump market. Driven by rising healthcare costs, technological advances, and patient preferences for home-based recovery, infusion therapy is increasingly being administered outside traditional clinical settings. Governments and insurers are recognizing the cost-effectiveness and improved patient satisfaction associated with home care, especially for chronic conditions like infections, diabetes, and cancer.

Home infusion therapy enables patients to receive antibiotics, pain medications, or nutritional support with minimal disruption to daily life. This has led to growing investment in portable and wearable infusion pumps designed specifically for home environments, offering user-friendly controls, safety features, and wireless monitoring.

Regulatory bodies such as CMS (Centers for Medicare & Medicaid Services) in the U.S. have implemented reimbursement policies that cover professional services linked to home infusion, further accelerating market adoption. Additionally, advancements in remote monitoring technologies and telehealth platforms allow clinicians to track patient progress, troubleshoot complications, and adjust dosages remotely.

Restraints in the Global Infusion Pump Market

Safety Concerns and Product Recalls

Despite technological advancements, infusion pumps are subject to safety concerns and frequent product recalls, which pose a major restraint on market growth. These devices are responsible for administering critical and sometimes life-threatening medications, making accuracy and reliability essential. However, device malfunctions, software errors, alarm failures, and user interface complications have led to adverse drug events and even fatalities.

The U.S. Food and Drug Administration (FDA) has identified infusion pumps as one of the most error-prone categories of medical devices, initiating multiple recalls and safety alerts in the past decade. Recalls not only disrupt supply chains but also diminish clinician confidence and increase liability for manufacturers. Regulatory scrutiny has intensified, requiring companies to invest heavily in safety features, post-market surveillance, and compliance documentation. This can delay product launches and inflate development costs.

High Cost of Advanced Infusion Systems

The cost of purchasing, maintaining, and operating advanced infusion pumps remains a significant barrier, especially in low- and middle-income healthcare systems. Smart infusion devices embedded with sensors, wireless connectivity, and data management features offer improved functionality but come at a much higher price point compared to traditional models. In addition to acquisition costs, hospitals incur expenses for software licenses, maintenance, calibration, and staff training. These costs often exceed the budgets of public healthcare institutions, particularly in emerging economies or rural healthcare settings.

Furthermore, patients in homecare environments may be unable to afford personal infusion equipment, limiting market penetration outside of high-income brackets. Reimbursement gaps also persist in many regions, where insurance policies do not fully cover device costs or associated services. In highly cost-sensitive environments, clinicians may opt for manual or semi-automated infusion methods despite the added risk, reducing overall adoption of modern technologies.

Opportunities in the Global Infusion Pump Market

Emerging Markets and Healthcare Infrastructure Development

Emerging economies across Asia-Pacific, Latin America, and Africa present untapped growth opportunities for the infusion pump market, driven by expanding healthcare infrastructure and rising disease prevalence. Governments in countries like India, Brazil, and Indonesia are investing heavily in hospital development, medical technology adoption, and universal healthcare coverage. As chronic diseases like diabetes, cancer, and cardiovascular ailments rise in these regions due to urbanization and changing lifestyles, the need for cost-effective and reliable drug delivery systems becomes more pronounced.

Infusion pumps, especially syringe and volumetric models, are being introduced to standardize medication administration in both public and private healthcare facilities. International collaborations and global health partnerships are facilitating the introduction of medical devices into underserved areas through subsidies and capacity-building initiatives. Additionally, the World Bank and WHO support infrastructure investments that include infusion therapy capabilities in rural and urban hospitals.

Technological Advancements in Wearable and Implantable Infusion Devices

Technological innovation is opening new avenues for growth in the infusion pump industry, particularly in the development of wearable and implantable drug delivery systems. These next-generation devices offer personalized therapy, greater mobility, and reduced dependence on clinical settings. Wearable infusion pumps are designed for continuous subcutaneous infusion and are increasingly used in insulin delivery, chemotherapy, and pain management.

These devices enhance patient compliance and comfort by allowing discreet, around-the-clock treatment without hospitalization. Innovations such as programmable dose delivery, Bluetooth connectivity, and integration with mobile health apps enable real-time monitoring and user control. Implantable infusion pumps, on the other hand, are used in long-term treatment of conditions such as chronic pain and spasticity, delivering medication directly to targeted sites within the body. These devices offer reduced systemic side effects and increased therapeutic efficacy.

