The insurance chatbot market has grown due to exponentially expanding demand for automation and AI-powered customer service solutions in the insurance sector. The insurance chatbots are AI-powered systems that converse like humans and enable insurance agencies to offer customer service 24/7, speed up the claims process, and enhance user experiences. With the evolution of digital insurance platforms, chatbot integration is becoming more advanced and industry-specific, including applications in term insurance,

healthcare insurance, and cyber insurance policies.

These tools will smooth the process of regular activities, such as answering queries, claims processing, underwriting, and sales inquiries management that are irreplaceable for insurers in pursuit of significant enhancements in operational efficiency and customer satisfaction.

Key drivers of the market encompass increasing adoption of AI technologies, rising digital transformation in the insurance industry, as well as increasing demand owing to the need for strategic personalization when it comes to customer experience. Insurance companies use

chatbots to save on operational costs by reducing time-consuming methods and providing a very smooth user interface to their customers.

The advancements in

Natural Language Processing (NLP) and

Machine Learning (ML) enable a chatbot to perceive and respond more precisely to inquiries made by customers, more vital than ever, hence the market will see significant growth during the forecast period. The global insurance chatbot market is projected to achieve key growth with a strong CAGR due to the increased adoption of these solutions by more insurance firms.

Regional development with the majority of the share, North America is on top, followed by Europe and the Asia-Pacific region. Increased penetration of digitization, heavy investment in AI technologies, and higher expectations from customers for faster responses pushed the market upwards. However, issues relating to data privacy and security remain one of the major concerns. This is particularly critical in domains like

cyber insurance, where sensitive digital liabilities are handled by chatbots on behalf of insurers.

As per tidio Around 60% of business owners believe AI chatbots enhance customer experience by automating routine tasks and providing real-time, personalized solutions. Chatbots' ability to analyze large datasets and spot patterns increases accuracy, support, and satisfaction. With 70% of businesses feeding AI with internal knowledge, companies are leveraging chatbots to streamline customer service and improve efficiency, making AI an essential tool.

However, 50% of people remain concerned about AI due to high costs, potential mistakes, and lack of human qualities. Despite these concerns, 94% of people believe chatbots will replace traditional call centers, with 82% preferring chatbots over waiting for human agents. By 2025, the number of businesses using AI chatbots is projected to increase by 34%, reflecting the growing adoption of this technology.

The chatbot market is rapidly expanding, expected to reach $15.5 billion by 2028, up from $4.7 billion in 2020. With a 23% annual growth rate, businesses are seeing the benefits of AI chatbots. More than 96% of respondents agree that chatbots show businesses care for customers, and 90% of customer queries are resolved in fewer than 11 messages, highlighting their efficiency.

