Market Overview

The Global

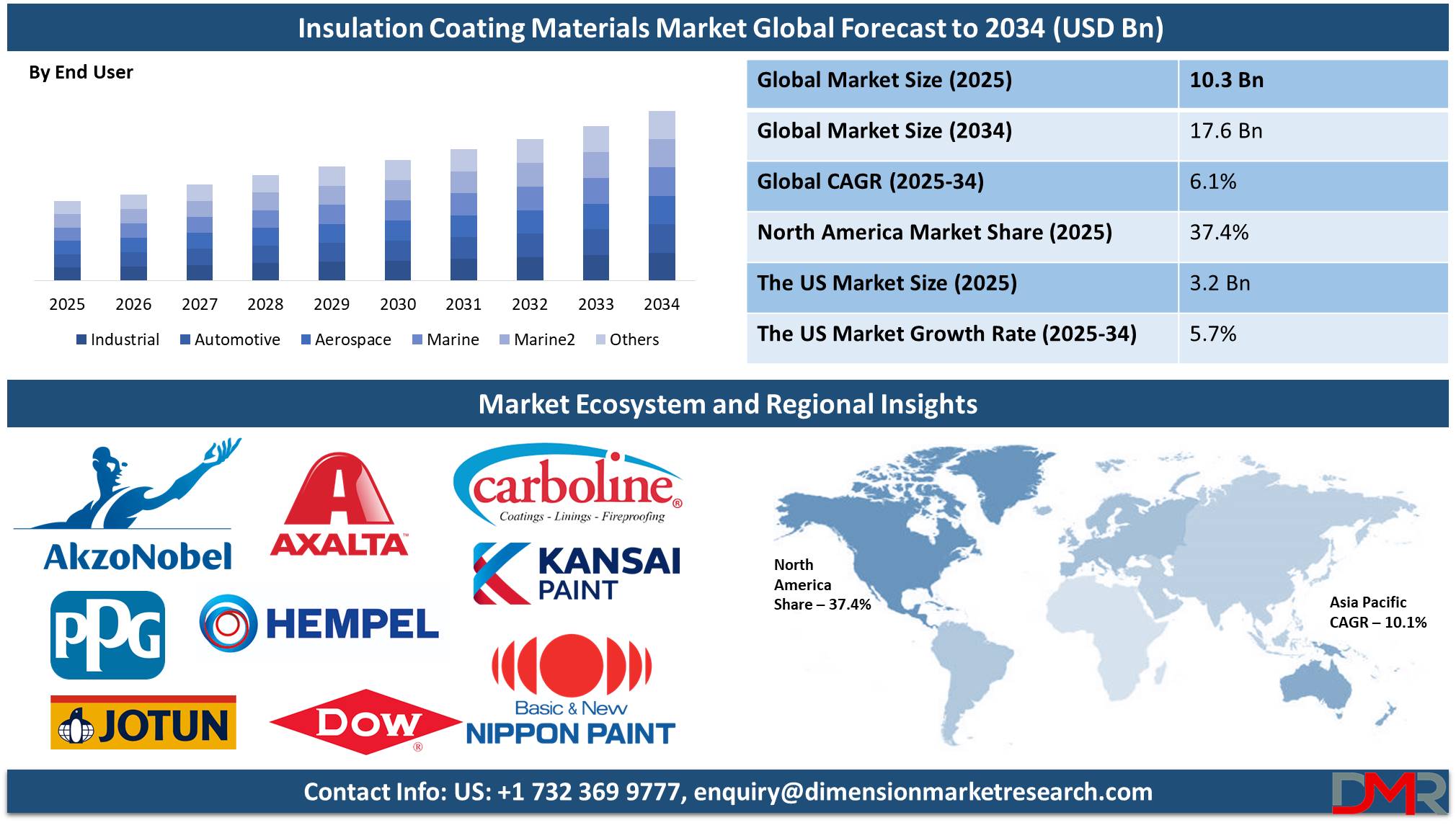

Insulation Coating Materials Market size is expected to be

valued at USD 10.3 billion in 2025, and it is further anticipated to reach a market

value of USD 17.6 billion by 2034 at a

CAGR of 6.1%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global insulation coating materials market is recording significant growth, with sharply increasing demand emanating from industries such as automotive, aerospace, marine, and energy. Major uses of insulation coatings include preventing the loss of heat, boosting the efficiency of energy use, and shielding surfaces against corrosion and temperature extremes. Rapid industrialization, together with stringent environmental regulations, has amplified the adoption of advanced insulation technologies. Besides, the demand for sustainable and energy-efficient solutions in the construction and manufacturing sectors is likely to continue boosting market growth. The growing emphasis on the reduction of carbon footprints and operational costs is one more factor that has widely utilized insulation coatings in thermal management applications.

Developments that enhance the performance of insulation coatings include nanotechnology and novel material composition. Integration of aerogels, ceramics, and epoxy-based coatings resulted in highly efficient products with improved thermal resistance and durability. Large players invest in R&D for the introduction of multifunctional coatings able to provide thermal insulation and at the same time protection against moisture, UV radiation, and chemicals. Interest in self-healing Smart Coatings and advanced thermal barriers is increasing, especially in aerospace but also in industrial applications for use in high-temperature environments.

There is, therefore, a fair deal of opportunities provided by the market, with an increasing focus on renewable energy and infrastructure development. In fact, this industry finds wider applications in the expanding offshore wind farms, solar power plants, and smart cities for thermal insulation to optimize energy consumption. Light and high-performance coatings are increasingly sought after in transportation as manufacturers try to achieve better fuel efficiency and lower emissions. This significant growth is also due to the expanding applications in the oil and gas industry, where high temperature requires strong thermal barriers for insulation coatings.

Despite the high potential for growth, certain challenges stare the insulation coating materials market right in the eye, such as high costs on account of advanced formulation, volatility of the prices of the raw material, complex procedures for the process of applications added by processes involved in gluing things together in relation to strict regulatory compliances. Increasing insulation methods would make more competitive scenarios, including traditional wraps and panels of thermals. Most small and medium-sized enterprises have difficulty raising the initial investment in advanced coating technologies, which in turn has tended to delay the pace of market penetration.

The global insulation coating materials market will see steady growth over the course of a decade, with the Asia-Pacific developing as a hotspot. The demand for performance coatings is accelerating in this region due to rapid industrialization and urbanization with infrastructural projects. Other important markets are North America and Europe, impelled by the strict regulations about energy efficiency and increasing retrofit activities. The trend is more towards eco-friendly and nontoxic coatings. This upward trend is influenced by the market dynamics. Companies also pay more attention to producing formulations that adhere to regulatory standards in order for them to grow more sustainably.

Advancements in technology, along with the rise in end-use applications, have set the direction for the continuous growth of industry innovations and their adaptability.

The US Insulation Coating Materials Market

The US Activated Carbon Market is projected to be valued at USD 3.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.3 billion in 2034 at a CAGR of 5.7%.

The US insulation coating materials market continues to witness sluggish growth on the wheels of advancements within the construction, automotive, and industrial sectors. This growth can also be credited to the concentration on energy conservation, coupled with strict building codes that have gone into effect. Government initiatives in furthering sustainable infrastructure along with green building standards have hastened the demand for high-performance insulation coatings. These coatings are also finding their application in the construction industry, particularly in commercial and residential buildings, for the purpose of ensuring energy efficiency with a view to reducing HVAC costs. In addition, the growing concerns over industrial safety and equipment longevity are resulting in greater demand for insulation coatings in manufacturing and power generation facilities.

It has an effective industrial backbone and skilled labor, making the US a prime hub for the manufacturers of insulation coatings. Growth in population and urbanization in the country provides demographic dividends for the development of infrastructure and helps drive the demand for insulation coatings. The presence of leading market players and their investment in R&D and technological innovations further enhances the outlook for the market. This trend is expected to continue to drive growth in the US insulation coating materials market, driven by investments in electric vehicles, advanced aerospace, and renewable energy projects, coupled with regulatory support for sustainability concerns addressed by industries.

Global Insulation Coating Materials Market: Key Takeaways

- Global Market Size: The Global Insulation Coating Materials Market size is estimated to have a value of USD 10.3 billion in 2025 and is expected to reach USD 17.6 billion by the end of 2034.

- The US Market Size: The US- Insulation Coating Materials market is projected to be valued at USD 3.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.3 billion in 2035 at a CAGR of 5.7%.