Trends in the Global Infusion Pump Market

Shift Toward Ambulatory and Home-Based Infusion Therapy

The infusion pump market is witnessing a significant shift from inpatient hospital care to ambulatory and home-based care settings. This transition is driven by a combination of patient preferences, technological advancements, and cost-efficiency goals within healthcare systems. Ambulatory infusion pumps are compact, battery-operated devices that allow patients to receive continuous drug therapy without hospitalization, enhancing quality of life and reducing healthcare costs. Rising demand for home healthcare services, particularly among the elderly and chronically ill populations, further fuels this trend.

Healthcare providers and insurers now favor models that decrease hospital readmissions while ensuring treatment continuity. Moreover, regulations and reimbursement frameworks in markets such as the U.S. and Europe are evolving to support outpatient infusion services. Integration of real-time monitoring, remote programming, and dose tracking into infusion pumps has made them safer and more viable for home use.

Integration of Smart Technology and Interoperability Features

One of the most transformative trends in the infusion pump industry is the integration of smart technology, including wireless connectivity, AI algorithms, and interoperability with electronic health records (EHRs). Modern infusion pumps now feature embedded sensors, touch interfaces, barcode readers, and safety algorithms that prevent medication errors through dose verification and alarm systems. These smart pumps enable clinicians to remotely monitor infusion status, adjust dosages, and receive alerts for occlusions or empty reservoirs. This level of automation reduces human error, increases operational efficiency, and improves patient safety, particularly in critical care units.

Moreover, infusion systems integrated with hospital EHR platforms ensure seamless data capture, real-time dosage documentation, and compliance with medication administration records. Regulatory agencies like the FDA have encouraged infusion pump interoperability as a key component of the "Total Product Life Cycle" approach to medical device safety. Additionally, AI-powered infusion pumps are being trialed to personalize drug delivery based on biometric inputs like glucose levels or patient movement. This innovation supports precision medicine and adaptive therapy models.

Research Scope and Analysis

By Product Analysis

In the context of the product, devices are projected to dominate this segment as they hold 63.1% of the market share in 2025 and are expected to show significant growth in the forthcoming period of 2025 to 2034. The dominance of specific products within the infusion pump market is influenced by their efficacy in addressing distinct medical requirements, technological advancements, and adaptability to diverse healthcare settings.

Volumetric infusion pumps excel in controlled dosage administration, particularly in critical care scenarios. Insulin pumps lead to diabetes management, providing continuous subcutaneous insulin infusion for better glycemic control. Enteral infusion pumps are essential for nutritional support, while ambulatory pumps offer mobility during infusion therapy. Implantable pumps cater to long-term therapy needs, such as chronic pain management.

Traditional infusion pumps, known for their reliability, are widely adopted, while specialty pumps cater to advanced therapies. Stationary pumps find prominence in hospitals, while portable pumps respond to the trend of home healthcare. In the accessories and consumables category, dedicated products ensure compatibility, while non-dedicated ones offer versatility across devices. Essential components like infusion catheters and IV administration sets prevent contamination, emphasizing patient safety and maintaining infusion integrity. Overall, the market's evolution is marked by innovations that enhance patient care, user experience, and the range of treatable conditions using infusion pump technology.

By Application Analysis

Based on application, pediatrics is poised to dominate this segment as it holds 28.0% of the market share in 2025 and is projected to show significant growth in the upcoming period of 2025 to 2034. The dominance of pediatrics in the infusion pump market is rooted in the critical role these devices play in addressing the unique healthcare needs of infants and children. Infusion pumps are vital for ensuring precise medication delivery in pediatric patients, considering their smaller body sizes and distinct physiological characteristics.

Their versatility allows for the administration of medications, fluids, nutrients, and blood products, making them indispensable in various pediatric care settings, including neonatal intensive care units (NICUs) and pediatric oncology units. In NICUs, infusion pumps contribute significantly to the care of premature and critically ill infants by ensuring accurate delivery of fluids and medications. The pumps also play a crucial role in managing chronic conditions in pediatrics, such as cystic fibrosis and diabetes, where continuous or periodic medication administration is required.

Additionally, infusion pumps contribute to reducing pain and discomfort for pediatric patients, particularly in cases of repeated or prolonged medication administration. The growing trend towards home healthcare for pediatric patients is facilitated by infusion pumps, allowing for comfortable treatment in a home environment under the supervision of healthcare professionals or caregivers.

