An Interactive Whiteboard (IWB) is a large touch-sensitive display connected to a computer & projected using projectors. IWBs contain several technologies like ultrasonic, touch, resistive, or electromagnetic pens.

They find applications in classrooms, training rooms, and more, allowing control via stylus, pen, or fingers. Originally developed for business, IWBs often aren't fully used & can function merely as advanced blackboards in classrooms & business settings.

The Global Interactive Video Wall Market is experiencing unprecedented growth, thanks to advances in display technologies. Interactive video walls featuring HD displays and touch interactivity have gained increasing interest across retail, education, and entertainment sectors, helping businesses engage customers with dynamic content while improving user experiences.

As per clarus Interactive whiteboards have gained significant traction over the past decade, becoming an essential tool for educators. After undergoing research and testing, they offer a range of features that enhance teaching. In 2004, 26% of primary schools in the UK had interactive whiteboards, with 73% of schools now equipped with at least one.

In the U.S., 557,000 interactive whiteboards were shipped in 2008, reflecting a 32% increase from the previous year. With over two million units installed globally, the demand continues to grow, and projections indicate that by the end of 2013, one in five classrooms will have an interactive whiteboard.rd companies foresee the one out of every five classrooms will have an interactive whiteboard by the end of 2013.

Recent events have demonstrated the increasing trend toward artificial intelligence-powered content management systems being utilized in video walls. This technology allows real-time updates with engaging, timely information; video walls are becoming an integral component of smart cities and command centers where large-scale real-time data visualization is crucial for decision-making and public information dissemination.

Opportunities in the interactive video wall market are expanding, particularly in emerging economies. Retailers and businesses are rapidly adopting video walls as part of customer interactions and brand visibility strategies, while educational institutions use interactive video walls for collaborative learning purposes. With demand rising for immersive visual experiences in hospitality, healthcare and corporate settings - interactive video walls appear set for further growth!

Key Takeaways

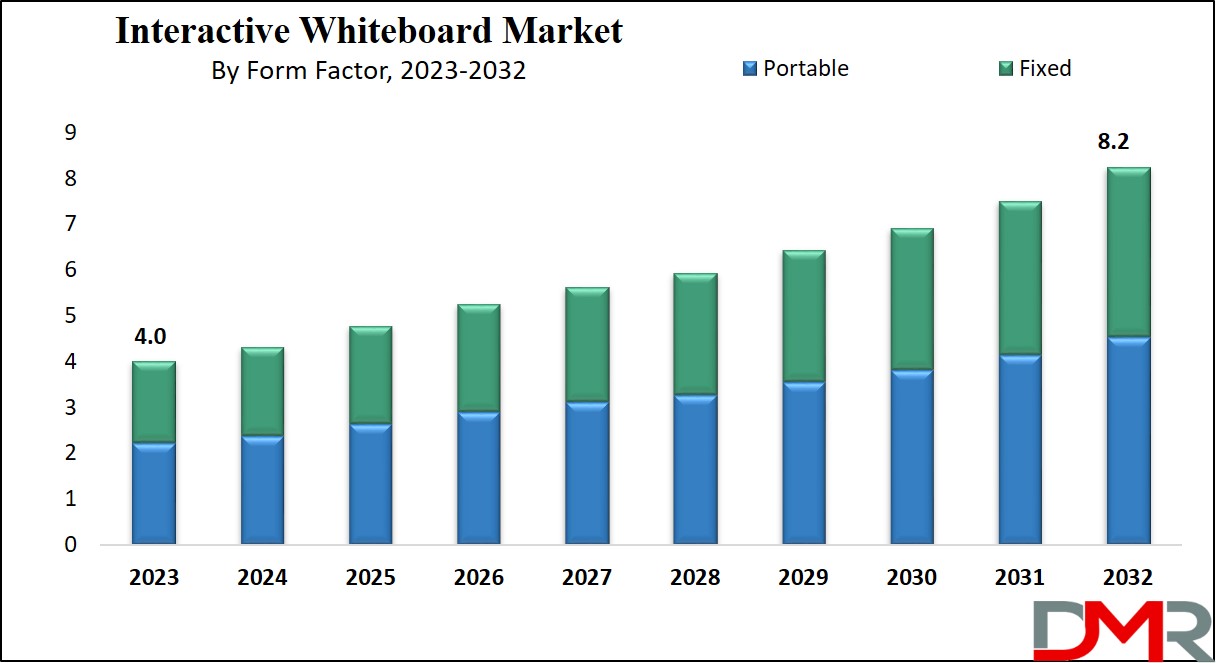

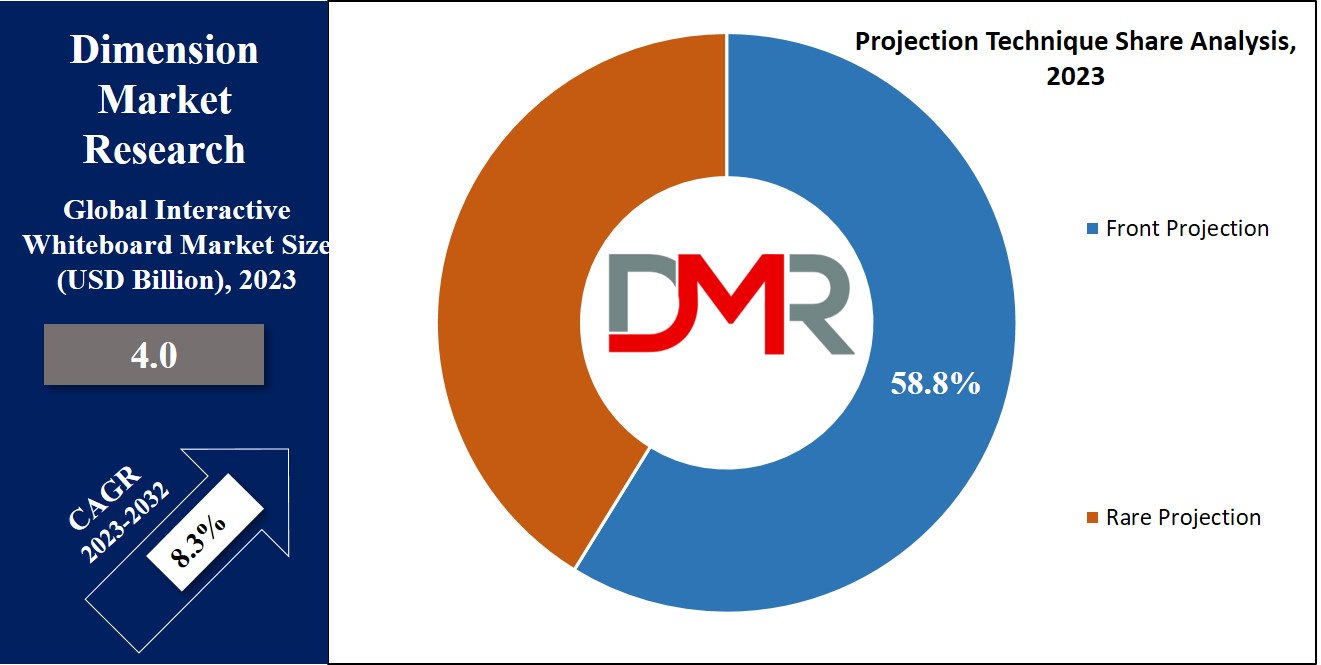

- Market Growth: The global interactive whiteboard market is projected to double from USD 4.0 billion in 2023 to USD 8.2 billion by 2032, at a CAGR of 8.3%.

- Technology Trends: Resistive membrane and infrared technologies lead due to their intuitive touch features and cost-effective, durable design, meeting user demand for ease and reliability.

- Form Factor Shift: Portable whiteboards see strong adoption from BYOD policies and classroom upgrades, while fixed boards offer high image quality and responsive touch for permanent setups.

- Projection Advances: Front projection dominates for immersive classroom experiences; rear projection is emerging to address presenter's shadow issues, despite higher cost and larger size.

- Education Dominance: The educational sector drives market growth as interactive whiteboards provide personalized visual learning, flexible feedback, and remote teaching capabilities.

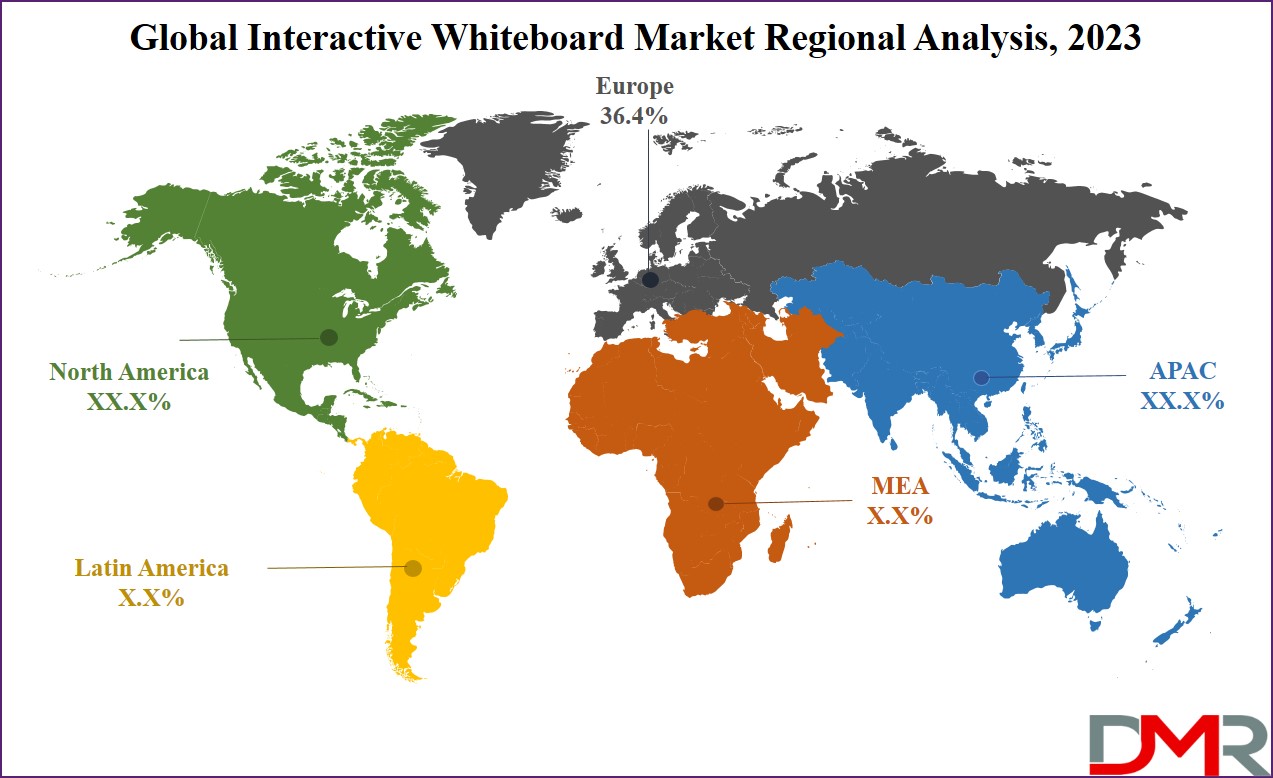

- Regional Insights: Europe holds a 36.4% market share in 2023 due to widespread remote working and online education; Asia Pacific is the fastest-growing region, driven by rising e-learning and student information systems.

- Competitive Strategies: Leading companies focus on R&D, product innovation, and strategic partnerships, such as Newline Interactive’s alliance with Google for smart board tech in education.

Use Cases

- Classroom Engagement: Interactive whiteboards enable teachers to deliver dynamic visual content, boosting student participation and supporting personalized lesson plans in schools and colleges.

- Remote Collaboration: Businesses use IWBs for virtual meetings, allowing remote teams to share screens, annotate documents, and save digital notes for future reference.

- Corporate Training: Facilitators leverage IWBs to design interactive presentations, streamline product development sessions, and enhance employee skills with hands-on demonstrations.

- Smart City Command: Municipalities deploy AI-driven video walls for real-time data visualization, supporting decision-making for public safety and information dissemination.

- Retail Interaction: Stores utilize video walls and IWBs with dynamic touch displays to engage customers, improve brand visibility, and provide immersive product presentations.

- Healthcare Visualization: Hospitals adopt IWBs for collaborative diagnosis, image sharing, and patient education, enhancing care coordination and treatment planning.

Market Dynamic

The global Interactive Whiteboard (IWB) Market is experiencing significant growth due to the rise in the adoption of virtual learning courses & e-learning. Universities and schools are prioritizing enhanced learning experiences, driving the demand for interactive whiteboards.

An important driver is the cost-saving feature of IWBs, as they become more economical than providing individual laptops or setting up dedicated IT rooms. Additionally, the growth of gamification in education, along with government funding for IWB integration across different sectors, contributes to market growth.

However, the high initial investment & limited awareness about interactive whiteboards become key challenges to market expansion. Furthermore, the competition from interactive flat panels & the widespread use of smartphones & tablets presents significant hurdles for the growth of the Interactive Whiteboard (IWB) Market.

Research Scope and Analysis

By Technology

The resistive membrane technology claims a significant share of the market in 2023. Resistive membrane-based interactive whiteboards provide intuitive touch-based interactions, enabling users to operate them with ease using a stylus or their fingers.

When a finger is pressed on the surface, it functions as a left mouse click, making this smart board technology user-friendly & natural. Furthermore, their affordability is expected to drive the demand for interactive whiteboards equipped with resistive technology in the coming years.

In addition, the infrared segment is expected to expand in the forecast period. Infrared-based interactive whiteboards are known for their accessibility & durability in comparison to other technology-based alternatives like resistive or capacitive membrane IWBs.

These boards deliver multi-touch functionality & find a number of uses in boardrooms, corporate training rooms, and classrooms. The growth in demand & positive reception of this IWB type is expected to drive the segment's growth in the forecasted period.

By Form Factor

In terms of form factor, the market has been characterized into two, portable & fixed. Further, the portable form factor holds a substantial market share in 2023, driven by growth in corporate adoption of BYOD (Bring Your Own Device) policies, government initiatives to upgrade classrooms, & increase in public awareness of tech-enhanced education benefits.

Portable interactive whiteboards are ideal for on-the-go presentations during business trips, needing no external assistance, & supporting multi-touch functionality. These advantages have led to their growth in popularity among consumers, resulting in significant market growth expectations.

Furthermore, the fixed form factor is predicted to have substantial growth in the coming years, which is attributed to features like high resolution for excellent image quality, low latency, and accurate & responsive interactivity.

Fixed interactive whiteboards are user-friendly, having standard aspect ratios compatible with most computer setups & projectors. Their sturdy design, enhanced finger-touch capabilities, & compatibility with existing equipment without developments are expected to drive the need for fixed interactive whiteboards in the coming future.

By Projection Technique

Based on the projection technique, the market is divided into two, front projection & rear projection. In 2023, the front projection segment dominates the market. Front projection interactive whiteboards consist of video projectors & provide students with an immersive learning experience with a broad range of materials like charts, high-resolution videos, diagrams, & maps displayed live on a large screen, which engages students via appealing audio-visual content & equips teachers with different

digital resources & internet connectivity to improve the teaching process.

Further, the rear projection segment is anticipated to experience significant growth during the forecast period, which addresses a major issue with front-projection IWBs by detecting & removing the shadow cast by the presenter near the interactive whiteboard. While this is an advantage, rear-projection interactive whiteboards are generally more expensive & larger in size, which can make installation more challenging compared to the front-projection.

By Application

The educational sector commands the largest market share of the growth of the market in 2023 due to the large adoption of interactive whiteboards in schools & colleges. These tools empower educators to build custom learning materials from existing content, providing students with a dynamic visual learning experience.

The flexibility they provide allows students to learn at their own pace and from any place is a key factor in the sector's growth. In addition, the ability to provide personalized feedback & customized learning resources plays a major role in improving student success, further driving the use of interactive whiteboards in education.

Moreover, the growth in the corporate sector is expected to be significant in the coming years. Interactive whiteboards (IWBs) are gaining popularity in corporate settings, helping professionals in planning & designing essential processes like product development during meetings. IWBs are currently linked to business networks, enabling remote users to see the screen & save digital content directly to a server for future reference, which eliminates the need for taking pictures or physical notes.

The Interactive Whiteboard Market Report is segmented on the basis of the following:

By Technology

- Resistive Membrane

- Infrared

- Electromagnetic Pen

- Capacitive

- Others

By Form Factor

By Projection Technique

- Rear Projection

- Front Projection

By Application

- Commercial

- Corporate

- Educational

- Others

Regional Analysis

Europe maintains a significant hold on the market, contributing a substantial

revenue share of 36.4% in 2023, which can be attributed to the growth in the adaptation of remote work & online education by a wide range of organizations and institutions. The rise in the availability of different cloud network options & the increase in the importance of ensuring uninterrupted business operations have driven this trend in recent times.

Moreover, the Asia Pacific region is anticipated to be the fastest-growing area throughout the forecasted period, which is fueled by the increase in the usage of student information systems & e-learning solutions in the region. These technologies have steadily made their way into lower-tier universities, middle schools, & high schools over the past decade, building a favorable environment for the growth of the regional market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The players in the market are actively investing in R&D efforts aimed at expanding their growth & refining their internal operations. Further companies are noticeably pursuing mergers, acquisitions, & partnerships to elevate their product offerings and gain a competitive edge. In addition, they are also focused on creating & building new products & enhancing existing ones to attract new customers & expand their market presence.

Like, in January 2023, Newline Interactive introduced a strategic alliance with Google as part of the Education Partner Program. This partnership's focus is to offer smart board technology, equipping educators with the necessary tools & services to effectively conduct teaching sessions, whether in remote, hybrid, or in-person settings.

Some of the prominent players in the global Interactive Whiteboard Market are

- BenQ Corp

- Cisco Systems

- Samsung

- Microsoft Corp

- Panasonic Corp

- Google LLC

- Boxlight Corp

- Hitachi Ltd

- Computek International

- Ricoh

- Other Key Players

Recent Developments

- In January 2025, Samsung unveiled its new AI-powered Interactive Display (WAFX-P model) at Bett 2025, Europe’s largest education technology event.

- In February 2025, SMART Technologies launched the SMART Board Mini interactive podium, the SMART Board M Pro High Secure Series, and the SMART OneLaunch meeting tool at ISE 2025.

- In August 2025, Newline Interactive achieved the #1 market share for interactive display products in the U.S., reaching 23.7% for Q2 and the first half of the year.

- In May 2024, SHARP Business Systems (India) launched new Interactive Whiteboard models (PN-LC752 and PN-LC862), expanding their technology product lineup.

- In September 2024, SMART Technologies released the SMART Board MX Series and SMART Board GX Series interactive displays in Delhi, expanding their global presence.

- In March 2024, CG Brand, a top electronics provider in Nepal, launched a new Interactive Whiteboard targeting education, corporate, and healthcare sectors.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 4.0 Bn |

| Forecast Value (2032) |

USD 8.2 Bn |

| CAGR (2023–2032) |

8.3% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology (Resistive Membrane, Infrared, Electromagnetic Pen, Capacitive, and Others), By Form Factor (Fixed and Portable), By Projection Technique (Rear Projection and Front Projection), By Application (Commercial, Corporate, Educational, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BenQ Corp, Cisco System, Samsung, Microsoft Corp, Panasonic Corp, Google LLC, Boxlight Corp, Hitachi Ltd, Computek International, Ricoh, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |