Market Overview

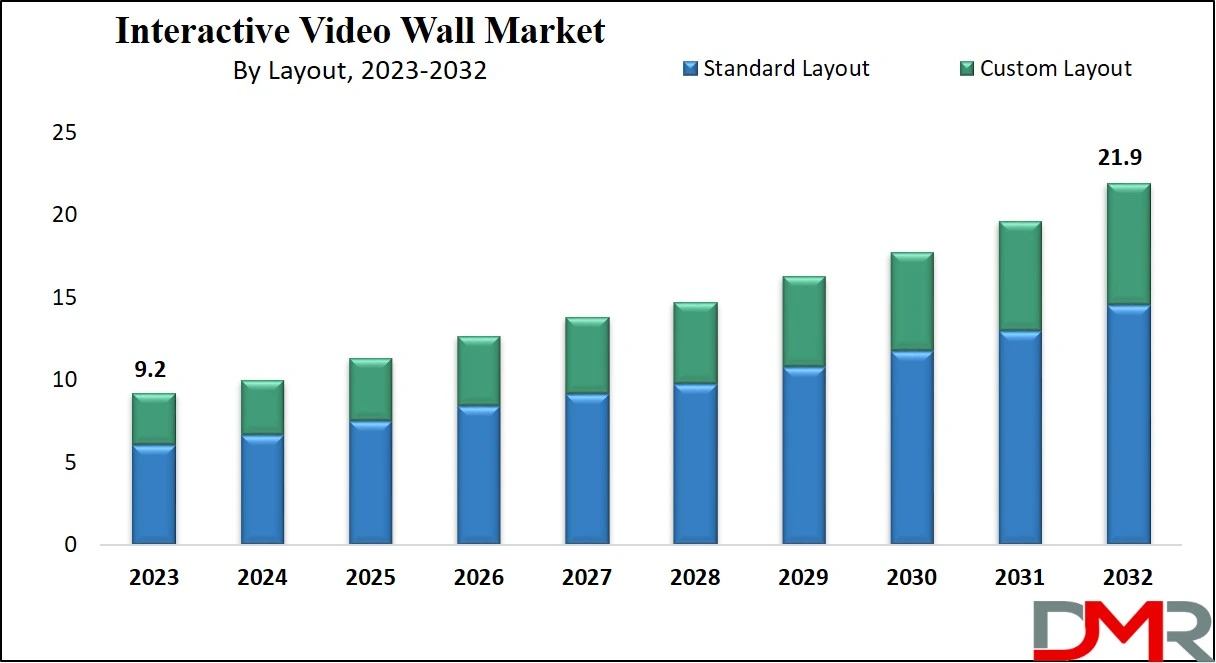

The Global Interactive Video Wall Market is expected to reach a value of USD 9.2 billion in 2023, and it is further anticipated to reach a market value of USD 21.9 billion by 2032 at a CAGR of 10.2%. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

Interactive video walls are a compelling way to showcase messages or information in a larger-than-life manner. By merging multiple displays, these walls bring a striking presentation that captivates viewers.

Unlike traditional video walls, interactive video wall technology goes a step further, providing engaging & practical interactive displays to the audience. With touchscreen video walls, one brings the viewers greater control over the content they interact with, enhancing their experience.

The Global Interactive Video Wall Market is experiencing unprecedented growth due to advancements in display technologies. Interactive video walls that incorporate high-definition displays and touch interactivity have quickly become popular in sectors such as retail, education and entertainment, helping businesses engage customers with dynamic content while improving user experiences.

Recent events have shed light on the increasingly prevalent use of AI-powered content management systems for video walls. This technology enables automated real-time updates of displays with relevant and engaging material to ensure they always remain up-to-date and relevant.

Furthermore, video walls are being deployed in smart cities and command centers where large-scale real-time data visualization is key for decision-making and public information dissemination.

Interactive video wall markets are expanding, especially in emerging regions. Retailers and businesses are adopting video walls as a tool to increase customer interaction and brand visibility; educational institutions use video walls for collaborative learning purposes; as demand for immersive and impactful visual experiences increase, so will this sector of growth, with opportunities present across sectors like hospitality, healthcare and corporate environments.

As per The global video walls market, valued at approximately 14 billion U.S. dollars, is projected to reach this figure by 2027. In 2017, the market size was significantly lower, indicating a steady growth trend over the coming decade. This surge highlights the increasing demand and adoption of video wall technology across various industries worldwide.

Key Takeaways

- Market Growth: The interactive video wall market is projected to grow from USD 9.2 billion in 2023 to USD 21.9 billion by 2032, registering a CAGR of 10.2% over the period.

- Key Application Sectors: Leading adoption comes from retail, education, and entertainment sectors, with expanding opportunities in hospitality, healthcare, smart cities, and corporate environments due to demand for dynamic, engaging visual experiences.

- Technology Advancements: Recent innovations include high-definition touch displays and AI-powered content management systems, enabling real-time updates and greatly enhancing user interaction and relevance.

- Display Type Trends: LED displays, especially curved LED video walls, dominate the market owing to their brightness, energy efficiency, and lightweight build, with growing use in outdoor events and corporate functions.

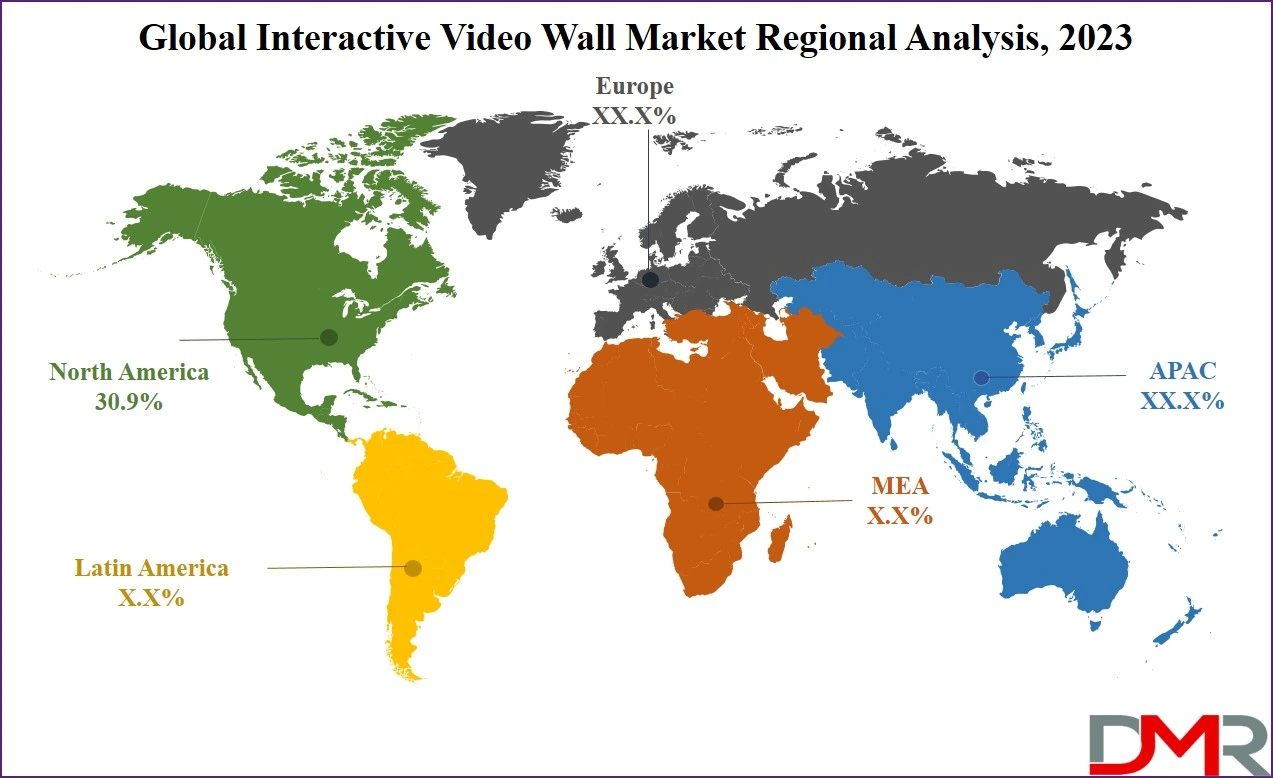

- Regional Leadership: North America captures the largest market share (30.9% in 2023), driven by rapid adoption in commercial facilities and early interest in touch technology, with notable growth expected across Europe and Asia Pacific.

- Cost Consideration: High initial investments for hardware and installation pose a challenge, particularly for smaller businesses, with factors like size, resolution, and customization impacting up-front costs.

- Competitive Strategies: Major players are advancing via new product launches, R&D, partnerships, and acquisitions, as seen with SHARP and VuWall expanding their footprint through strategic acquisitions in 2024-2025.

Use Cases

- Retail Experience Enhancement: Interactive video walls allow customers to browse product offerings, check stock, and explore in-store promotions, making shopping more engaging and personalized.

- Collaborative Learning Spaces: In educational institutions, these walls enable collaborative learning and interactive presentations for students, supporting deeper engagement and improved outcomes.

- Smart City Command Centers: Video walls are deployed in command centers to visualize real-time city data, aiding swift decision-making and efficient public information dissemination.

- Transport Hubs Advertising: Airports and railway stations use interactive video walls for dynamic advertising and timely traveler information, improving experience and operational efficiency.

- Museum Immersive Exhibits: Museums leverage video walls for immersive, interactive exhibits, letting visitors explore information at their own pace and increasing engagement.

- Outdoor Event Displays: Curved LED video walls used at product launches, sports events, and concerts capture attention and enhance audience entertainment with large-scale, vivid visuals.

Market Dynamic

Major transportation hubs such as airports, railways, & bus stations broadly adopting video walls as a major digital technology. Interactive ads through video walls prove more time-efficient and informative than traditional advertising, meeting travelers' growing demand for relevant digital content and information.

The growth in the adoption of touchscreen technology eases the use of digital devices, saving time. With the growth in the availability of touch-sensitive devices, market growth is further driven by the growing popularity of these user-friendly gadgets among consumers.

However, setting up video walls can be a huge investment for businesses, especially smaller ones, due to the high initial hardware and installation costs. The cost of an interactive video wall differs based on factors like its size, customization, resolution, interactive capabilities, and unique project requirements. These elements collectively contribute to the initial investment needed to restrain the growth of the interactive video wall.

Research Scope and Analysis

By Layout

Players in the interactive video wall market offer a range of products tailored to different display layouts. The standard layout comprises landscape & portrait interactive video walls, mainly found in settings like museums, trade shows, education, & hospitality.

They also serve as menu boards in restaurants, displaying, menus, pricing, and wait times. The growth in need for high-resolution multi-touch displays, particularly in conference rooms & retail spaces, fuels the popularity of landscape & portrait touch video walls while maintaining their lead in 2023.

On the other side, interactive video walls with custom layouts are expected to experience high growth. These walls offer flexibility, enabling users to switch between layouts as needed & providing strong preview options for the desired view. They are mostly utilized in corporate environments, museums, & the healthcare sector, where the advantages of custom layout touch video walls enhance the overall customer experience.

By Display

The display segment of the market has been categorized into LED, LCD, and more. In 2023, the LED segment captured the largest market share, signifying its dominant position in the industry. As the curved LED interactive video walls are now creating new opportunities for every participant in the value chain.

These curved displays are finding demand in applications in various outdoor events, including product launches, political gatherings, sports competitions, & music concerts, where they change conventional widescreen displays to captivate and entertain the audience.

Further, in recent years, the utilization of interactive video walls has become more prevalent in corporate events, which can be attributed to factors like enhanced brightness, energy efficiency, & the lightweight nature of LED displays, making them easier to transport. These qualities are anticipated to continue driving the need for LED display technology further driving the global interactive video wall market.

