Market Overview

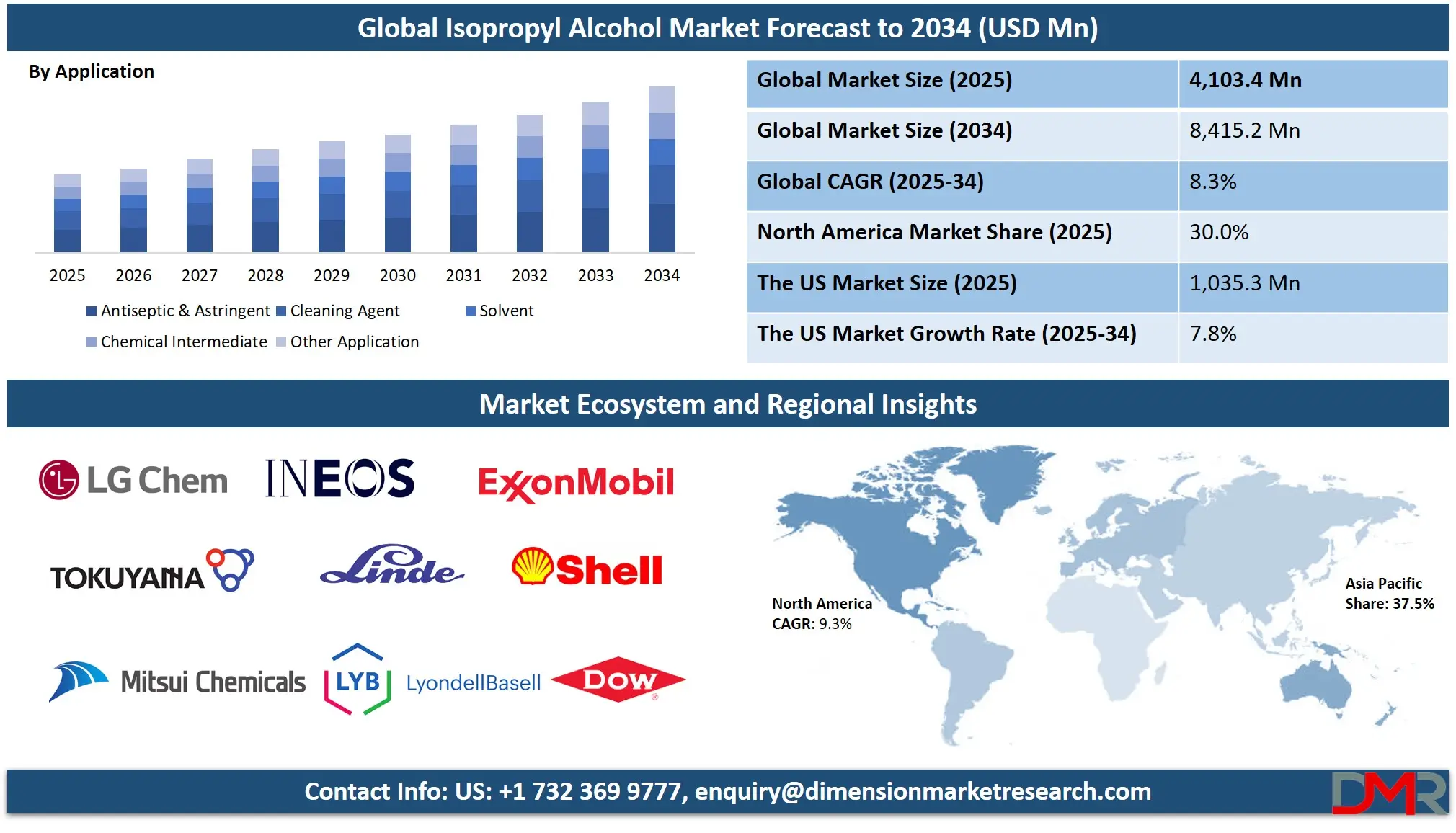

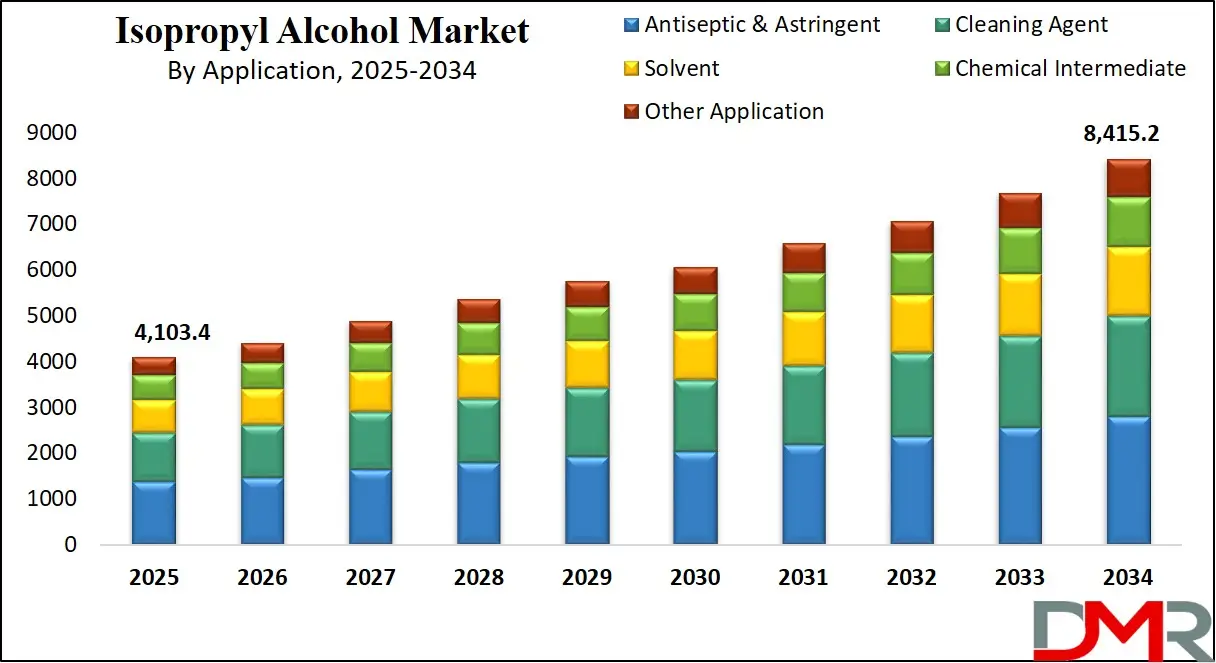

The Global Isopropyl Alcohol Market is projected to reach USD 4,103.4 million in 2025 and grow at a compound annual growth rate of 8.3% from there until 2034 to reach a value of USD 8,415.2 million.

The global isopropyl alcohol (IPA) market is witnessing sustained growth due to its vital role in numerous end-use industries, including pharmaceuticals, cosmetics, electronics, and chemicals. In recent years, the market has expanded steadily, fueled by increased demand for sanitization products, pharmaceutical-grade solvents, and electronic cleaning agents. Isopropyl alcohol's effectiveness as an antiseptic and solvent positions it as a preferred choice in both industrial and consumer applications.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A key trend shaping the industry is the growing demand for high-purity IPA, especially in semiconductor manufacturing, where precision cleaning is critical. Technological advancements and digital transformation are increasing reliance on microelectronics, boosting IPA consumption in chip fabrication facilities. Additionally, the surge in personal care and hygiene product consumption across emerging economies is presenting robust growth opportunities.

Market opportunities also stem from the growing pharmaceutical sector, where IPA is essential in formulation, sterilization, and disinfection. The rise of hospital-acquired infection control protocols and expanded healthcare access in developing regions is further driving demand.

Nonetheless, challenges persist, including volatile raw material prices, supply chain constraints, and environmental concerns related to hydrocarbon-based chemical production. Regulatory pressures are prompting manufacturers to invest in sustainable production practices and explore bio-based IPA alternatives.

Despite these restraints, the market outlook remains positive, supported by increasing industrial applications and rising health consciousness. With expanding applications in biotech, healthcare, and precision manufacturing, the isopropyl alcohol market is expected to evolve rapidly, emphasizing purity, sustainability, and efficiency in the coming years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Isopropyl Alcohol Market

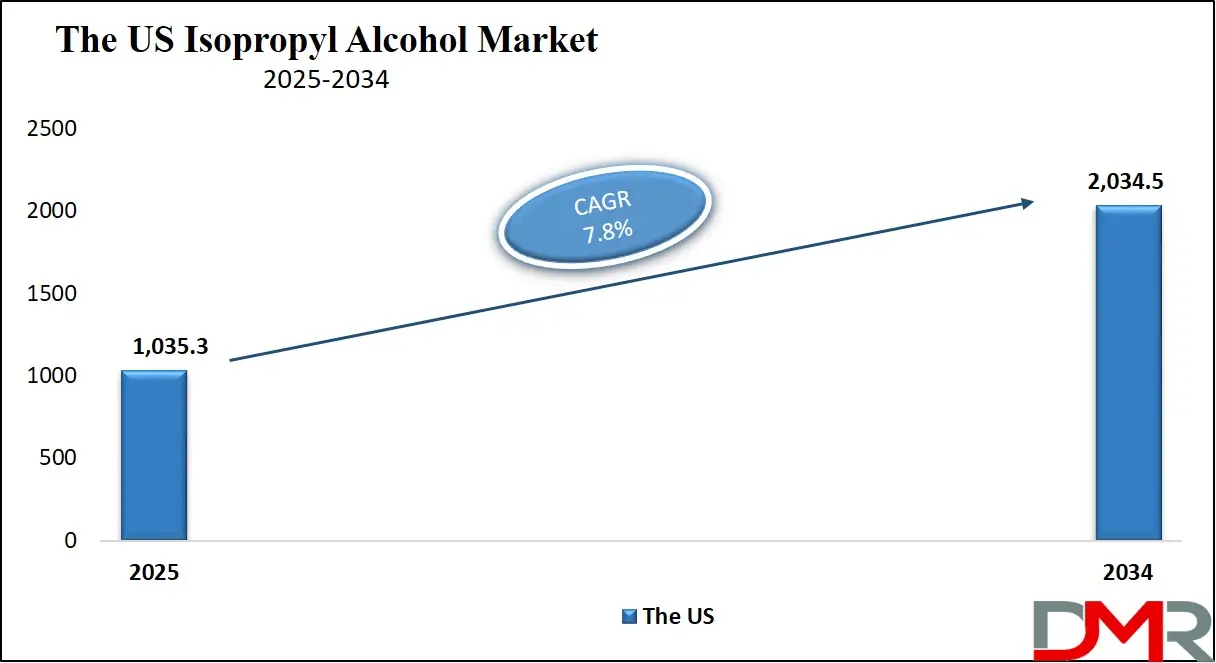

The US Isopropyl Alcohol Market is projected to reach USD 1,035.3 million in 2025 at a compound annual growth rate of 7.8% over its forecast period.

The United States is a dominant force in the global isopropyl alcohol market, supported by a robust industrial base, advanced healthcare infrastructure, and strong regulatory frameworks. Annual IPA consumption in the U.S. is substantial, reflecting widespread usage across sectors such as pharmaceuticals, personal care, automotive, and electronics. The country benefits from a mature chemicals manufacturing ecosystem and abundant raw material availability due to a developed petrochemical industry.

IPA plays a vital role in U.S. healthcare, where it is used for sanitization, surgical sterilization, and pharmaceutical compounding. With a population exceeding 330 million, the large consumer base contributes to high demand for IPA in personal hygiene products such as hand sanitizers, antiseptic wipes, and disinfectants. The Centers for Disease Control and Prevention (CDC) promotes the use of alcohol-based products for infection control, further driving IPA utilization.

The U.S. also enjoys a demographic advantage through a growing aging population and a focus on preventive healthcare, which fuels consistent demand for IPA-based medical and cleaning products. Moreover, government incentives supporting domestic semiconductor manufacturing are propelling the need for ultra-pure IPA in chip fabrication and electronic assembly processes.

U.S. manufacturers are increasingly investing in cleaner and more sustainable IPA production technologies to meet environmental regulations enforced by the Environmental Protection Agency (EPA). Overall, the market is poised for continued growth due to innovation, consumer health awareness, and industrial demand across a technologically advanced economy.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Isopropyl Alcohol Market

The Europe Isopropyl Alcohol Market is estimated to be valued at USD 722.2 million in 2025 and is further anticipated to reach USD 1,327.7 million by 2034 at a CAGR of 7.0%.

The isopropyl alcohol market in Europe is characterized by high standards of health, hygiene, and regulatory compliance. European industries utilize IPA in pharmaceuticals, food processing, cosmetics, industrial solvents, and specialty chemicals. The demand for isopropyl alcohol in Europe remains stable due to its critical role in healthcare, manufacturing, and personal care sectors.

Europe’s emphasis on public health, especially post-COVID, has led to sustained consumption of IPA-based disinfectants and sanitizers in hospitals, clinics, and households. The European Medicines Agency (EMA) supports stringent safety and efficacy criteria for pharmaceutical excipients, solidifying IPA’s role in drug formulation and hospital hygiene protocols. Additionally, IPA's role in surface sterilization and cleanroom disinfection makes it essential in the region's pharmaceutical production hubs.

Germany, France, and the UK are among the top consumers, driven by their mature healthcare and cosmetics industries. Europe’s demographic structure, with an aging population and increasing chronic health conditions, contributes to the demand for IPA in healthcare settings and home-use medical products.

Europe's stringent environmental regulations under REACH and the EU’s Green Deal are encouraging manufacturers to adopt eco-friendly production processes and develop bio-based IPA alternatives. This has spurred research and innovation within chemical firms to reduce emissions and enhance process sustainability.

With increasing investments in biotechnology, clean energy, and green chemistry, the European IPA market is set to grow steadily. Its application versatility and alignment with environmental goals ensure long-term resilience and adaptability across diverse European markets.

The Japan Isopropyl Alcohol Market

The Japan Isopropyl Alcohol Market is projected to be valued at USD 246.2 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 472.0 million in 2034 at a CAGR of 7.5%.

Japan's isopropyl alcohol (IPA) market is a key player in several sectors, driven by the country's emphasis on precision, technological advancement, and stringent quality control. As a global leader in electronics and automotive manufacturing, Japan's demand for high-purity IPA is robust, particularly in the precision cleaning of semiconductor wafers, printed circuit boards, and optical components. The country's advanced manufacturing capabilities ensure a consistent and growing requirement for solvents like IPA, which is integral in maintaining the high standards of Japan's technological industries.

In healthcare, IPA is widely utilized for its disinfectant and sterilizing properties. It plays an essential role in medical facilities, where it is used for sanitizing instruments, wound treatment, and surface disinfection. The aging population in Japan, with nearly 30% of citizens over the age of 65, significantly contributes to the increasing demand for healthcare products. The Ministry of Health, Labour, and Welfare ensures that IPA-based products meet rigorous safety standards, maintaining its high level of trust in medical and healthcare applications.

The cosmetic and personal care industries in Japan are also major consumers of IPA, using it in products such as perfumes, facial cleansers, and hair care items. The cultural emphasis on cleanliness and grooming supports the steady demand for IPA in these consumer products. Furthermore, IPA is indispensable in scientific research, where it is used in laboratories and universities for sterilization, chemical preparations, and sample preservation. This diverse range of applications underpins the growing significance of IPA in Japan's economy.

Global Isopropyl Alcohol Market: Key Takeaways

- Global Market Size Insights: The Global Isopropyl Alcohol Market size is estimated to have a value of USD 4,103.4 Mn in 2025 and is expected to reach USD 8,413.2 Mn by the end of 2034.

- The US Market Size Insights: The US Isopropyl Alcohol Market is projected to be valued at USD 1,035.3 Mn in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,034.5 Mn in 2034 at a CAGR of 7.8%.

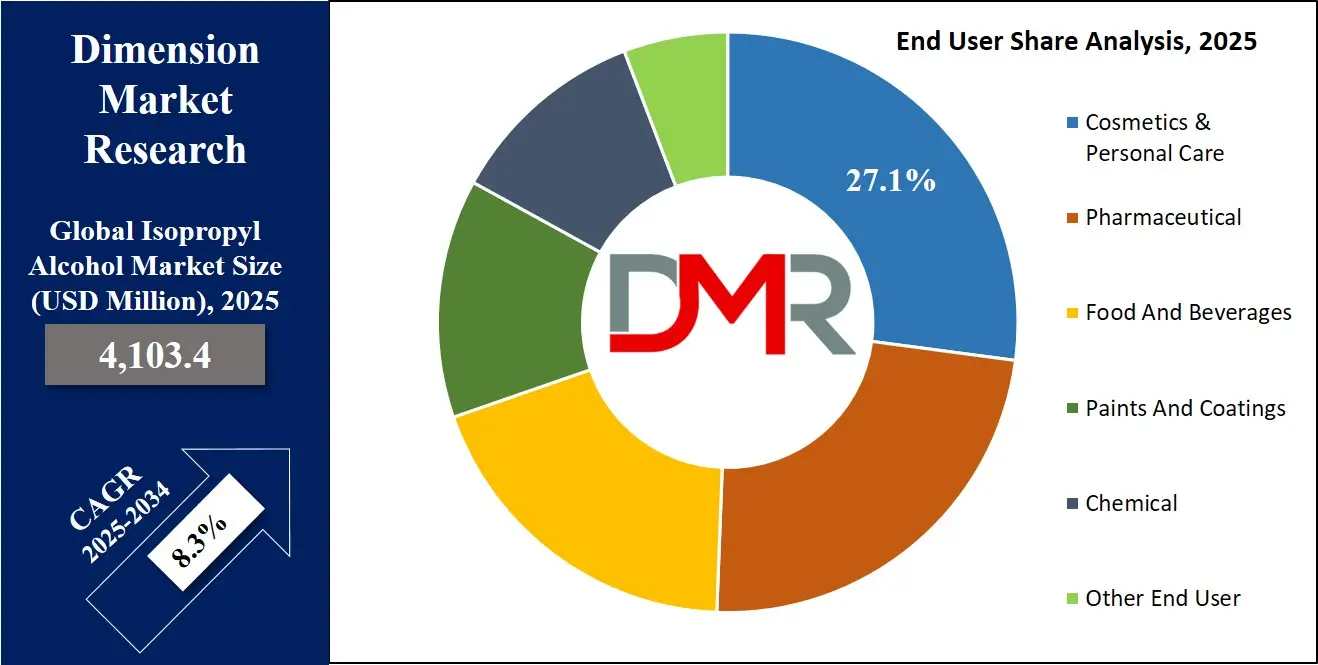

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Isopropyl Alcohol Market with a share of about 37.5% in 2025.

- Key Players: Some of the major key players in the Global Isopropyl Alcohol Market are Dow Chemical Company, ExxonMobil Corporation, Royal Dutch Shell plc, LyondellBasell Industries N.V., INEOS Group Ltd., Linde plc, Ecolab Inc., Mitsui Chemicals Inc., LG Chem Ltd., Tokuyama Corporation, and many others.

- The Global Market Growth Rate Insights: The market is growing at a CAGR of 8.3 percent over the forecasted period of 2025.

Global Isopropyl Alcohol Market: Use Cases

- Pharmaceutical Manufacturing: Isopropyl alcohol is critical in the pharmaceutical industry for equipment sterilization, surface disinfection, and as a solvent in drug formulation. Its rapid evaporation and antimicrobial properties make it indispensable in maintaining cleanroom standards and preventing contamination in medicine production and laboratory environments.

- Electronics and Semiconductor Cleaning: High-purity IPA is essential in cleaning printed circuit boards and semiconductor wafers. It effectively removes dust, flux residues, and microscopic contaminants without damaging sensitive components. The electronics industry relies heavily on IPA for its non-conductive nature and fast-drying capability, ensuring precision and safety in microelectronic assembly.

- Personal Care and Cosmetics: Used widely in aftershaves, deodorants, and hand sanitizers, IPA serves as a quick-drying, non-oily solvent. It enhances the formulation of perfumes, skin cleansers, and hair care products. Its compatibility with fragrances and active ingredients contributes to its prominence in the global personal care market.

- Automotive Maintenance: Isopropyl alcohol is used in automotive detailing and repair shops for cleaning engine parts, removing grease, and de-icing windshields. It is valued for dissolving oils and evaporating without leaving residues, making it ideal for automotive surface preparation, maintenance, and electronics repair within vehicles.

- Laboratory and Industrial Applications: In research laboratories, IPA is used to sterilize instruments, preserve biological specimens, and prepare surfaces. Its role in chemical synthesis, sample preparation, and general lab hygiene highlights its significance in scientific, analytical, and quality assurance operations across academic and industrial sectors.

Global Isopropyl Alcohol Market: Stats & Facts

- U.S. Environmental Protection Agency (EPA)

- Production in the U.S.: The U.S. produces over 500,000 tons of isopropyl alcohol annually.

- IPA as a Solvent: IPA is listed in the EPA's Toxic Substances Control Act (TSCA) Inventory as an approved chemical used as a solvent in industrial processes.

- U.S. Food and Drug Administration (FDA)

- Use in Pharmaceutical Products: Isopropyl alcohol is used in various pharmaceutical and OTC products, including as an antiseptic with FDA approval for concentrations of 70% and 91%.

- USP Monograph: IPA meets the standards set by the U.S. Pharmacopeia (USP) for use in pharmaceutical formulations and sterilization.

- European Chemicals Agency (ECHA)

- Use in Disinfectants: IPA is listed as an active substance in the ECHA’s Biocidal Products Regulation for use in disinfectants, particularly in healthcare settings.

- Production Data: The total EU production capacity of isopropyl alcohol exceeds 200,000 tons annually.

- Japan Ministry of Health, Labour, and Welfare (MHLW)

- Medical Disinfection: IPA is an essential ingredient for hand sanitizers and other medical disinfectants approved by the MHLW for use in hospitals and healthcare environments in Japan.

- Annual Consumption: Japan consumes approximately 180,000 metric tons of IPA each year, primarily used in industrial and medical applications.

- U.S. Centers for Disease Control and Prevention (CDC)

- Sanitizer Guidelines: The CDC recommends the use of hand sanitizers containing at least 60% isopropyl alcohol as an effective method for reducing the spread of infectious diseases.

- Alcohol-Based Hand Sanitizers: During the COVID-19 pandemic, the demand for IPA surged due to increased use of alcohol-based hand sanitizers, with public health guidance highlighting IPA's role in reducing viral transmission.

- European Food Safety Authority (EFSA)

- Use in Food and Beverage Industry: IPA is approved as a processing aid in the food industry in specific applications such as extraction processes.

- Maximum Residue Levels (MRLs): EFSA has established MRLs for IPA in food products where it is used in the production process, ensuring safety for consumers.

- U.S. Department of Energy (DOE)

- Alternative Bio-based Production: The DOE has supported research into bio-based IPA production methods to reduce reliance on petrochemical processes, with pilot projects demonstrating a 30% increase in yield efficiency from renewable resources.

- National Institutes of Health (NIH)

- Use in Laboratory Settings: IPA is frequently used in medical laboratories for sterilizing instruments, especially in settings requiring stringent contamination control.

- Antimicrobial Properties: IPA is recognized for its antimicrobial efficacy, particularly in killing bacteria and viruses on surfaces, a critical component of laboratory and hospital sanitation protocols.

- U.S. Occupational Safety and Health Administration (OSHA)

- Workplace Safety: OSHA has established permissible exposure limits (PELs) for isopropyl alcohol vapors in workplace settings to ensure safety for workers handling large quantities of IPA.

- Flammability Risks: OSHA also issues guidelines for the safe handling and storage of IPA to prevent fire hazards due to its highly flammable nature.

- China National Petroleum Corporation (CNPC)

- Production Capacity in China: China is one of the largest global producers of IPA, with production facilities capable of producing over 1.4 million tons annually.

- Use in Electronics Manufacturing: IPA is extensively used in China for cleaning and degreasing electronic components, particularly in the semiconductor industry, which is a significant driver of IPA demand.

Global Isopropyl Alcohol Market: Market Dynamics

Driving Factors in the Global Isopropyl Alcohol Market

Surge in Demand for Disinfection and Sanitization Products

The COVID-19 pandemic dramatically increased the global demand for disinfectants and sanitizers, which has been a major growth driver for the isopropyl alcohol market. IPA is an effective antimicrobial agent used in hand sanitizers, surface disinfectants, and medical sanitizing products, making it essential in controlling the spread of infections. Health organizations such as the CDC and WHO recommend IPA-based hand sanitizers for hygiene and disinfection, further driving their demand. As awareness of hygiene practices increases globally, the use of IPA in household, industrial, and healthcare cleaning products continues to rise. In addition, the pandemic has heightened public focus on infection prevention, leading to sustained, long-term growth in the sanitization product segment. Even as the pandemic subsides, the heightened emphasis on hygiene is expected to maintain demand for IPA across various industries.

Growth in the Pharmaceutical and Healthcare Sector

IPA’s essential role in the pharmaceutical and healthcare industries is another significant growth driver. The chemical’s versatility as a solvent, disinfectant, and sterilizing agent makes it indispensable in these sectors. It is widely used for sterilizing medical instruments, preparing pharmaceutical formulations, and manufacturing vaccines. Additionally, IPA is commonly employed in hospitals, laboratories, and healthcare facilities for sanitization purposes. With the global healthcare sector expanding, especially in emerging economies, there is a growing need for IPA to support healthcare infrastructure.

The rise of chronic diseases, an aging population, and increasing healthcare accessibility in developing regions are all contributing to greater IPA consumption. Furthermore, the ongoing advancements in biotechnology and the increasing importance of aseptic manufacturing processes further drive IPA demand in pharmaceutical and biotech applications.

Restraints in the Global Isopropyl Alcohol Market

Fluctuating Raw Material Prices

The prices of raw materials used to produce isopropyl alcohol, particularly propylene, are volatile and significantly affect IPA production costs. Propylene is a key feedstock for IPA production through the propylene hydration process, and its prices are influenced by fluctuations in crude oil prices and supply-demand imbalances in the petrochemical industry. Any increase in raw material prices due to geopolitical factors, natural disasters, or disruptions in supply chains can result in higher production costs, which could negatively impact profit margins for IPA manufacturers. These price fluctuations make it difficult for companies to predict costs and maintain stable pricing, which can create uncertainty in the market. As a result, IPA manufacturers may need to explore alternative, more cost-effective production methods or pass on the increased costs to consumers, potentially reducing demand in price-sensitive markets.

Environmental and Regulatory Challenges

The isopropyl alcohol market faces increasing pressure from environmental regulations, particularly in regions like Europe and North America, where sustainability and carbon footprint reduction are key priorities. The production of traditional IPA from petrochemical feedstocks is associated with high energy consumption and greenhouse gas emissions. As governments around the world tighten regulations on emissions and promote cleaner industrial practices, IPA manufacturers are required to invest in cleaner technologies and adapt their operations to comply with new environmental standards.

Additionally, concerns over the environmental impact of chemical waste and pollution are prompting regulatory bodies to impose stricter controls on IPA production. These regulatory and environmental challenges increase operational costs and could potentially limit production capacities for companies that fail to meet compliance standards. While bio-based IPA presents a sustainable solution, the transition to greener production processes can be expensive and technologically challenging, limiting the adoption of eco-friendly practices in the short term.

Opportunities in the Global Isopropyl Alcohol Market

Expansion in Emerging Markets

Emerging markets in regions like Asia-Pacific, the Middle East, and Latin America offer significant growth opportunities for the isopropyl alcohol market. As industrialization accelerates in these regions, the demand for IPA in sectors such as manufacturing, electronics, and personal care is increasing. In particular, the expanding pharmaceutical and healthcare sectors in countries like India, China, and Brazil present new avenues for growth. These regions are witnessing rapid urbanization, which leads to rising hygiene standards and growing demand for IPA-based disinfectants and sanitizers. The expanding automotive, electronics, and construction industries in these regions also contribute to the growth of IPA consumption. Furthermore, government initiatives to boost healthcare infrastructure and pharmaceutical production offer ample opportunities for market players to tap into these high-growth regions.

Development of Green and Sustainable Products

The increasing consumer demand for eco-friendly products presents a unique opportunity for the isopropyl alcohol market, especially in the context of bio-based IPA. Manufacturers who can offer sustainable, bio-based IPA products produced from renewable sources will have a competitive edge. Governments worldwide are also introducing stricter environmental regulations and incentivizing sustainable manufacturing practices, which creates an opportunity for companies to shift towards more eco-friendly production methods. Bio-based IPA has significant potential in industries such as cosmetics, pharmaceuticals, and personal care, where consumers are becoming more environmentally conscious. Companies that innovate to develop and commercialize bio-IPA can position themselves as leaders in sustainability, gaining consumer trust and meeting regulatory requirements while simultaneously expanding their market share in emerging green markets.

Trends in the Global Isopropyl Alcohol Market

Increased Demand for High-Purity Isopropyl Alcohol

The demand for high-purity IPA is on the rise, particularly in industries such as electronics and semiconductors. High-purity IPA is essential for cleaning and removing contaminants from microchips, semiconductor wafers, and circuit boards during production. As electronics and semiconductor manufacturing processes become more advanced, the need for solvents that offer precision and efficiency continues to grow.

The increasing complexity of modern electronic devices has led to an increased focus on contamination control, which has directly impacted the demand for ultra-pure IPA. Furthermore, the growing use of advanced manufacturing technologies, such as 5G and artificial intelligence, requires ultra-pure solvents to ensure the integrity of electronic components. This trend has been particularly evident in regions like Asia-Pacific, where semiconductor production is a key economic driver.

Rising Preference for Bio-based Isopropyl Alcohol

There is a growing trend toward sustainability and environmental responsibility across various industries, leading to an increased focus on bio-based isopropyl alcohol (bio-IPA). Traditional IPA production is derived from petroleum-based feedstocks, which contribute to carbon emissions and other environmental issues. As environmental regulations become stricter, particularly in Europe and North America, there is increasing pressure on manufacturers to adopt greener production methods.

Bio-IPA, produced from renewable sources such as plant-based ethanol, offers a more sustainable alternative. Additionally, bio-based IPA is gaining traction in markets where eco-conscious consumers are demanding products with minimal environmental impact. This trend aligns with broader shifts toward green chemistry and sustainable industrial practices, positioning bio-IPA as a key market trend in the coming years.

Global Isopropyl Alcohol Market: Research Scope and Analysis

By Application Analysis

Isopropyl alcohol (IPA) is projected to hold a dominant position in the antiseptic and astringent application due to its remarkable ability to disinfect and clean surfaces effectively. The primary reason for its prevalence in this application is its efficacy in killing a broad range of pathogens, including bacteria, viruses, and fungi. IPA works by denaturing proteins in microorganisms, rendering them inactive and preventing the spread of infections. This property makes IPA indispensable in both medical and consumer hygiene products, such as hand sanitizers, antiseptic wipes, and cleaning solutions for surfaces and medical instruments.

The demand for IPA as an antiseptic and astringent has seen significant growth, particularly during the COVID-19 pandemic, where its use surged as a critical component in sanitation products. The pandemic heightened global awareness of the importance of hygiene, resulting in a sustained demand for hand sanitizers, surface disinfectants, and personal hygiene products. In addition to healthcare and hospitals, IPA is now widely used in households, schools, and public spaces, making it a key player in general sanitation efforts.

Moreover, IPA’s quick evaporation rate and non-toxic nature (in moderate concentrations) further solidify its position in the antiseptic and astringent market. It is effective for both surface and skin sanitization, with its rapid drying time making it convenient for quick disinfection. The ongoing global focus on cleanliness, health, and infection prevention ensures that IPA will continue to dominate the antiseptic and astringent application for the foreseeable future.

By End-user Analysis

The cosmetics and personal care industry is expected to be the leading end-user of isopropyl alcohol (IPA) due to its versatility and effectiveness as a solvent, disinfectant, and cleansing agent. IPA is used extensively in the formulation of various beauty products, including perfumes, skin toners, facial cleansers, and hair products. It plays a crucial role in dissolving oils, enhancing the texture of formulations, and ensuring smooth application for consumers. Additionally, IPA acts as a solvent that helps mix different ingredients, creating stable and high-quality cosmetic products. Its ability to remove oil and impurities from the skin without irritating further reinforces its popularity in skincare routines.

The dominance of IPA in the cosmetics and personal care market can also be attributed to the growing consumer demand for high-quality, efficient, and multi-functional products. With the increasing focus on skin health and hygiene, consumers increasingly favor products that are not only effective but also safe and quick-drying. IPA, with its fast evaporation rate, meets these consumer expectations, making it a crucial ingredient in the cosmetics industry. Furthermore, the demand for alcohol-based hand sanitizers, which gained unprecedented importance during the pandemic, further drove IPA’s use in the personal care segment.

In addition to skincare and personal hygiene products, IPA is widely used in the formulation of cosmetics such as nail polish removers, deodorants, and facial cleansing wipes. Its ability to provide rapid drying and disinfecting action enhances its value in the fast-paced personal care industry, making it a dominant component in cosmetic and personal care products worldwide.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Global Isopropyl Alcohol Market Report is segmented on the basis of the following:

By Application

- Antiseptic & Astringent

- Cleaning Agent

- Solvent

- Chemical Intermediate

- Other Application

By End-user

- Cosmetics & Personal Care

- Pharmaceutical

- Food And Beverages

- Paints And Coatings

- Chemical

- Other End User

Global Isopropyl Alcohol Market: Regional Analysis

Region With the Largest Revenue Share

Asia-Pacific is expected to dominate the global isopropyl alcohol (IPA) market as it is poised to command over 37.5% of the revenue share by the end of 2025 due to its vast industrial base, particularly in electronics, pharmaceuticals, and personal care industries. The region’s significant role in the global electronics manufacturing sector drives high demand for high-purity IPA, essential for cleaning and maintaining semiconductor components, circuit boards, and other delicate electronic parts. Countries like China, Japan, and South Korea are key players in the semiconductor and electronics markets, where contamination control and precision are crucial.

Moreover, Asia-Pacific is home to rapidly expanding pharmaceutical, healthcare, and consumer goods sectors, all of which contribute to increasing IPA consumption. The region’s growing middle class and urbanization, particularly in countries like China and India, fuel the demand for personal care and hygiene products that contain IPA, such as hand sanitizers and cosmetics. In addition, lower production costs and favorable government policies have made Asia-Pacific a manufacturing hub for chemical products, including IPA, which further enhances its dominance in the global market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

North America exhibits the highest compound annual growth rate (CAGR) in the isopropyl alcohol market due to several factors. One major driver is the increased focus on healthcare and hygiene, particularly after the COVID-19 pandemic. IPA, being a crucial ingredient in sanitizers and disinfectants, saw an unprecedented surge in demand in North America, a trend that continues as hygiene awareness remains heightened.

Additionally, the region’s strong pharmaceutical and healthcare sectors, alongside a growing preference for sustainable, eco-friendly solutions, drive the demand for bio-based IPA. The U.S. and Canada have seen rising investments in research and development, with key players focusing on innovating and expanding production capacities to cater to growing market needs. Furthermore, the presence of well-established distribution networks and stringent regulations regarding product quality and safety contribute to the region's market growth. As North America adapts to trends in green chemistry and sustainability, the market is poised for continued expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Isopropyl Alcohol Market: Competitive Landscape

The competitive landscape of the global isopropyl alcohol (IPA) market is highly dynamic, with several key players dominating the market. Industry giants such as Dow Chemical, ExxonMobil, and Shell lead the way in production, setting benchmarks in terms of product quality and innovation. These companies have extensive global reach and robust manufacturing capabilities, enabling them to meet the diverse needs of sectors such as electronics, pharmaceuticals, personal care, and chemicals.

In addition to the large multinational corporations, there is a growing presence of regional players who are expanding their market share through strategic partnerships and local production facilities. Companies like LG Chem, Mitsui Chemicals, and INEOS Group have strengthened their position by catering to specific regional demands, such as bio-based IPA in Europe and Asia-Pacific.

The market is also witnessing increased investments in research and development, particularly for bio-based IPA production, as industries across the world demand more sustainable alternatives. Regulatory compliance and quality assurance play a crucial role in shaping competition, as companies are required to adhere to stringent standards, especially in industries like healthcare and pharmaceuticals. As market demand continues to rise, companies are focusing on enhancing their production capacities, technological advancements, and geographic reach to maintain a competitive edge.

Some of the prominent players in the Global Isopropyl Alcohol Market are:

- Dow Chemical Company

- ExxonMobil Corporation

- Royal Dutch Shell plc

- LyondellBasell Industries N.V.

- INEOS Group Ltd.

- Linde plc

- Ecolab Inc.

- Mitsui Chemicals, Inc.

- LG Chem Ltd.

- Tokuyama Corporation

- ISU Chemical Co., Ltd.

- LCY Chemical Corp.

- KLK OLEO

- Manali Petrochemicals Ltd.

- Deepak Fertilisers and Petrochemicals Corporation Ltd.

- Perrigo Company plc

- Suzhou Jiutai Group

- Mistral Industrial Chemicals

- ReAgent Chemicals Ltd.

- Sasol Limited

- Other Key Players

Recent Developments in the Global Isopropyl Alcohol Market

- In April 2025, ExxonMobil announced a significant expansion of its IPA production capabilities in the United States. This development is aligned with the increasing demand for high-purity isopropyl alcohol in the electronics and pharmaceutical industries. The new facility will leverage advanced technologies to increase production efficiency and reduce environmental impact, addressing the growing market need for high-quality solvents used in precision cleaning.

- In February 2025, INEOS Group Ltd. launched a new line of bio-based isopropyl alcohol (bio-IPA) in February 2025, marking a key step toward sustainability in the chemical industry. The bio-IPA, derived from renewable sources, aims to cater to the growing demand for eco-friendly solutions, particularly in the cosmetics and healthcare sectors. This move is in response to the global shift towards green chemistry and environmental responsibility.

- In December 2024, Dow Chemical Company successfully integrated a new IPA production technology in December 2024 to improve yield and reduce energy consumption. This technology innovation supports the company's strategy to meet the expanding demand for IPA in the pharmaceutical and healthcare industries. The technology uses proprietary processes that minimize waste and improve operational efficiency, contributing to both environmental sustainability and cost-effectiveness.

- In November 2024, Mitsui Chemicals made a strategic investment in new IPA manufacturing facilities in Japan in November 2024. This investment aims to cater to the rising demand from the electronics and automotive industries, especially for high-purity IPA used in semiconductor cleaning. The move solidifies Mitsui's presence in the growing Asia-Pacific market, ensuring the company can meet future demand more effectively.

Investments, Collaborations, and Mergers in the Isopropyl Alcohol Market

- In March 2025, Sasol Limited entered a joint venture with Linde plc to develop a cutting-edge isopropyl alcohol production plant in South Africa. This collaboration combines Sasol's chemical processing expertise with Linde's technology in gases and industrial systems. The plant aims to leverage new methods of producing IPA, with a particular focus on increasing operational efficiency and reducing carbon emissions in the production process.

- In January 2025, LG Chem Ltd. and Mitsui Chemicals signed a strategic partnership in January 2025 to enhance the production and distribution of bio-based IPA. This collaboration focuses on establishing a stronger foothold in the European and North American markets. Both companies aim to develop a comprehensive supply chain for bio-IPA, catering to the rising demand for sustainable and environmentally friendly chemical solutions in personal care, healthcare, and industrial applications.

- In October 2024, ExxonMobil completed a significant merger with Chevron to strengthen its position in the global IPA market. The merger combines both companies’ resources and technological capabilities, allowing them to expand production capacities and offer a more diverse range of IPA products. The move is seen as an effort to better compete in both the traditional and bio-based IPA markets, especially in North America and Asia-Pacific.

- In July 2024, Ecolab Inc. announced a multi-million-dollar investment in expanding its IPA production facilities in Europe. The investment is aimed at meeting the growing demand for high-purity IPA in healthcare and pharmaceutical applications. Ecolab's expanded facilities will include cutting-edge, sustainable manufacturing technologies, positioning the company as a leader in environmentally conscious chemical production.

Expos and Conferences in the Isopropyl Alcohol Market

- In March 2025, The Global Chemical Engineering Conference (GCEC) held in March 2025 in Singapore featured key discussions on sustainable production methods in the isopropyl alcohol market. Industry leaders, including representatives from Dow Chemical and ExxonMobil, presented breakthroughs in green chemistry and innovative IPA production technologies. The event focused on solutions to meet increasing demand while addressing environmental concerns and resource efficiency.

- The 2024 Global Pharmaceutical and Chemical Manufacturing Expo in Los Angeles, held in December 2024, showcased the latest developments in the isopropyl alcohol market, particularly in the pharmaceutical and healthcare sectors. Numerous manufacturers exhibited advancements in IPA production, with a strong emphasis on bio-based and eco-friendly alternatives. The expo featured several key industry players, including INEOS Group Ltd. and Mitsui Chemicals, who showcased their latest products and technologies for sustainable IPA production.

- In September 2024, The International Cosmetics and Personal Care Expo took place in Paris in September 2024, where IPA’s role in the beauty and personal care industry was highlighted. Leading cosmetic brands and chemical producers, including LG Chem Ltd. and Ecolab, discussed IPA’s versatility in formulating high-quality personal care products. The expo also highlighted emerging trends such as green chemistry and sustainable sourcing of ingredients like IPA.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4,103.4 Mn |

| Forecast Value (2034) |

USD 8,415.2 Mn |

| CAGR (2025–2034) |

8.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1,035.3 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Application (Antiseptic & Astringent, Cleaning Agent, Solvent, Chemical Intermediate, Other Application), By End-user (Cosmetics & Personal Care, Pharmaceutical, Food and Beverages, Paints and Coatings, Chemical, Other End User |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Dow Chemical Company, ExxonMobil Corporation, Royal Dutch Shell plc, LyondellBasell Industries N.V., INEOS Group Ltd., Linde plc, Ecolab Inc., Mitsui Chemicals Inc., LG Chem Ltd., Tokuyama Corporation, ISU Chemical Co. Ltd., LCY Chemical Corp., KLK OLEO, Manali Petrochemicals Ltd., Deepak Fertilisers and Petrochemicals Corporation Ltd., Perrigo Company plc, Suzhou Jiutai Group, Mistral Industrial Chemicals, ReAgent Chemicals Ltd., Sasol Limited., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Global Isopropyl Alcohol Market?

▾ The Global Isopropyl Alcohol Market size is estimated to have a value of USD 4,103.4 million in 2025 and is expected to reach USD 8,413.2 million by the end of 2034.

What is the size of the US Isopropyl Alcohol Market?

▾ The US Isopropyl Alcohol Market is projected to be valued at USD 1,035.3 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2,034.5 million in 2034 at a CAGR of 7.8%.

Which region accounted for the largest Global Isopropyl Alcohol Market?

▾ Asia Pacific is expected to have the largest market share in the Global Isopropyl Alcohol Market with a share of about 37.5% in 2025.

Who are the key players in the Global Isopropyl Alcohol Market?

▾ Some of the major key players in the Global Isopropyl Alcohol Market are Dow Chemical Company, ExxonMobil Corporation, Royal Dutch Shell plc, LyondellBasell Industries N.V., INEOS Group Ltd., Linde plc, Ecolab Inc., Mitsui Chemicals Inc., LG Chem Ltd., Tokuyama Corporation, and many others.

What is the growth rate in the Global Isopropyl Alcohol Market in 2025?

▾ The market is growing at a CAGR of 8.3 percent over the forecasted period of 2025.