Advancements in pediatric-specific infusion pump designs, featuring adjustable flow rates and user-friendly interfaces, further emphasize the commitment to meeting the unique needs of pediatric populations. The supportive regulatory environment ensures that these devices meet stringent safety and efficacy standards for pediatric use. Overall, the prominence of pediatrics in the infusion pump market underscores the vital role these devices play in delivering safe and effective care tailored to the specific requirements of infants and children.

By End User Analysis

Hospitals are expected to remain the leading end-users in the infusion pump market due to their advanced infrastructure, specialized departments, and the need for high-precision medication administration in complex clinical scenarios. Infusion pumps are vital tools in critical care environments such as intensive care units (ICUs), surgical wards, and emergency rooms where continuous, controlled delivery of fluids and drugs is essential for patient survival and recovery. Hospitals deal with a wide range of medical conditions, ranging from chronic illnesses to acute emergencies, and the adaptability of infusion pumps makes them indispensable for addressing this diverse spectrum of care.

Moreover, hospitals benefit from skilled medical professionals, including nurses, anesthesiologists, and pharmacists who are thoroughly trained in the safe operation and calibration of infusion devices. These institutions also maintain strict protocols and adhere to regulatory standards, ensuring the secure and error-free use of such technology. Departments such as oncology, cardiology, neonatal, and perioperative care rely on infusion pumps for chemotherapy, pain management, total parenteral nutrition, and fluid resuscitation, further highlighting their critical role.

Integrated electronic health record (EHR) systems in hospitals facilitate smart infusion systems that enhance accuracy, automate documentation, and reduce human errors. In contrast, while home healthcare and ambulatory care centers are growing markets, they often lack the infrastructure for managing high-acuity patients or those with unpredictable infusion needs. Hospitals' ability to manage both chronic and critical conditions under one roof, with access to continuous monitoring and multidisciplinary expertise, solidifies their dominant position in the global infusion pump market.

The Infusion Pump Market Report is segmented on the basis of the following:

By Product

- Device

- By Product

- Volumetric Infusion Pumps

- Insulin Pumps

- Enteral Infusion Pumps

- Ambulatory Infusion Pumps

- Implantable Infusion Pumps

- By Technology

- Traditional Infusion Pumps

- Specialty Infusion Pumps

- By Type

- Stationary Infusion Pumps

- Portable Infusion Pumps

- Accessories & Consumables

- Dedicated Accessories & Consumables

- Volumetric Infusion Pumps

- Insulin Pumps

- Enteral Infusion Pumps

- Syringes, Infusion Pumps

- Ambulatory Infusion Pumps

- Implantable Infusion Pumps

- Non-Dedicated Accessories & Consumables

- Infusion Catheters

- IV Administration Sets

- Needleless Connector

- Cannulas

- Tubing & Extension Sets

- Others

By Application

- Pediatrics

- Oncology

- Diabetes Management

- Gastroenterology

- Pain Management

- Hematology

- Others

By End User

- Hospital

- Home Care Settings

- Ambulatory Care Institutes

- Academic & Research Institutes

Impact of Artificial Intelligence in the Global Infusion Pump Market

-

Enhanced Drug Delivery Precision: Artificial Intelligence (AI) plays a vital role in improving the accuracy of drug delivery by analyzing real-time patient data to automatically adjust infusion parameters. AI-powered infusion pumps minimize human errors by continuously monitoring vital signs and recalibrating dosages in response to changing physiological conditions, thereby reducing the risk of overdose or underdose.

- Predictive Maintenance and Downtime Reduction: AI algorithms help predict maintenance needs by identifying early signs of mechanical or software failure in infusion pumps. This predictive maintenance capability reduces unplanned downtime, ensuring continuous therapy for patients and improving equipment lifecycle management in hospital settings.

- Smart Alarm Management: AI enhances alarm management by filtering non-critical alerts and prioritizing life-threatening issues. Traditional pumps often trigger alarm fatigue due to frequent false or low-priority alerts. AI enables context-aware alarm systems that intelligently evaluate clinical relevance, significantly reducing noise, improving clinician response time, and enhancing patient safety in high-acuity environments.

- Workflow Optimization in Clinical Settings: AI integration streamlines workflows by automating routine tasks such as dosage calculations, infusion scheduling, and data entry into Electronic Health Records (EHRs). This reduces manual workload, minimizes clerical errors, and allows nurses and clinicians to focus more on direct patient care.

- Remote Monitoring and Telehealth Integration: AI enables real-time remote monitoring of infusion therapy, supporting telehealth models and home-based care. Smart infusion pumps integrated with AI can transmit usage data, adherence patterns, and patient vitals to clinicians via secure cloud platforms.

- Clinical Decision Support: AI-powered infusion pumps offer clinical decision support by providing evidence-based recommendations tailored to the patient's medical history, lab results, and co-morbidities. These intelligent systems guide healthcare professionals in selecting optimal drug combinations, infusion rates, and treatment durations, enhancing clinical accuracy and improving patient outcomes, especially in critical care and oncology.

Global Infusion Pump Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global infusion pump market as it holds 51.1% market share in 2025 and is expected to show subsequent growth in the upcoming period of 2025 to 2034. This dominance can be attributed to a combination of factors. The region benefits from advanced healthcare infrastructure, marked by modern facilities and a robust network of healthcare professionals. High healthcare expenditure, consistently allocating a substantial portion of GDP to healthcare, enables significant investments in advanced medical technologies, including infusion pumps.

North America's position as a hub for technological advancements and medical device innovation, along with a stringent regulatory framework ensuring product safety and efficacy, further enhances its market leadership. The region's elevated incidence of chronic diseases and a growing aging population contribute to the sustained demand for infusion pumps in various healthcare settings.

Market competition, consolidation through mergers and acquisitions, and a proactive approach to home infusion therapy have collectively reinforced North America's strong presence. However, other regions are also experiencing notable growth in the infusion pump market, driven by increasing healthcare infrastructure development and growing awareness of advanced medical technologies.

Region with the Highest CAGR

Asia Pacific is poised to exhibit the highest CAGR in the global infusion pump market due to a convergence of demographic, economic, and healthcare infrastructure shifts. A rapidly aging population, especially in countries like Japan, South Korea, and China, has significantly increased the demand for chronic disease management, cancer care, and long-term treatment protocols, key areas where infusion pumps are indispensable. The rising incidence of diabetes, cardiovascular conditions, and other lifestyle-related diseases further fuels the adoption of infusion technologies across clinical and homecare settings.

Government-backed healthcare reforms and substantial investments in public health infrastructure are also pivotal. Countries such as India and China have significantly scaled up access to healthcare through initiatives like Ayushman Bharat and Healthy China 2030, respectively. These policies emphasize improving patient care quality and expanding access to advanced medical equipment, including infusion devices.

Moreover, the region is witnessing a rise in medical tourism and private healthcare investments, prompting hospitals and clinics to modernize with smart and AI-integrated infusion pumps. Local manufacturing initiatives under schemes like "Make in India" and favorable regulatory reforms have also reduced costs and boosted adoption. Collectively, these factors position Asia Pacific as the fastest-growing market for infusion pumps during the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global infusion pump market exhibits a competitive and innovation-driven landscape, with prominent players actively shaping the industry's trajectory. Major companies such as Medtronic plc, Baxter International Inc., B. Braun Melsungen AG, Fresenius Kabi AG, Smiths Medical, Terumo Corporation, Pfizer Inc. (via Hospira), ICU Medical, Inc., Johnson & Johnson, and Caesarea Medical Electronics (CME) play critical roles in delivering technologically advanced infusion pump systems.

These firms offer an extensive portfolio of solutions designed for various clinical applications such as intravenous drug delivery, epidural anesthesia, enteral feeding, and insulin administration for diabetes care. The competitive landscape is continuously reshaped by strategic mergers and acquisitions, new product introductions, and technological advancements, especially those integrating smart features and connectivity.

Additionally, regulatory updates, growing demand for home healthcare, and rising global health expenditures are key influencers of market behavior. Innovation in miniaturized and wearable devices and the push towards automation and remote monitoring have intensified R&D efforts across major players. These companies also engage in regional expansions, partnerships, and participation in global medical expos to maintain a competitive edge. Given the pace of transformation, stakeholders must closely monitor developments to leverage opportunities and respond to industry shifts effectively.

Some of the prominent players in the Global Infusion Pump Market are

- Becton, Dickinson and Company (BD)

- Baxter International Inc.

- Fresenius Kabi AG

- Medtronic plc

- Smiths Medical (ICU Medical)

- ICU Medical, Inc.

- Roche Diagnostics

- Terumo Corporation

- Nipro Corporation

- Mindray Medical International Limited

- Moog Inc.

- Hospira, Inc. (Pfizer Inc.)

- Ypsomed Holding AG

- B. Braun Melsungen AG

- Tandem Diabetes Care, Inc.

- Insulet Corporation

- Zyno Medical LLC

- JMS Co., Ltd.

- Trivitron Healthcare

- Codan Medical

- Other Key Players

Recent Developments

July 2025

- B. Braun expanded its infusion therapy production in Malaysia, aiming to cater to rising Asia-Pacific demand, particularly in hospitals seeking reliable, high-volume delivery systems with advanced safety features to support regional healthcare infrastructure growth.

- ICU Medical showcased next-gen infusion pump software upgrades during a closed-door demo with U.S. hospital systems, focusing on interoperability, smart alarms, and real-time monitoring to reduce medication errors and enhance clinical workflow efficiencies.

June 2025

- Fresenius Kabi partnered with an AI diagnostics firm to improve infusion pump alert accuracy, aiming to create intelligent systems that reduce false alarms and optimize fluid administration precision through machine learning algorithms.

- Medtronic hosted a workshop in Tokyo emphasizing AI-integrated pain management infusion systems, highlighting automated dose titration and patient-specific treatment algorithms to drive precision in chronic pain therapy delivery.

May 2025

- Terumo Corporation launched an R&D lab in Singapore to innovate smart infusion pump systems, focusing on miniaturization, data integration, and enhanced battery performance, targeting home care and outpatient settings across Southeast Asia.

- Mindray Medical signed distribution agreements with 12 partners in Latin America, expanding market access for its infusion systems and aligning with its global strategy to penetrate emerging markets through local partnerships and training support.

April 2025

- Baxter International participated in HIMSS 2025, presenting infusion systems integrated with electronic medical records to support closed-loop medication delivery, reduce manual entry errors, and streamline clinical decision-making in real-time.

- Roche Diagnostics revealed investments in smart infusion systems for pediatric and oncology applications in developing regions, aiming to provide affordable, data-driven solutions that ensure accurate, low-volume dosing and real-time monitoring.

March 2025

- Smiths Medical partnered with Samsung Medison to co-develop infusion pumps compatible with diagnostic imaging systems, targeting smoother integration in surgical suites and improved visual feedback for fluid management during complex procedures.

- BD (Becton, Dickinson and Company) began pilot trials of real-time infusion pump monitoring in European hospitals, aiming to enhance clinical visibility, reduce downtime, and support predictive maintenance through remote analytics.

February 2025

- Ivenix finalized its merger with Fresenius Kabi, announcing the co-development of closed-loop infusion control systems designed to automate drug delivery using real-time patient data to improve accuracy and therapy response times.

- Q Core Medical launched a lightweight ambulatory infusion pump tailored for oncology and post-op care, focusing on mobility, discreet operation, and patient comfort in extended care scenarios outside traditional hospital environments.

January 2025

- Philips Healthcare unveiled smart infusion interface modules at CES 2025, demonstrating connectivity between infusion systems and broader hospital tech ecosystems to enable real-time data flow, predictive analytics, and therapy optimization.

- Eitan Medical secured major funding to accelerate its Sorrel wearable infusion pump development, targeting chronic conditions like multiple sclerosis and rheumatoid arthritis by offering discreet, user-friendly drug delivery with Bluetooth-enabled patient monitoring.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 6.1 Bn

|

| Forecast Value (2034) |

USD 13.3 Bn

|

| CAGR (2025–2034) |

9.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

2.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Device and Accessories & Consumables), By Application (Pediatrics, Oncology, Diabetes Management, Gastroenterology, Pain Management, Hematology, and Others), By End User (Hospital, Home Care Settings, Ambulatory Care Institutes and Academic & Research Institutes) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Tandem Diabetes Care Inc., Smith Medical, Terumo Corporation, Becton Dickinson and Company, Fresenius SE & Co. KGaA, F. Hoffmann-La Roche Ltd., B. Braun Holding GmbH & Co. KG, Baxter International Inc., Medtronic, ICU Medical, Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Infusion Pump Market size is estimated to have a value of USD 6.1 billion in 2023 and is expected to reach USD 13.3 billion by the end of 2032.

North America has the largest market share for the Global Infusion Pump Market with a share of about 51.1% in 2023.

Some of the major key players in the Global Infusion Pump Market are Abbott, Medtronic, Boston Scientific Corporation, Terumo Corporation, and many others.

The market is growing at a CAGR of 9.0 percent over the forecasted period.