- Regional Analysis: North America is expected to have the largest market share in the Global Insulation Coating Materials Market with a share of about 37.4% in 2025.

- Key Players: Some of the major key players in the Global Insulation Coating Materials Market are AkzoNobel, PPG Industries, Sherwin-Williams Company, Kansai Paint Co. Ltd., Jotun Group, and many others.

- Global Market Growth Rate: The market is growing at a CAGR of 6.1 percent over the forecasted period.

Global Insulation Coating Materials Market: Use Cases

- Protection of Industrial Equipment: Industrial machinery and pipelines have a perfect insulation coating for heat loss, energy efficiency improvement, and surface protection against corrosion; in this respect, insulation could reduce maintenance costs and energy losses.

- Automotive Heat Management: Coating insulation is done on engine components, exhaust systems, and underbody structures in automobiles to improve thermal management to guarantee comfort for passengers and efficiency in vehicles at extremely high or low temperatures.

- Aerospace Thermal Barrier Coating: Advanced insulation coatings providing high-temperature-resistant capabilities against various wear and tears on several aircraft and spacecraft components, engine and structural, for fuel economy.

- Marine and Offshore Applications: The ships, submarines, and rigs in the case of offshore drilling apply insulative coatings in order to bar the transfer of heat, prevent surfaces from being attacked by salinity on seawater, and maintain higher levels of operating efficiencies under unfavorable sea conditions.

Global Insulation Coating Materials Market: Stats & Facts

- Sealing drafts before insulation helps raise comfort and cut energy costs by preventing unwanted airflow and letting insulation do its job. As such, draft sealing efforts around windows can yield a 10-20% reduction in energy costs, as warm or cool air is no longer escaping through gaps. It is much easier to take care of a child than it is to try to fix an adult using different therapies.

- R-value has become profoundly important in considering, for instance, that a material with an R-value of 30 is extremely better than one with 10 in repressing the possible rate of heat loss. Again, such high R-values, as explained in this case, do not point directly to increased thickness; more so, material varieties having higher R-values can be thinner but more adequate in performance. The U.S. Department of Energy gives various recommendations for different regions, basing its reasoning on colder regions that require higher values in insulation.

- Insulation, according to Insulate Kansas City, stays effective over time if it is kept away from wind, sunlight, or moisture. There is the possibility of settling, but thermal performance does not change. It is tough and insulation does not deteriorate over time under appropriate conditions. For instance, fiberglass and cellulose insulation can last for decades without any loss in effectiveness. Insulate Kansas City also said that settling, which may occur in some materials such as cellulose over time, does not greatly affect their thermal performance as long as the insulation remains intact and is not damaged in any way.

- Insulation saves more energy by preventing the loss of heat, unlike devices like heaters or LED lights, and Insulate Kansas City says that insulation helps lower energy costs without consuming power. Insulation is a completely passive process; it requires no energy to function. Unlike other devices like heaters or air conditioners, insulation helps reduce the work of heating and cooling systems to lower energy consumption. According to the U.S. The Environmental Protection Agency estimates that a well-insulated house could save up to 20% on heating and cooling bills; that is a huge saving over time.

- Heat is insulated from escaping; therefore, this lessens furnace usage and the use of fossil fuel. According to Insulate Kansas City, this reduces carbon dioxide emissions by an average of 780 million tons every year. A very good contribution, considering climate change. Energy-efficient insulation cuts the energy used to heat or cool a home; it, in turn, cuts down the burning of fossil fuels. This has a snowballing effect as more homes are insulated, the greater reduction in emissions and energy use. The EPA estimates that the amount of energy saved by insulation in the U.S. is equivalent to taking 15 million cars off the road every year.

- It has been reported by Oliver Heating and Cooling, that about 60% of a home's energy can escape without insulation through its walls, driving up heating bills while forcing comfort to slide. Proper insulation serves to prevent loss of energy. This is common mostly for houses that have walls and attics without proper insulation.

- According to the U.S. Department of Energy, properly insulating one's home can save homeowners between 10-50% on energy costs, depending on the climate and levels of existing insulation. Insulation helps maintain comfort levels throughout the year and puts less pressure on HVAC systems to maintain comfortable temperatures, thus minimizing energy costs.

Global Insulation Coating Materials Market Dynamic

Driving Factors in the Global Insulation Coating Materials Market

Increasing Demand for Energy-Efficient SolutionsEnergy price increases and carbon footprint reduction create a dire need for energy-efficient insulation materials. The insulation coatings help in reducing heat loss, optimum utilization of energy, and thereby enhance the performance of the equipment. Energy efficiency standards, set by various governments and regulatory bodies in commercial and residential buildings, will further drive demand for high-performance insulation coatings. There is, consequently, a high demand for thermal application coatings within industries like oil and gas, manufacturing, and power generation due to their helping in thermal management and a reduction in operational costs.

Growth of Key End-Use Industries

The growth of critical industries like construction, automotive, aerospace, and marine is promoting the growth of the insulation coating materials market. Increasing demand for electric vehicles is boosting demand for lightweight and thermal-efficient coatings that would enhance battery performance while ensuring vehicle safety. Similarly, in aerospace, insulation coatings protect components from extreme temperatures while helping reduce energy consumption. This again, in turn, enriches the demand for insulation coatings in residential, commercial, and industrial applications, further contributing to the value of infrastructure development projects, especially in emerging economies.

Restraints in the Global Insulation Coating Materials Market

High Initial Costs and Raw Material Price VolatilityOne of the major issues challenging the insulation coating materials market has to do with the high upfront cost of advanced formulations. High-performance coatings have a higher selling price-for example, by using nanotechnology, aerogels, or specialty polymers-which can limit industrial acceptance in many cost-sensitive applications. In addition, profitability is affected due to the unstable prices of raw materials, especially resins, pigments, and specialty additives.

This is an industrial challenge that manufacturers face, having to balance between price and quality, while ensuring conformity with environmental regulations. This holds particularly true for SMEs, which cannot always afford investment in premium insulation solutions.

Regulatory Compliance and Application Challenges

The insulation coating materials must meet strict measures in terms of environmental safety and chemical composition regulations, as well as performance parameters. Compliance involves evolving government policy and industry standards, complexities, and therefore costs for enterprises. Moreover, the application itself calls for quite special equipment that requires skilled labor, definitely discouraging mainly for smaller-scale operations.

Poor application can reduce the performance of insulation coatings, which leads to a high maintenance cost. All these regulatory and technical challenges remain very important for manufacturers to increase their presence in the market.

Opportunities in the Global Insulation Coating Materials Market

Emerging Markets and Infrastructure Development

The rapid pace of industrialization and urbanization in the developing economies, especially in the Asia-Pacific region, offers immense potential for growth and development in the insulation coating market. Massive infrastructural development has been or is being carried out in developing countries like China, India, and Indonesia, comprising smart cities, transportation systems, and energy-efficient buildings. In addition to the large-scale involvement of such projects, high-performance insulation coatings are required to achieve optimal energy consumption and increase the life span of such structures. Additionally, government initiatives on sustainable construction and retrofitting existing buildings with energy-efficient solutions are also favoring the market's growth.

Technological Innovations in Coating Formulations

Continuous research and development are giving birth to new high-performance insulation coatings with greater thermal resistance, more effective corrosion protection, and prolonged durability. New hybrid coatings based on ceramic and polymeric compounds represent an innovative solution using PCMs and are the mainstream in the growth of modern technology. Next-generation coatings demonstrate far superior thermal insulation performance with retained flexibility and ease of application.

Insulation, anti-corrosion, fire resistance, and waterproofing properties developed within multi-functional coatings have opened up new avenues of growth for the market. Quick-drying and self-cleaning characteristics former achieved by way of representing the latest developments that further improve the adoption rate.

Trends in the Global Insulation Coating Materials Market

Advancements in Nanotechnology and Smart Coatings

The integration of Nanotechnology into insulation coatings has increased their efficiency, durability, and versatility. Among others, aerogel and silica-based nanomaterials have superior thermal insulation properties combined with lightweight and flexible features. Future industrial applications are finding a place in smart coatings having the property of self-healing and adaptive thermal regulation. Such coatings can adapt to environmental changes and optimize insulation performance with minimal need for maintenance. Increasing demand for high-performance coatings in aerospace, automotive, and energy sectors accelerates the adoption of nanotechnology-based insulation solutions.

Shift Toward Eco-Friendly and Non-Toxic Coatings

The demand for traditional insulation coatings has been changing lately, with growing environmental regulations and sustainability initiatives toward eco-friendly and non-toxic coating alternatives. Governments all over the world have established strict regulations to limit VOC and hazardous chemicals in coatings. As a consequence, a strong trend has been observed from the manufacturers' side toward water-based, bio-based, and low-VOC formulations that can provide the same insulation efficiency but without adverse impacts on the environment. This trend goes in line with the general demand increase for green building materials and further addresses the need for sustainable industrial applications. The shift to biodegradable and recyclable insulation coatings will be accelerated further over the coming years.

Research Scope and Analysis

By Type

Acrylic-based insulation coatings are projected to dominate the global insulation coating materials market due to their versatility, durability, and cost-effectiveness. Among the key factors for their high consumption rate, one might point out the excellent thermal insulation properties of acrylic coatings that have helped industries reduce energy consumption and enhance operational efficiency. Acrylic coatings provide very good heat resistance with maintained flexibility and, hence, find applications in industrial equipment, pipelines, automotive components, and construction surfaces. Their ability to form a protective layer against moisture, UV radiation, and corrosion further increases their demand across multiple industries.

One major plus associated with acrylic insulation coatings is ease of application along with quick-drying characteristics. Other coatings require some special application technique and take considerable time to cure, whereas most acrylic-based coatings can easily be applied using standard methods of spraying, brushing, or rolling. This saves labor costs and reduces downtime, hence preferred in time-sensitive industrial and construction projects. Besides, acrylic coatings have excellent adhesion to the most common substrates-metal, concrete, and plastics-assuring long-life insulation performance.

Other factors that have contributed to the dominance of acrylic insulation coatings include environmental and regulatory factors. With increased restrictions on VOCs and hazardous chemicals, water-based acrylic formulations have gained wide acceptance due to their low toxicity and minimal environmental impact. They offer an environmentally friendly alternative to solvent-based coatings with no performance compromise. Second, high-performance variants of acrylic formulations have been made possible, boasting fire resistance, anti-corrosion properties, and improved thermal efficiency.

Due to their cost-effectiveness, ease of use, and versatility in many areas of application, acrylic-based insulation coatings are still the most popular in the market. Industries are likely to continue placing priority on energy efficiency, sustainability, and strict adherence to environmental policies, which may sustain dominance in the near future.

By End User

The industrial sector is expected to dominate the global insulation coating materials market due to its extensive use of thermal management solutions for efficiency, safety, and regulatory compliance. Industries such as manufacturing, oil and gas, power generation, and chemical processing rely heavily on insulation coatings to optimize energy usage, protect equipment from extreme temperatures, and enhance operational longevity. With rising energy costs and stringent government policies aimed at reducing industrial emissions, businesses are increasingly adopting insulation coatings to improve energy efficiency and minimize heat loss in production processes.

One of the key factors contributing to the dominance of the industrial sector is the need for corrosion resistance and durability. Industrial environments expose equipment, pipelines, and machinery to harsh conditions, including high temperatures, chemicals, and moisture. Insulation coatings help mitigate these challenges by providing an additional layer of protection that extends equipment lifespan and reduces maintenance costs. In oil and gas refineries, for instance, insulation coatings play a crucial role in preventing heat loss from storage tanks and pipelines, improving process efficiency and safety.

Regulatory mandates further drive the adoption of insulation coatings in the industrial sector.

Governments worldwide impose strict safety and environmental standards that require industries to implement effective insulation solutions to reduce energy consumption and emissions. Additionally, with the rise of Industry 4.0 and smart manufacturing, companies are integrating advanced insulation technologies to enhance thermal management and operational performance.

As industries continue to prioritize energy conservation, safety, and equipment longevity, the demand for insulation coatings in the industrial sector remains strong. The growing focus on sustainable and high-performance insulation solutions will further reinforce the sector’s dominance in the global insulation coating materials market.

The Insulation Coating Materials Market Report is segmented on the basis of the following

By Type

- Acrylic

- Epoxy

- Polyurethane

- YSZ

- Mullite

- Others

By End User

- Industrial

- Automotive

- Aerospace

- Marine

- Building & Construction

- Others

Regional Analysis

North America is projected to dominate the insulation coating materials market as it will

hold 37.4% of the market share by the end of 2025. Stringent regulations for energy efficiency and commitments to reduce carbon emissions are driving factors behind North America's dominance in the insulation coating materials market. In the region, various governments have issued rigorous standards for energy-efficient materials, both in construction and industrial use.

For example, the U.S. The Department of Energy enforces efficient insulation through building codes as a means of reducing energy consumption and, therefore, increasing by up to many folds demand for high-performance insulation coating. Advanced insulation coating serves to provide an enhanced level of thermal performance in components to meet the increasingly strict environmental standards.

Also, various initiatives such as the Inflation Reduction Act provide billions in funding for energy-efficient technologies.

In all, this gives a very propitious backdrop to move ahead with the broad diffusion of insulation coatings. Such financial backing will surely accelerate the movement of different sectors towards sustainable practices, be it residential and commercial construction, manufacturing, or power generation.

The industrial base is well-established in the region, playing an equally crucial role in maintaining regional market leadership. Key industries, such as oil and gas, manufacturing, and power generation, rely on insulation coatings to enhance operational efficiency, protect equipment, and provide protection against extreme temperatures and corrosion. The oil and gas industry, in particular, requires high-performance coatings to bear the brunt of extreme conditions during exploration and refining processes with safety and efficiency in mind.

Additionally, the increased focus of the manufacturing industry on energy conservation and process optimization is driving the demand for insulation coatings. The North American region leads the insulation coating material market due to its robust industrial infrastructure, proactive government policy, and growing environmental awareness. This market has been consistently pushed forward by the continued demand for energy-efficient solutions, and such a scenario is likely to further strengthen North America's competitive edge on the global platform.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global insulation coating materials market is fragmented, with the presence of several key players. The competition is thus very intense, where pioneering innovation and strategic steps determine their course towards gaining a greater market share. Key companies in the market such as Akzo Nobel N.V., PPG Industries, The Sherwin-Williams Company, and Kansai Paint Co., Ltd. have wide product portfolios in various industries. The focus of these companies is to develop advanced coatings with superior thermal insulation, corrosion resistance, and environmental compliance.

Akzo Nobel, for instance, has different thermal insulation coatings targeted at increasing energy efficiency in industrial applications. These companies also usually adopt strategies related to strategic collaborations, mergers, and acquisitions with the aim of increasing their positioning in the market.

Investments in research and development remain key to higher introduction of new and innovative products that meet changing industry standards and customer needs. The competitive landscape is also characterized by regional expansion, wherein companies look at tapping emerging markets with high growth potential. Overall, the market is dynamic, with continuous efforts by key players aimed at improving product performance, expanding their global footprint, and achieving sustainable growth.

Some of the prominent players in the Global Insulation Coating Materials Market are

- AkzoNobel

- PPG Industries

- The Sherwin-Williams Company

- Kansai Paint Co., Ltd.

- Jotun Group

- Nippon Paint Holdings Co., Ltd.

- Axalta Coating Systems

- Hempel

- Seal For Life Industries

- Carboline

- Sharpshell Engineering

- Mascoat

- The Dow Chemical Company

- Other Key Players

Recent Developments

Investment: AkzoNobel, a leading manufacturer in the coatings sector, announced a substantial investment in expanding its production capacity for acrylic-based insulation coatings. This investment is aimed at meeting the growing demand in the aerospace and automotive sectors, which are increasingly adopting high-performance insulation solutions.

Collaboration: PPG Industries, a prominent insulation coating company, entered into a partnership with First Solar, a renewable energy firm. Together, they aim to develop specialized coatings for solar panel applications, focusing on enhancing energy efficiency and durability, key factors in the long-term sustainability of solar energy systems.

Expo: The International Insulation Coatings Expo 2024 was held in Berlin, showcasing the latest advancements in insulation materials and attracting industry leaders from around the globe. Exhibitors included companies like BASF and Sherwin-Williams, presenting new developments in thermal and fire-resistant coatings.

Conference: The Global Insulation Coatings Conference 2024 took place in Tokyo, where industry experts, including representatives from Jotun and Henkel, discussed sustainable practices and technological innovations within the insulation coatings industry. The event focused on the future of eco-friendly materials and energy-efficient technologies.

Mergers: BASF and Axalta Coating Systems merged to form a new entity, consolidating resources to expand their global market presence in the insulation coatings sector. This strategic merger allows both companies to combine their expertise and expand into new regions.

Investment: Hempel made a significant investment in research and development to create high-performance insulation coatings tailored for the marine industry. The investment focuses on addressing specific challenges such as corrosion resistance and thermal management, with the aim of improving performance in harsh maritime environments.

Collaboration: AkzoNobel entered into an agreement with Skanska, a leading construction conglomerate, to supply advanced insulation coatings for a series of high-profile building projects. This collaboration emphasizes the use of energy-efficient and sustainable materials for commercial and residential developments.

Expo: The Global Coatings and Insulation Materials Expo 2024 took place in New York, featuring seminars and workshops on the latest trends and technologies in the insulation coatings sector. Key participants included 3M and BASF, who presented their latest innovations in coatings designed to improve energy efficiency in buildings.

Investment: PPG Industries announced a major investment in a state-of-the-art production facility specializing in polyurethane-based insulation coatings. This expansion is particularly targeted at the automotive industry's growing demand for high-performance, lightweight coatings that also provide thermal and sound insulation.

Mergers: AkzoNobel and RPM International finalized a strategic merger, enhancing their competitive edge and operational efficiencies in the insulation coatings market. The merger is expected to expand both companies' reach in emerging markets and allow for more robust product offerings.

Collaboration: PPG Industries initiated a joint venture with Rivian, a technology startup, to develop smart coatings integrated with IoT (Internet of Things) capabilities. These advanced coatings will enable real-time monitoring of insulation performance in high-demand sectors like automotive and construction.

Conference: The International Conference on Advanced Insulation Materials 2024 took place in London, bringing together experts from companies like Sherwin-Williams and Hempel to discuss innovations in insulation coatings and future directions for energy-efficient technologies.

Investment: Sherwin-Williams made a substantial investment to expand its production line for epoxy-based insulation coatings, aiming to meet the growing demand in the industrial sector for high-temperature resistant materials, particularly in power generation and heavy industries.

Expo: The Global Insulation Materials Expo 2024 was held in Paris, featuring exhibitors and presentations from industry leaders such as AkzoNobel and 3M. The event showcased new developments in insulation technologies and materials, focusing on sustainable solutions.

Mergers: Jotun and Tnemec announced a merger, bringing together their complementary product lines and regional expertise to form a stronger player in the insulation coatings market. The merger is expected to enhance innovation and expand their product offerings in key growth markets.

Collaboration: BASF partnered with Siemens Gamesa, a renewable energy company, to develop specialized coatings for wind turbine blades, focusing on improving durability, energy efficiency, and resistance to environmental challenges.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 10.3 Bn |

| Forecast Value (2033) |

USD 17.6 Bn |

| CAGR (2024-2033) |

6.1% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 3.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Acrylic, Epoxy, Polyurethane, YSZ, Mullite, and Others), By End User (Industrial, Automotive, Aerospace, Marine, Building & Construction, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

AkzoNobel, PPG Industries, The Sherwin-Williams Company, Kansai Paint Co. Ltd., Jotun Group, Nippon Paint Holdings Co., Ltd., Axalta Coating Systems, Hempel, Seal For Life Industries, Carboline, Sharpshell Engineering, Mascoat, The Dow Chemical Company, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Insulation Coating Materials Market?

▾ The Global Insulation Coating Materials Market size is estimated to have a value of USD 10.3 billion in 2025 and is expected to reach USD 17.6 billion by the end of 2034.

What is the size of the US Insulation Coating Materials market?

▾ The US- Insulation Coating Materials market is projected to be valued at USD 3.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.3 billion in 2035 at a CAGR of 5.7%.

Which region accounted for the largest Global Insulation Coating Materials Market?

▾ North America is expected to have the largest market share in the Global Insulation Coating Materials Market with a share of about 37.4% in 2025.

Who are the key players in the Global Insulation Coating Materials Market?

▾ Some of the major key players in the Global Insulation Coating Materials Market are AkzoNobel, PPG Industries, Sherwin-Williams Company, Kansai Paint Co. Ltd., Jotun Group, and many others.

What is the growth rate in the Global Insulation Coating Materials Market?

▾ The market is growing at a CAGR of 6.1 percent over the forecasted period.