Market Overview

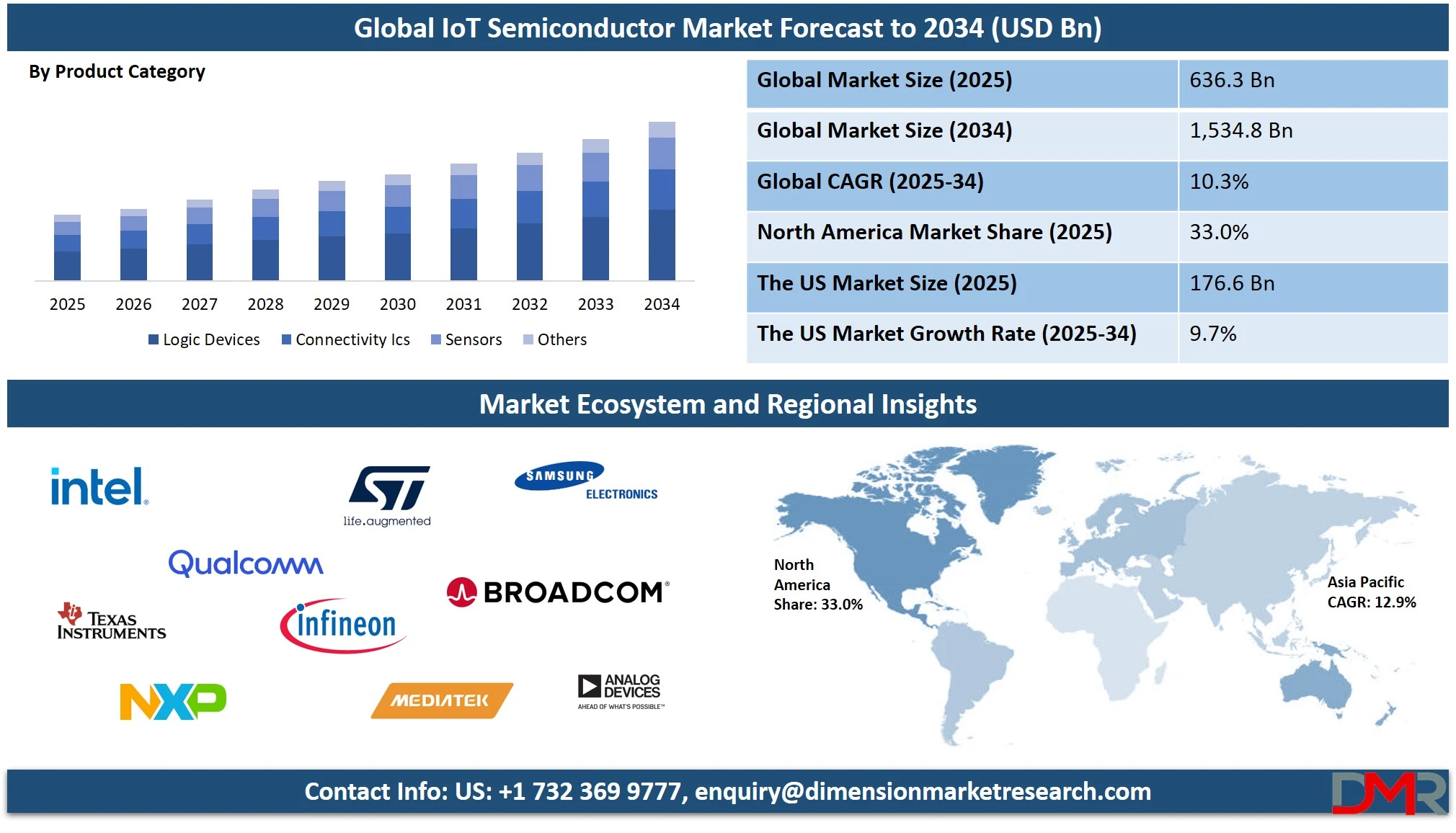

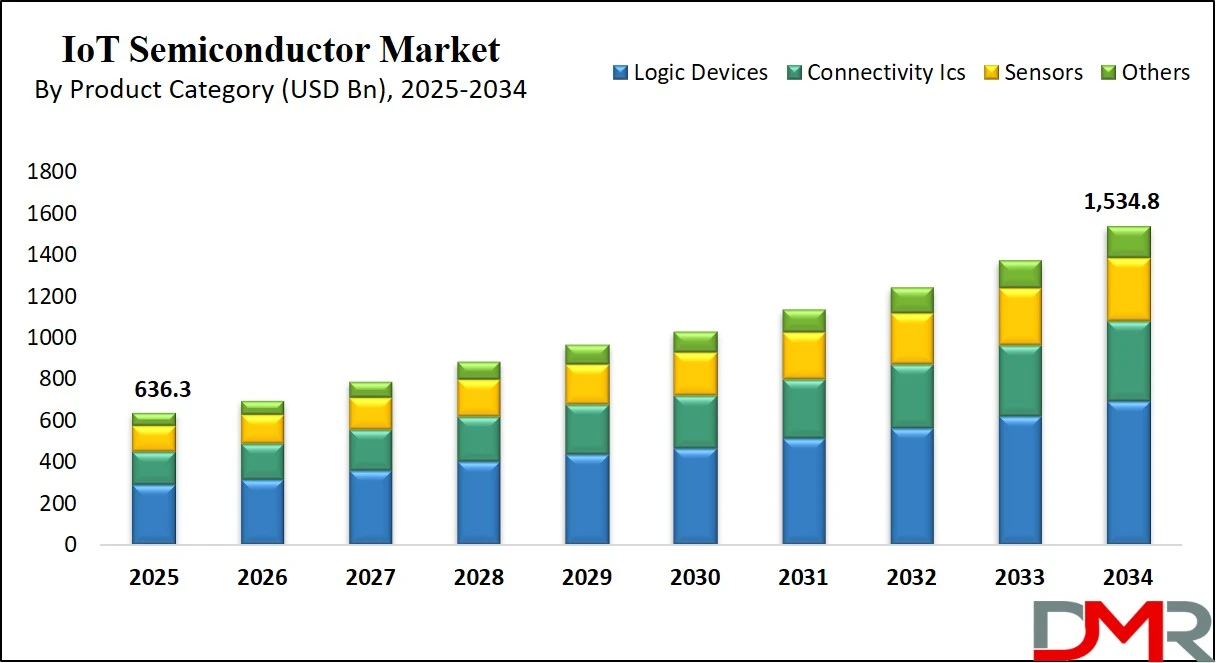

The global IoT semiconductor market is projected to reach USD 636.3 billion in 2025 and is expected to grow at a CAGR of 10.3%, hitting USD 1,534.8 billion by 2034. This growth is driven by rising adoption of smart devices, edge computing, 5G integration, and increased demand for low-power IoT chips across automotive, industrial, and consumer electronics applications.

IoT semiconductors refer to the microelectronic components specifically designed to support the connectivity, processing, sensing, and communication needs of Internet of Things (IoT) devices. These semiconductors encompass a diverse range of integrated circuits, including microcontrollers, sensors, wireless communication chips, memory devices, and analog components, which enable real-time data processing and transmission across IoT networks.

They act as the fundamental building blocks of smart systems by providing low-power, high-efficiency performance essential for embedded systems operating in connected environments. From wearables and smart home appliances to industrial automation and connected vehicles, IoT semiconductors ensure seamless integration of devices into digital ecosystems through secure, scalable, and responsive chip-based infrastructure.

The global IoT semiconductor market is witnessing significant growth driven by rapid advancements in edge computing, 5G deployment, and widespread adoption of smart technologies across various sectors. Increasing demand for energy-efficient, real-time analytics in industries such as automotive, healthcare, agriculture, and manufacturing is fostering the integration of intelligent semiconductor chips into IoT-based solutions. The proliferation of smart cities and industrial IoT (IIoT) infrastructure is pushing the need for chips that can support machine learning at the edge, high-speed data transfer, and robust wireless communication across large-scale systems.

Moreover, growing reliance on cloud connectivity, AI-enhanced devices, and real-time monitoring systems has amplified the role of semiconductors in building scalable IoT networks. Companies are focusing on developing application-specific integrated circuits (ASICs), system-on-chips (SoCs), and sensor hubs tailored for IoT performance, including ultra-low latency and power optimization.

The convergence of advanced fabrication techniques, miniaturization of hardware, and the emergence of secure chipsets for device-to-device communication further contribute to the market’s momentum. As enterprises and governments continue to prioritize digital transformation, the IoT semiconductor market is set to evolve as a key enabler of intelligent, interconnected environments.

The US IoT Semiconductor Market

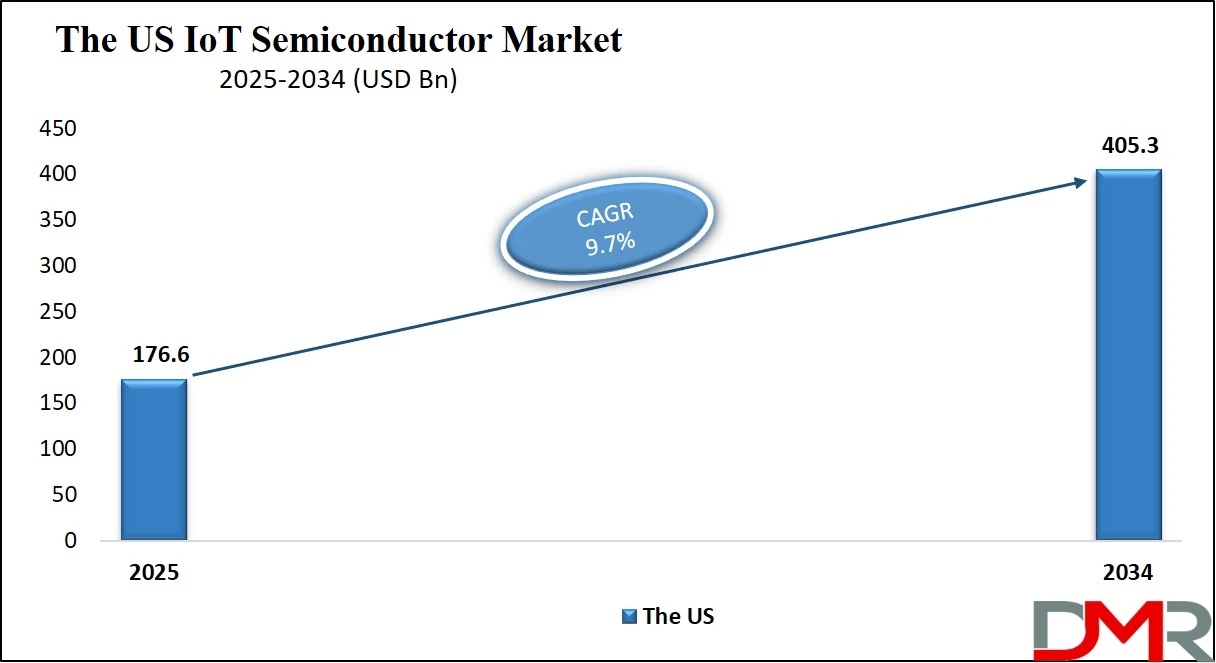

The U.S. IoT Semiconductor market size is projected to be valued at USD 176.6 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 405.3 billion in 2034 at a CAGR of 9.7%.

The US IoT semiconductor market is experiencing robust growth, driven by rapid technological advancements and increasing integration of connected devices across industries. As a key hub for innovation and semiconductor manufacturing, the United States plays a pivotal role in the global IoT ecosystem. The rising demand for smart home technologies, connected healthcare solutions, autonomous vehicles, and industrial automation is significantly boosting the adoption of IoT-enabled chips and processors.

American semiconductor giants are investing heavily in research and development to produce ultra-low power chipsets, secure microcontrollers, and high-performance communication ICs tailored for IoT applications. Moreover, the rollout of 5G networks and edge computing infrastructure in the US is further fueling demand for high-speed, energy-efficient IoT semiconductor components.

In addition, favorable government initiatives such as the CHIPS Act are strengthening domestic semiconductor production, reducing supply chain dependency, and supporting IoT innovation. The US market is also witnessing increased deployment of AI-powered IoT solutions in sectors like agriculture, logistics, and energy management, which require advanced SoCs, sensor networks, and wireless connectivity modules.

The focus on cybersecurity, real-time data processing, and smart infrastructure is creating new opportunities for embedded systems and custom semiconductor designs. With strong collaboration between tech companies, academia, and government bodies, the US IoT semiconductor landscape is positioned for sustained growth, driving digital transformation and enabling next-generation intelligent devices.

Europe IoT Semiconductor Market

In 2025, the Europe IoT semiconductor market is projected to be valued at approximately USD 139.9 billion. This growth trajectory is being driven by widespread adoption of smart technologies across automotive, industrial automation, and energy sectors. With Europe emphasizing green and digital transformation under initiatives like the European Green Deal and Industry 4.0, IoT semiconductor components such as sensors, connectivity ICs, and microcontrollers are seeing rapid integration into smart infrastructure and intelligent transportation systems.

Additionally, strong policy backing for connected vehicles, smart grids, and factory automation is significantly boosting demand for low-power and high-performance semiconductor solutions across the region.

The regional market is anticipated to grow at a compound annual growth rate (CAGR) of 8.0% from 2025 to 2034, underpinned by ongoing innovations in 5G networks, cybersecurity frameworks, and AI-enabled IoT devices. Countries like Germany, France, and the Netherlands are leading the regional charge, with robust R&D investments, a strong manufacturing base, and growing adoption of connected solutions in logistics, healthcare, and consumer electronics.

Furthermore, the presence of key semiconductor players and ecosystem partnerships between European and global tech firms are strengthening the region’s capacity to design and deploy cutting-edge IoT chipsets tailored to evolving industry needs.

Japan IoT Semiconductor Market

In 2025, the Japan IoT semiconductor market is expected to reach a valuation of USD 25.4 billion. This growth is largely driven by the country's deep-rooted strengths in electronics, automotive manufacturing, and industrial automation. Japan continues to be a hub for sensor technologies, microcontrollers, and embedded systems that form the backbone of IoT applications across smart homes, robotics, and connected vehicles.

Government-backed initiatives focused on Society 5.0 and the integration of AI, big data, and IoT into public services and infrastructure are further propelling demand for sophisticated semiconductor components across multiple verticals.

With a projected CAGR of 5.0% between 2025 and 2034, Japan's market growth is steady but measured, reflecting a mature economy focused on optimizing efficiency and energy usage through smart solutions. Key players in Japan are heavily investing in the miniaturization and low-power optimization of chips to suit applications in wearable devices, smart appliances, and automotive safety systems.

Furthermore, collaborations between traditional electronics giants and emerging IoT startups are fostering innovation in areas such as edge AI, 6G research, and real-time data processing hardware. The country’s focus on reliability, precision, and long product life cycles continues to position Japan as a critical, quality-driven contributor to the global IoT semiconductor landscape.

Global IoT Semiconductor Market: Key Takeaways

- Market Value: The global IoT semiconductor market size is expected to reach a value of USD 1,534.8 billion by 2034 from a base value of USD 636.3 billion in 2025 at a CAGR of 10.3%.

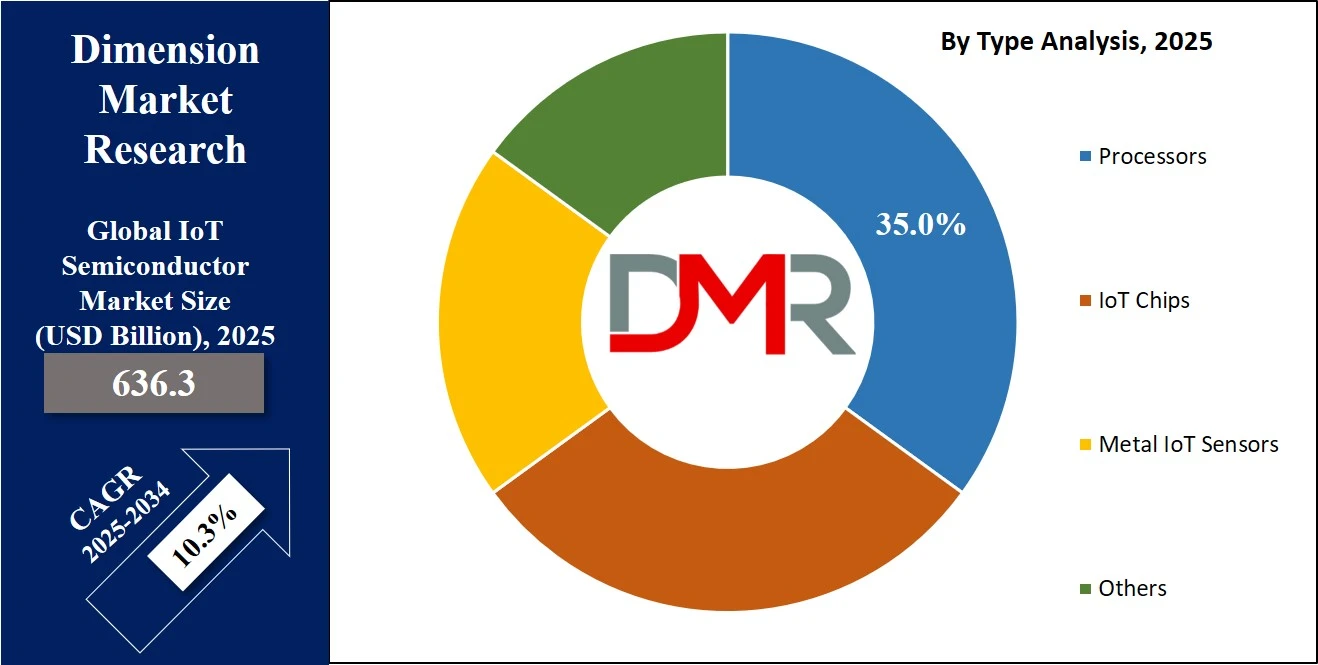

- By Type Segment Analysis: Processors are anticipated to dominate the type segment, capturing 35.0% of the total market share in 2025.

- By Product Category Segment Analysis: Logic Devices are expected to maintain their dominance in the product category segment, capturing 45.0% of the total market share in 2025.

- By End-Use Industry Segment Analysis: The Automotive industry is poised to consolidate its dominance in the end-use industry segment, capturing 40.0% of the market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global IoT semiconductor market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global IoT semiconductor market are Intel Corporation, Qualcomm Technologies Inc., Texas Instruments Inc., NXP Semiconductors N.V., STMicroelectronics, Infineon Technologies AG, MediaTek Inc., Samsung Electronics Co., Ltd., Broadcom Inc., Analog Devices Inc., Microchip Technology Inc, and Others.

Global IoT Semiconductor Market: Use Cases

- Smart Automotive and Autonomous Vehicles: IoT semiconductors are a foundational technology for modern connected vehicles and autonomous driving systems. Advanced microcontrollers, automotive-grade sensors, and low-latency communication chipsets enable features such as real-time navigation, vehicle-to-everything (V2X) communication, adaptive cruise control, and automatic emergency braking. In electric and autonomous vehicles, IoT-enabled system-on-chips (SoCs) process data from radar, LiDAR, and camera modules to support advanced driver-assistance systems (ADAS). These chips also manage in-car infotainment, over-the-air updates, and vehicle diagnostics. The growing demand for intelligent mobility solutions and the rollout of 5G are accelerating the need for high-performance, low-power semiconductors in the automotive IoT landscape.

- Industrial IoT and Smart Manufacturing: In industrial environments, IoT semiconductors are essential for deploying smart manufacturing systems and achieving Industry 4.0 transformation. These chips power a wide range of applications including real-time equipment monitoring, predictive maintenance, robotic automation, and digital twin technology. Semiconductor solutions enable machines and sensors on the factory floor to communicate seamlessly through wireless protocols, capturing data for advanced analytics and process optimization. Ruggedized microcontrollers and low-power processors are embedded in industrial control systems, supporting edge computing and AI-driven decision-making. With increasing adoption of machine-to-machine communication and smart sensors, the industrial IoT segment continues to drive demand for reliable, scalable semiconductor technologies.

- Smart Healthcare and Remote Patient Monitoring: The healthcare sector is leveraging IoT semiconductors to improve patient outcomes and enable continuous, real-time monitoring. These chips are embedded in wearable medical devices, remote diagnostic tools, and smart implants that track vital signs such as heart rate, blood pressure, oxygen levels, and glucose levels. Ultra-low power consumption, wireless connectivity, and secure data transmission are critical features provided by IoT chipsets in medical applications. Healthcare providers utilize these technologies to deliver virtual care, manage chronic diseases, and respond proactively to patient health data. The growth of telehealth and mobile health applications is propelling the adoption of semiconductor solutions that meet medical-grade reliability and performance standards.

- Smart Home Automation and Consumer Electronics: IoT semiconductors are at the core of smart home ecosystems, enabling devices such as smart thermostats, lighting systems, security cameras, and voice-activated assistants. These chips support wireless protocols like Wi-Fi, Bluetooth, Zigbee, and Z-Wave, allowing devices to communicate and be controlled via mobile apps or cloud-based platforms. Embedded processors and sensors enhance user experience by automating lighting, temperature, and appliance usage based on behavioral patterns. In consumer electronics, IoT-enabled semiconductors are integrated into smart TVs, audio systems, and connected appliances to enable seamless connectivity and real-time data exchange. As consumers increasingly adopt smart living technologies, the demand for efficient, interoperable IoT chipsets continues to expand.

Impact of Artificial Intelligence on IoT Semiconductor Market

Artificial Intelligence (AI) is significantly reshaping the IoT semiconductor market by driving demand for more intelligent, efficient, and specialized chip architectures. As AI capabilities increasingly converge with IoT applications, there is a growing need for semiconductors that can support real-time data processing, machine learning, and edge inference without relying heavily on cloud infrastructure.

This has led to the development and deployment of AI-optimized chipsets such as neural processing units (NPUs), application-specific integrated circuits (ASICs), and system-on-chips (SoCs) tailored for edge AI tasks. These chips enable faster decision-making, reduced latency, and enhanced performance for use cases like predictive maintenance, autonomous driving, smart surveillance, and personalized healthcare.

Furthermore, AI is pushing semiconductor companies to design energy-efficient chipsets that balance processing power with low power consumption, especially for battery-powered IoT devices. The integration of AI accelerators in microcontrollers and sensor modules has become a key differentiator, enabling smarter and more adaptive devices that can learn from data locally.

AI also improves chip manufacturing itself, using predictive analytics to optimize production yields and reduce defects. Overall, the fusion of AI with IoT is driving innovation across the semiconductor value chain, resulting in intelligent hardware solutions that empower next-generation connected ecosystems in automotive, industrial, healthcare, and consumer applications.

Global IoT Semiconductor Market: Stats & Facts

Bureau of Industry and Security (BIS)

- In 2022, global semiconductor product revenue was estimated at at least USD 660 billion, with an additional USD 190 billion accounted for by outsourced manufacturing and OSAT services.

- In 2023, among 97 surveyed end users representing nearly USD 3 trillion in annual revenue, estimated total chip content was USD 111 billion—more than one-sixth of global chip sales value.

Bureau of Labor Statistics (BLS)

- Semiconductor manufacturing import price index rose by 2.4% in 2022, then decreased by 3.8% in 2023, and remained unchanged in 2024.

- Export semiconductor manufacturing price index increased 1.4% in 2022, decreased 4.7% in 2023, and further declined 0.2% in 2024.

- Producer price index for semiconductor manufacturing rose 3.9% in 2022, declined 0.1% in 2023, then advanced 2.2% in 2024, resulting in a 6.1% total increase from December 2021 to December 2024.

- In 2024, semiconductor exports from the U.S. totaled USD 70.1 billion, a 6.3% increase from 2023. Texas and Oregon accounted for USD 32 billion, and California exported USD 10.3 billion.

Congressional Research Service (CRS)

- Analog chips accounted for about 13% of global semiconductor sales in 2021 (USD 74 billion).

- Logic chips were the largest category in 2021, holding 42% of global semiconductor sales (USD 232 billion).

- In 2021, memory chips represented 28% of global semiconductor sales (USD 154 billion), with U.S.-based Micron holding about 23% of that market.

- Optoelectronics, sensors, and discretes accounted for 17% of global semiconductor revenue in 2021.

United States–China Economic and Security Review Commission (USCC) / SEMI

- Global semiconductor fab capacity projected to expand 6% in 2024 and 7% in 2025.

- At the end of 2025, manufacturing capacity share by region is projected as: China 30%, Taiwan 17%, Korea 16%, Japan 14%, Americas 9%, Europe & Middle East 8%, Southeast Asia 5%.

- Chinese firm Innoscience’s share of the power GaN (gallium nitride) compound semiconductor market rose to 31% in 2023, up from under 15% in 2021.

- In SiC (silicon carbide) substrate market, U.S. supplier Wolfspeed held 53% in 2022, falling to 34% in 2024, while Chinese firms TanKeBlue and SICC each held 17%.

U.S. Department of Commerce

- The CHIPS for America program is investing USD 50 billion through 2030 to strengthen U.S. semiconductor manufacturing, R&D, and workforce.

- More than USD 20 billion in public-private funding will go toward new fabs focused on mature nodes and IoT chips between 2024 and 2026.

- Over 10,000 jobs in semiconductor manufacturing are projected to be created by CHIPS investments through 2025.

National Institute of Standards and Technology (NIST)

- The NIST CHIPS R&D program received USD 11 billion in funding to focus on future semiconductor innovation including edge AI and IoT systems.

- NIST aims to deploy four new innovation centers focused on advanced packaging, compound semiconductors, metrology, and manufacturing standards by 2025.

European Commission

- Under the EU Chips Act, EUR 43 billion is allocated to strengthen Europe's semiconductor capacity by 2030.

- Europe aims to double its global semiconductor production share from 10% in 2020 to 20% by 2030.

- The EU is funding over 70 projects focused on edge computing and embedded semiconductor applications between 2023 and 2025.

Japan Ministry of Economy, Trade and Industry (METI)

- The Japanese government committed JPY 1.3 trillion (USD 9.5 billion) between 2023 and 2025 to support semiconductor R&D and fabrication.

- Japan’s Rapidus Corporation plans to begin 2nm chip production by 2027, with government-backed R&D scaling from 2023 onward.

- Japan’s share in global mature-node production for IoT components is expected to remain steady at 14% through 2025.

Korea Ministry of Trade, Industry and Energy (MOTIE)

- South Korea has pledged USD 450 billion investment by 2030 under its K-Semiconductor Strategy, with priority on AI and IoT semiconductor supply chains.

- As of 2025, South Korea aims to account for over 25% of global logic and memory chip production capacity.

- Korean companies are expected to increase 6G and IoT chip R&D spending by 12% annually through 2025.

Global IoT Semiconductor Market: Market Dynamics

Global IoT Semiconductor Market: Driving Factors

Proliferation of Connected Devices across Industries

The rapid expansion of smart devices in sectors such as automotive, manufacturing, agriculture, and healthcare is significantly boosting the demand for IoT-enabled semiconductor components. As industries adopt intelligent automation, real-time monitoring, and machine-to-machine communication, the need for low-power, high-performance chipsets has surged. The deployment of smart sensors, embedded controllers, and wireless communication ICs is becoming essential in applications like predictive maintenance, smart meters, and autonomous systems, accelerating the overall growth of the IoT semiconductor ecosystem.

Growth of Edge Computing and AI Integration

The shift towards edge computing is transforming the IoT semiconductor landscape by requiring chips that can perform advanced analytics directly on connected devices. Edge AI integration reduces latency and bandwidth usage by processing data locally, which is particularly important for time-sensitive applications like autonomous vehicles and industrial robotics. As a result, there is rising demand for AI-optimized semiconductors such as system-on-chips (SoCs), neural processing units (NPUs), and microcontrollers designed for edge inference, propelling innovation in intelligent chip architecture.

Global IoT Semiconductor Market: Restraints

High Cost of Advanced Chip Manufacturing

The development and fabrication of next-generation IoT semiconductors involve high capital expenditure, especially with advanced nodes such as 5nm and 3nm technology. The cost of equipment, cleanrooms, skilled labor, and raw materials continues to climb, making it difficult for smaller players to compete in a highly concentrated market. Moreover, creating AI-integrated or energy-efficient designs for edge devices adds to the R&D burden, which may delay time-to-market and limit adoption across cost-sensitive applications.

Security Vulnerabilities in Connected Hardware

IoT devices often operate in decentralized environments and remain exposed to security threats due to their limited hardware-based protection. Semiconductor chips lacking robust encryption or secure boot features can become entry points for cyberattacks. The challenge of embedding scalable, end-to-end security protocols within tiny, low-power chipsets is a significant restraint, particularly in sectors like healthcare and finance where data privacy and integrity are critical.

Global IoT Semiconductor Market: Opportunities

Rising Demand for Smart Infrastructure and Cities

Governments and private sectors are investing heavily in smart city initiatives, which include intelligent traffic systems, connected utilities, surveillance networks, and automated public services. These infrastructure projects rely on vast networks of IoT-enabled devices powered by semiconductors capable of supporting real-time communication, edge analytics, and remote diagnostics. This expanding ecosystem presents a strong opportunity for chipmakers to supply specialized components like sensor hubs, wireless SoCs, and power-efficient processors tailored to urban connectivity.

Expansion of 5G and LPWAN Technologies

The rollout of 5G and Low Power Wide Area Networks (LPWAN) such as NB-IoT and LoRaWAN is opening new frontiers for the IoT semiconductor market. These next-gen connectivity technologies enable long-range, low-latency, and energy-efficient communication, particularly useful for massive IoT deployments in agriculture, logistics, and industrial automation. The need for modems, RF transceivers, and baseband processors that support these networks is generating strong demand, offering chip manufacturers a lucrative growth avenue.

Global IoT Semiconductor Market: Trends

Shift toward Application-Specific Integrated Circuits (ASICs)

To meet the performance and power constraints of diverse IoT applications, manufacturers are increasingly designing ASICs that are customized for specific use cases. These chips offer optimized processing speed, lower energy consumption, and greater reliability compared to general-purpose processors. This trend is especially prominent in edge AI applications such as wearable health devices, smart cameras, and industrial sensors, where purpose-built silicon offers a competitive edge in efficiency and miniaturization.

Increasing Emphasis on Sustainable and Energy-Efficient Design

With billions of IoT devices expected to come online, power efficiency has become a core design principle in semiconductor development. The market is witnessing a growing push toward ultra-low-power chipsets that can operate on limited battery or energy-harvesting sources for years. This trend is especially relevant for environmental sensors, remote asset trackers, and smart metering systems. Semiconductor firms are focusing on sub-threshold voltage design, power gating, and energy-aware computing to address the sustainability challenges in IoT networks.

Global IoT Semiconductor Market: Research Scope and Analysis

By Type Analysis

In the type-based segmentation of the IoT semiconductor market, processors are expected to lead by holding approximately 35.0% of the total market share in 2025. This dominance is primarily attributed to the growing need for real-time data processing, control logic, and computation at the edge of IoT networks. Processors, particularly microcontrollers (MCUs) and system-on-chips (SoCs), are embedded within a wide range of IoT devices including smart home systems, connected vehicles, industrial machinery, and wearable electronics.

These components enable the execution of embedded software, sensor integration, and communication with cloud platforms. With the rise in smart automation, artificial intelligence at the edge, and machine-to-machine interaction, the demand for high-efficiency, low-power processors continues to accelerate, making them a critical building block in connected ecosystems.

Alongside processors, IoT chips also hold a significant share of this segment, encompassing a broader category of semiconductor components that include communication modules, power management ICs, sensor interfaces, and memory units. IoT chips are tailored to support specific functions within connected devices, such as wireless connectivity (Bluetooth, Wi-Fi, Zigbee), environmental sensing, and signal conversion.

They are particularly important in enabling miniaturized, battery-efficient designs for applications like smart meters, asset tracking systems, and healthcare monitoring tools. The market for IoT chips is expanding rapidly due to increased deployment of embedded devices across smart city infrastructure, logistics, and industrial IoT applications, where specialized, function-specific chips are essential for reliability and seamless connectivity.

By Product Category Analysis

Within the product category segmentation of the IoT semiconductor market, logic devices are projected to maintain a dominant position, accounting for approximately 45.0% of the total market share in 2025. This category includes field-programmable gate arrays (FPGAs), application-specific integrated circuits (ASICs), and other programmable logic devices that offer high flexibility, processing power, and energy efficiency.

Logic devices are crucial in handling complex computations, managing data flows, and enabling device intelligence, particularly in applications requiring real-time responsiveness and low latency. Their adaptability makes them ideal for diverse IoT use cases such as industrial automation, autonomous vehicles, and AI-enabled edge devices. As the demand for customizable and high-performance solutions grows, logic devices continue to be at the core of embedded IoT systems.

Connectivity ICs also form a vital component of this segment, enabling wireless and wired communication between IoT devices, gateways, and cloud platforms. These integrated circuits support protocols such as Bluetooth, Wi-Fi, Zigbee, LoRa, NB-IoT, and 5G, making them indispensable for maintaining seamless data transmission in connected environments. Connectivity ICs are widely used in consumer electronics, smart meters, healthcare wearables, and transportation systems where real-time communication is essential.

The rise in remote monitoring, smart city development, and cloud-based services is further driving the demand for robust and energy-efficient connectivity solutions. With IoT networks growing more complex and distributed, the role of connectivity ICs is becoming increasingly critical in ensuring interoperability, scalability, and consistent performance across various devices and applications.

By End-Use Industry Analysis

In the end-use industry segment of the IoT semiconductor market, the automotive industry is set to consolidate its leading position by capturing around 40.0% of the total market share in 2025. This growth is largely driven by the rapid integration of IoT technologies in modern vehicles, including advanced driver-assistance systems (ADAS), vehicle-to-everything (V2X) communication, real-time navigation, and autonomous driving capabilities.

Semiconductors play a critical role in enabling these functions through high-performance processors, sensors, and communication modules that ensure safety, connectivity, and efficiency. As electric vehicles and smart mobility solutions gain traction, automakers are investing heavily in semiconductor technologies to support predictive maintenance, in-car infotainment systems, and energy management. The demand for robust, reliable, and low-power IoT-enabled chips in automotive applications continues to grow, making this sector a dominant force in the global market.

Consumer electronics also represent a significant portion of the IoT semiconductor market, driven by the proliferation of smart home devices, wearables, and connected appliances. Devices such as smart speakers, fitness trackers, smart TVs, and home automation systems rely heavily on IoT chips for processing, sensing, and connectivity.

As consumers seek convenience, personalization, and seamless user experiences, manufacturers are embedding advanced microcontrollers, sensor hubs, and wireless communication ICs into everyday devices. The adoption of voice assistants, real-time data sync, and AI-powered features further amplifies the need for high-efficiency semiconductor components. With continuous innovation in form factors, battery life, and wireless integration, consumer electronics are expected to remain a key driver of volume demand in the IoT semiconductor landscape.

The IoT Semiconductor Market Report is segmented based on the following:

By Type

- Processors

- IoT Chips

- Metal IoT Sensors

- Others

By Product Category

- Logic Devices

- Connectivity ICs

- Sensors

- Others

By End-Use Industry

- Automotive

- Consumer Electronics

- Energy & Utility

- Healthcare

- BFSI

- Others

Global IoT Semiconductor Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is expected to dominate the global IoT semiconductor market in 2025, accounting for approximately 38.0% of the total market revenue. This leadership is fueled by the region’s strong manufacturing base, rapid adoption of smart technologies, and significant investments in 5G infrastructure and industrial automation. Countries like China, Japan, South Korea, and India are at the forefront of deploying IoT across various sectors, including automotive, consumer electronics, healthcare, and smart cities.

The presence of major semiconductor foundries and chipmakers, coupled with government initiatives supporting digital transformation and domestic semiconductor production, further strengthens the region’s position. Additionally, the high concentration of electronics exports and the growing demand for connected devices across both urban and rural areas make Asia Pacific a pivotal hub in the global IoT semiconductor landscape.

Region with significant growth

North America is projected to witness significant growth in the IoT semiconductor market over the coming years, driven by rapid advancements in smart infrastructure, widespread adoption of edge computing, and strong demand across industries such as automotive, healthcare, and industrial automation.

The region benefits from a robust ecosystem of leading semiconductor manufacturers, tech innovators, and AI-driven startups that are continuously developing advanced chip architectures for connected devices. Government support through initiatives like the CHIPS and Science Act, along with increasing investments in smart cities and digital healthcare, is further accelerating regional expansion. Additionally, the early rollout of 5G networks and a high penetration rate of IoT applications across enterprises make North America a key growth engine within the global market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global IoT Semiconductor Market: Competitive Landscape

The global competitive landscape of the IoT semiconductor market is characterized by intense innovation, strategic collaborations, and continuous investment in advanced chip technologies. Leading players such as Intel, Qualcomm, NXP Semiconductors, Texas Instruments, and STMicroelectronics dominate the market with diversified IoT chip portfolios catering to various sectors including automotive, industrial, consumer electronics, and healthcare. These companies focus on developing low-power, AI-enabled, and edge-compatible semiconductors to meet the growing demand for real-time processing and connectivity.

At the same time, newer entrants and fabless semiconductor firms are gaining traction by offering niche solutions tailored for specific IoT use cases. The market is also witnessing increased mergers and acquisitions, as established players seek to expand their capabilities in areas like wireless communication, edge AI, and security. With rapid technological evolution and regional policy support for domestic chip manufacturing, competition is expected to intensify, driving innovation and diversification in the global IoT semiconductor ecosystem.

Some of the prominent players in the global IoT semiconductor market are:

- Intel Corporation

- Qualcomm Technologies Inc.

- Texas Instruments Inc.

- NXP Semiconductors N.V.

- STMicroelectronics

- Infineon Technologies AG

- MediaTek Inc.

- Samsung Electronics Co., Ltd.

- Broadcom Inc.

- Analog Devices, Inc.

- Microchip Technology Inc.

- Renesas Electronics Corporation

- Marvell Technology Group Ltd.

- ON Semiconductor Corporation

- ARM Holdings

- Skyworks Solutions, Inc.

- Silicon Labs

- Nordic Semiconductor

- Cypress Semiconductor

- Dialog Semiconductor

- Other Key Players

Global IoT Semiconductor Market: Recent Developments

- August 2025: Tata Electronics is exploring the acquisition of a semiconductor fabrication or OSAT facility in Malaysia, part of its broader strategy to build semiconductor assembly and packaging capabilities.

- August 2025: Silvaco Group completed its acquisition of Mixel Group, incorporating expertise in low-power, high-performance semiconductor IP across markets including IoT, automotive, and VR/AR.

- July 2025: Sequans Communications unveiled Iris, a next-generation RF integrated transceiver series tailored for software-defined radio applications, reinforcing its role in the cellular IoT semiconductor sector.

- July 2025: Nordic Semiconductor executed a strategic double acquisition of Memfault and Neuton.AI, enabling a full-stack chip-to-cloud IoT lifecycle platform with integrated edge AI (tinyML) capabilities.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 636.3 Bn |

| Forecast Value (2034) |

USD 1,534.8 Bn |

| CAGR (2025–2034) |

10.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 176.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Processors, IoT Chips, Metal IoT Sensors, Others), By Product Category (Logic Devices, Connectivity ICs, Sensors, Others), By End-Use Industry (Automotive, Consumer Electronics, Energy & Utility, Healthcare, BFSI, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Intel Corporation, Qualcomm Technologies Inc., Texas Instruments Inc., NXP Semiconductors N.V., STMicroelectronics, Infineon Technologies AG, MediaTek Inc., Samsung Electronics Co., Ltd., Broadcom Inc., Analog Devices Inc., Microchip Technology Inc, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global IoT semiconductor market size is estimated to have a value of USD 636.3 billion in 2025 and is

expected to reach USD 1,534.8 billion by the end of 2034.

The US IoT semiconductor market is projected to be valued at USD 176.6 billion in 2025. It is expected to

witness subsequent growth in the upcoming period as it holds USD 405.3 billion in 2034 at a CAGR of

9.7%.

Asia Pacific is expected to have the largest market share in the global IoT semiconductor market, with a

share of about 38.0% in 2025.

Some of the major key players in the global IoT semiconductor market are Intel Corporation, Qualcomm

Technologies Inc., Texas Instruments Inc., NXP Semiconductors N.V., STMicroelectronics, Infineon

Technologies AG, MediaTek Inc., Samsung Electronics Co., Ltd., Broadcom Inc., Analog Devices Inc.,

Microchip Technology Inc, and Others.

The market is growing at a CAGR of 10.3 percent over the forecasted period.