Integrated Pest Management Pheromones Market Overview

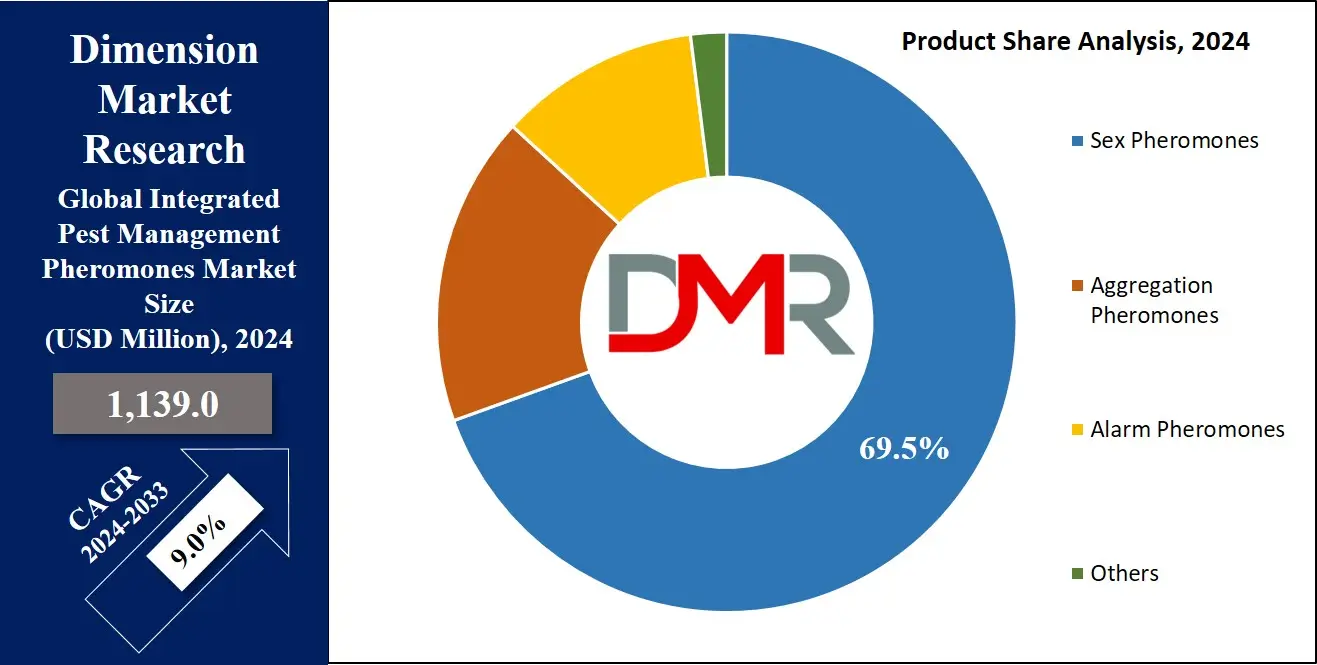

The Global Integrated Pest Management (IPM) Pheromones Market is expected to reach a valuation of USD 1,139.0 million in 2024 and is projected to experience a robust CAGR (compound annual growth rate) of 9.0% for the forecast period (2024-2033).

The rising consciousness regarding the security of food & apprehensions about the adverse impacts of synthetic crop protection chemicals are foreseen to propel market expansion. IPM (Integrated Pest Management) pheromones are deemed environmentally pleasant & easy alternatives to pesticides, underscoring their appeal. These pheromone-based pest control solutions provide sustainable and eco-friendly crop protection, especially in high-value agricultural settings such as

Commercial Greenhouse operations and large-scale field crops.

These pheromones belong to a product category used for trapping, capturing, or eliminating pests, particularly in agricultural contexts, providing a more sustainable & eco-friendly solution than traditional pesticides. Additionally, integration with

Precision Farming systems and

Agriculture Biotechnology initiatives has enhanced the adoption of IPM pheromones by enabling data-driven pest management and precision pest monitoring of crop health.

However, the acceptance of IPM pheromones in emerging agro-nations such as China, India, Thailand & Brazil remains limited compared to conventional pesticides. This limited use in such nations acts as a restraining factor for market growth. The persistent use & efficacy of chemical pesticides have contributed to their established presence, inhibiting the widespread adoption of newer techniques among farmers. Globally, governments are taking several proactive measures to educate farmers & cultivators about the benefits of integrating Integrated Pest Management pheromones into their practices.

The persistent use & efficacy of pesticides have contributed to their established presence, inhibiting the widespread adoption of newer techniques among farmers. Globally, governments are taking several proactive measures to educate farmers & cultivators about the benefits of integrating Pest Management pheromones into their practices.

Key Takeaways

- Market Size & Growth: The global integrated pest management (IPM) pheromones market is projected to reach USD 1,139.0 million in 2024, expanding at a robust CAGR of 9.0% from 2024 to 2033.

- Leading Segments: Sex pheromones dominate the product segment, while mating disruption is the leading functional application, capturing over 44% of the revenue share in 2024. Agriculture is the primary application segment driving market demand.

- Applications & Use Cases: IPM pheromones are widely applied in crop protection for monitoring, mating disruption, and mass trapping of pests. Their use enables targeted pest control, reduces reliance on chemical pesticides, preserves ecosystem balance, and supports sustainable agriculture.

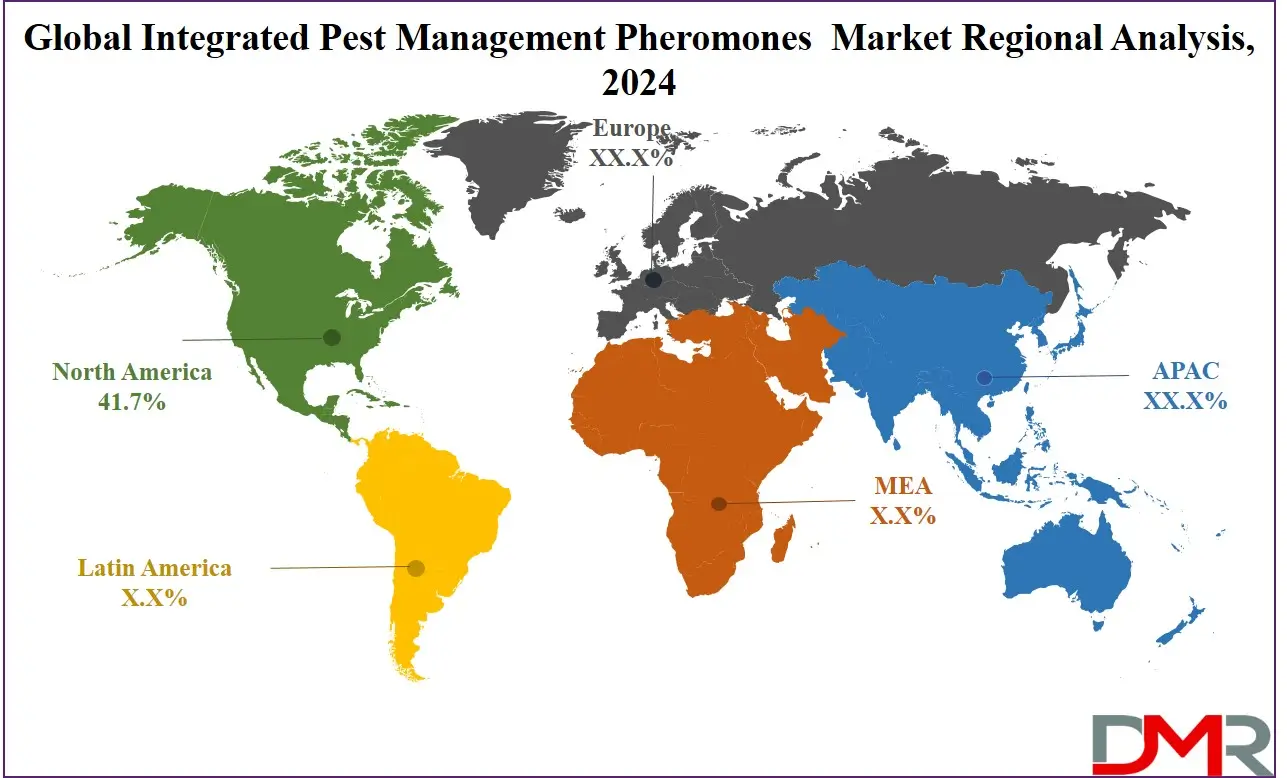

- Regional Performance: North America leads the market with a 41.7% revenue share in 2024, primarily driven by U.S. adoption of IPM technologies and government initiatives. Europe follows as the second-largest market, with high projected growth due to strict environmental regulations and increased focus on sustainable farming.

- Growth Drivers: Rising awareness of food safety, environmental concerns regarding chemical pesticides, government initiatives promoting sustainable farming, and the adoption of precision agriculture technologies are key drivers for market expansion.

Use Cases

- Targeted Pest Monitoring: IPM pheromones are used in traps to detect and monitor pest populations in crops, enabling farmers to take timely, precise action and reduce crop damage.

- Mating Disruption: Sex pheromones are applied to confound male insects, preventing successful mating and reducing the proliferation of larvae that harm crops.

- Mass Trapping of Pests: Aggregation and alarm pheromones attract large numbers of pests to traps, minimizing the use of broad-spectrum chemical pesticides and maintaining ecosystem balance.

- Sustainable Agriculture Practices: Pheromone-based IPM allows farmers to implement environmentally friendly pest management strategies, supporting organic farming initiatives and compliance with food safety regulations.

- Enhanced Crop Protection Efficiency: Integration of pheromone use with precision agriculture technologies, such as IoT-enabled monitoring, drones, and Agricultural Films And Bonding for crop protection, improves the effectiveness of pest control measures and reduces unnecessary pesticide application.

Integrated Pest Management Pheromones Market Dynamic

North America stands as the largest consumer of Integrated Pest Management pheromones, majorly driven by robust demand within the United States. The United States is actively engaged in uplifting its agriculture sector via several governmental initiatives, a move anticipated to enhance the demand for IPM pheromones.

Noteworthy among these efforts is the establishment of the Federal IPM Coordinating Committee in 2001, by the USDA (United States Department of Agriculture), acting as a hub for cross-agency guidance on integrated pest management strategies & budgets.

The inclusion of IPM technology into crop protection provides several advantages, spanning economic risk mitigation for farmers, promotion of cost-effective pest management practices, enhanced field worker safety through best practice acceptance, and less crop and land destruction. These combined factors are anticipated to elevate the demand for Integrated Pest Management pheromones for the forecast period.

However, a significant challenge arises in the proper implementation of IPM pheromones because of their targeted efficacy against specific insect species. This particular method presents limitations, as insecticide applications for specific pests often unintentionally affect non-targeted species. To expand their reach to a wider range of pests, Integrated Pest Management pheromone suppliers must allocate significant resources to R&D efforts, enabling them to accurately identify & target diverse types of pests.

Driving Factors

Driver for IPM Pheromones The global integrated pest management (IPM) pheromones market is driven by rising demands for sustainable agricultural

practices and effective pest control solutions. Rising awareness about chemical pesticides' environmental hazards has spurred adoption of eco friendly pheromone based alternatives that target specific insects instead, further driving market expansion.

Global food safety regulations limiting pesticide residues further accelerate market expansion; organic farming's increased yield crops has made IPM pheromones an ideal choice to reduce pest damage while meeting consumer demands for safe produce while complying with food safety regulations further propelling market expansion.

Trendding Factors

A major trend in IPM pheromones market is the advancement of advanced formulations such as microencapsulation and slow release technologies that ensure prolonged effectiveness with reduced application frequency. Integration of IPM practices with precision agriculture practices utilizing drone technology and IoT pest monitoring systems has significantly reshaped pest control strategies.

Trends towards customized pheromone blends targeting specific pests or regions increase efficiency while increasing market appeal. Collaborations between agricultural research institutions and private manufacturers are also fuelling innovation in pheromone delivery systems, leading to widespread adoption. Furthermore, organic produce purchases contribute further to this trend of using pheromone based solutions for improving yield.

Restraining Factors

The IPM pheromone market faces several barriers due to high initial costs and its complexity compared with conventional pesticides. Small scale farmers typically lack awareness and technical expertise regarding the benefits and application of IPM pheromones, making their adoption difficult.

Furthermore, these products often target specific pest species which makes their implementation even more complicated. Climate variations influencing pest behaviors and efficacy of pheromone products further impede market expansion. Furthermore, regulatory hurdles and lengthy approval processes for new pheromone products add costs for development that prevent smaller manufacturers from entering or expanding their portfolios in this market.

Opportunity

With increasing interest in organic farming and sustainable agricultural practices, there are vast opportunities in IPM pheromones market. Growing government initiatives and subsidies aimed at encouraging eco friendly pest control methods create an ideal setting for market expansion. Emerging economies across Asia Pacific and Africa boast vast untapped potential, thanks to their growing agricultural activities and increasing need for effective pest management solutions.

Technological advances in pheromone synthesis and delivery mechanisms, combined with increased integration into Precision Farming and Agriculture Biotechnology systems, are driving innovation. Partnerships between manufacturers and agribusinesses to educate farmers can further promote adoption, leading to long-term market expansion.

Integrated Pest Management Pheromones Market Research Scope and Analysis

By Product

The major categories of Integrated Pest Management pheromones consist of sex, aggregation, & alarm pheromones. Among these, sex pheromones show market dominance, commanding a maximum revenue share in 2024. This dominance can be accredited to their wide range of application in regulating insect populations within fields.

Well known for their effectiveness in pest management, sex pheromones play a vital role in avoiding mating disruptions & reducing the chances of larvae proliferation on crops & trees.

These sex pheromones are extracted primarily from female insects, & they serve the purpose of attracting male counterparts for mating, facilitating the larvae eggs’ deposition on the crops. Subsequently, these larvae feed on the crops, causing adverse impacts on overall yield.

By Application

In 2024, the agriculture domain asserts its dominance within the market's application segment, capturing a substantial revenue share. This prominence can be attributed to the worldwide acceptance of sustainable farming practices, Commercial Greenhouse adoption, and the enforcement of stringent regulations & policies regarding pesticide use. Proactive government initiatives in countries such as India, China, & Indonesia are effectively elevating awareness regarding the benefits of integrated pest management pheromones among farmers.

However, challenges arising from farmers' limited awareness regarding the proper usage of IPM pheromones have affected the demand of the product. Moreover, proactive initiatives by local governments, especially in developing economies such as India, China, & Indonesia, are effectively elevating awareness regarding the benefits of integrated pest management pheromones among farmers. This dedicated effort is driving the product demand in the agricultural domain.

By Function

The mating disruption takes the lead in the market, commanding a maximum revenue share exceeding 44% in 2024. This approach includes confounding male insects by utilizing artificial dispensers, causing a disruption in their mating behavior and consequently, hindering in the reproduction of pest. Sex pheromones find prevalent use in mating disruption method, significantly for their efficacy in changing the behavior of male insects that influence the development of moth.

However, it's important to note that mating disruption is a targeted pest management strategy limited to specific moth species, & its effectiveness reduces in regions with high populations of moth. The monitoring & detection domain is anticipated to expand at a notable CAGR in the forthcoming years.

This application technique is essential in the field of pest management as it serves as an initial evaluation of pest varieties and volumes in fields. Acting as an early alert system, monitoring & detection utilize data analysis from monitoring records to comprehend pest dynamics.

The Integrated Pest Management Pheromones Market Report is segmented on the basis of the following

By Product

- Sex Pheromones

- Aggregation Pheromones

- Alarm Pheromones

- Others

By Application

By Function

- Monitoring and Detection

- Mating Disruption

- Mass Trapping

- Others

Integrated Pest Management Pheromones Market Regional Analysis

The North American region is anticipated to command market leadership, capturing a

revenue share of 41.7% in 2024. This achievement can be foreseen due to the escalating demand for IPM (integrated pest management) pheromones within North America's agricultural sector. The mechanization & steady integration of systems to support businesses related to agriculture have enhanced the requirement for IPM solutions in the region.

The acceptance of advanced & better developed technologies, including integrated pest management strategies, chemical & biofertilizers, & grain elevators, is gaining popularity among farmers of North America. The necessity for efficient pest control techniques, especially to promote specialized crop cultivation, has driven the adoption of integrated pest management initiatives.

Furthermore, Europe emerges as the second-largest market, all set to experience a substantial growth with a high CAGR for the forecast period. This growth is driven by rising demand in nations such as Italy, Spain, & the United Kingdom. Government bodies in these nations firmly advancing goals for environmental quality that prioritize biodiversity, leading to strict rules & regulations against pesticide utilization.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Integrated Pest Management Pheromones Market Competitive Landscape

Prominent participants in the integrated pest management pheromones market are strategically concentrating on increased product recognition through amplified market presence, innovative solutions, diversified product portfolios, & extensive research and development endeavors.

Rising demand for food crops and a growing awareness & consciousness regarding sustainable pest management techniques are projected to be the driving forces for market expansion. Remarkable key market players like Active IPM, & Russell IPM, are actively engaged in these efforts.

Several companies are dedicatedly pursuing governmental approvals to validate their product applications. Regulatory policies play a pivotal role in market competitiveness. Industry contenders are making substantial investments in novel product enhancements & advancements aimed at tapping into new regions and enhancing their offerings.

Some of the prominent players in the Global Integrated Pest Management Pheromones Market are

- Active IPM

- Hercon Environmental

- AGRICHEM, S.A.

- ATGC Biotech Pvt. Ltd.

- Russell IPM Ltd.

- Sumi Agro France

- SemiosBio Technologies Inc.

- Shin-Etsu Chemical Co., Ltd.

- Syngenta Bioline Ltd.

- BASF SE

- Ecolab Inc.

- Sumitomo Corporation

- Isagro

- Other Key Players

Recent Development

- In May 2023, one of the major player in bio pesticides industry Bioworks Inc. was offered an acquisition by Biobest Group NV for their bio pesticides market expansion and manufacturing capabilities in North America.

- In January 2023, Linderso AB was acquired by Koppert Biological Systems that would make the company able to its market presence and strength in the Scandinavian market.

- In February 2022, Wonderful Company LLC’s subsidiary Suterra LLC launched its new product that will monitoring lure for pear, apple and walnut pests. This product will be effective on the codling moth that target fruit crops.

- In August 2022, yo expand their market Bio partner was acquired by Biobest as they bought 60% stake of bio partner.

Integrated Pest Management Pheromones Market Report Details

| Report Characteristics |

| Market Size (2023) |

USD 1,319.0 Mn |

| Forecast Value (2032) |

USD 2,480.7 Mn |

| CAGR (2023-2032) |

9.0% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Sex Pheromones, Aggregation Pheromones, Alarm Pheromones, and Others), By Application (Agriculture, and Others), and By Function (Monitoring and Detection, Mating Disruption, Mass Trapping, and Others). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Active IPM, Hercon Environmental, AGRICHEM, S.A., ATGC Biotech Pvt. Ltd., Russell IPM Ltd., Sumi Agro France, SemiosBio Technologies Inc., Shin-Etsu Chemical Co., Ltd., Syngenta Bioline Ltd., BASF SE, Ecolab Inc., Sumitomo Corporation, Isagro, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Market size for Integrated Pest Management (IPM) Pheromones is expected to reach a

valuation of USD 1,139.0 million in 2024.

The Global Integrated Pest Management Pheromones Market is expected to grow with a compound

annual growth rate (CAGR) of 9.0% from 2024 to 2033.

The North American region is expected to commands market leadership, capturing a revenue share of

41.7% in 2024.

Some of the prominent players in the Global Integrated Pest Management Pheromones Market include

Active IPM, Hercon Environmental, AGRICHEM, S.A., ATGC Biotech Pvt. Ltd., Russell IPM Ltd., Sumi Agro

France, SemiosBio Technologies Inc., Shin-Etsu Chemical Co., Ltd., Syngenta Bioline Ltd., BASF SE, Ecolab

Inc., Sumitomo Corporation, etc.