By End User

The retail sector has the largest market share of the market in 2023, presenting a significant opportunity for businesses along the value chain, which is driven by the growth in various commercial spaces, like malls & shopping complexes, where interactive video walls are making their mark.

In retail settings, touch video walls enable customers to explore a store's product offerings & check stock availability at specific locations. Technological advancements, like the latest introduction of LED interactive video walls with better picture quality & almost bezel-less displays, have further boosted their adoption in the retail segment.

Also, interactive video walls find their uses in different sectors, including museums, and hospitality, among others, where the museum segment is expected to have significant growth in the coming future, mainly owing to the benefits they provide in terms of simple installation & immersive experiences.

These walls enable museum visitors to take control of their learning, utilizing interactive technology to explore deeper into their areas of interest. Moreover, they revolutionize the museum experience by covering several walls in an exhibition room with multiple displays, transforming the space into a captivating environment that enhances the visitor's overall experience.

The Interactive Video Wall Market Report is segmented based on the following

By Layout

- Custom Layout

- Standard Layout

By Display

By End User

- Retail

- Museum

- Corporate

- Healthcare

- Hospitality

- Others

Interactive Video Wall Market: Regional Analysis

North America stands as the leader in the interactive display market, claiming the biggest market share at 30.9% in 2023, which is a result of the growing adaptation of interactive technologies in commercial facilities across the region. Currently, the United States drives the growth of the market in North America, particularly in the adaptation of touch video walls within corporate, government, & retail sectors, due to their early interest in interactive display tech. Also, North America is also home to a number of touch display manufacturers & solution providers.

Following North America, Europe also contributes highly towards the revenue in 2023. The growth in this region is driven by a growing need for portrait, landscape, & 3D installation video walls. Moreover, Asia Pacific is anticipated to deliver high growth opportunities in the coming years, owing to increased investments geared toward enhancing digital classrooms.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global interactive video wall market experiences moderate competition owing to the presence of many key players. To grow in this competitive landscape, companies depend on strategies like introducing new products, investing significantly in R&D forming partnerships, & making acquisitions. These tactics are crucial for these companies to maintain their presence & stay competitive in the global market.

In September 2022, Samsung introduced the Wall All-In-One, designed specifically for corporate office environments & available in 110-inch 7 146-inch sizes. Also, its user-friendly installation process is innovative, featuring a pre-adjusted seam & a 'Pre-Assembled Frame Kit,' making it exceptionally convenient for setting up in office spaces.

Some of the prominent players in the global Interactive Video Wall Market are:

- Planar System

- Daktronics

- Datapath

- EIZO Corp

- NEC Display Solutions

- LG Electronics

- Eyevis

- Samsung Electronics

- Barco

- Sony Corp

- Other Key Players

Recent Development

- In February 2025, SHARP expanded its operations by acquiring the Display Business of NEC India, aiming to enhance its market presence and technological capabilities in the region.

- In January 2025, VuWall, renowned for its video wall control and visualization solutions, was acquired by Naxicap Partners, marking a significant step in VuWall's strategy to expand its global footprint and innovate its offerings.

- In October 2024, UVS introduced a new generation of Lucidity video wall controllers and software, designed to deliver enhanced performance and user experience, setting a new standard in video wall technology.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 9.2 Bn |

| Forecast Value (2032) |

USD 21.9 Bn |

| CAGR (2023–2032) |

10.2% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Layout (Custom Layout and Standard Layout), By Display (LED, LCD, and Others), By End User (Retail, Museum, Corporate, Healthcare, Hospitality, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Planar System, Daktronics, Datapath, EIZO Corp, NEC Display Solutions, LG Electronics, Eyevis, Samsung Electronics, Barco, Sony Corp, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Interactive Video Wall Market size is estimated to have a value of USD 9.2 billion in 2023 and

is expected to reach USD 21.9 billion by the end of 2032.

North America dominates the Global Interactive Video Wall Market with a share of 30.9% in 2023.

Some of the key players in the Global Interactive Video Wall Market are Planar System, Datapath, Sony

Corp, and many others.

The market is growing at a CAGR of 10.2 percent over the forecasted period.