Market Overview

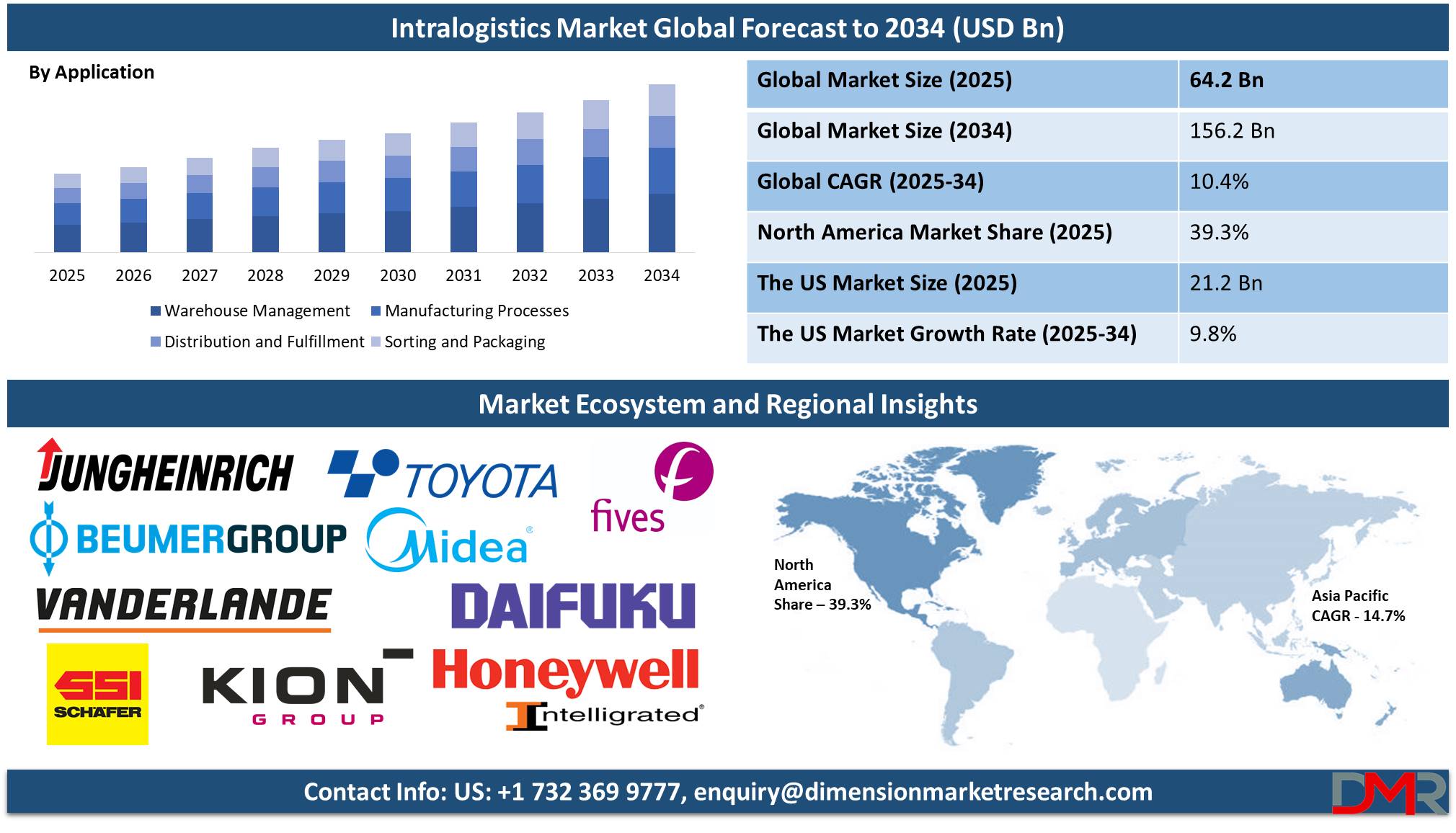

The Global Intralogistics Market is projected to be valued at USD 64.2 billion by the end of 2025 and is further expected to reach a market value of USD 156.2 billion in 2034 at a CAGR of 10.4%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

With fast-emerging e-commerce, advanced automation, and globalization, the intralogistics market has rapidly emerged as the cornerstone for efficient supply chain operations. It has grown exponentially, driven by increased complexity in logistics operations and rising demand for productivity enhancement in warehouses, manufacturing facilities, and distribution centers. During this quest for operational efficiency, technologies like automated guided vehicles, warehouse management systems, and robotic picking systems have become quite indispensable. Strongly propelling this growth in the market is the strong emphasis on enabling a reduction in operational costs and errors in logistics workflows. Intralogistics solutions are being invested in by businesses in order to stay competitive due to the increasing volumes of trade happening globally.

In particular, the integration of Artificial Intelligence and the Internet of Things into intralogistics provides an enabling ground for real-time data collection, predictive analytics, and therefore informed decision-making for agile and responsive supply chains. Cloud-based logistics solutions further enhance the scalability and flexibility of small and medium-sized enterprises. In emerging economies, increasing demand for effective logistics operations arising from expanding manufacturing and retail sectors presents untapped opportunities. Likewise, the introduction of electric and autonomous vehicles into intralogistics opens up innovation and growth opportunities with a view to global sustainability.

Despite the towering potential of any intralogistics market, there remain a couple of drawbacks that such a market faces. Higher initial investments in deploying advanced automated systems keep many firms, particularly small and medium enterprises, away from joining business ventures in this industry segment. Apart from this, every sophisticated logistics technology requires a dearth of talented personnel in several aspects regarding its operational and maintenance duty. This keeps the need for an increased sense of updates and therefore integration with any legacy systems; it does extend the operational complexity of the solutions sometimes. Besides, data security and privacy issues of cloud-based logistics solutions restrain wide adoption.

Growth prospects for the global intralogistics market remain very optimistic. Increasing investment in smart warehouses, rising omnichannel retail, and integration of 5G networks are likely to further drive market demand. AR and blockchain are some of the emerging technologies that will shape the future of intralogistics by bringing more transparency and accuracy to operations. The market is also likely to benefit from strategic collaborations and partnerships with industry players for the delivery of end-to-end logistics solutions. Growing sustainability concerns will drive the market toward developing energy-efficient systems and using eco-friendly materials.

The US Intralogistics Market

The U.S. Intralogistics Market continues to be a global leader and is projected to reach USD 21.2 billion in 2025 at a compound annual growth rate of 9.8% over its forecast period.

Intralogistics is considered one of the fastest-growing market segments in the U.S., which is underpinning its rapid growth due to rapid growth in automation and the heavy development of the country's e-commerce industry. These factors constitute almost half of the total retail sales. Thus, such an unprecedented growth trajectory triggers demanding actions for an appropriate supply chain; therefore, new innovative technologies like automatic guided vehicles, warehouse management systems, and robotics pickers are immensely deployed. These innovations target the most critical needs of the industry, such as speed, accuracy, and cost efficiency, placing the United States in the leading position concerning modernization in logistics. One big plus for the U.S. is its demography, with an extensive labor pool skilled in both technology development and application.

This demography contributes to the ease of adoption and seamless maintenance of the latest intralogistics solutions. In addition, this is a highly competitive market with giant intralogistics players such as Honeywell Intelligrated and Dematic, further encouraging continuous innovation and strategic partnerships. The U.S. also gains advantages from a strong, extensive structure of transport infrastructure; high-quality ports, a system of rails, and highways can become an efficient way of integration in intralogistics systems, therefore assuring efficient operations. Growing environmental concerns are seen to increasingly apply energy-efficient solutions, like green sorting technologies or monitoring tools enabled by the use of the Internet of Things, thus answering ecological objectives and the needs of industry.

This focus on sustainability not only enhances operational efficiency but also means long-term growth and compliance with changing regulations. From technological advances to skilled labor, robust infrastructure, and active approaches to sustainability, it solidifies the U.S.'s position as a driver of innovation and growth in the intralogistics market globally.

Key Takeaways

- Global Market Value: The Global Intralogistics Market size is estimated to have a value of USD 64.2 billion in 2025 and is expected to reach USD 156.2 billion by the end of 2034.

- The US Market Value: The US Intralogistics Market is projected to be valued at USD 21.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 49.1 billion in 2034 at a CAGR of 9.8%.

- Regional Analysis: North America is expected to have the largest market share in the Global Intralogistics Market with a share of about 39.3% in 2025.

- Key Players: Some of the major key players in the Global Intralogistics Market are KION Group, Jungheinrich AG, Swisslog Holding AG, Daifuku Co. Ltd., Honeywell Intelligrated, Midea Group, Toyota Industries Corporation, and many others.

- Global Growth Rate: The market is growing at a CAGR of 10.4 percent over the forecasted period.

Use Cases

- Warehouse Automation: Advanced robotics systems that automate order picking and packaging not only reduce labor costs but also make the processes more accurate in high-demand warehouse environments, thereby having orders processed faster and without errors.

- Smart Distribution Centers: IoT-enabled intralogistics systems guarantee the best possible inventory tracking and real-time order management, which increases operational efficiency and improves delivery timelines to meet customer expectations.

- Manufacturing Optimization: Automation of conveyor lines and the provision of AGVs improve the flow of material, reduce downtimes, and facilitate just-in-time production, thereby optimizing manufacturing efficiency and timely delivery of components.

- Retail E-commerce Fulfillment: AI-driven solutions speed up sorting and packing processes to keep up with the high-volume demands of online retail order fulfillment, improving the speed and accuracy at which items get shipped.

Market Dynamic

Driving Factors

E-commerce Expansion

The rapidly growing e-commerce industry has emerged as one of the major growth drivers for the intralogistics market. As online shopping is becoming the new norm, companies are facing unprecedented pressure to process volumes of orders quickly and accurately. Companies can process orders more quickly and at a lower cost with automated solutions such as robotic sorting systems and warehouse management software. Therefore, the demand for fast shipment options such as same-day or next-day delivery will continue to raise the already high bar for intralogistics advanced systems. Further supported by recent predictions that put e-commerce sales above USD 7.0 trillion by the year 2025, for example, there is enormous potential for intralogistics providers to realize this growing demand.

Industry 4.0 Adoption

Industry 4.0 rose to revolutionize supply chain management by introducing digital twins, predictive analytics, and smart sensors. Intralogistics systems with Industry 4.0 capabilities enhance visibility across the supply chain, reduce downtime through predictive maintenance, and improve overall operational efficiency. Digital twins, for example, let companies simulate warehouse operations and then find inefficiencies to optimize workflows. These value-creating networks for cyber-physical systems interact with human operators and machines more smoothly and functionally in one ecosystem. Many governments are also encouraging investments in smart manufacturing, which is further contributing to the growth in the intralogistics market and encouraging the adoption of Industry 4.0.

Restraints

High Initial Investment Costs

Advanced intralogistics solutions are very capital-intensive. Automation technologies involve a huge up-front investment in areas like robotics, AGVs, and sophisticated software solutions, which in turn makes it difficult for SMEs to afford the solutions. Not only this, the recurring expenses like maintenance, training, and upgrading of a system continuously enhance the cost aspect. For many firms, the integration of new technologies often becomes difficult to digest with their traditional structure; this leads to disruption and further costs. In many cases, despite a generally high return on investment in these systems, the high investment cost stands as a barrier to wider penetration, especially within cost-sensitive markets or industries.

Lack of Skilled Workforce

Intralogistics solutions rely on highly trained manpower that can deal with sophisticated systems operating the equipment. But, generally worldwide, professionals skilled in robotics, AI, and logistics software are scarce. Under such circumstances, where the proper availability of qualified labor is low, companies would find it rather impossible to introduce automation since one can't acquire people to maintain the technologies. Training programs and upskilling initiatives can help bridge this gap, but they require time and resources. In emerging markets, this is particularly hard due to a lack of access to sophisticated education and training infrastructures. A shortage of skilled labor inhibits the complete penetration of intralogistics solutions and, in turn, slows down the market growth.

Opportunities

Emerging Markets in Asia-Pacific and Latin America

Emerging economies like India, China, Brazil, and Mexico also offer tremendous growth opportunities for the intralogistics market. Rapid industrialization and urbanization in these regions result in higher demand for good logistics and warehouse management solutions. Growing e-commerce in the regions, along with an increase in the middle-class population, has raised demand for faster and more reliable delivery services. Infrastructural development initiatives by governments in these regions also try to derive logistics operations. For example, India's "Make in India" initiative has spurred investments in manufacturing and logistics. Companies that enter these markets can take advantage of the low competition levels and high demand for automation to establish their leadership positions in the growth economies.

Integration of Artificial Intelligence and Blockchain

The integration of AI with blockchain technology can bring a revolutionary change to the intralogistics market. The AI-powered systems enable real-time analytics, demand forecasting, and route optimization, greatly improving the efficiency and accuracy of logistics operations. Blockchain technology builds an immutable ledger of transactions; thus, transparency and security are ensured in industries such as food, pharmaceuticals, and electronics.

All these put together facilitate frictionless collaboration in a supply chain and help to establish a degree of trust among different stakeholders. The companies that move on to the adoption of AI and blockchain raise the bar for the service offering a competitive advantage to secure customers who give importance to operational transparency and efficiency.

Trends

Rise of Smart Warehousing

The

Smart Warehousing Market is considered one of the revolutionary influences on the intralogistics market, integrating top-class technologies like Artificial Intelligence, the Internet of Things, and robotics. While this technology streamlined other processes related to inventory tracking, order picking, and monitoring of warehouses with efficiency and accuracy, IoT devices enable the collecting of data in real-time. This helps businesses with their supply chain operations and decision-making. Robotics helps reduce human intervention along with achieving greater productivity and reduced errors. The growth of 5G networks will further enhance device communication, making systems within the warehouses more responsive and coordinated. As the industry focuses on speed, cost reduction, and achieving customer satisfaction, the Smart Warehousing Market is thus poised for continued growth globally.

Shift Toward Sustainability in Intralogistics

The growing concern for environmental sustainability has marked the intralogistics market, wherein companies are integrating green practices into their logistics operations. Energy-efficient systems, including electric-powered automation equipment and hybrid vehicles, are being adopted to reduce greenhouse gas emissions. The trend also sees businesses moving toward recyclable and biodegradable packaging materials, with operations aligned toward eco-friendly goals. Circular supply chains that aim at waste reduction and recycling of resources are gaining momentum. Besides the stringent environmental regulations that companies have to follow, it also enhances brand image, especially for eco-conscious customers. This trend towards sustainability is most likely to drive innovative green intralogistics solutions in the coming years.

Research Scope and Analysis

By Component

Hardware is projected to lead the global intralogistics market because it is the base of automation and optimization of supply chain operations. The main components of AS/RS, conveyors, robotic arms, and AGVs are highly important in managing workflows and reducing human interference in warehouses and production facilities. These technologies enhance precision, speed, and reliability that are critical in industries requiring high-volume operations. AS/RS systems improve storage density and enable faster retrieval, for example, while AGVs guarantee seamless material transport.

The other reason hardware maintains the leading position is because of the gradual inroads of Industry 4.0 practices, which rely on physical automation infrastructure. The investments being made by companies in smart factories and advanced warehouse systems are more towards hardware installations to achieve operational efficiency coupled with cost savings. Improvements in robotics and IoT-enabled devices have increased the functionality and adaptability of hardware components greatly, making them an indispensable element in today's supply chain setup.

This fast growth of the e-commerce sector further accelerates hardware dominance. With an uptick in online retail, companies pursue automation to handle increased volumes of orders and achieve rapid fulfillment. Such automation of hardware solutions includes robotic sorting systems and automatic packaging lines, integral in meeting the demand for such volume and speed. Besides, long life spans and durable nature justify high initial investment for long-term value to businesses. Domination by hardware in the intralogistics market is a repercussion of its critical contribution to improving efficiency in operational activities, besides being aligned with automation trends, which makes fulfilling today's demanding and fast-evolving global supply chain quite impossible without it.

By Automation Level

Semi-automated systems are projected to be predominant in intralogistics because they offer a great balance between operational efficiency and cost-effectiveness. Semi-automated systems integrate human and automated elements in such a way that a business can achieve considerable advantages in productivity without having to invest in the high capital needed for full automation. For instance, semi-automated conveyors and sortation systems do allow faster material handling but still depend on human judgment or interference to make decisions or correct any eventual errors, assuring flexibility in operations.

One of the main drivers behind this dominance is the ease with which semi-automated systems can adapt to different scales and complexities of operation. SMEs often prefer semi-automation due to the relatively low initial investment costs compared to a fully automated system. These solutions allow gradual integration of technology into existing workflows, minimizing disruption while providing incremental efficiency gains.

Other benefits of semi-automated systems include the fact that they can be used in a wide variety of industries and applications. For example, industries with high product variability or those with unpredictable demand have the agility to accommodate changes without requiring significant reprogramming or system modifications. Besides, they help businesses retain a human element in processes that require judgment, such as quality control or custom order handling.

This is further supported by the rising focus on hybrid automation, in which complete and perfect collaboration of humans and machines will take place. These systems use high-end technologies like IoT and machine learning to further optimize workflows, while the human ensures both efficiency and adaptability at every step. The semi-automated ones are leading due to cost-efficiency, adaptability, and capability to combine human intuition with machine precision; therefore, preferred in business by any sector.

By Application

Warehouse management is anticipated to dominate the intralogistics market, as it forms the backbone of supply chain operations and ensures that goods are stored, retrieved, and distributed efficiently. In addition, with the rapid increase in e-commerce and higher demand for speed in order fulfillment, WMS and other technologies leading to higher operational efficiencies are being focused on by enterprises very strongly. Some of the automated solutions in wide use in a warehouse for optimum space utilization, minimization of errors, and increasing speed in order processing include AS/RS, robotic picking systems, and inventory tracking devices.

This dominance is partly attributed to the crucial role warehouses play in inventory management and demand forecasting. Advanced WMS solutions are integrated with enterprise resource planning systems that allow real-time visibility of inventory levels to inform decision-making. This ensures optimum stock levels, reduction of waste, and avoidance of stockouts, which are vital in maintaining continuity within the supply chain.

Besides, warehouse management also plays a role in supporting a multi-channel distribution strategy, now imperative in every retail business. Automate warehouses efficiently manage a broad range of order profiles, which run the gamut from bulk shipments to retail stores or small parcels to individual customers.

The push for sustainability further underlines the importance of efficient warehouse management. Technologies that reduce energy consumption, optimize routing, and improve space utilization are in line with green logistics practices, hence making warehouses more sustainable. In summary, warehouse management dominates the intralogistics market due to its pivotal role in ensuring operational efficiency, its alignment with multi-channel distribution needs, and its contribution to sustainable supply chain practices.

By Industry Vertical

The logistics and transportation sectors are projected to dominate the intralogistics market as they are important market segments of intralogistics that guarantee the mobility of merchandise in supply chains on a global scale. Trade globalization and electronic commerce growth increase the need to create more effective logistics and transport solutions. Applied intralogistics technologies-from AGVs to automated sorting machines, including route optimization software-continue to find increasing usage because of their possible contribution to gains in efficiency, speed, and accuracy with cost reductions.

One major factor contributing to this dominance is the fact that the sector relies on real-time data to make decisions. In addition, logistics companies are increasingly adopting IoT-enabled devices and sensors to track shipments, monitor vehicle performance, and optimize routes. These technologies enhance operational visibility, reduce delays, and lead to better customer satisfaction. Besides, the integration of AI and machine learning into logistics processes enables predictive analytics, helping companies predict and mitigate potential disruptions.

Besides that, sustainability concern is another sector where the intralogistics solution finds a niche, as an electric-powered vehicle, energy-efficient warehousing system, and eco-friendly packaging material all go in tune with green logistics objectives for reducing carbon footprint.

Besides, last-mile delivery complications have increased demands for effective logistics solutions. The tussle remains on how much-automated delivery, including drones and autonomous cars, can happen to solve these challenges that further indicate its dominance in this sector. The reason why logistics and transportation dominate the intralogistics market is that it has a central role in world trade, depends on advanced technologies, and is committed to sustainable and efficient operations.

The Intralogistics Market Report is segmented on the basis of the following

By Component

- Hardware

- Conveyor Systems

- Horizontal Carousels

- Vertical Carousels

- Automated Guided Vehicles (AGVs)

- Unit-Load

- Fixed-aisle Cranes

- Moveable-aisle Cranes

- Mini-Load

- AS/RS Cranes

- AS/RS Shuttles

- Sortation Systems

- Palletizing and Depalletizing Systems

- Robotic Systems

- Others

- Software

- Warehouse Management Systems (WMS)

- Warehouse Execution Systems (WES)

- Transportation Management Systems (TMS)

- Yard Management Systems

- Others (Order Management Software)

- Services

- Maintenance and Support

- Consulting and Implementation

- Training and Education

By Automation Level

- Manual

- Semi-Automated

- Fully Automated

By Application

- Warehouse Management

- Manufacturing Processes

- Distribution and Fulfillment

- Sorting and Packaging

By Industry Vertical

- Logistics and Transportation

- Retail and E-commerce

- Automotive

- Food & Beverage

- Healthcare

- Aerospace and Defense

- Pharmaceutical

- Energy and Utilities

- Electronics and Semiconductors

- Others

Regional Analysis

North America is projected to dominate the global intralogistics market with

39.3% of the market share by the end of 2025. North America dominates owing to its highly developed industrial infrastructure in the region, along with extensive diffusion of automation technologies and an e-commerce market. The growing adoption of Industry 4.0 principles, comprising the integration of IoT, AI, and robotics, is driving various end-users in the region to significantly invest in automated warehouse and logistics systems.

This is further pronounced in the United States, where the region has emerged as the hotbed for technological innovations, with numerous intralogistics solution providers being headquartered in the country. The surge in e-commerce has further propelled the demand for efficient warehouse management and distribution systems. Companies like Amazon and Walmart invest in cutting-edge intralogistics technologies to meet customer demands for faster deliveries, boosting overall market growth. Moreover, the region enjoys a highly skilled workforce and a favorable regulatory environment, accelerating the deployment of semi- and fully automated solutions.

The established transportation network and strong focus on supply chain optimization in North America add to the reasons for its dominance. Focusing on operational cost reduction and sustainability, green logistics practices, such as energy-efficient warehouses and electric-powered material handling equipment, are being adopted by businesses in the region.

The region also features a string of industry expos, conferences, and community programs that support innovations and drive the growth of the market. Leadership positions in intralogistics come from the fact that North America is one of the early adopters of advanced technologies to continuously invest in R&D, with a strong supplier and solution provider ecosystem.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The intralogistics market is highly competitive at the global level, and key players are investing in innovation to maintain their market share. Companies like KION Group, Jungheinrich AG, and Daifuku Co., Ltd. have emerged as leading players due to their diversified product portfolios and strong presence across different geographies. These firms focus on developing advanced automated solutions, such as AGVs, AS/RS systems, and robotic picking technologies, to meet evolving customer demands. Emerging players like Vanderlande Industries and BEUMER Group are gaining momentum by targeting niche markets and offering customized intralogistics solutions.

Strategic collaborations, mergers, and acquisitions are common in this industry, as these help companies expand their market presence and technological capabilities. For example, partnerships with software providers allow hardware manufacturers to offer integrated solutions that improve operational efficiency for end users. It also responds to the mindful awareness of sustainability issues, therefore shaping the competitive landscape. Leaders in many markets invest in green logistics technologies energy-efficient warehousing and electric material handling equipment to appeal to environmentally conscious customers.

Some of the prominent players in the Intralogistics Market are

- KION Group

- Jungheinrich AG

- Swisslog Holding AG

- Daifuku Co., Ltd.

- Honeywell Intelligrated

- Midea Group

- Toyota Industries Corporation

- Dematic

- SSI Schaefer

- Murata Machinery

- BEUMER Group

- Vanderlande Industries

- Fives Group

- Other Key Players

Recent Developments

- December 2024: KION Group partnered with a leading software firm to incorporate AI-driven analytics into its warehouse management systems, enabling improved real-time decision-making, predictive maintenance, and enhanced operational efficiency across its client networks.

- November 2024: Jungheinrich AG unveiled a new series of advanced Automated Guided Vehicles (AGVs) at a prestigious logistics expo in Germany, specifically designed to address the growing automation needs of the e-commerce sector.

- October 2024: Daifuku Co., Ltd. announced a significant $150 million investment aimed at expanding its production capacity in North America, focusing on advanced automation solutions to cater to the region's rising demand.

- September 2024: Vanderlande Industries collaborated with a major U.S. retail giant to implement cutting-edge robotic picking systems, aiming to enhance order accuracy, speed, and overall efficiency in fulfillment operations.

- August 2024: BEUMER Group introduced an innovative, energy-efficient sortation system at an international logistics conference, targeting eco-conscious businesses seeking sustainable automation solutions.

- July 2024: SSI Schaefer acquired a robotics startup specializing in AI-driven automation technologies, enhancing its capabilities in smart material handling and warehouse automation solutions.

- June 2024: Honeywell Intelligrated hosted a global logistics summit to showcase its latest advancements in warehouse automation, including robotic sorting and integrated IoT solutions.

- May 2024: Toyota Industries Corporation signed a strategic agreement to deploy IoT-enabled tracking systems for a global retail chain, improving inventory management and supply chain transparency.

- March 2024: Murata Machinery expanded its presence in Europe by establishing an innovation center focused on intralogistics, reinforcing its commitment to delivering advanced automation solutions in the region.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 64.2 Bn |

| Forecast Value (2033) |

USD 156.2 Bn |

| CAGR (2024-2033) |

10.4% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 21.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Hardware, Software, and Services), By Automation Level (Manual, Semi-Automated, and Fully Automated), By Application (Warehouse Management, Manufacturing Processes, Distribution and Fulfillment, and Sorting and Packaging), and By Industry Vertical (Logistics and Transportation, Retail and E-commerce, Automotive, Food & Beverage, Healthcare, Aerospace and Defense, Pharmaceutical, Energy and Utilities, Electronics and Semiconductors, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

KION Group, Jungheinrich AG, Swisslog Holding AG, Daifuku Co., Ltd., Honeywell Intelligrated, Midea Group, Toyota Industries Corporation, Dematic, SSI Schaefer, Murata Machinery, BEUMER Group, Vanderlande Industries, Fives Group, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Intralogistics Market?

▾ The Global Intralogistics Market size is estimated to have a value of USD 64.2 billion in 2025 and is expected to reach USD 156.2 billion by the end of 2034.

What is the size of the US Intralogistics Market?

▾ The US Intralogistics Market is projected to be valued at USD 21.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 49.1 billion in 2034 at a CAGR of 9.8%.

Which region accounted for the largest Global Intralogistics Market?

▾ North America is expected to have the largest market share in the Global Intralogistics Market with a share of about 39.3% in 2025.

Who are the key players in the Global Intralogistics Market?

▾ Some of the major key players in the Global Intralogistics Market are KION Group, Jungheinrich AG, Swisslog Holding AG, Daifuku Co. Ltd., Honeywell Intelligrated, Midea Group, Toyota Industries Corporation, and many others.

What is the growth rate in the Global Intralogistics Market?

▾ The market is growing at a CAGR of 10.4 percent over the forecasted period.