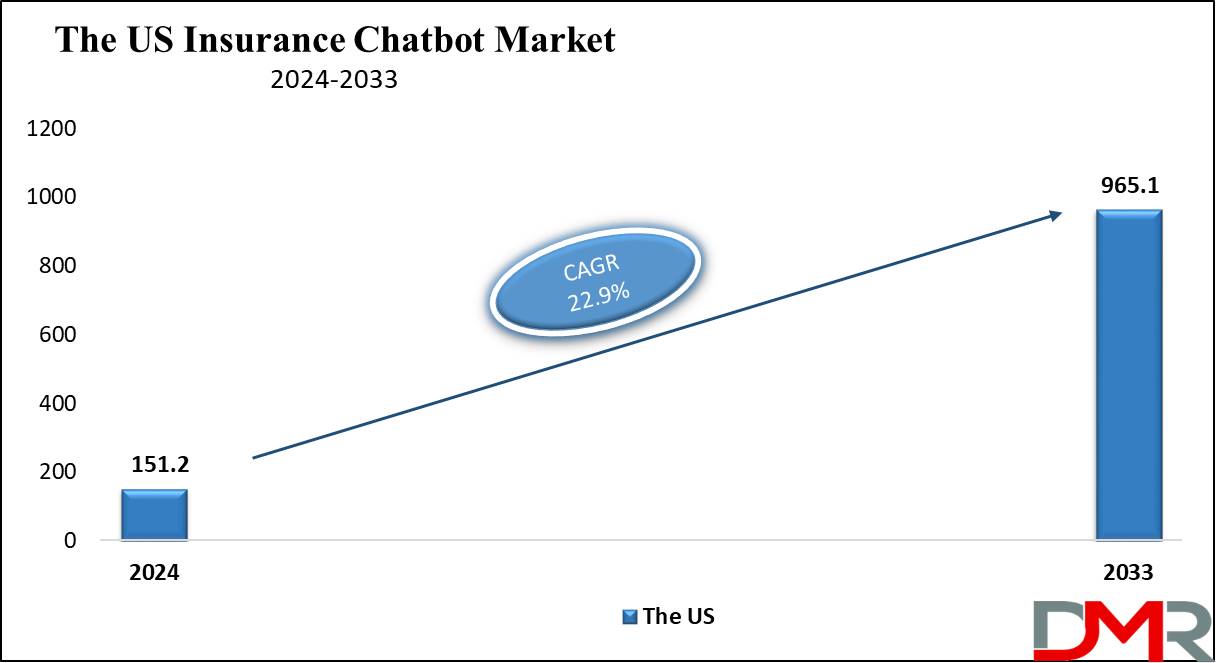

The US Insurance Chatbot Market

The

US Insurance Chatbot Market is projected to be

valued at USD 151.2 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds

USD 965.1 million in 2033 at a

CAGR of 22.9%. The US insurance chatbot market leads in the global landscape, due to the high adoption of advanced AI technologies and an urge for an efficient customer service solution in the insurance market.

Healthcare chatbots are increasingly being used to guide patients through healthcare insurance policies and assist in claims related to treatments or medications.

Chatbots are increasingly integrated into the digital platforms of U.S. insurance companies to supply key functions that range from claims processing and sales to customer inquiries, and human interactions, which in turn raise operational efficiency.

The fact that chatbots have the potential to revolutionize traditional customer service has not gone unnoticed by U.S. insurance companies. The digital transformation gaining ground across the insurance industry and the need for 24/7 customer service adoption were other stimuli for the growing demand for these AI-powered solutions. U.S. companies also benefit from innovations in machine learning and natural language processing, enabling even more accurate and personalized contacts with a chatbot.

In addition, the United States market also witnesses more investments by insurance companies in a way that will help reduce operation costs while improving customer service. With a special outlook on improving self-service and increasing the speed of operations like claims and underwriting, U.S. insurers use chatbots to ease operations and improve client engagement.

Peculiarly, regulatory concerns come to lighten the brakes on widescale U.S. adoption of insurance chatbots. New technologies and customer-centric strategies will drive the continuous growth of the U.S. insurance chatbot market.

Key Takeaways

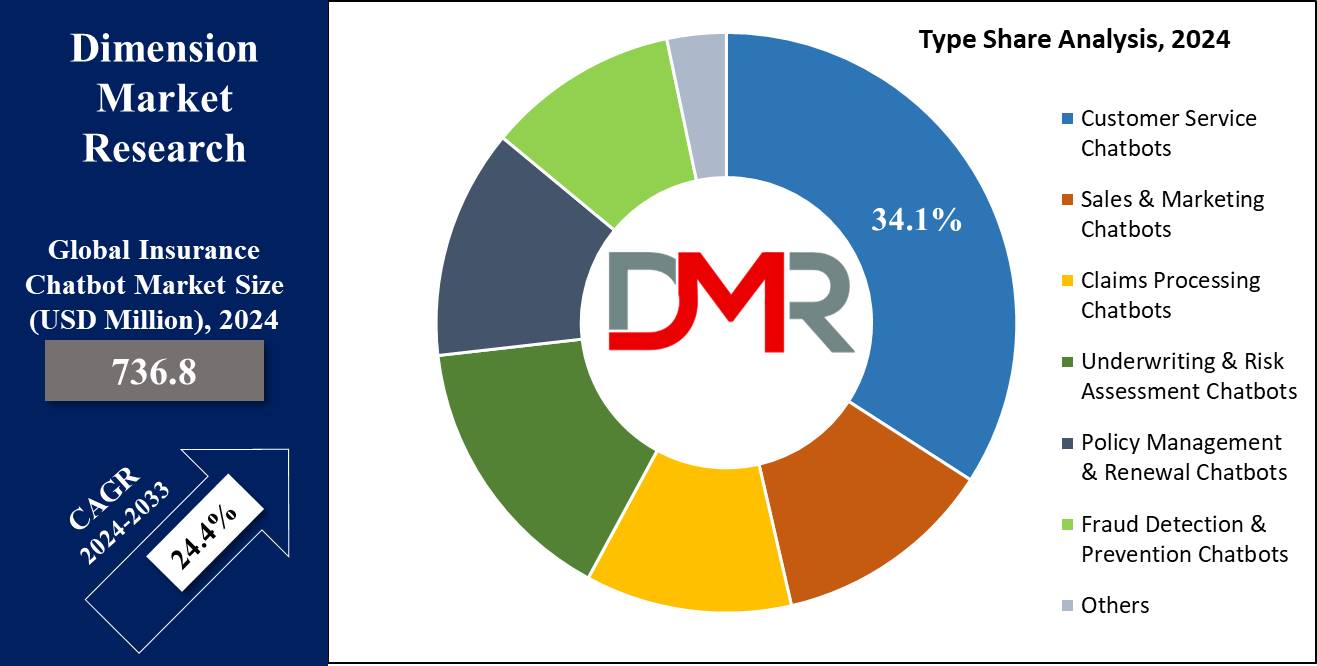

- The Global Market Value: The global insurance chatbot market size is estimated to have a value of USD 736.8 million in 2024 and is expected to reach USD 5,238.4 million by the end of 2033.

- The US Market Value: The US Insurance Chatbot Market is projected to be valued at USD 965.1 million in 2033 from a base value of USD 151.2 million in 2024 at a CAGR of 22.9%.

- By Type Segment Analysis: Customer service chatbot is projected to dominate this segment as it is anticipated to command 34.1% of market share in 2024.

- By User Interface Segment Analysis: Text-based interface is anticipated to dominate this segment with 73.1% of market share in 2024.

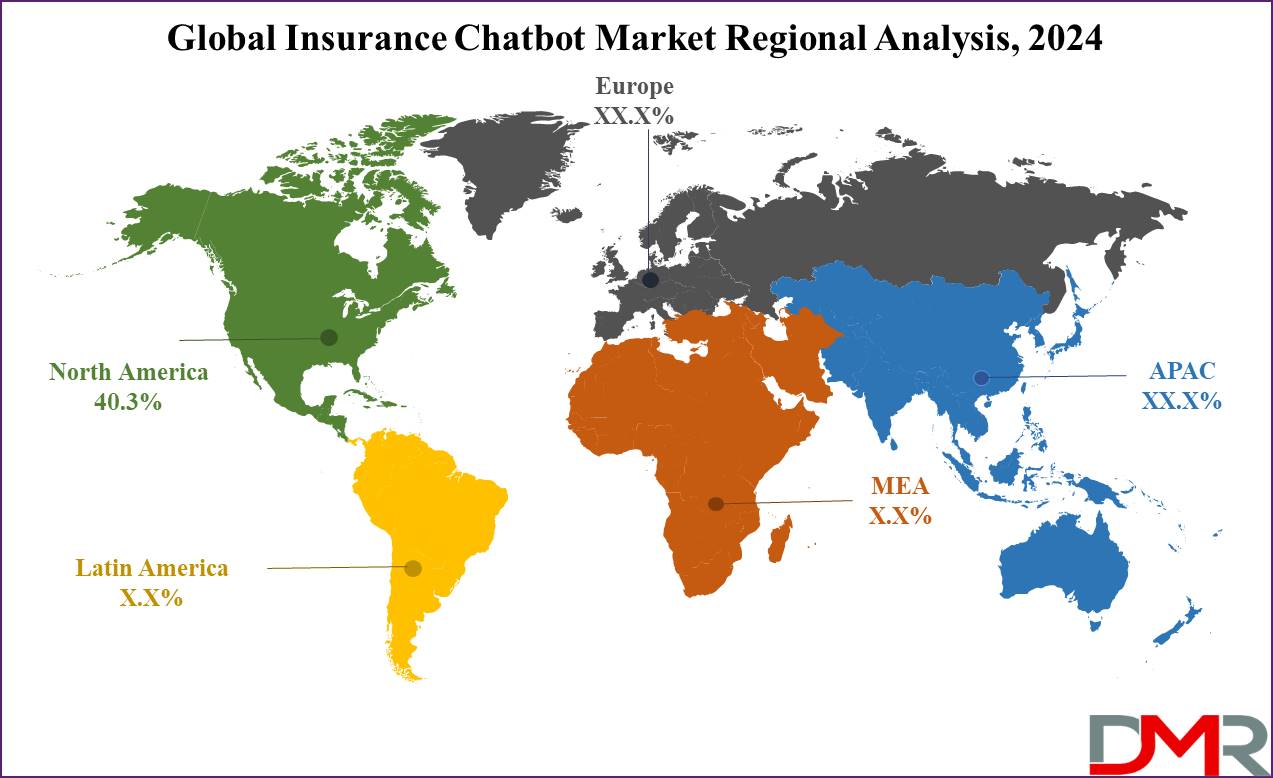

- Regional Analysis: North America is expected to have the largest market share in the Global Insurance Chatbot Market with a share of about 40.3% in 2024.

- Key Players: Some of the major key players in the Global Insurance Chatbot Market are Oracle, IBM Corporation, Nuance Communications Inc., LivePerson, AlphaChat, and many others

- Global Growth Rate: The market is growing at a CAGR of 24.4 percent over the forecasted period.

Use Cases

- Claims Processing: The use of insurance chatbots automates the claiming process, thereby reducing the paper trail. Real-time claim status updates are also made possible through them, enhancing customer experience while speeding up the process for insurers and policyholders.

- Customer Service: Chatbots answer frequent customers' inquiries, provide policy information, and help with some other common questions. That means the service is available around the clock and therefore is more liked by users while lessening the burden on human support teams.

- Sales Support: Chatbots assist in quoting insurance policies, recommend products to customers based on their needs and even lead potential customers through the purchase process to help raise the conversion rate for insurers.

- Underwriting Assistance: It underwrites through chatbots by gathering customer details and responding to preliminary questions which reduce the time taken to make a decision and involves fewer humans in the main preliminary stages of underwriting.

Market Dynamic

Trends

AI-Powered PersonalizationAI-driven personalization in insurance chatbots is one of those relatively fast-moving markets. Insurers are increasingly leaning on chatbots powered by sophisticated machine learning algorithms and NLP to deliver personalized experiences to customers. Such chatbots analyze customer behaviors and preferences to provide highly tailored recommendations, policy updates, and customized services that help improve customer engagement.

This trend will also engender customer loyalty since insurers could be enabled with a more personalized experience, thereby increasing retention rates. It could lead to the wider diffusion of chatbots in the insurance market.

Omnichannel Integration

Omnichannel integration is on the rise in the adoption of chatbots, whereby insurance firms can reach out to their customers on every available platform. Also, bots now act on websites, mobile applications, and common messaging platforms like WhatsApp, and Facebook Messenger, and further into voice assistants like Amazon Alexa.

This trend improves customer experience since insurers can now reach customers wherever they are, ensuring a much more consistent, easier-to-reach-out service. Omnichannel integration also allows less friction to occur in customer support, policy management, and claims processing, thus improving operational efficiency and satisfaction.

Voice-Assisted AI Integration

The integration of voice-based AI is being integrated into chatbots. Within the insurance sector, voice-based chatbots are emerging; customers can now get connected with insurers through smart speakers, such as Amazon Echo and Google Home.

This is voice-activated support given for handling all sorts of insurance-related tasks, right from policy inquiries to reporting claims naturally. Voice has improved the customer experience by allowing users to navigate through information and services available to them without much traction, appealing to the tech-savvy customer who is interested in bother-free interactions.

Growth Drivers

24/7 Customer Service Demand

One of the key drivers in the growth of the insurance chatbot market is the demand for 24/7 customer service. For any query on the part of the customer, there is increasing pressure to get quick responses without considering the time and day of the week. In this respect, the ideal solution is a chatbot, which will be able to provide real-time automated customer support at any time.

This feature increases the speed at which such queries are resolved and reduces frustration to a minimum, hence increasing customer satisfaction. The rise in customer expectations concerning instant service is driving the application of insurance chatbots, thereby further encouraging market growth.

Cost Efficiency in Operations

Another major driver in the insurance industry is the need for cost-efficient operations. This they do by automating the handling of customer queries, submissions of claims, and managing policies that quite substantially reduce the need for human intervention.

Coupled with the capability to handle enormous volumes simultaneously, this reduction in labor costs brings about significant cost savings for insurers. Moreover, it also smoothes out operational efficiency, thus enabling companies to offer consistent service at lower costs while turning in top-notch customer experiences.

Growing Customer Preference for Self-Service

A large part of customers now would like to use self-service platforms for maintaining their insurance-related queries, thus driving the adoption of chatbots. Many consumers, especially millennials and Gen Z, prefer the ease of interacting with chatbots rather than going through traditional means such as calling or visiting an agency for customer service purposes.

It helps in empowering the customers to perform tasks like claims reporting, policy renewal, and other basic queries themselves, saving on waiting time. This improves overall customer satisfaction. Several customers are moving towards self-service solutions; hence, insurers are deploying chatbots to meet the demand for the same. This, in turn, is driving the growth of the market.

Growth Opportunities

Expansion into Emerging Markets

The emerging markets, especially in regions such as Asia-Pacific, Latin America, and Africa, provide a very good opportunity for growth in the insurance chatbot market. This is because insurers make use of the technology to reach the unserved populations in these regions as they witness rapid digital transformation with increased internet penetration and the adoption of mobile phones.

Offering customer support 24/7, which may not be feasible through traditional means, is quite scalable with the help of chatbots. This presents insurers with a significant opportunity both for growth in the number of customers and for diversification into emerging revenues via accessible, digital-first services provided to growing markets.

Advances in Natural Language Processing (NLP)

Continuous improvement in the NLP technology is certainly giving some exciting growth opportunities for insurance chatbots. Thus, NLP can allow the chatbot to interpret and process the input of linguistically complicated structures, hence increasing the level of sophistication of customers' queries to be dealt with.

Because of all these factors, chatbots will now be able to engage in conversations like human beings, while also accomplishing other similar tasks, such as claims processing, underwriting, and customer support, more accurately. With each passing day, NLP technology gets even better, which means insurers will be able to deploy even more sophisticated chatbots that result in superior customer experience, reduce the need for human intervention, and further streamline operations.

Integration with Blockchain for Claims Processing

This is one promising growth opportunity in chatbots reborn into the integration of blockchain technology. Blockchain offers secure, transparent, and decentralized recording of transactions that can develop more efficiency and reliability in the claims management system driven by chatbots.

Therefore, insurers will be able to automate and accelerate the claims process through the integration of chatbots with blockchain, reduce fraudulent activities, and protect the data of clients. This could be an innovative way of revolutionizing insurers, helping them improve resolution time and hence allowing customers to have more trust, which will help drive further growth in the market.

Restraints

Data Privacy and Security Concerns

The processing of sensitive customer data by the chatbot raises significant data privacy and security-related concerns. Insurance chatbots very often operate with personal identification information, financial details, and health data, making them a target for cyber-attacks. The aftermath of data breaches can be severe in terms of financial losses, legal liabilities, and damage to the reputation of insurance companies.

One of the important challenges is ensuring that chatbots conform to such data protection regulations, like the GDPR and HIPAA while implementing appropriate strength in security. Such various privacy concerns may inhibit or restrain insurers, especially in regions with highly stringent data protection laws, from widely adopting these chatbots.

Limited Ability to Handle Complex Queries

While highly effective in handling routine queries, bots cannot generally deal with complex or emotionally sensitive situations. Major insurance customers experiencing crucial issues and claims arising due to accidents or natural disasters need personalized and empathetic help in human-like dialogue, which is beyond the capabilities of a bot.

The fact that AI cannot replicate the display of human empathy and critical thinking in sensitive situations can lead to dissatisfied customers. For this reason, insurers might be shy about chatting with a bot for very high-stakes or emotionally charged interactions, which holds back the rate of adoption.

High Initial Implementation Costs

While in the longer run, engagement with chatbots may work out cost-effectively, for many insurers high upfront investments in developing and deploying advanced AI-powered chatbot solutions are a challenge. It can be hard for small and medium-sized general insurance firms to justify the upfront costs associated with the integration of chatbots: technological development, training, and migration may prove too costly or just too risky.

Also, the continuous update and maintenance costs to keep the chatbot efficient and safe add to the expense. This is expected to remain a challenge for smaller insurers or in those markets where digital transformation is still in its early stages.

Research Scope and Analysis

By Type

Customer service chatbot is projected to dominate the global insurance chatbot market in terms of types as it holds 34.1% of the market share in 2024 which is further anticipated to show the subsequent growth in the upcoming period of 2024 to 2033. Customer service chatbots dominate the insurance chatbot market, as they find wide applications in handling and managing customer inquiries with instant responses to resolve simple issues without human intervention.

Such chatbots can handle frequently asked questions regarding policy knowledge, coverage options, and the calculation of premiums effectively, thereby decreasing the workload of human customer service representatives to a minimum. While Insurance Chatbots enter the mainstream of customer service, insurance companies will be able to free their human resources for other, more complex tasks requiring human judgment while dealing with volumes of routine queries.

Another reason for this dominant type is the growing pressure for 24/7 customer service. Whatever the time of the day, people want immediate answers, and this is where the chatbots just fit in. Because the response time is improved with the help of a chatbot, insurance companies can offer their customers better satisfaction and retention.

Besides, customer service chatbots often serve as the front door for prospective clients by offering product suggestions and guiding users in buying insurance policies, hence improving the sales pipeline. This is supported by various technological advances in AI and NLP that are making customer service chatbots increasingly powerful.

These can understand user intent at an individual level for more relevant solutions. Such personalization is important in this industry, considering customer loyalty and satisfaction are among the utmost concerns. The reason that contributes much to their dominance in the market presently pertains to performance.

By User Interface

The text-based user interface is projected to dominate this segment in the global insurance chatbot market as it will hold 73.1% of the market share in 2024. The dominance of the text-based interface in the insurance chatbot market is primarily due to its familiarity and ease of use for customers. Unlike voice or other advanced interfaces, text-based chatbots offer a simple and intuitive platform with which most users are comfortable on websites, mobile apps, or messaging platforms like WhatsApp.

In fact, for many users, it is much easier and less interfering to type questions or concerns and receive immediate text responses compared to having to deal with voice or other complex visual interfaces. This ease of interaction has made text-based interfaces the favorite for insurers and customers alike.

Apart from that, text-based interfaces let users connect with chatbots at their convenience.

Users can give enough time to type out queries read the responses and understand them without feeling hurried, sometimes the case with voice-based interactions. Another thing that happens in cases of text is that buyers can multitask while talking to a chatbot because the nature of this is asynchronous, hence this becomes quite convenient for busy people. Text-based chatbots are less challenging to develop and deploy than voice or GUI interfaces from just a purely technical perspective.

Text-based systems demand less on the part of AI training, hardware, and maintenance. Such variants of chatbots rely on NLP understanding of what was asked by the customer and formulate an appropriate response without having to employ complex speech recognition technology.

Besides, the text-based chatbot itself will easily integrate with already existing customer service platforms, such as live chat systems, and permit hybrid solutions whereby human agents could take over where and when necessary. This versatility, combined with the lower deployment costs, makes the text-based interface the dominant choice for insurance companies in their pursuit of improving customer service efficiency.

The Insurance Chatbot Market Report is segmented on the basis of the following

By Type

- Customer Service Chatbots

- Sales & Marketing Chatbots

- Claims Processing Chatbots

- Underwriting & Risk Assessment Chatbots

- Policy Management & Renewal Chatbots

- Fraud Detection & Prevention Chatbots

- Others

By User Interface

- Text-based Interface

- Voice-based Interface

Regional Analysis

North America is projected to dominate the global insurance chatbot market as it will

hold 73.1% of the total revenue share by the end of 2024. This region is dominant due to the owing to several factors that include developed technological infrastructure and high adaptation of the region to AI-driven solutions.

Both the U.S. and Canada have early adopters of new technologies among insurers, while several of them have already deployed chatbots as a means of ensuring greater customer service, operational efficiency, and cost optimization. The high presence of leading technology companies specializing in AI and machine learning, such as IBM, Google, and Microsoft, should further accelerate the adoption of chatbots within insurance.

The other reason that significantly contributes to this leading position in North America is the presence of a well-established insurance industry in this region. Due to having a large and more diversified customer base, there is increasing pressure on insurance providers in North America to provide more personalized service in less time. Such chatbots, capable of real-time customer support, claims processing, and policy management assistance, are the primary tools used by insurance companies.

The meeting of customer expectations is very high due to which there seems to be a growing demand for 24/7 support, quicker claims processing, and engagement of customers, ultimately forcing North American insurers to adopt the technology of chatbots more aggressively.

Besides, the regulatory landscape in North America allows AI technologies to complement the usage of chatbots, putting a clear framework for insurance companies in the implementation of such while guaranteeing data security and customer privacy.

The insurers are using these chatbots to maintain compliance with regulations like HIPAA and GDPR and simultaneously enable cost economy and operational gains from the technologies applied. In addition, the high investment in research and development related to AI, along with overall digital literacy among clients, cements North America's status to further dominate this insurance chatbot market.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Competition in the global insurance chatbot market is still very high as leading players are in a strive for innovation, technology development, strategic partnership, or competitive edge. Some of the leading companies in the market include IBM, Microsoft, Nuance Communications, Inc., and Aivo, among others. Large investments in AI-powered solutions by these companies support the offering of developed, proficient, and personalized chatbot systems in the insurance sector.

For example, there's IBM's Watson Assistant, which enjoys huge recognition throughout the world because of the NLP applied to offer very accurate customer service and support. Another major player is Microsoft's Azure Bot Services due to seamless integration with insurance platforms, letting companies automate customer communications through varied channels. All such firms are continuously enhancing their offerings with a continuous inflow of

AI, machine learning, and NLP capabilities, making them distinguished from the small players.

Startups and other niche players continue to make remarkable developments in the insurance chatbot market by availing highly specialized solutions that meet the specific needs of insurance firms. In this respect, companies like Insurify and Lemonade have already integrated advanced chatbot capabilities into their customer interaction and claims processing.

Strategic partnerships by insurers and technology providers further accelerate competition within the market. With the increased demand for AI-powered customer service solutions, the competitive landscape will further intensify with activities in deal-making, including mergers and acquisitions, and partnership strategic initiatives to promote chatbot technologies and attain presence.

Some of the prominent players in the Global Insurance Chatbot Market are

- Oracle

- IBM Corporation

- Nuance Communications, Inc.

- LivePerson

- AlphaChat

- Chatfuel

- Botsify

- Amazon.com, Inc.

- Verint Systems, Inc.

- Inbenta Holdings Inc.

- Baidu Inc.

- NVIDIA Corporation

- Other Key Players

Recent Developments

- September 2024: IBM released an upgraded version of its Watson Assistant, designed specifically for the insurance industry. The new version features advanced machine learning algorithms and enhanced natural language processing (NLP) capabilities, allowing insurers to deliver more accurate and personalized customer service.

- July 2024: Microsoft introduced new capabilities in its Azure Bot Services, enabling deeper integration with social media platforms. This development allows insurance firms to deploy chatbots across popular social channels like Facebook Messenger and WhatsApp, providing a unified customer communication experience.

- April 2024: Nuance Communications partnered with AXA, a leading global insurer, to launch AI-powered chatbots that offer multilingual support. These chatbots are designed to improve the customer experience by providing real-time assistance in various languages, making them suitable for AXA’s diverse global customer base.

- February 2024: Lemonade, a fast-growing insurtech company, unveiled its enhanced AI-powered chatbot "Maya," designed to fully automate the claims process. Maya provides real-time status updates, handles customer inquiries, and processes claims faster than traditional methods.

- October 2023: Aivo expanded its product portfolio by introducing new AI chatbot solutions for the insurance industry, focusing on customer service and sales support. Aivo's chatbots now offer personalized, real-time interaction with customers, capable of handling multiple languages and providing 24/7 assistance.

- August 2023: Insurify launched an AI chatbot designed to simplify the insurance purchasing process. This chatbot integrates with major U.S. insurance companies, allowing customers to compare policies and get quotes instantly.

- May 2023: HDFC ERGO, a major insurance provider in India, introduced its chatbot "DIA," which offers instant support for policy inquiries, claims status, and policy renewal reminders. DIA is integrated into HDFC ERGO's mobile app, providing a seamless experience for users.

- March 2023: Allstate introduced an AI-powered claims chatbot that helps customers report accidents, submit claims, and receive updates in real time. This chatbot also uses machine learning to analyze claims data, providing faster and more accurate estimates for settlements.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 736.8 Mn |

| Forecast Value (2033) |

USD 5,238.4 Mn |

| CAGR (2024-2033) |

24.4% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 151.2 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Customer Service Chatbots, Sales & Marketing Chatbots, Claims Processing Chatbots, Underwriting & Risk Assessment Chatbots, Policy Management & Renewal Chatbots, Fraud Detection & Prevention Chatbots, and Others), By User Interface (Text-based Interface, and Voice-based Interface) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Oracle, IBM Corporation, Nuance Communications Inc., LivePerson, AlphaChat, Chatfuel, Botsify, Amazon.com Inc., Verint Systems Inc., Inbenta Holdings Inc., Baidu Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |