Market Overview

The Global Injection Molded Plastic Market is expected to achieve a valuation of USD 345.8 billion in 2024, & 494.5 billion by 2033. This market is poised to sustain a CAGR of 4.1% for the forecast period (2024-2033).

The Global Injection Molded Plastic Market consists of the process linked with injecting molten material into a mold, which solidifies to become the final product after melting & cooling. It is used for numerous plastic products in different industries.

Thermosetting and thermoplastic injection molded plastics are used for the production of different parts & components. The most renowned thermoplastic polymers are low-density polyethylene, & polypropylene, high-density polyethylene, polycarbonate, and PVC.

Other instances of this type include the styrene polystyrene fluorine as well as glycolite, Polyurethane, & Polysulfone. Important contributors to the injection-molding segment for thermosetting polymers include polyester, epoxy resin & melamine formaldehyde.

Escalating construction investments, notably in developing economies such as India, China, Russia, Brazil, Mexico, & South Africa, are anticipated to stimulate the requirement for these products. The easily adaptable features of the final goods, consisting of heightened heat & pressure resilience, make them increasingly apt for diverse sectors.

The growth of the U.S. injection molded plastics market is anticipated to be propelled by rising demand in the automotive, medical, and building & construction sectors. Additionally, the increasing adoption of electronic appliances such as refrigerators, washing machines, and microwave ovens is expected to further drive market expansion in North America during the forecast period.

In the U.S., the segment dominated with an impressive 81.7% volume share of the total injection molded plastics market demand, highlighting its significance across diverse applications.

Key Takeaways

- Market Size & Growth: The global injection molded plastic market is projected to reach USD 345.8 billion in 2024 and USD 494.5 billion by 2033, growing at a CAGR of 4.1% during the forecast period (2024–2033).

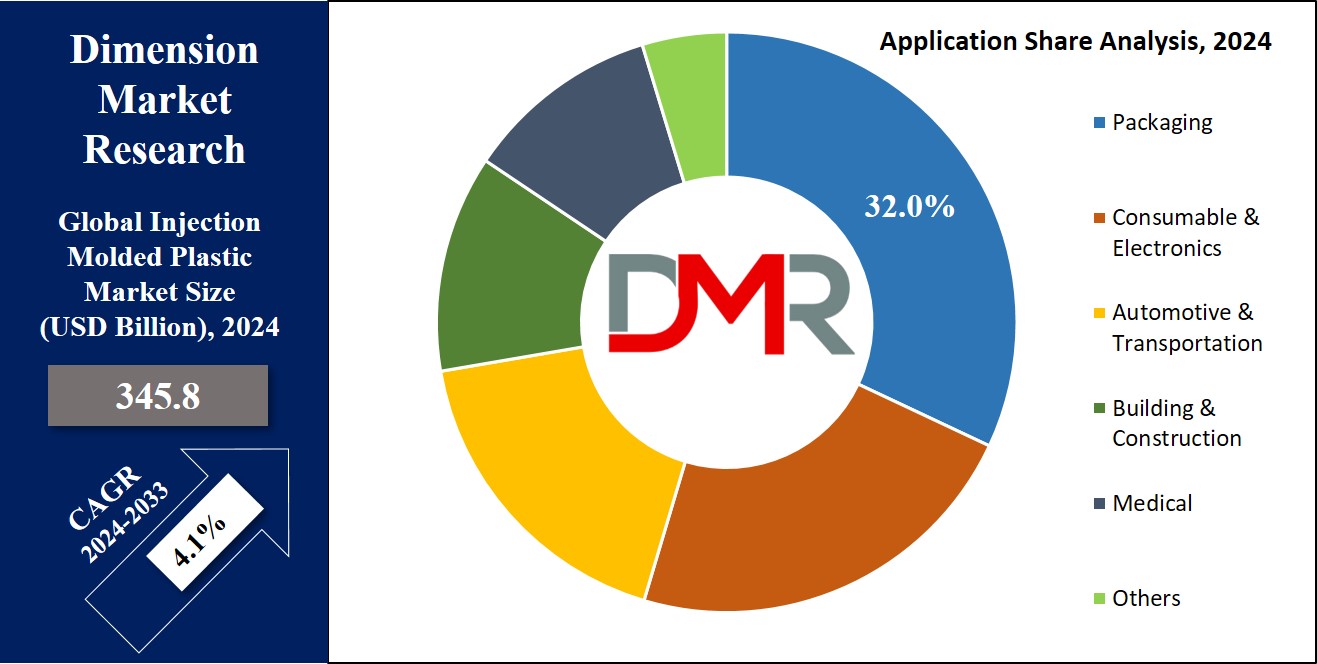

- Leading Segments: Polypropylene dominates the market by revenue, followed by ABS and other polymers. The packaging segment holds the largest application revenue share, while medical devices and automotive components are significant growth contributors.

- Applications & Use Cases: Injection-molded plastics are extensively used in automotive dashboards, consumer appliances, packaging (bottles, boxes, caps), medical devices (diagnostic and drug delivery components), electronics (housings, connectors), and manufacturing (pipes, fittings, structural parts).

- Regional Performance: Asia Pacific leads global demand with a projected 40.9% revenue share in 2024, driven by industrialization and infrastructure spending. Europe and North America follow, supported by electronics, automotive, and construction sectors.

- Growth Drivers: Key drivers include rising demand across automotive, packaging, healthcare, and consumer goods sectors, cost-effective high-volume production, bio-based plastics adoption, and increased infrastructure investments in emerging economies.

Use Cases

- Injection-molded plastic is widely used for the production of complex dashboard parts, inclusive of instrument panels, air vents, and trim components.

- In the packaging industry, injection-molded plastic unearths substantial used in developing bottles, boxes, and caps for loads of products, inclusive of food, beverages, prescription drugs, and personal care products, in which its versatility allows for the production of bins with unique shapes and sizes.

- Consumer items gain from injection-molded plastics through the manufacturing of long-lasting and cost-effective products. This includes plastic elements for home equipment like washing machines, fridges, and microwave ovens.

- Injection molding plays an essential role within the clinical industry by way of generating precision-molded additives for diverse medical devices. This can encompass additives for diagnostic systems, drug delivery structures, and other scientific gadgets, to ensure accuracy and consistency.

- Injection-molded plastics are applied in the manufacturing industry for producing pipes, fittings, and structural additives.

- In the electronics sector, injection-molded plastic is used to fabricate housings, casings, and connectors for a wide range of electronic devices.

Market Dynamic

The expansion of the Global Injection Molded Plastic Market is primarily driven by the rising demand for plastic components across a range of applications & sectors, including electrical and electronics, packaging, automotive, home appliances, as well as medical devices. This rise in demand underscores the vital role of the injection-molded method in efficiently producing intricate plastic shapes on a large scale.

However, the market growth trajectory may face hindrances because of the fluctuating prices of major raw materials such as ethylene, benzene, propylene, & styrene. Additionally, enhanced consciousness regarding environmental concerns about the disposal of these materials could potentially create hurdles for market growth from 2024 to 2033. Therefore, several Key companies are directing their attention towards crafting injection molded plastics using bio-based alternatives, aiming to surmount these obstacles.

Major sectors such as automotive & electronics are strategically relocating their manufacturing hubs to Asia Pacific nations, including China, India, Indonesia, & Thailand, mostly because of the cost-effective labor. Incentives by the Government, including tax advantages, are extended to manufacturers in these regions, amplifying the desire to produce several automotive & electrical components.

China & India in particular, have garnered benefits through government initiatives such as tax benefits & financial incentives to attract FDI (Foreign Direct Investments), fostering their

plastics markets. These efforts, along with low-cost labor, have resulted in a reduction in manufacturing costs. However, this shift has led to an overcapacity of plastic products, affecting their prices. Overall, it is anticipated to drive product demand throughout the anticipated period.

Driving Factors

The injection molded plastic market is driven by increasing demand in sectors such as automotive, packaging, healthcare and consumer goods. Cost-effective, high-volume production capabilities and its ability to create complex yet lightweight and durable components make CNC milling indispensable. Automotive sector demand for lightweight materials designed to enhance fuel efficiency and lower carbon emissions is fueling an upsurge in demand for injection molded plastics.

Plastic's versatility and durability has contributed significantly to the rapid expansion of food and beverage packaging industries worldwide, particularly for food and beverages. Bio-based plastics' growing adoption is supporting market expansion while contributing towards global sustainability initiatives and environmental awareness trends.

Trending Factors

A key trend defining the injection molded plastic market is the rise of advanced manufacturing technologies such as automation and Industry 4.0 practices. Smart injection molding machines equipped with sensors and Internet of Things capabilities enable real-time monitoring, improved precision, and reduced material waste.

Another significant trend is the increasing emphasis on recycled and biodegradable plastics, driven by environmental regulations and consumer demand for more eco-friendly products.

3D printing combined with injection molding techniques is creating hybrid manufacturing solutions, enabling faster prototyping and custom production. These trends are pushing the industry toward more eco-friendly and adaptive practices.

Restraining Factors

The injection molded plastic market faces constraints due to environmental concerns associated with plastic waste and tighter government regulations on single-use plastics. Rising raw material prices, particularly those associated with petrochemical-based plastics, further diminish market profitability. Establishing advanced injection molding facilities requires significant initial investments, limiting entry for smaller players.

Furthermore, alternative materials like glass, metal and paper-based composites impede demand further for plastics as public perception of them as environmentally damaging increases pressure for companies to invest in sustainable solutions, which may increase production costs while inhibiting short-term growth in highly price-sensitive markets.

Opportunity

Injection molded plastic offers considerable promise in healthcare, electronics, and renewable energy sectors. Rising healthcare demands for disposable medical devices, drug delivery systems and diagnostic equipment present an especially lucrative avenue.

Miniaturization and precision part requirements have propelled electronics adoption, while renewable energy projects, particularly solar and wind, demand lightweight plastic components with excellent durability for equipment.

Bio-based and recycled plastics offer an eco-friendly solution, filling a niche market. Additionally, emerging markets in Asia Pacific and Africa present opportunities due to rapid industrialization and increasing consumer bases.

Research Scope and Analysis

By Raw Material

Polypropylene commands the revenue landscape, capturing a maximum share in 2024. Its ascendancy is due to its growing utilization in household goods, automotive components, & packaging.

Significantly, its expanding role in protective caps for battery housings, electrical contacts, &

food packaging is predicted to drive demand further in the coming years. Polypropylene's corrosion resistance & electrical insulation properties make it valuable in segments such as food packaging & electrical contacts, setting the stage for steady growth.

However, the hurdles brought about by the recent pandemic caused a setback in polypropylene consumption because of the manufacturing slowdowns & challenges related to logistics. The constraints on production have resulted in a decline in demand across applications.

ABS (Acrylonitrile butadiene styrene) emerged as another significant player, contributing notably to overall revenue in 2024. ABS's rising demand for medical devices, electronic housings, automotive components, & consumer appliances is anticipated to fuel its growth trajectory in the forthcoming years.

By Application

The packaging domain dominates the segment with a maximum revenue share in 2024. Products meant for packaging undergo a series of developmental stages to align with regulatory standards & user needs. For packaging applications, plastics must meet specific criteria, including enhancing the shelf life of food products, showcasing resilience to wear & tear, and ensuring durability.

Injection-molded plastics hold significance within the medical & automotive sectors. Among these, the medical devices and components sector is all set for the highest growth. Factors such as biocompatibility, optical clarity, & an economical production approach are projected to fuel demand in the medical sector.

The rigorous regulatory standards regarding the utilization of medical-grade polymers in healthcare are expected to positively influence sector growth throughout the forecast period. The rising preference for biodegradable polymers among medical device manufacturers further anticipates creating better opportunities in the medical sector during the forecast period.

The Injection Molded Plastic Market Report is segmented based on the following

By Raw Material

- Polypropylene (PP)

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Density Polyethylene (HDPE)

- Others

By Application

- Packaging

- Consumable & Electronics

- Automotive & Transportation

- Building & Construction

- Medical

- Others

Regional Analysis

Asia Pacific spearheads the global demand, expected to command a revenue market share of about 40.9% in 2024. The rise in infrastructure spending, complemented by increased automobile requisites in countries such as India, China, Indonesia, & Malaysi,a is all set to propel market reach across the region.

Europe stood out as a significant hub for injection-molded plastics. Remarkably, the European market finds significance in non-food & beverage packaging sectors, including pharmaceuticals, cosmetics, & household chemicals.

Anticipated escalation in the consumption of electronic gadgets such as laptops & cell phones across several nations, including the United Kingdom, France & Germany is set to elevate the demand within the consumables & electronics sector. The recent expansion of the automobile sector within Europe further adds impetus to regional demand projections throughout the forecast duration.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Global Market shows substantial fragmentation, especially noticeable in Asia Pacific & Latin America, where unorganized sectors flourish. Companies in Asia Pacific have consistently engaged in significant capacity expansions in recent years to leverage operational excellence & attain profits. The market's competitive landscape is marked by several product portfolios & differentiation, influencing competitive pricing and distribution channels.

Within this context, enterprises have involved diverse marketing tactics including new product introductions, joint ventures, expansions, & acquisitions to uphold their competitive position in the global injection molded plastics market. Significantly, the launch of new products emerges as a vital strategy accepted by key players in the injection-molded plastics market.

Some of the prominent players in the Global Injection Molded Plastic Market are

- BASF SE

- SABIC

- IAC Group

- LACKS ENTERPRISES, INC.

- Dow, Inc.

- ExxonMobil Corporation

- DuPont de Nemours, Inc.

- Huntsman International LLC

- Berry Global, Inc.

- Aptar Group, Inc.

- Master Molded Products Corporation

- Magna International, Inc.

- Other Key Players

Recent Development

- In October 2023, IPEX opens a 200,000 sq ft electric-injection molding facility in Pineville, NC, enhancing US manufacturing capacity for plumbing, electrical, industrial, and municipal fittings with cutting-edge technology and safety standards.

- In April 2023, Nexa3D purchased Addifab Inc., which was the parent firm of Freeform Injection Molding. The deal also was primarily focused around Addifab's high-temperature soluble and excessive-impact resins to be used at the side of Nexa3D's ultrafast 3-D printers to supply superior tools that can be used with any type of injection mold.

- In March 2023, EMG Technologies was acquired by ABC Technologies in USD 165 million. ABC Technologies provides a diverse portfolio of products to its clients across various categories, including fluids, HVAC systems, while MGT specializes in supplying advanced tooling solutions for injection-molded exterior and interior parts.

- In October 2022, with current 183 injection molding machines, Evco Plastics announced expansion of their manufacturing capacity as they proposed to invest USD 11 million in Wisconsin, the United States.

- In July 2022, Alpha decided to open its 3rd facility in India after Austria and Germany. That is why they invested USD 8,50,000 in Indian market for their expansion.

- In July 2022, Sinopec has signed three petrochemical deals which values around USD 7 billion with INEOS to expand their influence to Chinese market.

| Report Characteristics |

| Market Size (2023) |

USD 345.8 Bn |

| Forecast Value (2032) |

USD 494.5 Bn |

| CAGR (2023-2032) |

4.1% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Raw Material (Polypropylene (PP), Polystyrene (PS), Acrylonitrile Butadiene Styrene (ABS), and High- Density Polyethylene (HDPE), and Others), and By Application (Packaging, Consumable & Electronics, Automotive & Transportation, Building & Construction, Medical, and Others). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BASF SE, SABIC, IAC Group, LACKS ENTERPRISES, INC., Dow, Inc., ExxonMobil Corporation, DuPont de Nemours, Inc., Huntsman International LLC, Berry Global, Inc., Aptar Group, Inc., Master Molded Products Corporation, Magna International, Inc. and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Injection Molded Plastic Market is expected to achieve a valuation of USD 345.8 billion in

2024.

The Global Injection Molded Plastic Market is expected to increase by 4.1% (CAGR) from 2024 to 2033.

The Asia Pacific region is anticipated to dominate in the Global Injection Molded Plastic Market, holding

a revenue share of over 40.9% in 2024.

Some of the prominent key players in the Global Injection Molded Plastic Market include BASF SE,

SABIC, IAC Group, LACKS ENTERPRISES, INC., Dow, Inc., ExxonMobil Corporation, DuPont de Nemours,

Inc., Huntsman International LLC, Berry Global, Inc., Aptar Group, Inc., Master Molded Products

Corporation, and other key players.